The 5 questions we ask before every options trade

Most options expire worthless.

Not because options are bad. Because people ask the wrong questions.

"Is this stock going up?" "What's the news?" "Should I buy calls or puts?"

These matter. But they're not enough.

After years of working with options, we realized the most successful investors don't just guess direction — they evaluate opportunity quality.

So we built a simple framework. 5 questions. Easy to understand, powerful enough to make a difference.

The 5-Pillar Framework

1. VALUE — "Are options priced fairly?" Are options cheap, fair, or expensive right now? (Think of it like checking if a stock is on sale.)

2. SENTIMENT — "What are other investors doing?" Are more people betting the stock goes up or down? We look at the balance of buying activity.

3. ACTIVITY — "Is something unusual happening?" Sudden spikes in trading can signal that something is brewing — earnings, news, or big moves ahead.

4. LIQUIDITY — "Can I get in and out easily?" Some options have wide gaps between buy and sell prices. That hidden cost can eat into your returns.

5. TIMING — "Is now a good time to act?" Is there an earnings report coming? A big event? Sometimes the best move is to wait.

Here's what it looks like in practice

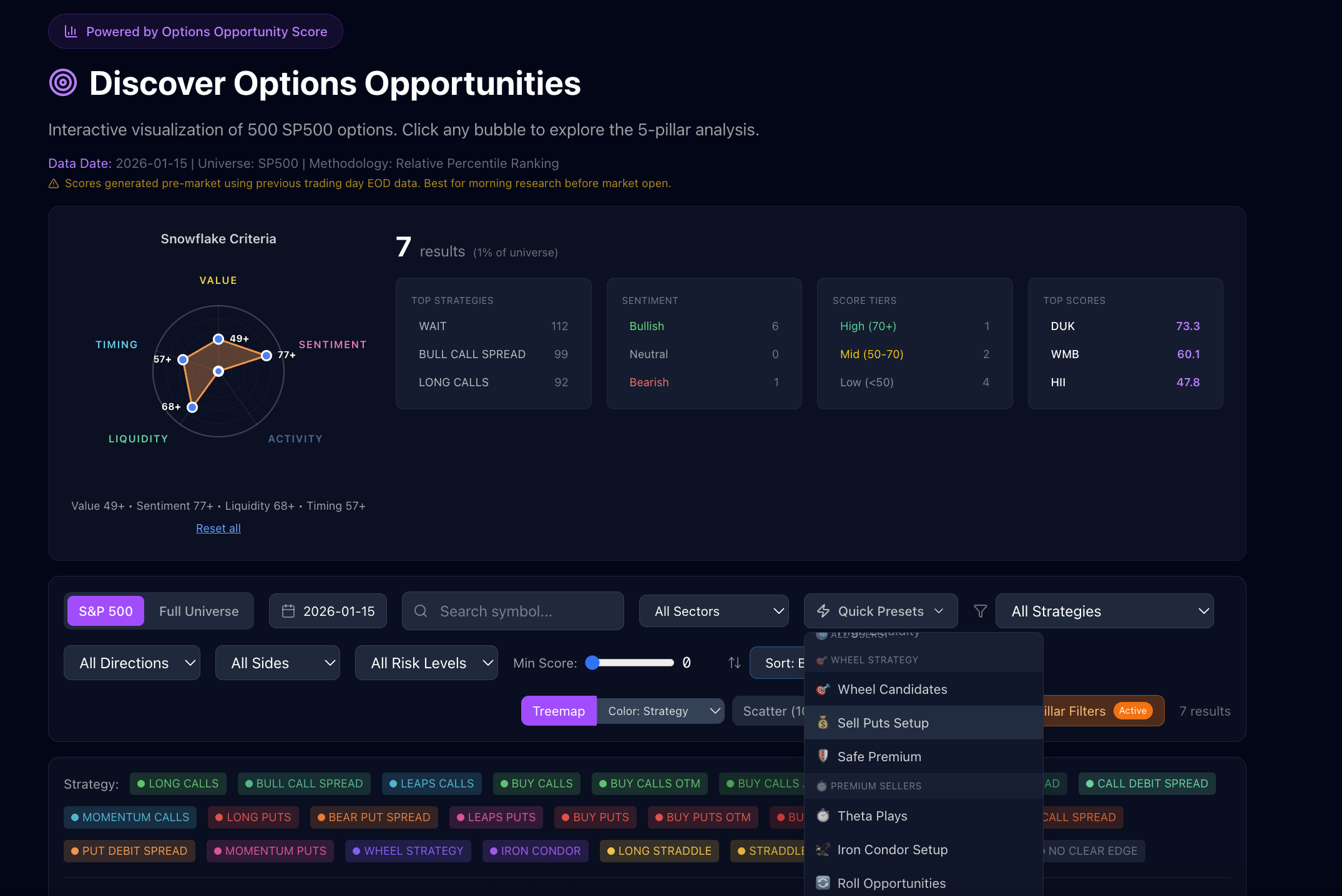

Discover Page — Find opportunities across 4000+ stocks:

Browse the full universe of optionable stocks — not just the S&P 500. Use the interactive filter to find stocks that match YOUR criteria. Filter by bullish/bearish outlook, minimum scores, sectors, and strategies. We're also building Quick Presets for different goals — income generation (Wheel Strategy), selling premium (Cash-Secured Puts), time decay plays (Theta Strategies), and more. Whether you're a beginner or experienced, the 5-pillar scoring helps you navigate options information in plain English.

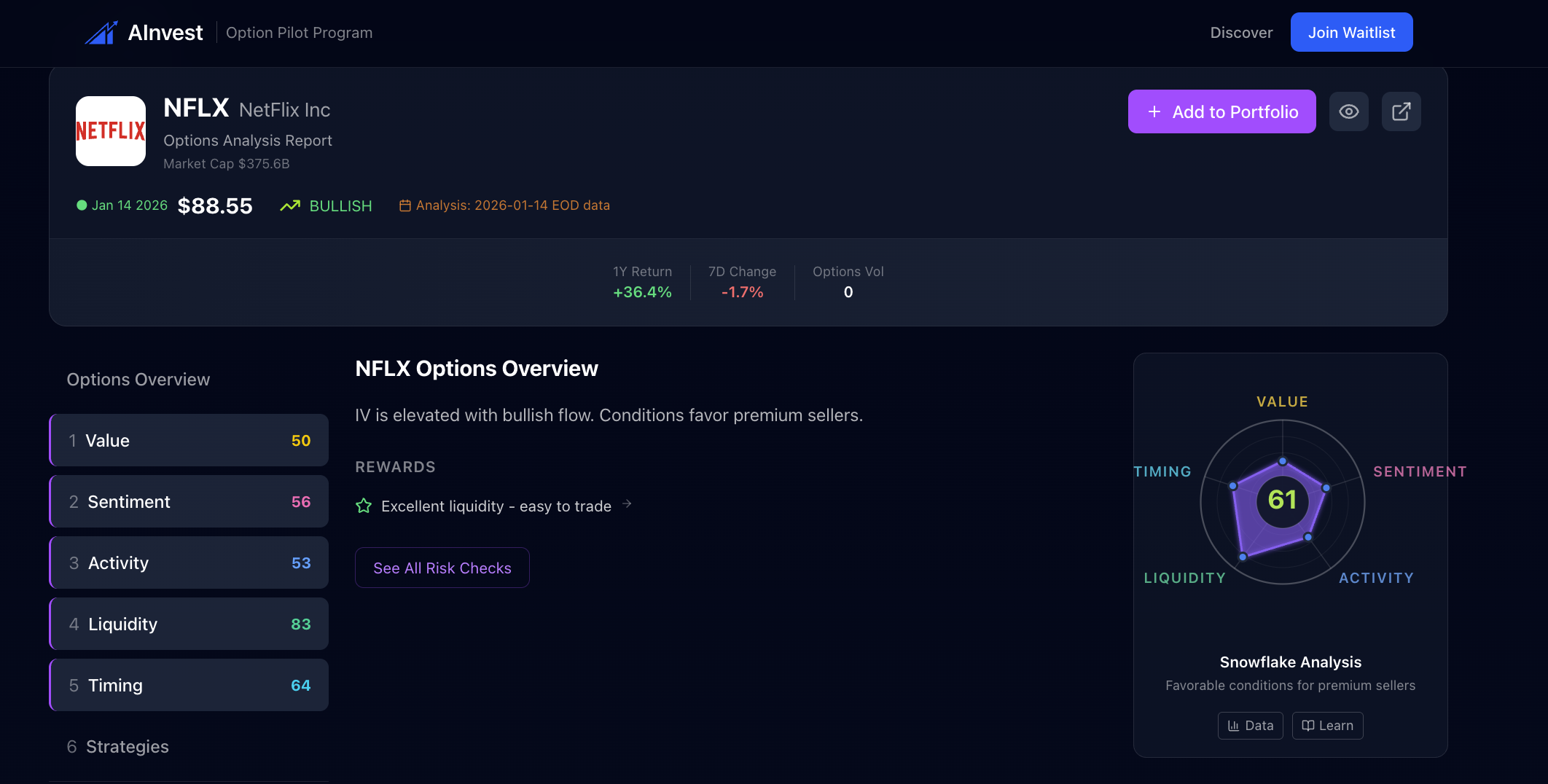

Ticker Deep-Dive — NFLX Example:

Each stock gets a full breakdown. NFLX shows: Value 50 (fairly priced), Sentiment 56 (slightly bullish), Activity 53 (normal trading), Liquidity 83 (easy to trade), Timing 64 (good entry window). The radar chart summarizes everything at a glance — in this case, conditions favor selling premium because liquidity is high and timing is decent.

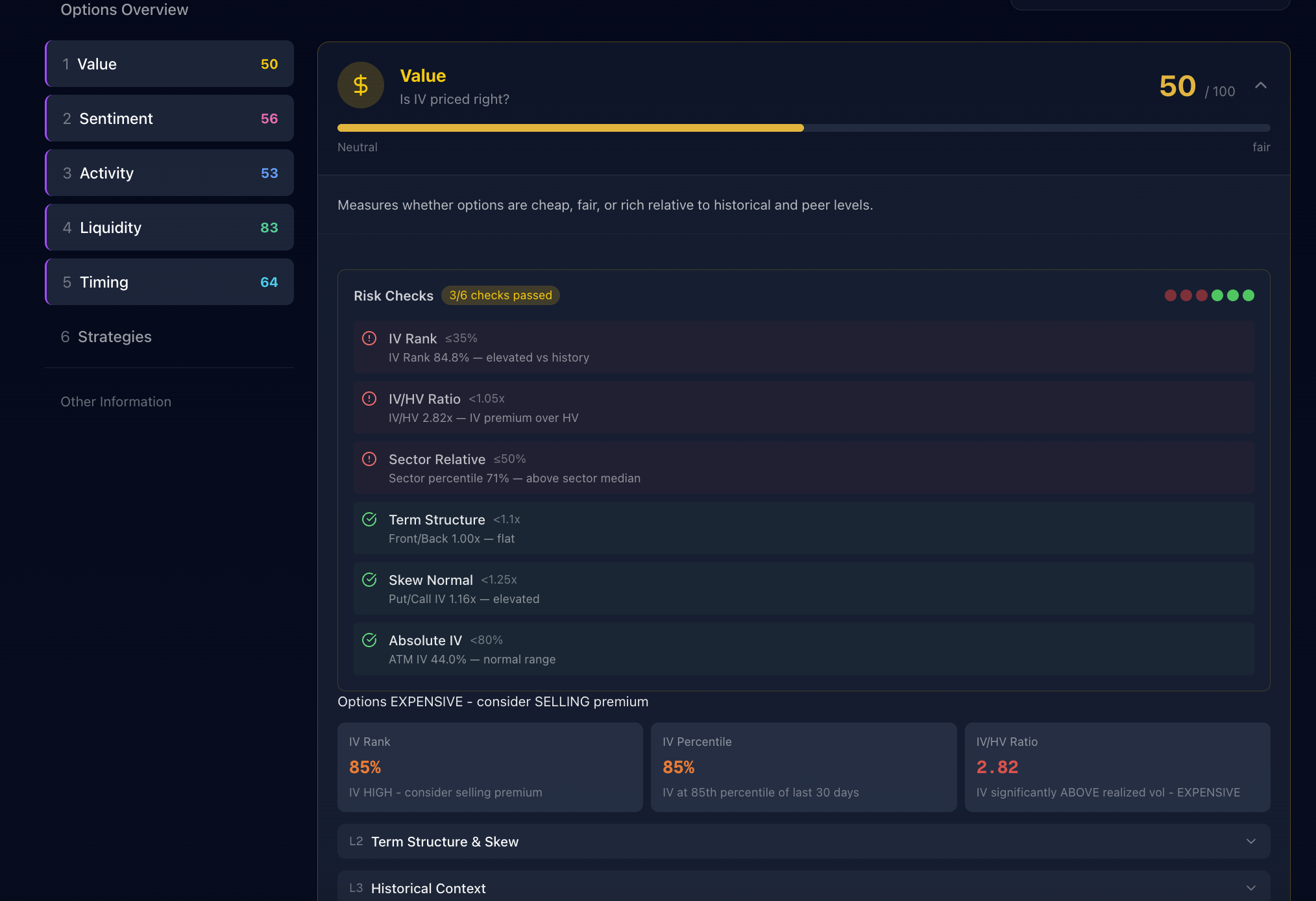

Pillar Sneak Peak — Value Check Example:

Want to understand why a stock scored the way it did? Drill into any pillar to see the underlying checks — each with a simple pass/fail indicator. No jargon, just clear answers.

From Framework to Tool

We used to check options pricing on one website, sentiment on another, and earnings calendars on a third. It was tedious and easy to miss things.

So we automated it.

Options Pilot analyzes 4000+ optionable stocks across all 5 pillars. Every trading day, Pre-market ready.

Each stock gets:

- Simple scores from 0-100 for each pillar

- Pass/fail checks so you understand the "why"

- Plain English summaries — no confusing jargon

This is analysis, not advice. We help you understand the landscape — you make your own decisions.

Early Access

We're opening Options Pilot to a small group first.

If you want to:

- Know if options are cheap or expensive before you trade

- See what other investors are doing at a glance

- Find opportunities without jumping between 10 different websites

Get Early Access →

We'll share updates, early access, and free analysis examples before launch.