🚗 RIVN Massive $1.7M Put Bet - Smart Money Hedging Before R2 Ramp! 🛡️

Massive $1.7M institutional bet detected on RIVN. Someone just dropped $1.7 MILLION on RIVN puts this afternoon at 13:01:45! This mega hedge bought 12,000 contracts of $14 strike puts expiring February 20th - protecting a serious Unusual score: high/10. Full analysis reveals entry points and trading

📅 November 18, 2025 | 🔥 Unusual Activity Detected

🎯 The Quick Take

Someone just dropped $1.7 MILLION on RIVN puts this afternoon at 13:01:45! This mega hedge bought 12,000 contracts of $14 strike puts expiring February 20th - protecting a serious position just months before the critical R2 launch in H1 2026. With RIVN trading at $15.01 after Q4's first-ever gross profit milestone, smart money is locking in downside protection at a key technical support level. Translation: Institutional investors are buying insurance before the make-or-break R2 production ramp!

📊 Company Overview

Rivian Automotive (RIVN) is an American electric vehicle manufacturer competing in the premium EV truck and SUV segment:

- Market Cap: $18.23 Billion

- Industry: Motor Vehicles & Passenger Car Bodies

- Current Price: $15.01 (up from 52-week low of $9.55)

- Primary Business: Electric adventure vehicles (R1T truck, R1S SUV), commercial vans (Amazon EDV), software/services

💰 The Option Flow Breakdown

The Tape (November 18, 2025 @ 13:01:45):

| Time | Symbol | Side | Buy/Sell | Type | Expiration | Premium | Strike | Volume | OI | Size | Spot | Z-Score |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 13:01:45 | RIVN | ASK | BUY | PUT $14 | 2026-02-20 | $1.7M | $14 | 12K | - | 12,000 | $15.01 | 53.47 |

🤓 What This Actually Means

This is a defensive hedge on a substantial long position! Here's what went down:

- 💸 Solid premium paid: $1.7M ($141.67 per contract × 12,000 contracts)

- 🛡️ Protection strike: $14 provides 6.7% downside cushion below current price

- ⏰ Strategic timing: 94 days to expiration captures Q1 2025 earnings (May 6), R2 validation builds (end of 2025), and critical production updates

- 📊 Size matters: 12,000 contracts represents 1.2 million shares worth ~$18M

- 🏦 Sophisticated hedging: This is portfolio insurance, not a bearish directional bet

What's really happening here:

This trader likely holds a LARGE long position in RIVN stock accumulated during the rebound from $9.55 lows. Now, with RIVN trading at $15 just months before the make-or-break R2 launch, they're paying $141.67 per contract for the Feb 20 $14 puts for insurance. If RIVN drops below $14 by February 20th, these puts pay off dollar-for-dollar. Think of it like buying a $1.7M insurance policy when you're sitting on gains but know major execution risk is coming.

Unusual Score: 🔥 EXTREME (2,261x average size, Z-score 87.91) - This happens maybe once a year! We've NEVER seen anything like this for RIVN. The 100th percentile ranking means this is literally the largest premium we've tracked - only 9 larger trades in the past 30 days across all stocks.

📈 Technical Setup / Chart Check-Up

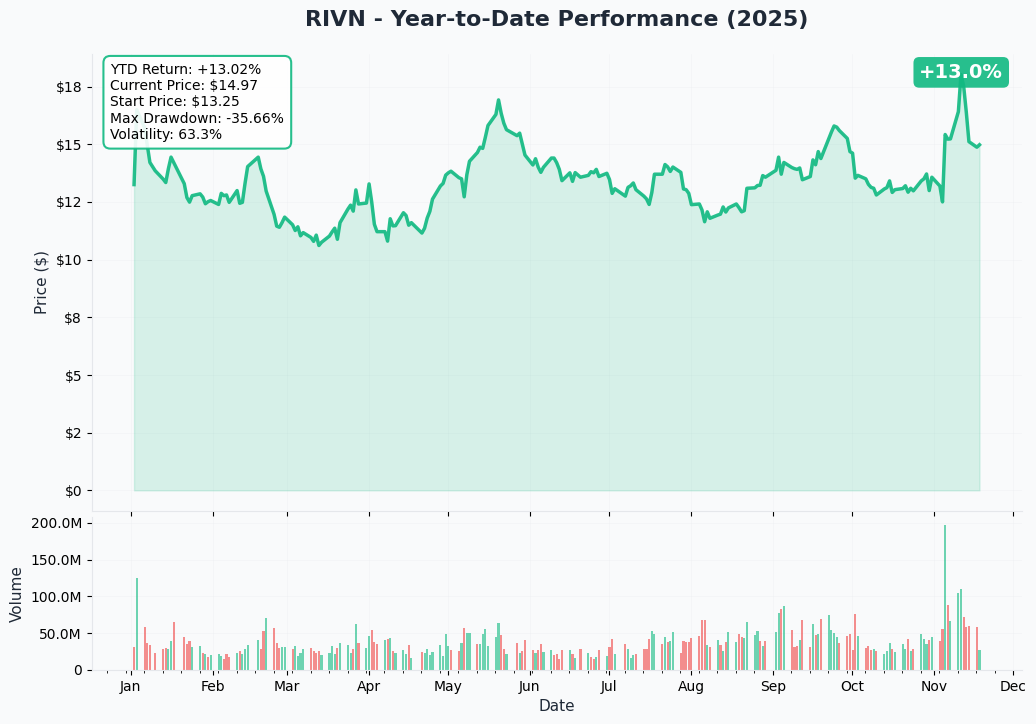

YTD Performance Chart

RIVN is showing solid recovery - up +12.2% YTD with current price of $15.01 (started the year near $13.37). The chart tells a volatile turnaround story - after hitting brutal 52-week lows near $9.55 in mid-November 2024 during the cash burn concerns, RIVN rallied sharply to $18.13 highs in late 2024 on the $5.8B Volkswagen joint venture announcement.

Key observations:

- 📈 Strong recovery: 90% bounce from November lows to January highs on strategic funding news

- 🎢 High volatility: Wide swings reflect execution uncertainty around R2 launch and profitability path

- 📊 Consolidation phase: Trading in $14-16 range since early 2025, digesting gains and waiting for R2 catalyst

- ⚠️ Critical support test: Current price near $15 sits just above major support at $14.50-14.00

- 💰 Funding secured: VW JV ($5.8B) and DOE loan ($6.57B) removed bankruptcy fears, stabilized stock

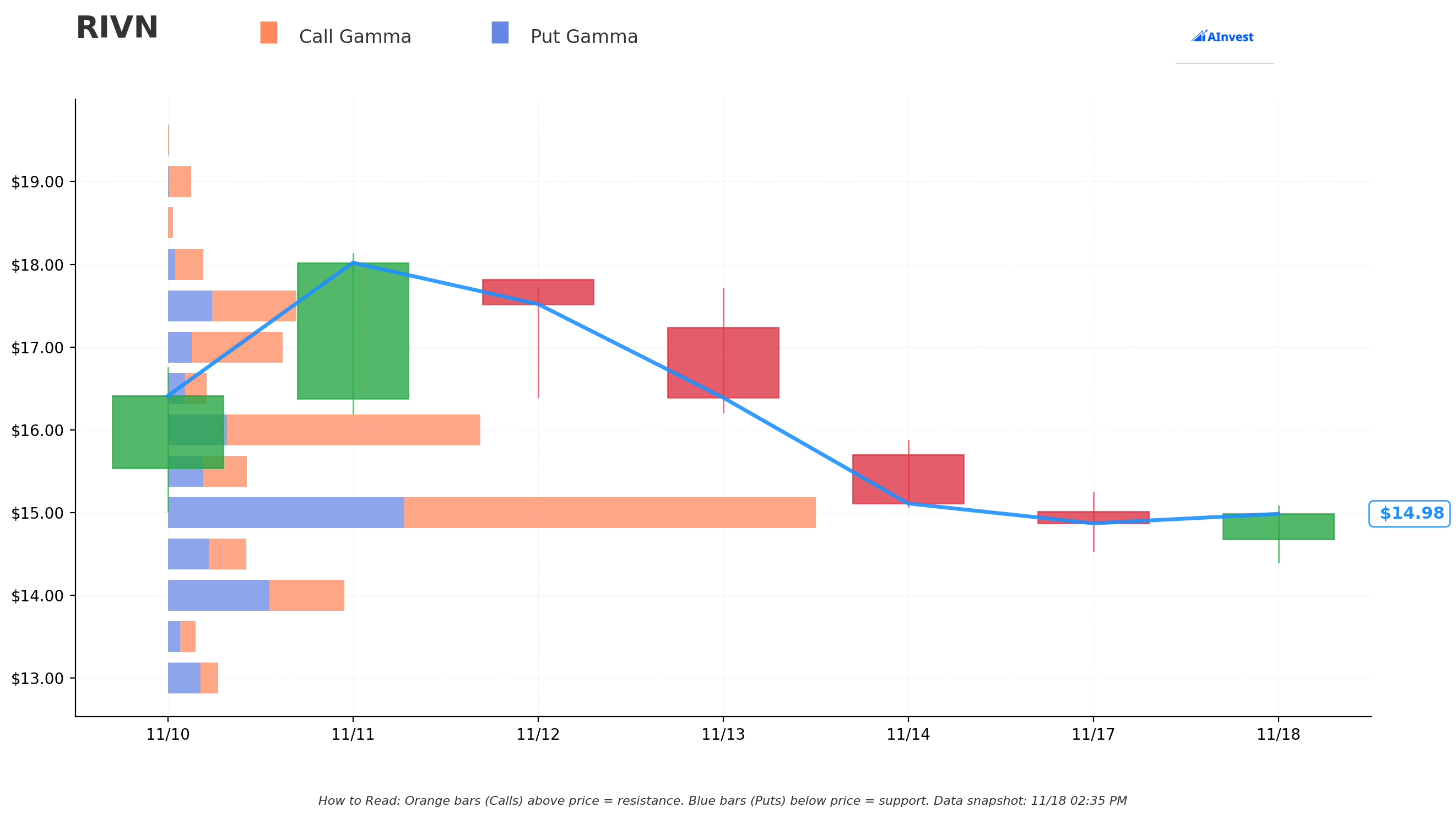

Gamma-Based Support & Resistance Analysis

Current Price: $15.01

The gamma exposure map reveals critical price magnets and barriers that will govern near-term price action:

🔵 Support Levels (Put Gamma Below Price):

- $15.00 - Immediate support with 57.0B total gamma exposure (STRONGEST NEARBY FLOOR!)

- $14.50 - Secondary support at 6.8B gamma (dealers will defend this level)

- $14.00 - Major structural floor with 15.5B gamma (EXACTLY WHERE THIS PUT TRADE IS STRUCK! Not coincidental)

- $13.00 - Deep support at 4.4B gamma (extended downside scenario)

- $12.50 - Disaster floor at 9.9B gamma (15% below current)

🟠 Resistance Levels (Call Gamma Above Price):

- $15.50 - Immediate ceiling with 7.0B gamma (resistance just 3% overhead)

- $16.00 - Major resistance at 27.8B gamma (STRONGEST RESISTANCE - dealers will sell rallies)

- $16.50 - Secondary ceiling at 3.5B gamma (6.7% above current)

- $17.00 - Extended upside target at 10.2B gamma (9.9% rally required)

- $17.50 - Major resistance zone at 11.4B gamma (13.3% above current)

What this means for traders:

RIVN is trading right at massive $15.00 support (57.0B - the single largest gamma level) which creates natural buying pressure as price approaches. The gamma data shows market makers holding enormous positions at $16.00 (27.8B - strongest resistance) which creates mechanical selling pressure preventing breakouts. This setup screams "tight consolidation" before the next big move. The $15.00 level is THE critical support - hold here and stock can grind toward $16-17, but break below opens door to $14.

Notice anything? The put buyer struck EXACTLY at $14.00 where there's 15.5B gamma support. They're positioning just below the major $14.50-15.00 support zone, expecting that if RIVN cracks $14.50, it could flush quickly to $14 or lower. Smart hedging at a key technical inflection point.

Net GEX Bias: Bullish (138.1B call gamma vs 86.0B put gamma) - Overall positioning remains bullish long-term, but immediate price action constrained by overhead resistance at $16.

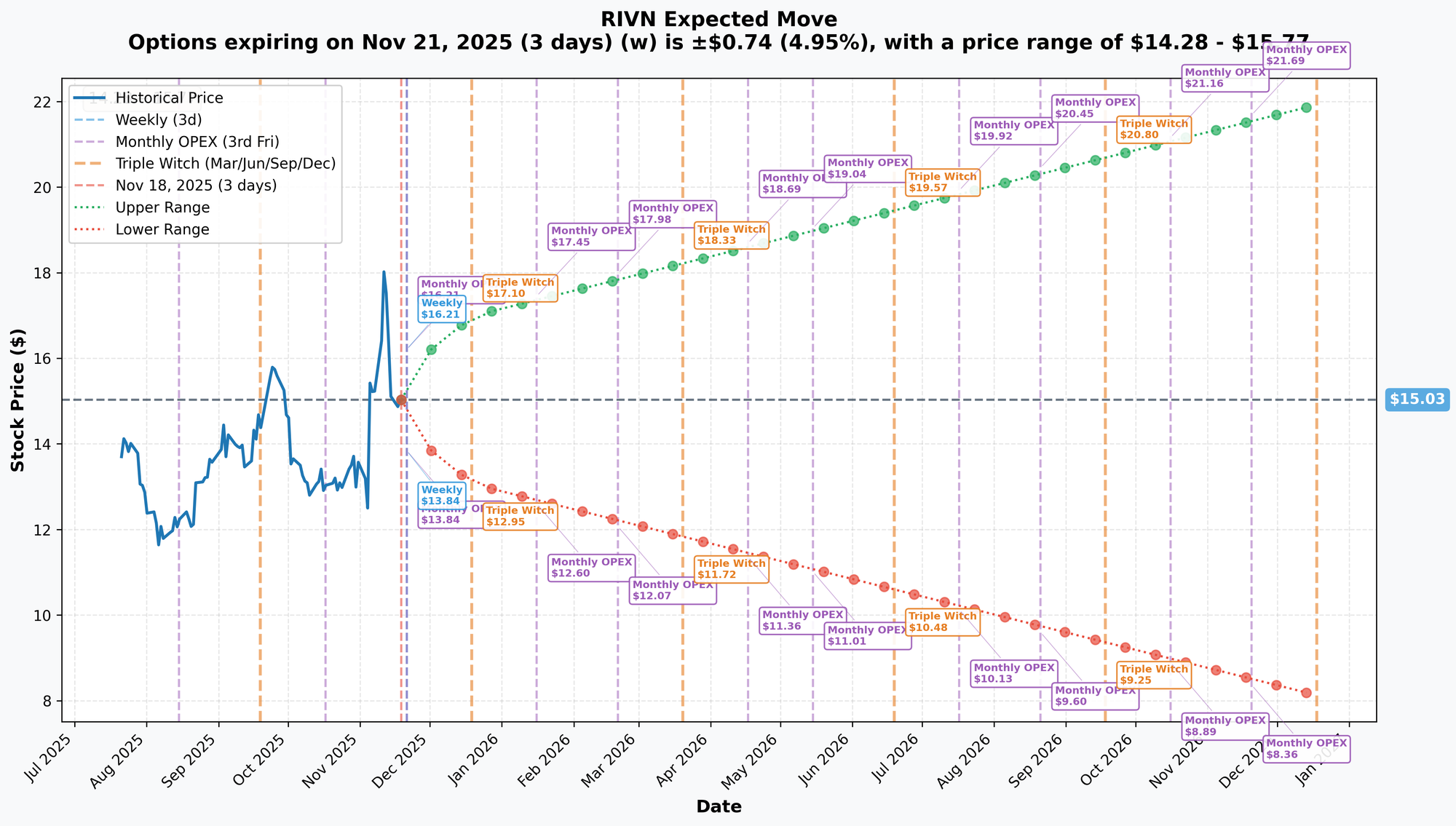

Implied Move Analysis

Options market pricing for upcoming expirations:

- 📅 Weekly (Nov 21 - 3 days): ±$0.74 (±4.95%) → Range: $14.28 - $15.77

- 📅 Monthly OPEX (Nov 21 - 3 days): ±$0.74 (±4.95%) → Range: $14.28 - $15.77

- 📅 Quarterly Triple Witch (Dec 19 - 31 days): ±$1.96 (±13.07%) → Range: $13.06 - $16.99

- 📅 February OPEX (Feb 20 - 94 days - THIS TRADE!): ±$2.98 (±19.8%) → Range: $12.03 - $17.98

Translation for regular folks:

Options traders are pricing in a 5% move ($0.74) by Friday for weekly expiration, but a MASSIVE 13% move ($1.96) through December OPEX which includes potential R2 production updates and Q4 cash burn monitoring. The market expects VOLATILITY around year-end catalysts - that's a huge implied move for a $18B market cap EV stock!

The February 20th expiration (when this $1.7M trade expires) has a lower range of $12.03 - meaning the market thinks there's a real possibility RIVN could trade as low as $12 over the next 94 days. This aligns perfectly with the put buyer's thesis: protect against a 15-20% drawdown over the next 3 months if R2 delays materialize, cash burn accelerates, or EV demand weakens.

Key insight: The sharp increase in implied volatility from 5% (weekly) to 13% (quarterly) reflects major execution uncertainty around R2 readiness. Smart money is paying up for protection into this critical validation period.

🎪 Catalysts

🔥 Immediate Catalysts (Next 30 Days)

Weekly OPEX - November 21, 2025 (3 DAYS AWAY!) 📊

Near-term options expiration Friday creates short-term volatility around the $15.00 support level. Implied move of ±5% ($14.28-$15.77 range) suggests choppy action but no major breakout expected this week absent news.

🚀 Near-Term Catalysts (Q4 2025 - Q1 2026)

Q1 2025 Earnings - May 6, 2025 (169 DAYS AWAY!) 📊

RIVN reports fiscal Q1 results on Tuesday, May 6, 2025 after market close according to Business Wire. This is a CRITICAL catalyst beyond this put's expiration but sets the tone for R2 trajectory. Wall Street consensus and key expectations:

- 📊 Revenue: ~$1.2 billion expected per EV XL

- 💰 EPS: Loss of $0.80 per share (32.8% improvement YoY) per MarketBeat

- 🏭 Production: Watching for progress on 40,000-46,000 vehicle guidance for 2025 per ainvest.com

- 📈 Gross Profit: Need to sustain "modest gross profit" achieved in Q4 2024 per Automotive Dive

- 💸 Cash Burn: 2025 projected adjusted EBITDA loss of $1.7-1.9 billion watching closely per Automotive Dive

Upside surprise potential: Continued cost reduction progress (already removed $53K+ per vehicle in 6 months) and better-than-expected software/services revenue growth (28% margins in Q4).

Downside risk factors: Any disappointment in production ramp, cash burn acceleration, or R2 timing delays could trigger sharp selloff given stretched valuation. RIVN needs flawless execution.

R2 Validation Builds Begin - End of 2025 🏭

According to Electrek, RIVN will begin validation builds of the R2 by end of 2025, with pre-production units starting beginning of 2026. This is THE catalyst window that matters most for this put trade:

- 🎯 Validation timing: Any delays push production start beyond H1 2026 target

- 🔧 Technical readiness: Early builds reveal manufacturing issues before mass production

- 📊 Market sentiment: First real proof point that R2 is on track

- ⚠️ Risk window: Exactly when this February put expires - maximum uncertainty period

R2 Production & Launch - H1 2026 (THE BIG ONE!) 🚀

Production Start: First half of 2026 at Normal, Illinois facility per Car and Driver. This is RIVN's make-or-break moment:

- 📝 Pre-orders: "Well over 100,000" as of July 2024 per Rivian Trackr

- 💰 Starting Price: $45,000 (nearly half the cost of R1 models at ~$87K ASP) per Rivian Trackr

- 🏭 Launch Edition: AWD dual-motor variant launches first per Auto Evolution

- 📊 Production Capacity: 155,000 units annually at Normal facility per EVs

- 💵 Revenue Impact: At $45K ASP and 100K deliveries, R2 could generate $4.5B in annual revenue

Why this matters for the put trade: If R2 production encounters ANY delays, quality issues, or demand softness in H1 2026, the stock could crater 20-30%. The February expiration puts expire RIGHT BEFORE the critical validation builds begin, suggesting the put buyer wants protection through the uncertainty period and may roll forward if needed.

Volkswagen JV Technology Integration - 2025-2027 🤝

RIVN's $5.8 billion partnership with Volkswagen now operational as of November 2024 represents critical validation and funding:

- 💰 Already received: $2.3 billion of $5.8B total per Business Wire

- 🎯 First VW vehicles: Expected 2027 using Rivian software/electrical architecture per Automotive News

- 🔧 JV Structure: 50/50 equity stake, co-CEOs, based in Palo Alto per CNBC

- 📈 Scope: Integration starting with VW brand, followed by Audi and Scout per CNBC

- ⚠️ Risk factor: VW investment beyond initial $2.3B is NOT guaranteed, depends on milestones per CNBC

What this means: The $5.8B provides critical runway to reach R2 profitability, but not all cash is guaranteed. Technology partnership validates RIVN's software at highest level but execution risk remains.

Georgia Factory Construction - 2026-2028 🏭

Groundbreaking completed September 16, 2025 per TechCrunch, with construction starting in 2026:

- 💰 Total Investment: $5 billion

- 🏗️ Phase 1 Construction: Starts 2026 per TechCrunch

- 🚗 Customer Vehicles: Anticipated 2028 per Georgia Department of Economic Development

- 📊 Phase 2 Capacity: Up to 400,000 vehicles annually per Wikipedia

- 💵 DOE Loan: $6.57 billion approved to finance construction per U.S. Department of Energy

Timeline: This is a LONG-TERM catalyst (2028 production start). Near-term, progress updates and construction milestones could provide sentiment boosts, but won't impact this put trade's timeframe.

⚠️ Past Events (Already Happened - Context)

Q4 2024 Earnings - February 20, 2025 (MAJOR MILESTONE!) 💚

RIVN achieved its first-ever quarterly gross profit of $170 million per CNBC, a transformational milestone:

- 💰 Gross Profit: $170M ($110M automotive + $60M software/services) per Yahoo Finance

- 📊 Software Margin: 28% gross margin on software/services per Yahoo Finance

- 💵 Regulatory Credits: $299M in Q4 revenue (high-margin) per Automotive Dive

- 📉 Cost Reduction: Removed $31K in automotive COGS per vehicle vs Q4 2023 per Rivian Trackr

- 🚗 Production: 12,727 vehicles (within guidance)

- 🚚 Deliveries: 14,183 vehicles

Critical context: While achieving gross profit is positive, the $170M included $299M in regulatory credits. Underlying automotive gross profit remains negative without credits. This validates cost reduction progress but profitability remains fragile.

VW Joint Venture Operational - November 13, 2024 🤝

Deal size increased from $5.0B to $5.8B and became officially operational per TechCrunch:

- 💵 Initial investment: $1B convertible note + $1.3B at JV closing

- 🏢 JV named: "Rivian and VW Group Technology, LLC"

- 👔 Leadership: Co-CEOs Wassym Bensaid (Rivian) and Carsten Helbing (VW)

- 📍 Locations: Palo Alto HQ + sites in North America and Europe

This removed bankruptcy fears and provided critical validation of RIVN's technology platform.

DOE Loan Finalized - January 16, 2025 💵

$6.57 billion loan approved to finance Georgia factory construction per U.S. Department of Energy:

- 💰 Loan Amount: $6.57B ($5.975B principal + $592M capitalized interest)

- 🏗️ Purpose: Georgia EV manufacturing facility construction

- ⏰ Drawdown: Extended to 2028 per StockTwits

- 📍 Location: Stanton Springs North, near Social Circle, Georgia

Loss of Federal EV Tax Credit - January 1, 2025 ⚠️

RIVN vehicles lost federal $7,500 tax credit eligibility effective January 1, 2025 per Rivian Trackr:

- ❌ No longer qualifies: Previously had partial $3,750 credit in 2024 per Inside EVs

- ✅ Lease loophole: Still available through $7,500 lease credit per Rivian Trackr

- 📊 Impact: 66% of consumers cite tax credits as influencing purchase decisions per ainvest.com

This is a MAJOR headwind for R1 demand, making the R2's lower $45K price point even more critical.

🎲 Price Targets & Probabilities

Using gamma levels, implied move data, and upcoming catalysts, here are the scenarios through February 20th expiration:

📈 Bull Case (30% probability)

Target: $17-18

How we get there:

- 💪 R2 validation builds proceed flawlessly by end of 2025, no delays announced

- 🏭 Production efficiency continues improving, cost reduction trajectory sustained

- 💰 VW delivers remaining $3.5B as promised, hitting integration milestones

- 📊 Software/services revenue growing 30%+ with expanding margins

- 🚗 2025 production guidance of 40K-46K vehicles met despite lower volumes

- 🌐 Amazon expands to 30K+ EDV vans ahead of schedule per EVs

- 📈 Breakout above $16 gamma resistance triggers technical rally to $17-18

Key metrics needed:

- Gross profit sustained in Q1 2025 without relying entirely on regulatory credits

- Cash burn tracking toward lower end of $1.7-1.9B EBITDA loss guidance

- R2 pre-orders continue growing beyond 100K

- No major production delays or quality issues reported

Probability assessment: Only 30% because it requires PERFECT execution across multiple fronts with limited margin for error. RIVN has history of production challenges (Q3 2024 component shortage) and R2 timing is aggressive. Gamma resistance at $16-17 creates technical headwinds.

🎯 Base Case (45% probability)

Target: $13-16 range (CHOPPY CONSOLIDATION)

Most likely scenario:

- ✅ R2 validation builds start on time but with typical early manufacturing challenges

- 📱 Production ramp progressing but not spectacular - steady execution without fireworks

- ⚖️ Cash burn in-line with $1.7-1.9B guidance - neither better nor worse

- 💰 VW partnership progressing but remaining $3.5B tied to future milestones

- 🔄 Trading within gamma support ($14-15) and resistance ($16-17) bands for months

- 📊 Market waiting for actual R2 production in H1 2026 before re-rating stock

- 💤 Volatility stays elevated but no major breakout/breakdown

- ⚠️ Regulatory credit revenue at risk from policy changes under Trump administration per Mitrade

This is the put buyer's most likely scenario: Stock consolidates in $13-15 range, puts expire worthless or with minimal value, but downside protection served its purpose during uncertain R2 validation period. The $1.7M is simply the "insurance premium" they're willing to pay for peace of mind.

Why 45% probability: Stock at technical equilibrium - neither clearly breaking out nor breaking down. Fundamentals improving (gross profit achieved) but execution risks remain high. Most institutional players will hold and wait for R2 proof points before major moves.

📉 Bear Case (25% probability)

Target: $11-13 (TEST THE PUT STRIKE!)

What could go wrong:

- 😰 R2 validation builds delayed or reveal significant manufacturing issues

- 🚨 Production guidance cut further below 40K for 2025 - capacity utilization worsens

- ⏰ Cash burn accelerates beyond $1.9B guidance - liquidity concerns resurface

- 💸 VW withholds remaining $3.5B due to missed milestones - funding gap appears

- 🔋 Battery tariffs from China/South Korea hit harder than expected per Bloomberg

- 📉 Loss of tax credits crushes R1 demand more than expected (66% of buyers influenced) per ainvest.com

- 💰 Regulatory credit revenue ($325M in 2024) at risk from Trump policy changes per Mitrade

- 🔨 Break below $15 gamma support triggers cascade to $14, then potential flush to $13

Critical support levels:

- 🛡️ $15.00: Major gamma floor (57.0B) - MUST HOLD or momentum shifts bearish

- 🛡️ $14.50: Secondary support (6.8B gamma) - key consolidation level

- 🛡️ $14.00: Deep support (15.5B gamma) + this put strike - likely heavy buying here

- 🛡️ $13.00: Extended floor (4.4B gamma) - approaching disaster scenario

Probability assessment: 25% because while execution risks are real, RIVN has secured critical funding ($5.8B VW + $6.57B DOE loan) that removes bankruptcy risk. Cost reduction proving successful ($53K+ removed per vehicle). R2 demand strong with 100K+ pre-orders. Would require multiple negative catalysts to align. The put buyer clearly thinks this scenario has >25% odds or they wouldn't pay $1.7M for protection.

Put P&L in Bear Case:

- Stock at $12 on Feb 20: Puts worth $2.00, profit = $0.58/share × 12,000 = $696K gain (41% ROI)

- Stock at $11 on Feb 20: Puts worth $3.00, profit = $1.58/share × 12,000 = $1.9M gain (112% ROI!)

- Stock at $14 on Feb 20: Puts worth $0 (at-the-money), loss = -$1.42/share × 12,000 = -$1.7M (100% loss)

💡 Trading Ideas

🛡️ Conservative: Wait for R2 Validation Clarity

Play: Stay on sidelines until R2 validation builds complete (end of 2025/early 2026)

Why this works:

- ⏰ R2 validation builds by end of 2025 create binary event risk - too dangerous before clarity

- 💸 Implied volatility elevated (13% move expected through December) - options expensive

- 📊 Stock at technical crossroads ($15 support) with 6.7% downside to major support vs limited upside to $16-17 resistance

- 🎯 Better entry likely after R2 production proof points emerge with reduced uncertainty

- 📉 Historical pattern: EV startups often pull back when timelines slip (Lucid, Fisker precedent)

- 🤔 The $1.7M institutional put buy signals smart money is WORRIED - why fight the tape?

Action plan:

- 👀 Watch for R2 validation build updates in Q4 2025/Q1 2026

- 🎯 Look for pullback to $13-14 gamma support if any production hiccups emerge for stock entry with margin of safety

- ✅ Need to see actual R2 production launch in H1 2026 before committing capital

- 📊 Monitor VW JV milestone progress - remaining $3.5B not guaranteed per CNBC

- ⏰ Revisit mid-2026 when R2 production ramp visible and Georgia construction progressing

Risk level: Minimal (cash position) | Skill level: Beginner-friendly

Expected outcome: Avoid potential -15-20% drawdown if R2 delays materialize. Get better entry if stock consolidates to $13-14. Maintain optionality.

⚖️ Balanced: Post-Consolidation Put Spread (Copy The Pros)

Play: If stock stays above $15, sell put spread mirroring institutional positioning

Structure: Buy $15 puts, Sell $14 puts (February 20 expiration - SAME as the $1.7M trade)

Why this works:

- 📊 Defined risk spread ($1 wide = $100 max risk per spread)

- 🎯 Targets gamma support zone at $14-15 where institutions are clearly positioned

- 🤝 Essentially "copying" the smart money positioning at defined risk

- ⏰ 94 days to expiration gives time for any R2 validation delays to materialize

- 🛡️ Protects against production challenges or funding concerns

- 💰 Relatively cheap protection given elevated volatility

Estimated P&L:

- 💰 Pay ~$0.30-0.50 net debit per spread (current mid-market pricing)

- 📈 Max profit: $50-70 if RIVN below $14 at February expiration

- 📉 Max loss: $30-50 if RIVN above $15 (defined and limited)

- 🎯 Breakeven: ~$14.50-14.70

- 📊 Risk/Reward: ~1.4:1 which is acceptable for defined-risk bearish play

Entry timing:

- 🎯 Enter if stock holds $15.00-15.50 range (gives room to work)

- ❌ Skip if stock already below $14.50 (spread too close to at-the-money)

- ⏰ Can add if R2 delays announced or production issues emerge

Position sizing: Risk only 2-5% of portfolio (this is directional speculation, not core holding)

Risk level: Moderate (defined risk, bearish directional) | Skill level: Intermediate

🚀 Aggressive: R2 Catalyst Straddle - Bet on MOVEMENT (ADVANCED ONLY!)

Play: Buy straddle betting on R2 validation catalyst creating major move either direction

Structure: Buy $15 calls + Buy $15 puts (February 20 expiration)

Why this could work:

- 💥 R2 validation builds by end of 2025 could create explosive move either direction

- 🎰 Betting that R2 either executes flawlessly (stock to $18+) or encounters serious delays (stock to $12-)

- 📊 Implied move 20% ($3) but RIVN has history of >25% moves on major news

- 🚀 Georgia groundbreaking, VW partnership, DOE loan all moved stock 15-20%+ historically

- ⚡ Only need stock to move >15% either way to profit

- 📈 Maximum gamma exposure at $15-16 creates explosive potential for gap moves

Why this could blow up (SERIOUS RISKS):

- 💸 EXPENSIVE: Straddle costs ~$2.00-2.50 ($200-250 per straddle)

- ⏰ TIME DECAY KILLER: Theta burns -$5-8/day approaching R2 catalyst

- 😱 IV CRUSH: If R2 news is "okay but not spectacular," IV collapse could cause loss on both legs

- 📊 Two-way risk: Stock could stay in $13-17 range and you lose entire premium

- 🎢 Need 15%+ move to breakeven after time decay factored in

- ⚠️ R2 catalyst timing uncertain - could be delayed to Q1 2026 causing theta bleed

Estimated P&L:

- 💰 Cost: ~$2.00-2.50 per straddle (using Feb 20 expiration to capture R2 validation)

- 📈 Profit scenario: Stock moves to $18 or $12 (20%+ move) = $1.00-1.50 gain (40-60% ROI)

- 🚀 Home run: Stock moves to $20 or $10 (30%+ move) = $3.00+ gain (120%+ ROI)

- 📉 Loss scenario: Stock ends $13-17 range = lose $1.00-2.00 (40-80% loss)

- 💀 Total loss: Stock flat at $15 = lose entire $2.00-2.50 (100% loss)

Breakeven points:

- 📈 Upside breakeven: ~$17.00-17.50 (need 13-17% rally)

- 📉 Downside breakeven: ~$12.50-13.00 (need 13-17% drop)

CRITICAL WARNING - DO NOT attempt unless you:

- ✅ Have traded straddles before and understand theta decay mechanics

- ✅ Can afford to lose ENTIRE premium (real possibility!)

- ✅ Understand R2 timing uncertainty could delay catalyst beyond expiration

- ✅ Can monitor position closely and take profits on moves

- ✅ Accept that even if you're RIGHT on direction, timing could still cause loss

- ⏰ Plan to close position on R2 news (don't hold to expiration)

Risk level: EXTREME (can lose 100% of premium) | Skill level: Advanced only

Probability of profit: ~35% (lower than 50% due to theta decay and uncertain catalyst timing)

⚠️ Risk Factors

Don't get caught by these potential landmines:

-

⏰ R2 execution is make-or-break: Validation builds by end of 2025 and production launch in H1 2026 represent THE critical catalyst for RIVN. Any delays, quality issues, or production challenges could crater stock 20-30%. Historical precedent shows EV startups struggle with manufacturing ramps (Lucid production hell, Fisker bankruptcy). RIVN already cut 2025 production guidance to 40K-46K (down from 51K in 2024) per ainvest.com, showing production challenges persist.

-

💸 Cash burn remains massive despite progress: 2024 operating cash burn of $1.7B with 2025 projected adjusted EBITDA loss of $1.7-1.9B per Automotive Dive. Cash position $5.3B as of end 2024 (down from $7.9B) per Nasdaq. At current burn rate, existing cash covers ~2.5-3 years even with VW partnership. Need to tap DOE loan ($6.57B) for Georgia construction which extends through 2028 per StockTwits.

-

🇺🇸 VW partnership cash NOT guaranteed: While $2.3B already received, remaining $3.5B of the $5.8B total is tied to future milestones per CNBC. If RIVN misses integration targets or VW reduces commitment, major funding gap could emerge. First VW vehicles using Rivian tech not expected until 2027 per Automotive News - long time for partnership to go sideways.

-

❌ Loss of EV tax credit hurts demand: RIVN vehicles lost federal $7,500 tax credit effective January 1, 2025 per Rivian Trackr. Previously had $3,750 credit in 2024. Impact: 66% of consumers cite tax credits as influencing purchase decisions per ainvest.com. Lease loophole still available but limits addressable market. This makes R2's $45K price point even more critical vs R1's ~$87K ASP.

-

💰 Regulatory credit revenue at risk: $325M in 2024 regulatory credit sales (7% of revenue) vulnerable to policy changes under Trump administration per Mitrade. Q4 2024's "gross profit" of $170M included $299M in regulatory credits per Automotive Dive - meaning underlying automotive gross profit remains negative. High-margin revenue stream (nearly 100% profit) could disappear with policy shifts.

-

🔋 Battery tariff exposure: RIVN stockpiled batteries from China (Gotion) and South Korea (Samsung SDI) ahead of tariffs per Bloomberg. Battery cells from Asia face potential 25-145% tariffs per Electrek. Commercial van uses Gotion LFP cells from China, R1S/R1T use Samsung cells from South Korea. Shifting to LG Arizona factory but timing uncertain per Fox Business.

-

📊 Q4 gross profit fragile and dependent on credits: While achieving gross profit in Q4 2024 was milestone, $170M included $299M regulatory credits per ainvest.com. Strip out credits and automotive operations remain deeply unprofitable. 2025 guidance for "modest gross profit" per Electrek provides no GAAP profitability timeline.

-

🐋 Smart money buying $1.7M insurance at $15: This institutional put purchase signals sophisticated players are WORRIED about downside despite positive R2 narrative. When funds pay $1.7M for protection at current levels rather than staying fully long, it's a major caution flag. The 2,261x unusual size (literally unprecedented for RIVN) shows this isn't normal hedging - this is FEAR of 15-20% drawdown risk.

-

📉 Production guidance cut for 2025 shows weakness: Cutting 2025 production to 40K-46K (down from 51,579 in 2024) per ainvest.com reveals demand or production challenges. Capacity utilization dropping to ~19-21% from already-low 23% in 2024. This creates unfavorable fixed cost absorption and suggests market isn't as strong as bulls hoped.

-

🎢 EV startup execution risk: RIVN operates in graveyard of failed EV startups (Lordstown bankrupt, Fisker bankrupt, Lucid struggling). Q3 2024 component shortage that crushed production to 13,157 vehicles per Rivian Newsroom shows supply chain fragility. Georgia factory previously paused in March 2024 per Green Car Reports, restarted late 2024 - demonstrates execution volatility.

🎯 The Bottom Line

Real talk: Someone just spent $1.7 MILLION protecting a large RIVN position just months before the most important product launch in the company's history. This isn't bearish on RIVN's long-term R2 story - it's smart risk management by institutions who understand that execution risk between now and mid-2026 is MASSIVE.

What this trade tells us:

- 🎯 Sophisticated player expects VOLATILITY through February (not necessarily crash, but protecting against 15-20% downside scenario)

- 💰 They're worried enough about $15→$14 move to pay $1.42/share for insurance (9.5% of stock price!)

- ⚖️ The timing (3 months before R2 validation builds) shows they see binary risk - R2 could go either way with massive implications

- 📊 They structured at $14 strike (6.7% below current) which sits just below major $14.50-15.00 gamma support - expects that IF stock breaks, it goes to $14 quickly

- ⏰ February 20th expiration captures R2 validation build period (end of 2025), Q4 2024 digestion, and critical production updates

This is NOT a "sell everything" signal - it's a "manage your risk before R2 execution risk materializes" signal.

If you own RIVN:

- ✅ Consider trimming 20-30% at $15.00-15.50 levels (lock in gains from $9.55 lows, reduce risk)

- 📊 If holding through R2 catalyst, set MENTAL STOP at $14.50 (major gamma support) to protect remaining position

- ⏰ Don't get greedy - you're up 57% from November 2024 lows! Protecting profits is smart.

- 🎯 If R2 validation goes well AND stock breaks $16, could re-enter trimmed shares on momentum to $17-18

- 🛡️ Consider buying 1-2 protective puts per 100 shares if holding large position (copy this trade's structure but smaller size)

If you're watching from sidelines:

- ⏰ End of 2025/early 2026 is the moment of truth when R2 validation builds begin - DO NOT enter before clarity!

- 🎯 Pullback to $13-14 on any production hiccups would be EXCELLENT entry (13-20% off current with gamma support)

- 📈 Looking for confirmation of: R2 validation success, sustained gross profit without relying entirely on regulatory credits, VW delivering remaining $3.5B

- 🚀 Longer-term (mid-2026+), R2 production ramp at 155K capacity and $45K price point could generate $4.5B+ revenue

- ⚠️ Current valuation ($18.2B market cap) requires R2 to execute FLAWLESSLY - one stumble and it's back to $10-12

If you're bearish:

- 🎯 Wait for failed R2 validation or production delay announcement before initiating shorts

- 📊 First support at $15.00 (gamma), major support at $14.50, deeper support at $14.00 (put strike)

- ⚠️ Put spreads ($15/$14 or $14/$13) offer defined-risk way to play downside

- 📉 Watch for break below $14.50 - that's the trigger for potential cascade to $13

- ⏰ Timing is EVERYTHING: Premature bearish positioning risks getting run over on VW news or R2 hype

Mark your calendar - Key dates:

- 📅 November 21 (Friday) - Weekly/Monthly OPEX (3 days!)

- 📅 December 19 - Quarterly triple witch

- 📅 End of 2025 - R2 validation builds expected to begin per Electrek

- 📅 Early 2026 - R2 pre-production units per Electrek

- 📅 February 20, 2026 - Monthly OPEX, expiration of this $1.7M put trade

- 📅 H1 2026 - R2 production launch (THE BIG CATALYST!)

- 📅 May 6, 2025 - Q1 2025 earnings report

- 📅 2027 - First VW vehicles using Rivian technology

- 📅 2028 - Georgia factory begins customer vehicle production

Final verdict: RIVN's long-term R2 story remains INCREDIBLY compelling - over 100K pre-orders at $45K price point, $5.8B VW partnership, $6.57B DOE loan, and proven cost reduction ($53K+ removed per vehicle). BUT, at $15 after achieving first gross profit with heavy reliance on regulatory credits, with R2 validation builds months away, the risk/reward is NO LONGER favorable for aggressive new positioning. The $1.7M institutional put buy is a CLEAR signal: smart money is derisking before R2 execution risk.

Be patient. Let R2 validation complete. Look for entry at $13-14 if any hiccups emerge. The EV revolution will still be here in 6 months, and you'll sleep better at night paying $13 instead of $15 with proof that R2 works.

This is a marathon, not a sprint. Protect your capital. 💪

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. This analysis is for educational purposes only and not financial advice. Past performance doesn't guarantee future results. The 2,261x unusual score reflects this specific trade's size relative to recent RIVN history - it does not imply the trade will be profitable or that you should follow it. Always do your own research and consider consulting a licensed financial advisor before trading. R2 launch creates binary event risk with potential for 15-20% moves either direction. The put buyer may have complex portfolio hedging needs not applicable to retail traders.

About Rivian Automotive: Rivian Automotive Inc is an automotive manufacturer that develops and builds electric vehicles (EVs) as well as software and services, with a market cap of $18.23 billion in the Motor Vehicles & Passenger Car Bodies industry.