RIO Unusual Options Report - August 14, 2025: $48M Mining Mega Trade

🌋 VOLCANIC ALERT! Someone just orchestrated $48 MILLION in RIO options trades across multiple strikes and expirations - this is institutional warfare! With the ex-dividend date TODAY and iron ore prices weak, this whale is playing a complex recovery strategy. The size and sophistication scream he...

🎯 The Quick Take

🌋 VOLCANIC ALERT! Someone just orchestrated $48 MILLION in RIO options trades across multiple strikes and expirations - this is institutional warfare! With the ex-dividend date TODAY and iron ore prices weak, this whale is playing a complex recovery strategy. The size and sophistication scream hedge fund positioning! ⛏️

Translation for us regular folks: When someone deploys $48M in options on ex-dividend day with a 16% dividend cut just announced, they're either hedging massive exposure or betting on a violent snapback. This is Olympic-level options trading!

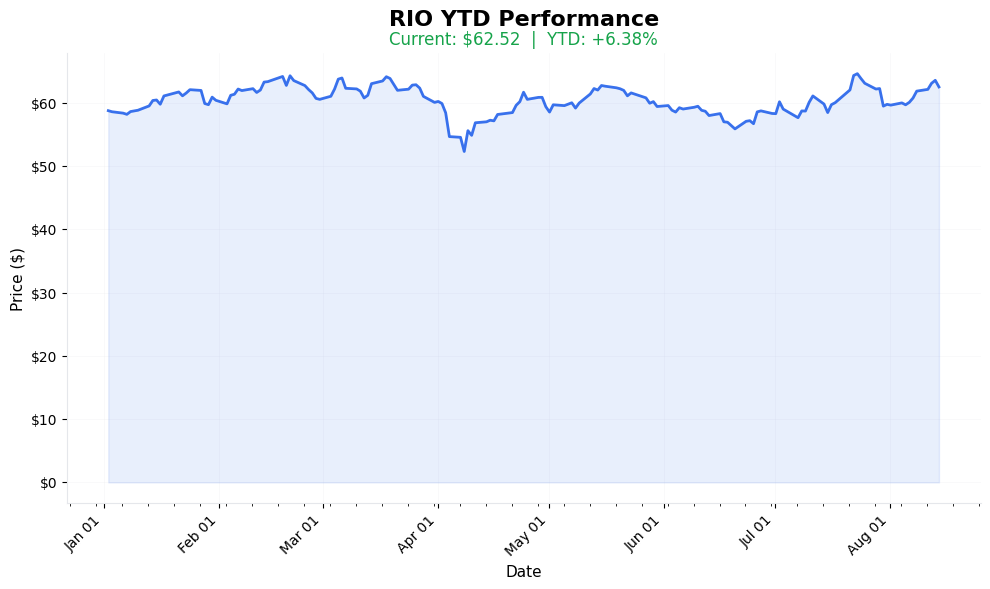

📈 YTD Performance

RIO Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: $48M Multi-Strike Madness!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 148,090 contracts | MASSIVE institutional flow! |

| Total Premium | $48.7M | Hedge fund warfare |

| Spot Price | $62.35 | Mid-range positioning |

| Strike Range | $52.5-$60 | Multiple levels |

| Expiries | Aug 15 & Sep 19 | Near & medium term |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟩🟩🟩⬜ 9/10 | EXTREME Activity |

🎬 The Actual Trade Tape

📊 Order Flow: Simultaneous multi-strike execution at 15:38:06

🎯 Execution: ASK/BID/MID mix (complex institutional strategy)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 15:38:06 | 🟢 BUY | 📈 CALL | $52.5 | 2025-08-15 | 78,000 | $23M | $62.35 | $9.90 |

| 15:38:06 | 🔴 SELL | 📈 CALL | $57.5 | 2025-09-19 | 27,000 | $9.7M | $62.35 | $4.80 |

| 15:38:06 | 🟢 BUY | 📈 CALL | $55 | 2025-09-19 | 25,000 | $13M | $62.35 | $7.40 |

| 15:38:06 | 🔴 SELL | 📈 CALL | $60 | 2025-08-15 | 75,000 | $3M | $62.35 | $2.32 |

⚡ Strategy Detection: DIVIDEND CAPTURE + RECOVERY PLAY

What This Means in Plain English:

- 🎯 DEEP ITM BUYS: $52.5 calls = synthetic stock

- 💰 CALENDAR SPREAD: Aug vs Sep positioning

- 📊 CALL SPREAD: Buying $55, selling $57.5

- ⏰ EX-DIV PLAY: Capturing adjusted price action

Translation: This is a sophisticated bet on RIO recovering from dividend-adjusted weakness while managing risk through spreads. Institutional-grade positioning!

🎯 What The Smart Money Knows

The Setup They're Playing:

The Ex-Dividend Dynamics:

- Stock dropped for $1.48 dividend payout

- 16% dividend cut (lowest since 2018)

- Mechanical price adjustment creates opportunity

- Oversold conditions after earnings miss

- Positioning for snapback rally

Why RIO? The Recovery Catalysts:

Key Highlights:

- 🏗️ Simandou Iron Ore (November 2025)

- World's largest untapped deposit

- Exports start November 2025

Additional Points: Game-changer for production;

Could add $10B+ revenue

;🔋 Copper Surge Coming

; Oyu Tolgoi mine ramping; 50% production increase 2025Plus 17 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want the bounce!"

- Play: $65 September calls

- Cost: ~$2.00 per contract

- Risk: -100% if below $65

- Reward: +300% if hits $70

- Position Size: 1% MAX

🏄 Swing Traders

"I'll ride the recovery"

- Play: Buy shares at $61-62

- Stop: $59

- Target: $68-70

- Position Size: 4-5% of account

💎 Premium Collectors

"I'll sell the fear"

- Play: Sell $60 puts for September

- Collect: $2.50 premium

- Risk: Assignment at $57.50

- Win If: Stock stays above $60

👶 Entry Level Investors

"Mining stocks confuse me"

- Play: Buy 25 shares for dividend

- Stop Loss: $59 (-5%)

- Target: $70 (+12%)

- Collect: 6.36% yield

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🇨🇳 China Weakness: No stimulus = pain

- 📉 Commodity Crash: Iron ore could fall further

- 💸 Dividend Cuts: More cuts possible

- 🌍 Global Recession: Demand destruction

- ⛏️ Execution Risk: Project delays

🎯 The Bottom Line

Real talk: This $48M options extravaganza on ex-dividend day is institutional chess:

1. Buying deep ITM calls for leverage

2. Selling OTM calls to finance

3. Playing dividend adjustment mechanics

4. Positioning for Simandou catalyst

5. Someone's betting on a violent recovery!

This is how hedge funds play oversold mining stocks!

📋 Your Action Checklist

✅ If Following: Watch for continuation patterns

✅ Set Alerts: $59 (support), $65 (resistance), $70 (target)

✅ Mark Calendar: Nov 2025 (Simandou), Sep 19 (OPEX)

✅ Watch For: China policy, iron ore prices, copper trends

✅ Risk Management: Commodities are volatile - use stops!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | RIO | Rio Tinto Group |

| Strategy | Complex Multi-Strike | Institutional play |

| Total Premium | $48.7M | Massive deployment |

| Contracts | 148,090 | Extreme volume |

| Strike Range | $52.5-$60 | Multiple levels |

| Spot Price | $62.35 | Mid-range |

| Key Expiries | Aug 15 & Sep 19 | Near & medium term |

| Ex-Dividend | Aug 14-15 | TODAY! |

| Dividend Cut | -16% | Bearish but priced in |

| 52-Week Range | $51.67-$72.08 | Near lows |

| Analyst Target | $73-80 | 20-30% upside |

| Risk Level | 🔥🔥🔥🔥⬜ (4/5) | High commodity risk |

🏷️ Tags for This Trade

Sector: #Mining #Commodities #Materials

Strategy Type: #ComplexSpread #DividendPlay

Catalyst: #ExDividend #Simandou #China

Risk Level: #HighRisk #Cyclical

Trader Types: #Institutional #HedgeFunds

⚠️ Disclaimer: This $48M options position represents sophisticated institutional positioning around ex-dividend mechanics and commodity cycles. Mining stocks face significant risks from China demand, commodity prices, and global growth. The complexity of this trade suggests professional management. This is education, not financial advice! ⛏️