Pillar Deep-Dive #5: TIMING — "Is Now a Good Time?"

Today we're diving into the TIMING pillar — the fifth and final pillar that powers Options Pilot. You found a cheap option with bullish flow... but you entered two days before FOMC. Here's how to never make that mistake again.

Subject Line: LNT has FOMC in 2 days. Here's what that means for your trade.

The Invisible Force That Kills Options Trades

You did everything right.

You found a stock with cheap IV. The sentiment was bullish. Liquidity was good.

You bought calls. Two days later, your position is down 20%.

What happened?

You ignored timing. There was an FOMC meeting two days away, and the IV crush after the event wiped out your gains.

This is the timing trap. The market doesn't care about your analysis if you enter at the wrong moment.

Why Timing Is Different From the Other Four Pillars

VALUE tells you if options are cheap. SENTIMENT tells you what traders are betting. ACTIVITY tells you if something unusual is happening. LIQUIDITY tells you if you can execute efficiently.

TIMING tells you whether to act NOW or WAIT.

It's the final gatekeeper. All other pillars can be green, but if timing is wrong, the trade fails.

The 4 Components of Options Timing

1. Event Proximity

Earnings, FOMC, CPI, and other macro events create IV spikes that crush option buyers after the event.

| Days to Event | Risk Level | Impact |

|---|---|---|

| >14 days | Low | Safe to enter |

| 7-14 days | Moderate | Consider the strategy |

| 3-7 days | High | Size down or wait |

| <3 days | Very High | Avoid buying premium |

2. Theta Decay (Time Erosion)

Options lose value every day. The closer to expiration, the faster the decay.

| DTE | Daily Theta | Buyer Impact | Seller Opportunity |

|---|---|---|---|

| 7 DTE | ~2.8%/day | High bleed | High premium |

| 14 DTE | ~1.8%/day | Medium bleed | Medium premium |

| 30 DTE | ~1.2%/day | Low bleed | Low premium |

| 45 DTE | ~0.9%/day | Minimal bleed | Sweet spot |

3. Term Structure

The shape of IV across expirations tells you where the market expects volatility.

- Contango: Far-dated options more expensive. Normal market. No event priced.

- Backwardation: Near-dated options more expensive. Event is priced in.

- Flat: Minimal slope. No clear signal.

4. Gamma/Pin Risk

Near expiration, options become sensitive to price moves. Large open interest at specific strikes creates "pinning" forces that pull the stock toward max pain.

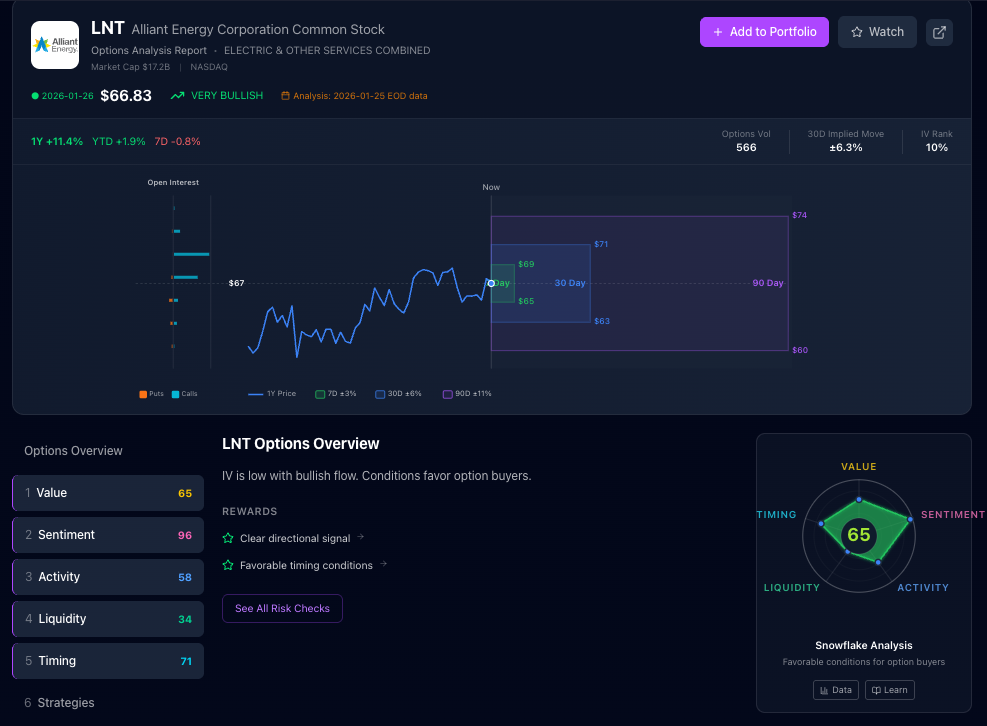

Real Example: LNT Today

Let's look at Alliant Energy (LNT) using Options Pilot:

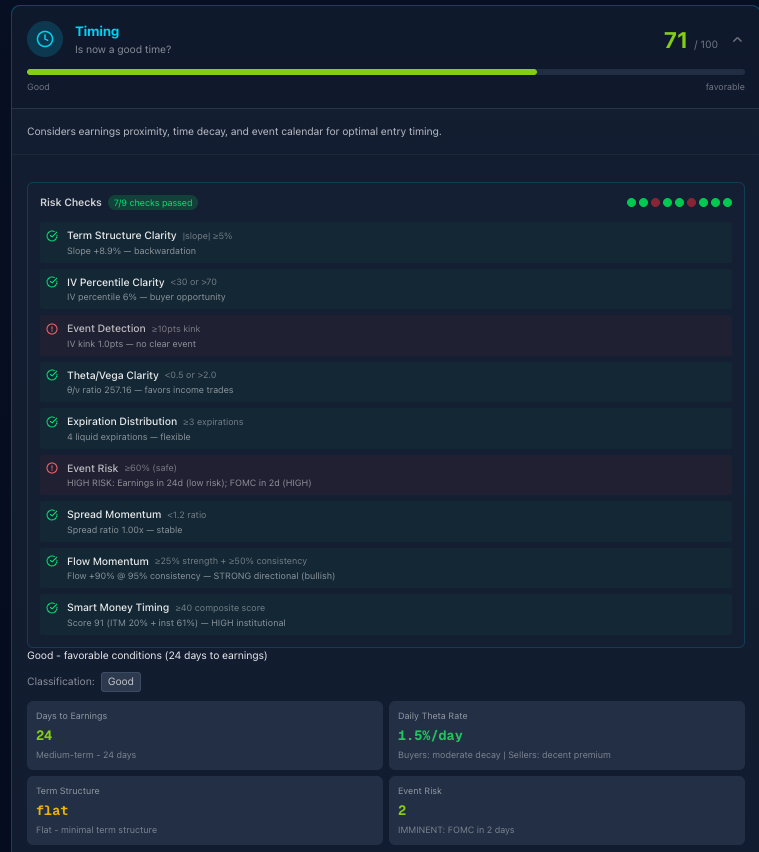

TIMING Score: 71/100 — Good. Favorable conditions for entry.

Here's what the 9 Risk Checks tell us:

| Check | Threshold | LNT | Status |

|---|---|---|---|

| Term Structure Clarity | |slope| ≥5% | +8.9% | ✅ Backwardation |

| IV Percentile Clarity | <30 or >70 | 6% | ✅ Buyer opportunity |

| Event Detection | ≥10pts kink | 1.0pts | ❌ No clear event |

| Theta/Vega Clarity | <0.5 or >2.0 | 257.16 | ✅ Favors income trades |

| Expiration Distribution | ≥3 expirations | 4 liquid | ✅ Flexible |

| Event Risk | ≥60% (safe) | HIGH RISK | ❌ FOMC in 2d |

| Spread Momentum | <1.2 ratio | 1.00x | ✅ Stable |

| Flow Momentum | ≥25% + ≥50% consistency | +90% @ 95% | ✅ STRONG directional (bullish) |

| Smart Money Timing | ≥40 composite | 91 | ✅ HIGH institutional |

7 of 9 checks passed.

Translation: LNT has excellent flow momentum and institutional activity. IV is very cheap (6th percentile = buyer opportunity). However, FOMC is in 2 days — that's event risk to consider.

Classification: Good — favorable conditions (24 days to earnings)

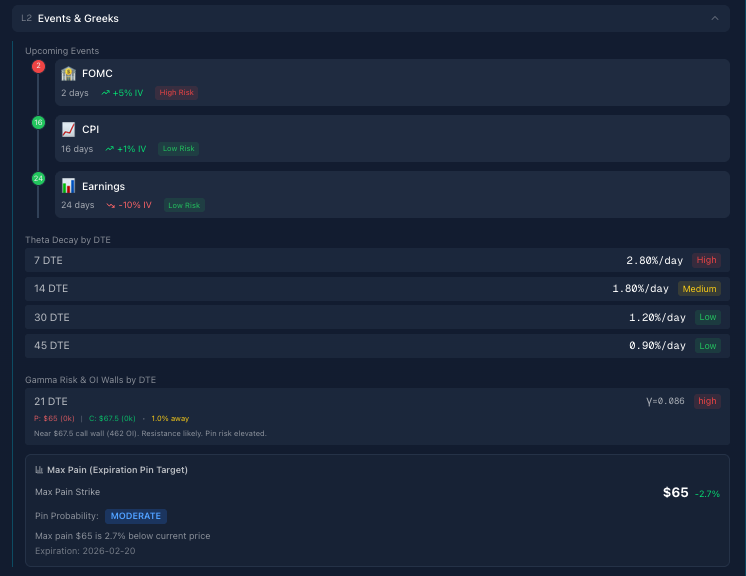

The Events & Greeks: Where It Gets Interesting

Upcoming Events

| Event | Days Away | IV Impact | Risk Level |

|---|---|---|---|

| FOMC | 2 days | +5% IV | High Risk |

| CPI | 16 days | +1% IV | Low Risk |

| Earnings | 24 days | -10% IV | Low Risk |

The insight: FOMC in 2 days is the primary timing concern. After FOMC, IV typically drops 5-10%. If you're buying premium, this is a headwind.

Theta Decay by DTE

| DTE | Daily Theta | Acceleration |

|---|---|---|

| 7 DTE | 2.80%/day | High |

| 14 DTE | 1.80%/day | Medium |

| 30 DTE | 1.20%/day | Low |

| 45 DTE | 0.90%/day | Low |

The math: At 7 DTE, you're losing 2.8% of your option's value every day just from time decay. At 30+ DTE, that drops to ~1% — much more survivable.

Gamma Risk & OI Walls

| DTE | Put Wall | Call Wall | Distance | Gamma Risk |

|---|---|---|---|---|

| 21 DTE | $65 (0k) | $67.5 (462 OI) | 1.0% away | High |

Max Pain: $65 — 2.7% below current price.

Pin Probability: MODERATE — Max pain $65 is close to current price. Near expiration, the stock may gravitate toward this level.

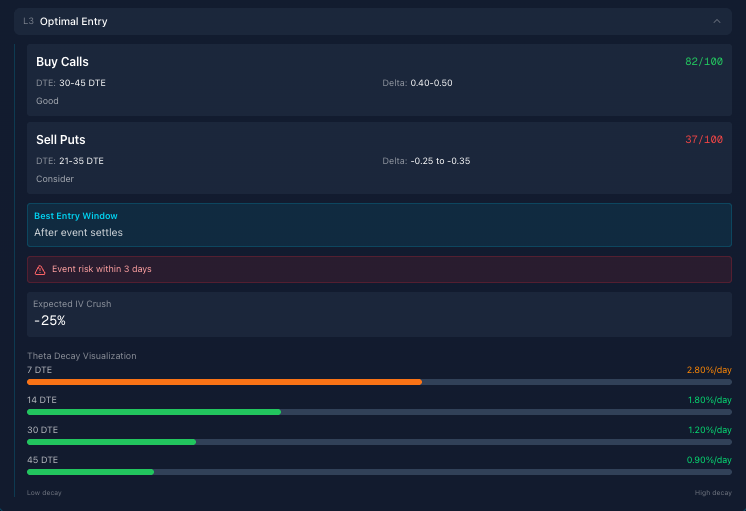

The Optimal Entry: When to Pull the Trigger

Best Entry Window: After event settles

Event risk within 3 days — FOMC is imminent.

Strategy-Specific Timing

| Strategy | Best DTE | Best Delta | Current Score | Recommendation |

|---|---|---|---|---|

| Buy Calls | 30-45 DTE | 0.40-0.50 | 82/100 | Good |

| Sell Puts | 21-35 DTE | -0.25 to -0.35 | 37/100 | Consider |

| Iron Condor | 30-45 DTE | ±0.15 | -- | Wait |

Theta Decay Visualization

The chart shows theta acceleration by DTE:

- 7 DTE: Steep decay (2.80%/day) — avoid buying here

- 14 DTE: Moderate decay (1.80%/day) — workable

- 30+ DTE: Gentle decay (0.90-1.20%/day) — optimal for buyers

Expected IV Crush: -25%

After earnings or major events, expect IV to drop approximately 25%. If you buy calls now, factor this into your target.

The Strategy Suggestions

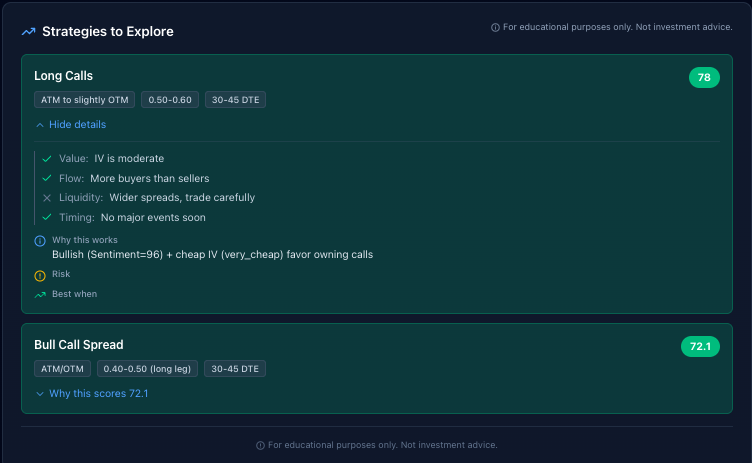

Long Calls: 78/100

- ATM to slightly OTM | Delta 0.50-0.60 | 30-45 DTE

- ✅ Value: IV is moderate

- ✅ Flow: More buyers than sellers

- ✗ Liquidity: Wider spreads, trade carefully

- ✅ Timing: No major events soon

Why this works: Bullish (Sentiment=96) + cheap IV (very_cheap) favor owning calls.

Bull Call Spread: 72.1/100

- ATM/OTM | Delta 0.40-0.50 (long leg) | 30-45 DTE

- Defined risk alternative to naked long calls.

The Simple Framework

Here's how to use TIMING in your trading:

| TIMING Score | What It Means | What To Do |

|---|---|---|

| 80-100 | Optimal | Enter now, ideal conditions |

| 60-79 | Good | Enter with awareness of event risk |

| 40-59 | Acceptable | Consider waiting or adjust strategy |

| 20-39 | Risky | Wait for better timing |

| 0-19 | Poor | Do not enter |

LNT at 71? Good timing. The flow is excellent, IV is cheap, but FOMC in 2 days means you should either:

- Wait until after FOMC to enter

- Go further out in time (45+ DTE) to reduce IV crush impact

- Use a defined-risk strategy like a bull call spread

The Buyer vs. Seller Framework

TIMING isn't one-size-fits-all. What's bad for buyers is often good for sellers:

| Condition | Buyer Impact | Seller Impact |

|---|---|---|

| Event in 2 days | ❌ IV crush risk | ✅ High premium |

| High theta decay | ❌ Time bleed | ✅ Time decay profit |

| Backwardation | ❌ Near-term expensive | ✅ Rich front month |

| Low IV percentile | ✅ Cheap entry | ❌ Low premium |

LNT's Dual Score:

- Buyer Timing: Favorable (cheap IV, strong flow, but FOMC risk)

- Seller Timing: Moderate (can sell post-event when IV is still elevated)

The interpretation: "Buyers: moderate decay | Sellers: decent premium"

Why Waiting Is Sometimes the Best Trade

Here's what happens when you ignore timing:

Scenario: You're right on direction, wrong on timing

- You buy LNT calls Monday (2 days before FOMC)

- IV is 6th percentile — great value

- FOMC happens Wednesday, no surprise

- IV drops 5-10% across the board

- Stock is flat, your calls are down 15%

- Result: Loss despite being right about direction

The fix: Wait until Thursday (after FOMC). Enter at lower IV, but without the crush risk.

The Timing Checklist

Before every options trade, ask:

- What events are within 7 days? (Earnings, FOMC, CPI)

- What's my DTE? (<14 DTE = accelerated decay)

- What's the term structure? (Backwardation = event priced)

- Am I buying or selling? (Events hurt buyers, help sellers)

- Where's max pain? (Pin risk near expiration)

If timing shows red flags:

- Wait for the event to pass

- Go further out in time (30-45 DTE)

- Use defined-risk strategies

- Consider selling premium instead of buying

Get the Full Picture

TIMING is one of five pillars we analyze:

- VALUE — Are options cheap or expensive?

- SENTIMENT — What are traders betting?

- ACTIVITY — Is something unusual happening?

- LIQUIDITY — Can you trade efficiently?

- TIMING — Is now the right moment? ← You are here

We score 4,000+ stocks across all five pillars. Every trading day.

Stop Getting Crushed by Events

Every poorly-timed entry is money left on the table — or worse, money lost.

If you want:

- Event calendars showing earnings, FOMC, CPI proximity

- Theta decay curves by DTE

- Clear "wait" signals when timing is poor

- Buyer vs. seller timing scores

Join the Options Pilot waitlist: