Pillar Deep-Dive #4: LIQUIDITY — "Can I Trade This Efficiently?"

Today we're diving into the LIQUIDITY pillar — the fourth of our five pillars that power Options Pilot. A great trade idea means nothing if you can't execute it efficiently. Wide spreads and thin order books can turn winners into losers before you even start.

Subject Line: UNP has an 11.5% bid-ask spread. Here's what that costs you.

The Hidden Tax Nobody Talks About

You found a great setup. The VALUE is there. The SENTIMENT is bullish.

You buy calls. The stock moves in your favor.

But when you try to exit... you realize you're down 15% even though the stock went up.

What happened?

You traded an illiquid option. The bid-ask spread ate your profit.

This is the hidden tax that destroys retail traders — and most platforms don't even show you the data to avoid it.

Why Liquidity Matters More Than You Think

The bid-ask spread is the price you pay to enter AND exit a trade.

Let's do the math on UNP:

- ATM Spread: 11.51%

- You buy at the ask, sell at the bid

- Round-trip cost: ~11.51% just in spread

- Add slippage for larger orders: another 5-10%

That means you need UNP to move 15-20% just to break even.

This is why professionals obsess over liquidity. It's not glamorous. But it's the difference between making money and donating it to market makers.

The 4 Components of Options Liquidity

Most traders only look at volume. That's a mistake.

Real liquidity comes from four factors:

1. Bid-Ask Spread

The tighter the spread, the less you lose on entry/exit.

| Spread | Quality | Impact |

|---|---|---|

| <1% | Excellent | Minimal cost |

| 1-2% | Good | Acceptable |

| 2-5% | Moderate | Use limit orders |

| 5-10% | Poor | Significant drag |

| >10% | Very Poor | Avoid or size down |

UNP: 11.51% — Very wide. Difficult execution.

2. Open Interest (OI)

More open contracts = more counterparties = easier fills.

| OI | Quality |

|---|---|

| >1M | Excellent |

| 100K-1M | Good |

| 10K-100K | Moderate |

| <10K | Thin |

UNP: 93K — Adequate, but not deep.

3. Daily Volume

Higher volume = more activity = better price discovery.

| Volume | Quality |

|---|---|

| >500K | Excellent |

| 100K-500K | Good |

| 10K-100K | Moderate |

| <10K | Thin |

UNP: 6.1K — Low daily activity.

4. Order Book Depth

How many contracts sit at the bid/ask? Thin books mean slippage on larger orders.

UNP: 130 bid / 101 ask — Adequate for small orders, problematic for size.

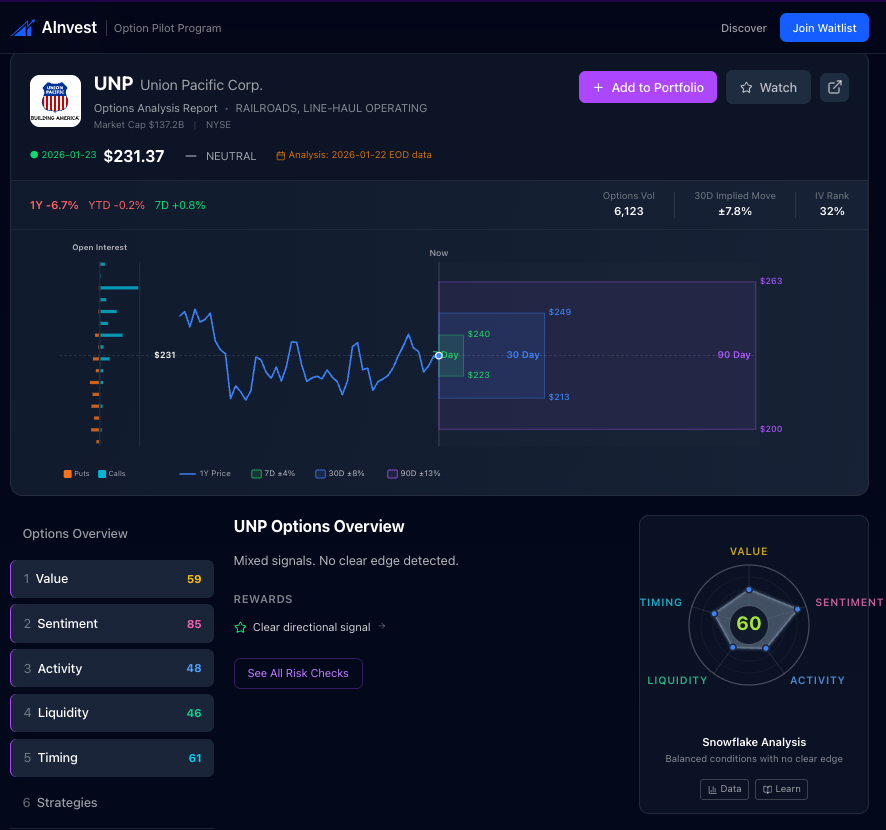

Real Example: UNP Today

Let's look at Union Pacific (UNP) using Options Pilot:

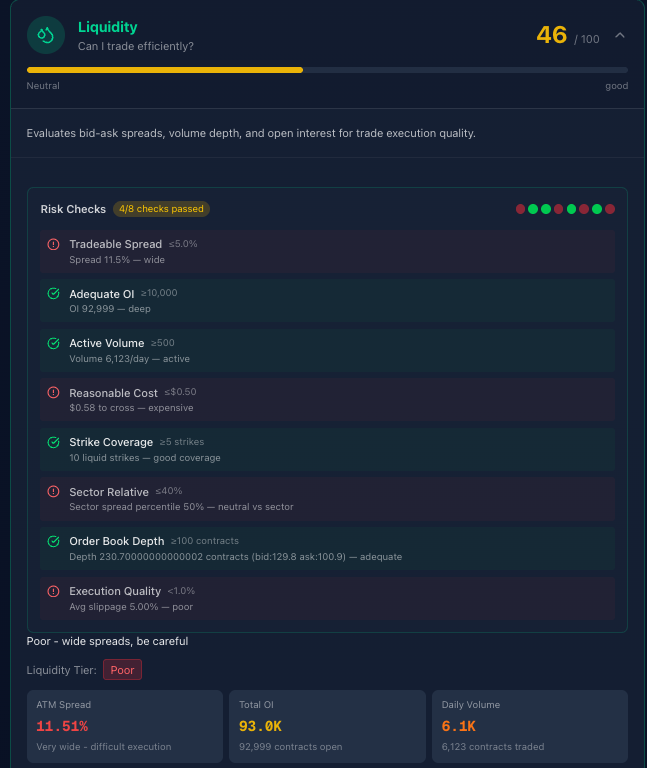

LIQUIDITY Score: 46/100 — Poor. Wide spreads, be careful.

Here's what the 8 Risk Checks tell us:

| Check | Threshold | UNP | Status |

|---|---|---|---|

| Tradeable Spread | ≤5.0% | 11.5% | ❌ Wide |

| Adequate OI | ≥10,000 | 92,999 | ✅ Deep |

| Active Volume | ≥500/day | 6,123 | ✅ Active |

| Reasonable Cost | ≤$0.50 | $0.58 | ❌ Expensive |

| Strike Coverage | ≥5 strikes | 10 liquid | ✅ Good |

| Sector Relative | ≤40% | 50% | ❌ Neutral vs sector |

| Order Book Depth | ≥100 contracts | 230 | ✅ Adequate |

| Execution Quality | <1.0% | 5.00% | ❌ Poor |

Only 4 of 8 checks passed.

Liquidity Tier: Poor

Translation: UNP has enough open interest and volume to trade, but the wide spreads make execution expensive. Every trade starts at a disadvantage.

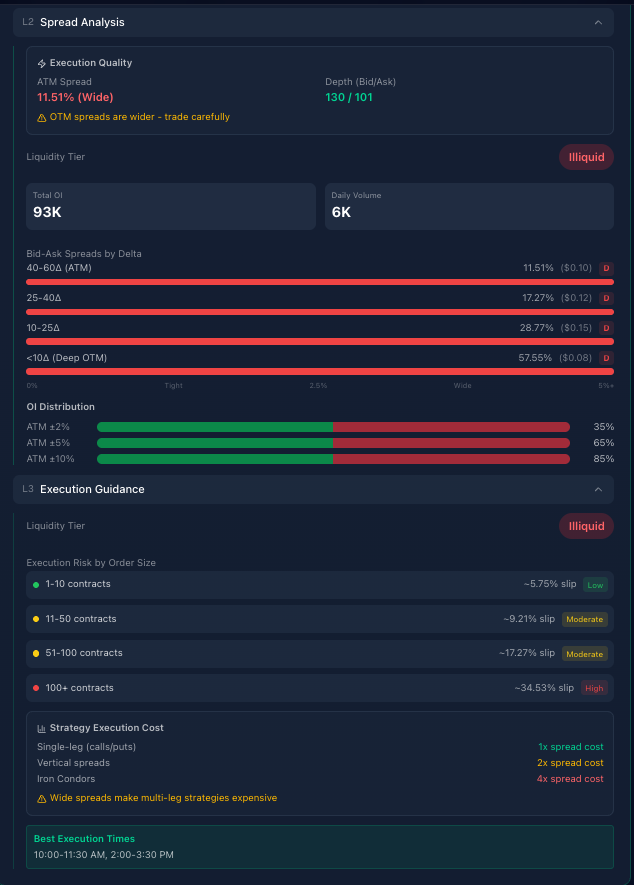

The Spread Analysis: Where It Gets Expensive

Spreads by Delta (Moneyness)

| Delta Range | Spread | Cost to Cross | Grade |

|---|---|---|---|

| 40-60Δ (ATM) | 11.51% | $0.10 | D |

| 25-40Δ | 17.27% | $0.12 | D |

| 10-25Δ | 28.77% | $0.15 | D |

| <10Δ (Deep OTM) | 57.55% | $0.08 | D |

The insight: Spreads widen dramatically as you move away from ATM. Deep OTM options have 57% spreads — essentially untradeable.

OI Distribution

| Strike Range | % of Chain |

|---|---|

| ATM ±2% | 35% |

| ATM ±5% | 65% |

| ATM ±10% | 85% |

Translation: Most liquidity is concentrated near ATM. Going further out = worse execution.

Execution Guidance: The Real Cost

Slippage by Order Size

| Order Size | Est. Slippage | Execution Risk |

|---|---|---|

| 1-10 contracts | ~5.75% | Low |

| 11-50 contracts | ~9.21% | Moderate |

| 51-100 contracts | ~17.27% | Moderate |

| 100+ contracts | ~34.53% | High |

The math is brutal: If you try to trade 100 contracts, expect 17-35% slippage on top of the spread.

Strategy Execution Cost

| Strategy | Legs | Spread Cost |

|---|---|---|

| Single-leg (calls/puts) | 1 | 1x spread |

| Vertical spreads | 2 | 2x spread |

| Iron Condors | 4 | 4x spread |

Warning: Wide spreads make multi-leg strategies expensive.

With UNP's 11.51% ATM spread:

- Vertical spread: ~23% round-trip cost

- Iron Condor: ~46% round-trip cost

At that cost, the strategy needs to be nearly perfect to profit.

Best Execution Times

Trade during: 10:00-11:30 AM, 2:00-3:30 PM

Avoid: First 15 minutes, Last 15 minutes (widest spreads, most volatile)

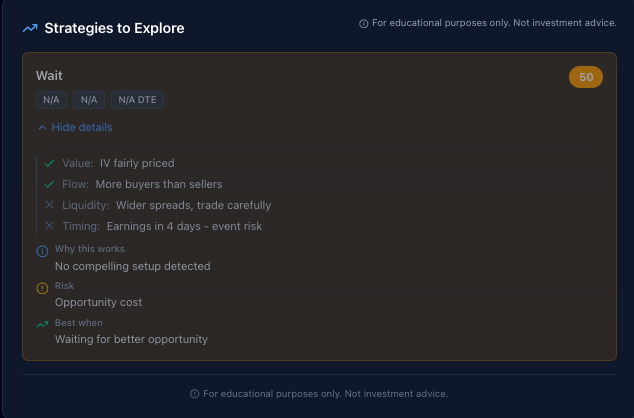

The Strategy Recommendation: WAIT

Strategy: Wait (Score: 50)

Why:

- ✅ Value: IV fairly priced

- ✅ Flow: More buyers than sellers

- ❌ Liquidity: Wider spreads, trade carefully

- ❌ Timing: Earnings in 4 days — event risk

"No compelling setup detected"

The liquidity warning is critical: Even if the setup looks good on other metrics, the wide spreads make efficient execution difficult.

The Simple Framework

Here's how to use LIQUIDITY in your trading:

| LIQUIDITY Score | Spread Quality | What To Do |

|---|---|---|

| 80-100 | Excellent (<1%) | Trade freely, market orders OK |

| 60-79 | Good (1-2%) | Normal trading, limit orders preferred |

| 40-59 | Moderate (2-5%) | Use limit orders, be patient |

| 20-39 | Poor (5-10%) | Size down, wide limits, or avoid |

| 0-19 | Illiquid (>10%) | Experienced traders only |

UNP at 46? Poor liquidity. If you must trade, use limit orders and expect slippage. Better yet, find a more liquid alternative.

Why Poor Liquidity = Poor Trades

Here's what happens when you ignore liquidity:

Scenario: You're right on direction, wrong on execution

- You buy UNP calls at $2.00 (the ask)

- The stock moves 3% in your favor

- Your calls are now worth $2.20 theoretically

- But the bid is only $1.90 (11.5% spread)

- You sell at $1.90

- Result: -5% loss despite being right

This happens every day to traders who don't check liquidity first.

What Good Liquidity Looks Like

For comparison, here's what a LIQUIDITY score of 80+ looks like:

- ATM Spread: <1% (not 11.5%)

- Daily Volume: 100K+ (not 6K)

- OI: 500K+ (not 93K)

- Slippage: <1% for 100 contracts (not 17%)

Stocks like AAPL, SPY, QQQ, NVDA have this kind of liquidity. UNP doesn't.

The Liquidity Checklist

Before every options trade, ask:

- What's the ATM spread? (>5% = caution, >10% = avoid)

- What's the daily volume? (<10K = thin)

- What's the OI? (<10K = limited counterparties)

- How does slippage scale? (Check execution guidance)

- Is my strategy multi-leg? (Multiply spread cost by legs)

If liquidity fails these checks, either:

- Find a more liquid alternative

- Size down significantly

- Use very wide limit orders and be patient

- Skip the trade entirely

Get the Full Picture

LIQUIDITY is one of five pillars we analyze:

- VALUE — Are options cheap or expensive?

- SENTIMENT — What are traders betting?

- ACTIVITY — Is something unusual happening?

- LIQUIDITY — Can you trade efficiently? ← You are here

- TIMING — Is now the right moment?

We score 4,000+ stocks across all five pillars. Every trading day.

Stop Donating to Market Makers

Every wide spread is a transfer from your account to theirs.

If you want:

- ATM spread data before you trade

- Slippage estimates by order size

- Execution guidance and best trading windows

- Clear warnings when liquidity is poor

Join the Options Score waitlist: