NVAX Unusual Options Report - August 14, 2025: $1.5M Biotech Squeeze Setup

⚡ VERY HIGH ALERT! Someone just bought $1.5 million in NVAX calls expiring TOMORROW - deep in the money at $6 strike with stock at $9.07! After crushing Q2 earnings with a 608% revenue surge and Sanofi partnership milestones, this whale is playing expiration day mechanics. This is surgical precis...

🎯 The Quick Take

⚡ VERY HIGH ALERT! Someone just bought $1.5 million in NVAX calls expiring TOMORROW - deep in the money at $6 strike with stock at $9.07! After crushing Q2 earnings with a 608% revenue surge and Sanofi partnership milestones, this whale is playing expiration day mechanics. This is surgical precision trading! 💉

Translation for us regular folks: When someone spends $1.5M on options expiring in 24 hours that are already $3 in the money, they're either exercising for shares or know something immediate. This isn't speculation - it's positioning!

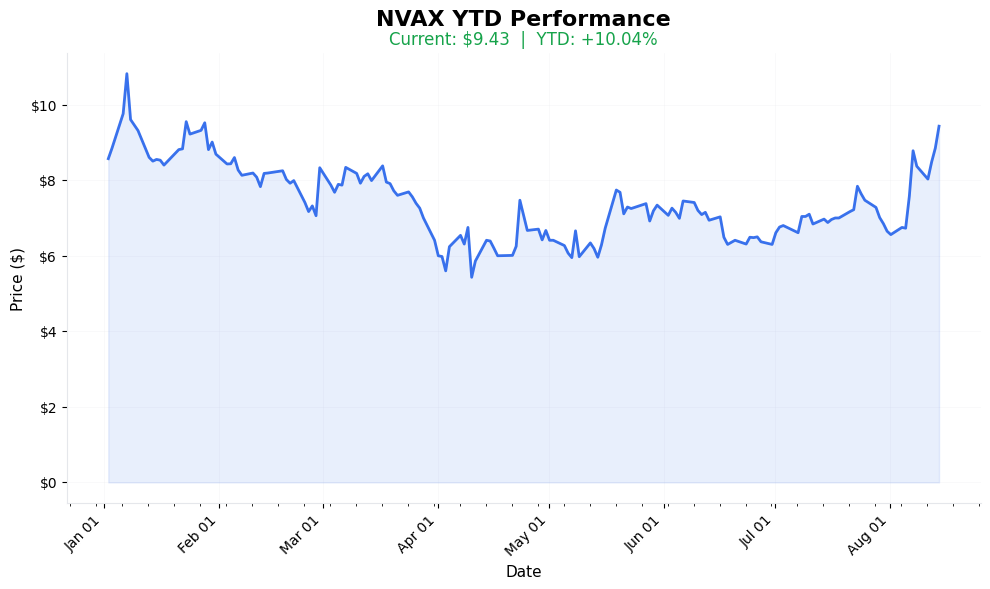

📈 YTD Performance

NVAX Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: Tomorrow's Expiry Madness!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 5,000 contracts | Large institutional block! |

| Total Premium | $1.5M | Serious capital at risk |

| Spot Price | $9.07 | Well above strike |

| Strike Price | $6.00 | Deep ITM ($3.07 cushion) |

| Days to Expiry | 1 day | EXPIRES TOMORROW! |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟩🟨⬜⬜ 7.5/10 | Extreme Timing |

🎬 The Actual Trade Tape

📊 Order Flow: Single block at 12:52

🎯 Execution: BUY at ASK (urgent!)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 12:52:00 | 🟢 BUY | 📈 CALL | $6 | 2025-08-15 | 5,000 | $1.5M | $9.07 | $3.05 |

⚡ Strategy Detection: EXERCISE PLAY OR NEWS ANTICIPATION

What This Means in Plain English:

- 🎯 DEEP ITM: $3.07 intrinsic value (all real value!)

- 💰 NO TIME VALUE: Actually -$0.02 (below intrinsic)

- 📊 TOMORROW EXPIRY: Maximum urgency

- ⏰ OPEN INTEREST: 15,000 existing = liquidity

Translation: This is either preparing to exercise for 500,000 shares or positioning for immediate news. The negative time value suggests arbitrage or conversion strategy!

🎯 What The Smart Money Knows

The Setup They're Playing:

Why Deep ITM Expiring Tomorrow?

- Exercise for shares without moving market

- Arbitrage between options and stock

- Positioning for weekend news

- Tax-efficient stock acquisition

- Avoiding slippage on large buy

Why NVAX? The Turnaround Story:

Key Highlights:

- 📊 Q2 Earnings Explosion

- Revenue: $239.2M vs $156M expected (+53% beat!)

- EPS: $0.62 vs -$0.06 expected (profitable!)

Additional Points: Net income: $107M (turned profitable);

Stock surged 18% on results

;💰 Sanofi Partnership Gold Mine

; $175M FDA milestone received; $50M more milestones pendingPlus 20 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want the squeeze!"

- Play: $10 weekly calls (if available)

- Cost: ~$0.20 per contract

- Risk: -100% if below $10

- Reward: +500% on squeeze

- Position Size: 0.5% MAX

🏄 Swing Traders

"I'll ride the turnaround"

- Play: Buy shares at $9

- Stop: $8

- Target: $12-15

- Position Size: 3-4% of account

💎 Premium Collectors

"I'll sell volatility"

- Play: Sell $8 puts for September

- Collect: $0.50 premium

- Risk: Assignment at $7.50

- Win If: Stock stays above $8

👶 Entry Level Investors

"Biotech comeback story?"

- Play: Start small with 25 shares

- Stop Loss: $8 (-12%)

- Target: $12 (+32%)

- Time Frame: 3-6 months

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 💉 Vaccine Competition: Big pharma rivals

- 📉 Biotech Volatility: Can swing 20% daily

- 🦠 COVID Fatigue: Market exhaustion

- 💸 Dilution History: Past share offerings

- 🎯 Execution Risk: Turnaround not guaranteed

🎯 The Bottom Line

Real talk: This $1.5M deep ITM call purchase expiring tomorrow is extreme:

1. All intrinsic value = not speculation

2. Negative time value = arbitrage signal

3. After massive earnings beat

4. Sanofi milestones flowing

5. Someone wants 500,000 shares NOW!

This is either brilliant positioning or insider confidence!

📋 Your Action Checklist

✅ If Following: Watch for exercise/assignment activity

✅ Set Alerts: $8 (support), $10 (resistance), $12 (breakout)

✅ Mark Calendar: Tomorrow expiry, Q3 earnings coming

✅ Watch For: Sanofi updates, FDA news, bird flu developments

✅ Risk Management: Biotech = volatile, respect position sizes!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | NVAX | Novavax Inc. |

| Strategy | Deep ITM Calls | Exercise/arbitrage play |

| Premium | $1.5M total | Large commitment |

| Contracts | 5,000 | Block trade |

| Strike | $6.00 | Deep ITM |

| Spot Price | $9.07 | $3.07 above strike |

| Expiration | Aug 15, 2025 | TOMORROW! |

| Intrinsic Value | $3.07 | All real value |

| Time Value | -$0.02 | Below intrinsic! |

| Q2 Revenue Beat | +53% | Massive surprise |

| Short Interest | 26.52% | Squeeze potential |

| P/E Ratio | 2.47 | Extremely cheap |

| Risk Level | 🔥🔥🔥🔥⬜ (4/5) | High biotech risk |

🏷️ Tags for This Trade

Sector: #Biotech #Vaccines

Strategy Type: #DeepITM #ExpiryPlay

Catalyst: #Earnings #Partnership

Risk Level: #HighRisk #Turnaround

Trader Types: #Institutional #Arbitrage

⚠️ Disclaimer: Same-day expiration deep ITM calls represent sophisticated positioning, likely for exercise or arbitrage. While NVAX has shown remarkable turnaround with Sanofi partnership and earnings beats, biotech stocks remain volatile. The 26.52% short interest adds squeeze potential but also reflects skepticism. This is education, not financial advice! 💉