MGA Unusual Options Report - August 14, 2025: $11M Auto Sector Whale

🌋 VOLCANIC ALERT! Someone just dropped $11 MILLION on deep ITM MGA calls - that's like buying a fleet of luxury cars! With 53,400 contracts at $27.50 strike (stock at $44.61), this is either brilliant institutional hedging or someone positioning for major EV news. The sheer size is mind-blowing! 🚗⚡

🎯 The Quick Take

🌋 VOLCANIC ALERT! Someone just dropped $11 MILLION on deep ITM MGA calls - that's like buying a fleet of luxury cars! With 53,400 contracts at $27.50 strike (stock at $44.61), this is either brilliant institutional hedging or someone positioning for major EV news. The sheer size is mind-blowing! 🚗⚡

Translation for us regular folks: When someone controls $238 million worth of stock through $11M in options, they're not gambling - they're positioning for something BIG. This is whale-level conviction!

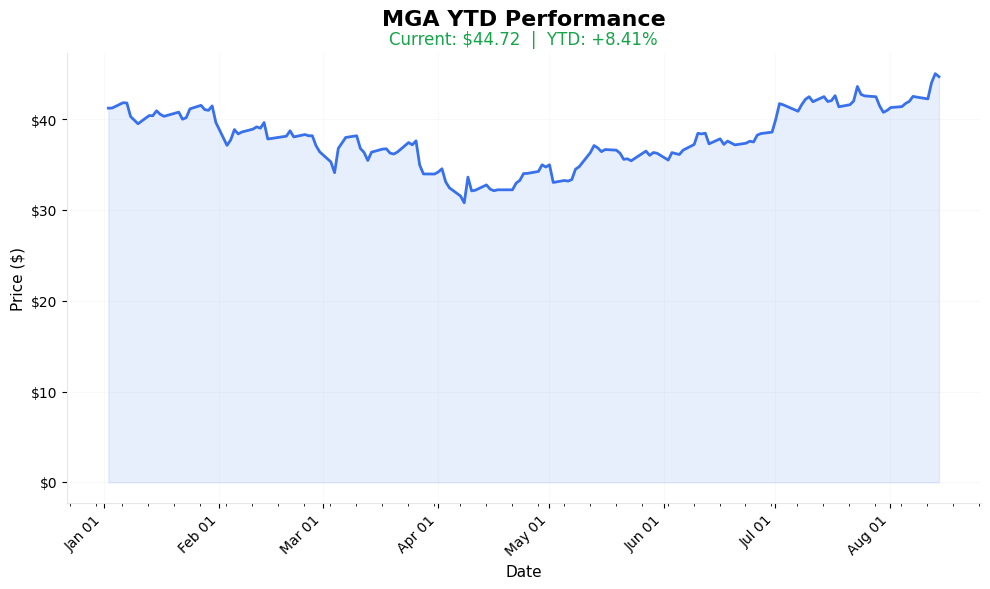

📈 YTD Performance

MGA Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: $11 Million Call Wall!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 53,400 contracts | MASSIVE institutional flow! |

| Total Premium | $11.0M | Hedge fund level capital |

| Spot Price | $44.61 | Well above strike |

| Strike Price | $27.50 | Deep ITM ($17 cushion!) |

| Days to Expiry | 36 days | September 19 expiration |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟩🟩🟩🟩 10/10 | VOLCANIC Activity! |

🎬 The Actual Trade Tape

📊 Order Flow: Multiple waves from 14:23-14:29

🎯 Execution: ASK and MID (aggressive accumulation)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 14:24:25 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 1,600 | $1.4M | $44.61 | $17.20 |

| 14:23:48 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 800 | $1.4M | $44.61 | $17.20 |

| 14:28:57 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 6,400 | $821K | $44.61 | $17.10 |

| 14:28:54 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 5,900 | $821K | $44.61 | $17.10 |

| 14:28:23 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 3,000 | $821K | $44.61 | $17.10 |

| 14:28:29 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 3,500 | $821K | $44.61 | $17.10 |

| 14:28:33 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 4,000 | $821K | $44.61 | $17.10 |

| 14:29:26 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 8,300 | $821K | $44.61 | $17.10 |

| 14:29:13 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 7,800 | $821K | $44.61 | $17.10 |

| 14:28:12 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 2,100 | $821K | $44.61 | $17.10 |

| 14:29:08 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 7,400 | $821K | $44.61 | $17.10 |

| 14:28:16 | 🟢 BUY | 📈 CALL | $27.5 | 2025-09-19 | 2,600 | $821K | $44.61 | $17.10 |

⚡ Strategy Detection: INSTITUTIONAL ACCUMULATION

What This Means in Plain English:

- 🎯 DEEP ITM: 99% delta = synthetic stock position

- 💰 MINIMAL TIME VALUE: $0.04 = not speculation

- 📊 CONVERSION PLAY: Likely delta hedging or arb

- ⏰ SEPTEMBER OPEX: Key institutional roll date

Translation: This isn't retail gambling - it's sophisticated institutional positioning using options for leverage and capital efficiency!

🎯 What The Smart Money Knows

The Setup They're Playing:

Why Deep ITM Calls?

- Acts like stock (99% delta)

- Less capital required than shares

- Potential tax advantages

- Flexibility for rolling/adjusting

- Leverage without margin

Why MGA? The EV Revolution:

Key Highlights:

- 📊 Q2 Earnings Crush

- EPS: $1.44 vs $1.19 expected (+21% beat!)

- Revenue: $10.82B beat by $720M

Additional Points: Free cash flow: $301M (+$178M YoY);

Margins expanding despite headwinds

;⚡ EV Transformation Leader

; $4.5B EV revenue target by 2025; Mercedes eDS Duo partnershipPlus 21 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want the EV moonshot!"

- Play: $50 October calls

- Cost: ~$0.80 per contract

- Risk: -100% if below $50

- Reward: +300% if hits $55

- Position Size: 2% MAX

🏄 Swing Traders

"I'll follow the whale"

- Play: Buy shares at $44-45

- Stop: $42

- Target: $50-52

- Position Size: 5-7% of account

💎 Premium Collectors

"I'll sell puts for income"

- Play: Sell $42 October puts

- Collect: $1.20 premium

- Risk: Assignment at $40.80

- Win If: Stock stays above $42

👶 Entry Level Investors

"Auto parts are boring but profitable"

- Play: Buy 25-50 shares

- Stop Loss: $42 (-6%)

- Target: $50 (+12%)

- Collect: 4.28% dividend

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🚗 Auto Cycle: Cyclical industry risk

- 💸 Tariff Exposure: $200M impact (90% hedged)

- 📉 Revenue Decline: -3% YoY in Q2

- 🏭 Capital Intensive: EV transition costs

- 🎯 Customer Concentration: GM is 15.4% of revenue

🎯 The Bottom Line

Real talk: This $11M deep ITM call position screams institutional confidence:

1. Controls $238M in stock value

2. Minimal time premium = not speculation

3. September OPEX positioning

4. EV transformation undervalued

5. Someone's accumulating ahead of catalysts!

This is how smart money builds positions without moving the market!

📋 Your Action Checklist

✅ If Following: Watch for continuation buying

✅ Set Alerts: $42 (support), $47 (resistance), $50 (breakout)

✅ Mark Calendar: Sep 19 OPEX, Oct 31 earnings

✅ Watch For: EV partnership news, auto sales data

✅ Risk Management: Auto stocks are cyclical - respect stops!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | MGA | Magna International |

| Strategy | Deep ITM Calls | Institutional accumulation |

| Premium | $11.0M total | Whale-sized position |

| Contracts | 53,400 | Massive volume |

| Strike | $27.50 | Deep ITM ($17 below spot) |

| Spot Price | $44.61 | Well above strike |

| Expiration | Sep 19, 2025 | 36 days out |

| Intrinsic Value | $17.11 | 99.8% of premium |

| Time Value | $0.04 | Minimal speculation |

| Delta | ~0.99 | Stock replacement |

| P/E Ratio | 10.56 | Value territory |

| Dividend Yield | 4.28% | Income + growth |

| Risk Level | 🔥🔥🔥⬜⬜ (3/5) | Moderate |

🏷️ Tags for This Trade

Sector: #Automotive #EVs #AutoParts

Strategy Type: #DeepITM #Institutional

Catalyst: #EVTransition #Earnings

Risk Level: #Moderate #ValuePlay

Trader Types: #Institutional #SmartMoney

⚠️ Disclaimer: While deep ITM calls suggest institutional positioning rather than speculation, auto sector stocks face cyclical risks and EV transition uncertainties. The $11M position represents sophisticated positioning but doesn't guarantee future performance. September OPEX can cause volatility. This is education, not financial advice! 🚗