KSS Unusual Options Report - August 14, 2025: $1.1M Retail Rally Spread

🔥 EXTREME ALERT! Someone just deployed $1.1 million on a KSS call spread betting on a massive rally! With 49% short interest (that's INSANE!) and earnings coming August 27, this whale is positioning for either an earnings beat or epic short squeeze. The stock needs to rally 15% just to breakeven ...

🎯 The Quick Take

🔥 EXTREME ALERT! Someone just deployed $1.1 million on a KSS call spread betting on a massive rally! With 49% short interest (that's INSANE!) and earnings coming August 27, this whale is positioning for either an earnings beat or epic short squeeze. The stock needs to rally 15% just to breakeven - someone's swinging for the fences! 🚀

Translation for us regular folks: When a stock has HALF its float shorted and someone bets $1M on calls before earnings, they're playing the squeeze game. This is meme stock territory!

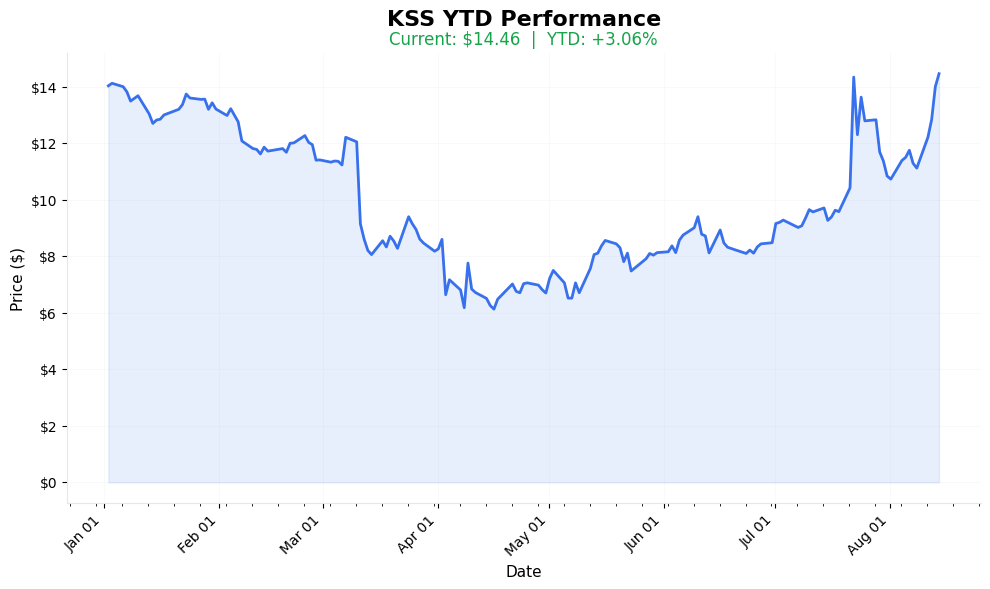

📈 YTD Performance

KSS Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: Million Dollar Call Spread!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Strategy | Call Spread | Defined risk bullish bet |

| Net Premium | $1.08M | Serious conviction capital |

| Max Profit | $11.4M | 10x potential return! |

| Spot Price | $13.81 | Below breakeven |

| Breakeven | $15.86 | Need 14.8% move |

| Days to Expiry | 35 days | September 19 expiration |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟨⬜⬜⬜ 6/10 | Very High Activity |

🎬 The Actual Trade Tape

📊 Order Flow: Simultaneous execution at 11:18:22

🎯 Execution: MID (Professional spread execution)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 11:18:22 | 🟢 BUY | 📈 CALL | $15 | 2025-09-19 | 14,000 | $1.4M | $13.81 | $1.14 |

| 11:18:22 | 🔴 SELL | 📈 CALL | $25 | 2025-09-19 | 14,000 | $324K | $13.81 | $0.26 |

Trade Structure Analysis

📊 Strategy: Long $15 Call / Short $25 Call Spread

🎯 Net Debit: $1.08M ($1.14 - $0.26 = $0.88 per spread)

| Component | Strike | Premium | Purpose |

|---|---|---|---|

| LONG CALL | $15 | $1.4M paid | Bullish exposure |

| SHORT CALL | $25 | $324K collected | Cap gains at $25 |

| Net Cost | - | $1.08M | Maximum risk |

| Max Gain | - | $11.4M | If stock above $25 |

⚡ Strategy Detection: SHORT SQUEEZE PLAY

What This Means in Plain English:

- 🎯 NEEDS RALLY: Stock must hit $15.86 to profit

- 💰 CAPPED UPSIDE: Max profit at $25 (81% move)

- 📊 EARNINGS CATALYST: Aug 27 report critical

- ⏰ SQUEEZE SETUP: 49% short interest = powder keg

Translation: This is a calculated bet on a violent short squeeze triggered by earnings surprise or meme momentum. The trader risks $1M to make $11M!

🎯 What The Smart Money Knows

The Setup They're Playing:

The Squeeze Mathematics:

- 49% of float shorted (53M shares!)

- 5.7 days to cover

- Borrow rates elevated

- Reddit army watching

- Earnings catalyst approaching

Why KSS? The Perfect Storm:

Key Highlights:

- Q2 Earnings August 27

- Critical catalyst date

Low expectations = surprise potential

Additional Points:

📊 Earnings Beat Pattern

; Q1 beat by 47% (-$0.13 vs -$0.22 expected); Revenue beat: $3.05B vs $3.01B; Q2 earnings August 27;History of surprises

Plus 20 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want the squeeze!"

- Play: $20 September calls

- Cost: ~$0.30 per contract

- Risk: -100% if below $20

- Reward: +1000% if squeeze to $25

- Position Size: 0.5% MAX (lottery ticket)

🏄 Swing Traders

"I'll ride the earnings wave"

- Play: Buy shares at $13.50

- Stop: $12.50

- Target: $17-20

- Position Size: 2-3% of account

💎 Premium Collectors

"I'll sell the volatility"

- Play: Sell $12 puts for September

- Collect: $0.40 premium

- Risk: Assignment at $11.60

- Win If: Stock stays above $12

👶 Entry Level Investors

"This looks crazy!"

- Play: Watch from sidelines

- Or: Buy 10-25 shares for fun

- Stop Loss: $12 (-13%)

- Learn: How squeezes work

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 📉 Earnings Miss: Stock could crater to $10

- 🛍️ Retail Apocalypse: Sector weakness

- 💸 Cash Burn: Negative earnings trend

- 🎯 Analyst Hate: $9.89 average target (-29%!)

- 🏃 CEO Vacuum: Still no permanent leader

🎯 The Bottom Line

Real talk: This $1M call spread is a high-stakes bet on:

1. Earnings beat on August 27

2. Short squeeze acceleration

3. Meme stock momentum return

4. September OPEX volatility

5. Breakeven at $15.86 (need 15% rally!)

Someone's betting on fireworks - either genius or gambling!

📋 Your Action Checklist

✅ If Following: Size TINY - this is speculative!

✅ Set Alerts: $15 (breakeven), $20 (squeeze level), $25 (max profit)

✅ Mark Calendar: August 27 earnings, September 19 expiry

✅ Watch For: Reddit chatter, short interest updates, borrow rates

✅ Risk Management: This is casino-level risk - treat accordingly!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | KSS | Kohl's Corporation |

| Strategy | Call Spread | $15/$25 strikes |

| Premium | $1.08M invested | High conviction |

| Max Profit | $11.4M | 10x potential |

| Breakeven | $15.86 | Need 14.8% rally |

| Spot Price | $13.81 | Below breakeven |

| Expiration | Sep 19, 2025 | 35 days out |

| Earnings Date | Aug 27, 2025 | Key catalyst |

| Short Interest | 49% of float | EXTREME! |

| Days to Cover | 5.7 days | Squeeze potential |

| Analyst Target | $9.89 | Bearish (-29%) |

| Risk Level | 🔥🔥🔥🔥🔥 (5/5) | Maximum risk |

🏷️ Tags for This Trade

Sector: #Retail #Department

Strategy Type: #CallSpread #ShortSqueeze

Catalyst: #Earnings #MemeStock

Risk Level: #ExtremeRisk #Speculative

Trader Types: #WSB #Squeeze #Gamblers

⚠️ Disclaimer: This trade represents extreme speculation on a heavily shorted, fundamentally challenged retailer. The 49% short interest creates squeeze potential but also reflects genuine business concerns. The need for a 15% rally just to breakeven makes this a high-risk/high-reward play. Meme stocks can move violently in either direction. This is education, not financial advice! 🛍️