IRON Unusual Options Report - August 14, 2025: $1.5M Diagonal Calendar Play

🔥 EXTREME ALERT! Someone just executed a $1.5M diagonal calendar spread on IRON - buying tomorrow's $55 calls and selling September $60 calls. This is PhD-level options trading! With the FDA decision on Bitopertin coming in October, this whale is playing the waiting game while collecting premium....

🎯 The Quick Take

🔥 EXTREME ALERT! Someone just executed a $1.5M diagonal calendar spread on IRON - buying tomorrow's $55 calls and selling September $60 calls. This is PhD-level options trading! With the FDA decision on Bitopertin coming in October, this whale is playing the waiting game while collecting premium. Smart money at work! 💊

Translation for us regular folks: This trader expects IRON to stay around $60 through September, then potentially explode on FDA news in October. They're getting paid to wait - that's institutional-level strategy!

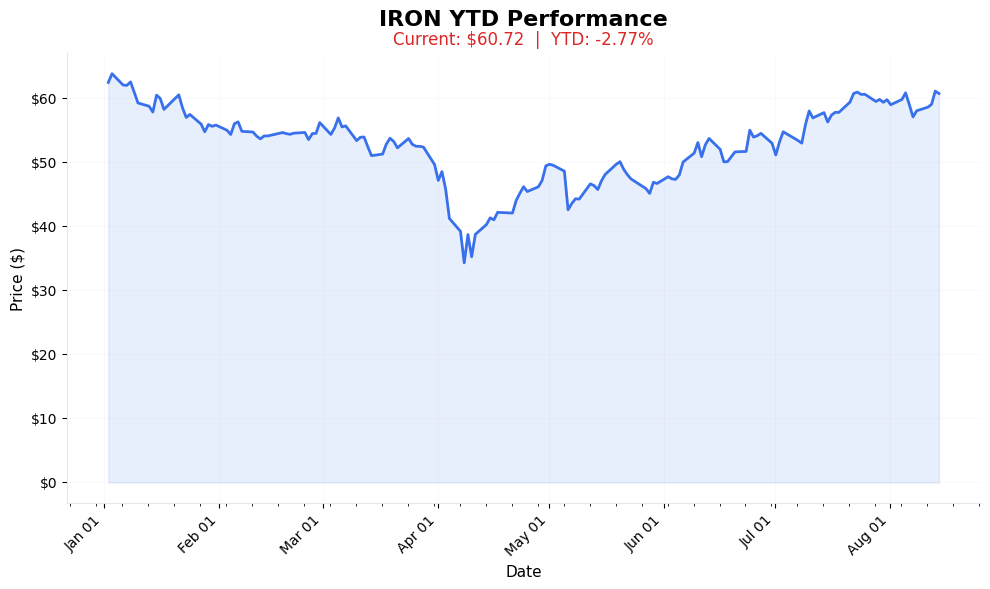

📈 YTD Performance

IRON Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: Diagonal Calendar Spread Detected!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 4,200 contracts | Institutional complexity! |

| Total Premium | $1.54M net | Sophisticated positioning |

| Spot Price | $60.84 | Right between strikes |

| Strike Range | $55-$60 | Tight profit zone |

| Strategy | Diagonal Spread | Advanced options play |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟩🟨⬜⬜ 7.5/10 | Extreme Sophistication |

🎬 The Actual Trade Tape

📊 Order Flow: Simultaneous execution at 14:06:45

🎯 Execution: ASK buy / BID sell (professional spread)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 14:06:45 | 🟢 BUY | 📈 CALL | $55 | 2025-08-15 | 2,100 | $960K | $60.84 | $6.00 |

| 14:06:45 | 🔴 SELL | 📈 CALL | $60 | 2025-09-19 | 2,100 | $576K | $60.84 | $3.60 |

⚡ Strategy Detection: DIAGONAL CALENDAR SPREAD

What This Means in Plain English:

- 🎯 NET DEBIT: Paid $384K net ($960K - $576K)

- 💰 MAX PROFIT: If stock at $60 in September

- 📊 RISK PROFILE: Limited downside, capped upside

- ⏰ TIME DECAY: Working FOR the trader

Translation: This is a bet that IRON stays range-bound near $60 until September, then potentially rockets on October FDA news. Brilliant positioning!

🎯 What The Smart Money Knows

The Setup They're Playing:

The Diagonal Spread Math:

- Buy Aug $55 calls (deep ITM, expires tomorrow)

- Sell Sep $60 calls (slightly ITM, 35 days out)

- Max profit: If stock at $60 on Sep 19

- Breakeven: Around $58.50

- Risk: Limited to net debit paid

Why IRON? The FDA Catalyst Timeline:

Key Highlights:

- 🏛️ Bitopertin NDA (October 2025)

- FDA submission for EPP treatment

- Accelerated approval pathway

Additional Points: Pre-NDA meetings successful;

$900M market opportunity

; ; Only 5,000-10,000 patients globally; Current treatment costs $200K+/yearPlus 17 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want the FDA lottery ticket!"

- Play: October $70 calls

- Cost: ~$2.50 per contract

- Risk: -100% if no approval

- Reward: +500% on approval

- Position Size: 1% MAX

🏄 Swing Traders

"I'll trade the range"

- Play: Buy at $58, sell at $63

- Stop: $55

- Target: $65-70

- Position Size: 2-3% of account

💎 Premium Collectors

"I'll copy the whale strategy"

- Play: Sell $65 September calls

- Collect: $2.00 premium

- Risk: Stock rallies above $67

- Win If: Stock below $65

👶 Entry Level Investors

"Biotech is too risky but interesting"

- Play: Wait for FDA decision

- If approved: Buy on pullback

- If rejected: Stay away

- Position Size: 1-2% MAX

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🏛️ FDA Rejection: Stock could drop 50%

- 🧬 Clinical Failures: Phase 2/3 trials ongoing

- 💊 Competition: Scenesse already established

- 📉 Biotech Volatility: Can swing 20% daily

- 💸 Cash Burn: $55M quarterly losses

🎯 The Bottom Line

Real talk: This $1.5M diagonal spread is sophisticated positioning:

1. Collecting premium while waiting for FDA

2. Protected if stock drops below $55

3. Maximum profit at $60 in September

4. Then free to ride October FDA catalyst

5. This is how smart money plays biotech!

Someone's playing 4D chess with the FDA timeline!

📋 Your Action Checklist

✅ If Following: Understand the strategy complexity first

✅ Set Alerts: $55 (support), $60 (sweet spot), $65 (resistance)

✅ Mark Calendar: Sep 19 (short call expiry), October (NDA submission)

✅ Watch For: FDA communications, trial updates

✅ Risk Management: Biotech = binary outcomes, size accordingly!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | IRON | Disc Medicine Inc. |

| Strategy | Diagonal Spread | Range-bound play |

| Net Premium | $384K spent | Sophisticated bet |

| Contracts | 4,200 total | Large position |

| Long Strike | $55 Aug 15 | Deep ITM, expires tomorrow |

| Short Strike | $60 Sep 19 | Slightly ITM, 35 days |

| Spot Price | $60.84 | Perfect for strategy |

| Max Profit Zone | $60 | September expiry |

| FDA Catalyst | October 2025 | NDA submission |

| Market Opportunity | $900M | EPP indication |

| Analyst Target | $95.73 | +67% upside |

| Risk Level | 🔥🔥🔥🔥⬜ (4/5) | High biotech risk |

🏷️ Tags for This Trade

Sector: #Biotech #RareDisease

Strategy Type: #DiagonalSpread #Advanced

Catalyst: #FDA #ClinicalTrials

Risk Level: #HighRisk #Sophisticated

Trader Types: #Institutional #Professional

⚠️ Disclaimer: Biotech stocks face binary outcomes on FDA decisions. This diagonal spread represents sophisticated positioning but carries significant risk. The strategy profits from time decay and range-bound movement but could lose if the stock moves dramatically. FDA decisions can cause 50%+ moves. This is education, not financial advice! 💊