IBIT: $30M Complex Roll Strategy Detected (Nov 18)

Massive $30M institutional bet detected on IBIT. Someone just executed a $30 MILLION options adjustment on BlackRock's Bitcoin ETF (IBIT) this morning! This sophisticated trader rolled 15,000 puts from November to December while Unusual score: high/10. Full analysis reveals entry points and trading

💎 IBIT $30M Put Roll - Smart Money Adjusts Bitcoin ETF Protection! 🛡️

📅 November 18, 2025 | 🔥 Unusual Activity Detected

🎯 The Quick Take

Someone just executed a $30 MILLION options adjustment on BlackRock's Bitcoin ETF (IBIT) this morning! This sophisticated trader rolled 15,000 puts from November to December while closing another massive 15,000-contract position - all happening between 10:21 and 10:46. With Bitcoin consolidating around $100K after its 16% correction from all-time highs, smart money is adjusting protection rather than panicking. Translation: Institutions are fine-tuning their hedges, not abandoning ship.

📊 Company Overview

iShares Bitcoin Trust (IBIT) is BlackRock's spot Bitcoin ETF, the undisputed heavyweight champion of crypto ETFs:

- Total Net Assets: $72.4 Billion (as of November 17, 2025)

- Market Share: 62.75% of all spot Bitcoin ETF volume

- Sector: Exchange-Traded Funds - Cryptocurrency

- Primary Holdings: Physical Bitcoin (793,000 BTC worth ~$87 billion)

- Current NAV: $52.94 (down from 52-week high of $71.32)

- Expense Ratio: 0.25%

IBIT isn't just another ETF - it generates $187.2 million in annual revenue for BlackRock, exceeding even their flagship $624 billion S&P 500 fund (IVV) due to the higher fee structure[^2_5]. This thing is a money-printing machine for BlackRock just 18 months after launch.

💰 The Option Flow Breakdown

The Tape (November 18, 2025):

| Time | Symbol | Buy/Sell | Type | Expiration | Strike | Premium | Volume | Z-Score | Classification |

|---|---|---|---|---|---|---|---|---|---|

| 10:21:35 | IBIT | BUY | PUT | 2025-12-12 | $61 | $9.0M | 12,000 | 525.5 | EXTREMELY_UNUSUAL |

| 10:21:35 | IBIT | BUY | PUT | 2025-11-21 | $61 | $8.8M | 13,000 | 4.38 | EXTREMELY_UNUSUAL |

| 10:21:35 | IBIT | BUY | PUT | 2025-12-12 | $61 | $1.6M | 2,200 | 95.46 | EXTREMELY_UNUSUAL |

| 10:21:35 | IBIT | SELL | PUT | 2025-11-21 | $61 | -$1.6M | -2,300 | 0.61 | TYPICAL |

| 10:46:01 | IBIT | SELL | PUT | 2025-11-21 | $60 | -$11.0M | -15,000 | 3.34 | EXTREMELY_UNUSUAL |

Total Net Premium Deployed: ~$30 Million

🤓 What This Actually Means

This is a COMPLEX_ROLL strategy - not a directional bet, but sophisticated position management! Here's the play-by-play:

The Opening Legs (10:21:35):

- 💸 Bought 12,000 December $61 puts for $9M (new protection through Dec 12)

- 💸 Bought 13,000 November $61 puts for $8.8M (short-term hedge into weekly OPEX)

- 💸 Added 2,200 more December $61 puts for $1.6M (layering in)

The Closing Legs (10:21-10:46):

- ✂️ Sold 2,300 November $61 puts for $1.6M (partial close of old position)

- ✂️ Dumped 15,000 November $60 puts for $11M (major position exit at 10:46)

What's really happening here:

This trader is rolling protection forward from November 21st (3 days away!) to December 12th (24 days), while simultaneously closing a massive 15,000-contract position at the $60 strike. They're not betting IBIT crashes - they're adjusting the timing and strike of existing hedges as Bitcoin stabilizes around $100K.

Strategic Insight: The $60 and $61 strikes sit about 13-15% below current price ($52.94), providing deep downside protection. By rolling from November to December, they're extending coverage through the critical December 19th quarterly OPEX and Bitcoin's next volatility window.

Unusual Score Breakdown:

- 🔥 Z-Score 525.5 on the largest leg = 525x more unusual than average IBIT put activity (EXTREME!)

- 📊 75x normal volume on the December $61 puts (Vol/OI Ratio of 75.47)

- 🏦 Institutional hallmarks: Multiple simultaneous legs, large round-lot sizes (12K, 13K, 15K), precise timing

This isn't retail panic - this is a fund manager with a MASSIVE IBIT position ($100M+) who's protecting through year-end volatility. The combined 27,200 puts opened represent exposure to 2.72 million shares worth approximately $144 million at current prices.

📈 Technical Setup / Chart Check-Up

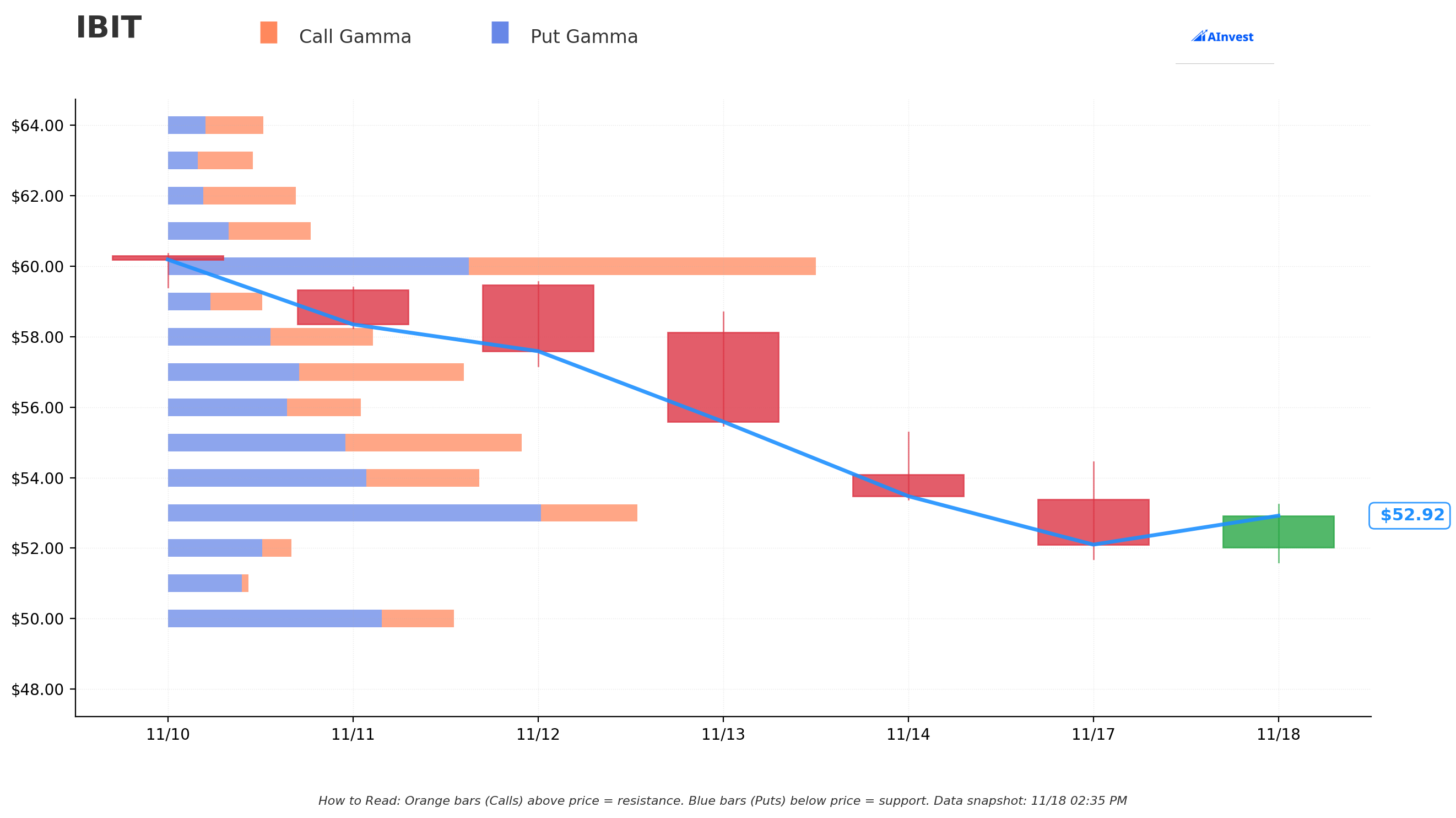

Gamma-Based Support & Resistance Analysis

Current Price: $52.94

The gamma exposure map reveals IBIT is trading in a narrow battleground between major support and resistance:

🔵 Support Levels (Put Gamma Below Price):

- $50.00 - MASSIVE support floor with 42.5B total gamma exposure (31.8B put gamma vs 10.8B call gamma)

- This is THE line in the sand - 5.6% below current price

- Dealers will aggressively buy any dips toward $50 to hedge their short put exposure

- Notice the put buyer's $60-61 strikes are well above this level - they're positioned for a move to $50 area

🟠 Resistance Levels (Call Gamma Above Price):

- $53.00 - Immediate ceiling with 69.9B total gamma (55.5B put gamma + 14.4B call gamma)

- Only 0.1% overhead but creates strong magnetic effect

- Largest single gamma concentration on the entire chain!

- $54.00 - Secondary resistance at 46.4B gamma (2% above current)

- $55.00 - Major ceiling with 52.9B gamma (3.9% rally required)

- $57.00 - Extended resistance at 44.3B gamma (7.7% above current)

- $60.00 - Upper boundary with 99.5B gamma (13.3% rally needed)

- THIS is where the puts were struck - $60 and $61!

- Massive gamma wall suggesting this is the upper range limit through December

What this means for traders:

IBIT is currently pinned between $50 support (5.6% down) and $53-$55 resistance (up to 4% up). The options market is pricing a tight consolidation range - not a crash, not a moonshot. The $53 strike with 69.9B gamma is acting like a gravity well, pulling price back every time it approaches.

Put buyer positioning insight: They struck at $60-$61, which sits at the TOP of the gamma resistance zone (99.5B at $60). This tells us they expect IBIT to stay BELOW $60 through December, with potential downside to the $50 major support if Bitcoin weakens further. Smart positioning - they're not betting on a disaster, just protecting against a 6-15% pullback.

Net GEX Bias: Bullish (417.8B call gamma vs 394.6B put gamma) - Despite heavy put buying, overall positioning remains net long, suggesting dealers are structurally long deltas and will support dips.

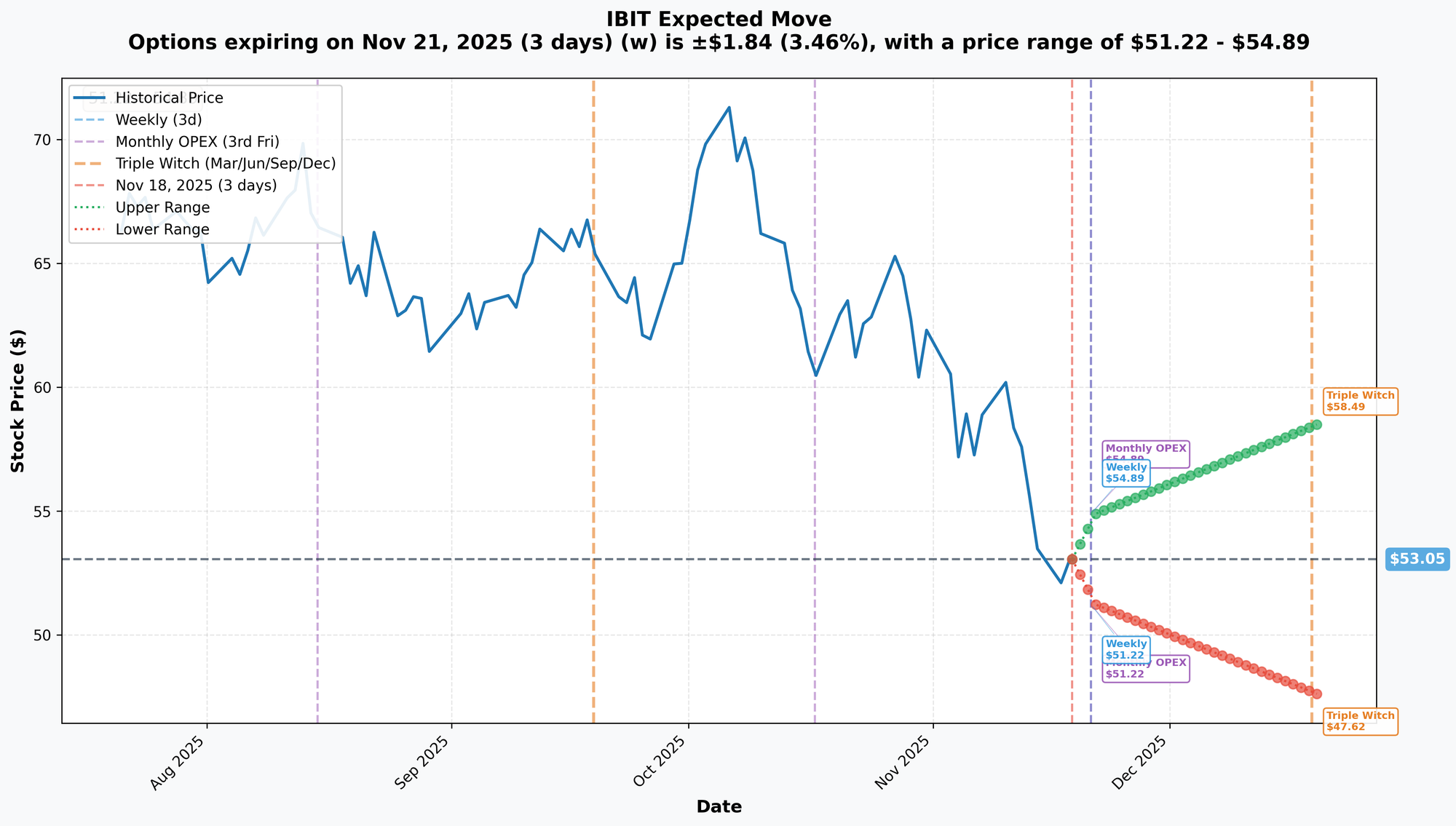

Implied Move Analysis

Options market pricing for upcoming expirations:

- 📅 Weekly OPEX (Nov 21 - 3 days): ±$1.84 (±3.46%) → Range: $51.22 - $54.89

- 📅 Monthly OPEX (Nov 21 - 3 days): ±$1.84 (±3.46%) → Range: $51.22 - $54.89

- 📅 Quarterly Triple Witch (Dec 19 - 31 days): ±$5.44 (±10.25%) → Range: $47.62 - $58.49

Translation for regular folks:

The options market expects IBIT to stay in a $51-$55 range through November 21st OPEX (only 3 days away!). That's a super tight 3.5% range, reflecting Bitcoin's recent consolidation around $100K. However, by December 19th quarterly OPEX, the market is pricing a MUCH wider 10.25% potential move - acknowledging that Bitcoin could break either way over the next month.

Key insight: The December implied move's lower range of $47.62 sits BELOW the put buyer's $60-$61 strikes by a wide margin. The market is assigning real probability to IBIT trading in the high $40s by mid-December if Bitcoin corrects further from $100K. This aligns perfectly with the put buyer's thesis: protect against a 10-15% drawdown scenario through year-end.

Volatility context: The 3-day 3.5% implied move expands to 10.25% over 31 days, indicating the market expects volatility to INCREASE into December (likely around Bitcoin hitting psychological levels, ETF rebalancing, and holiday liquidity concerns).

🎪 Catalysts

🔥 Immediate Catalysts (Next 7 Days)

November 21 Monthly OPEX - November 21, 2025 (3 DAYS AWAY!) 📊

Weekly and monthly options expire simultaneously this Friday, creating potential for outsized volatility as dealers unwind massive hedges. With IBIT's implied move at ±3.46% ($51.22-$54.89 range), we could see sharp moves Thursday-Friday as gamma flips.

Why this matters for the put roll: The trader rolled OUT OF November 21st expirations (closing 15,000 Nov $60 puts and 2,300 Nov $61 puts) and INTO December 12th. They're explicitly avoiding this week's OPEX volatility, suggesting they expect chop rather than directional move.

Bitcoin Consolidation Around $100,000 - November 2025 🪙

Bitcoin is currently trading near $104,724 after correcting 16% from its October all-time high near $126,000[^4_1][^4_2]. The psychological $100K level is creating a battlefield:

- 🚀 Bulls argue the consolidation is healthy after parabolic rally

- 😰 Bears point to record $1.26 billion November IBIT outflows as warning sign[^2_1]

- 📊 Institutional whales accumulated 36,000 BTC in recent months, suggesting bottom-fishing[^4_4]

Critical levels: Bitcoin support at $95,000-$100,000 zone (JPMorgan warns of $95K downside if support fails)[^24_1]. Any breakdown below $95K would proportionally impact IBIT's NAV.

Record IBIT Outflow Reversal - Mid-November 2025 💸

After record $1.26 billion monthly outflows in early November (largest since launch), IBIT saw dramatic reversal:

- November 6: $112.44 million inflows, ending 7-day outflow streak[^6_5]

- Mid-November: $224.2 million single-day inflow as part of $524M total Bitcoin ETF flows[^7_1]

What this tells us: The outflow panic has stabilized. Institutions stopped selling and are selectively adding again at lower prices. This improves near-term stability but doesn't guarantee upside - hence the put buyer maintaining protection.

🚀 Near-Term Catalysts (Next 6 Months)

U.S. Strategic Bitcoin Reserve Implementation - Q1 2026 🇺🇸

President Trump's Executive Order signed March 6, 2025 established a Strategic Bitcoin Reserve capitalized with the government's 207,000 BTC holdings (worth ~$17 billion)[^16_1][^16_5]. The government committed to NEVER selling these coins[^16_4].

Impact on IBIT:

- 🏛️ Sovereign validation of Bitcoin as reserve asset (huge institutional confidence boost)

- 🌍 Could trigger copycat policies from other nations, removing 200K+ BTC from circulating supply

- 📈 Reinforces Bitcoin scarcity narrative just as ETF demand accelerates

- 🎯 Likely drives flows back into IBIT as retail/institutional chase sovereign adoption trend

Timing: Implementation in Q1 2026 (January-March) falls within the put buyer's December 12th expiration window. They're positioned through the announcement but not necessarily the full implementation phase.

CME 24/7 Crypto Trading Launch - Early 2026 🔄

CME Group announced 24/7 Bitcoin futures and options trading launching early 2026, pending regulatory approval[^17_1]. This is MASSIVE for institutional adoption:

- ⏰ Eliminates weekend gap risk that terrifies fund managers

- 💰 Improves price discovery and reduces basis spreads vs spot

- 🏦 Allows institutions to hedge and rebalance 24/7 like crypto-native firms

- 📊 Expected to drive significant new institutional capital into Bitcoin ecosystem

IBIT benefit: Round-the-clock futures trading provides better hedging tools for IBIT holders, reducing tracking error risk and improving arbitrage efficiency. Could reduce IBIT's discount/premium volatility to NAV.

Harvard Endowment's $443 Million IBIT Stake - November 2025 🎓

Harvard University's endowment disclosed a $443 million IBIT position in November 2025, representing over 20% of its U.S. public equity holdings[^2_6][^11_1]. This is UNPRECEDENTED for a major university endowment.

Why this matters:

- 🎯 Validates Bitcoin as legitimate endowment asset class (opens floodgates to other endowments)

- 💰 Harvard's $53 billion endowment is benchmark for institutional asset allocation worldwide

- 🏛️ Other Ivy League and major foundations will study this allocation closely

- 📊 Creates "FOMO" effect among institutional allocators who can't afford to ignore crypto anymore

Ripple effect: If Harvard's allocation performs well, expect dozens of other endowments/foundations to allocate 1-2% to IBIT in 2026, representing tens of billions in potential inflows.

IBIT Model Portfolio Inclusion - March 2025 (ONGOING IMPACT) 📋

IBIT officially joined BlackRock's model portfolios in March 2025, opening access to $150 billion in advisory assets[^2_3][^9_1]. Financial advisors can now allocate 1-2% to IBIT in target allocation portfolios[^2_3].

Slow-burn catalyst: Model portfolio adoption is glacial (advisors rebalance quarterly/annually), but represents STRUCTURAL bid that builds over 2026. Every 1% allocation across $150B = $1.5B in IBIT inflows.

In-Kind Creation/Redemption Approval - July 2025 (EFFICIENCY BOOST) ✅

SEC approved in-kind creations/redemptions on July 29, 2025, aligning IBIT with traditional commodity ETF operations[^2_2][^8_1]. This:

- 💰 Reduces transaction costs by avoiding cash conversion of Bitcoin

- 📊 Minimizes tax inefficiencies for shareholders

- 🔄 Reduces market impact during large creation/redemption events

- 🎯 Improves IBIT's competitive positioning vs cash-only competitors

Ongoing benefit: Every large institutional flow now executes more efficiently, tightening tracking and reducing friction. Competitive advantage vs Fidelity's FBTC and others.

📊 Bitcoin Price Catalysts (December 2025 - April 2026)

Halving Cycle Dynamics - Current Phase 🔄

Bitcoin's April 19, 2024 halving cut daily new supply from 900 to 450 BTC[^14_1][^14_2]. Historical patterns suggest price peaks occur 450 days post-halving - pointing to September-November 2025 as optimal timeframe[^15_1].

Current status: We're potentially IN or PAST the typical cycle peak window (November 2025). This creates dual scenarios:

- 🐂 Bull case: Peak delayed due to unprecedented institutional demand (ETFs absorbing supply); rally continues into Q1 2026 targeting $150K-$200K

- 🐻 Bear case: October's $126K high WAS the cycle peak; Bitcoin enters distribution phase, targets $70K-$90K by Q2 2026

Q1 2026 Price Projections:

- Bullish: $121,791 to $202,839 by January 2026[^18_5][^18_6]

- Base case: $131,934 by December 18, 2025 (+45% from current)[^18_7]

- Bearish: $68,809 by January 2026 (-31% from current)[^18_8]

Supply-demand math: Daily Bitcoin issuance is 450 BTC (~$47M/day) while spot ETFs often absorb 500+ BTC/day during accumulation phases. This structural supply deficit supports higher prices IF demand remains steady.

Institutional Adoption Wave - Q1-Q2 2026 🏦

Spot Bitcoin ETFs projected to hold 1.5 million+ BTC by 2026 (up from current 1.13 million)[^18_1]. With IBIT's 62.75% market share, this implies IBIT alone could hold 940,000+ BTC by mid-2026 (currently 793,000).

Corporate treasury trend: 172 public companies now hold Bitcoin, with 70 non-crypto companies holding on balance sheets[^12_1][^12_2]. Analysts project hundreds more will add Bitcoin in 2025-2026 following MicroStrategy's playbook[^12_3].

MicroStrategy accumulation continues: Michael Saylor's firm owns 649,870 BTC as of November 17, 2025 (cost basis: $33.1B at $66,385/BTC average)[^12_4]. Recent purchases slowed but ongoing, providing consistent spot demand.

IBIT Australian Securities Exchange Listing - Mid-November 2025 🌏

BlackRock launched IBIT on the ASX in mid-November 2025, marking pivotal international expansion[^4_6]:

- 🌍 Opens IBIT to Australian retail/institutional investors

- ⏰ Extends trading hours across global time zones

- 📊 Validates international demand beyond U.S. markets

- 💰 Creates arbitrage opportunities between U.S. and Australian listings

Impact: While AUM effect may be modest initially (Australian market smaller than U.S.), it establishes IBIT as global brand and could foreshadow European/Asian expansions.

🎲 Price Targets & Probabilities

Using gamma levels, implied move data, and Bitcoin catalysts, here are scenarios through December 12th (put expiration):

📈 Bull Case (30% probability)

Target: $58-$60 (IBIT tests upper gamma resistance)

How we get there:

- 🚀 Bitcoin breaks above $110K resistance, rallying toward $120K-$125K retest of October highs

- 💰 IBIT sees renewed inflows of $500M+ weekly as retail FOMO returns

- 🏛️ Strategic Bitcoin Reserve implementation details exceed expectations, triggering sovereign buying speculation

- 📊 Harvard allocation success story drives copycat university endowment allocations

- 🎯 Post-Thanksgiving buying surge (historical seasonal strength November-December)

- 🔄 CME 24/7 trading approval announcement catalyzes institutional confidence

Key metrics needed:

- Bitcoin sustains above $110K for 5+ consecutive days

- IBIT weekly inflows return to +$300M range (vs recent outflows)

- Realized volatility compresses below 40% (calming fear)

IBIT levels: Breakout above $55 gamma resistance ($52.9B) triggers momentum to $57-$60 zone where massive 99.5B gamma awaits. Would require 10-13% rally from current $52.94.

Put buyer P&L in Bull Case:

- IBIT at $58 on Dec 12: December $61 puts worth $3.00, loss = -$4.75/contract × 14,200 contracts = -$67M loss on opened positions (ouch, but they still have other portfolio gains)

- IBIT at $60 on Dec 12: December $61 puts worth $1.00, loss = -$6.75/contract × 14,200 = -$96M loss (near-total loss, but insurance cost)

Probability assessment: Only 30% because requires multiple positive catalysts to align AND Bitcoin breaking above $110K resistance where it's failed repeatedly in November. IBIT's $53-$55 gamma resistance creates headwinds. Possible but not base case.

🎯 Base Case (50% probability)

Target: $50-$55 range (CHOPPY CONSOLIDATION)

Most likely scenario:

- 📊 Bitcoin chops between $95K-$110K through December (no clear breakout either way)

- 💰 IBIT flows stabilize near neutral (small ins/outs, no massive redemptions or inflows)

- 🎢 Weekly OPEX on Nov 21st creates volatility but no sustained directional move

- ⚖️ Macro backdrop mixed: Fed holds rates steady, no major crypto regulatory surprises

- 🤝 Strategic Reserve implementation proceeding but not accelerating (already priced in)

- 📈 IBIT trades within gamma support ($50) and resistance ($55) bands for weeks

Technical setup: The $53 level with 69.9B gamma acts as magnet, pulling price back repeatedly. $50 support (42.5B gamma) provides floor on any dips. This creates a 5.5% range-bound environment - boring but stable.

Why 50% probability: This matches the current consolidation pattern in both Bitcoin and IBIT. Neither bulls nor bears have conviction to break the range. Gamma positioning reinforces range-bound action. Institutions content to wait for clearer catalyst.

Put buyer outcome: Puts expire with minimal value (IBIT at $52-54 means $61 puts worth $7-9), recouping some premium but accepting most as insurance cost. The December 12th expiration allows them to reassess and either roll again or let expire based on January setup.

This is EXACTLY what the put buyer likely expects - the $30M is simply portfolio insurance premium they're willing to pay for peace of mind through year-end volatility. If IBIT stays $50-55, mission accomplished (protected downside risk without giving up upside participation in their long holdings).

📉 Bear Case (20% probability)

Target: $47-$50 (TEST THE MAJOR SUPPORT!)

What could go wrong:

- 😰 Bitcoin breaks below $95K support, cascading toward $80K-$85K on technical breakdown

- 🚨 Renewed IBIT outflows exceed $2B monthly as institutions de-risk into year-end

- 💸 Broader risk-off environment: stocks correct 10%+, liquidity drains from all risk assets

- 🇨🇳 China announces new crypto crackdown or major exchange faces regulatory action

- 📊 MicroStrategy forced selling due to margin calls on debt (tail risk but possible)

- 🏦 Major institution discloses large IBIT redemption, spooking market

- ⚠️ ETF approval delays for staking products signal regulatory headwinds

Critical support levels:

- 🛡️ $53: First support (69.9B gamma) - already testing this level

- 🛡️ $50: MAJOR floor (42.5B gamma) - must hold or panic accelerates

- 🛡️ $47.62: December implied move lower range - disaster scenario

IBIT breakdown scenario: Failure below $50 (5.6% drop) would break the strongest gamma support and likely trigger stop-losses, accelerating to $47-$48 area (December implied move lower bound). That's a 10-11% drop from current levels.

Put buyer P&L in Bear Case:

- IBIT at $50 on Dec 12: December $61 puts worth $11.00, profit = +$4.25/contract × 14,200 = +$60M gain (134% ROI!)

- IBIT at $47 on Dec 12: December $61 puts worth $14.00, profit = +$7.25/contract × 14,200 = +$103M gain (243% ROI!!)

- IBIT at $45 on Dec 12: December $61 puts worth $16.00, profit = +$9.25/contract × 14,200 = +$131M gain (310% ROI!!!)

Why only 20% probability? Requires multiple negative catalysts to align AND Bitcoin breaking key $95K support that's held for weeks. IBIT's structural demand from model portfolios and institutional adoption provides floor. Strategic Reserve narrative remains bullish backdrop.

However, the put buyer clearly thinks this scenario has meaningful odds (probably 25-30% in their model) or they wouldn't deploy $30M in protection. They're protecting against tail risk that would devastate their long portfolio.

💡 Trading Ideas

🛡️ Conservative: Wait for December OPEX Clarity

Play: Stay on sidelines until after December 19th quarterly OPEX volatility settles

Why this works:

- ⏰ November 21st weekly/monthly OPEX in 3 days creates unpredictable gamma-driven moves

- 📊 December 19th quarterly triple witch (31 days out) has ±10.25% implied move - too much uncertainty

- 💸 Implied volatility elevated pre-OPEX - options premiums 30-40% more expensive than normal

- 🎯 Better entries likely post-OPEX after volatility crush and clearer Bitcoin direction emerges

- 🧠 Smart money (the $30M put buyer) is positioning DEFENSIVELY, not aggressively - follow their lead

Action plan:

- 👀 Monitor Bitcoin's hold of $95K-$100K support zone through November

- 📈 Watch IBIT flows - need to see sustained $200M+ weekly inflows to confirm bottom

- ⏰ Revisit in January 2026 when Strategic Reserve implementation clarity emerges

- 📊 Look for IBIT pullback to $50-$51 (major gamma support) for stock entry with 5-6% margin of safety

- ✅ If Bitcoin breaks above $110K and holds for a week, reassess bullish positioning

Risk level: Minimal (cash position) | Skill level: Beginner-friendly

Expected outcome: Avoid potential 10% drawdown if Bitcoin fails support. Get clearer risk/reward setup in January. Maintain optionality for Q1 2026 catalysts.

⚖️ Balanced: Small Long Position + Protective Puts (Copy The Smart Money)

Play: Buy IBIT shares at current levels (~$53) and hedge with December puts (mirroring institutional positioning)

Structure:

- 📈 Buy 100 shares IBIT at $53.00 ($5,300 position)

- 🛡️ Buy 1x December $60 put for ~$7.00 ($700 cost)

- 📊 Net cost: $6,000 for protected position through Dec 12th

Why this works:

- 🎯 Essentially copying the smart money's strategy at smaller scale

- 💰 Defined maximum risk: If IBIT crashes to $40, put protects below $60, limiting loss to $400 max (7% max risk)

- 🚀 Unlimited upside if Bitcoin rallies to $120K+ and IBIT hits $65-$70

- ⚖️ The $700 put cost is insurance premium - you're paying 13% of position for peace of mind

- 📅 Through December 12th captures Strategic Reserve updates and year-end positioning

Estimated P&L scenarios (at December 12 expiration):

- 🚀 Bull case (IBIT $60): Stock gain +$700, put expires worthless -$700, net: $0 (breakeven)

- 🎯 Base case (IBIT $53): Stock flat $0, put expires worthless -$700, net: -$700 loss (13% cost of protection)

- 📉 Bear case (IBIT $47): Stock loss -$600, put gain +$600, net: -$700 (protected downside!)

- 😱 Disaster (IBIT $40): Stock loss -$1,300, put gain +$1,300, net: -$700 (FULL protection below $60!)

Breakeven: Need IBIT above $60 by December 12th to profit (13% rally required). Below $53 you start losing money but losses capped.

Position sizing: Risk only 5-10% of portfolio on this structure (it's speculative with defined risk)

Entry timing:

- ✅ Can enter now at $52-53 (near current levels)

- ⏰ Or wait for post-Nov 21 OPEX volatility crush to get cheaper puts (might pay $5-6 instead of $7)

Risk level: Moderate (defined maximum loss, requires upside to profit) | Skill level: Intermediate

Advanced twist: If Bitcoin breaks $110K, consider selling the put early for $3-4 to reduce cost basis and ride the upside unhedged.

🚀 Aggressive: December Call Spread - Bet on Bitcoin Bounce (ADVANCED ONLY!)

Play: Bull call spread targeting breakout above gamma resistance

Structure:

- 📈 Buy $55 calls (December 19 expiration)

- 📉 Sell $60 calls (December 19 expiration)

- 💰 Net debit: ~$1.50-2.00 per spread ($150-200 cost)

Why this could work:

- 🎯 If Bitcoin rallies to $110K-$120K in December, IBIT could hit $58-$62 (10-17% upside)

- 📊 Spread targets the $55-$60 gamma resistance zone where calls become ITM

- 💸 Defined risk ($150-200 max loss) vs $350-400 max gain (2:1 reward/risk)

- ⚡ Strategic Reserve implementation news could catalyze sharp rally

- 🎢 Lower cost than buying naked calls (selling $60 call reduces cost by ~60%)

Why this could blow up (SERIOUS RISKS):

- ⏰ Time decay: Need 4-10% IBIT rally in just 31 days (aggressive timeline)

- 📊 Gamma resistance: Massive resistance at $55-$60 zone could cap upside exactly where you need it

- 💸 Bitcoin dependency: 100% correlated to Bitcoin breaking $110K - no edge if BTC stays below

- 😰 Capped upside: Even if IBIT explodes to $70, your max gain is $400 (limited by short $60 call)

- 🎰 Breakeven requires IBIT at ~$56.50-57.00 (6-8% rally) just to recover premium

Estimated P&L:

- 💰 Cost: $1.50-2.00 per spread (risk $150-200)

- 🚀 Max profit: IBIT above $60 = $350-400 gain (175-200% ROI)

- 🎯 Breakeven: IBIT at $56.50-57.00 (need 6-8% rally)

- 📉 Partial loss: IBIT stays $53-55 = lose $100-150 (50-75% loss)

- 💀 Total loss: IBIT below $55 = lose entire $150-200 (100% loss)

Breakeven requires: IBIT rallying from $52.94 to $56.50+ (6.7% minimum gain) by December 19th

CRITICAL WARNING - DO NOT attempt unless you:

- ✅ Can afford to lose ENTIRE premium (realistic 40-50% probability of total loss)

- ✅ Believe Bitcoin will break and HOLD above $110K in next 30 days

- ✅ Understand gamma resistance at $55-$60 may cap your gains exactly where you need upside

- ✅ Have traded credit/debit spreads before and understand assignment risk

- ⏰ Plan to manage position actively - take profits at 50-75% max gain, don't wait for expiration

Risk level: HIGH (can lose 100% of premium, requires strong directional move) | Skill level: Advanced only

Probability of profit: ~35-40% (need sustained rally in tight timeframe against resistance)

⚠️ Risk Factors

Don't get caught by these potential landmines:

-

🪙 Bitcoin Price Volatility is EXTREME: Bitcoin corrected 16% from $126K to $106K in just weeks (October-November)[^2_1][^4_2]. JPMorgan warns of potential $95K downside if Bitcoin fails to reclaim $110K or trade tensions escalate[^24_1]. IBIT's NAV moves essentially 1:1 with Bitcoin - if BTC drops 15%, IBIT drops 15%. The Fear & Greed Index hit 17 (extreme fear) in November[^24_2], showing how fast sentiment can flip from greed to panic.

-

💸 Record Outflows Show Institutional Nervousness: IBIT suffered $1.26 BILLION in net outflows in November - the largest monthly redemption since launch in January 2024[^2_1]. While mid-November showed $524M reversal inflow[^7_1], the 7-day outflow streak totaling $2.04 billion demonstrates how quickly institutional flows can reverse[^6_4]. When big money heads for the exits, retail gets trampled. Six prior instances of $1B+ daily inflows preceded local tops[^6_1], suggesting massive flows mark sentiment extremes in both directions.

-

🏛️ Regulatory Uncertainty Despite Pro-Crypto Administration: While Trump's Strategic Bitcoin Reserve sounds bullish, actual implementation remains unclear. Delays in crypto ETF staking approvals and CLARITY Act passage create uncertainty[^24_4]. The SEC approved in-kind creation/redemption but could reverse course with new commissioners. International headwinds include China's reinforced 2025 ban on crypto causing 5% Bitcoin drop in 24 hours[^25_1][^25_2]. Any surprise regulatory crackdown would devastate IBIT.

-

📊 Gamma Ceiling at $53-$55 Creates Natural Resistance: Massive 69.9B gamma concentration at $53 (largest on entire chain) means market makers will systematically SELL into rallies to hedge exposure. This creates mechanical selling pressure making breakouts difficult above $55. Current price ($52.94) sitting right under this ceiling. Would need massive institutional buying wave to overcome - not impossible but creates headwind.

-

⚖️ Fee Competition and Market Share Erosion Risk: While IBIT dominates with 62.75% market share, competitors are fighting back. Fidelity's FBTC posted $67M inflows vs IBIT's $59.6M on October 28, with ARKB leading at $75.8M[^26_1]. ARKB's 0.21% fee vs IBIT's 0.25% could attract price-sensitive investors[^13_4][^22_2]. If Ethereum/Solana staking ETFs get approved in 2026, they could drain capital from non-yielding Bitcoin exposure[^19_2][^19_3].

-

💰 Macroeconomic Headwinds from Fed Policy: Fed officials signaled no further easing in December 2025, strengthening USD and pushing up Treasury yields - a combination that typically drains liquidity from risk assets including crypto[^24_5]. Rising correlation between Bitcoin and tech stocks (particularly NVDA, TSLA) reduces diversification benefits and amplifies drawdown risk during equity corrections[^4_7]. If Nasdaq drops 10%, Bitcoin likely follows, taking IBIT down proportionally.

-

🏦 Custody and Operational Risk with $72B Bitcoin Holdings: IBIT holds $72.4 billion worth of Bitcoin (793,000 BTC)[^13_1] - an enormous honeypot for hackers. Any custody breach, exchange compromise, or operational error could trigger panic redemptions and permanent reputational damage. While BlackRock uses institutional-grade custody (Coinbase Custody), the risk isn't zero. A Mt. Gox or FTX-style event would be catastrophic.

-

📉 Halving Cycle Peak May Be BEHIND Us: Historical Bitcoin cycles peak ~450 days post-halving (September-November 2025)[^15_1]. October's $126K high may have BEEN the cycle top. If true, Bitcoin enters 12-18 month distribution phase targeting $60K-$80K by late 2026. IBIT would proportionally decline 25-40% from current levels. The put buyer may be positioning for exactly this scenario.

-

🎢 December Triple Witch Volatility (Dec 19): Quarterly options expiration creates outsized volatility as dealers unwind massive hedges. IBIT's ±10.25% implied move ($47.62-$58.49 range) through Dec 19 means we could see violent swings in both directions. Gap risk over weekends when crypto trades 24/7 but IBIT is closed. Wake up Monday to 8% gap down? Totally possible.

-

🐋 Smart Money Deploying $30M Protection is RED FLAG: This institutional put buying signals sophisticated players are WORRIED about downside through December despite bullish long-term narrative. When funds managing hundreds of millions pay $30M for protection rather than staying fully long, it's a caution signal. The COMPLEX_ROLL structure (rolling Nov to Dec, closing 15K contracts) shows active risk management, not passive hedging.

-

🇦🇺 International Expansion Could Create Tracking Complications: IBIT's Australian Securities Exchange listing in mid-November[^4_6] creates potential for price dislocations between U.S. and Australian shares during different trading hours. Arbitrage opportunities are good for market makers but could create temporary NAV tracking errors that confuse retail investors.

🎯 The Bottom Line

Real talk: Someone just spent $30 MILLION adjusting Bitcoin ETF protection - not panicking out, not going all-in bullish, just carefully managing risk through year-end. This is what smart institutional money does when uncertainty is high but the long-term thesis remains intact.

What this trade tells us:

- 🎯 Sophisticated player expects CONTINUED VOLATILITY through December (not crash, not moonshot - chop)

- 💰 They're protecting against 10-15% downside scenario (strikes at $60-$61 with IBIT at $53)

- ⚖️ The roll from November 21st to December 12th shows they want coverage through Strategic Reserve updates and quarterly OPEX

- 📊 Closing 15,000 November $60 puts suggests they're REDUCING protection vs prior positioning (slightly less bearish than before)

- ⏰ December 12 expiration is strategic - captures year-end volatility but expires before Christmas illiquidity

This is NOT a "sell everything and run" signal - it's a "hedge your bets and stay disciplined" signal.

If you own IBIT:

- ✅ Consider trimming 20-30% if you're up big (take some profits, de-risk into year-end)

- 🛡️ If holding through December, consider buying 1 protective put per 100 shares (costs ~$700 but limits downside)

- 📊 Set mental stop at $50 (major gamma support) to protect remaining position

- ⏰ Don't panic on volatility - Bitcoin consolidations can last weeks before next big move

- 🎯 If IBIT breaks below $50, reassess aggressively (that's THE line in the sand)

If you're watching from sidelines:

- ⏰ November 21st and December 19th OPEX are key volatility windows - avoid entering right before

- 🎯 Post-OPEX pullback to $50-$51 would be EXCELLENT entry (6% margin of safety with gamma support)

- 📈 Looking for confirmation: Bitcoin holding $100K+, IBIT weekly inflows positive, Fear/Greed above 30

- 🚀 Long-term (6-12 months), Strategic Reserve implementation and model portfolio adoption are legit bullish catalysts for $65-$75

- ⚠️ Current setup (Bitcoin at $104K after 16% correction, mixed flows, gamma resistance overhead) is NOT screaming "buy now!"

If you're bearish:

- 🎯 Wait for Bitcoin to break below $95K before initiating aggressive shorts - fighting 62.75% market-dominant ETF is risky

- 📊 First support at $53 (already testing), major support at $50 (42.5B gamma), deeper floor at $47.62 (implied move)

- ⚠️ December put spreads ($55/$50 bear put spread) offer defined-risk way to play downside after Nov 21 OPEX

- 📉 Watch for break below $50 - that's trigger for acceleration toward $47-$48

- ⏰ Year-end tax-loss selling could pressure IBIT in late December (seasonal factor)

Mark your calendar - Key dates:

- 📅 November 21, 2025 (Thursday) - Weekly + Monthly OPEX (±3.46% expected move)

- 📅 December 12, 2025 - Put expiration for the $30M roll trade

- 📅 December 19, 2025 - Quarterly Triple Witch (±10.25% expected move, $47.62-$58.49 range)

- 📅 Q1 2026 (Jan-Mar) - Strategic Bitcoin Reserve implementation

- 📅 Early 2026 - CME 24/7 crypto trading launch

- 📅 Mid-2026 - Projected 1.5M BTC in spot ETFs milestone

Final verdict: IBIT's long-term story remains COMPELLING - Strategic Bitcoin Reserve validation, Harvard's $443M endorsement, 62.75% market dominance, $187M revenue generation, and model portfolio inclusion are all real structural positives. BUT, near-term setup shows elevated risk: Bitcoin consolidating after 16% correction, record outflows reversing but not resolved, massive gamma resistance overhead at $53-$60, and smart money deploying $30M in protection.

Be patient. Let the November 21st OPEX clear. Watch how Bitcoin handles the $95K-$110K range. Look for better risk/reward in January 2026 when Strategic Reserve details emerge and year-end volatility settles. The Bitcoin revolution will still be here in 60 days, and you'll sleep better buying IBIT at $50 with conviction than chasing it at $53 with uncertainty.

The institutions are hedging for a reason. Follow their lead. Protect your capital. 💪

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. This analysis is for educational purposes only and not financial advice. Past performance doesn't guarantee future results. The Z-scores and unusual classifications reflect this specific trade's size relative to recent IBIT history - they do not imply the trade will be profitable or that you should follow it. IBIT's value moves essentially 1:1 with Bitcoin price, which can experience 10-20% swings in days. Always do your own research and consider consulting a licensed financial advisor before trading. The put buyer may have complex portfolio hedging needs (protecting a $100M+ long IBIT position) that are not applicable to retail traders with smaller accounts.

About iShares Bitcoin Trust (IBIT): BlackRock's iShares Bitcoin Trust is a spot Bitcoin ETF providing direct exposure to Bitcoin through physical holdings, with $72.4 billion in net assets and 62.75% market share of all spot Bitcoin ETF trading volume, commanding the exchange-traded cryptocurrency market.

References

[^2_1]: "Record $1.26B Outflow Hits BlackRock's Bitcoin IBIT Fund," CoinDesk, November 18, 2025, https://www.coindesk.com/markets/2025/11/18/record-usd1-26b-outflow-hits-blackrock-bitcoin-etf-as-bearish-options-cost-soars

[^2_2]: "BlackRock's IBIT Embraces In-Kind: A New Dawn for Bitcoin ETFs," FinancialContent, September 17, 2025, https://markets.financialcontent.com/stocks/article/marketminute-2025-9-17-blackrocks-ibit-embraces-in-kind-a-new-dawn-for-bitcoin-etfs-and-institutional-capital

[^2_3]: "BlackRock's IBIT ETF Breaks into Mainstream Model Portfolios," Blockhead, March 3, 2025, https://www.blockhead.co/2025/03/03/blackrocks-ibit-etf-breaks-into-mainstream-model-portfolios/

[^2_5]: "BlackRock's Most Profitable ETF (IBIT) Is a Nearly $100 Billion Bitcoin Giant," Bloomberg, October 7, 2025, https://www.bloomberg.com/news/articles/2025-10-07/blackrock-s-most-profitable-etf-ibit-is-a-nearly-100-billion-bitcoin-giant

[^2_6]: "Harvard Endowment Takes Rare Leap Into Bitcoin With $443M Bet on BlackRock's IBIT," CoinDesk, November 15, 2025, https://www.coindesk.com/markets/2025/11/15/harvard-endowment-takes-rare-leap-into-bitcoin-with-usd443m-bet-on-blackrock-s-ibit

[^4_1]: "Bitcoin Hits $125K Record High (Oct 2025)," Plus500, October 2025, https://us.plus500.com/en/newsandmarketinsights/bitcoin-hits-125k-record-high

[^4_2]: "Betting On IBIT As Bitcoin Correction Nears Its End," Seeking Alpha, November 2025, https://seekingalpha.com/article/4839173-betting-on-ibit-as-bitcoin-correction-nears-its-end

[^4_4]: "Bitcoin's Institutional Adoption Surge: November 2025," AInvest, November 2025, https://www.ainvest.com/news/bitcoin-institutional-adoption-surge-catalyst-sustained-bullish-momentum-november-2025-2511/

[^4_6]: "Bitcoin Price Outlook for November 2025: Global Portfolios Transformed," Bitget News, November 2025, https://www.bitget.com/news/detail/12560605055236

[^4_7]: "Bitcoin's Volatility and Institutional Adoption in November 2025," AInvest, November 2025, https://www.ainvest.com/news/bitcoin-volatility-institutional-adoption-november-2025-maturing-market-speculative-excess-2511/

[^6_1]: "U.S. BTC ETFs See $1B Inflows, Seen 6 Times Before and Each Time Marked a Local Top," CoinDesk, October 7, 2025, https://www.coindesk.com/markets/2025/10/07/u-s-bitcoin-etfs-log-usd1b-inflows-again-a-level-that-s-marked-local-tops-six-times-before

[^6_4]: "Bitcoin ETF Exodus Extends to Six Days as BTC Slips Below $103K," CoinLaw, November 2025, https://coinlaw.io/bitcoin-etf-outflows-103k-price-drop/

[^6_5]: "Bitcoin and Ethereum ETFs See First November Inflows After $2.9 Billion Outflow Streak," Yahoo Finance, November 6, 2025, https://finance.yahoo.com/news/bitcoin-ethereum-etfs-see-first-124007976.html

[^7_1]: "Bitcoin ETF Inflows Hit $524M As BlackRock's IBIT Leads Institutional Revival," Trading News, November 2025, https://www.tradingnews.com/news/bitcoin-btc-usd-etf-inflows-surge-to-524m-usd-blackrocks-ibit-dominate

[^8_1]: "SEC Permits In-Kind Creations and Redemptions for Crypto ETPs," SEC Press Release 2025-101, July 29, 2025, https://www.sec.gov/newsroom/press-releases/2025-101-sec-permits-kind-creations-redemptions-crypto-etps

[^9_1]: "BlackRock's IBIT ETF Breaks into Mainstream Model Portfolios," Blockhead, March 3, 2025, https://www.blockhead.co/2025/03/03/blackrocks-ibit-etf-breaks-into-mainstream-model-portfolios/

[^11_1]: "Harvard University boosts its BlackRock Bitcoin ETF investment to $442.8m," DL News, November 2025, https://www.dlnews.com/articles/markets/harvard-university-boosts-blackrock-bitcoin-etf-position/

[^12_1]: "Bitcoin's Institutional Adoption Surge: November 2025," AInvest, November 2025, https://www.ainvest.com/news/bitcoin-institutional-adoption-surge-catalyst-sustained-bullish-momentum-november-2025-2511/

[^12_2]: "Why Hundreds of Companies Will Buy Bitcoin in 2025," Nasdaq, 2025, https://www.nasdaq.com/articles/why-hundreds-companies-will-buy-bitcoin-2025

[^12_3]: "Why Hundreds of Companies Will Buy Bitcoin in 2025," Nasdaq, 2025, https://www.nasdaq.com/articles/why-hundreds-companies-will-buy-bitcoin-2025

[^12_4]: "Strategy (MicroStrategy) Bitcoin Holdings Chart & Purchase," Bitbo, accessed November 18, 2025, https://treasuries.bitbo.io/microstrategy

[^13_1]: "IBIT vs FBTC: Fees, Performance & Which Bitcoin ETF to Buy," CryptoNews, 2025, https://cryptonews.com/cryptocurrency/ibit-vs-fbtc/

[^13_4]: "11 Spot Bitcoin ETFs to Buy in 2025," U.S. News, 2025, https://money.usnews.com/investing/articles/new-spot-bitcoin-etfs-to-buy

[^14_1]: "Bitcoin Halving: Impact on Price & What's Next," Cash2Bitcoin, 2024, https://cash2bitcoin.com/blog/bitcoin-halving/

[^14_2]: "Examining the 2024 Bitcoin Halving Effect on Price Movements," Bitcoin Magazine Pro, 2025, https://www.bitcoinmagazinepro.com/blog/examining-the-2024-bitcoin-halving-effect-on-price-movements/

[^15_1]: "Could Bitcoin's Price Peak in 2025? Analyzing the Historical Halving Cycles," OneSafe Blog, 2025, https://www.onesafe.io/blog/whats-next-for-bitcoin-halving-cycles-market-trends

[^16_1]: "Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve," The White House, March 6, 2025, https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-strategic-bitcoin-reserve-and-u-s-digital-asset-stockpile/

[^16_4]: "Trump Administration Establishes Strategic Bitcoin Reserve and Digital Asset Stockpile," Burr & Forman LLP, March 2025, https://www.burr.com/newsroom/articles/trump-administration-establishes-strategic-bitcoin-reserve-and-digital-asset-stockpile

[^16_5]: "4 things to know about Trump's plan for a 'crypto strategic reserve'," NPR, March 4, 2025, https://www.npr.org/2025/03/04/g-s1-51748/trump-crypto-reserve-bitcoin-stockpile-ether

[^17_1]: "CME Group to Launch 24/7 Crypto Futures and Options Trading in Early 2026," CoinDesk, October 2, 2025, https://www.coindesk.com/business/2025/10/02/cme-group-to-launch-24-7-crypto-futures-and-options-trading-in-early-2026

[^18_1]: "Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $110K in November?," CoinDCX, November 2025, https://coindcx.com/blog/price-predictions/bitcoin-price-weekly/

[^18_5]: "Bitcoin (BTC) Price Prediction 2025 2026 2027 - 2030," Changelly, 2025, https://changelly.com/blog/bitcoin-price-prediction/

[^18_6]: "Bitcoin Forecast 2025-2026, Long-Term BTC Price Prediction 2030-2050," Libertex, 2025, https://libertex.com/blog/bitcoin-price-forecasts

[^18_7]: "Bitcoin (BTC) Price Prediction 2025, 2026-2030," CoinCodex, 2025, https://coincodex.com/crypto/bitcoin/price-prediction/

[^18_8]: "BITCOIN PRICE PREDICTION 2025, 2026, 2027, 2028, 2029," Long Forecast, 2025, https://longforecast.com/bitcoin-price-predictions-2017-2018-2019-btc-to-usd

[^19_2]: "Crypto ETF Watchlist 2025: Key Filings, Top Players & What's Next," CCN, 2025, https://www.ccn.com/education/crypto/crypto-etf-watchlist-filings-players-updates/

[^19_3]: "12 Pending Crypto ETF Decisions: How Will the SEC Shape 2026?," Webopedia, 2025, https://www.webopedia.com/crypto/learn/pending-crypto-etf-2026/

[^22_2]: "10 Best Bitcoin ETFs of 2025 | Compare Fees, Structure & Performance," Benzinga, 2025, https://www.benzinga.com/money/best-spot-bitcoin-etfs

[^24_1]: "Bitcoin's October 2025 Inflection Point: Macroeconomic Catalysts," AInvest, October 2025, https://www.ainvest.com/news/bitcoin-october-2025-inflection-point-macroeconomic-catalysts-sentiment-dynamics-2509/

[^24_2]: "The crypto market turns cautious in November 2025—what are the reasons behind the bearish shift?," Bitget News, November 2025, https://www.bitget.com/news/detail/12560605043861

[^24_4]: "Bitcoin's Price Outlook in November 2025: Navigating Seasonality and Macroeconomic Catalysts," AInvest, November 2025, https://www.ainvest.com/news/bitcoin-price-outlook-november-2025-navigating-seasonality-macroeconomic-catalysts-2511/

[^24_5]: "Bitcoin's Price Outlook in November 2025: Navigating Seasonality and Macroeconomic Catalysts," AInvest, November 2025, https://www.ainvest.com/news/bitcoin-price-outlook-november-2025-navigating-seasonality-macroeconomic-catalysts-2511/

[^25_1]: "Crypto Regulations in China Statistics 2025: Real Trends," CoinLaw, 2025, https://coinlaw.io/crypto-regulations-in-china-statistics/

[^25_2]: "Bitcoin forecast 2025: trends, scenarios and expert opinions," Bitpanda Academy, 2025, https://www.bitpanda.com/academy/en/lessons/bitcoin-forecast-2025-trends-scenarios-and-expert-opinions/

[^26_1]: "US Spot Bitcoin BTC ETF Net Inflows Hit $202.4M on 2025-10-28: ARKB $75.8M, FBTC $67M, IBIT $59.6M," Blockchain.News, October 28, 2025, https://blockchain.news/flashnews/us-spot-bitcoin-btc-etf-net-inflows-hit-202-4m-on-2025-10-28-arkb-75-8m-fbtc-67m-ibit-59-6m