HSY Unusual Options Report - August 14, 2025: $2M Earnings Day Gamble

⚡ VERY HIGH ALERT! Someone just bought $2 million in HSY calls expiring TODAY - the same day as the ex-dividend date! With 1,320 contracts at $165 strike (stock at $180), this is either brilliant dividend capture or someone knows something about earnings. This is the definition of high conviction...

🎯 The Quick Take

⚡ VERY HIGH ALERT! Someone just bought $2 million in HSY calls expiring TODAY - the same day as the ex-dividend date! With 1,320 contracts at $165 strike (stock at $180), this is either brilliant dividend capture or someone knows something about earnings. This is the definition of high conviction trading! 🍫

Translation for us regular folks: When big money spends $2M on options expiring in hours, they're either capturing the $1.37 dividend with leverage or expecting immediate news. This is surgical precision trading!

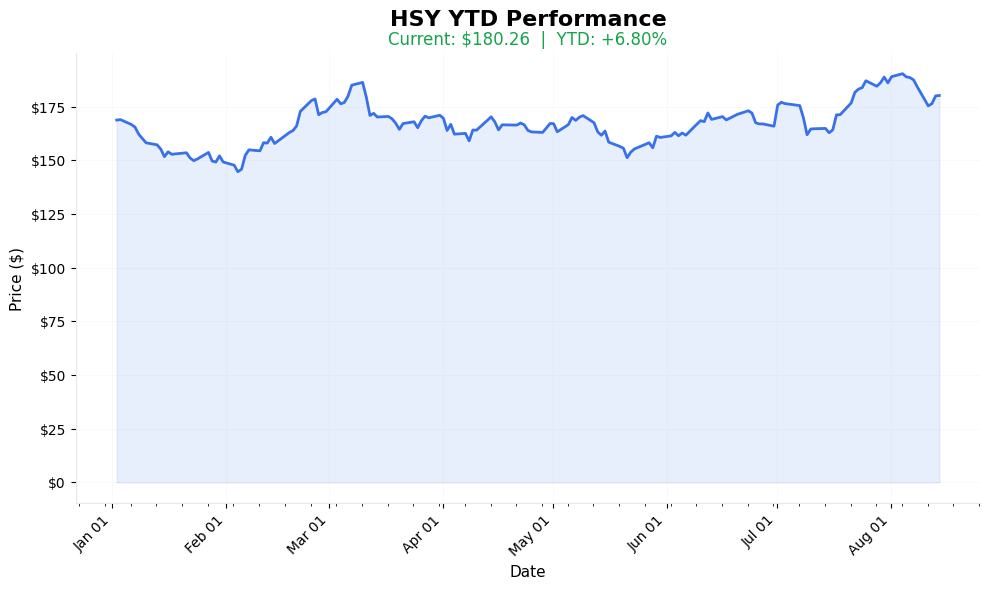

📈 YTD Performance

HSY Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: Same-Day Expiry Madness!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 1,320 contracts | Institutional positioning! |

| Total Premium | $2.0M | Major capital deployment |

| Spot Price | $180.16 | Well above strike |

| Strike Price | $165 | Deep ITM ($15 cushion) |

| Days to Expiry | 0 days | EXPIRES TODAY! |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟩⬜⬜⬜ 7/10 | Extreme Activity |

🎬 The Actual Trade Tape

📊 Order Flow: Aggressive accumulation over 4 minutes

🎯 Execution: ASK & MID (paid up for speed!)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 14:08:10 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 6,200 | $918K | $180.04 | $15.30 |

| 14:07:15 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 5,600 | $918K | $180.05 | $15.30 |

| 14:04:35 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 5,000 | $544K | $180.15 | $15.10 |

| 14:04:31 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 4,700 | $544K | $180.15 | $15.10 |

| 14:03:53 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 1,800 | $540K | $180.16 | $15.00 |

| 14:04:17 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 3,600 | $540K | $180.16 | $15.00 |

| 14:04:03 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 2,500 | $540K | $180.16 | $15.00 |

| 14:03:49 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 1,400 | $540K | $180.16 | $15.00 |

| 14:04:22 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 4,000 | $540K | $180.16 | $15.00 |

| 14:04:14 | 🟢 BUY | 📈 CALL | $165 | 2025-08-15 | 3,200 | $540K | $180.16 | $15.00 |

⚡ Strategy Detection: EX-DIVIDEND CAPTURE PLAY

What This Means in Plain English:

- 🎯 DEEP ITM: $15 intrinsic value = stock replacement

- 💰 EX-DIV TODAY: Capturing $1.37 dividend (3.11% yield)

- 📊 SAME DAY EXPIRY: Maximum capital efficiency

- ⏰ URGENT EXECUTION: All trades within 5 minutes

Translation: This is a sophisticated dividend capture strategy using deep ITM calls to control $23.8M worth of stock for just $2M premium. Genius or gambling!

🎯 What The Smart Money Knows

The Setup They're Playing:

Key Events TODAY:

- Ex-dividend date: August 15 (TODAY!)

- Dividend amount: $1.37 per share

- Payment date: September 15

- New CEO starts: August 18 (3 days!)

Why HSY? The Catalyst Convergence:

Key Highlights:

- 💵 Dividend Capture TODAY

- $1.37 quarterly dividend

- 3.11% annual yield

Additional Points: Stock typically holds on ex-div day;

Options provide leverage

;👔 New CEO Era (Aug 18)

; Kirk Tanner from Wendy's/PepsiCo; 30+ years CPG experiencePlus 17 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"Too late for today but..."

- Play: Next ex-div (Nov 2025) calls

- Strike: $180-185

- Cost: Watch for ~$5-8 premium

- Risk: Time decay between dividends

- Position Size: 1% MAX

🏄 Swing Traders

"I'll play the CEO honeymoon"

- Play: Buy HSY on any dip to $175

- Stop: $170

- Target: $190-195

- Position Size: 3-4% of account

💎 Premium Collectors

"I'll sell volatility"

- Play: Sell $175 puts for September

- Collect: ~$2.50 premium

- Risk: Assignment at $172.50

- Win If: Stock stays above $175

👶 Entry Level Investors

"Chocolate is recession-proof!"

- Play: Buy shares for dividend

- Entry: $175-180 range

- Hold: Through Q3 earnings

- Collect: 3.11% dividend yield

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🍫 Cocoa Costs: Still 121% higher than 2 years ago

- 💸 Tariff Impact: $170-180M headwind in 2025

- 📉 EPS Decline: Expected -36-38% due to costs

- 🛒 Consumer Pushback: Price increases may hurt volume

- 📊 Valuation: 31.6x forward PE is expensive

🎯 The Bottom Line

Real talk: This $2M same-day options play is EXTREME:

1. Ex-dividend capture with leverage

2. New CEO starts in 3 days

3. Deep ITM = high probability win

4. 5-minute execution = urgency

5. Someone's very confident about today!

This is either brilliant financial engineering or inside knowledge of positive news!

📋 Your Action Checklist

✅ If Following: Too late for today - watch for Q3 setup

✅ Set Alerts: $175 (support), $185 (resistance), $190 (target)

✅ Mark Calendar: Aug 18 (new CEO), Oct 30 (Q3 earnings)

✅ Watch For: CEO strategy announcements, cocoa prices

✅ Risk Management: Defensive stock but expensive valuation!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | HSY | The Hershey Company |

| Strategy | ITM Call Buying | Dividend capture play |

| Premium | $2.0M total | Whale-sized bet |

| Contracts | 1,320 | Large block trades |

| Strike | $165 | Deep ITM ($15 cushion) |

| Spot Price | $180.16 | Well above strike |

| Expiration | Aug 15, 2025 | TODAY! |

| Ex-Dividend | Aug 15, 2025 | TODAY! |

| Dividend | $1.37/share | 3.11% yield |

| Intrinsic Value | $15.16 | Mostly intrinsic |

| Short Interest | 10.33M shares | 5.1% of float |

| Risk Level | 🔥🔥🔥🔥🔥 (5/5) | Maximum (same day!) |

🏷️ Tags for This Trade

Sector: #ConsumerStaples #Food

Strategy Type: #DividendCapture #DeepITM

Catalyst: #ExDividend #NewCEO #Earnings

Risk Level: #ExtremeRisk #SameDay

Trader Types: #Institutional #Sophisticated

⚠️ Disclaimer: Same-day expiration options are the highest risk trades possible. This $2M position expiring TODAY represents extreme conviction in dividend capture or immediate news. The deep ITM nature provides some protection but time decay is instant. This sophisticated strategy requires perfect execution. This is education, not financial advice! 🍫