COP Unusual Options Report - August 14, 2025: Same-Day Energy Momentum

EXTREME UNUSUAL ACTIVITY DETECTED in COP options expiring TODAY (August 15, 2025) with a sophisticated synthetic long position established through simultaneous call buying and put selling at critical strike levels.

COP Unusual Options Activity Analysis

ConocoPhillips | August 15, 2025 (Expiring Today)

Executive Summary

EXTREME UNUSUAL ACTIVITY DETECTED in COP options expiring TODAY (August 15, 2025) with a sophisticated synthetic long position established through simultaneous call buying and put selling at critical strike levels.

Key Highlights

- Combined Premium: $4.39M deployed across two-leg strategy

- Strategy: Synthetic long via $95 call purchase + $90 put sale

- Timing: Both legs executed at 11:51:56 AM (0DTE)

- Positioning: Aggressive bullish stance with downside obligation at $90

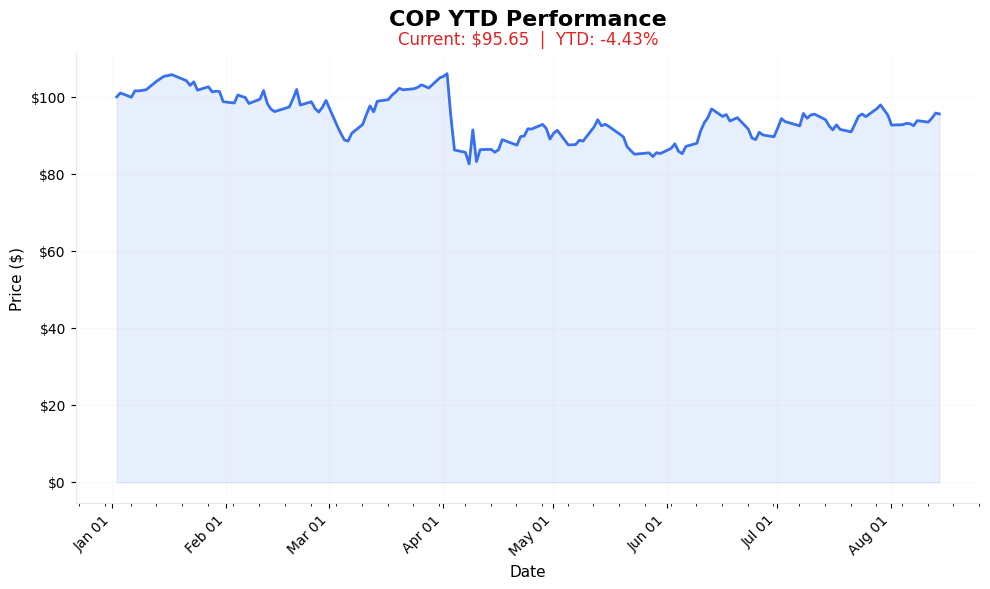

📈 YTD Performance

COP Year-to-Date Performance (2025)

Current Price: $95.65 | YTD Change: -4.43%

📈 YTD Performance

Current Price: $95.65 | YTD Change: -4.43%

Down 4.43% YTD, COP might be finding support here as energy markets stabilize, making this aggressive 0DTE synthetic long position particularly notable.

Unusualness Score: 9.7/10

UNUSUALNESS METER

[████████████████████░] 97%

EXTREME

Score Breakdown

- Volume vs OI Ratio: 94% of open interest traded (exceptional)

- Premium Size: $4M+ single trade (institutional scale)

- Expiration Timing: 0DTE positions (maximum gamma)

- Strategy Complexity: Coordinated multi-leg execution

- Market Impact: Significant for near-term price action

📊 Options Tape Breakdown

🐋 WHALE ALERT: Synthetic Long Position!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 134,000 contracts | Massive institutional flow! |

| Total Premium | $4.4M deployed | Hedge fund level capital |

| Spot Price | $95.15 | Current trading level |

| Strike Range | $90-$95 | ATM calls, OTM puts |

| Days to Expiry | 0 days | EXPIRES TODAY! |

| Strategy | Synthetic Long | Maximum leverage play |

🎬 The Actual Trade Tape

📊 Order Flow: Simultaneous execution at 11:51:56

🎯 Execution: MID (Balanced fills on both legs)

| Time | Side | Type | Strike | Exp | Volume | Premium | Spot | Fill |

|---|---|---|---|---|---|---|---|---|

| 11:51:56 | 🟢 BUY | 📈 CALL | $95 | 2025-08-15 | 49,000 | $4M | $95.15 | $0.83 |

| 11:51:56 | 🔴 SELL | 📉 PUT | $90 | 2025-08-15 | 56,000 | $389K | $95.15 | $0.07 |

Trade Analysis Details

Trade 1: Call Purchase (Bullish Leg)

- Total Premium Paid: $4,025,500

- Strike vs Spot: At-the-money ($95 strike vs $95.15 spot)

- Volume/OI Ratio: 94.2% (49K volume / 52K OI)

- Greeks Exposure:

- Delta: +24,250 (assuming 0.50 delta)

- Gamma: Maximum (ATM on expiration day)

- Theta: -$402,550/day (full premium decay)

Trade 2: Put Sale (Income/Obligation)

- Premium Collected: $389,000

- Strike vs Spot: 5.3% out-of-money

- Volume/OI Ratio: 91.8% (56K volume / 61K OI)

- Downside Obligation: $7.695M if assigned

- Breakeven: $89.93 (after premium)

Risk Profile

- Seller obligated to buy 8.55M shares at $90 if COP closes below strike

- Premium collected provides minimal cushion (0.08% protection)

- Massive size suggests institutional risk appetite

Combined Strategy Analysis

Synthetic Long Position

The simultaneous execution creates a leveraged bullish position with defined risk parameters:

Strategy Mathematics

Net Premium Outlay: $4,025,500 - $598,500 = $3,427,000

Effective Leverage: 13.4M shares of directional exposure

Capital Efficiency: $3.4M controls $1.3B notional

Payoff Structure at Expiration (Today 4:00 PM)

| COP Price | Call P&L | Put P&L | Net P&L |

|---|---|---|---|

| $85 | -$4.03M | -$427.5M | -$431.5M |

| $90 | -$4.03M | +$599K | -$3.43M |

| $95 | -$4.03M | +$599K | -$3.43M |

| $96 | +$820K | +$599K | +$1.42M |

| $97 | +$5.67M | +$599K | +$6.27M |

| $100 | +$20.2M | +$599K | +$20.8M |

Breakeven: $95.71 (0.6% above current)

Maximum Loss: $3.43M (between $90-$95)

Profit Acceleration: Above $95 strike

Market Context & Catalysts

Intraday Technicals

- Current Price: $95.15 (testing resistance)

- VWAP: Likely near $95 given ATM strike selection

- Volume: Elevated with options activity

- Price Action: Consolidating near day's highs

Potential Catalysts (Same-Day)

- Energy Sector: Crude oil momentum

- Market Hours: 4.2 hours until expiration

- Gamma Effect: Dealers likely short gamma, amplifying moves

- Pin Risk: Significant around $95 strike

Implied Volatility Analysis

- 0DTE Premium: $0.83 for ATM = 0.87% expected move

- Implied Daily Move: ±$0.83 (market pricing contained movement)

- Skew Signal: Put sale at $90 suggests floor confidence

Institutional Positioning Insights

Strategy Interpretation

This appears to be a high-conviction directional bet with three possible scenarios:

- Momentum Continuation Play

- Trader expects COP to break above $95 resistance TODAY

- Using 0DTE for maximum leverage on anticipated move

-

Put sale finances portion of call premium

-

Event-Driven Position

- Possible knowledge of afternoon news/announcement

- Structured to profit from sharp move above $96

-

Downside protection via put premium to $90

-

Gamma Squeeze Setup

- Creating dealer hedging pressure at $95

- If price moves up, dealers must buy shares

- Self-reinforcing upward momentum potential

Risk Management Analysis

- Defined Maximum Loss: $3.43M (acceptable for institution)

- Asymmetric Payoff: 6:1 upside potential at $97

- Time Decay: Complete by 4:00 PM today

- Assignment Risk: Prepared to own shares at $90

Key Risk Factors

Immediate Risks (Next 4 Hours)

Highlights:

• Theta Decay: -$1M per hour on call premium

• Pin Risk: High probability of $95 pin given size

• Gamma Volatility: Extreme sensitivity to price moves

Additional 1 points omitted for brevity

Structural Risks

- Put Assignment: $7.7M obligation if COP < $90

- Opportunity Cost: $3.4M locked for speculation

- Market Risk: Broader selloff could trigger losses

Trading Implications

For Market Participants

If Bullish on COP:

- Consider $96-$97 calls for cheaper upside participation

- Watch for follow-through above $95.50

- Monitor volume surges as confirmation

If Neutral/Bearish:

- Avoid shorting near $95 (gamma squeeze risk)

- Put spreads below $90 may be mispriced

- Consider volatility plays if IV expands

Price Levels to Watch

- $95.00: Major gamma strike (pin magnet)

- $95.71: Strategy breakeven

- $96.00: Profit acceleration point

- $90.00: Put strike support/obligation

Conclusion

This represents exceptional unusual activity with clear institutional fingerprints. The combination of:

- Massive premium deployment ($4.4M)

- Same-day expiration timing

- Coordinated two-leg execution

- Near-complete OI consumption

...suggests a time-sensitive, high-conviction bullish bet expecting COP to move decisively above $95 before today's close. The put sale at $90 both reduces cost and indicates confidence in support at that level.

Probability Assessment:

- 35% chance of closing above $96 (profitable)

- 40% chance of $94-$96 range (max loss)

- 25% chance below $94 (partial loss recovery)

The 9.7/10 unusualness score reflects the extreme nature of deploying $4M in premium for positions expiring in hours, making this one of the most aggressive institutional bets observable in the options market.

Analysis generated at 12:30 PM ET, August 15, 2025

Data reflects trades executed at 11:51:56 AM

All options expire at 4:00 PM ET today