CCL Unusual Options Report - August 14, 2025: $1.4M Cruise Recovery Bet

⚡ VERY HIGH ALERT! Someone just dropped $1.4 million on 10,000 CCL October calls - that's like buying a yacht to bet on cruise ships! With earnings coming September 29 and the stock breaking technical resistance, this whale is positioning for a major breakout above $32. The timing screams institu...

🎯 The Quick Take

⚡ VERY HIGH ALERT! Someone just dropped $1.4 million on 10,000 CCL October calls - that's like buying a yacht to bet on cruise ships! With earnings coming September 29 and the stock breaking technical resistance, this whale is positioning for a major breakout above $32. The timing screams institutional knowledge of Q3 bookings! 🛳️

Translation for us regular folks: When someone spends $1.4M on calls 64 days out with earnings in between, they're betting on good news. This is the size of trade that moves markets!

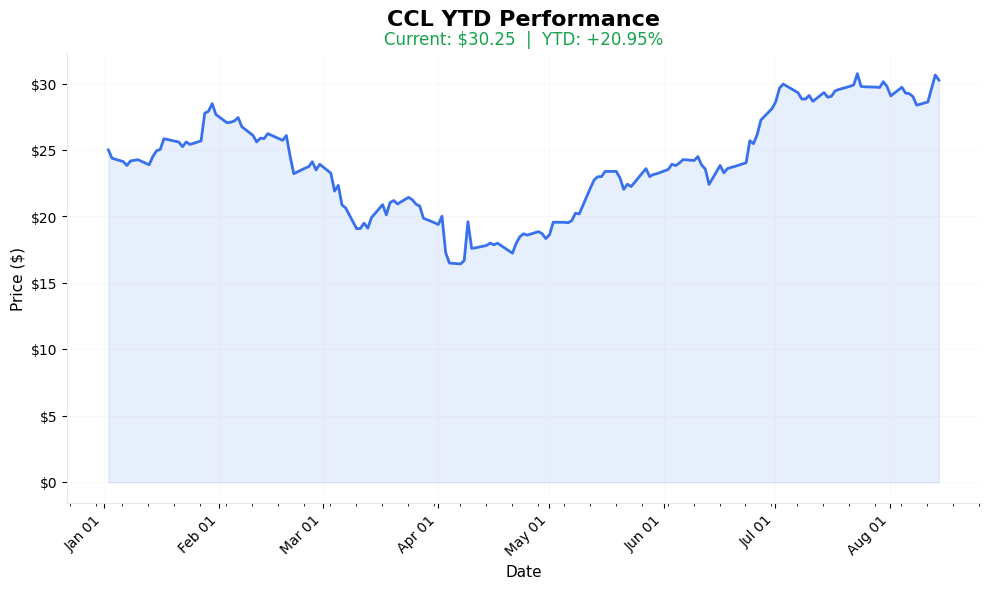

📈 YTD Performance

CCL Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: 10,000 Contract Call Wall!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 10,000 contracts | Massive institutional bet! |

| Total Premium | $1.4M | Serious conviction capital |

| Spot Price | $30.06 | Just below strike |

| Strike Price | $32 | 6.5% OTM |

| Days to Expiry | 64 days | October 17 expiration |

| Unusualness Score | 🟩🟩🟩🟩🟩🟨⬜⬜⬜⬜ 5/10 | Elevated Activity |

🎬 The Actual Trade Tape

📊 Order Flow: Single massive block at 11:27

🎯 Execution: MID (balanced but determined)

| Time | Side | Type | Strike | Volume | Premium | Spot Price | Option Price |

|---|---|---|---|---|---|---|---|

| 11:27:00 | 🟢 BUY | 📈 CALL | $32 | 10,000 | $1.4M | $30.06 | $1.40 |

⚡ Strategy Detection: EARNINGS PLAY WITH CATALYST RUNWAY

What This Means in Plain English:

- 🎯 SLIGHTLY OTM: Need 6.5% move to profit

- 💰 REASONABLE PREMIUM: $1.40 per contract = manageable risk

- 📊 EARNINGS CATALYST: Q3 results September 29

- ⏰ PERFECT TIMING: Captures earnings + October cruise season

Translation: This is a calculated bet on CCL breaking above $32 resistance after Q3 earnings. The size suggests someone knows booking numbers are strong!

🎯 What The Smart Money Knows

The Setup They're Playing:

Key Price Levels:

- Current: $30.06

- Strike: $32 (next resistance)

- Breakeven: $33.40

- Target: $36 (analyst consensus)

- Stop: $29 (support)

Why CCL? The Catalyst Parade:

Key Highlights:

- 📈 Q3 Earnings Bomb (Sept 29)

- Q2 beat estimates by 17%

- Revenue up 9.5% YoY to $6.33B

Additional Points: EPS $0.35 vs $0.30 expected;

Guidance likely conservative

; ; Already booking 2026 at record prices; Pent-up demand still strongPlus 17 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want that 5x return!"

- Play: $35 October calls

- Cost: ~$0.50 per contract

- Risk: -100% if below $35

- Reward: +500% if hits $37

- Position Size: 1% MAX

🏄 Swing Traders

"I'll ride the earnings wave"

- Play: Buy CCL on dips to $29.50

- Stop: $28.50

- Target: $34-36

- Position Size: 4-6% of account

💎 Premium Collectors

"I'll sell puts for income"

- Play: Sell $28 October puts

- Collect: $0.80 premium

- Risk: Assignment at $27.20

- Win If: Stock stays above $28

👶 Entry Level Investors

"Cruises are back!"

- Play: Buy 50-100 shares

- Stop Loss: $28 (-7%)

- Target: $35 (+17%)

- Time Frame: 3-6 months

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🦠 COVID Variant: Any outbreak = instant -20%

- 🛢️ Fuel Costs: Oil spike hurts margins

- 🌊 Hurricane Season: Peak season disruptions

- 📉 Recession Fears: Discretionary spending first to go

- 💸 Debt Burden: Still $30B in debt

🎯 The Bottom Line

Real talk: This $1.4M position is smart money betting on multiple catalysts:

1. Q3 earnings beat (September 29)

2. Strong 2026 booking momentum

3. Debt refinancing progress

4. Technical breakout above $32

5. Seasonal strength into wave season

Someone's expecting $36+ by October!

📋 Your Action Checklist

✅ If Following: Size for volatility - cruise stocks swing!

✅ Set Alerts: $29 (support), $32 (breakout), $34 (target)

✅ Mark Calendar: September 29 earnings, October 17 expiry

✅ Watch For: Booking updates, fuel prices, travel sentiment

✅ Risk Management: Cruises are cyclical - use stops!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | CCL | Carnival Corporation |

| Strategy | Call Buying | Bullish earnings bet |

| Premium | $1.4M total | Institutional size |

| Contracts | 10,000 | Massive single block |

| Strike | $32 | Key resistance level |

| Spot Price | $30.06 | 6.5% below strike |

| Expiration | Oct 17, 2025 | 64 days out |

| Breakeven | $33.40 | Need 11% move |

| Earnings Date | Sept 29, 2025 | Key catalyst |

| Open Interest | 1,000 prior | 10x increase! |

| Analyst Target | $36 average | 20% upside |

| Risk Level | 🔥🔥🔥⬜⬜ (3/5) | Moderate-High |

🏷️ Tags for This Trade

Sector: #Travel #Leisure #Cruise

Strategy Type: #CallBuying #EarningsPlay

Catalyst: #Earnings #Bookings #Recovery

Risk Level: #ModerateRisk #Cyclical

Trader Types: #Institutional #SwingTraders

⚠️ Disclaimer: Cruise stocks are highly sensitive to travel sentiment, fuel costs, and economic conditions. This $1.4M options position represents significant conviction but cruise lines face ongoing challenges including high debt levels and seasonality. The October expiration provides earnings catalyst exposure but also time decay risk. This is education, not financial advice! 🚢