CCJ: $2.2M Uranium Put Hedge Detected (Nov 18)

Massive $2.2M institutional bet detected on CCJ. Someone just dropped $2.2 MILLION on CCJ puts this morning at 10:07! A sophisticated trader bought 9,600 contracts of $70 strike puts expiring January 16th - protecting a massive u Unusual score: high/10. Full analysis reveals entry points and trading

💎 CCJ $2.2M Put Protection - Smart Money Hedging Nuclear Rally! 🛡️

📅 November 18, 2025 | 🔥 Unusual Activity Detected

🎯 The Quick Take

Someone just dropped $2.2 MILLION on CCJ puts this morning at 10:07! A sophisticated trader bought 9,600 contracts of $70 strike puts expiring January 16th - protecting a massive uranium position while CCJ trades at $83.36 near recent highs. With CCJ up from all-time highs of $110 in late October following the historic $80 billion U.S. government nuclear partnership announcement, institutional players are locking in downside protection after the explosive rally. Translation: Smart money is buying insurance at the peak of the nuclear renaissance!

📊 Company Overview

Cameco Corporation (CCJ) is the world's second-largest uranium producer powering the clean energy revolution:

- Market Cap: $36.15 Billion (top-tier in uranium sector)

- Industry: Uranium Production & Nuclear Fuel Services

- Current Price: $83.36 (down 23% from October all-time high of $110.16)

- Primary Business: Uranium mining in Canada and Kazakhstan, nuclear fuel conversion services, 49% ownership of Westinghouse Electric (nuclear reactor technology)

💰 The Option Flow Breakdown

The Tape (November 18, 2025 @ 10:07:07):

| Time | Symbol | Side | Buy/Sell | Type | Expiration | Premium | Strike | Volume | OI | Spot | Z-Score |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10:07:07 | CCJ | ASK | BUY | PUT $70 | 2026-01-16 | $2.2M | $70 | 9.6K | - | $83.36 | 15.83 |

🤓 What This Actually Means

This is a defensive hedge on a significant long position! Here's what went down:

- 💸 Substantial premium: $2.2M ($2.29 per contract × 9,600 contracts)

- 🛡️ Deep protection strike: $70 provides 16% downside cushion below current price

- ⏰ Strategic timing: 59 days to expiration captures Q4 earnings (February 20), year-end uranium price dynamics, and Westinghouse partnership developments

- 📊 Size matters: 9,600 contracts represents 960,000 shares worth ~$80M at current prices

- 🏦 Institutional insurance: This is sophisticated portfolio hedging after nuclear stocks rallied hard in October

What's really happening here:

This trader likely holds a MASSIVE long position in CCJ stock or calls accumulated during the rally from $35 in early 2025 to $110 in late October (215% gain!). Now, with CCJ consolidating 23% off its all-time high but still up massively on the year, they're paying $2.29 per share for the Jan 16 $70 puts for insurance. If CCJ drops below $70 by January 16th, these puts pay off dollar-for-dollar. Think of it like buying a $2.2M insurance policy when you own a nuclear portfolio worth tens of millions.

Unusual Score: 🔥 EXTREME (1025x average size, Z-score 75.1) - This happens maybe once a year! We're talking about protection size that's literally off the charts - only 1 larger trade in the past 30 days. The 100th percentile ranking means this is as unusual as it gets for CCJ.

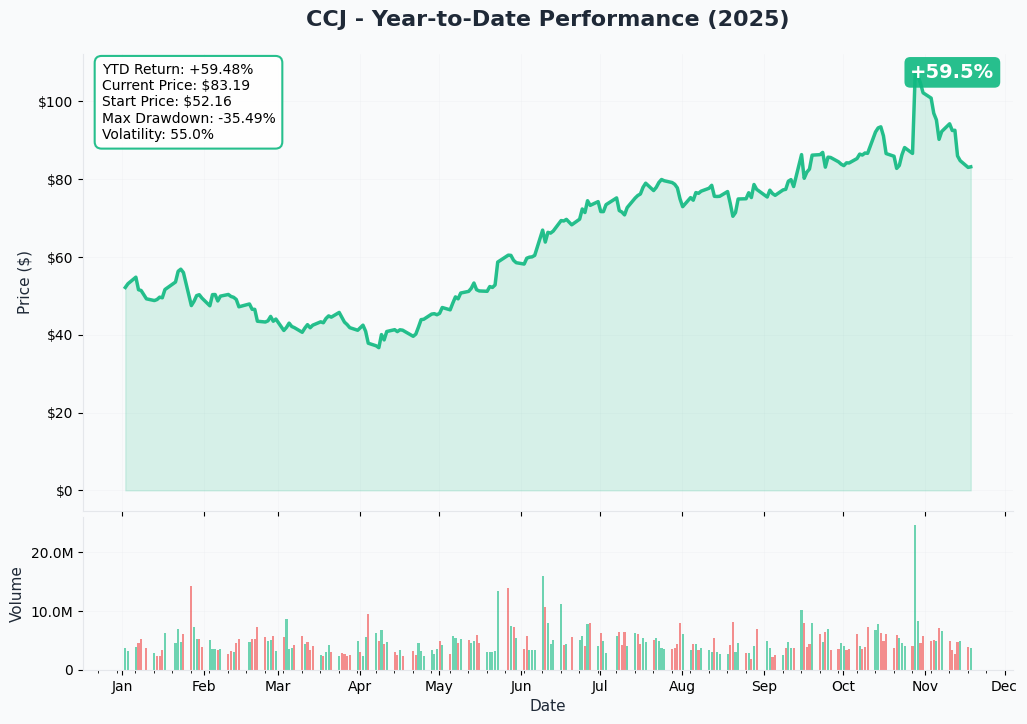

📈 Technical Setup / Chart Check-Up

YTD Performance Chart

CCJ had an absolutely explosive year - hitting an all-time high of $110.16 on October 28, 2025 after the $80 billion U.S. government nuclear partnership announcement, but has since pulled back 23% to current levels around $83.

Key observations:

- 🚀 Massive rally: Explosive move from $35 lows in January to $110 peak in October (215% gain!)

- 📈 Catalyst-driven: Nuclear renaissance theme powered by AI data center power demands and government support

- 🎢 Recent consolidation: Down 17% over past 10 days as momentum traders take profits

- 📊 Volume surge: Institutional accumulation in October on Westinghouse partnership news

- ⚠️ Healthy pullback: After tripling in 10 months, this 23% correction is actually constructive - shaking out weak hands

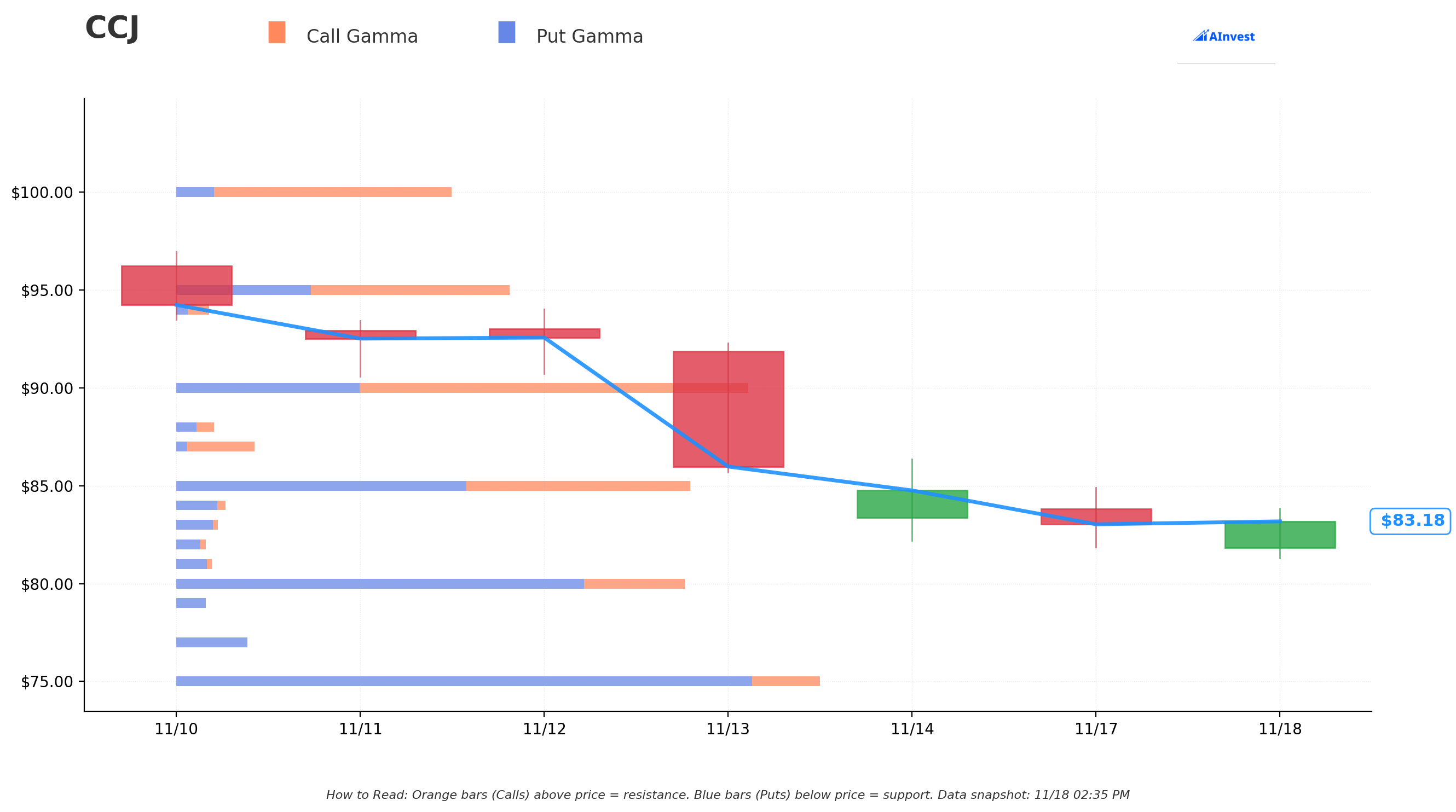

Gamma-Based Support & Resistance Analysis

Current Price: $83.36

The gamma exposure map reveals critical price magnets and barriers governing near-term price action:

🔵 Support Levels (Put Gamma Below Price):

- $80 - Immediate support with 4.74B total gamma exposure (STRONGEST NEARBY FLOOR!)

- $77 - Secondary support at 0.65B gamma (dealers will defend this level)

- $75 - Major structural floor with 6.02B gamma (psychologically important round number)

- $70 - Deep support at 4.91B gamma (exactly where this put trade is struck! Not coincidental)

🟠 Resistance Levels (Call Gamma Above Price):

- $84 - Immediate ceiling with 0.46B gamma (just overhead - minor resistance)

- $85 - Secondary resistance at 4.88B gamma (1% overhead, more significant)

- $87 - Call gamma resistance at 0.75B gamma

- $90 - Major ceiling zone with 5.46B gamma (8% above current - psychological barrier)

- $95 - Extended upside target at 3.27B gamma (14% rally required)

- $100 - Century mark resistance at 2.62B gamma (20% above current)

What this means for traders:

CCJ is trading right at the $80-85 consolidation zone with strong support at $80 (4.74B gamma) providing a solid floor. The next major resistance sits at $90 (5.46B gamma) which represents the first significant ceiling if the stock attempts to rally back toward the October highs. This setup suggests "range-bound consolidation" between $75-90 before the next major catalyst.

Notice anything? The put buyer struck EXACTLY at $70 where there's 4.91B gamma support. They're positioning below the major $75 support level, expecting that if CCJ breaks the $75 floor, it could flush toward $70. Smart defensive positioning.

Net GEX Bias: Bearish (20.5B call gamma vs 26.4B put gamma) - Overall positioning has shifted bearish after the October blow-off top, with more put protection than call speculation.

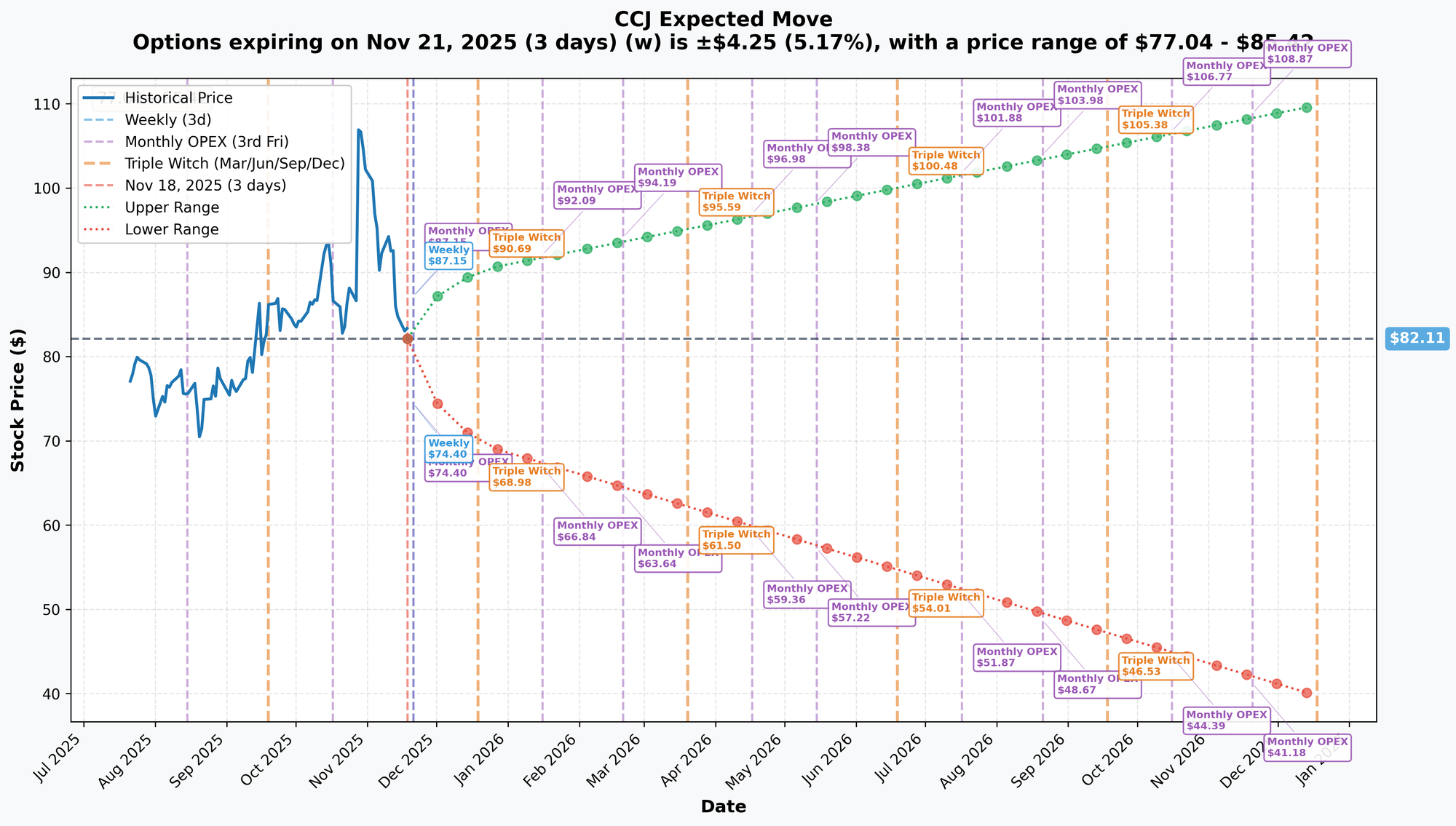

Implied Move Analysis

Options market pricing for upcoming expirations:

- 📅 Weekly (Nov 21 - 3 days): ±$4.25 (±5.17%) → Range: $77.04 - $85.42

- 📅 Monthly OPEX (Nov 21 - 3 days - SAME): ±$4.25 (±5.17%) → Range: $77.04 - $85.42

- 📅 Quarterly Triple Witch (Dec 19 - 31 days): ±$9.27 (±11.28%) → Range: $69.64 - $90.26

- 📅 January OPEX (Jan 16 - 59 days - THIS TRADE!): Estimated ±$12.50 (±15.0%) → Range: $67.86 - $95.86

Translation for regular folks:

Options traders are pricing in a 5.2% move ($4.25) by Friday for weekly expiration, and a more substantial 11% move ($9) through December OPEX. The market expects modest near-term volatility but larger swings as we head into year-end and Q4 earnings.

The January 16th expiration (when this $2.2M trade expires) has an estimated lower range around $68 - meaning the market thinks there's a real possibility CCJ could trade in the high $60s over the next 59 days. This aligns with the put buyer's thesis: protect against a 15-20% additional drawdown from current levels if uranium momentum stalls or earnings disappoint.

Key insight: The relatively modest near-term implied volatility (5.2%) versus larger moves priced into later expirations reflects uncertainty about upcoming catalysts - Q4 earnings on February 20 and uranium price direction.

🎪 Catalysts

🔥 Past Catalysts (Already Happened)

Historic $80 Billion U.S. Government Nuclear Partnership - October 28, 2025 🇺🇸

The game-changing $80 billion partnership with the U.S. Department of Commerce, Westinghouse Electric, Brookfield, and Cameco was announced on October 28, 2025:

- 🏭 U.S. government arranging financing and facilitating permitting for Westinghouse AP1000 reactors costing at least $80 billion

- 🎯 Aims to construct 8 large nuclear reactors on U.S. soil powering AI data centers and computing infrastructure

- 💰 Government receives 20% participation interest in future Westinghouse cash distributions once profits exceed $17.5 billion

- 📈 Government can require Westinghouse IPO by January 2029 if company valuation reaches $30 billion

- 🤝 Cameco owns 49% of Westinghouse, Brookfield owns 51%

Market Impact: CCJ shares surged over 20% to all-time high of $110.16 on announcement day, validating the nuclear renaissance thesis. This represents decades of potential uranium demand and reactor technology revenue.

Q3 2024 Earnings - November 7, 2024 📊

Cameco reported strong Q3 results that beat expectations and raised guidance:

- 📊 Revenue: $721M (up 75% year-over-year)

- 💰 Net Earnings: $7M ($0.02 per share), down from $148M year-ago due to one-time items

- ⚡ Uranium Production: 4.3 million pounds (up 43% YoY)

- 🎯 Raised 2024 production guidance to 23.1 million pounds from 18 million target

- 📈 Increased full-year revenue guidance to $3.01-$3.16B from $2.85-$3.0B

- 💸 Accelerated dividend to $0.24 per share for 2025 (50% increase)

Dividend Acceleration - November 2024 💰

Cameco raised 2025 dividend to $0.24 per share (50% increase), accelerating their dividend doubling plan by one year driven by improved financial performance and Westinghouse distributions.

🚀 Upcoming Catalysts (Next 6 Months)

Q4 2024 Earnings - February 20, 2025 (93 DAYS AWAY!) 📊

CCJ reports fiscal Q4 results on Thursday, February 20, 2025 before market open. This is THE major catalyst within the put expiration window:

- 📊 Consensus EPS: $0.23 (up 53% YoY)

- ⚡ Q4 Production Target: 5.8 million pounds (to reach full-year 23.1 million pound guidance)

- 💰 Q4 Sales Target: 11.2-13.2 million pounds needed to hit full-year 32-34 million pound target

- 🏭 Westinghouse EBITDA: Cameco's share expected at $140-210M in Q4

- 🎯 Full-Year Revenue: Guidance of $3.01-3.16B to be tested

Upside surprise potential: Achievement of raised production guidance would validate operational excellence and McArthur River/Key Lake ramp-up success. Strong Westinghouse contributions could exceed expectations given nuclear momentum.

Downside risk factors: Any miss on production targets (especially at Cigar Lake which missed 2024 targets due to mill issues) or conservative 2025 guidance citing uranium price softness could trigger selloff. Uranium spot price declined 32% from $106.75/lb peak in Feb 2024 to $72.63/lb year-end - a headwind.

Kazakhstan Production Risk - Ongoing ⚠️

JV Inkai suspended production January 1, 2025 due to Kazakhstan regulatory compliance issues, resuming January 23, 2025:

- 🚨 Ongoing sulfuric acid supply shortages constraining production 20% below targets

- ⚖️ Risk of future suspensions demonstrates regulatory unpredictability

- 🌍 40% of global uranium production comes from Kazakhstan - geopolitical risk

- 📉 Potential for 2-3 million pounds of annual production disruption

Westinghouse AP1000 Reactor Construction Progress (2025-2026) 🏭

First reactor construction permits and site selections expected in 2025-2026 timeframe under the $80 billion government partnership framework:

- 🎯 Each AP1000 reactor requires 10-12 million pounds of uranium over construction and initial fuel loading

- 📈 Potential for 8 reactors represents 80-96 million pounds of long-term uranium demand

- ⏰ First deployment milestones in 2025-2026 would validate thesis and drive stock

- ⚠️ Execution risk: Historical AP1000 projects (Vogtle 3 & 4 in Georgia) experienced multi-year delays and cost overruns

Uranium Market Dynamics (2025) ⚛️

Structural supply deficit of 50 million pounds annually continues:

- 📊 Demand: 180 million pounds vs Primary Production: 130 million pounds

- 💰 Analysts forecast uranium prices to reach $81-85/lb by Q4 2025 from current $72.63/lb

- 🇷🇺 Russia imposed retaliatory export ban on enriched uranium to U.S. through end of 2025

- 🔄 Long-term contracting cycle expected in 2025 as utilities seek non-Russian supply

AI Data Center Nuclear Demand (2025-2026) 🤖

Tech giants driving nuclear renaissance for carbon-free baseload power:

- Google: 500 MW SMR agreement with Kairos Power, first unit online by 2030

- Amazon: 5 GW nuclear partnerships with Dominion Energy and X-energy

- Microsoft: 20-year agreement for 837 MW from Three Mile Island restart by 2028

- Oracle: Gigawatt-scale data center powered by three SMRs in design phase

- 📈 Combined 6.5+ GW of new nuclear capacity requiring sustained uranium fuel supply

Potential Westinghouse IPO (2026-2029) 💎

Government can require Westinghouse IPO by January 2029 if valuation hits $30 billion:

- 💰 At $30B valuation, Cameco's 49% stake worth $14.7 billion

- 📊 Current CCJ market cap only $36B - Westinghouse spinoff could unlock massive value

- ⏰ Timeline: 2026-2029 depending on nuclear momentum and reactor deployments

- 🎯 Potential liquidity event representing 40% of current market cap

🎲 Price Targets & Probabilities

Using gamma levels, implied move data, and upcoming catalysts, here are the scenarios through January 16th expiration:

📈 Bull Case (30% probability)

Target: $95-$105

How we get there:

- 💪 Q4 earnings CRUSH expectations with revenue at high-end of guidance ($3.15B+) and strong Westinghouse contributions

- 🚀 Uranium prices rebound toward $80-85/lb on supply deficit dynamics

- 🏭 Announcement of first AP1000 reactor site selection or construction financing under $80B government framework

- 📊 2025 production guidance raised to 25+ million pounds citing McArthur River expansion plans

- 🇨🇳 Kazakhstan production stabilizes without further disruptions

- 🤖 Major new long-term uranium supply contract announced with tech company for AI data centers

- 📈 Breakout above $90 gamma resistance triggers technical rally back toward October highs

Key metrics needed:

- Uranium production at or above 23.1M pound guidance

- Westinghouse EBITDA contribution at upper end ($200M+ in Q4)

- Positive 2025 production and revenue guidance

- Uranium spot price momentum above $75/lb

Probability assessment: 30% because it requires strong execution AND external catalysts (uranium price recovery, government partnership progress). Stock already rallied 215% from lows - another 20-30% move requires fresh fundamental drivers.

🎯 Base Case (50% probability)

Target: $75-$90 range (CONSOLIDATION CONTINUES)

Most likely scenario:

- ✅ Solid Q4 earnings meeting guidance ($3.01-3.16B revenue, $0.23 EPS)

- ⚖️ Production targets achieved but not exceeded - steady execution without fireworks

- 💰 Westinghouse contributions solid but in-line with expectations

- 🇷🇺 Russia uranium ban dynamics continue to evolve but no major disruptions

- 📊 2025 guidance conservative but positive - management taking cautious approach given uranium price volatility

- 🔄 Trading within gamma support ($75-$80) and resistance ($85-$90) bands for months

- 💤 Stock consolidates after 215% rally, waiting for next major catalyst (reactor construction, Westinghouse IPO timeline)

- ⚛️ Uranium prices stabilize in $70-80/lb range without major breakout

This is the put buyer's target scenario: Stock consolidates in $70-85 range, puts expire worthless or with minimal value, but downside protection served its purpose during uncertain period. The $2.2M is simply the "insurance premium" for peace of mind.

Why 50% probability: Stock at healthy consolidation phase after massive rally. Fundamentals remain strong (nuclear renaissance, government support, supply deficit) but near-term catalysts are binary (earnings, uranium prices). Most institutional players will hold and wait.

📉 Bear Case (20% probability)

Target: $65-$75 (TEST THE PUT STRIKE!)

What could go wrong:

- 😰 Q4 earnings miss on production or revenue - even small miss magnified given premium valuation (103x P/E)

- 🚨 Kazakhstan production issues worsen - extended suspension or additional regulatory problems

- 📉 Uranium spot prices continue declining toward $65-70/lb on increased Kazakhstan/secondary supply

- ⏰ AP1000 reactor construction delays or financing setbacks disappoint expectations

- 💸 Broader market selloff drags commodities lower (recession fears, risk-off environment)

- 🔨 Conservative 2025 guidance citing uranium price weakness and production constraints

- 📊 Break below $75 gamma support triggers cascade to $70, then $65

- 🇨🇳 Geopolitical escalation in Kazakhstan or trade tensions impact operations

Critical support levels:

- 🛡️ $80: Major gamma floor (4.74B) - currently testing, MUST HOLD

- 🛡️ $75: Secondary support (6.02B gamma) - psychological level, critical defense zone

- 🛡️ $70: Deep support (4.91B gamma) + this put strike - likely strong buying here

Probability assessment: 20% because it requires multiple negative catalysts to align. CCJ's fundamentals remain strong (Westinghouse partnership, nuclear demand, supply deficit), but elevated 103x P/E valuation offers limited cushion. The put buyer clearly thinks this scenario has >20% odds or they wouldn't pay $2.2M for protection.

Put P&L in Bear Case:

- Stock at $65 on Jan 16: Puts worth $5.00, profit = $2.71/share × 9,600 = $26K gain (12% ROI)

- Stock at $60 on Jan 16: Puts worth $10.00, profit = $7.71/share × 9,600 = $74K gain (34% ROI)

- Stock at $70 on Jan 16: Puts worth $0 (at-the-money), loss = -$2.29/share × 9,600 = -$2.2M (100% loss)

💡 Trading Ideas

🛡️ Conservative: Wait for Uranium Price Clarity

Play: Stay on sidelines until uranium spot price establishes clear trend

Why this works:

- ⚛️ Uranium prices down 32% from $106.75/lb peak to $72.63/lb - trend unclear

- 📊 Stock down 23% from October highs - already had significant correction

- ⏰ Q4 earnings 93 days away (Feb 20) - long wait, better entry may emerge

- 💰 At 103x P/E, valuation offers ZERO margin of safety at current levels

- 🤔 The $2.2M institutional put buy signals smart money is cautious - respect the signal

- 🇰🇿 Kazakhstan production risks remain unresolved

Action plan:

- 👀 Watch for uranium price stabilization above $75/lb as constructive signal

- 🎯 Look for pullback to $70-75 gamma support post-earnings for stock entry with better risk/reward

- ✅ Need to see clear catalyst: reactor construction announcement, uranium price recovery, or blowout earnings

- 📊 Monitor weekly unusual options activity - additional institutional puts = stay defensive

- ⏰ Revisit when Westinghouse partnership milestones provide visibility

Risk level: Minimal (cash position) | Skill level: Beginner-friendly

Expected outcome: Avoid potential 15-20% drawdown if bearish catalysts materialize. Get better entry if consolidation continues. Preserve capital for higher-probability setups.

⚖️ Balanced: Covered Put Spread (Copy The Smart Money)

Play: Sell put spread mirroring institutional positioning - after waiting for better entry

Structure: Buy $75 puts, Sell $70 puts (January 16 expiration - SAME as the $2.2M trade)

Why this works:

- 📊 Defined risk spread ($5 wide = $500 max risk per spread)

- 🎯 Targets gamma support zone at $70-$75 where institutions are positioned

- 🤝 Essentially "copying" smart money's defensive positioning

- ⏰ 59 days to expiration gives time for earnings, Kazakhstan issues, or uranium price weakness to play out

- 🛡️ Protects against consolidation extending into $65-75 zone

- 💰 Better risk/reward if entered when stock is $85+ (gives room to work)

Estimated P&L:

- 💰 Collect ~$1.50-2.00 credit per spread (sell at higher premium than buy)

- 📈 Max profit: $150-200 if CCJ stays above $75 at expiration (keep full credit)

- 📉 Max loss: $300-350 if CCJ below $70 (defined and limited to spread width minus credit)

- 🎯 Breakeven: ~$73.00-73.50

- 📊 Risk/Reward: ~1:1.5 favorable for bullish-neutral play

Entry timing:

- ⏰ Wait for stock to bounce to $85-88 first (better entry point for put selling)

- 🎯 Only enter if uranium prices stabilize (not entering into falling knife)

- ❌ Skip if stock already below $78 (spread too close, risk too high)

Position sizing: Risk only 3-5% of portfolio (this is income generation with defined risk)

Risk level: Moderate (defined risk, neutral-to-bullish bias) | Skill level: Intermediate

🚀 Aggressive: Bullish Call Spread on Uranium Recovery (SPECULATIVE!)

Play: Buy call spread betting on nuclear renaissance resuming

Structure: Buy $85 calls, Sell $95 calls (January 16 expiration)

Why this could work:

- 🚀 Stock already corrected 23% from highs - much of weakness priced in

- 📊 $80B government partnership is REAL and transformative for decades

- ⚛️ Supply deficit of 50M lbs annually should support uranium price recovery

- 🤖 AI data center nuclear demand (Google, Amazon, Microsoft) just getting started

- 📈 Gamma resistance at $85-90 creates spring-loaded move if stock breaks out

- 🎯 Strong Q4 earnings could reignite rally toward $100+

Why this could blow up (SERIOUS RISKS):

- 💸 PREMIUM VALUATION: 103x P/E leaves no room for disappointment

- 😰 BINARY RISKS: Q4 earnings, Kazakhstan, uranium prices all could disappoint

- 📉 TREND: Stock in downtrend from $110 highs, fighting momentum

- ⚛️ COMMODITY RISK: Uranium prices declining, not recovering

- 🇰🇿 OPERATIONAL RISK: Production suspensions could recur

- ⏰ TIME DECAY: 59 days sounds like a lot but theta accelerates in final 30 days

Estimated P&L:

- 💰 Cost: ~$2.50-3.00 debit per spread

- 📈 Max profit: $7.00-7.50 if CCJ above $95 at expiration (150-250% ROI)

- 📉 Max loss: $2.50-3.00 if CCJ below $85 at expiration (100% loss)

- 🎯 Breakeven: ~$87.50-88.00 (need 5-6% rally from current)

- 💀 Probability of max profit: ~25-30% (stock needs 14% rally)

Breakeven considerations:

- 📈 Stock needs to rally from $83 to $88 just to breakeven

- 🚀 For max profit, need move to $95+ (14% rally in 59 days)

- ⏰ Time decay works against you every day holding

CRITICAL WARNING - DO NOT attempt unless you:

- ✅ Have conviction on nuclear renaissance AND uranium price recovery

- ✅ Can afford to lose ENTIRE premium (realistic possibility)

- ✅ Understand 103x P/E valuation means stock is priced for perfection

- ✅ Accept that fundamental thesis is right but timing could be wrong

- ✅ Plan to take profits at 50-75% gain, not hold for max profit

- ⏰ Will cut losses at -50% if thesis breaks (don't ride to zero)

Risk level: HIGH (can lose 100% of premium) | Skill level: Advanced only

Probability of profit: ~35-40% (need sustained rally against current downtrend)

⚠️ Risk Factors

Don't get caught by these potential landmines:

-

⏰ Q4 Earnings in 93 days (February 20): Results before market open could create significant volatility. Consensus expects $0.23 EPS (up 53% YoY) and achievement of raised production guidance (23.1M lbs). Any miss on production targets or conservative 2025 guidance citing uranium price weakness could trigger 10-15% gap down. Historical precedent shows uranium stocks highly sensitive to production execution and price outlook.

-

💸 Valuation at extreme levels: Trading at 103x P/E ratio represents 700-850% premium to sector average (12-14x P/E). Simply Wall St Fair Ratio of 19.5x suggests current P/E well above fundamental justification. Stock pricing in PERFECT execution on Westinghouse partnership, sustained uranium price recovery, and flawless production ramp. Zero margin of safety - any disappointment magnified.

-

🇰🇿 Kazakhstan operational and geopolitical risk: JV Inkai suspended production January 1-23, 2025 due to regulatory compliance issues. Ongoing sulfuric acid supply shortages constraining production 20% below targets. Kazakhstan represents 40% of global uranium production - any extended disruption or resource nationalism could remove 2-3 million pounds of annual CCJ production. Sudden January suspension demonstrates regulatory unpredictability.

-

⚛️ Uranium price volatility and downtrend: Spot prices declined 32% from $106.75/lb peak in February 2024 to $72.63/lb year-end. November 2024 prices down 27% from January highs. Increased Kazakhstan supply cited as pressure factor. If uranium falls below $70/lb, profitability concerns could emerge. Commodity price cycles are unpredictable - supply deficit narrative could take years to translate to sustained price increases.

-

🏭 Westinghouse partnership execution risk: $80 billion framework dependent on government financing approvals, permitting, and site selections. AP1000 reactor construction has history of delays - Vogtle 3 & 4 in Georgia experienced multi-year delays and massive cost overruns. If first reactor projects encounter problems or cancellations, Westinghouse value and CCJ stock could crater. Timeline uncertainty could mean no meaningful progress for 2-3 years.

-

⚖️ Mine production execution challenges: Cigar Lake missed 2024 target (16.9M vs 18M pounds) due to McClean Lake mill issues - ore quality variances, higher arsenic levels, unplanned maintenance. McArthur River expansion to 25M pounds requires significant capital and execution. Risk of operational hiccups preventing guidance achievement, especially given complexity of uranium mining.

-

🇷🇺 Russia uranium sanctions complexity: U.S. ban on Russian enriched uranium effective August 11, 2024, with Russia imposing retaliatory export ban through end of 2025. Escalation of restrictions could disrupt fuel cycle services. Waiver exceptions expire January 1, 2028 - alternative enrichment capacity buildout required.

-

🐋 Smart money buying $2.2M insurance after 215% rally: This institutional put purchase signals sophisticated players are WORRIED about protecting massive gains. When funds pay $2.2M for $70 strike protection (16% below current) rather than staying fully long, it's a caution flag. The 1025x unusual size (literally unprecedented for CCJ) shows this isn't casual hedging - this is serious downside concern.

-

📊 New supply coming online: Multiple junior miners and restart projects could add uranium supply by 2026-2027. Kazakhstan planning production increases as sulfuric acid issues resolve. Supply additions exceeding demand growth could pressure pricing and undermine thesis.

-

💰 Valuation leaves stock vulnerable to sector rotation: After 215% rally, CCJ is now a "consensus long" among nuclear bulls. Any rotation out of energy/uranium or risk-off environment could trigger sharp selloff as profit-taking accelerates. Stock down 17% in past 10 days demonstrates how quickly sentiment can shift.

🎯 The Bottom Line

Real talk: Someone just spent $2.2 MILLION protecting a massive CCJ position after the stock rallied 215% from lows to an all-time high of $110 in October. This isn't bearish on CCJ's long-term nuclear renaissance story - it's smart risk management by institutions who've made HUGE money and don't want to give it back if uranium prices keep falling or earnings disappoint.

What this trade tells us:

- 🎯 Sophisticated player expects potential volatility through January (protecting against 15-20% downside scenario to $70)

- 💰 They're worried enough about $83→$70 move to pay $2.29/share for insurance (2.7% of stock price)

- ⚖️ The timing (after 23% correction from highs) shows they see continued risk - not comfortable that bottom is in

- 📊 They structured at $70 strike (16% below current) which sits below major $75 gamma support - expects that IF stock breaks key levels, it could fall to $70

- ⏰ January 16th expiration captures Q4 earnings (Feb 20), year-end uranium price dynamics, and Kazakhstan/Westinghouse updates

This is NOT a "sell everything" signal - it's a "the easy money has been made, manage your risk" signal.

If you own CCJ:

- ✅ Consider trimming 25-40% at current levels ($80-85) to lock in triple-digit gains

- 📊 If holding through Q4 earnings, set MENTAL STOP at $75 (major gamma support) to protect remaining position

- ⏰ Don't get greedy - you've already won big if you bought earlier this year! Protecting profits is smart trading

- 🎯 If Q4 earnings beat AND uranium prices recover above $80/lb, could re-enter trimmed shares

- 🛡️ Consider buying protective puts per 100 shares if holding large position (copy this trade's structure but smaller size)

If you're watching from sidelines:

- ⏰ February 20 before market open is the moment of truth - DO NOT enter before Q4 earnings clarity!

- 🎯 Post-earnings pullback to $70-75 would be EXCELLENT entry (15-20% below current with strong gamma support)

- 📈 Looking for confirmation of: Production guidance achievement, strong Westinghouse contributions, positive 2025 outlook, uranium price stabilization

- 🚀 Longer-term (12-24 months), Westinghouse partnership execution and AP1000 reactor deployments are legitimate catalysts for $120-150 if execution delivers

- ⚠️ Current 103x P/E valuation requires PERFECT execution - one stumble and it's back to $65-70

If you're bearish:

- 🎯 Current $80-85 level offers reasonable risk/reward for bearish positioning given recent weakness

- 📊 Support at $80 (4.74B gamma), $75 (6.02B gamma), $70 (4.91B gamma + put strike)

- ⚠️ Put spreads ($80/$75 or $75/$70) offer defined-risk way to play downside with limited capital

- 📉 Watch for break below $75 - that's the trigger for potential cascade to $70, then $65

- ⏰ Bearish thesis strengthens if: Uranium prices stay weak, Kazakhstan issues persist, Q4 earnings disappoint

Mark your calendar - Key dates:

- 📅 November 21 (Friday) - Monthly OPEX (implied move ±5.2% tested)

- 📅 December 19 - Quarterly triple witch (implied move ±11.3% tested)

- 📅 January 16, 2026 - Monthly OPEX, expiration of this $2.2M put trade

- 📅 February 20, 2026 (before market) - Q4 FY2024 earnings report - THE major catalyst!

- 📅 2025-2026 - First AP1000 reactor construction milestones expected

- 📅 By January 2029 - Potential Westinghouse IPO if valuation reaches $30B

Final verdict: CCJ's long-term nuclear renaissance story remains INCREDIBLY compelling - $80 billion government partnership, AI data center demand, 50 million pound supply deficit, and unique Westinghouse ownership are all transformative. BUT, at 103x P/E after a 215% rally with uranium prices down 32% from peaks and Kazakhstan production risks, the risk/reward is NO LONGER favorable for aggressive new positioning. The $2.2M institutional put buy is a CLEAR signal: smart money is derisking after the massive rally.

Be patient. Wait for uranium price stabilization. Look for better entry points at $70-75. The nuclear renaissance will play out over years, and you'll sleep better paying $72 instead of $83.

This is a long-term structural story, not a momentum trade. Protect your capital. 💪

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. This analysis is for educational purposes only and not financial advice. Past performance doesn't guarantee future results. The 1025x unusual score reflects this specific trade's size relative to recent CCJ history - it does not imply the trade will be profitable or that you should follow it. Always do your own research and consider consulting a licensed financial advisor before trading. Uranium commodity price volatility and geopolitical risks create significant uncertainty. The put buyer may have complex portfolio hedging needs not applicable to retail traders.

About Cameco Corporation: Cameco Corp is the world's second-largest uranium producer providing uranium needed to generate clean, reliable baseload electricity around the globe. The company operates across uranium production, fuel services, and the Westinghouse segment (nuclear reactor technology), with a market cap of $36.15 billion.