🛡️ CAVA $4.3M Defensive Put Play - Smart Money Protecting Fast-Casual Rally!

Massive $4.3M institutional bet detected on CAVA. Someone just dropped $4.3 MILLION on CAVA puts this morning at 11:18:19, buying 46,000 contracts across two strikes - protecting a massive position in the fast-casual Mediterranean Unusual score: high/10. Full analysis reveals entry points and tradin

📅 November 18, 2025 | 🔥 Unusual Activity Detected

🎯 The Quick Take

Someone just dropped $4.3 MILLION on CAVA puts this morning at 11:18:19, buying 46,000 contracts across two strikes - protecting a massive position in the fast-casual Mediterranean darling. With CAVA trading at $44.98 after a brutal 37% decline from its 2024 peak, smart money is hedging against further downside through year-end and into January. Translation: Institutional investors are buying insurance on a stock that's already taken a beating - they're worried the pain isn't over.

📊 Company Overview

CAVA Group (CAVA) is the category-defining Mediterranean fast-casual restaurant brand bringing together healthful food and bold flavors at scale:

- Market Cap: $5.25 Billion

- Industry: Retail-Eating Places (Fast-Casual Dining)

- Current Price: $44.98 (down 29% in 3 months)

- Primary Business: Mediterranean-inspired fast-casual restaurants with digital-first loyalty program, operating 352 locations across 26 states + DC

💰 The Option Flow Breakdown

The Tape (November 18, 2025 @ 11:18:19):

| Time | Symbol | Buy/Sell | Type | Expiration | Premium | Strike | Volume | OI | Z-Score | Unusualness |

|---|---|---|---|---|---|---|---|---|---|---|

| 11:18:19 | CAVA | BUY | PUT $45 | 2025-11-21 | $2.4M | $45 | 23K | - | 11.31 | EXTREME |

| 11:18:19 | CAVA | BUY | PUT $35 | 2026-01-16 | $1.9M | $35 | 23K | - | 352.03 | EXTREME |

Total Premium Deployed: $4.3 MILLION

🤓 What This Actually Means

This is a dual-timeframe defensive hedge protecting against near-term and extended downside! Here's what went down:

- 💸 Massive premium paid: $4.3M total across two tranches

- 🎯 Two-pronged protection:

- Near-term: $45 strike puts expiring November 21 (3 days!) protect against immediate breakdown

- Extended: $35 strike puts expiring January 16 (59 days) guard against 22% additional downside

- ⚖️ Strategic strikes: $45 is RIGHT AT current price ($44.98), while $35 represents disaster-scenario protection

- 📊 Size matters: 46,000 total contracts represents 4.6 million shares worth ~$207M at current price

- 🏦 Institutional hedging: This is sophisticated portfolio protection, not a directional bearish bet

What's really happening here:

This trader likely holds a SUBSTANTIAL long position in CAVA stock accumulated during the rally from IPO to the $172 peak. Now, with CAVA already down 68% from highs at $45, they're STILL worried about more downside. The $45 weekly puts protect against a flush below key support THIS WEEK (maybe related to Friday's options expiration), while the $35 January puts guard against a catastrophic decline through year-end earnings season.

Unusual Score Analysis:

-

$45 strike (Nov 21): 🔥 EXTREME (1,347x average size, Z-score 11.31) - Happens maybe once a year! This is 1,347x larger than typical CAVA option flow. Only 11 larger trades in the past 30 days, averaging one every 2.7 days.

-

$35 strike (Jan 16): 🔥 EXTREME (1,067x average size, Z-score 352.03) - Absolutely UNPRECEDENTED! This is 1,067x larger than average with a stratospheric Z-score of 352.03. Only 13 larger trades in the past month, occurring roughly every 2.3 days.

Translation: Combined, this is ~2,414x average option activity for CAVA. We're talking about protection for a position larger than most small hedge funds manage. When someone pays $4.3M to hedge a stock that's ALREADY down 68%, they're genuinely terrified of further losses.

📈 Technical Setup / Chart Check-Up

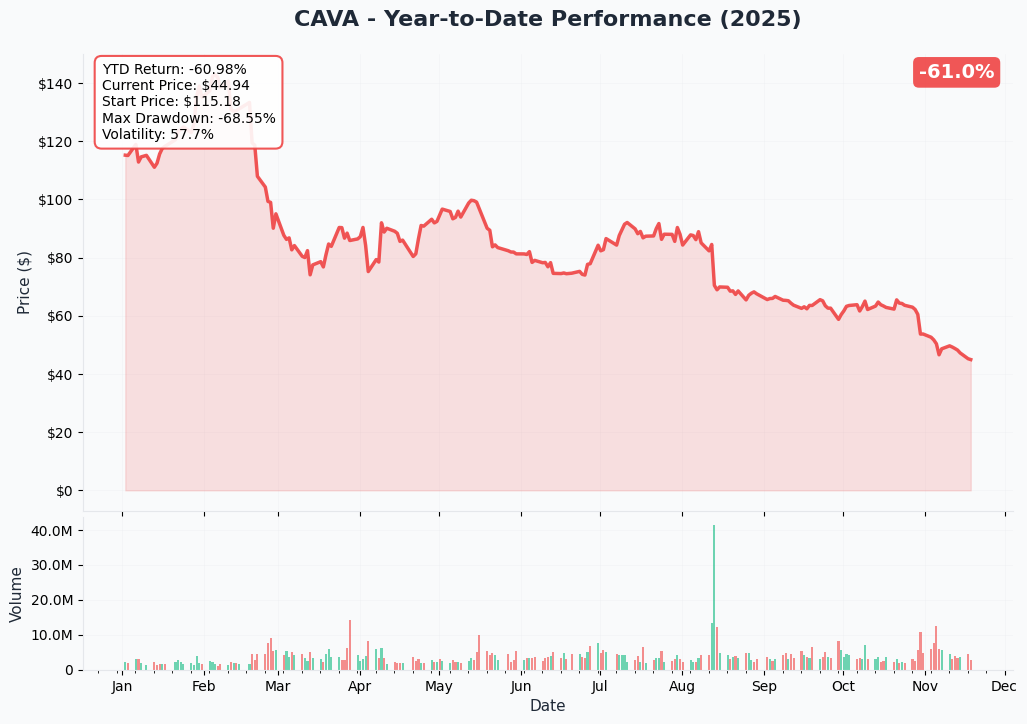

YTD Performance Chart

CAVA is experiencing a severe correction - down 68% from its 2024 peak of $172.43 to current levels around $45. The chart tells a story of euphoria followed by brutal reality - after hitting all-time highs in the summer, the stock has been in freefall since November.

Key observations:

- 📉 Severe selloff: Plummeted from $172 high to $54.90 low (52-week low) in just months

- 😰 Broken support: Failed to hold multiple support levels during descent

- 🎢 High volatility: Massive swings characteristic of growth stocks facing valuation reset

- 📊 Volume spike: Selling pressure intensified during earnings disappointments

- ⚠️ Oversold but fragile: While down 68%, no clear bottoming pattern yet - could go lower

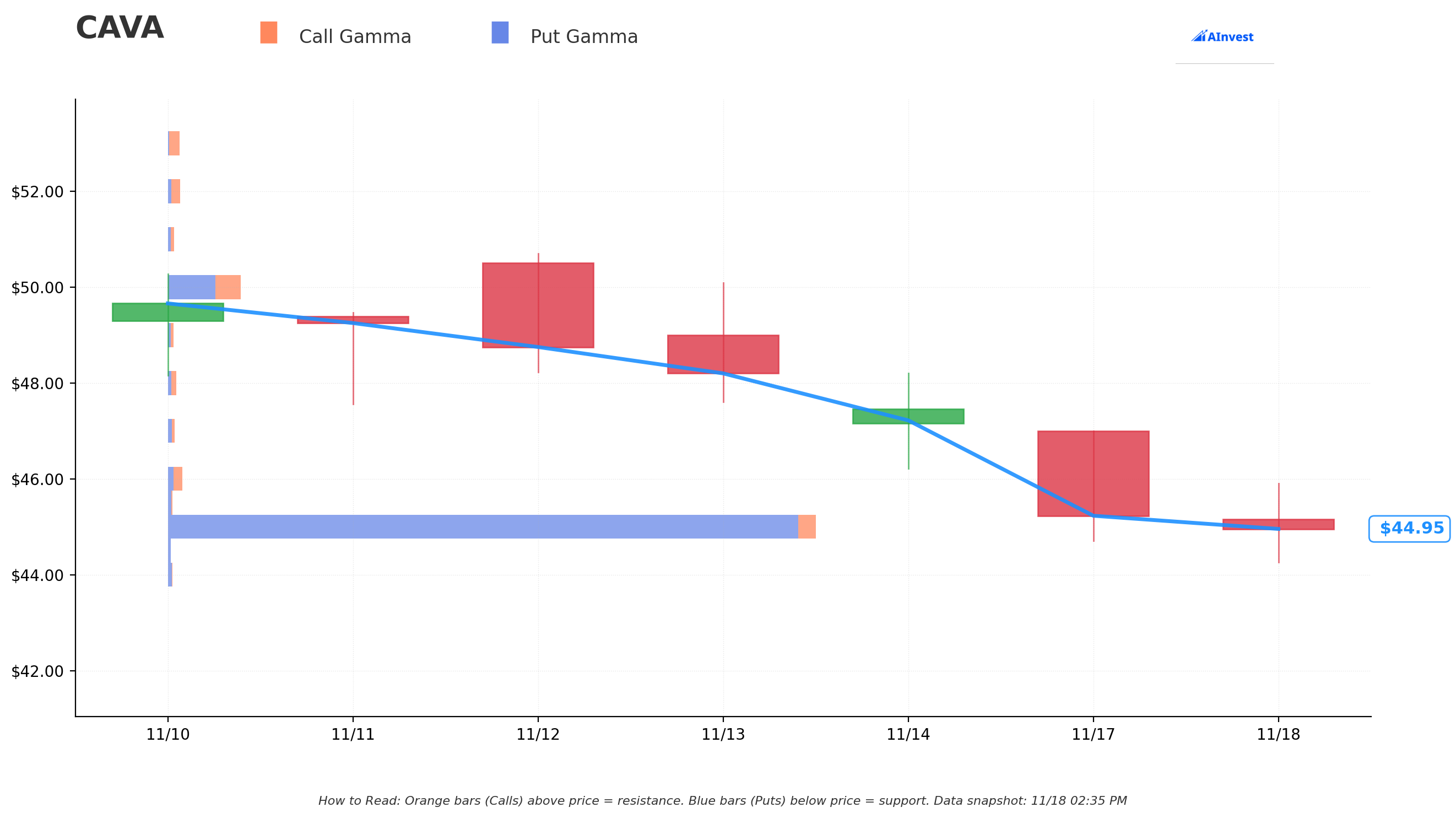

Gamma-Based Support & Resistance Analysis

Current Price: $44.98

The gamma exposure map reveals critical price levels that will govern near-term price action:

🔵 Support Levels (Put Gamma Below Price):

- $40 - Strongest support with 1.79B put gamma (11% below current - major floor!)

🟠 Resistance Levels (Call Gamma Above Price):

- $45 - MASSIVE resistance with 22.58B put gamma (0.04% above current - THIS IS THE WALL!)

- $46 - Secondary resistance at 0.51B total gamma (2.3% overhead)

- $47 - Additional ceiling at 0.24B gamma (4.5% above)

- $48 - Resistance zone with 0.30B gamma (6.7% overhead)

- $49 - Further ceiling at 0.20B gamma (8.9% above)

- $50 - Major psychological resistance with 2.58B total gamma (11.2% overhead)

- $51 - Resistance at 0.22B gamma (13.4% above)

- $52 - Ceiling zone with 0.43B gamma (15.6% overhead)

- $53 - Upper resistance at 0.41B gamma (17.8% above)

What this means for traders:

CAVA is trading RIGHT AT a CRITICAL gamma level at $45 with 22.58B in put gamma - the single largest level on the entire chain. This represents MASSIVE hedging activity (exactly what we're seeing in today's unusual flow!). The stock is essentially pinned at $45 by enormous put positioning.

The next major support is $40 (11% below), while resistance extends in layers from $46 all the way to $50. This setup suggests the stock is likely to trade in a tight range between $40-$46 unless a major catalyst breaks it out either direction.

Notice anything? The put buyer struck EXACTLY at $45 for the weekly options where there's 22.58B gamma - they're protecting the most critical near-term support level. If $45 breaks, there's a clear path to $40. The January $35 puts represent catastrophic downside protection if the stock completely falls apart.

Net GEX Bias: Bearish (7.94B call gamma vs 30.53B put gamma) - Overwhelming defensive positioning dominates the options chain.

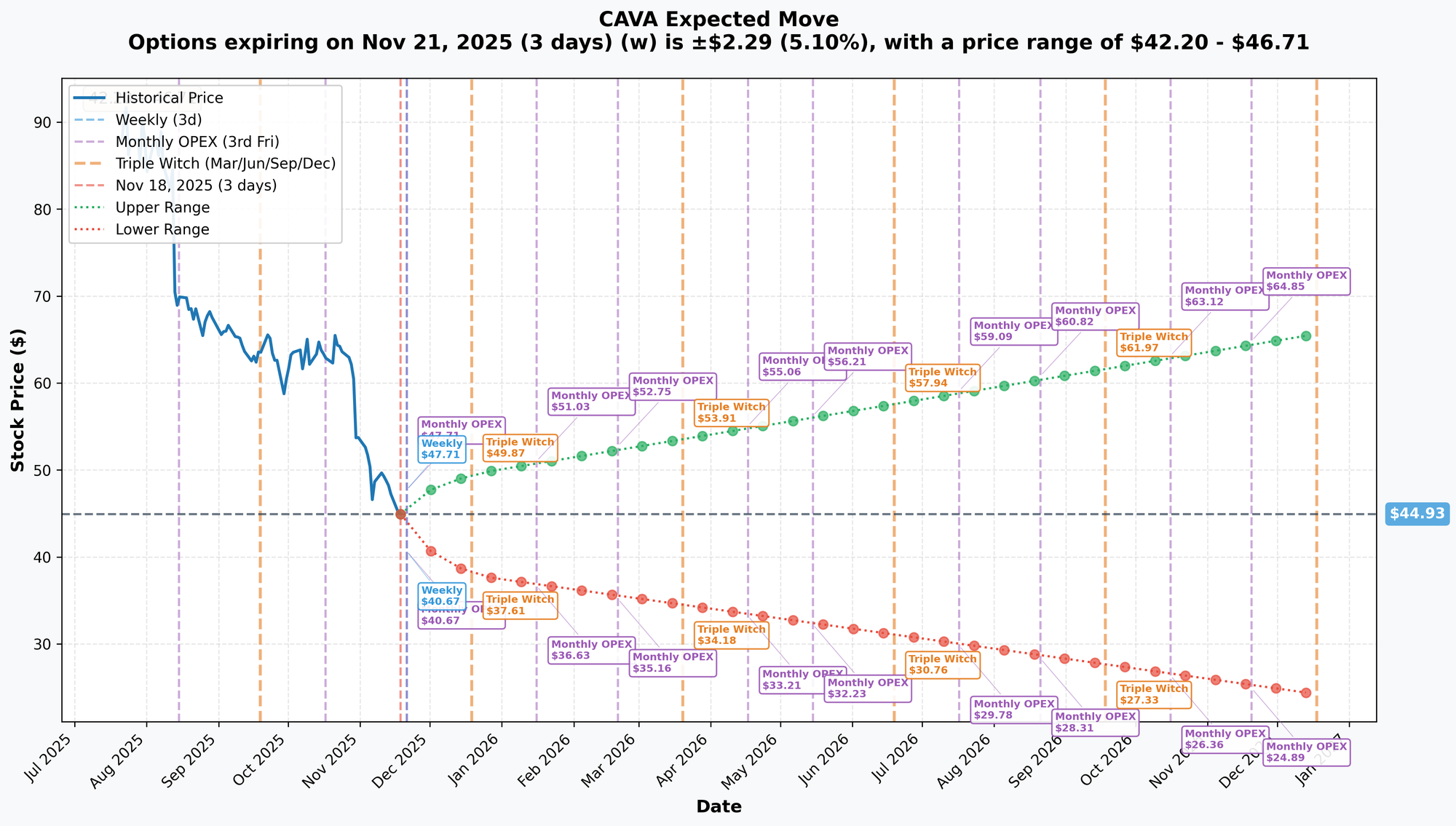

Implied Move Analysis

Options market pricing for upcoming expirations:

- 📅 Weekly (Nov 21 - 3 days): ±$2.29 (±5.1%) → Range: $42.20 - $46.71

- 📅 Monthly OPEX (Nov 21 - 3 days - SAME): ±$2.29 (±5.1%) → Range: $42.20 - $46.71

- 📅 Quarterly Triple Witch (Dec 19 - 31 days): ±$5.22 (±11.6%) → Range: $37.91 - $49.52

- 📅 January OPEX (Jan 16 - 59 days - THE BIG TRADE!): ±$8.22 (±18.3%) → Range: $36.63 - $51.03

Translation for regular folks:

Options traders are pricing in a 5.1% move ($2.29) by Friday for weekly expiration, and a MASSIVE 18.3% move ($8.22) through January OPEX. The market expects significant volatility through year-end.

The January 16th expiration (when the $35 put position expires) has a lower range of $36.63 - meaning the market thinks there's a real possibility CAVA could trade as low as $36-37 over the next two months. This aligns with the put buyer's thesis: protect against another 20%+ decline through year-end earnings and holiday season.

Key insight: The sharp increase in implied volatility from 5.1% (weekly) to 18.3% (2-month) reflects massive uncertainty around upcoming catalysts including Q4 2024 earnings (Feb 25, 2025) and continued consumer spending weakness in the fast-casual space.

🎪 Catalysts

🔥 Immediate Catalysts (Next 7 Days)

Weekly Options Expiration - November 21, 2025 (3 DAYS AWAY!) 📊

Friday's weekly options expiration is the immediate event for the $45 strike puts. With the stock trading RIGHT AT $45.00, this is a critical pin level. Any break below $45 before Friday could trigger aggressive selling as these puts move in-the-money.

Fast-Casual Sector Weakness Continues 🍔

The broader fast-casual restaurant space is experiencing severe headwinds as younger consumers (25-35 age group) are reducing $13-15 bowl purchases amid inflation fatigue^[24_1]. All three major chains showing weakness:

- Chipotle stock: -28% in 2025^[15_2]

- CAVA stock: -37% from peak^[15_3]

- Sweetgreen stock: -70% in 2025^[15_4]

🚀 Near-Term Catalysts (Q4 2025 - Q1 2026)

Q4 2024 & Full Year Earnings - February 25, 2025 (99 DAYS AWAY!) 📊

CAVA reports fiscal Q4 and full year 2024 results on February 25, 2025 at 4:10 PM ET^[8_1]. This is THE catalyst that could determine if the stock has bottomed or faces further declines.

Key Metrics to Watch:

- 📊 Q4 Same-Store Sales: Guidance was slashed to 3-4% vs Wall Street expecting 8.7% - this caused the initial selloff^[3_12]

- 💰 Restaurant-Level Margins: Must maintain 25%+ despite labor/food inflation pressures

- 🏢 Full Year Unit Count: Guidance of 56-58 net new restaurants (opened 58 in FY2024)

- 🎯 2025 Expansion Guidance: Critical update on 62-66 restaurant target for 2025

- 🤖 Loyalty Program Growth: Currently at 8 million members with 50,000 weekly additions^[4_2]

- 💸 Consumer Spending Commentary: Any signs of stabilization or further weakness in core demographic

Downside risk factors: Any miss on same-store sales guidance, margin compression commentary, or conservative 2025 outlook could trigger another 15-20% selloff given stock's fragile technical position.

Q1 2025 Earnings - May 27, 2025

- Consensus Revenue Estimate: $327 million^[9_2]

- Consensus EPS Estimate: $0.14 (16.67% YoY increase)^[9_3]

- Key Focus: Impact of 1.7% January 2025 price increase^[5_2] on traffic and customer pushback

2025 Restaurant Expansion Program (Throughout Year):

Target: 62-66 net new CAVA restaurant openings in 2025^[10_2], representing 17% unit growth. New markets include:

- Detroit, Michigan^[10_4]

- South Florida (early 2025)^[10_4]

- Pittsburgh, Pennsylvania^[10_4]

- Indianapolis, Indiana^[10_4]

At $2.9M average AUV, 64 new restaurants = ~$186M incremental annual revenue potential.

Loyalty Program Milestones:

Target: 10 million+ members by end of 2025^[11_2] (from current 8M). Revamped program structure with three tiers (Sea/Sand/Sun) and 340 basis point lift in loyalty sales since October 2024 relaunch^[4_3].

⚠️ Risk Catalysts (Negative)

Valuation Still Stretched Despite Decline 📊

At 51.2x trailing P/E and 79.13x forward P/E^[17_2]^[17_3], CAVA STILL trades at a massive premium vs US Hospitality industry average of 23.9x despite the 68% decline. Stock is pricing in significant growth that may not materialize given consumer weakness.

Same-Store Sales Deceleration 📉

Traffic growth slowed dramatically from 18.1% in Q3 2024 to guided 3-4% for Q4 2024^[3_12] - a MASSIVE momentum loss. This validates concerns about premium pricing vulnerability ($13.47 entrees) in weakening consumer environment.

Competition from Value QSR Chains 🍔

QSR chains (McDonald's, Wendy's, Burger King) aggressively promoting $5-7 value meals, making CAVA's $13-15 Mediterranean bowls increasingly difficult to justify^[14_2] for price-sensitive younger consumers. Chipotle maintains 30-40% pricing advantage at $10.31 average entree^[14_2].

Labor & Cost Pressures 💸

California $20 minimum wage impact^[5_5], food inflation on grains/proteins, and rising real estate costs could compress restaurant-level margins from current 25.6% to 23-24% range.

🎲 Price Targets & Probabilities

Using gamma levels, implied move data, and upcoming catalysts, here are the scenarios through January 16th expiration:

📈 Bull Case (20% probability)

Target: $50-$53

How we get there:

- 💪 Q4 earnings surprise to upside with same-store sales beating lowered 3-4% guidance

- 🚀 2025 expansion program launches successfully in Detroit, South Florida markets

- 🤖 Loyalty program accelerates to 9M+ members showing strong engagement

- 📊 Consumer spending stabilizes, fast-casual sector finds footing

- 💸 Management provides optimistic FY2025 guidance restoring growth narrative

- 📈 Stock breaks above $46-47 gamma resistance triggering short covering rally to $50

Key metrics needed:

- Q4 same-store sales >5% (beat lowered guidance)

- Restaurant-level margins hold 25%+ despite cost pressures

- New restaurant AUVs maintain $2.9M target

- Digital/loyalty penetration continues increasing

Probability assessment: Only 20% because it requires stabilization of deteriorating trends AND positive surprises when expectations are already lowered. Current bearish sentiment and gamma resistance at $45-50 create significant headwinds.

🎯 Base Case (50% probability)

Target: $40-$47 range (CHOPPY CONSOLIDATION)

Most likely scenario:

- ✅ Q4 earnings meet lowered consensus (same-store sales ~3.5-4%, in-line margins)

- 📱 2025 expansion proceeds as planned but without fireworks

- ⚖️ Consumer weakness persists but doesn't dramatically worsen

- 🤖 Loyalty program grows steadily to ~8.5M members

- 🔄 Stock trades within gamma support ($40) and resistance ($47-50) bands through January

- 📊 Market digests valuation compression, waits for proof of re-acceleration

- 💤 Volatility remains elevated (20-25% IV) as uncertainty persists

This is the put buyer's target scenario: Stock consolidates in $40-47 range, with the $45 weekly puts expiring worthless but providing peace of mind, while the $35 January puts protect against year-end disaster. The $4.3M is simply "insurance premium" they're willing to pay for downside protection during uncertain period.

Why 50% probability: Stock at technical inflection after 68% decline - neither clearly bottoming nor clearly breaking down further. Fundamentals remain solid (18.1% Q3 same-store sales, 25.6% margins^[1_1]) but momentum fading and valuation still rich.

📉 Bear Case (30% probability)

Target: $30-$35 (TEST THE DEEP PUT STRIKE!)

What could go wrong:

- 😰 Q4 earnings disappoint with same-store sales <3% and margin compression

- 🚨 Holiday season consumer weakness intensifies, January sales crater

- ⏰ 2025 expansion targets reduced or new restaurants underperform

- 🇨🇳 Broader restaurant sector selloff drags all fast-casual names lower

- 💸 Analyst downgrades accelerate as growth story unravels

- 📊 Competition from value QSR and Chipotle becomes existential threat

- 💰 Institutional ownership (75.99%)^[22_2] sells aggressively on broken growth narrative

- 🔨 Break below $40 gamma support triggers cascade to $35, then $30

Critical support levels:

- 🛡️ $40: Major gamma floor (1.79B put gamma) - MUST HOLD or momentum shifts extremely bearish

- 🛡️ $35: Deep support + January put strike - likely final stand

- 🛡️ $30: Catastrophic scenario - 33% additional decline from current levels

Probability assessment: 30% because it requires continued deterioration of already-weak trends. However, stock already down 68% from peak^[2_5], and same-store sales deceleration from 18% to 3-4%^[3_12] shows momentum clearly broken. The put buyer paying $4.3M clearly thinks this scenario has >30% odds or they wouldn't deploy that much capital for protection.

Put P&L in Bear Case:

- Stock at $30 on Jan 16: $35 puts worth $5.00, potential profit on hedge

- Stock at $35 on Jan 16: $35 puts at breakeven, insurance served its purpose

- Stock at $40 on Jan 16: Most puts expire worthless, but protected against worst-case scenario

💡 Trading Ideas

🛡️ Conservative: Stay Away Until Clarity

Play: Avoid CAVA entirely until after February 25th Q4 earnings and FY2025 guidance

Why this works:

- ⏰ Earnings in 99 days creates extended uncertainty period - why catch falling knife?

- 💸 Stock already down 68% but STILL expensive at 51.2x P/E with no growth catalyst visible

- 📊 Same-store sales decelerating from 18% to 3-4%^[3_12] - broken momentum rarely recovers quickly

- 🎯 Better entry likely after Q4 results when visibility improves

- 🤔 The $4.3M institutional put buy signals smart money is WORRIED despite already being down huge

Action plan:

- 👀 Watch Q4 earnings February 25 for same-store sales trends, margin trajectory, 2025 guidance quality

- 🎯 Only consider entry if stock pulls back to $35-38 range providing TRUE margin of safety

- ✅ Need to see re-acceleration of traffic growth >8% and proof consumer spending stabilizing

- 📊 Monitor sector trends - if Chipotle, Sweetgreen continue struggling, CAVA unlikely to outperform

- ⏰ Revisit after Q1 2025 results (May 27) when full year trends become clearer

Risk level: Minimal (cash position) | Skill level: Beginner-friendly

Expected outcome: Avoid potential -20-30% additional drawdown if bear case plays out. Get better entry if stock finds true bottom. Preserve capital for higher-probability opportunities.

⚖️ Balanced: Sell Cash-Secured Puts at Support (For Income Seekers)

Play: Sell cash-secured puts at $40 strike to generate income while defining entry point

Structure: Sell $40 puts (January 16 expiration - SAME as the big institutional trade)

Why this works:

- 🎢 Collect premium selling puts at major gamma support level ($40 with 1.79B put gamma)

- 🎯 If assigned, own CAVA at effective price ~$37-38 (11% below current, 78% below all-time high)

- 📊 Defined risk - know EXACTLY what entry price would be if assigned

- 💰 Generate income whether stock goes up, down, or sideways

- ⏰ 59 days to expiration gives time for consolidation and volatility crush

Estimated P&L (check current quotes for exact pricing):

- 💰 Collect ~$2.50-3.50 premium per put sold (adjust based on current IV)

- 📈 Max profit: Keep entire premium if CAVA stays above $40 at January expiration

- 📉 Breakeven: ~$36.50-37.50 (40 - premium collected)

- 🎯 Assignment scenario: Own CAVA at net cost $36.50-37.50, 19-22% below current price

- 📊 Return: ~6-9% premium yield on capital at risk over 59 days

Entry requirements:

- ✅ Must have cash to buy 100 shares per put sold (~$4,000 per contract)

- ✅ Comfortable owning CAVA long-term at $37-38 if assigned

- ❌ Skip if not willing to hold through potential further decline

Position sizing: Sell only number of puts you're comfortable being assigned (owning stock)

Risk level: Moderate (cash-secured, defined risk) | Skill level: Intermediate

🚀 Aggressive: Copy The Institutional Hedge Structure (ADVANCED ONLY!)

Play: Buy protective puts mirroring institutional positioning for speculation OR to hedge existing long position

Structure: Buy $45 puts (Nov 21) + $35 puts (Jan 16) if holding CAVA shares

Why this could work:

- 💥 Institutions paying $4.3M to protect positions - they clearly see significant downside risk

- 🎰 Betting smart money is RIGHT about continued weakness through year-end

- 📊 Two-tiered protection matches institutional structure for different timeframes

- 🚀 If stock breaks below $40, puts could return 50-200% as rapid decline unfolds

- ⚡ Near-term $45 puts provide immediate protection for this week's expiration

- 📈 Longer-dated $35 puts guard against extended decline through earnings

Why this could blow up (SERIOUS RISKS):

- 💸 EXPENSIVE: Puts cost significant premium when stock already down 68%

- ⏰ TIME DECAY: Theta burns value daily if stock consolidates

- 😱 NO REBOUND PARTICIPATION: If stock surprises and rallies 20%+, lose entire put premium

- 📊 Volatility crush: If fear subsides, IV collapse crushes put values even without stock moving

- 🎢 Stock could grind sideways at $43-46 and puts expire worthless

- ⚠️ Already down massively - how much MORE downside realistic?

For Speculators (No Stock Position):

- 💰 Cost: Check current pricing for $45 weekly puts and $35 Jan puts

- 📈 Profit scenario: Stock breaks to $38-40 → weekly puts profit, or to $30-32 → Jan puts profit massively

- 📉 Loss scenario: Stock stays $43-48 range → lose 50-100% of put premium

- ⏰ Plan to close profitable positions quickly - don't hold to expiration

For Hedgers (Own CAVA Stock):

- 🛡️ Buy 1 $45 put per 100 shares for near-term protection

- 🛡️ Buy 1 $35 put per 100 shares for extended protection through earnings

- 📊 This "collars" downside while maintaining upside if stock recovers

- 💰 Accept premium cost as insurance expense to sleep better at night

CRITICAL WARNING - DO NOT attempt unless you:

- ✅ Understand options pricing and Greeks (Delta, Theta, Vega)

- ✅ Can afford to lose ENTIRE put premium (real possibility if stock stabilizes!)

- ✅ Have clear exit plan - don't just buy and hope

- ✅ Accept you're betting AGAINST potential recovery rally

- ⏰ Monitor position actively - don't "set and forget"

Risk level: EXTREME for speculators, Moderate for hedgers | Skill level: Advanced only

Probability of profit: ~35-40% for speculators (stock needs to move >10% down), ~70% for hedgers (insurance provides peace of mind even if not profitable)

⚠️ Risk Factors

Don't get caught by these potential landmines:

-

⏰ Earnings uncertainty 99 days away: Results on February 25, 2025^[8_1] create extended uncertainty period. Same-store sales guidance already slashed to 3-4% from previous 18%^[3_12] - any further disappointment could trigger additional 15-20% selloff. Consumer spending weakness among younger demographics (25-35 age cohort) showing no signs of improvement^[8_4].

-

💸 Valuation STILL expensive despite 68% decline: Trading at 51.2x P/E and 79x forward P/E^[17_2]^[17_3] vs industry average 23.9x. This is STILL stretched - stock priced for growth re-acceleration that may never come. Zero margin of safety even after massive selloff.

-

🇨🇳 Consumer spending weakness could persist through 2025: All three major fast-casual chains experiencing simultaneous pressure^[1_2] as inflation-fatigued consumers trade down to value QSR or pack lunches. CAVA's premium pricing ($13.47 entrees)^[14_2] increasingly vulnerable in recession scenario. If macro worsens, restaurant stocks get hammered.

-

⚖️ Chipotle's competitive advantage widening: Chipotle maintains 30-40% pricing advantage at $10.31 average entree vs CAVA's $13.47^[14_2]. Superior scale allows promotional flexibility CAVA cannot match. Market share losses possible if price-conscious consumers shift to cheaper Mexican alternative.

-

🚀 2025 expansion execution risk with 62-66 new restaurants: Aggressive growth into new markets including Detroit, South Florida, Pittsburgh, Indianapolis^[10_4] requires flawless execution. Real estate inflation, construction delays, or weak performance in new markets could force guidance reduction. Management bandwidth stretched scaling from 352 to 1,000 locations by 2032.

-

🐋 Institutions paying $4.3M insurance at current levels signals FEAR: When sophisticated players deploy massive capital protecting positions in stock that's ALREADY down 68%, it's a major caution flag. The dual-strike structure ($45 + $35) shows they're worried about BOTH near-term flush AND extended decline. This isn't normal hedging - this is legitimate concern.

-

📊 Gamma wall at $45 creates resistance: Massive 22.58B put gamma at $45 represents enormous hedging activity. Stock essentially pinned at this level by options positioning. Breaking above $46-47 will be extremely difficult without major positive catalyst.

-

💰 Same-store sales momentum completely broken: Deceleration from 18.1% (Q3) to 3-4% (Q4 guidance)^[3_12] is CATASTROPHIC for growth stock. Traffic growth of 12.9% in Q3^[3_4] unlikely sustainable. When fast-casual darling loses momentum, rarely recovers quickly - see Chipotle 2016-2017, Sweetgreen currently.

-

🎢 High institutional ownership (75.99%) creates volatility: Large institutional positions^[22_2] create potential for rapid selling if growth narrative completely breaks. Funds that rode stock from IPO to $172 have massive unrealized gains even at $45 - any indication of permanent impairment could trigger wholesale exit.

-

📉 Already catastrophic decline might NOT be over: Just because stock down 68% doesn't mean it can't go down another 30-40%. Many pandemic/2021 growth stocks fell 80-90% from peaks before bottoming. CAVA's valuation at 51x P/E still not "cheap" in absolute terms - could compress to 25-30x if growth stalls permanently.

🎯 The Bottom Line

Real talk: Someone just spent $4.3 MILLION protecting a CAVA position that's already down 68% from its peak. Let that sink in. This isn't bearish on CAVA's long-term Mediterranean fast-casual concept - it's cold-eyed risk management by institutions who've watched their positions crater and don't want to give back even MORE.

What this trade tells us:

- 🎯 Sophisticated player expects CONTINUED VOLATILITY through January (not necessarily crash, but protecting against another 15-25% downside scenario)

- 💰 They're worried enough about $45→$40 near-term move and $45→$35 extended move to pay $4.3M for insurance

- ⚖️ The dual-timeframe structure (weekly $45 puts + January $35 puts) shows concerns about BOTH immediate weakness AND extended decline through year-end

- 📊 They're positioned exactly at critical gamma levels ($45 with 22.58B gamma, $35 as disaster floor)

- ⏰ January 16th expiration captures Q4 earnings aftermath, holiday season results, early 2025 consumer spending trends

This is NOT a "sell everything" signal - but it's DEFINITELY a "don't try to catch falling knives" signal.

If you own CAVA:

- ✅ Consider trimming 30-50% at current $44-46 levels (protect remaining capital, reduce risk)

- 📊 If holding through year-end, set MENTAL STOP at $40 (major gamma support) to protect against further deterioration

- ⏰ Don't average down blindly - wait for PROOF of stabilization (positive same-store sales trends, margin stability)

- 🎯 If Q4 earnings surprise positively (Feb 25) AND stock breaks $50, could re-add trimmed shares

- 🛡️ Consider buying protective puts on remaining position (copy this trade's structure but smaller size)

If you're watching from sidelines:

- ⏰ DO NOT chase here - wait for clear catalyst or true capitulation

- 🎯 $35-38 range would provide 20-25% additional margin of safety and align with deep put strike

- 📈 Looking for confirmation of: Same-store sales stabilization >5%, loyalty program growth continuing, new restaurant performance meeting targets

- 🚀 Longer-term (12-24 months), 1,000 location target by 2032 and Mediterranean category leadership remain compelling IF execution delivers

- ⚠️ Current valuation (51x P/E) requires re-acceleration of growth - without it, fair value likely $30-35 range

If you're bearish:

- 🎯 Buying puts here is EXPENSIVE after 68% decline - consider waiting for any relief rally to $48-50

- 📊 First support at $40 (gamma), catastrophic support at $35 (January put strike)

- ⚠️ Shorting stock directly has unlimited risk - use defined-risk put spreads if bearish

- 📉 Watch for break below $40 - that's the trigger for potential cascade to $35

- ⏰ Most bearish opportunity may be AFTER any Q4 earnings relief rally if guidance disappoints again

Mark your calendar - Key dates:

- 📅 November 21 (Friday) - Weekly options expiration, $45 puts expire

- 📅 December 19 - Quarterly triple witch (implied move ±11.6%)

- 📅 January 16, 2026 - Monthly OPEX, expiration of $35 put protection

- 📅 February 25, 2025 (4:10 PM ET) - Q4 2024 & Full Year earnings report - THE BIG CATALYST

- 📅 May 27, 2025 - Q1 2025 earnings

Final verdict: CAVA's long-term story as Mediterranean fast-casual category leader with superior unit economics ($2.9M AUV, 25.6% margins)^[1_1] remains intact. BUT, momentum is broken (18%→3-4% same-store sales deceleration)^[3_12], consumer spending is weakening across entire fast-casual sector^[1_2], and valuation STILL isn't cheap despite 68% decline. The $4.3M institutional put purchase is a CLEAR signal: smart money expects more pain before recovery.

Be patient. Wait for proof of stabilization. Don't catch falling knives. The Mediterranean revolution will still be here if/when CAVA finds a true bottom at $35-38.

This is about capital preservation, not FOMO. Protect yourself. 💪

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. This analysis is for educational purposes only and not financial advice. Past performance doesn't guarantee future results. The 1,347x and 1,067x unusual scores reflect these specific trades' size relative to recent CAVA history - they do not imply the trades will be profitable or that you should follow them. Always do your own research and consider consulting a licensed financial advisor before trading. The stock has already declined 68% from peak but could decline further. The put buyers may have complex portfolio hedging needs not applicable to retail traders.

About CAVA Group: Cava Group Inc owns and operates a chain of restaurants, bringing together healthful Mediterranean food and bold, satisfying flavors at scale, with a market cap of $5.25 billion in the Retail-Eating Places industry.