ARM: $2.4M Put Hedge Detected (Nov 18)

Massive $2.4M institutional bet detected on ARM. Someone just loaded $2.4 MILLION worth of ARM puts this morning at 10:21:39 - buying 2,000 contracts of $125 strike puts! This protective position locks in downside insu Unusual score: high/10. Full analysis reveals entry points and trading

🛡️ ARM $2.4M Put Hedge - Protecting Gains After 81% Rally!

📅 November 18, 2025 | 🔥 Unusual Activity Detected

🎯 The Quick Take

Someone just loaded $2.4 MILLION worth of ARM puts this morning at 10:21:39 - buying 2,000 contracts of March 2026 $125 strike puts! This protective position locks in downside insurance on ARM shares now trading at $138.51, up 81% year-to-date. With ARM facing key catalysts ahead (February Q4 earnings, ongoing Qualcomm litigation), smart money is buying insurance near all-time highs. Translation: Institutions are protecting massive profits while staying in the AI chip game!

📊 Company Overview

Arm Holdings (ARM) is the IP powerhouse behind 99% of the world's smartphone processors and a rising force in data center computing:

- Market Cap: $148.8 Billion (semiconductor IP licensing giant)

- Business Model: Architecture licensing + per-unit royalties from chips used in phones, tablets, servers, IoT devices

- Current Price: $138.51 (near recent highs after pullback from $173 peak)

- YTD Performance: +81% (massive rally on AI infrastructure demand and Armv9 adoption)

- Technology Leadership: ARM architecture powers everything from iPhone chips to cloud data centers (AWS Graviton, Google Axion, Microsoft Cobalt)

💰 The Option Flow Breakdown

The Tape (November 18, 2025 @ 10:21:39):

| Date | Time | Symbol | Buy/Sell | Call/Put | Expiration | Premium | Strike | Volume | OI | Size | Spot Price | Option Price | Option Symbol |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-11-18 | 10:21:39 | ARM | BUY | PUT $125 | 2026-03-20 | $2.4M | $125 | 2,000 | - | 2,000 | $138.51 | $12.00 | ARM20260320P125 |

🤓 What This Actually Means

This is a smart hedging play on ARM shares! Here's the breakdown:

- 💸 Substantial premium: $2.4M ($12.00 per contract × 2,000 contracts)

- 🛡️ Protection level: $125 strike provides 9.8% downside cushion from current $138.51 price

- ⏰ Strategic timing: 122 days to expiration captures Q4 earnings (Feb 4, 2026), Qualcomm trial (March 2026), MediaTek Dimensity 9500 launches, and potential China/RISC-V headwinds

- 📊 Position size: 2,000 contracts represents 200,000 shares worth ~$27.7M at current prices

- 🏦 Professional hedging: This is portfolio insurance, not a bearish directional bet

What's really happening:

This trader likely accumulated ARM during the rally from $120 to $173, sitting on 50-80% gains. Now with stock near $139 after recent pullback, and major binary events ahead (earnings, legal resolution, product launches), they're paying $12 per share for March $125 puts as insurance. If ARM drops below $125 by March 20th, these puts pay off dollar-for-dollar. Think of it like paying $2.4M for homeowner's insurance on a property that's appreciated significantly.

Unusual Score: 🔥 EXTREME (916x average size!) - This is unprecedented for ARM options. The data shows only 12 larger trades in the past 30 days, with similar-sized activity happening every ~2.5 days. With a Z-score of 50.25 and 100th percentile ranking, this trade is literally off the charts. This happens maybe once or twice a year for ARM - massive institutional positioning.

📈 Technical Setup / Chart Check-Up

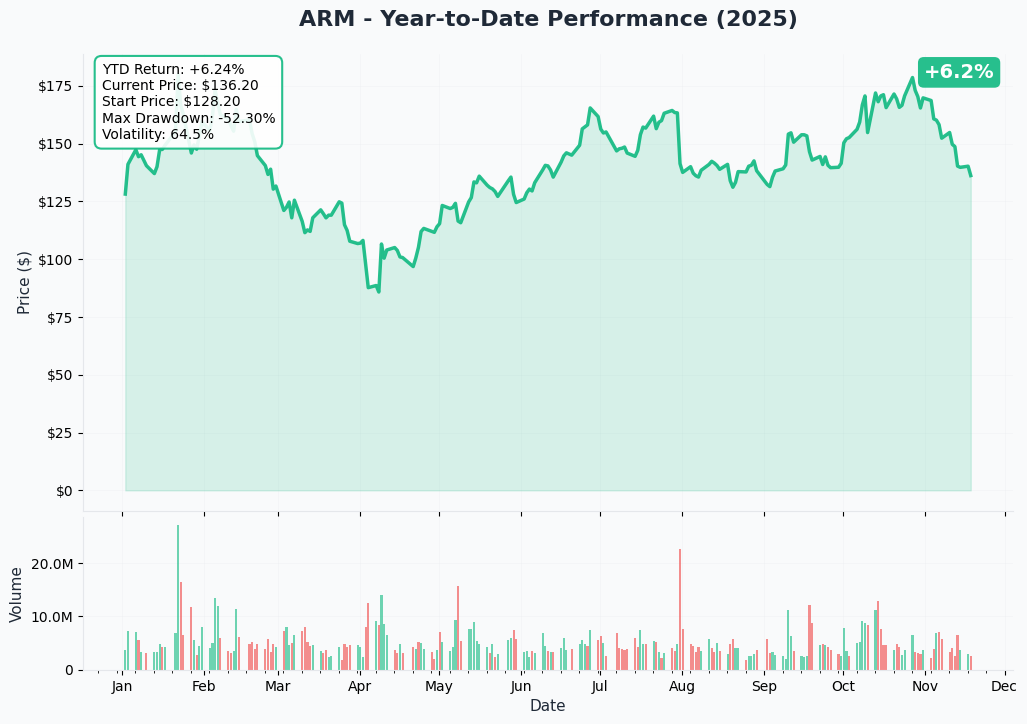

YTD Performance Chart

ARM has had a wild ride in 2025 - up +81% YTD from starting price of $76.48 to current $138.51. The chart tells a compelling story of AI-driven growth expectations tempered by recent reality checks.

Key observations:

- 🚀 Parabolic rally to $173: Stock exploded from mid-October highs after Q3 earnings beat ($1.14B revenue, up 34% YoY) and accelerating Armv9 adoption

- 📉 Sharp pullback: Recent decline from $173 to $139 (19.7% correction) despite strong fundamentals - market digesting premium valuation

- 🎢 High volatility zone: Stock showing characteristics of momentum play - big swings in both directions

- 📊 Gap areas: Multiple price gaps suggest emotional trading and potential support/resistance levels

- ⚠️ Consolidation needed: After doubling from $70 lows, healthy pullback creates better risk/reward for new entries

The recent pullback from $173 to $139 coincided with the narrowed Q4 guidance and withdrawal of full-year FY26 guidance due to tariff uncertainty. Even though Q3 results crushed expectations, the market wanted more certainty on 2026 outlook.

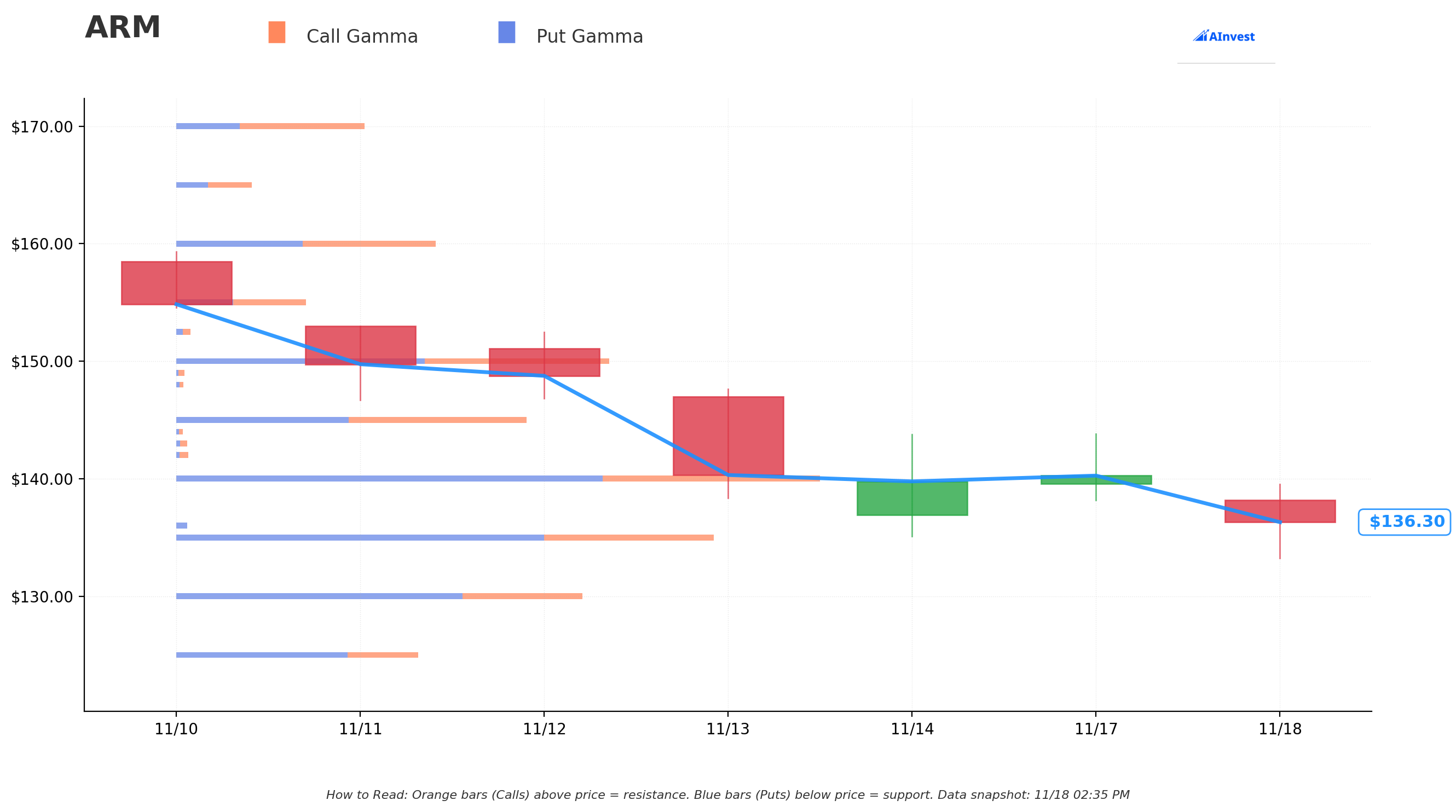

Gamma-Based Support & Resistance Analysis

Current Price: $136.55 (at time of gamma calculation)

The gamma exposure map reveals critical price magnets that will govern ARM's near-term trading range:

🔵 Support Levels (Put Gamma Below Price):

- $135 - IMMEDIATE FLOOR with 8.5B total gamma (strongest nearby support - 1.1% below current)

- $130 - Secondary support at 6.4B gamma (4.8% downside buffer)

- $125 - MAJOR structural floor at 3.8B gamma (EXACTLY where this put trade is struck! - 8.5% below current)

- $120 - Deep support zone at 5.4B gamma (12% downside)

- $115 - Extended floor at 2.4B gamma (disaster scenario at 15.8% below current)

- $110 - Ultimate support at 3.0B gamma (19.4% crash level)

🟠 Resistance Levels (Call Gamma Above Price):

- $140 - IMMEDIATE CEILING with 10.2B gamma (STRONGEST RESISTANCE at 2.5% overhead)

- $145 - Secondary resistance at 5.6B gamma (6.2% rally required)

- $150 - Major ceiling at 7.1B gamma (9.9% above current - psychological level)

- $160 - Extended upside target at 4.2B gamma (17.2% rally to retest recent highs)

What this means for traders:

ARM is trading in a compressed range between strong $135 support and crushing $140 resistance. The gamma data shows the single largest level is $140 ceiling (10.2B) which creates natural selling pressure as price approaches - market makers will hedge by selling shares. This setup screams "tight consolidation range" before the next catalyst.

Notice the put strike placement: The trader struck EXACTLY at $125 where there's 3.8B gamma support and significant put open interest. This is NOT random! They're positioning just below the $130 secondary support level, expecting that IF ARM breaks down through $135-130 support, it could flush quickly toward $125. Smart hedging targets the next major support zone.

Net GEX Bias: Bearish (45.6B put gamma vs 34.9B call gamma) - Overall dealer positioning is net short gamma, meaning they'll hedge by selling into rallies and buying dips, which creates two-way volatility and range-bound price action. This contrasts with ARM's fundamental bullish story, suggesting near-term technical consolidation despite long-term growth prospects.

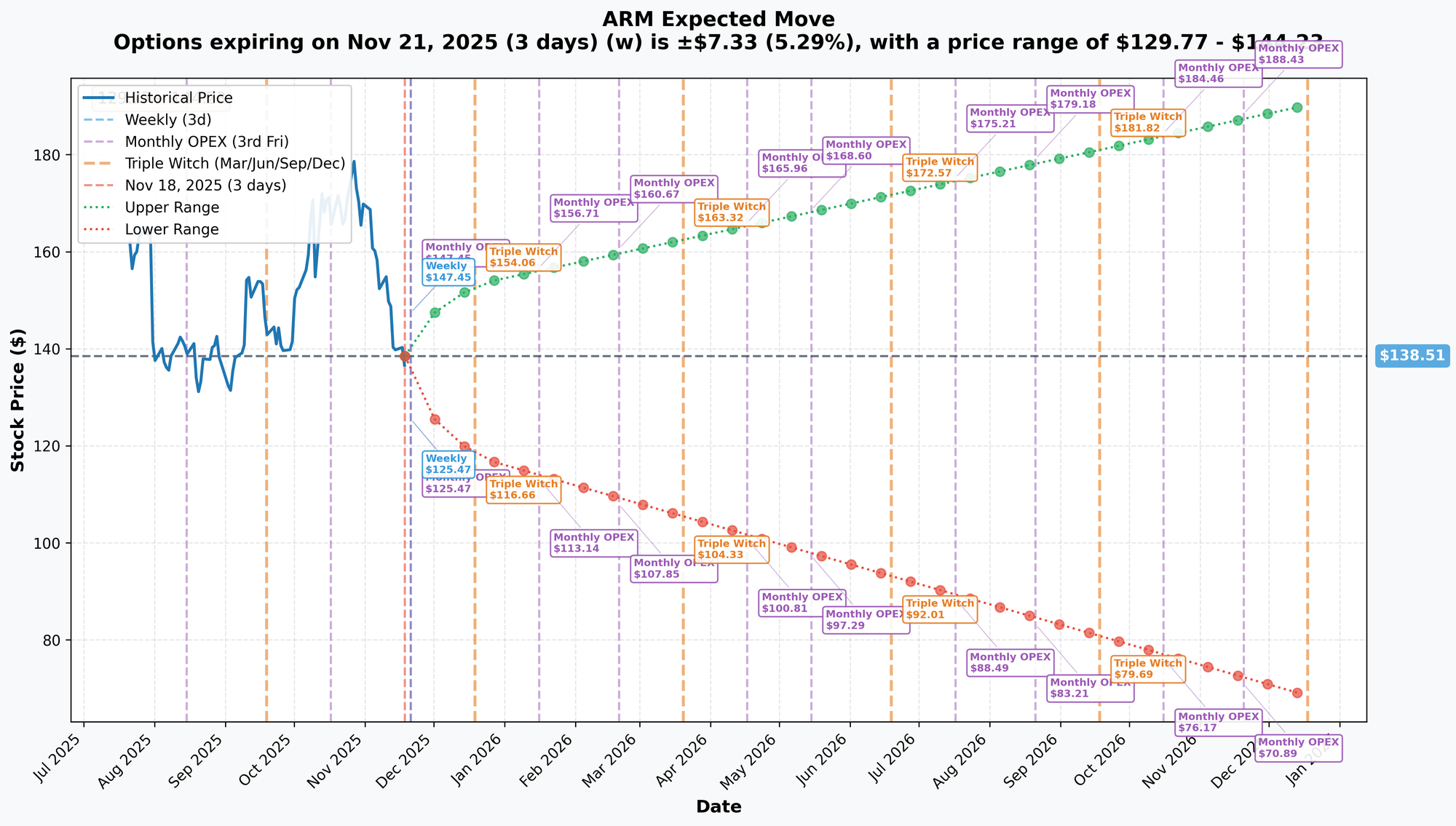

Implied Move Analysis

Options market pricing for upcoming expirations:

- 📅 Weekly (Nov 21 - 3 days): ±$7.33 (±5.29%) → Range: $129.77 - $144.23

- 📅 Monthly OPEX (Nov 21 - 3 days): ±$7.33 (±5.29%) → Range: $129.77 - $144.23

- 📅 Quarterly Triple Witch (Dec 19 - 31 days): ±$16.17 (±11.68%) → Range: $117.74 - $153.25

- 📅 LEAPS (Dec 18, 2026 - 395 days): ±$54.63 (±39.44%) → Range: $68.45 - $190.26

Translation for regular folks:

Options traders are pricing in a 5.3% move ($7.33) through this Friday for weekly expiration - that's HUGE for a 3-day window! The market expects continued volatility in ARM shares. By December quarterly expiration, the expected range widens dramatically to ±11.68% ($117-153 range), reflecting uncertainty around earnings guidance and competitive positioning.

The March 20th expiration (when this $2.4M put trade expires) isn't shown directly, but interpolating between monthly and quarterly moves suggests a ±15-20% expected range over the next ~120 days. This means the market sees realistic scenarios where ARM could trade as low as $110-115 OR as high as $160-165 by March.

Key insight: The sharp near-term implied volatility (5.3% in just 3 days!) reflects uncertainty around immediate catalysts. Smart money buying $125 puts with 9.8% cushion isn't being paranoid - the options market is pricing meaningful downside scenarios into the December-March timeframe.

🎪 Catalysts

🔥 Upcoming Catalysts (Next 6 Months)

Q4 Fiscal 2026 Earnings - February 4, 2026 (78 DAYS AWAY!) 📊

ARM reports fiscal Q4 results on Wednesday, February 4, 2026 after market close. This is THE major catalyst that could propel the next leg higher or validate bear concerns. Market expectations:

- 📊 Revenue Consensus: $906.97M for fiscal Q ending March 2026

- 💰 EPS Estimate: $0.40 expected for Q3 FY26 (Q4 estimates forming)

- 🤖 Key Metrics to Watch:

- Armv9 royalty percentage: Target >35% of total revenue (up from 30% in Q4 FY25) - this is THE critical metric[^3_1]

- CSS license momentum: Need 2-3 new Compute Subsystem design wins to validate 10%+ royalty rate thesis

- Full-year FY27 guidance: CRUCIAL after management withdrew FY26 guidance due to tariff uncertainty[^10_2]

- China revenue trends: 19% of revenue with only 7.5% YoY growth - watching for stabilization or further deterioration[^18_1]

- Data center design win announcements: AWS, Google, Microsoft CSS V3/N3 deployments

Upside surprise potential: If ARM announces major hyperscaler CSS V3 design wins (AWS Graviton next-gen, Google Axion expansion) and raises Armv9 penetration targets above 40% of royalty mix by FY27, stock could re-test $160-170 highs. Armv9 royalty rates at ~5% vs 2.5-3% for v8[^3_1] create powerful operating leverage.

Downside risk factors: Any disappointment in CSS adoption pace (still only 5 of 19 licensees shipping chips[^11_1]), China revenue decline, or conservative FY27 guidance citing macro uncertainty could trigger selloff back toward $120-125 support zone. At 72x forward P/E[^4_1], valuation offers no cushion for misses.

Why this matters for the put trade: These March $125 puts expire 44 days AFTER earnings, allowing the position to capture both the immediate earnings reaction AND the post-earnings reassessment period when guidance quality becomes clear.

Qualcomm Counter-Lawsuit Trial - March 2026 (THE BIG UNKNOWN) ⚖️

The Qualcomm litigation saga[^16_5] reaches its next critical phase with trial expected in March 2026 - right in the middle of this put trade's timeframe:

Background:

- September 30, 2025: U.S. District Court dismissed ARM's last remaining claim against Qualcomm[^16_1]

- Jury cleared Qualcomm of Architecture License Agreement violations in December 2024 trial[^16_3]

- Qualcomm filed counter-lawsuit in January 2025 alleging ARM breach of contract[^16_5]

- ARM vowed to "immediately file an appeal" to overturn adverse judgment[^16_6]

What's at stake:

- 💰 ARM downside: If Qualcomm prevails in March trial, could validate broad use of Nuvia-derived technology without additional ARM licensing fees → potential $500M-$1B annual royalty loss

- 💰 ARM upside: Settlement generating $500M-$1B upfront payment if both parties want to end legal uncertainty

- 🎯 Precedent risk: Adverse ruling could embolden other ARM licensees to challenge royalty structure

- 📊 Investor uncertainty: Legal overhang keeps institutional buyers on sidelines until resolved

Why this matters for the put trade: March 2026 trial timing falls EXACTLY when these $125 puts expire (March 20th). An adverse ruling could send ARM sharply lower if market prices in structural royalty risks. The put buyer is clearly worried about this binary legal catalyst.

MediaTek Dimensity 9500 Smartphone Launches - Q4 2025 through Q1 2026 📱

ARM's latest technology powers MediaTek's flagship Dimensity 9500 chip[^17_1] launching in premium smartphones this quarter:

Technology highlights:

- 🔬 Built on ARM's C1 CPU cluster and G1-Ultra GPU with Armv9.3 architecture[^17_2]

- 💪 33% higher peak GPU performance vs prior generation

- 🏭 OEM partners: Oppo Find X9 Pro, Vivo X300 series, Samsung Galaxy Tab, Tecno, Lava[^17_3]

- 📈 MediaTek targets 100M+ units annually in flagship segment

Revenue impact: Higher Armv9.3 royalty rates (~5%) on flagship smartphone shipments drive meaningful revenue growth even with flat smartphone unit volumes globally. Each percentage point of Armv9 penetration adds $50-100M in incremental annual royalties.

Risk factor: Smartphone market growing <2% YoY[^3_1] - ARM's growth depends entirely on mix shift to higher-royalty v9 devices, not volume expansion. Any delay in OEM launches or consumer resistance to premium pricing could slow Armv9 adoption.

Neoverse V3/N3 Data Center Deployments - Q1-Q2 2026 🖥️

ARM's next-generation data center platforms entering production with hyperscaler partners:

Product roadmap:

- 🚀 CSS V3 (Poseidon): 50% performance-per-socket improvement over CSS N2[^12_2]

- ⚡ CSS N3 (Pioneer): 20% higher performance-per-watt vs N2[^12_2]

- 💰 CSS royalty rates exceed 10% (essentially doubling v9 rates)[^3_1] - this is THE profit driver

Partner deployments:

- ✅ Microsoft Azure Cobalt 100 (CSS N2-based) already shipping[^12_1]

- 🏭 SocioNext chiplet based on Neoverse CSS V3 (TSMC 2nm) scheduled for 2025[^12_1]

- 🔬 Samsung/ADTechnology/Rebellions AI CPU chiplet platform (Samsung 2nm) in development[^12_1]

Expected catalyst: Major cloud provider (AWS, Google, Oracle) CSS V3 design win announcement in Q1 2026. Each hyperscaler CSS license represents $50-100M in annual royalties at maturity, validating ARM's data center thesis.

Why this matters: ARM's ambitious 50% data center market share target by end of 2025[^21_3] appears unrealistic (analysts expect 20-23%[^21_4]), but CSS adoption momentum is the TRUE metric. Success here justifies premium valuation; disappointment validates bear case.

Meta Partnership Expansion - October 2025 (ALREADY ANNOUNCED) 🤝

Strategic partnership announced in October 2025[^11_1] highlights full range of ARM compute platform:

- 🤖 Meta using Neoverse platform to power AI-based search ranking and recommendation engines for Facebook and Instagram[^12_1]

- 🏭 Meta's infrastructure runs on ARM-based custom silicon: Google Axion, AWS Graviton, NVIDIA Grace, Microsoft Cobalt[^11_1]

- 💪 Spans AI-enabled wearables to AI data centers

Impact: Validates ARM's technology across AI workload spectrum, but financial contribution won't materialize until 2026-2027 deployments ramp. Near-term stock catalyst limited; longer-term validation of architecture leadership.

⚠️ Risk Catalysts (Already Happened - Context for Put Hedge)

Recent Q3 Earnings Reaction - November 6, 2025 📉

ARM's Q3 results beat expectations handily but stock sold off[^2_3]:

- ✅ Results: Revenue $1.14B (up 34% YoY, beat $947M consensus), EPS $0.39 (beat $0.34 consensus)[^2_1]

- ✅ Royalty strength: $620M (up 21% YoY) driven by Armv9 adoption[^8_1]

- ❌ Stock reaction: Dropped from $173.26 to $163 in after-hours despite beat[^2_3]

- ⚠️ Guidance concerns: Q4 revenue guidance $1.225B (±$50M) viewed as conservative; full-year FY26 guidance withdrawn[^10_1][^10_2]

Why the selloff despite beat: Market wanted clearer path to 50% data center share and more aggressive FY26 guidance. Tariff uncertainty cited for guidance withdrawal[^10_2] created uncertainty overhang. At 72x forward P/E, any ambiguity gets punished.

Analyst downgrades followed:

- UBS maintained Buy but cut price target from $200 to $195[^14_2]

- Consensus price target at $168.52 (down from $180+ pre-earnings)[^14_1]

This recent experience shows ARM's vulnerability to "good but not great" quarters - explaining why institutions are buying protection even after the 19% pullback from $173 peak.

China Export Restrictions & RISC-V Competition 🇨🇳

China contributed 19% of fiscal 2025 revenue with only 7.5% YoY growth[^18_1] (slowest region):

- 🚨 ARM CEO publicly criticized export controls as "ultimately bad for consumers and companies"[^18_3]

- 🇨🇳 Chinese government promoting RISC-V as Western technology alternative[^18_2]

- 📊 RISC-V projected to have 20+ billion cores by 2025[^22_1] - particularly threatening in China and embedded systems

- 💰 Intel invested $1B in RISC-V; EU committed €270M[^22_2]

Downside scenario: Further RISC-V adoption in China could reduce ARM royalty growth to flat/negative, removing 100-200 basis points from total revenue growth rate. This is a slow-burn risk but structural threat to licensing model.

Upside scenario: Export control relaxation or major design wins in China could accelerate ARM growth back to 15%+, adding upside optionality.

🎲 Price Targets & Probabilities

Using gamma levels, implied move data, and upcoming catalysts, here are the scenarios through March 20th expiration:

📈 Bull Case (30% probability)

Target: $160-$175

How we get there:

- 💪 February earnings crush: Q4 revenue exceeds $950M (above $907M consensus), Armv9 royalty percentage hits 38%+, FY27 guidance confident with 25%+ revenue growth target

- 🚀 CSS momentum accelerates: 3-4 new Compute Subsystem design wins announced including AWS Graviton 5 or Google Axion Gen2, validating 10%+ royalty rates

- ⚖️ Qualcomm settlement: Both parties agree to comprehensive licensing deal worth $500M-$1B upfront to ARM, removing legal overhang and setting positive precedent

- 🇨🇳 China stabilizes: Export clarity emerges, ARM wins major design at Alibaba or Tencent for cloud infrastructure

- 📊 Data center share gains: Clear evidence of 20%+ server CPU market share with pathway to 30% by 2027, validating hyperscaler adoption

- 📈 Technical breakout: Stock breaks above $145-150 gamma resistance, triggering momentum rally back toward $173 recent highs

Key metrics needed:

- Armv9 penetration >35% and rising (proves royalty rate expansion story)

- CSS licenses >22 total with 8+ customers shipping (validates premium pricing)

- Gross margins expanding above 45% (demonstrates operating leverage)

- Data center revenue growing 30%+ YoY (confirms secular shift)

Probability assessment: Only 30% because it requires multiple positive catalysts to align simultaneously. While ARM's fundamental story remains strong (Armv9 adoption accelerating[^3_2], Meta partnership validating technology[^12_1]), the 72x forward P/E valuation and recent earnings disappointment reaction show limited margin for error. Stock needs PERFECT execution across earnings, legal, and adoption metrics to re-rate higher.

🎯 Base Case (45% probability)

Target: $125-$145 range (CHOPPY CONSOLIDATION)

Most likely scenario:

- ✅ Solid but unspectacular earnings: Q4 results meet consensus ($900-920M revenue), Armv9 penetration 33-35% (good not great), FY27 guidance conservative citing macro uncertainty

- 📱 CSS adoption steady: 1-2 new design wins announced but no tier-1 hyperscaler announcements yet, customer shipments progressing at expected pace

- ⚖️ Legal uncertainty persists: Qualcomm trial pushed to later in 2026 OR mixed verdict that doesn't fully resolve licensing questions

- 🇨🇳 China remains question mark: Neither major breakthrough nor catastrophic deterioration - muddles along at 5-10% growth

- 🔄 Range-bound trading: Stock oscillates between $130-135 support and $140-145 resistance for months as market awaits proof points

- 📊 Valuation multiple compression: P/E compresses from 72x toward 60-65x as growth expectations moderate, offset by steady fundamentals

- 💤 Volatility normalizes: After recent wild swings, ARM settles into $10-15 trading range pending next major catalyst

This is where the puts provide value: Stock consolidates in $125-145 range, puts expire with minimal value or slight profit, but downside protection served its purpose through uncertain earnings and legal periods. The $2.4M is simply the "insurance premium" accepted as cost of staying long with protection.

Why 45% probability: This reflects ARM's position at inflection point - strong fundamentals (34% revenue growth[^2_1], Armv9 adoption accelerating, hyperscaler partnerships) but stretched valuation (72x P/E) and elevated expectations. Most likely outcome is time-based consolidation as company "grows into" current valuation rather than explosive moves in either direction. Gamma structure ($135 support, $140-145 resistance) supports range-bound thesis.

📉 Bear Case (25% probability)

Target: $110-$125 (TEST THE PUT STRIKE!)

What could go wrong:

- 😰 Earnings disappointment: Q4 revenue misses at $880-900M OR meets but Q1 FY27 guidance weak (<$1B), Armv9 penetration stalls at 32-33%

- 🚨 CSS adoption slower than expected: Only 5-6 customers shipping by February (vs current 5), new licenses limited to tier-2 players, hyperscalers staying with x86 for majority of deployments

- ⚖️ Qualcomm wins trial: March verdict validates Qualcomm's broad use of Nuvia IP without additional ARM fees → $500M-$1B annual royalty risk, sets negative precedent for other licensees

- 🇨🇳 China accelerates RISC-V shift: Major Chinese cloud provider (Alibaba, Tencent) announces RISC-V architecture adoption, ARM China revenue declines 10-15%

- 💸 Broader semiconductor selloff: Nvidia weakness or macro recession fears drag all chip stocks lower, ARM down 20-30% in sympathy

- 📊 Data center share disappoints: Evidence emerges that ARM stuck at 15-17% server CPU share, far below 50% target, questioning investment thesis

- 💰 Margin compression: Aggressive pricing to win share vs x86 competitors pressures gross margins below 43%, reducing profitability leverage

- 🔨 Technical breakdown: Break below $135 support triggers cascade through $130 to $125, then potentially $120

Critical support levels:

- 🛡️ $135: Immediate gamma floor (8.5B) - MUST HOLD or momentum shifts bearish

- 🛡️ $125: Major support (3.8B gamma) + this put strike - institutional buying likely here

- 🛡️ $120: Deep floor (5.4B gamma) - represents 13% total downside from current levels

- 🛡️ $115: Disaster scenario (2.4B gamma) - would require multiple catastrophic catalysts

Probability assessment: 25% because it requires several negative catalysts to align. ARM's fundamentals remain solid (Q3 revenue up 34% YoY[^2_1], third consecutive quarter exceeding $1B revenue[^7_1], strategic partnerships with Meta and hyperscalers[^12_1]), but execution risks are real and valuation offers no cushion. The put buyer clearly thinks this scenario has ≥25% odds or they wouldn't pay $2.4M for protection.

Put P&L in Bear Case:

- Stock at $110 on March 20: Puts worth $15.00, profit = $3.00/share × 2,000 = $600K gain (25% ROI)

- Stock at $115 on March 20: Puts worth $10.00, loss = -$2.00/share × 2,000 = -$400K (17% loss but provided valuable protection)

- Stock at $125 on March 20: Puts worth $0 (at-the-money), loss = -$12.00/share × 2,000 = -$2.4M (100% loss but stock position intact)

💡 Trading Ideas

🛡️ Conservative: Collar Strategy for Existing Holders

Play: If you own ARM shares, copy the institutional playbook with a collar

Structure:

- Own 100 shares of ARM at $138.51

- Buy 1 × March 2026 $125 put for downside protection ($12.00)

- Sell 1 × March 2026 $150 call to finance the put (~$6.00)

- Net cost: ~$6.00 per share ($600 per collar)

Why this works:

- 🛡️ Defined downside: Maximum loss locked at $125 (9.8% protection from current $138.51)

- 📈 Upside preserved: Can participate up to $150 (8.3% gain potential)

- 💰 Partially funded: Selling $150 call reduces put cost from $12 to ~$6 net debit

- ⏰ Strategic timing: Covers February earnings, March Qualcomm trial, CSS adoption updates through Q1 2026

- 🎯 Peace of mind: Sleep well knowing worst-case scenario is $125 floor, best case is 8% gain

Risk/Reward Profile:

- 📉 Max loss: Stock at $125 or below = -$13.51/share loss on stock, +$12.00 put gain, -$6.00 net collar cost = -$7.51/share total (-5.4%)

- 📈 Max gain: Stock at $150 or above = +$11.49/share gain on stock, -$6.00 net collar cost = +$5.49/share total (+4.0%)

- 🎯 Breakeven: $144.51 (current $138.51 + $6.00 collar cost)

Ideal for: ARM shareholders with 30-80% gains who want to stay in the position through major catalysts but protect against downside surprises. Particularly suited for those who believe in the long-term story but are nervous about near-term earnings and legal risks.

Position sizing: Apply collar to 50-100% of ARM holdings depending on risk tolerance.

Risk level: Low (protection defined) | Skill level: Beginner-friendly

⚖️ Balanced: Post-Volatility Put Spread

Play: Wait for next volatility spike (earnings, legal news), then sell put spread

Structure:

- Wait for ARM to rally to $145+ OR for IV spike above 50%

- Buy March 2026 $130 puts

- Sell March 2026 $125 puts

- Target entry: $2.50-3.00 net debit per spread

Why this works:

- 🎯 Copy smart money levels: Targets same $125-130 support zone where institutions are positioned

- 📊 Defined risk: $5 wide spread = $500 max risk per contract, $250-300 net after credit

- 💰 Better pricing: Enter AFTER volatility spike when premiums rich, not now when IV already elevated

- ⏰ Catalyst coverage: Captures February earnings reaction and March trial uncertainty

- 🤝 Institutional validation: $125 strike has proven institutional interest from this $2.4M trade

Entry triggers (wait for ONE of these):

- ✅ Stock rallies to $145-150 (gives put spread room to work)

- ✅ Positive news catalyst spikes IV above 50% (earnings beat, legal settlement)

- ✅ VIX spike above 25 creates general market volatility

Estimated P&L:

- 💰 Max profit: $200-250 per spread if ARM below $125 at expiration

- 📉 Max loss: $250-300 per spread if ARM above $130 (defined and limited)

- 🎯 Breakeven: ~$127.50-128

- 📊 Risk/Reward: ~1:1 acceptable for defined-risk bearish play

Position sizing: Risk only 2-5% of portfolio (this is directional speculation on consolidation/pullback)

Risk level: Moderate (defined risk, requires timing) | Skill level: Intermediate

🚀 Aggressive: Pre-Earnings Straddle on February 4th (ADVANCED ONLY!)

Play: Bet on volatility explosion around Q4 earnings announcement

Structure:

- Entry timing: 2-3 days BEFORE February 4th earnings

- Buy ATM calls (likely $140 strike)

- Buy ATM puts (likely $140 strike)

- Use February 20th expiration to capture post-earnings drift

- Estimated cost: $18-22 per straddle

Why this could work:

- 💥 ARM has history of VIOLENT post-earnings moves - recent Q3 saw $173 → $163 gap despite beat

- 🎰 At 72x P/E, stock could EXPLODE either direction on guidance quality

- 📊 Recent range ($125-$145) might underestimate true earnings volatility potential

- 🚀 Armv9 penetration[^3_2] and CSS momentum[^11_1] could surprise materially either way

- ⚡ FY27 guidance will be CRITICAL after FY26 withdrawal - stock could gap $20+ on confident outlook

Why this could blow up (SERIOUS RISKS):

- 💸 VERY EXPENSIVE: Straddle costs $18-22 ($1,800-2,200 per straddle) - that's 13-16% of stock price!

- ⏰ TIME DECAY BRUTAL: Theta burns -$80-120/day as earnings approaches

- 😱 IV CRUSH KILLER: Even if stock moves 10%, volatility collapse could still create LOSS on both legs

- 📊 Need HUGE move: Stock must move >15-17% either direction just to breakeven after IV crush

- 🎢 Two-sided loss risk: Stock could stay $130-150 range (only 7-10% move) and you lose 50-70% of premium

- ⚠️ Recent Q3 reaction showed "good but not good enough" → stock only moved 6% despite beat

Estimated P&L:

- 💰 Cost: $18-22 per straddle

- 📈 Profit scenario: Stock moves to $160 or $120 (15%+ move) = $15-20 gain (75-100% ROI)

- 🚀 Home run: Stock moves to $170 or $110 (22%+ move) = $30+ gain (150%+ ROI)

- 📉 Loss scenario: Stock ends $130-150 range = lose $10-18 (50-80% loss)

- 💀 Total loss: Stock flat at $140 = lose entire $18-22 (100% wipeout)

Breakeven points:

- 📈 Upside: ~$158-162 (need 14-17% rally from entry on ARM)

- 📉 Downside: ~$118-122 (need 14-17% drop from entry on ARM)

CRITICAL WARNINGS - DO NOT attempt unless you:

- ✅ Have traded earnings straddles before and understand IV crush mechanics DEEPLY

- ✅ Can afford to lose ENTIRE premium (very real possibility!)

- ✅ Understand you're betting AGAINST options market's probability assessment

- ✅ Will monitor position on February 5th morning and take profits within 24-48 hours

- ✅ Accept that even if you're RIGHT on direction, IV collapse from 60% to 35% could still cause loss

- ⏰ Plan to close within 2 days post-earnings - do NOT hold to expiration hoping for recovery

Alternative (lower risk): Instead of straddle, play directional with single side after assessing earnings pre-release indicators (analyst preview articles, options flow, management tone).

Risk level: EXTREME (can lose 100% easily) | Skill level: Advanced only

Probability of profit: ~35% (lower than implied 50% due to brutal IV crush on ARM)

⚠️ Risk Factors

Don't underestimate these potential landmines:

-

📊 Valuation at 72x forward P/E leaves ZERO margin for error: ARM trading at 72.19x forward P/E[^4_1] and 36.4x P/S vs semiconductor industry average 4.7x[^4_2] after 81% YTD gain. Stock is priced for PERFECT execution. Requires AI products to reach 40% of revenue by 2027 vs <15% currently. Any stumble in Armv9 adoption, CSS momentum, or data center share gains could trigger 20-30% correction. Recent Q3 reaction (beat expectations but stock dropped from $173 to $163[^2_3]) shows how unforgiving market is at these multiples.

-

⚖️ Qualcomm litigation creates $500M-$1B annual royalty uncertainty: March 2026 trial on Qualcomm's counter-lawsuit[^16_5] represents MAJOR binary risk. After September 2025 court dismissed ARM's last claim[^16_1], ARM is on defensive. If Qualcomm prevails, could validate broad Nuvia IP usage without additional licensing fees → potential $500M-$1B annual loss. Worse, sets negative precedent encouraging other licensees to challenge royalty structures. This legal overhang keeps institutional buyers cautious until resolved. ARM vowed immediate appeal[^16_6], suggesting protracted litigation ahead.

-

🇨🇳 China geopolitical tensions threaten 19% of revenue: China contributed 19% of fiscal 2025 revenue with only 7.5% growth[^18_1] (slowest region). Chinese government actively promoting RISC-V as alternative to Western architectures[^18_2] creates structural headwind. RISC-V projected 20B+ cores by 2025[^22_1] with Intel $1B investment and EU €270M commitment[^22_2] accelerating adoption. Further export restrictions OR major Chinese cloud provider (Alibaba, Tencent) shifting to RISC-V could remove $200-300M annual revenue overnight. ARM CEO's public criticism of export controls[^18_3] shows frustration but limited ability to influence policy.

-

🚀 Ambitious 50% data center market share target appears unrealistic: ARM publicly targeting 50% of data center CPU market by end of 2025[^21_3] but current share only 13.2% at beginning of 2025[^21_2]. Analysts project more conservative 20-23% by end of 2025[^21_4]. Missing this self-set target damages credibility and questions investment thesis. While ARM expects 50% of new hyperscaler server chips to be ARM-based in 2025[^3_2] (different metric), market will view 50% share miss as failure. x86 (Intel/AMD) defending enterprise with legacy software ecosystem and superior high-performance computing capabilities.

-

📉 CSS adoption still nascent - only 5 of 19 licensees shipping chips: Despite 19 CSS licenses with 11 companies[^11_1], only 5 customers actually shipping CSS-based chips as of Q2 FY26[^11_1]. This is THE critical metric for ARM's 10%+ royalty rate thesis. Slow ramp suggests design complexity, customer hesitancy, or competitive challenges. Need to see 8-10 customers shipping by February earnings to validate momentum. Any customer cancellations or delays would crater stock as CSS represents future margin expansion story.

-

💰 Recent earnings showed market's "good enough isn't enough" mentality: Q3 revenue $1.14B up 34% YoY crushed $947M consensus, EPS $0.39 beat $0.34[^2_1], yet stock dropped from $173 to $163 in after-hours trading[^2_3]. Why? Q4 guidance $1.225B viewed as conservative and full-year FY26 guidance withdrawn due to tariff uncertainty[^10_2]. This reaction pattern shows even BEAT quarters can disappoint if guidance quality lacks confidence. February Q4 earnings faces same risk - meet/beat won't suffice without strong FY27 outlook.

-

🎢 Insider selling signals near-term caution: CFO Jason Child sold $2.75M worth of shares at $136.50 in November 2025; executives sold $1.5M in last 3 months[^24_1]. While routine selling isn't necessarily bearish, timing after 81% YTD rally suggests insiders view current valuation as rich. Combined with SoftBank's 87-90% controlling stake[^23_1], creates overhang risk if SoftBank needs liquidity for other investments.

-

🏭 RISC-V competition threatens long-term licensing model: Beyond China, RISC-V gaining traction in embedded systems, IoT, and cost-sensitive applications[^22_1]. Open-source, royalty-free architecture appeals to companies wanting to avoid licensing fees. Hyperscalers (Google, Amazon, Meta) exploring RISC-V for specific AI workloads[^22_2]. If RISC-V captures 10-15% of markets ARM targets (data center, automotive, IoT), could reduce ARM's TAM by $2-5B over 5 years. This is slow-burn threat but structural challenge to growth assumptions.

-

🛡️ Smart money buying $2.4M insurance at 81% YTD gains signals caution: This institutional put purchase isn't bearish on ARM's long-term story - it's sophisticated risk management. But the SIZE (916x average, unprecedented[^unusual_score]) and TIMING (78 days before earnings, 122 days covering Qualcomm trial) shows institutions worried enough about 10-15% downside scenarios to pay $12 per share for March $125 protection. When funds managing hundreds of millions hedge this aggressively rather than staying fully long, retail should pay attention.

-

📊 Gamma ceiling at $140-145 creates mechanical selling pressure: The 10.2B call gamma at $140 resistance (strongest single level) means market makers will systematically SELL shares into rallies above $140 to hedge their exposure. This creates natural supply that makes breakouts difficult. Would require sustained institutional buying or major catalyst to overcome. Current price ($138-139) sitting just below this ceiling - multiple failed attempts to break higher increases frustration selling.

🎯 The Bottom Line

Real talk: Someone just spent $2.4 MILLION protecting an ARM position four months before major catalysts (February earnings, March Qualcomm trial). This isn't bearish on ARM's long-term semiconductor IP dominance - it's smart portfolio management by institutions that have made MASSIVE money on the 81% YTD rally and don't want a single bad quarter or adverse legal ruling to erase their gains.

What this trade tells us:

- 🎯 Sophisticated player expects potential VOLATILITY through March (protecting against 10-15% downside scenario to $125 support)

- 💰 They're concerned enough about $138→$125 move to pay $12/share for insurance (8.7% of stock price!)

- ⏰ The 122-day timeframe captures ALL major near-term catalysts: Q4 earnings, FY27 guidance, Qualcomm trial, CSS adoption updates

- 📊 They structured at exactly $125 strike where gamma shows 3.8B support and significant put OI - expecting IF stock breaks $130-135, it could flush to $125 quickly

- 🏦 916x average size (unprecedented in ARM's trading history) suggests this is MAJOR fund protecting eight-figure long position

This is NOT a "sell everything" signal - it's a "manage your risk intelligently" signal.

If you own ARM:

- ✅ Consider trimming 20-30% at $138-145 levels to lock in 60-80% gains, reduce exposure

- 📊 If holding through catalysts, use collar strategy (buy $125 puts, sell $150 calls) to define risk

- ⏰ Don't get greedy - you've already won big! Protecting 81% gains is professional.

- 🎯 Set mental stops at $130-135 (gamma support) if not using options protection

- 🛡️ Consider buying 1-2 protective puts per 100 shares if holding large position (copy this trade's structure proportionally)

If you're watching from sidelines:

- ⏰ Don't chase at $138-145 - wait for catalyst resolution or pullback to better entry

- 🎯 Ideal entry zone: $125-130 on pullback (would offer 10-15% margin of safety from current levels)

- 📈 Looking for confirmation: February earnings beat[^9_1] with strong FY27 guidance, Armv9 penetration >35%[^3_2], CSS customers >8 shipping, Qualcomm settlement

- 🚀 Longer-term (12-18 months): Armv9 royalty rate expansion[^3_1] from 2.5% to 5%+ and CSS 10%+ rates[^11_1] are legitimate catalysts for $160-180 IF execution delivers

- ⚠️ Current 72x forward P/E requires flawless execution - one stumble sends it back to $110-120

If you're bearish:

- 🎯 Wait for specific catalyst failures before shorting - don't fight 81% momentum blindly

- 📊 Key support levels: $135 (first line), $130 (secondary), $125 (major floor where institutions protecting)

- ⚠️ Post-earnings put spreads ($135/$125 or $130/$120) offer defined-risk way to play downside after news

- 📉 Watch for break below $130 with volume - that's trigger for cascade toward $125, then $120

- ⏰ Timing is critical: Premature bearish bets risk getting run over; wait for concrete negative catalysts

Mark your calendar - Key dates ahead:

- 📅 November 21 (Friday) - Weekly/Monthly OPEX (±5.3% implied move window closes)

- 📅 December 19 - Quarterly triple witch (±11.68% range)

- 📅 February 4, 2026 (Wednesday) - Q4 FY2026 earnings after close (MAJOR CATALYST!)

- 📅 February 5-6 - Post-earnings price discovery and analyst reactions

- 📅 March 2026 - Qualcomm counter-lawsuit trial expected (exact date TBD)

- 📅 March 20, 2026 - Monthly OPEX, expiration of this $2.4M put trade

- 📅 Q2-Q3 2026 - Neoverse V3/N3 CSS deployments[^12_2] from hyperscalers expected

- 📅 2026-2027 - Armv9 penetration projected to reach 60-70% of royalty mix[^3_2]

Final verdict: ARM's long-term story remains extremely compelling - Armv9 royalty rate doubling to 5%+[^3_1], CSS commanding 10%+ rates[^11_1], 99% smartphone market share expanding to data centers, Meta partnership validating AI workload capabilities[^12_1], and structural shift to ARM architecture in cloud infrastructure. BUT, at 72x P/E after 81% YTD gain with major binary catalysts ahead (earnings, legal, adoption metrics), the risk/reward is NO LONGER overwhelmingly favorable for aggressive new money.

The $2.4M institutional put buy is a CLEAR signal: smart money is protecting gains at elevated valuations while staying in the game.

Be patient. Wait for catalyst resolution. Look for better entry points at $125-130 support. The ARM architecture revolution will still be here in 6 months, and you'll sleep better paying $127 instead of $142.

This is about capital preservation and intelligent position sizing, not timing perfection. Protect what you have.

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. This analysis is for educational purposes only and not financial advice. Past performance doesn't guarantee future results. The 916x unusual score reflects this specific trade's size relative to recent ARM history - it does not imply the trade will be profitable or that you should follow it. Always do your own research and consider consulting a licensed financial advisor before trading. Earnings and legal proceedings create binary event risk with potential for 15-20% gaps either direction. The put buyer may have complex portfolio hedging needs not applicable to retail traders.

About Arm Holdings: Arm Holdings is the IP owner and developer of the ARM architecture used in 99% of the world's smartphone CPU cores, with growing presence in data centers, automotive, and IoT devices, operating on a licensing model where customers pay architectural fees and per-unit royalties. Market cap: $148.8 billion.

References

[^1_1]: StockAnalysis.com, "Arm Holdings (ARM) Market Cap & Net Worth", November 17, 2025, https://stockanalysis.com/stocks/arm/market-cap/

[^2_1]: Shacknews, "Arm Holdings Q3 2025 earnings results beat EPS and revenue expectations", November 6, 2025, https://www.shacknews.com/article/143010/arm-holdings-q3-2025-earnings-results

[^2_3]: The Motley Fool, "Arm Stock Delivered a Smashing Quarter. It Wasn't Enough.", November 12, 2025, https://www.fool.com/investing/2025/11/12/arm-delivered-a-smashing-quarter-it-wasnt-enough/

[^3_1]: NextPlatform, "Armv9 Architecture Helps Lift Arm To New Financial Heights", May 12, 2025, https://www.nextplatform.com/2025/05/12/armv9-architecture-helps-lift-arm-to-new-financial-heights/

[^3_2]: Benzinga, "Arm's Rising Royalties and v9 Adoption Strengthen Market Position, Analysts Say", February 6, 2025, https://www.benzinga.com/analyst-ratings/analyst-color/25/02/43540659/arms-rising-royalties-and-v9-adoption-strengthen-market-position-analysts-say

[^4_1]: GuruFocus, "ARM (ARM Holdings) Forward PE Ratio", November 2025, https://www.gurufocus.com/term/forward-pe-ratio/ARM

[^4_2]: Simply Wall St, "Arm Holdings (NasdaqGS:ARM) Stock Valuation, Peer Comparison & Price Targets", November 2025, https://simplywall.st/stocks/us/semiconductors/nasdaq-arm/arm-holdings/valuation

[^7_1]: Arm Newsroom, "Arm Q2 FYE26 revenue surpasses $1 billion for third consecutive quarter", November 5, 2025, https://newsroom.arm.com/news/arm-q2-fye26-results

[^8_1]: Business Research Insights, "ARM Microprocessor Market Size, Share, Analysis, 2033", 2025, https://www.businessresearchinsights.com/market-reports/arm-microprocessor-market-108035

[^9_1]: Nasdaq, "Arm Holdings plc American Depositary Shares (ARM) Earnings Report Dates & Earnings Forecasts", November 2025, https://www.nasdaq.com/market-activity/stocks/arm/earnings

[^10_1]: Investing.com, "Earnings call transcript: ARM's Q2 2025 revenue jumps 34% amid AI surge", November 2025, https://www.investing.com/news/transcripts/earnings-call-transcript-arms-q2-2025-revenue-jumps-34-amid-ai-surge-93CH-4335848

[^10_2]: Morningstar UK, "ARM Earnings: Tariffs Shut Down 2026 Guidance, Revenue Growth Still Strong", November 2025, https://www.morningstar.co.uk/uk/news/264621/arm-earnings-tariffs-shut-down-2026-guidance-revenue-growth-still-strong.aspx

[^11_1]: Arm Newsroom, "Arm Q2 FYE26 revenue surpasses $1 billion for third consecutive quarter", November 5, 2025, https://newsroom.arm.com/news/arm-q2-fye26-results

[^12_1]: Data Center Dynamics, "Meta partners with Arm for efficient AI system scaling on chip designer's Neoverse platform", October 15, 2025, https://www.datacenterdynamics.com/en/news/meta-partners-with-arm-for-efficient-ai-system-scaling-on-chip-designers-neoverse-platform/

[^12_2]: The Register, "Arm targets AI performance with latest Neoverse Compute Subsystems", February 21, 2024, https://www.theregister.com/2024/02/21/arm_neoverse_compute/

[^14_1]: Benzinga, "ARM Holdings Analyst Ratings and Price Targets", November 2025, https://www.benzinga.com/quote/ARM/analyst-ratings

[^14_2]: GuruFocus, "UBS Lowers Price Target for ARM Holdings Amidst Maintained 'Buy' Rating", November 6, 2025, https://www.gurufocus.com/news/3191830/ubs-lowers-price-target-for-arm-holdings-amidst-maintained-buy-rating-arm-stock-news

[^16_1]: Bloomberg, "Qualcomm Says Arm's Last Remaining Legal Claim Rejected by Court", October 1, 2025, https://www.bloomberg.com/news/articles/2025-10-01/qualcomm-says-arm-s-last-remaining-legal-claim-rejected-by-court

[^16_3]: PYMNTS, "Qualcomm Secures Partial Victory in Licensing Dispute with Arm, Jury Splits on Key Issues", December 2024, https://www.pymnts.com/cpi-posts/qualcomm-secures-partial-victory-in-licensing-dispute-with-arm-jury-splits-on-key-issues/

[^16_5]: Futurum Group, "Litigation SITREP: What You Need To Know About the Ongoing Dispute Between Qualcomm and Arm", 2025, https://futurumgroup.com/insights/litigation-sitrep-ongoing-dispute-between-qualcomm-and-arm/

[^16_6]: RCR Wireless, "'Full and final judgment' reached in Qualcomm vs. Arm case", October 1, 2025, https://www.rcrwireless.com/20251001/business/qualcomm-arm-2

[^17_1]: GadgetMatch, "Dimensity 9500 will power 2026's flagship 5G smartphones", September 2025, https://www.gadgetmatch.com/mediatek-dimensity-9500-launch/

[^17_2]: NextPit, "MediaTek Launches the Dimensity 9500 Chip: Flagship Redefined", September 2025, https://www.nextpit.com/news/mediatek-dimensity-9500-mobile-processor-launch-specifications

[^17_3]: Android Police, "The first phones with the new MediaTek Dimensity 9500 are almost here", September 2025, https://www.androidpolice.com/mediatek-dimensity-9500-announcement/

[^18_1]: Bloomberg, "Arm CEO Sides With Nvidia Against US Export Limits on China", June 12, 2025, https://www.bloomberg.com/news/articles/2025-06-12/arm-ceo-sides-with-nvidia-against-us-export-limits-on-china

[^18_2]: Yahoo Finance, "Is China's RISC-V Pivot Undermining Arm's Growth Prospects?", 2025, https://finance.yahoo.com/news/chinas-risc-v-pivot-undermining-172500539.html

[^18_3]: Global Times, "Arm CEO says US export controls on China threaten to slow overall tech advances", June 2025, https://www.globaltimes.cn/page/202506/1336063.shtml

[^21_2]: Heise Online, "ARM exceeds 10 percent CPU market share in notebooks and servers", Q1 2025, https://www.heise.de/en/news/ARM-exceeds-10-percent-CPU-market-share-in-notebooks-and-servers-10386761.html

[^21_3]: Tom's Hardware, "Arm aims to capture 50% of data center CPU market in 2025", 2025, https://www.tomshardware.com/pc-components/cpus/arm-aims-to-capture-50-percent-of-data-center-cpu-market-in-2025

[^21_4]: Techerati, "Arm Predicts Data Centre CPU Market Share to Surge to 50% in 2025", 2025, https://www.techerati.com/news-hub/arm-predicts-data-centre-cpu-market-share-to-surge-to-50-in-2025/

[^22_1]: PatentPC, "The Rise of RISC-V: Is It a Threat to ARM and x86? (Market Growth Stats)", 2025, https://patentpc.com/blog/the-rise-of-risc-v-is-it-a-threat-to-arm-and-x86-market-growth-stats

[^22_2]: TS2 Space, "RISC-V vs ARM vs x86: The 2025 Silicon Architecture Showdown", 2025, https://ts2.tech/en/risc-v-vs-arm-vs-x86-the-2025-silicon-architecture-showdown/

[^23_1]: WallStreetZen, "Arm Holdings Stock Ownership - Who Owns Arm Holdings in 2025?", 2025, https://www.wallstreetzen.com/stocks/us/nasdaq/arm/ownership

[^24_1]: TipRanks, "Insider Trading: Arm Holdings' (ARM) Major Insider Offloads Stock Worth $2.75M", November 2025, https://www.tipranks.com/news/insider-trading-arm-holdings-arm-major-insider-offloads-stock-worth-2-75m