APLS Unusual Options Report - August 14, 2025: $3.2M Biotech Breakout Play

🔥 EXTREME ALERT! A massive whale just dropped $3.2 million on APLS October calls - that's like buying a mansion in Beverly Hills! With the FDA approval of EMPAVELI just weeks ago and October earnings approaching, someone's betting BIG on a continued rally. The stock's already up 11% but these str...

🎯 The Quick Take

🔥 EXTREME ALERT! A massive whale just dropped $3.2 million on APLS October calls - that's like buying a mansion in Beverly Hills! With the FDA approval of EMPAVELI just weeks ago and October earnings approaching, someone's betting BIG on a continued rally. The stock's already up 11% but these strikes suggest another 25%+ move coming! 🚀

Translation for us regular folks: When institutional money spends $3.2M on calls 64 days out, they're positioning for major catalysts. This isn't a day trade - it's a calculated bet on biotech transformation!

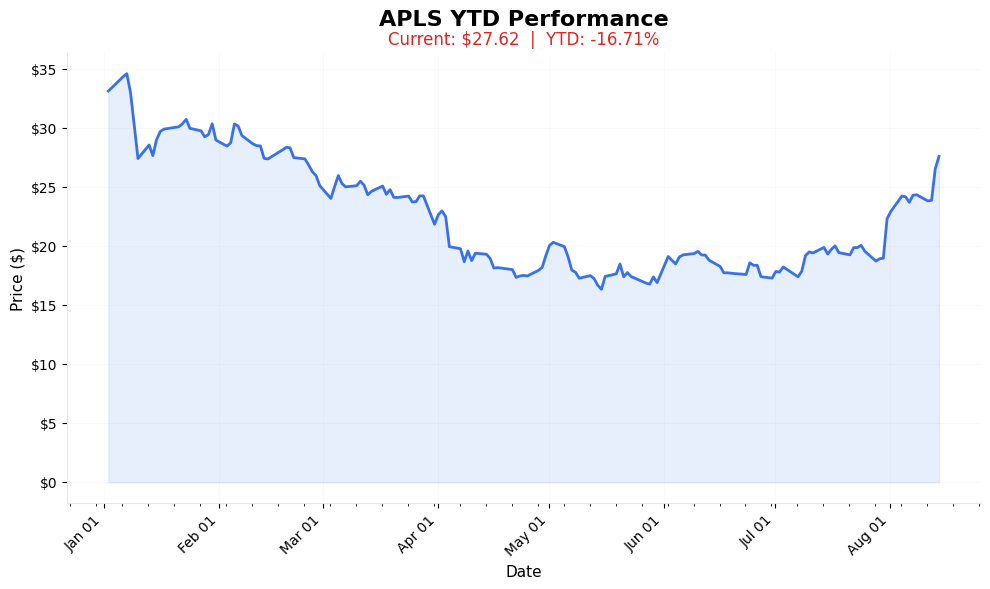

📈 YTD Performance

APLS Year-to-Date Performance (2025)

Current Price: See chart | YTD Performance: Visualized above

📊 Options Tape Breakdown

🐋 WHALE ALERT: Massive Call Wall at $20 & $25!

📈 Trade Metrics Dashboard

| Metric | Value | What It Means |

|---|---|---|

| Total Volume | 5,500 contracts | Institutional-sized positioning! |

| Total Premium | $3.2M | Hedge fund level capital |

| Spot Price | $27.54 | Already rallying |

| Strike Range | $20-$25 | Deep ITM calls (bullish!) |

| Days to Expiry | 64 days | October 17 expiration |

| Unusualness Score | 🟩🟩🟩🟩🟩🟩🟨⬜⬜⬜ 6/10 | Very High Activity |

🎬 The Actual Trade Tape

📊 Order Flow: Single wave execution at 13:16:32

🎯 Execution: MID (balanced urgency)

| Time | Side | Type | Strike | Volume | Premium | Spot Price | Option Price |

|---|---|---|---|---|---|---|---|

| 13:16:32 | 🟢 BUY | 📈 CALL | $20 | 2,500 | $2.0M | $27.54 | $7.95 |

| 13:16:32 | 🟢 BUY | 📈 CALL | $25 | 3,000 | $1.2M | $27.54 | $3.95 |

⚡ Strategy Detection: INSTITUTIONAL ACCUMULATION

What This Means in Plain English:

- 🎯 DEEP IN THE MONEY: Both strikes already profitable

- 💰 HIGH DELTA: These act like stock with leverage

- 📊 OCTOBER EXPIRY: Positioned for Q3 earnings & pipeline news

- ⏰ SIMULTANEOUS EXECUTION: Single entity accumulating

Translation: This is a sophisticated bet on APLS continuing its rally through October. The deep ITM strikes suggest someone wants upside exposure with limited downside risk - classic institutional positioning!

🎯 What The Smart Money Knows

The Setup They're Playing:

Key Price Levels:

- $20 calls: Already $7.54 ITM (massive intrinsic value)

- $25 calls: Already $2.54 ITM (solid cushion)

- Breakeven: $27.95 for $20 calls, $28.95 for $25 calls

- Implied target: $35-40 (analyst consensus $41.68!)

Why APLS? The Catalyst Lineup:

Key Highlights:

- 💊 EMPAVELI FDA Approval (July 28)

- First treatment EVER for C3G/IC-MPGN

- $200K+ annual pricing potential

Additional Points: 5,000 patient addressable market;

Revenue catalyst just starting!

; ; 60-65% market share in geographic atrophy; $150.6M Q2 revenue (and growing!)Plus 12 more detailed points in the full analysis.

💡 How Different Traders Should Play This

🎰 YOLO Traders

"I want that 10x!"

- Play: October $30 calls

- Cost: ~$1.50 per contract

- Risk: -100% if below $30

- Reward: +400% if hits $35

- Position Size: 2% MAX

🏄 Swing Traders

"I'll ride the momentum"

- Play: Buy APLS on any dip to $26

- Stop: $24.50

- Target: $32-35

- Position Size: 3-5% of account

💎 Premium Collectors

"I'll sell puts for income"

- Play: Sell $25 October puts

- Collect: $1.20 premium

- Risk: Assignment at $23.80

- Win If: Stock stays above $25

👶 Entry Level Investors

"Biotech scares me but this looks interesting"

- Play: Buy 25-50 shares

- Stop Loss: $25 (-9%)

- Target: $35 (+27%)

- Time Frame: 3-6 months

⚠️ The Risks (Let's Keep It Real)

What Could Go Wrong:

- 🧬 Biotech Volatility: Can swing 20% on any news

- 🏥 Clinical Trial Risk: Pipeline failures possible

- 💊 Competition: Astellas fighting for market share

- 📉 Market Rotation: Biotech out of favor recently

- 💰 Still Unprofitable: -$197M net loss last year

🎯 The Bottom Line

Real talk: This $3.2M position is sophisticated money betting on multiple catalysts:

1. EMPAVELI launch momentum building

2. SYFOVRE maintaining market leadership

3. October earnings potential surprise

4. Pipeline expansion announcements

5. Possible buyout speculation (always in biotech!)

Someone with deep pockets sees $40+ by October!

📋 Your Action Checklist

✅ If Following: Size appropriately - biotech is volatile!

✅ Set Alerts: $25 (support), $30 (resistance), $35 (target)

✅ Mark Calendar: October 17 expiration, Q3 earnings late October

✅ Watch For: EMPAVELI sales updates, pipeline news

✅ Risk Management: Use stops - biotech can gap down 20%!

📊 Quick Reference Card

| Metric | Value | Significance |

|---|---|---|

| Ticker | APLS | Apellis Pharmaceuticals |

| Strategy | Call Accumulation | Bullish positioning |

| Premium | $3.2M total | Institutional size |

| Contracts | 5,500 | Large block trade |

| Strike Range | $20-$25 | Deep ITM calls |

| Spot Price | $27.54 | Above both strikes |

| Expiration | Oct 17, 2025 | 64 days out |

| Largest Position | $25 calls @ 3,000 | Key accumulation level |

| Intrinsic Value | High | Limited time premium |

| Implied Move | +25-45% | To $35-40 range |

| Analyst Target | $41.68 average | 51% upside |

| Risk Level | 🔥🔥🔥🔥⬜ (4/5) | High biotech risk |

🏷️ Tags for This Trade

Sector: #Biotech #Pharma

Strategy Type: #CallAccumulation #Bullish

Catalyst: #FDAApproval #Earnings #Pipeline

Risk Level: #HighRisk #HighReward

Trader Types: #Institutional #Sophisticated

⚠️ Disclaimer: Biotech stocks are extremely volatile and can move 20%+ on any clinical news. This $3.2M options position represents sophisticated institutional positioning, but biotechs carry unique risks including clinical failures, regulatory setbacks, and competition. The October expiration provides time for catalysts but also exposes you to binary events. This is education, not financial advice! 💊