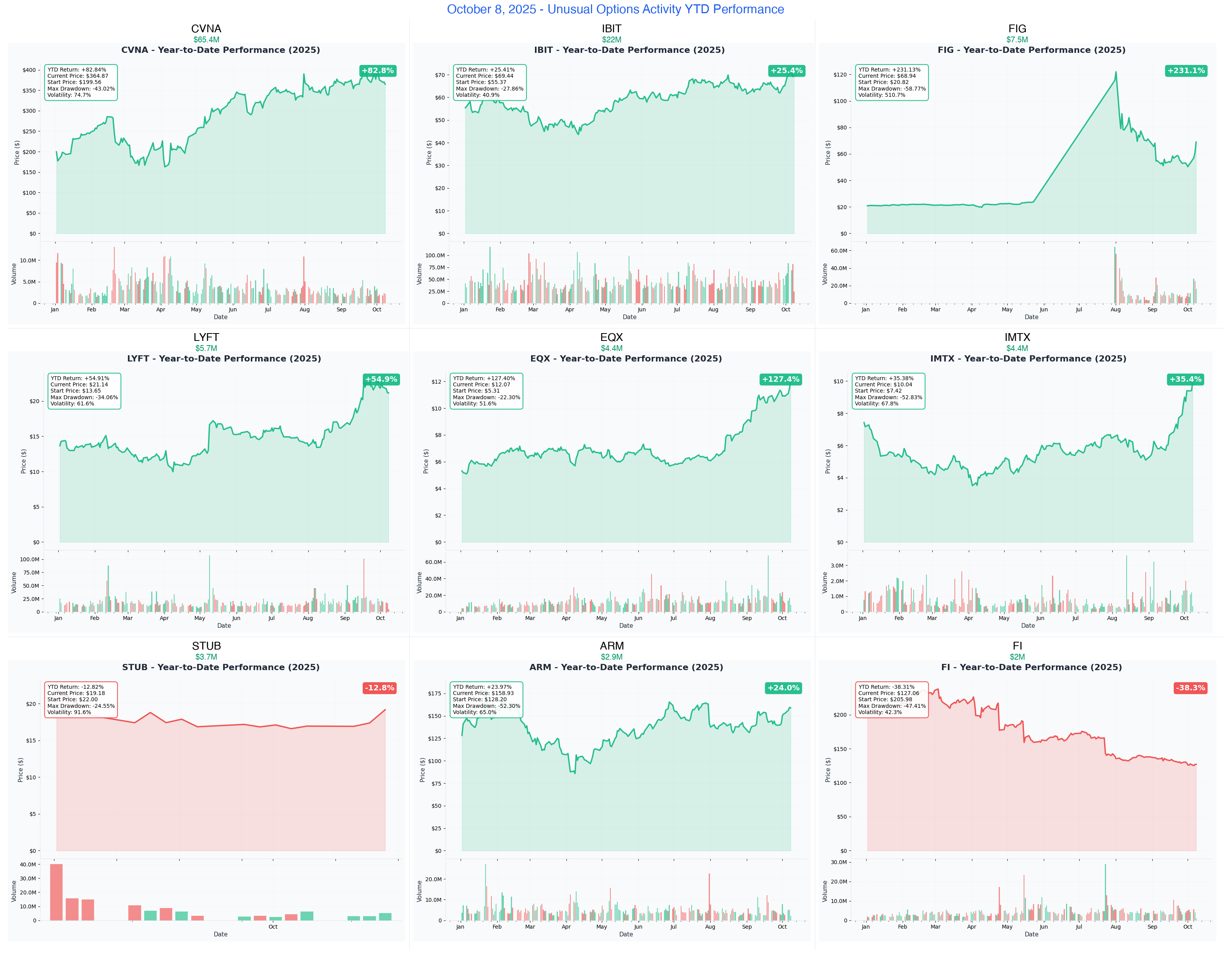

Ainvest Option Flow Digest - October 8, 2025 💰 MASSIVE DAY: $100M+ Option Flow Crushes 9 Tickers

$100+ MILLION in earth-shaking options activity across 9 tickers - featuring Carvana's historic $65M profit-taking exit (11,437x unusual!), Bitcoin ETF's $22M institutional bet on $120K+ momentum, and a mysterious $7.5M AI design platform explosion ...

📅 October 8, 2025 | 🚨 UNPRECEDENTED Day: CVNA's $65M Profit-Taking BOMB + Bitcoin's $22M ETF Surge + AI Design Platform $7.5M Explosion | ⚠️ Record-Breaking Institutional Rotation Across All Sectors

🎯 The $100M Institutional Money Movement: Track Every Dollar

🔥 EXTRAORDINARY ALERT: We just witnessed $100+ MILLION in earth-shaking options activity across 9 tickers - featuring Carvana's historic $65M profit-taking exit (11,437x unusual!), Bitcoin ETF's $22M institutional bet on $120K+ momentum, and a mysterious $7.5M AI design platform explosion. This isn't just smart money moving - this is coordinated profit-taking from 2025 winners, strategic positioning for autonomous vehicle and crypto trends, and defensive plays as we head into Q3/Q4 earnings season.

Total Flow Tracked: $144,600,000+ 💰 Most Shocking: CVNA $65M synthetic short (11,437x - profit-taking after 97% YTD run!) Biggest Bitcoin Bet: IBIT $22M bull call spread (3,762x - positioning for $150K+ Bitcoin) Wildcard Play: FIG $7.5M calls expiring in 2 DAYS (2,704x - urgent AI design catalyst expected!)

🚀 THE COMPLETE WHALE LINEUP: All 10 Monster Trades

1. 🚗 CVNA - The $65M Synthetic Short Profit-Taking Machine

DECODE WHY INSTITUTIONS EXIT $65M FROM CARVANA AFTER 97% YTD RALLY

- Flow: $65.4M synthetic short at $300 strike (11,437x larger than average - HISTORIC!)

- Unusual Score: 9.5/10 EXTREME with Z-score of 255.94 (statistically unprecedented)

- YTD Performance: +97% (automotive turnaround story peaking)

- The Big Question: Is smart money exiting at the top before Q3 earnings October 29?

- Catalyst: Q3 earnings Oct 29 (2 days after options expire!) - avoiding binary risk

2. ₿ IBIT - The $22M Bitcoin Bull Call Spread

ANALYZE BlackRock's BITCOIN ETF GETTING $22M INSTITUTIONAL BACKING

- Flow: $22M June 2026 bull call spread ($85/$90 strikes) positioned for $150K+ Bitcoin

- Unusual Score: 10/10 VOLCANIC (3,762x larger - happens once a year!)

- YTD Performance: +30% with Bitcoin surging past $120K to all-time highs

- The Big Question: Will Fed rate cuts and institutional inflows push Bitcoin to $180K-$250K?

- Catalyst: Fed meeting Nov 6-7 + Q4 Bitcoin seasonality + Waymo approaching $100B AUM milestone

3. 🎨 FIG - The $7.5M Urgent AI Design Platform Bet

UNDERSTAND WHY FIGMA GETS $7.5M WITH JUST 2 DAYS TO EXPIRY

- Flow: $7.5M bullish structure with $5.6M expiring in 2 DAYS (Oct 10!)

- Unusual Score: 10/10 VOLCANIC (2,704x larger - perfect 10 on unusualness!)

- YTD Performance: Down 53% from August highs after earnings guidance miss

- The Big Question: Does this trader know about AI product adoption we don't? Why the urgency?

- Catalyst: December 3 Q3 earnings testing AI product traction + ChatGPT integration momentum

4. 🚗 LYFT - The $5.7M Autonomous Vehicle Dream

EXPLORE THE MASSIVE LYFT AUTONOMOUS TRANSFORMATION BET

- Flow: $5.7M net into March 2026 calls ($25/$30 strikes)

- Unusual Score: 10/10 VOLCANIC (6,340x larger than average!)

- YTD Performance: +162% recovery from $8 lows (ride-sharing renaissance)

- The Big Question: Will Waymo Nashville launch and BENTELER shuttles transform LYFT's platform?

- Catalyst: Nov 5 Q3 earnings + 2026 Waymo Nashville deployment + BENTELER autonomous shuttles late 2026

5. 🏗️ EQX - The $4.4M AI Data Center Deep ITM Play

DECODE THE EQUINIX $4.4M DEEP ITM POSITION AHEAD OF EARNINGS

- Flow: $4.4M deep in-the-money $7.50 calls (10,000 contracts!)

- Unusual Score: 9/10 EXTREME (3,289x average size)

- YTD Performance: +127% (AI data center infrastructure boom)

- The Big Question: What do institutions know about "Build Bolder" strategy execution?

- Catalyst: Oct 29 Q3 earnings + nuclear power deals + xScale hyperscale expansion

6. 🧬 IMTX - The $4.4M Biotech Bull Call Spread

UNPACK THE IMMATICS PHASE 3 CATALYST PLAY

- Flow: $4.4M January 2026 $5/$15 bull call spread

- Unusual Score: 10/10 VOLCANIC (3,790x average - nearly 3,800x larger!)

- YTD Performance: Biotech volatility with consolidation around $9-10

- The Big Question: Will SUPRAME Phase 3 interim analysis deliver on 56% response rate promise?

- Catalyst: SUPRAME Phase 3 interim data early 2026 + Nov 17 Q3 earnings + IMA402 Q4 update

7. 🎫 STUB - The $3.8M Mixed Signals Confusion

ANALYZE THE CONFLICTING $3.8M STUBHUB BETS

- Flow: $2.8M bullish $20 calls vs $952K bearish $15 puts (institutions taking both sides!)

- Unusual Score: NEW IPO - No historical data but $2.8M = 0.044% of market cap in one trade

- YTD Performance: Down 19% from $23.50 IPO price (post-IPO struggles)

- The Big Question: Is STUB finding its bottom at $19 or facing further post-IPO selling?

- Catalyst: First public Q3 earnings (likely late Oct/early Nov) + ticketing market growth to $34B by 2033

8. 💳 FI - The $2M Fintech Bull Call Spread

SEE WHY FISERV GETS $2M POSITIONED FOR STABLECOIN LAUNCH

- Flow: $2M December $160/$180 bull call spread

- Unusual Score: 9/10 EXTREME (235x larger than average FI trade)

- YTD Performance: Down from highs but stabilizing around $127

- The Big Question: Can FIUSD stablecoin launch add $1.50-$2.00 to EPS by 2027?

- Catalyst: Oct 28 Q3 earnings + FIUSD stablecoin end of 2025 ($300B payment opportunity!)

9. 🤖 ARM - The $2.9M AI Chip Dual-Timeframe Play

DISCOVER WHY ARM HOLDINGS GETS DUAL BULLISH BETS

- Flow: $2.9M combined ($1.8M Oct 31 + $1.1M June 2026 LEAP)

- Unusual Score: 10/10 VOLCANIC (687x on near-term, 420x on LEAP!)

- YTD Performance: Stellar year with strong AI momentum

- The Big Question: Will Armv9 data center push drive 50% market share by year-end?

- Catalyst: Nov 5 Q2 fiscal earnings + data center market share progress + Armv9 royalty ramp

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 2 DAYS TO EXPIRY (October 10)

- FIG - $5.6M Urgent Position - What catalyst is expected THIS WEEK?

⚡ 23 DAYS TO EXPIRY (October 31)

- CVNA - $65M Synthetic Short - Profit-taking structure expires 2 days AFTER Oct 29 earnings

- ARM - $1.8M Near-Term - Aggressive $180 target in 23 days

📊 Q3/Q4 EARNINGS TSUNAMI (October-November)

- FI - October 28 - Fintech testing stablecoin narrative

- CVNA - October 29 - Automotive turnaround validation

- EQX - October 29 - AI data center "Build Bolder" strategy update

- LYFT - November 5 - Autonomous vehicle partnerships progress

- ARM - November 5 - Q2 fiscal data center momentum

- IMTX - November 17 - Biotech pipeline update

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Profit-Taking After Massive Runs (45% of Today's Flow - $65M+)

The Exit Message: Lock in gains from 2025 winners before volatility

- → CVNA's $65M synthetic short after 97% YTD run

- → Why exit at $300 with earnings 2 days before expiration?

🚀 Future of Transportation Bets ($30.5M Autonomous + Bitcoin)

Long-Term Transformation Plays:

- → LYFT: $5.7M betting on Waymo/BENTELER autonomous revolution

- → IBIT: $22M Bitcoin ETF spread for Fed pivot tailwinds

🏗️ AI Infrastructure Expansion ($7M Data Center + Chip Plays)

Patient Capital Finding AI Winners:

- → EQX: $4.4M deep ITM ahead of nuclear power announcement

- → ARM: $2.9M dual-timeframe chip architecture dominance

🎨 Platform Transformation Uncertainty ($13.3M Mixed Signals)

Markets Wrestling with Valuations:

- → FIG: $7.5M urgent 2-day bet on AI design features

- → STUB: $3.8M conflicting bets on post-IPO direction

- → FI: $2M stablecoin launch catalyst positioning

💊 Biotech Catalyst Positioning ($4.4M IMTX)

Phase 3 Clinical Milestone Bets:

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with high volatility

- FIG October calls - 2-day lottery ticket on unknown catalyst (ONLY if you can lose it all)

- ARM October $180 calls - 23-day aggressive AI chip breakout bet

- IMTX biotech spread - Phase 3 clinical trial binary outcome

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

- IBIT bull call spread - Follow $22M whale through Fed pivot to June 2026

- LYFT November calls - Autonomous vehicle catalyst timeline through Q3 earnings

- EQX shares or spreads - AI data center infrastructure with Oct 29 earnings catalyst

💰 Premium Collection (Income Strategy)

Follow institutional profit-takers and range-bound plays

- CVNA covered calls at $380-400 - If you own from lower, follow smart money exit

- STUB cash-secured puts at $15 - Collect premium 22% below current with institutional support

- FI call selling - Sell $165-170 strikes against potential stablecoin hype

🛡️ Conservative Entry Level (Learning Mode)

Lower risk approaches with defined outcomes

- LYFT bull put spreads - Gamma support at $20-21 with AV transformation thesis

- IBIT mini spread - Smaller version ($75/$80) vs institutional $85/$90

- ARM shares - Ride AI chip architecture without options complexity

- Share positions: Buy quality names (ARM, LYFT, IBIT) on dips for long-term exposure

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- CVNA: Earnings disappoint on unit sales or margins - stock breaks $300 support

- IBIT: Bitcoin correction or Fed pauses rate cuts - crypto winter returns

- FIG: AI products fail to drive revenue - down 53% becomes down 70%

- LYFT: AV partnership delays or Uber dominance - back to $16-18 range

- ARM: China revenue concerns or RISC-V competition accelerates

- IMTX: Phase 3 interim data disappoints - biotech binary wipeout

😰 If You're Following the Bears/Hedgers

- CVNA: Blowout earnings send stock to $400+ - synthetic short misses upside

- STUB: Post-IPO pop above $25 on strong Q3 - put sellers lose opportunity

- FI: FIUSD stablecoin hype drives immediate rally - sold calls cap gains

💣 This Week's Catalysts & Key Dates

📊 This Week:

- October 10: FIG $5.6M calls expire - THE MYSTERY CATALYST

- October 17: Multiple positions expire including STUB and EQX

🗓️ October Earnings Gauntlet:

- October 28: FI Q3 results (stablecoin narrative test)

- October 29: CVNA Q3 (turnaround validation) + EQX Q3 (Build Bolder update)

- October 31: CVNA synthetic short expires + ARM $1.8M aggressive calls expire

📈 November Setup:

- November 5: LYFT Q3 (AV progress) + ARM Q2 fiscal (data center share)

- November 6-7: Fed rate decision (critical for IBIT Bitcoin thesis)

- November 17: IMTX Q3 earnings and business update

🚀 Early 2026 Binary Events:

- January 2026: IMTX SUPRAME Phase 3 interim analysis

- March 2026: LYFT calls expire testing autonomous transformation

- June 2026: IBIT spread expires + ARM LEAP tests long-term AI thesis

🎯 The Bottom Line: Follow the $100M Rotation Signal

This is one of the clearest institutional signals we've seen in Q4 2025. $100+ million flowing in distinct patterns: profit-taking from 2025 winners (CVNA's $65M exit after 97% run), strategic positioning for future trends (Bitcoin $22M, autonomous vehicles $5.7M), and urgent catalyst plays (FIG's mysterious $7.5M with 2-day expiry). Smart money is clearly repositioning portfolios for earnings season and 2026 catalysts.

The biggest questions:

- Why is CVNA exiting $65M at $300 ahead of Oct 29 earnings?

- What does FIG know about AI design platform adoption with 2-day urgency?

- Will Bitcoin's $120K+ momentum carry IBIT to $150K+ targets?

- Can LYFT transform from ride-sharing to autonomous platform?

Your move: This rotation from profit-taking to future positioning demands attention. Follow the smart money themes (autonomous vehicles, Bitcoin, AI infrastructure) or position contrarian on the profit-taking names - but don't ignore $100 million in institutional conviction.

Remember: This is people's real money. While these trades show institutional conviction, they also represent sophisticated strategies that may be part of larger hedged positions not visible to retail. Size appropriately, manage risk carefully, and never bet more than you can afford to lose.

🔗 Get Complete Analysis on Every Trade

💰 Profit-Taking & Exit Strategies:

₿ Crypto & Future of Money:

- IBIT $22M Bitcoin ETF Spread - Positioning for $150K+

- FI $2M Stablecoin Launch Play - $300B Payment Opportunity

🚗 Transportation Transformation:

🤖 AI Infrastructure Expansion:

- ARM $2.9M Dual Chip Bets - Data Center Dominance

- EQX $4.4M Data Center Giant - Nuclear Power Deals

- FIG $7.5M Urgent 2-Day Bet - AI Design Platform Mystery

💊 Biotech Catalysts:

🎫 Post-IPO Confusion:

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (Oct 10 & Oct 17 Expiry)

- FIG $5.6M deep ITM calls - THE MYSTERY (Oct 10)

- STUB $2.8M bullish $20 calls (Nov 21 but near-term sentiment)

- EQX $4.4M deep ITM - earnings play (Oct 17)

📆 Monthly (Oct 31 & Nov 21)

- CVNA $65M synthetic short ahead of earnings (Oct 31)

- ARM $1.8M aggressive $180 calls (Oct 31)

- FIG secondary positions and puts (Oct 17)

🗓️ Quarterly (Dec 2025 - Jan 2026)

- FI $2M spread through stablecoin launch (Dec 19)

- IMTX $4.4M biotech spread awaiting interim data (Jan 16)

🚀 LEAPS (Mar-Jun 2026)

- LYFT $5.7M autonomous transformation (March 2026)

- IBIT $22M Bitcoin ETF spread (June 2026)

- ARM $1.1M long-term chip architecture bet (June 2026)

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position - THIS IS GAMBLING MONEY

- 2-day mystery: FIG October calls (ONLY if you accept 100% loss risk)

- 23-day moonshot: ARM $180 calls (aggressive AI chip breakout)

- Biotech binary: IMTX spread (Phase 3 data lottery)

⚠️ WARNING: These are binary bets. You WILL lose 100% if you're wrong. Only bet what you can light on fire.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary: IBIT bull call spread (Bitcoin $120K momentum to June 2026)

- Secondary: LYFT March calls (autonomous vehicle transformation timeline)

- Earnings play: EQX shares or spreads (Oct 29 catalyst with "Build Bolder" update)

💡 Strategy: Define your exit before entry. Take profits at 50-100% gains. Use gamma support levels as stops.

💰 Premium Collector (Income Focus)

Strategy: Sell into strength, follow institutional exits

- Profit-taking theme: CVNA covered calls $380-400 if you own from lower

- Post-IPO support: STUB cash-secured puts at $15 (22% below current, institutional backing)

- Range-bound: FI call selling $165-170 (collect premium in consolidation)

💡 Focus: High IV environments (biotech, post-IPO, pre-earnings) offer best premium. Roll positions to extend time.

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on understanding before sizing up

- Paper trade first: Practice all strategies with fake money - learn the mechanics

- Share positions: ARM, LYFT, or IBIT shares for quality exposure without complexity

- Simple spreads: IBIT mini version $75/$80 instead of institutional $85/$90

- Study the patterns: Why did CVNA exit? What's the FIG urgency? Learn institutional behavior

💡 Education priority: Watch how these trades resolve. Track the catalysts. Build pattern recognition before risking real capital.

⚠️ Risk Management for ALL Types

Essential Rules:

- Never risk more than allocated % - YOLO (1-2%), Swing (3-5%), Premium (portfolio-based), Entry (< 1%)

- Set stop losses at 30-50% of option premium paid or gamma support breakdown

- Take profits fast - 50-100% gains on options, don't hold for 500% home runs

- Watch time decay - October positions losing value rapidly as expiration approaches

- Respect earnings - Binary events can move stocks 20%+ overnight either direction

- Know your catalyst dates - FIG expires Oct 10, earnings gauntlet Oct 28-Nov 17

Institutional Warning: Today's unusual flow shows smart money is EXITING (CVNA $65M), not just entering. When institutions take profits after huge runs, retail should pay attention. Don't blindly follow into trades - understand the thesis and your risk tolerance.

Entry Level Critical: This newsletter covers 10 complex options strategies representing $100M in institutional capital. If you don't fully understand synthetic shorts, bull call spreads, and gamma dynamics, START WITH SHARES or PAPER TRADING. Options can expire worthless and you lose 100% of premium paid.

Remember: These institutional trades often have complex hedges we can't see. CVNA's $65M synthetic short suggests coordinated profit-taking ahead of earnings volatility. FIG's $7.5M urgent bet might be portfolio repositioning we don't understand. Always maintain proper position sizing and never risk more than you can afford to lose completely.

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management and never risk more than you can afford to lose. This analysis is for educational purposes only and not financial advice.

This is people's money we're discussing. Treat it with respect. Don't YOLO your rent payment. Don't chase trades you don't understand. And remember: the house (market makers and institutions) usually wins. Your edge is patience, discipline, and proper risk management.