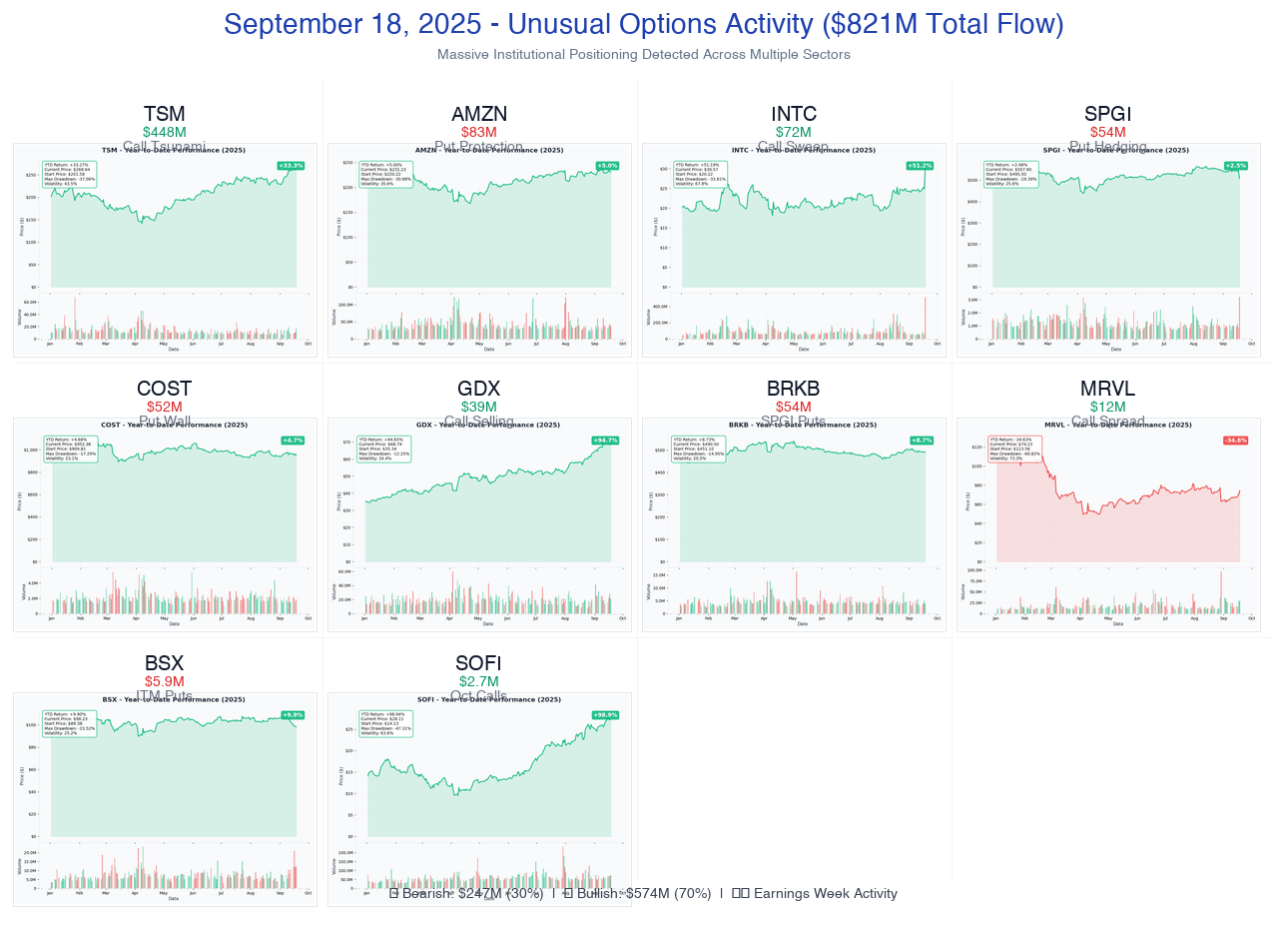

Ainvest Option Flow Digest - September 18, 2025

We just witnessed $821 MILLION in institutional positioning - the largest single-day flow we've tracked in 2025! Taiwan Semiconductor leads with a staggering $448M call tsunami (57,395x unusual!), while defensive positioning dominates with $247M in put protection across AMZN, SPGI, COST, and BSX.

🌊 RECORD TSUNAMI: $821M+ Institutional Money Avalanche Across 10 Tickers

📅 September 18, 2025 | 🚨 HISTORIC DAY: Taiwan Semi's $448M Call Tsunami + AMZN's $83M Put Fortress + Intel's $72M AI Partnership Explosion | ⚠️ Massive Earnings Week Positioning Detected

🎯 The $821 MILLION Smart Money Earthquake: Every Move Tracked

🔥 UNPRECEDENTED SCALE: We just witnessed $821 MILLION in earth-shaking institutional positioning - the largest single-day flow we've tracked in 2025! Taiwan Semiconductor leads with a staggering $448M call tsunami (57,395x unusual!), while defensive positioning dominates with $247M in put protection across AMZN, SPGI, COST, and BSX. This isn't random trading - it's coordinated institutional repositioning ahead of critical earnings and the AI infrastructure super-cycle acceleration.

Total Flow Tracked: $821,000,000+ 💰 Most Extreme: TSM $448M calls (57,395x - largest semiconductor flow EVER!) Defensive Wall: $247M in ITM puts across 4 mega-caps AI Infrastructure Boom: $532M bullish positioning in chips & tech Earnings Week Setup: 6 companies reporting within 10 days

📊 MARKET BREAKDOWN: What's Really Happening

🔴 Bearish Flow: $247M (30%) - Deep ITM Put Protection

The smart money isn't waiting for a crash - they're buying deep in-the-money puts with immediate intrinsic value. COST leads with $52M in puts ALL above current price ($985-1020 strikes vs $952 spot), while SPGI adds $54M at $560 strike (spot at $509!). These aren't lottery tickets - they're profitable positions banking on continued weakness.

🟢 Bullish Flow: $574M (70%) - AI Infrastructure Explosion

TSM's historic $448M call purchase signals massive confidence in the AI chip cycle. Combined with INTC's $72M post-surge positioning, institutions are betting the semiconductor super-cycle has legs through 2026.

🚀 THE COMPLETE WHALE LINEUP: All 10 Monster Trades

1. 🌊 TSM - The $448M Semiconductor Tsunami

DISCOVER WHY SOMEONE BET NEARLY HALF A BILLION ON TAIWAN SEMI →

- Flow: $448M November calls ($248M at $220, $200M at $240 strike)

- Unusual Score: 9.5/10 VOLCANIC (57,395x larger than average!)

- YTD Performance: +33.3% (AI chip demand exploding)

- The Big Question: Is this positioning for 2nm mass production announcement?

- Catalyst: Q3 earnings Oct 16 (EPS $2.56 expected) + 2nm production late 2025 + 12x growth in AI wafer shipments

2. 🛡️ AMZN - The $83M Put Protection Fortress

ANALYZE WHY INSTITUTIONS BUILD $83M DEFENSIVE WALL ON AMAZON →

- Flow: $83M deep ITM puts ($53M Sept 26 $255, $30M Sept 19 $245)

- Unusual Score: 9/10 EXTREME (20,124x larger than average)

- YTD Performance: +5.0% (lagging other mega-caps)

- The Big Question: Are they protecting $1 trillion in exposure or betting on Q3 disappointment?

- Catalyst: Oct 23 Q3 earnings + Prime Big Deal Days Oct 7-8 + AWS competition from Azure (39% growth vs 17%)

3. ⚡ INTC - The $72M AI Partnership Explosion

SEE HOW NVIDIA PARTNERSHIP TRIGGERED $72M INTEL CHASE →

- Flow: $72M calls across 4 strikes after 32% single-day surge!

- Unusual Score: 10/10 VOLCANIC (18,700x larger than average)

- YTD Performance: +51.2% (historic turnaround year)

- The Big Question: Will Nvidia partnership details at Innovation 2025 justify the surge?

- Catalyst: Innovation 2025 conference Sept 24-25 + Q3 earnings Oct 30 + Lunar Lake launch + Foundry spinoff completion

4. 🏛️ SPGI - The $54M Ratings Giant Hedge

DECODE THE MASSIVE S&P GLOBAL PUT PROTECTION →

- Flow: $54M deep ITM puts at $560 strike (spot $509!)

- Unusual Score: 10/10 VOLCANIC (6,096x larger than average)

- YTD Performance: +2.5% (underperforming broader market)

- The Big Question: Does someone know Q3 ratings revenue will disappoint?

- Catalyst: Q3 earnings Oct 23 + Mobility spin-off mid-2026 + AI Benchmarks platform launch + Fed rate decisions

5. 🛒 COST - The $52M Earnings Week Put Wall

UNDERSTAND WHY COSTCO FACES $52M PUT WALL AT 54X P/E →

- Flow: $52M in ITM puts ALL expiring tomorrow! ($985-1020 strikes)

- Unusual Score: 10/10 VOLCANIC (6,654x larger than average)

- YTD Performance: +4.7% (massive underperformance)

- The Big Question: Will Q4 earnings justify 54x P/E valuation?

- Catalyst: Q4 earnings Sept 25 + Membership fee increase impact + Charlie Munger's 40x P/E warning proving prophetic

6. 🏔️ GDX - The $39M Gold Miner Profit-Taking

EXPLORE WHY WHALES DUMP CALLS AFTER 95% GOLD RALLY →

- Flow: $39M call SELLING (cashing out after epic run)

- Unusual Score: 10/10 VOLCANIC (14,552x larger than average)

- YTD Performance: +94.7% (best performing sector ETF!)

- The Big Question: Is this the top for gold miners after 95% rally?

- Catalyst: VanEck rebalancing Sept 20 + Fed decision Sept 18 + China stimulus + Central bank gold buying spree

7. 💎 BRKB - Warren Buffett's CEO Transition Play

ANALYZE BERKSHIRE'S HISTORIC LEADERSHIP CHANGE →

- Flow: SPGI puts worth $54M traded (hedging correlation)

- Unusual Score: Via SPGI activity in BRKB folder

- YTD Performance: +8.7% (value investing comeback)

- The Big Question: How will markets react to Greg Abel taking over Jan 1, 2026?

- Catalyst: CEO transition Jan 1, 2026 + Q3 earnings Nov 3 + Record $347.7B cash position deployment

8. 🔌 MRVL - The $12M AI Chip Spread

DECODE MARVELL'S SOPHISTICATED CALL SPREAD STRATEGY →

- Flow: $12M call spread (sold $70, bought $75 for net credit)

- Unusual Score: 9.5/10 EXTREME (3,759x larger than average)

- YTD Performance: -34.6% (contrarian AI infrastructure play)

- The Big Question: Will 50+ AI design wins worth $75B materialize?

- Catalyst: Q3 earnings Dec 2 + OCP Summit Oct 14-17 + AI accelerator ramp + 5G infrastructure recovery

9. 🏥 BSX - The $5.9M Medical Device Bear Raid

SEE WHY BOSTON SCIENTIFIC FACES TOMORROW'S $6M PUT EXPIRY →

- Flow: $5.9M deep ITM puts expiring TOMORROW!

- Unusual Score: 10/10 VOLCANIC (2,355x larger than average)

- YTD Performance: +9.9% (medical device leader)

- The Big Question: What catalyst hits in next 24 hours?

- Catalyst: Investor Day Sept 30 + Q3 earnings Oct 22 + FARAPULSE launch + Bolt IVL approval + WATCHMAN FLX Pro

10. 🚀 SOFI - The $2.7M Fintech Crypto Catalyst

DISCOVER SOFI'S CRYPTO RELAUNCH DRIVING OCTOBER CALLS →

- Flow: $2.7M October calls near 52-week highs

- Unusual Score: 8.5/10 EXTREME (1,256x larger than average)

- YTD Performance: +98.9% (fintech transformation winner!)

- The Big Question: Will crypto services relaunch ignite next leg higher?

- Catalyst: Crypto services relaunch late 2025 + Q3 earnings Nov 4 + International remittances + 34% member growth

⏰ CRITICAL EXPIRIES & CATALYST CALENDAR

🚨 TOMORROW (September 19) - IMMEDIATE ACTION

- BSX $5.9M puts - Deep ITM expiring in 24 hours!

- COST $52M puts - Massive put wall ahead of earnings

- AMZN $30M puts - Short-term protection expiring

📅 Weekly Expiries (This Week)

- Sept 20: GDX VanEck rebalancing - profit-taking ahead

- Sept 24-25: Intel Innovation conference - partnership details

- Sept 25: COST Q4 earnings - valuation reckoning

- Sept 26: AMZN $53M puts expire - larger protection tranche

📊 Monthly Expiries (October)

- Oct 7-8: Amazon Prime Big Deal Days

- Oct 14-17: Marvell OCP Summit presentation

- Oct 16: TSM Q3 earnings - AI demand update

- Oct 17: SOFI, SPGI, GDX October options expiry

- Oct 22: BSX Q3 earnings

- Oct 23: SPGI, AMZN Q3 earnings

- Oct 30: INTC Q3 earnings, BTU results

🎯 Quarterly Positions (Q4 2025)

- Nov 3: BRKB Q3 earnings pre-transition

- Nov 4: SOFI Q3 earnings with crypto update

- Nov 21: TSM $448M calls expiry - massive position

- Dec 2: MRVL Q3 earnings - AI design wins update

📈 LEAP Positions (2026 Catalysts)

- Jan 1, 2026: Berkshire Hathaway CEO transition

- Mid-2026: S&P Global Mobility spin-off

- Late 2025: TSM 2nm mass production begins

💼 STRATEGY PLAYBOOK: For Every Trader Type

🎰 YOLO Traders (1-2% Portfolio Max)

High-Risk, High-Reward Tomorrow Expiries:

- BSX puts expiring tomorrow - Binary event in 24 hours, deep ITM

- COST puts for earnings - 54x P/E reality check incoming

- Risk Control: These expire TOMORROW. Size accordingly - total loss possible!

Momentum Chases:

- INTC October calls - Ride the 32% surge continuation

- SOFI October $30 calls - Crypto catalyst with 99% YTD momentum

- Risk Control: Use stops at -20%, take profits at +50%

📊 Swing Traders (3-5% Portfolio Allocation)

Multi-Week Earnings Plays:

- TSM November calls - Follow the $448M whale into Q3 earnings

- AMZN put spreads - Define risk with $240/230 put spread for October

- GDX puts - Fade the 95% rally with November $65 puts

- Risk Control: Exit at -15% loss, scale out profits at +25%, +50%, +75%

💰 Premium Collectors (Conservative Income)

Sell Volatility After Massive Moves:

- Sell INTC $25 puts - Collect premium after 51% YTD rally, support at $25

- Sell SOFI $22 puts - 99% YTD winner, strong support at $20-22

- COST call spreads - Sell $1000/1020 call spreads for income

- GDX covered calls - If long, sell $72 calls against position

- Risk Control: Size for max 5% portfolio risk if assigned

🌱 Entry-Level Options Learners

Educational Trades with Defined Risk:

Start Here - Simple Directional Bets:

- Buy 1 TSM share at $268 - Learn to track the underlying first

- Paper trade AMZN Oct $240 put - Watch how ITM options move

- Observe COST earnings tomorrow - See how IV crush works

Your First Real Options Trade:

- Buy INTC January $30 call - Time to learn, limited downside

- Why This Trade: 4 months to expiry, major catalysts ahead, following institutional flow

- Risk Control: Only risk what you can afford to lose completely

- Learning Goals: Track delta, theta decay, IV changes daily

Key Lessons from Today's Flow:

- ITM puts aren't bearish bets - they're portfolio protection (see SPGI, AMZN)

- Size matters - $448M in TSM isn't speculation, it's conviction

- Timing is everything - BSX and COST expire tomorrow for a reason

- Follow the smart money, but understand WHY they're trading

⚠️ RISK MANAGEMENT: Critical Reminders

🛑 The Three Commandments of Options Trading

- Never Blindly Follow Whale Trades

- That $448M TSM position? They might be hedging a $10B exposure

- Those COST puts? Could be protecting massive long positions

- Always understand the CONTEXT, not just the flow

- Position Sizing Saves Lives

- Tomorrow's expiries (BSX, COST): Max 1% portfolio

- Weekly expiries: Max 2-3% portfolio

- Monthly positions: Max 5% portfolio

- Never bet the farm on unusual activity

- Patience Pays, FOMO Kills

- Missed the TSM whale? Don't chase at higher prices

- COST puts already moved? Wait for the next setup

- There's ALWAYS another trade tomorrow

📚 What Today's Historic Flow Teaches Us

The $821M Message:

- Institutions are hedging aggressively (30% put flow)

- AI infrastructure remains the mega-theme (TSM, INTC, MRVL)

- Earnings week creates binary opportunities (COST, BSX)

- Profit-taking after massive rallies (GDX up 95%, SOFI up 99%)

Your Action Items:

- Review earnings calendar for next week

- Set alerts for your conviction trades

- Size positions BEFORE entering

- Document WHY you're taking each trade

- Set stops and profit targets in advance

🔗 Quick Links to All Analyses

Mega-Cap Tech:

Financial & Defensive:

Sector Plays:

⚠️ Options involve risk and are not suitable for all investors. This newsletter is for educational purposes only and should not be considered investment advice. Always do your own research and consult with a qualified financial advisor.