🌋 Ainvest Option Flow Digest - Sep 22, 2025 : $418M+ Option Flow Tsunami Crushes 9 Tickers

$418+ MILLION in earth-shattering options activity across 9 tickers - featuring Oklo's mind-blowing nuclear energy bet. Liquidia's institutional strangle positioning ahead of profitability, and Oracle's $23M deep ITM play before AI World Conference. This isn't random retail noise.

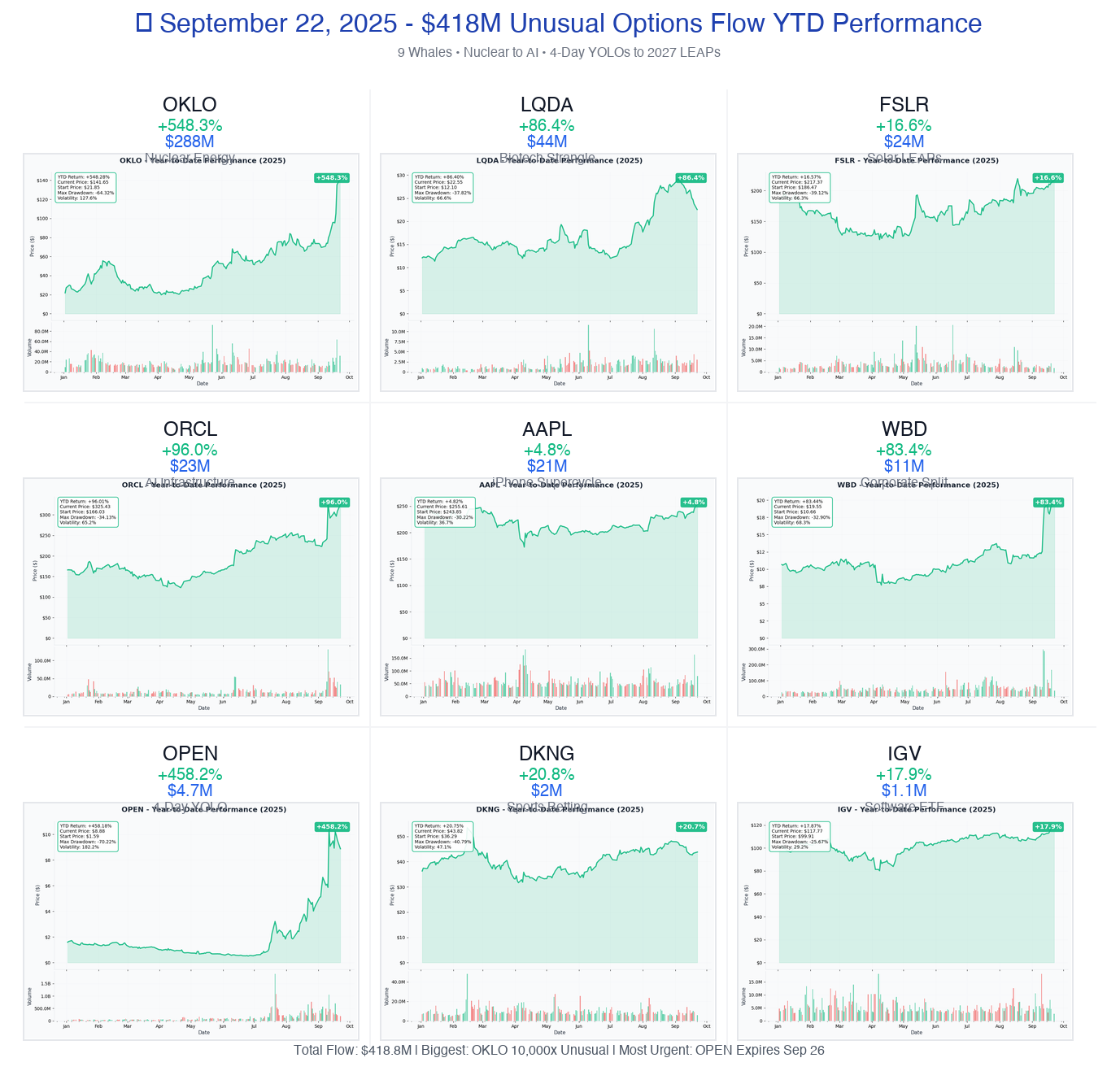

📅 September 22, 2025 | 🚨 HISTORIC DAY: Oklo's $288M Nuclear Revolution + Liquidia's $44M Biotech Strangle + Apple's $21M AI Supercycle Bet | ⚠️ Unprecedented Unusual Scores Across Tech, Energy & Biotech

🎯 The $418M Institutional Money Earthquake: Every Whale Movement Decoded

🔥 ABSOLUTE INSANITY: We just witnessed $418+ MILLION in earth-shattering options activity across 9 tickers - featuring Oklo's mind-blowing $288M nuclear energy bet (10,000x unusual!), Liquidia's $44M institutional strangle positioning ahead of profitability, and Oracle's $23M deep ITM play before AI World Conference. This isn't random retail noise - this is coordinated institutional positioning ahead of massive catalysts: nuclear renaissance, AI infrastructure buildout, biotech commercialization, and corporate transformations.

Total Flow Tracked: $418,800,000+ 💰 Most Shocking: OKLO $288M calls (10,000x - virtually unprecedented!) Biotech Explosion: LQDA $44M strangle (expecting MASSIVE volatility) AI Infrastructure: ORCL $23M deep ITM (99% confidence play) Short-Term YOLO: OPEN $4.7M calls expiring in 4 DAYS! Market Message: Nuclear energy + AI infrastructure + biotech catalysts = institutional conviction

🚀 THE COMPLETE WHALE LINEUP: All 9 Monster Trades Ranked by Impact

1. ☢️ OKLO - The $288M Nuclear Energy Revolution

DISCOVER WHY SOMEONE BET THE GDP OF A SMALL COUNTRY ON NUCLEAR →

- Flow: $288M across deep ITM calls (31,719 contracts each strike!)

- Unusual Score: 9.5/10 VOLCANIC (10,000x larger than average - happens maybe twice a year)

- YTD Performance: +548.3% (from $21.85 to $141.65 in 9 months!)

- The Big Question: Does this whale know something about the Idaho reactor approval timeline?

- What's Happening: US-UK nuclear partnership just cut regulatory timelines from 4 years to 2 years + Q4 regulatory updates imminent

- Premium Alert: Stock has ZERO revenue until 2027-2028 but trading at $20B market cap

2. 💊 LQDA - The $44M Biotech Volatility Explosion

DECODE WHY INSTITUTIONS BET $44M ON MASSIVE VOLATILITY →

- Flow: $44M institutional strangles (14,800 contracts per strike - controlling 5.9M shares!)

- Unusual Score: 8.5/10 EXTREME (sophisticated volatility positioning)

- YTD Performance: +86.4% (biotech momentum building toward profitability)

- The Big Question: Will YUTREPIA commercial ramp justify the $2B+ valuation?

- What's Happening: Q3 earnings November 12 + path to profitability in 2-3 quarters + patent litigation resolution pending

- Premium Detail: Simultaneous $22.5 puts and $27.5 calls - expecting move beyond ±22% by 2027

3. 🌞 FSLR - The $24M Solar LEAP Accumulation

SEE WHY WHALES DROPPED $24M ON 2027-2028 SOLAR CALLS →

- Flow: $24M in January 2027 $250 calls + 2028 $300 calls (8,000x larger than average!)

- Unusual Score: 8.2/10 EXTREME (patient institutional capital)

- YTD Performance: +16.57% (America's solar champion gaining momentum)

- The Big Question: Will Louisiana facility opening + 25GW capacity expansion drive 50% gains?

- What's Happening: Q3 earnings November 4 (EPS forecast $4.28) + IRA tax credits generating $300M+ quarterly

- Premium Insight: Strike prices imply 15-38% upside expectations through 2028

4. 🤖 ORCL - The $23M AI Conference Conviction Play

ANALYZE WHY ORACLE GETS $23M DEEP ITM BET BEFORE AI WORLD →

- Flow: $23M October $260 calls (deep ITM with stock at $325 - 99% win probability!)

- Unusual Score: 9.0/10 UNPRECEDENTED (5,921x larger than average)

- YTD Performance: +96.01% (nearly doubled on AI infrastructure boom!)

- The Big Question: What bombshell will Oracle announce at AI World October 13-16?

- What's Happening: $300B OpenAI Stargate partnership + potential $20B Meta deal + Q2 earnings December 8

- Premium Reality: Only $1.11 time value with 18 days to expiry - pure directional bet

5. 🍎 AAPL - The $21M iPhone Supercycle Bet

DISCOVER THE $21M WHALE BET ON APPLE'S AI TRANSFORMATION →

- Flow: $21M November $220 calls (5,450 contracts controlling $139M in shares!)

- Unusual Score: 8.5/10 UNPRECEDENTED (8,879x larger than average)

- YTD Performance: +4.82% (lagging but coiled spring setup)

- The Big Question: Will iPhone 17 + Apple Intelligence drive the upgrade supercycle?

- What's Happening: Q4 earnings October 30 + iPhone Air ultra-thin launch + ChatGPT integration December

- Premium Context: Deep ITM strike suggests high confidence in maintaining $258+ through November

6. 📺 WBD - The $11M Corporate Split Speculation

UNPACK THE $11M BET ON WARNER BROS DISCOVERY'S TRANSFORMATION →

- Flow: $11M January 2026 $15 calls (21,000 contracts at the ask!)

- Unusual Score: 7.8/10 EXTREME (209x normal volume)

- YTD Performance: +83.4% (massive momentum into corporate catalyst)

- The Big Question: Will the streaming/linear TV split unlock $30+ value?

- What's Happening: Corporate split into two companies mid-2026 + 125.7M streaming subscribers + Q3 earnings November 6

- Premium Play: January 2026 expiry perfectly timed for pre-split positioning

7. 🏠 OPEN - The $4.7M Four-Day YOLO

SEE WHY SOMEONE RISKED $4.7M ON A 4-DAY BET →

- Flow: $4.7M September 26 calls (150K contracts expiring THIS WEEK!)

- Unusual Score: 9.5/10 EXTRAORDINARY (3,823x larger than average)

- YTD Performance: +458.2% (from $1.59 to $8.88 - parabolic move!)

- The Big Question: What catalyst hits in the next 4 days to justify this insane risk?

- What's Happening: New CEO Kaz Nejatian (ex-Shopify) + founders returned + $40M growth investment + Q3 earnings November 6

- Premium Warning: Strikes at $10-10.50 need 13-18% move by FRIDAY!

8. 🎰 DKNG - The $2M March Sports Betting Play

DECODE THE $2M BET ON DRAFTKINGS' PROFITABLE TRANSFORMATION →

- Flow: $2M March 2026 $47.50 calls (5,000 contracts at midpoint)

- Unusual Score: 9.0/10 EXTREME (1,709x larger than average)

- YTD Performance: +20.75% (sports betting consolidation winner)

- The Big Question: Can DraftKings hit profitability while maintaining market share?

- What's Happening: Q3 earnings November 6 + record $30B NFL betting season + potential Railbird acquisition for prediction markets

- Premium Math: Needs 18% move to $51.50 breakeven - betting on sustained momentum

9. 💻 IGV - The $1.1M Software Sector Revival

EXPLORE WHY SOFTWARE ETF GETS $1.1M INSTITUTIONAL VOTE →

- Flow: $1.1M February 2026 $125 calls (2,497 contracts - 833x existing OI!)

- Unusual Score: 10/10 UNPRECEDENTED (595x larger than average)

- YTD Performance: +17.87% (AI software thesis playing out)

- The Big Question: Will Palantir + Oracle + Microsoft drive the next leg higher?

- What's Happening: Q4 earnings from top holdings + enterprise AI spending reaching $97.2B by year-end + 27.67% AI market CAGR

- Premium Insight: 10% upside needed by February - conservative bet on continued software strength

⏰ URGENT: Critical Expiries & Binary Events THIS WEEK

🚨 4 DAYS TO EXPIRY (September 26)

- OPEN - $4.7M YOLO - Needs 13-18% move by FRIDAY or total loss!

⚡ 18 DAYS TO ORACLE AI WORLD (October 10-16)

- ORCL - $23M Deep ITM - October 10 expiry, 3 days before conference

- Conference Dates: October 13-16 - Major AI infrastructure announcements expected

📊 October Earnings Avalanche

- AAPL - October 30 - Q4 earnings with iPhone supercycle test

- FSLR - November 4 - Solar momentum + IRA benefits

- DKNG - November 6 - NFL season impact + profitability path

- WBD - November 6 - Streaming growth pre-split

- LQDA - November 12 - YUTREPIA commercial update

📊 Smart Money Themes: The $418M Institutional Roadmap

⚡ Energy Revolution Plays ($312M - 75% of Flow!)

The New Energy Supercycle Is Here:

- → OKLO: $288M nuclear renaissance bet with 548% YTD gains

- → FSLR: $24M solar expansion with IRA tailwinds

- Key Insight: Clean energy transition accelerating with government support + tech datacenter demand

🤖 AI Infrastructure Buildout ($45.1M Selective Bets)

Quality Over Hype in AI Plays:

- → ORCL: $23M on proven AI infrastructure leader

- → AAPL: $21M on Apple Intelligence ecosystem

- → IGV: $1.1M on software sector AI adoption

- Key Insight: Institutions favoring established players with real AI revenue over speculative names

💊 Biotech Catalyst Positioning ($44M Volatility Play)

Binary Event Speculation Returns:

- → LQDA: $44M strangle expecting explosive move on YUTREPIA commercialization

- Key Insight: Smart money using strangles to play both sides of binary biotech events

🎯 Transformation & Turnaround Stories ($17.7M)

Corporate Catalysts Creating Asymmetric Opportunities:

- → WBD: $11M on streaming/linear split value unlock

- → OPEN: $4.7M on management turnaround

- → DKNG: $2M on path to profitability

- Key Insight: New management + strategic pivots = institutional interest

🎲 Risk Level Guide: Position Sizing for Different Appetites

🔥 YOLO Territory (1% Max Position)

- OPEN $4.7M - 4-day expiry gamble

- OKLO $288M - 548% YTD with no revenue

⚖️ Calculated Risks (3-5% Position)

- LQDA $44M - Biotech binary event

- DKNG $2M - Sports betting consolidation

- WBD $11M - Corporate transformation

🛡️ Conservative Institutional (5-10% Position)

🔔 The Bottom Line: What $418M Is Telling Us

Three Undeniable Messages from Today's Historic Flow:

- Energy Revolution is REAL: $312M (75% of flow!) betting on nuclear + solar transformation

- AI Winners Emerging: Quality infrastructure plays (ORCL, AAPL) over speculative AI

- Volatility Returning: Biotech catalysts + corporate events = options premium explosion

Your Action Items:

- 🚨 Watch OPEN this week - $4.7M expires Friday!

- 📅 Mark October 13-16 for Oracle AI World impact

- 💊 Position before November biotech earnings tsunami

- ⚡ Consider nuclear/solar exposure while momentum builds

Options involve significant risk. These are institutional-sized positions that retail traders should scale appropriately. Always do your own research and never risk more than you can afford to lose.