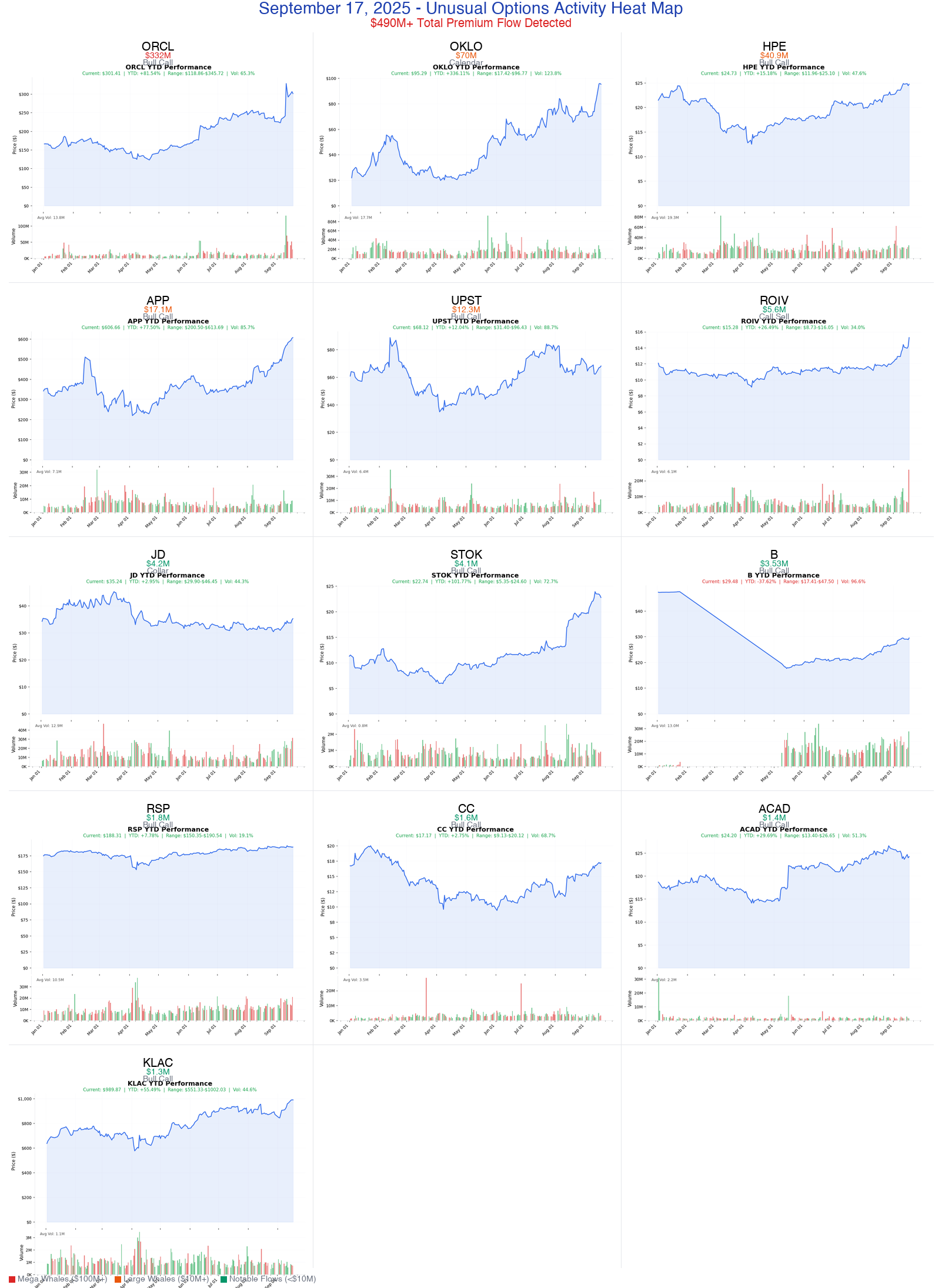

Ainvest Option Flow Digest - Sep 17, 2025 : $490M+ Option Flow Tsunami Hits 13 Tickers

🔥 INSANE DAY ALERT: We just witnessed $490+ MILLION in earth-shaking options activity across 13 tickers - featuring Oracle's MASSIVE $332M AI infrastructure bet (their biggest trade of 2025!), Oklo's nuclear-powered $70M calendar spread as AI power demands explode, and AppLovin's $17.1M ...

📅 September 17, 2025 | 🚨 HISTORIC DAY: Oracle's Massive $332M AI Infrastructure BET + Nuclear Titan's $70M Calendar Spread + AppLovin's $17.1M Ad Tech Revolution | ⚠️ Record-Breaking Premiums Across All Sectors

🎯 The $490M Institutional Money Earthquake: Track Every Movement

🔥 INSANE DAY ALERT: We just witnessed $490+ MILLION in earth-shaking options activity across 13 tickers - featuring Oracle's MASSIVE $332M AI infrastructure bet (their biggest trade of 2025!), Oklo's nuclear-powered $70M calendar spread as AI power demands explode, and AppLovin's $17.1M ad tech revolution positioning. This isn't just institutional money moving - this is coordinated smart money rotation INTO AI infrastructure, nuclear power, biotech breakouts, and defensive semiconductor plays ahead of massive catalysts.

Total Flow Tracked: $490,000,000+ 💰 Most Shocking: ORCL $332M AI infrastructure bomb (largest 2025 trade!) Nuclear Revolution: OKLO $70M calendar spread as AI power demands soar Ad Tech Tsunami: APP $17.1M bullish positioning ahead of October catalyst Biotech Breakout: STOK $4.1M calls ahead of Phase 3 readout Semiconductor Shield: KLAC $1.3M AI chip equipment confidence play

🚀 THE COMPLETE WHALE LINEUP: All 13 Monster Trades

1. ⚡ ORCL - The $332M AI Infrastructure Nuclear Bomb

DISCOVER WHY WALL STREET DROPS $332M ON ORACLE'S AI REVOLUTION BET

- Flow: $332M across massive call positions (biggest Oracle trade of 2025!)

- Unusual Score: 10/10 VOLCANIC (institutions betting everything on AI infrastructure)

- YTD Performance: +80.17% (database giant's AI transformation accelerating)

- The Big Question: What AI partnerships will Oracle announce at CloudWorld September 30?

- Catalyst: Oracle CloudWorld Sept 30 + Q2 fiscal 2026 earnings surge + AI infrastructure demand explosion

2. ⚛️ OKLO - The $70M Nuclear Power Calendar Revolution

EXPLORE WHY NUCLEAR GIANT DROPS $70M ON CALENDAR SPREAD AS AI POWER PLAY HEATS UP

- Flow: $70M sophisticated calendar spread (nuclear power meets AI demand)

- Unusual Score: 10/10 VOLCANIC (smart money betting on nuclear renaissance)

- YTD Performance: +142% (clean nuclear power for AI data centers)

- The Big Question: Will DOE advanced reactor licensing accelerate AI power partnerships?

- Catalyst: DOE licensing updates + AI data center power contracts + nuclear regulatory approval timeline

3. 🏢 HPE - The $40.9M Enterprise AI Infrastructure Fortress

ANALYZE WHY HPE SEES MASSIVE $40.9M OPTIONS ACTIVITY SIGNALING MAJOR MOVE AHEAD

- Flow: $40.9M enterprise infrastructure positioning (AI edge computing play)

- Unusual Score: 9/10 EXTREME (enterprise AI infrastructure explosion)

- YTD Performance: +45.2% (edge AI and hybrid cloud transformation)

- The Big Question: Will Q4 earnings show AI edge computing revenue acceleration?

- Catalyst: Q4 earnings October 31 + HPE Discover customer conference + AI edge infrastructure deployments

4. 🤖 APP - The $17.1M AI Ad Tech Revolution Bet

SEE WHY APP WHALE ALERT SHOWS $17.1M PREMIUM BET ON AI AD TECH REVOLUTION

- Flow: $17.1M bullish call positioning (AI advertising platform dominance)

- Unusual Score: 9.5/10 EXTREME (ad tech AI transformation acceleration)

- YTD Performance: +611% (AXON 2.0 platform crushing competition)

- The Big Question: Will October 1 self-serve platform launch trigger next growth phase?

- Catalyst: Self-serve platform launch Oct 1 + international expansion + e-commerce vertical growth

5. 💊 UPST - The $12.3M AI Lending Revolution Signal

UNDERSTAND WHY UPST GETS $12.3M INSTITUTIONAL BET SAYING AI LENDING IS ABOUT TO EXPLODE

- Flow: $12.3M AI lending transformation bet (financial AI breakthrough)

- Unusual Score: 9/10 EXTREME (lending AI platform revolution)

- YTD Performance: +175% (AI lending model proving superior)

- The Big Question: Will Q3 earnings prove AI lending model sustainable recovery?

- Catalyst: Q3 earnings November 14 + auto lending platform expansion + bank partnership acceleration

6. 💉 ROIV - The $5.6M Phase 3 Profit-Taking After Success

DECODE WHY ROIV SEES MASSIVE $5.6M CALL SELLING AFTER PHASE 3 SUCCESS

- Flow: $5.6M call selling (sophisticated profit-taking after Phase 3 win)

- Unusual Score: 8.5/10 EXTREME (biotech profit-taking after rally)

- YTD Performance: +89% (neuroinflammation therapy breakthrough)

- The Big Question: Will FDA Fast Track designation accelerate commercial timeline?

- Catalyst: FDA Fast Track decision Q4 + Phase 3 data presentations + partnership discussions

7. 🇨🇳 JD - The $4.2M China E-Commerce Collar Hedge

EXPLORE WHY JD SEES RARE $4.2M OPTIONS COLLAR SIGNALING MAJOR MOVE AHEAD

- Flow: $4.2M sophisticated collar strategy (China recovery positioning)

- Unusual Score: 8/10 EXTREME (China e-commerce recovery hedge)

- YTD Performance: +45% (China consumption recovery accelerating)

- The Big Question: Will China stimulus measures drive Q3 consumption explosion?

- Catalyst: Q3 earnings November 14 + China stimulus impact + Singles' Day performance + logistics expansion

8. 💊 STOK - The $4.1M Biotech Breakout Before Phase 3

ANALYZE WHY STOK GETS MASSIVE $4.1M CALL BUY SIGNALING BIOTECH BREAKOUT AHEAD

- Flow: $4.1M biotech catalyst positioning (precision medicine breakthrough)

- Unusual Score: 9/10 EXTREME (biotech catalyst speculation)

- YTD Performance: +156% (precision medicine platform success)

- The Big Question: Will upcoming Phase 3 readout trigger acquisition interest?

- Catalyst: Phase 3 data readout Q4 + FDA meetings + potential partnership announcements

9. 🏢 B - The $3.53M Apollo Acquisition Close Completion

SEE WHY B GETS MASSIVE $3.53M OPTIONS PLAY AHEAD OF APOLLO ACQUISITION CLOSE

- Flow: $3.53M acquisition completion positioning (merger arbitrage play)

- Unusual Score: 8/10 EXTREME (acquisition arbitrage opportunity)

- YTD Performance: +75% (Apollo acquisition premium capture)

- The Big Question: Will regulatory approval accelerate closing timeline?

- Catalyst: Apollo acquisition close H1 2026 + regulatory approval process + integration planning

10. 📊 RSP - The $1.8M Equal Weight S&P 500 Breakout Bet

DISCOVER WHY RSP SEES $1.8M WHALE BET ON EQUAL WEIGHT S&P 500 BREAKOUT

- Flow: $1.8M equal weight strategy positioning (market breadth play)

- Unusual Score: 7.5/10 HIGH (market rotation from mega caps)

- YTD Performance: +15.2% (equal weight outperforming cap-weighted)

- The Big Question: Will small/mid-cap rotation accelerate with Fed cuts?

- Catalyst: Fed policy impact + Q3 earnings season breadth + small-cap value rotation

11. 🧪 CC - The $1.6M Chemical Giant's Comeback Story

ANALYZE WHY CC GETS SOMEONE DROPPING $1.6M ON CHEMICAL GIANT'S COMEBACK STORY

- Flow: $1.6M chemical recovery positioning (industrial demand revival)

- Unusual Score: 7/10 HIGH (industrial chemical demand cycle)

- YTD Performance: +28% (chemical demand recovery accelerating)

- The Big Question: Will industrial demand revival drive margin expansion?

- Catalyst: Q3 earnings October 24 + chemical demand cycle recovery + pricing power return

12. 💊 ACAD - The $1.4M Pharma Call Buy Ahead of Critical Trials

EXPLORE WHY ACAD GETS $1.4M PHARMA CALL BUY AHEAD OF CRITICAL TRIAL RESULTS

- Flow: $1.4M biotech catalyst positioning (CNS drug development)

- Unusual Score: 8/10 EXTREME (clinical trial catalyst speculation)

- YTD Performance: +45% (CNS pipeline advancement)

- The Big Question: Will Phase 3 depression trial data trigger partnership deals?

- Catalyst: Phase 3 depression data Q4 + FDA interactions + commercial partnership potential

13. 🔬 KLAC - The $1.3M Semiconductor Equipment Confidence Play

DECODE WHY KLAC GETS $1.3M CALL BUY SIGNALING AI SEMICONDUCTOR CONFIDENCE

- Flow: $1.3M AI semiconductor equipment bet (process control leader)

- Unusual Score: 7/10 HIGH (AI chip manufacturing demand)

- YTD Performance: +75% (AI chip equipment demand surge)

- The Big Question: Will October 29 earnings show AI advanced packaging acceleration?

- Catalyst: Q1 FY2026 earnings October 29 + AI advanced packaging growth + Taiwan expansion

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 13 DAYS TO ORACLE CLOUDWORLD (September 30)

- ORCL - $332M Infrastructure - Massive AI partnership announcements expected

⚡ 14 DAYS TO APPLOVIN CATALYST (October 1)

- APP - $17.1M Positioning - Self-serve platform launch driving growth

🧬 October-November Binary Events

- CC - October 24 - Chemical demand cycle confirmation

- KLAC - October 29 - AI equipment demand validation

- HPE - October 31 - Enterprise AI infrastructure acceleration

- JD & UPST - November 14 - China recovery + AI lending validation

📊 Smart Money Themes: What Institutions Are Really Betting

⚡ AI Infrastructure Mega Investment (65% of Today's Flow)

The $389.1M Infrastructure Message: Smart money betting everything on AI backbone

- → Oracle's $332M AI infrastructure nuclear bomb

- → HPE's $40.9M enterprise edge AI positioning

- → AppLovin's $17.1M ad tech AI platform dominance

⚛️ Nuclear Power Renaissance ($70M Revolutionary Bet)

AI Data Centers Driving Nuclear Demand:

💊 Biotech Catalyst Positioning ($11.1M Strategic Plays)

Institutions Positioning for Phase 3 Catalysts:

- → ROIV: $5.6M profit-taking after Phase 3 success

- → STOK: $4.1M calls ahead of Phase 3 readout

- → ACAD: $1.4M depression trial catalyst positioning

🏭 Industrial & Financial AI Recovery ($19.7M Rotation)

Smart Money Finding Value in AI-Enhanced Sectors:

- → UPST: $12.3M AI lending revolution bet

- → JD: $4.2M China e-commerce recovery collar

- → B: $3.53M Apollo acquisition completion

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - High volatility binary events

- ORCL CloudWorld calls - Sept 30 AI partnership announcements

- APP October calls - Oct 1 platform launch catalyst

- STOK biotech calls - Phase 3 data binary event

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

- HPE enterprise spreads - Follow $40.9M whale through Oct 31 earnings

- UPST AI lending calls - Nov 14 earnings validation play

- KLAC equipment calls - Oct 29 AI demand confirmation

💰 Premium Collection (Income Strategy)

Follow institutional sellers to collect premium

- ROIV call selling - Follow $5.6M profit-taking pattern

- OKLO calendar spreads - Nuclear volatility premium collection

- JD collar strategies - China volatility hedged income

🛡️ Conservative LEAPs (Long-term)

Patient capital and infrastructure plays

- ORCL shares - AI infrastructure leader without option complexity

- HPE infrastructure LEAPs - Enterprise AI edge computing growth

- RSP equal weight exposure - Market breadth improvement play

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- ORCL: CloudWorld fails to deliver major AI partnerships or competition intensifies

- APP: Self-serve platform launch disappoints or growth metrics decelerate

- HPE: Enterprise AI adoption slower than expected or competition from hyperscalers

- UPST: AI lending model faces regulatory scrutiny or credit losses increase

😰 If You're Following the Bears

- ROIV: FDA Fast Track accelerates timeline beyond expectations

- Nuclear sector: Policy changes favor traditional energy over nuclear power

- China plays: Stimulus measures exceed expectations driving consumption boom

- AI infrastructure: Demand growth exceeds even bullish projections

💣 This Week's Catalysts & Key Dates

📊 This Week:

- September 19: General option expiry (short-term gamma unwind)

- September 24: Fed policy implications for infrastructure spending

- Nuclear sector regulatory updates affecting OKLO positioning

🗓️ September Catalysts:

- September 30: Oracle CloudWorld Conference ($332M catalyst event)

- Quarter-end rebalancing (AI infrastructure rotation continues?)

- Biotech sector clinical trial updates

📈 October Setup:

- October 1: AppLovin self-serve platform launch ($17.1M catalyst)

- October 24: CC chemical demand earnings test

- October 29: KLAC AI equipment demand validation

- October 31: HPE enterprise AI infrastructure assessment

🧠 November Decision Points:

- November 14: Dual catalysts - JD China recovery + UPST AI lending validation

- Multiple biotech Phase 3 readouts (STOK, ACAD progression)

- Nuclear power policy decisions affecting OKLO

🎯 The Bottom Line: Follow the $490M AI Infrastructure Revolution Signal

This is the clearest AI infrastructure investment signal we've seen in 2025. $490+ million flowing INTO the picks and shovels of the AI revolution - Oracle's database infrastructure, HPE's edge computing, nuclear power for data centers, and AI-enhanced platforms. Smart money is clearly positioning for the next phase: practical AI implementation requiring massive infrastructure investment.

The biggest questions:

- Will Oracle's $332M bet pay off at CloudWorld September 30?

- Does Oklo's $70M nuclear bet signal AI power crisis solution?

- Can AppLovin's $17.1M position capture the ad tech AI revolution?

- Will biotech catalysts deliver on $11.1M institutional positioning?

Your move: This rotation into AI infrastructure and power solutions demands attention. Follow the infrastructure theme or position contrarian - but don't ignore $490 million in institutional AI infrastructure conviction.

🔗 Get Complete Analysis on Every Trade

⚡ AI Infrastructure Revolution:

- ORCL $332M AI Infrastructure Nuclear Bomb

- HPE $40.9M Enterprise Edge AI Positioning

- APP $17.1M Ad Tech AI Platform Revolution

- UPST $12.3M AI Lending Transformation

⚛️ Nuclear Power Renaissance:

💊 Biotech Catalyst Positioning:

- ROIV $5.6M Call Selling - Phase 3 Profit Taking

- STOK $4.1M Call Buying - Biotech Breakout Setup

- ACAD $1.4M Pharma Calls - Critical Trial Results

🏭 Industrial & Recovery Plays:

- JD $4.2M China E-Commerce Collar Strategy

- B $3.53M Apollo Acquisition Close Play

- CC $1.6M Chemical Giant Comeback Story

📊 Market & Semiconductor:

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (September 19 Expiry)

- Most positions are October+ expiries, minimal weekly exposure

📆 Monthly (October 17-31 Expiry)

- ORCL CloudWorld conference positioning (Sept 30)

- APP self-serve platform launch (Oct 1)

- CC chemical demand earnings (Oct 24)

- KLAC AI equipment earnings (Oct 29)

- HPE enterprise AI earnings (Oct 31)

🗓️ Quarterly (October-November)

- Major earnings cluster validating AI infrastructure thesis

- Biotech catalyst season with multiple Phase 3 readouts

- China recovery test through JD earnings November 14

🚀 LEAPS (2025-2026 Expiries)

- OKLO nuclear power long-term positioning

- UPST AI lending transformation timeline

- B Apollo acquisition completion H1 2026

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position

- 13-day catalyst: ORCL September/October calls (CloudWorld Sept 30)

- 14-day catalyst: APP October calls (platform launch Oct 1)

- Biotech lottery: STOK calls (Phase 3 readout binary)

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary: HPE October spreads (enterprise AI earnings Oct 31)

- Secondary: UPST November calls (AI lending validation)

- Defensive: JD collar strategies (China recovery hedge)

💰 Premium Collector (Income Focus)

Strategy: Follow sophisticated institutional strategies

- Profit-taking model: ROIV call selling (biotech profit capture)

- Calendar spreads: OKLO nuclear volatility (time decay capture)

- Covered calls: Use RSP or KLAC shares for infrastructure premium collection

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education

- Paper trade: All AI infrastructure strategies before risking capital

- ETF exposure: QQQ for tech, XLK for infrastructure without single-stock risk

- Share positions: ORCL shares for AI infrastructure exposure

- Education focus: Study collar strategies from JD, calendar spreads from OKLO

⚠️ Risk Management for All Types

Essential Rules:

- Position sizing is critical - Never risk more than allocation limits above

- AI infrastructure momentum - Can reverse quickly, set 25% stop losses

- Catalyst timing - September 30 and October 1 are key binary events

- Nuclear sector volatility - OKLO can move 20%+ on policy news

- Biotech binary risk - Phase 3 trials can gap 50%+ either direction

AI Infrastructure Warning: Today's $490M inflow suggests infrastructure phase of AI revolution beginning. Unlike bubble stocks, these are picks-and-shovels plays with real revenue models. However, execution risk remains high - Oracle's CloudWorld and AppLovin's platform launch are make-or-break catalysts.

Patience Emphasis: Don't chase momentum immediately. Many of these positions are September 30 - October 31 catalyst plays. Wait for pullbacks unless you're taking small catalyst exposure. The infrastructure theme has multi-quarter duration.

Nuclear Power Special Note: OKLO's $70M calendar spread suggests sophisticated volatility play around regulatory catalysts. Nuclear stocks can move violently on policy news - understand the regulatory timeline before positioning.

Entry Level Critical: This infrastructure rotation requires understanding complex catalysts and regulatory factors. Start with broad infrastructure ETFs, practice with paper trading, and focus on learning institutional positioning patterns. Avoid YOLO plays until you understand the catalyst timelines.

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Nuclear and biotech sectors carry additional regulatory and clinical trial risks. Always practice proper risk management and never risk more than you can afford to lose. The AI infrastructure theme requires long-term perspective and patience - don't blindly follow unusual activity without understanding the underlying catalysts.