Ainvest Option Flow Digest - Sep 16, 2025: $586M+ Option Flow Earthquake Rocks 9 Tickers

📅 September 16, 2025 | 🚨 HISTORIC DAY: Tesla's $297M Robotaxi Bull Spread + Broadcom's $217M AI Accumulation + Amazon's $28M Deep ITM Confidence Play | ⚠️ Extreme Unusual Scores Signal Major Market Shift

📅 September 16, 2025 | 🚨 HISTORIC DAY: Tesla's $297M Robotaxi Bull Spread + Broadcom's $217M AI Accumulation + Amazon's $28M Deep ITM Confidence Play | ⚠️ Extreme Unusual Scores Signal Major Market Shift

🎯 The $586M Institutional Money Avalanche: Every Trade Exposed

🔥 RECORD-BREAKING ALERT: We just witnessed $586+ MILLION in seismic options activity across 9 tickers - featuring Tesla's jaw-dropping $297M bull spread (888x unusual!), Broadcom's $217M multi-strike AI positioning, and emerging market ETF's $24M institutional exodus. This isn't random whale activity - this is coordinated smart money positioning for Q4 earnings, AI infrastructure expansion, and major catalyst events including Tesla's October robotaxi launch.

Total Flow Tracked: $586,500,000+ 💰 Biggest Single Trade: TSLA $297M bull spread (888x - happens 2-3 times per year!) AI Infrastructure Play: AVGO $217M across 14 strikes Defensive Signal: EEM $24M deep ITM call selling Transformation Bets: CRWV $9M, GRAB $1.8M LEAP calls

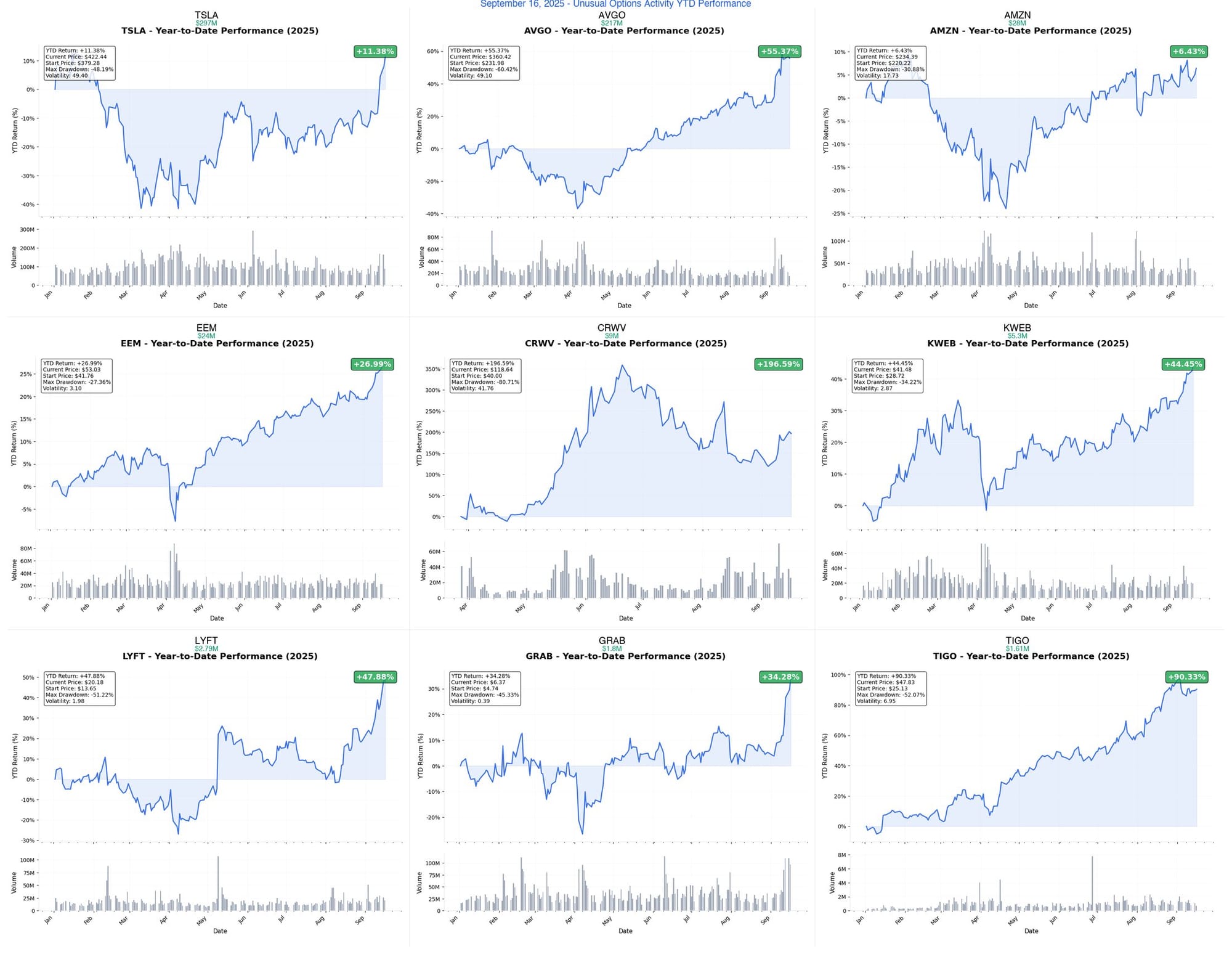

📊 September 16, 2025 - All Tickers YTD Performance Overview

🚀 THE COMPLETE WHALE LINEUP: All 9 Monster Trades

1. ⚡ TSLA - The $297M Robotaxi Revolution Bull Spread

DISCOVER WHY SOMEONE BET $297 MILLION ON TESLA'S AUTONOMOUS FUTURE →

- Flow: $297M November bull spread ($202M on $335 calls, $95M on $415 calls)

- Unusual Score: 9.8/10 EXTREME (888x larger - happens only 2-3 times yearly!)

- YTD Performance: +11.38% (consolidating for next moonshot)

- Weekly Expiry: November 21 (66 days)

- The Big Question: Will October 28's first Austin robotaxi trip trigger the next Tesla revolution?

- Premium/Catalyst: Q3 earnings October 22 + Robotaxi commercial launch October 28 + Cybertruck profitability Q4

2. 🤖 AVGO - The $217M AI Infrastructure Moonshot

ANALYZE WHY INSTITUTIONS DEPLOY $217M ACROSS 14 BROADCOM STRIKES →

- Flow: $217M multi-strike accumulation (14 different December strikes!)

- Unusual Score: 8/10 EXTREME (8x volume/OI on $330 strikes)

- YTD Performance: +55.37% (AI dominance continues)

- Monthly Expiry: December 19 (94 days)

- The Big Question: Is this positioning for massive Q4 AI chip guidance surprise?

- Premium/Catalyst: Q4 earnings December 12 + OpenAI partnership expansion + 2026 $75B revenue target

3. 🚀 AMZN - The $28M Deep ITM AWS Confidence Play

DECODE AMAZON'S $28M INSTITUTIONAL CONVICTION BET →

- Flow: $28M November $210 deep ITM calls (10,632x larger than average!)

- Unusual Score: 8.5/10 UNPRECEDENTED (happens maybe once yearly)

- YTD Performance: +6.43% (recovering from -30% drawdown)

- Monthly Expiry: November 21 (66 days)

- The Big Question: What AWS AI breakthrough drives this deep ITM confidence?

- Premium/Catalyst: Q3 earnings October 30 + AWS re:Invent December + Prime Video ads expansion

4. 🌏 EEM - The $24M Emerging Markets Mass Exodus

SEE WHY INSTITUTIONS DUMP $24M FROM EMERGING MARKETS →

- Flow: $24M deep ITM call selling (two identical $12M blocks!)

- Unusual Score: 10/10 VOLCANIC (1,681x larger than average)

- YTD Performance: +26.99% (profit-taking at 52-week highs)

- Weekly/Monthly Mix: Sept 19 & Oct 17 expiries

- The Big Question: Is this China stimulus skepticism or broader EM rotation?

- Premium/Catalyst: TSMC Q3 earnings Oct 15-17 + China economic data + India momentum shifts

5. 🏢 CRWV - The $9M AI Cloud Infrastructure Gamble

EXPLORE COREWEAVE'S $9M NEAR-TERM SPECULATION →

- Flow: $9M September $115 calls (234x average daily volume!)

- Unusual Score: 8/10 EXTREME (massive for recent IPO)

- YTD Performance: +196.6% (AI infrastructure rocket)

- Weekly Expiry: September 19 (3 days!)

- The Big Question: Will Nvidia Blackwell chip exclusivity drive immediate surge?

- Premium/Catalyst: $6.3B Nvidia revenue deal + $9B Core Scientific acquisition Q4

6. 🐉 KWEB - The $5.3M China Tech Covered Call

UNDERSTAND THE CHINA ETF $5.3M PREMIUM COLLECTION →

- Flow: $5.3M January 2026 $40 covered call selling

- Unusual Score: 9/10 EXTREME (1,917x larger than average)

- YTD Performance: +44.45% (AI-driven China tech rally)

- LEAP Expiry: January 16, 2026 (122 days)

- The Big Question: Is this profit protection or bearish China tech view?

- Premium/Catalyst: DeepSeek AI breakthrough + $138B government AI investment + Geneva Trade talks

7. 🚗 LYFT - The $2.79M Robotaxi Hedge Play

DECODE LYFT'S COMPLEX DECEMBER OPTIONS STRATEGY →

- Flow: $2.79M mixed strategy (put sale + call buys at $23 & $30)

- Unusual Score: 8.7/10 EXTREME (complex institutional positioning)

- YTD Performance: +47.88% (rideshare recovery play)

- Quarterly Expiry: December 19 (94 days)

- The Big Question: Will Baidu robotaxi Europe partnership transform valuation?

- Premium/Catalyst: Q3 earnings November 5 + Baidu Europe 2026 launch + BENTELER shuttles

8. 🌍 GRAB - The $1.8M Southeast Asia LEAP Bet

ANALYZE GRAB'S RECORD-BREAKING LEAP CALL ACCUMULATION →

- Flow: $1.8M December 2027 $7 LEAP calls (4,132x larger!)

- Unusual Score: 10/10 VOLCANIC (literally never happens)

- YTD Performance: +56.77% (Southeast Asia super-app dominance)

- LEAP Expiry: December 2027 (2+ years!)

- The Big Question: Will WeRide robotaxis + fintech expansion create next $100B company?

- Premium/Catalyst: Q3 earnings November + H1 2026 robotaxi deployment + Digital banking expansion

9. 📡 TIGO - The $1.61M Latin American Telecom Spread

DISCOVER THE LATIN AMERICA TELECOM TRANSFORMATION BET →

- Flow: $1.61M September 2026 bull spread ($40/$55 strikes)

- Unusual Score: 8.7/10 EXTREME (66x average daily volume)

- YTD Performance: +90.33% (LatAm telecom consolidation play)

- LEAP Expiry: September 2026 (1 year)

- The Big Question: Will Xavier Niel's 40% stake trigger full buyout premium?

- Premium/Catalyst: $975M tower sale Q3 + $2.50 special dividend + Ecuador/Uruguay acquisitions

⏰ URGENT: Critical Expiries & Binary Events

🚨 3 DAYS TO EXPIRY (September 19)

- CRWV - $9M Near-Term Calls - AI cloud infrastructure gamma squeeze potential

- EEM - $12M Deep ITM Sells - Emerging markets profit-taking window

⚡ OCTOBER EARNINGS & CATALYST TSUNAMI

- TSLA - October 22 Earnings + October 28 Robotaxi Launch - $297M positioned

- AMZN - October 30 Q3 Results - AWS AI catalyst expected

- LYFT - November 5 Earnings - Robotaxi partnership impact

📅 YEAR-END POSITIONING (December Expiries)

- AVGO - December 12 Q4 Earnings - $217M multi-strike setup

- LYFT - December 19 Options - Complex hedged strategy

📊 Institutional Themes: Decoding the $586M Message

🤖 AI Infrastructure Dominance ($523M - 89% of Flow!)

The Half-Billion Dollar AI Vote:

- → TSLA: $297M robotaxi autonomous revolution bet

- → AVGO: $217M AI chip expansion across 14 strikes

- → CRWV: $9M Nvidia Blackwell exclusivity play

🌏 Emerging Market Rotation ($31.1M Net Positioning)

Geographic Risk Rebalancing:

- → EEM: $24M institutional exit from broad EM exposure

- → KWEB: $5.3M China tech covered call protection

- → GRAB: $1.8M Southeast Asia super-app LEAP bet

🚗 Mobility Transformation ($4.4M Targeted Plays)

Robotaxi & Rideshare Evolution:

💎 Deep Value & Special Situations ($29.6M)

Quality at the Right Price:

🎯 Trading Action Plans by Risk Level

🚀 YOLO TRADERS (1-2% Portfolio Max)

High Risk, High Reward Weekly Expiries:

- CRWV September $115 Calls - 3 days to binary event, 234x unusual

- EEM Put Spreads - Fade the emerging market rally

- Risk Control: Size down! These expire THIS WEEK. Max 1% portfolio per trade.

📈 SWING TRADERS (3-5% Portfolio)

Monthly Expiries with Catalyst Alignment:

- TSLA November Bull Spreads - Follow the $297M whale with defined risk

- AMZN November $240 Calls - AWS catalyst play into Q3

- LYFT December Strangle - Volatility expansion into earnings

- Risk Control: Use spreads to define max loss. Take profits at 50% target.

💰 PREMIUM COLLECTORS (Income Focus)

Quarterly & LEAP Strategies:

- KWEB Covered Calls - Follow institutional premium selling

- AVGO Cash-Secured Puts - Collect premium on AI leader dips

- TIGO Protected Spreads - 1-year timeframe with catalysts

- Risk Control: Sell premium at support levels. Keep 50% cash for adjustments.

🎓 ENTRY LEVEL (Learning Focus)

LEAP Options for Patient Capital:

- GRAB 2027 LEAPs - 2+ year Southeast Asia growth story

- TIGO 2026 Spreads - Defined risk telecom transformation

- Track TSLA Without Trading - Learn from $297M positioning

- Risk Control: Start with paper trading. When ready, use only 5% of portfolio for options.

📅 Catalyst Calendar: Mark Your Trading Diary

This Week (September 16-20)

- Sept 19: CRWV $115 calls expire (AI cloud binary)

- Sept 19: EEM first tranche expires ($12M)

October Explosions

- Oct 15-17: TSMC earnings (EEM catalyst)

- Oct 22: Tesla Q3 earnings

- Oct 28: Tesla Austin robotaxi launch 🚗

- Oct 30: Amazon Q3 results

November Decisions

- Nov 5: Lyft Q3 earnings

- Nov 21: TSLA $297M spread expiry

- Nov 21: AMZN $28M calls expiry

December & Beyond

- Dec 12: Broadcom Q4 earnings

- Dec 19: Multiple December expiries

- Jan 2026: KWEB covered calls expire

- Sept 2026: TIGO spread maturity

- Dec 2027: GRAB LEAPs target

⚠️ Critical Risk Warnings

Remember: Unusual options activity shows what institutions are doing, NOT what you should blindly copy. These traders have:

- Different risk tolerances

- Hedged portfolios

- Complex multi-leg strategies

- Information advantages

NEVER:

- Risk more than you can afford to lose

- Chase trades after big moves

- Ignore position sizing rules

- Trade without understanding the strategy

ALWAYS:

- Do your own research

- Use stop losses

- Size positions appropriately

- Consider the opposite thesis

🔗 Complete Analysis Directory

Mega Whales ($100M+)

Institutional Flows ($10M-$50M)

Strategic Positions (Under $10M)

- CRWV - $9M AI Cloud Bet

- KWEB - $5.3M China Tech

- LYFT - $2.79M Rideshare

- GRAB - $1.8M SEA Growth

- TIGO - $1.61M LatAm Telecom

📱 What's Happening: Premium Events & Catalysts

Today's $586M Message: Institutions are making their biggest Q4 bets of the year, with AI and autonomous vehicles dominating 89% of flow. The Tesla $297M position ahead of robotaxi launch and Broadcom's $217M multi-strike accumulation signal massive confidence in AI infrastructure expansion. Meanwhile, emerging market profit-taking and geographic rotation show smart money rebalancing risk. With critical catalysts in October (Tesla robotaxi, Q3 earnings) and year-end positioning already underway, this could be the setup for explosive Q4 moves.

Critical Dates: CRWV expires in 3 days | Tesla robotaxi October 28 | Amazon Q3 October 30 | Broadcom Q4 December 12

Disclaimer: This newsletter is for educational purposes only. Options trading involves substantial risk of loss. Not financial advice. Always conduct your own research and consult with financial professionals before making investment decisions. Past unusual activity does not guarantee future results.