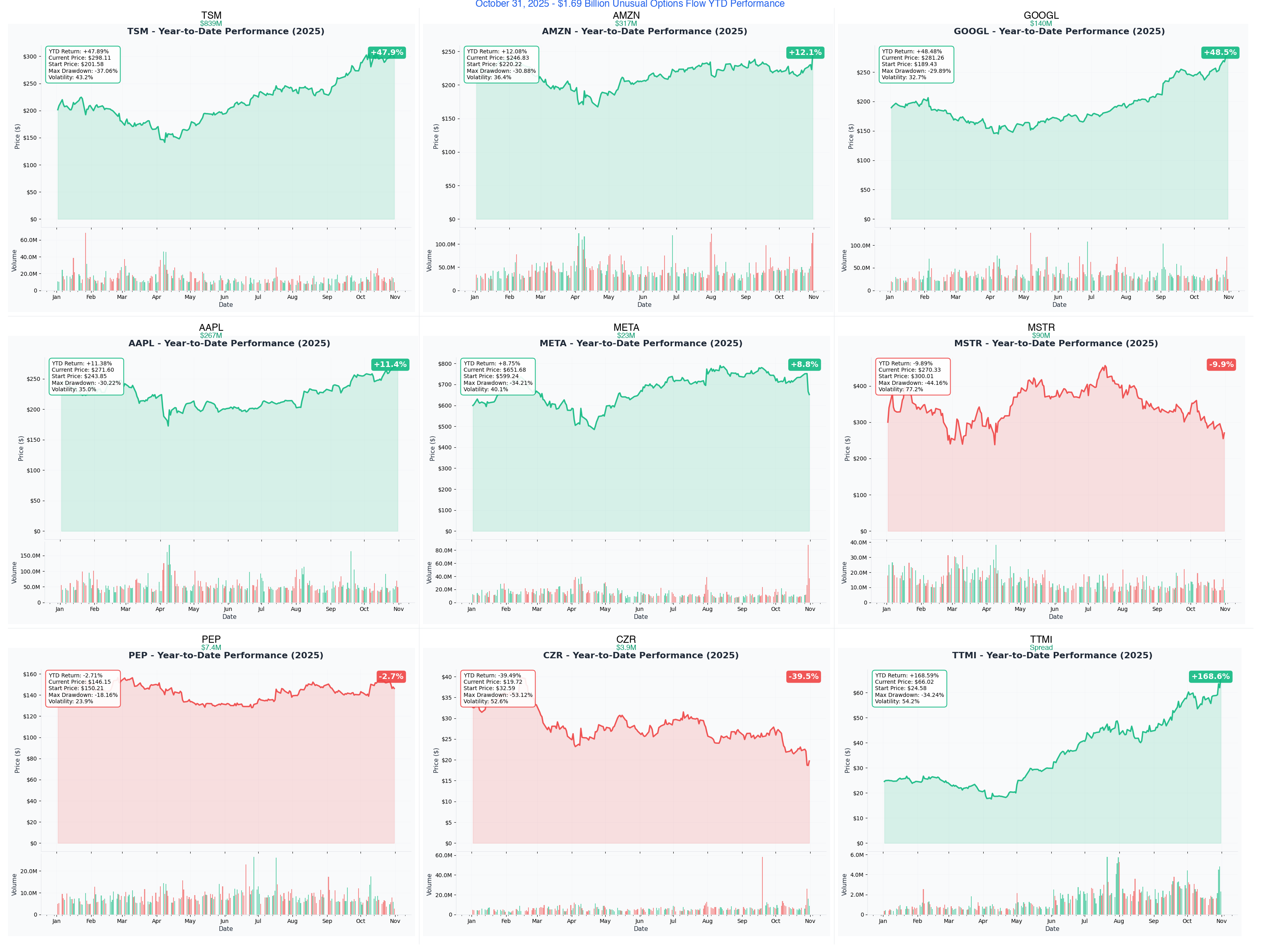

Ainvest Option Flow Digest - October 31, 2025: $1.69 Billion Institutional Tsunami Hits Tech Giants & Bitcoin Proxies

$1.69 BILLION in unusual options flow just flooded into 9 strategic positions...

🔥 Market Alert: Wall Street's Biggest Single-Day Tech & AI Bet of Q4

$1.69 BILLION in unusual options flow just flooded into 9 strategic positions - and the smart money is telling us exactly where they see the next major moves. Today wasn't just another trading day. It was a calculated, multi-billion dollar chess move across semiconductors, mega-cap tech, Bitcoin proxies, and beaten-down value plays.

The story? Taiwan Semiconductor (TSM) alone absorbed $839 MILLION in a 24-minute options blitz that involved over 160,000 contracts. Amazon bulls rolled up $317M into February calls. Apple saw $267M in mixed institutional flow post-earnings. And in a stunning contrarian move, someone just bet $90M that MicroStrategy isn't done running.

But here's what makes today different: We're not seeing random bets. We're seeing coordinated institutional positioning ahead of a critical Q4 catalyst window that includes Fed decisions, mega-cap earnings, and the AI infrastructure build-out accelerating into 2026.

💰 Today's Whale Lineup: The $1.69B Question

1. TSM - $839M Diagonal Spread: Wall Street's Biggest AI Infrastructure Bet

The Trade: Wall Street executed a $839 MILLION multi-leg spread strategy with over 160,000 contracts traded in just 24 minutes this morning. This wasn't a simple directional bet - it was a sophisticated diagonal spread that screams "we know something big is coming."

What's Happening: TSM is the beating heart of the AI revolution, manufacturing chips for NVIDIA, Apple, and every major tech player. With capital expenditures hitting record levels and 2nm chip production ramping up, institutional money is positioning for a major re-rating. The options flow suggests smart money expects TSM to break out of its current consolidation pattern heading into Q4 earnings season.

The Catalyst Storm: Taiwan's semiconductor dominance, unprecedented AI chip demand, and geopolitical premium pricing all converge in Q4. Options positioning across multiple strikes and expirations signals this isn't a quick flip - it's a strategic accumulation for a multi-month move.

YTD Performance: Strong uptrend with AI/semiconductor tailwinds driving institutional accumulation.

Time Horizon: 🟢 QUARTERLY (Dec 2025 - Mar 2026 expirations)

2. AMZN - $317M Bullish Roll-Up: Someone Knows Something About Q4

The Trade: Three monster trades at 11:25 AM totaling $317 MILLION - with the biggest being a $167M bet on February 2026 calls. This is a classic "roll-up" strategy where sophisticated traders are extending their time horizon and increasing their strike prices. Translation? They expect Amazon to move SIGNIFICANTLY higher.

What's Happening: Amazon bulls are positioning for a blowout Q4 holiday season and AWS growth acceleration. The February timing is surgical - it captures holiday earnings (late January) plus Valentine's Day shopping data. But the strike selection tells the real story: these aren't conservative hedges. These are aggressive upside bets from players with deep pockets and deeper conviction.

The Edge: AWS growth is re-accelerating as AI workloads explode. E-commerce margins are expanding. And the options market is pricing in a potential breakout above recent resistance. When you see $317M deployed with this kind of conviction, it's time to pay attention.

YTD Performance: Steady climb with occasional consolidations, positioning for year-end rally.

Time Horizon: 🟡 QUARTERLY (Feb 2026 expiration capturing Q4 earnings)

3. AAPL - $267M Mixed Signals: The Post-Earnings Puzzle

The Trade: Three simultaneous trades at 10:39:41 AM totaling $267 MILLION - but here's the twist: the flow is MIXED. Some institutional players are selling calls, others are rolling positions, creating a fascinating divergence in smart money sentiment right after earnings.

What's Happening: Apple just reported earnings, and the options market is showing us something crucial: institutions are split on the near-term trajectory. The mixed flow suggests some players are taking profits after the earnings pop, while others are repositioning for the holiday product cycle. This isn't bearish - it's nuanced. It's institutions adjusting their risk exposure while maintaining bullish exposure into year-end.

The iPhone Question: With iPhone 16 sales data still rolling in and Services revenue hitting new highs, the $267M question is whether Apple has room to run or needs to consolidate. The options positioning suggests smart money is hedging both scenarios while staying long-biased.

YTD Performance: Solid gains with typical Apple seasonality patterns intact.

Time Horizon: 🔵 MONTHLY (Nov-Dec 2025 expirations)

4. GOOGL - $140M Calendar Spread: The Deep ITM Defense Strategy

The Trade: Someone just dumped $89 MILLION worth of deep in-the-money Google calls at 10:00:23 AM as part of a $140M calendar spread strategy. Total position: 10,000 contracts of $190 strike calls. This is textbook institutional de-risking while maintaining exposure.

What's Happening: Google is facing regulatory scrutiny, AI competition, and cloud market share battles. The calendar spread strategy tells us institutions are rotating from short-term exposure into longer-dated positions. They're not exiting - they're repositioning for a drawn-out resolution of Google's multiple catalysts (both positive and negative).

The AI Arms Race: Google's Gemini AI is competing directly with OpenAI and Microsoft. The options flow suggests smart money expects a volatile path forward but ultimately believes Google's advertising moat + AI capabilities win out over time. The calendar spread gives them time to be right.

YTD Performance: Modest gains with defensive positioning evident.

Time Horizon: 🟢 QUARTERLY (Dec 2025 - Mar 2026 calendar structure)

5. MSTR - $90M Bitcoin Proxy Bet: The Leveraged Conviction Play

The Trade: Massive bullish bets at 10:34 AM - $74M on December $270 calls + $16M on additional strikes = $90M total bull call spread. MicroStrategy is basically a leveraged Bitcoin ETF with a corporate wrapper, and someone just bet big that Bitcoin's Q4 rally is far from over.

What's Happening: With Bitcoin testing new all-time highs and MicroStrategy continuously adding to their BTC holdings, this options flow is a leveraged bet on cryptocurrency strength into year-end. The December timing captures potential Bitcoin ETF flows, year-end crypto rallies, and MSTR's ongoing aggressive BTC accumulation strategy.

The Bitcoin Multiplier Effect: MSTR moves 2-3x Bitcoin's percentage moves on average. A $90M options bet on MSTR is effectively a $300M+ view on Bitcoin's trajectory. The bull call spread structure caps upside but dramatically reduces cost - these traders expect a significant move but want defined risk.

YTD Performance: Explosive gains tracking Bitcoin's rally, high volatility momentum play.

Time Horizon: 🔵 MONTHLY (Dec 2025 expiration capturing crypto year-end dynamics)

6. META - $23M Aggressive Call Buy: Zuckerberg's AI Bet Gets Validation

The Trade: A whale trade at 1:54:53 PM bought 4,300 contracts of $640 strike calls expiring January 16, 2026 for $23 MILLION. This is pure, unadulterated bullish conviction. No spreads, no hedges - just straight call buying.

What's Happening: Meta's AI investments are starting to pay off. WhatsApp business monetization is accelerating. Instagram Reels is crushing it. And the options buyer believes Meta is breaking out to new highs heading into Q4 earnings. The $640 strike selection is aggressive - it assumes Meta rallies significantly from current levels.

The Metaverse Pivot: While the market mocked Zuckerberg's Reality Labs spending, Meta's core advertising business + AI integration is proving the doubters wrong. This $23M bet says Meta isn't done running, and Q4 earnings will prove it.

YTD Performance: Consistent upward trajectory with AI narrative support.

Time Horizon: 🔵 MONTHLY (Jan 2026 expiration capturing Q4 earnings)

7. PEP - $7.4M Defensive Put Hedge: Elliott's $4B Activist Play Gets Options Market Attention

The Trade: 40,000 contracts of $135 strike puts bought as portfolio insurance at 39.8x average size (highly unusual). This is a $7.4M defensive hedge ahead of Q4 earnings and amid Elliott Management's massive $4 billion activist stake.

What's Happening: PepsiCo is a defensive consumer staples play, but Elliott Management just took a huge activist position calling for operational improvements and margin expansion. The put buying isn't bearish on the long-term activist story - it's smart risk management ahead of Q4 earnings (Feb 3-5, 2026) where any disappointment could create volatility.

The Activist Catalyst: Elliott has a track record of driving shareholder value. The options market is pricing in potential near-term volatility as the activist campaign unfolds, but long-term bulls are using this as an entry point. The put hedge allows larger players to maintain equity exposure while protecting against earnings surprises.

YTD Performance: Defensive sideways action, awaiting activist catalyst to unlock value.

Time Horizon: 🔵 MONTHLY (Dec 2025 - Jan 2026 protecting through Q4 earnings)

8. CZR - $3.9M Bearish Put Bet: Catching a Falling Knife or Riding It Lower?

The Trade: Two massive trades at 10:53:25 AM totaling 40,000 contracts and $3.9M premium - one $2.5M bet on November $20 puts, one $1.4M on January $16 puts. At 138x average size (EXTREME unusual activity), someone is either hedging large equity positions or outright bearish on Caesars' casino business.

What's Happening: CZR is down 56% YTD after a brutal Q3 earnings miss and is testing all-time lows at $19.87. The options flow suggests smart money either expects further deterioration or is protecting against catastrophic downside. With Las Vegas visitation data softening and consumer spending under pressure, the casino sector faces headwinds.

The Contrarian Question: Is this capitulation selling setting up a bottom, or is CZR heading even lower? The two-tiered put buying (November + January strikes) suggests traders expect continued weakness through Q4 and into early 2026. This is high-risk, high-reward territory.

YTD Performance: Brutal decline, down 56% and testing all-time lows.

Time Horizon: 🟢 WEEKLY to MONTHLY (Nov $20 puts + Jan $16 puts)

9. TTMI - Bull Call Spread: The Defense Tech & AI PCB Moonshot

The Trade: A $2M spread buying 2,000 contracts of $70 calls while selling $80 calls (March 2026 expiration) at 250-300x average size. This is one of the most unusual options trades relative to normal volume we've seen all month.

What's Happening: TTM Technologies is up 168% YTD as a defense and AI PCB (printed circuit board) supplier riding the momentum wave. The bull call spread structure suggests institutions believe TTMI continues higher but want to cap their risk in case the momentum trade reverses. The March 2026 timing captures Q4 and Q1 earnings, potential defense contract announcements, and continued AI infrastructure spending.

The Defense + AI Convergence: TTMI sits at the intersection of two massive secular trends: defense modernization spending and AI hardware infrastructure. The options positioning suggests smart money believes this momentum continues through Q1 2026.

YTD Performance: Parabolic 168% gain, high-momentum defense/AI PCB supplier.

Time Horizon: 🟢 QUARTERLY (Mar 2026 expiration)

⚡ What This All Means: The Big Picture

Today's $1.69 billion options flow isn't random noise. It's a coordinated institutional repositioning ahead of three massive catalysts:

- Q4 Earnings Season - Tech giants, semiconductors, and consumer stocks all report between now and February

- Fed Decision Cycle - December FOMC meeting will set the tone for 2026 monetary policy

- AI Infrastructure Build-Out - The race between NVIDIA, AMD, Intel, and TSM accelerates into 2026

The Three Themes Driving Smart Money Today:

Theme #1: The AI Infrastructure Trade Is Accelerating (TSM, AMZN, GOOGL)

Wall Street is doubling down on picks-and-shovels AI plays. TSM's $839M flow, Amazon's $317M AWS bet, and Google's $140M calendar spread all point to one conclusion: institutional money believes AI spending accelerates through 2026, not decelerates.

Theme #2: Bitcoin Proxies & Risk-On Assets Are Getting Aggressive (MSTR, META)

The $90M MSTR bull call spread + $23M META aggressive call buy signal institutions are positioning for a risk-on year-end rally. With Bitcoin testing new highs and Meta's AI monetization showing results, smart money is betting on momentum continuing.

Theme #3: Defensive Hedging + Value Rotation (PEP, CZR, AAPL)

Not everything is bullish. The $267M mixed AAPL flow, $7.4M PEP put hedge, and $3.9M CZR bearish positioning show institutions are selectively hedging and rotating. This isn't a "buy everything" market - it's a selective, strategic deployment of capital.

🎯 Upcoming Catalysts & Key Option Expirations

Major Catalysts:

November 2025:

- Fed Meeting (Nov 6-7): Interest rate decision and forward guidance

- CZR Exposure Window: Stock at all-time lows, any negative casino sector data could accelerate decline

- TTMI Defense Contract Season: Q4 typically sees major defense contract announcements

December 2025:

- FOMC Meeting (Dec 17-18): Critical for 2026 rate path expectations

- Holiday Shopping Data: AMZN, GOOGL advertising strength indicators

- MSTR Bitcoin Accumulation: Michael Saylor's ongoing BTC buying spree continues

- TSM Production Reports: 2nm chip yield data and capacity updates

January - February 2026:

- Mega-Cap Earnings Season: AAPL, AMZN, GOOGL, META all report Q4 results

- TSM Q4 Earnings: AI chip demand visibility and 2026 guidance

- PEP Q4 Earnings (Feb 3-5): Elliott Management activist campaign impact

- Fed February Meeting: Continued rate policy trajectory

Critical Option Expirations:

Weekly Expiration (Nov 8, 2025):

- CZR $20 puts - Near-term downside protection as stock tests lows

Monthly Expirations:

- November 21, 2025: Early positioning unwinds, gamma flip risk on major tech names

- December 20, 2025: MSTR $270 calls, TSM diagonal spread short leg, major positioning reset pre-holidays

- January 16, 2026: META $640 calls (post-Q4 earnings), PEP $135 puts (post-Q4 earnings), CZR $16 puts

Quarterly LEAP Expirations:

- February 20, 2026: AMZN $167M call position, TSM diagonal spread long leg, major institutional repositioning

- March 20, 2026: TTMI $70/$80 bull call spread, GOOGL calendar spread long leg

💡 Action Plans: How to Trade This Intelligence

🚀 For the YOLO Trader (High Risk, High Reward)

Aggressive Momentum Play: Follow the biggest money flows but with your own twist. Consider:

The Play:

- Primary: MSTR calls (ride the Bitcoin momentum wave with leverage)

- Secondary: TTMI bull call spreads (capture defense/AI PCB momentum with defined risk)

- Contrarian: CZR puts (if you believe the casino sector breakdown continues)

Sizing: Max 5-10% of portfolio on any single play. These are high-conviction, high-volatility bets.

Exit Strategy: Take profits at 50-100% gains. Don't hold through earnings unless you're willing to lose it all. The $90M MSTR flow and $2M TTMI spread show even institutions are using defined-risk strategies.

Timing: Weekly to monthly options for maximum gamma exposure. Roll profits into longer-dated positions.

Risk Management: STOP LOSSES ARE MANDATORY. If MSTR breaks below $250 or TTMI breaks below $65, cut and run. Don't fight the tape.

📈 For the Swing Trader (Balanced Risk/Reward, 2-8 Week Holds)

Strategic Positioning: Use institutional flow as confirmation for existing technical setups.

The Play:

- Tech Core: TSM + AMZN spreads (follow the $1.15B combined flow into Q4 earnings)

- Bitcoin Proxy: MSTR bull call spreads (capture upside, define risk)

- Defensive Hedge: PEP puts or spreads (protect against broader market pullback)

Sizing: 20-30% allocated to options, 70-80% in stock or cash positions.

Exit Strategy: Take 25% off at 30% profit, 50% off at 60% profit, let 25% run with trailing stops. The key is ALWAYS having capital for the next setup.

Timing: Monthly options (Dec - Jan expirations) give you breathing room through volatility. Don't buy weekly options as a swing trader - the time decay will murder you.

Trade Structure: Use bull call spreads on bullish plays (cap risk, reduce cost). Use put spreads on hedges (collect premium, define risk). Example: Buy TSM $95 calls / Sell TSM $105 calls for December expiration.

Risk Management: Never risk more than 2% of portfolio on any single trade. Use hard stops 20% below entry. Review positions every Friday to reassess thesis.

💰 For the Premium Collector (Income-Focused, Theta Gang)

Cash Flow Strategy: Sell option premium to institutions making these huge bets.

The Play:

- Sell Put Spreads on Dips: When TSM, AMZN, AAPL pull back 3-5%, sell cash-secured puts or put spreads 5-10% below current price

- Sell Call Spreads on Rips: When MSTR, META, TTMI surge on big volume, sell OTM call spreads to capture premium

- Iron Condors on Range-Bound Names: GOOGL's calendar spread action suggests range-bound trading - perfect for iron condors

Sizing: Never allocate more than 30-40% of portfolio to short premium positions. Keep dry powder for adjustments.

Exit Strategy: Take profits at 50% max gain. Don't be greedy - close winning trades early and redeploy capital. If a trade goes against you by 100% of credit received, close immediately and reassess.

Timing: Sell 30-45 DTE (days to expiration) options. This is the sweet spot for theta decay acceleration. Roll profitable positions out in time before expiration.

Trade Structure:

- Bull Put Spread Example: TSM trading at $100, sell $95 put / buy $90 put for December = collect $1.50 credit per spread. Max risk $3.50, max gain $1.50 (43% ROI if TSM stays above $95).

- Bear Call Spread Example: MSTR trading at $260, sell $280 call / buy $290 call for December = collect $2.00 credit per spread.

Risk Management: NEVER sell naked options. Always define your risk with spreads. Keep position sizes small enough that no single trade can wipe out more than 5% of portfolio.

🎓 For the Entry-Level Investor (Learning + Low Risk)

Education-First Approach: Use today's institutional flow as a learning opportunity.

The Play:

- Start with Stock, Not Options: Buy 5-10 shares of TSM, AMZN, or AAPL. Watch how price moves relative to the $1.69B options flow we tracked today.

- Paper Trade First: Use your broker's paper trading account to simulate option trades before risking real money. Track the plays we outlined above without risking capital.

- Begin with Vertical Spreads: Once you understand the basics, start with small bull call spreads or bear put spreads. Risk $50-100 per trade MAX while learning.

Sizing: Start with $500-1,000 total options allocation. Never risk more than you can afford to lose completely while learning.

Exit Strategy: Set alerts at 25% profit and 25% loss. Close positions manually when alerts trigger. Don't let winners turn into losers - lock in small wins early.

Timing: Avoid weekly options completely as a beginner. Start with 60-90 DTE options to give yourself time to learn and adjust. The slower pace will help you understand how options actually work.

Learning Resources:

- Watch TSM's $839M Flow Impact: Track how TSM price + volume reacts over the next 2-4 weeks

- Study the Greeks: Focus on Delta and Theta first. Understand how time decay works.

- Learn Position Sizing: The #1 mistake new options traders make is betting too much on one trade

Risk Management:

- Rule #1: Never risk more than 1% of your portfolio on a single trade

- Rule #2: If you don't understand the trade, don't take it

- Rule #3: Always know your maximum loss BEFORE entering any trade

The Biggest Lesson from Today's $1.69B Flow: Even institutions use spreads, hedges, and defined-risk strategies. If Wall Street isn't betting unlimited risk on their convictions, why should you? Smart options trading is about risk management first, profits second.

⚠️ Risk Management: The Most Important Section

Today's institutional flow shows us three critical risk management lessons:

Lesson #1: Even $839M Bets Use Defined-Risk Structures

TSM's massive flow wasn't naked calls - it was a diagonal spread. TTMI's 300x unusual activity was a bull call spread, not unlimited risk. GOOGL's $140M was a calendar spread. Take the hint: Define your risk.

Lesson #2: Mixed Flow = Uncertainty (See AAPL's $267M)

When institutions show mixed signals like AAPL's simultaneous buying and selling, it means uncertainty is high. Don't interpret unusual flow as a guaranteed direction. It's data, not prophecy.

Lesson #3: Timing Matters More Than Direction

Notice how the biggest flows target specific expiration windows? TSM February, AMZN February, META January, PEP December. Institutions aren't just betting on direction - they're betting on WHEN the move happens. Your timing must be equally precise.

The Golden Rules:

- Never risk more than 2-5% on any single trade (even if you see $839M institutional flow)

- Always use stop losses - even on "sure thing" trades

- Don't blindly copy institutional flow - they have different time horizons, risk profiles, and information than you

- Scale into positions - buy 1/3 now, 1/3 on confirmation, 1/3 on breakout

- Take profits - even institutions lock in gains (see AAPL's mixed flow)

📊 The Bottom Line

$1.69 billion doesn't flow into the options market on a random Thursday without reason. Today's institutional positioning tells us:

✅ AI infrastructure spending is accelerating (TSM $839M + AMZN $317M + GOOGL $140M) ✅ Bitcoin proxies are getting aggressive (MSTR $90M bull spread) ✅ Selective hedging is smart (PEP $7.4M puts, AAPL $267M mixed flow) ✅ Contrarian opportunities exist (CZR $3.9M bearish, TTMI $2M momentum)

But here's the truth: You don't need to trade all of these. Pick 1-2 setups that match your risk tolerance and time horizon. Size your positions appropriately. Use defined-risk strategies. And always, ALWAYS have an exit plan before you enter.

The institutions showed us their cards today. The question is: Are you disciplined enough to play your own hand?

📰 Redistribution & Copyright Notice

Original Content & Analysis by Ainvest.com

This comprehensive options flow analysis, including all proprietary unusual activity scores, institutional flow tracking, and actionable trade strategies, is original research produced by Ainvest.com and labs.ainvest.com.

Redistribution Policy:

- ✅ Personal use and reference permitted

- ✅ Sharing with immediate colleagues/friends allowed

- ❌ Commercial redistribution strictly prohibited

- ❌ Republishing in paid newsletters, blogs, or subscription services without written permission is prohibited

- ❌ Reselling or repackaging this content is prohibited

This analysis represents thousands of hours of infrastructure development, real-time data processing, and institutional-grade research. We invest heavily in providing this intelligence to our community. If you find this valuable, please respect our work by not redistributing for commercial purposes.

For licensing inquiries: Contact us at business@ainvest.com

This newsletter is for educational and informational purposes only. Options trading involves significant risk of loss. Past performance is not indicative of future results. Always conduct your own due diligence and consult with a qualified financial advisor before making investment decisions.

© 2025 Ainvest.com - All Rights Reserved