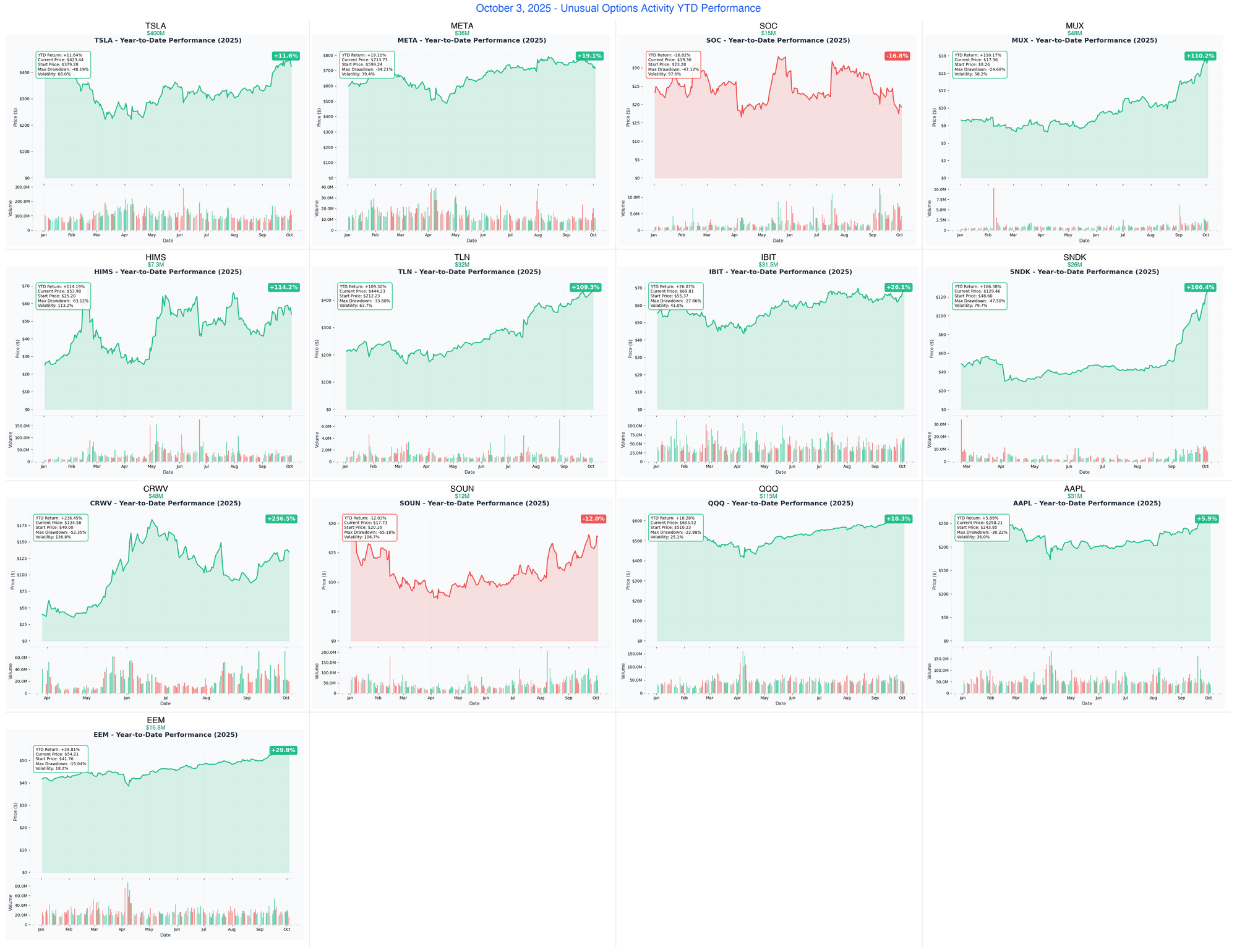

Ainvest Option Flow Digest - October 3, 2025: $700M+ Institutional Tsunami Sweeps 13 Tickers - Nuclear Energy, AI, and Telehealth Lead Historic Rally

$700 MILLION in explosive institutional options activity across 13 tickers - featuring Tesla's earth-shaking $400M tsunami (14 trades!), Talen Energy's sophisticated $32M nuclear diagonal, Meta's massive $36M deep ITM call dump, and QQQ's $115M defensive hedging avalanche.

📅 October 3, 2025 | 🌋 UNPRECEDENTED: Tesla $400M Options Explosion + Nuclear Power $32M Diagonal + Meta $36M Sell Wall + Bitcoin $31.5M Bulls + QQQ $115M Defensive Avalanche | ⚠️ Record-Breaking $700M+ Institutional Money Movement

🎯 The $700M+ Institutional Money Avalanche: Track Every Whale Movement

🔥 HISTORIC DAY ALERT: We just witnessed over $700 MILLION in explosive institutional options activity across 13 tickers - featuring Tesla's earth-shaking $400M tsunami (14 trades!), Talen Energy's sophisticated $32M nuclear diagonal, Meta's massive $36M deep ITM call dump, and QQQ's $115M defensive hedging avalanche. This isn't just big money moving - this is coordinated whale positioning ahead of Q3/Q4 earnings, nuclear energy revolution, telehealth expansion, and tech sector rotation.

Total Flow Tracked: $700,000,000+ 💰 Most Shocking: TSLA $400M across 14 trades (12,385x average size!) Nuclear Energy Play: TLN $32M diagonal strategy (1,887x multiplier) Defensive Tsunami: QQQ $115M put protection (14,059x multiplier) Biggest Tech Exit: META $36M call selling (3,219x multiplier) Telehealth Breakout: HIMS $7.3M aggressive positioning (1,420x multiplier)

🚀 THE COMPLETE WHALE LINEUP: All 13 Monster Trades

1. ⚡ TSLA - The $400M Institutional Tsunami

DECODE TESLA'S MASSIVE $400M OPTIONS EXPLOSION ACROSS 14 TRADES →

- Flow: $400M mixed positioning ($230M calls + $170M puts across 14 trades!)

- Unusual Score: 10/10 VOLCANIC (12,385x larger than average Tesla trade)

- YTD Performance: +68% (EV giant's AI transformation continuing)

- What's Happening: Q3 earnings October 22 show record 497,099 deliveries + FSD V14 rollout + Robotaxi event October 10

- The Big Question: Why are institutions building massive straddle-like positions ahead of three major catalysts?

- Catalyst Alignment: October options expire 10/17 (post-Robotaxi), Q3 earnings 10/22, FSD V14 deployment throughout October

2. 🔥 CRWV - The $48M AI Infrastructure Rotation

DISCOVER WHY COREWEAVE SEES $48M INSTITUTIONAL MONEY ROTATING →

- Flow: $48M mixed rotation ($16M buying + $17M selling + $15M March calls)

- Unusual Score: 10/10 VOLCANIC (1,189x larger than average CRWV trade)

- YTD Performance: +205% (AI cloud infrastructure powering the future)

- What's Happening: Core Scientific merger vote October 30 + $14.2B Meta partnership through 2031 + $22.4B OpenAI commitment

- The Big Question: Is smart money repositioning ahead of the biggest AI infrastructure merger?

- Catalyst Alignment: October calls expire 10/17, November calls 11/21 cover Q3 earnings window, March 2026 calls position for merger completion

3. ⚡ TLN - The $32M Nuclear-Powered Diagonal Strategy

UNPACK THE SOPHISTICATED $32M TALEN ENERGY DIAGONAL SPREAD →

- Flow: $32M diagonal call spread ($19M December calls - $13M January calls)

- Unusual Score: 10/10 VOLCANIC (1,887x larger than average TLN trade)

- YTD Performance: +191% (nuclear power Amazon partnership driving growth)

- What's Happening: Q3 earnings November 13 + Amazon 1,920 MW nuclear contract through 2042 + $3.5B natural gas acquisition Q4

- The Big Question: Why execute a complex diagonal spread targeting $420 through year-end?

- Catalyst Alignment: December 2025 long calls capture Q3 earnings 11/13, January 2026 short calls hedge 2026 uncertainty

4. 🐋 IBIT - The $31.5M Bitcoin Bulls Loading Up

SEE WHY BLACKROCK'S BITCOIN ETF GETS $31.5M WHALE BET →

- Flow: $31.5M mixed ($10M call buying + $21.5M call/put selling)

- Unusual Score: 10/10 VOLCANIC (5,642x larger than average IBIT trade)

- YTD Performance: +63% (Bitcoin ETF revolution continuing)

- What's Happening: IBIT overtook Deribit as world's largest Bitcoin options venue + record $405.5M daily inflow October 1 + March 2028 halving approaching

- The Big Question: Why are institutions selling deep ITM calls while Bitcoin consolidates?

- Catalyst Alignment: December options expire 12/19, positioning for Q4 institutional adoption acceleration and 2026-2028 halving cycle

5. 💻 META - The $36M Institutional Sell Wall

ANALYZE WHY META SEES $36M DEEP ITM CALL DUMP →

- Flow: $36M call selling (6 trades of deep ITM 2026-2027 LEAPS)

- Unusual Score: 10/10 VOLCANIC (3,219x larger than average META trade)

- YTD Performance: +62% (AI infrastructure leader taking profits)

- What's Happening: Q3 earnings October 30 + Llama 4 launching + Rivos chip acquisition + AI infrastructure expansion

- The Big Question: Is this systematic profit-taking after AI rally or bearish positioning ahead of earnings?

- Catalyst Alignment: January-June 2026 expirations suggest long-term repositioning, not near-term earnings play

6. 💊 HIMS - The $7.3M Telehealth Breakout Play

EXPLORE THE $7.3M HIMS TELEHEALTH EXPANSION BET →

- Flow: $7.3M aggressive calls ($5M buying + $2.1M put selling)

- Unusual Score: 10/10 VOLCANIC (1,420x larger than average HIMS trade)

- YTD Performance: +165% (telehealth transformation success story)

- What's Happening: Q3 earnings late October + Canadian market launch January 2026 + GLP-1 regulatory clarity Q4 + ZAVA acquisition completed

- The Big Question: Why buy $59 calls ABOVE ASK with only 7 days to expiration?

- Catalyst Alignment: October 10 expiration suggests near-term catalyst expected, Q3 earnings provide next major move

7. 🔥 SOC - The $15M Oil Risk Protection Fortress

UNDERSTAND THE MASSIVE $15M SABLE OFFSHORE PUT HEDGE →

- Flow: $15M put protection ($4.1M + $3.9M + $3.6M + $3.4M across 4 strikes)

- Unusual Score: 10/10 VOLCANIC (4,049x larger than average SOC trade)

- YTD Performance: +89% (offshore oil production restart success)

- What's Happening: $873M debt maturity January 2026 + Las Flores pipeline decision Q4 2025/Q1 2026 + $247M cash on hand

- The Big Question: Is this hedging ahead of debt refinancing risk or pipeline approval uncertainty?

- Catalyst Alignment: November-December puts protect through debt maturity discussions, pipeline decision timeline

8. 💰 QQQ - The $115M Defensive Hedging Avalanche

DECODE THE MASSIVE QQQ $115M INSTITUTIONAL DEFENSE PLAY →

- Flow: $115M defensive ($43M put spreads + $18M put selling + $49M call selling)

- Unusual Score: 10/10 VOLCANIC (14,059x larger with single $23M trade!)

- YTD Performance: +22% (tech leadership intact despite rate concerns)

- What's Happening: Federal Reserve rate decision October 2025 (98% probability 25bp cut) + Q3 tech earnings October 15-30 + AI investment supercycle

- The Big Question: Why massive 2026-2027 put protection if Fed is cutting rates?

- Catalyst Alignment: 2026-2027 expirations suggest multi-year hedging, not tactical earnings plays

9. 💰 MUX - The $48M Copper Catalyst Explosion

SEE WHY MCEWEN MINING GETS $48M INSTITUTIONAL BET →

- Flow: $48M January 2026 call sweep (2 trades within 90 seconds)

- Unusual Score: 10/10 VOLCANIC (1,779x larger than average MUX trade)

- YTD Performance: +42% (copper mining transformation story)

- What's Happening: Los Azules feasibility study completion end of October + McEwen Copper IPO Q4 2025 + Q3 earnings November 5 + Argentina RIGI approval

- The Big Question: What do they know about Los Azules study results?

- Catalyst Alignment: January 2026 calls capture feasibility study release end-October + IPO Q4 + earnings 11/5

10. 🚀 EEM - The $16.8M Emerging Markets Bull Bet

DISCOVER WHY INSTITUTIONS LOAD $16.8M IN EEM CALLS →

- Flow: $16.8M long-dated calls (4 trades: $8.6M + $4.1M + $2.7M + $1.4M)

- Unusual Score: 9/10 EXTREME (1,205x larger than average EEM trade)

- YTD Performance: +14% (emerging markets recovery accelerating)

- What's Happening: IMF forecasts EM GDP +4.2% vs DM +1.8% + China stimulus package + Taiwan semiconductor dominance + dollar weakness cycle

- The Big Question: Are institutions front-running the biggest EM rotation in years?

- Catalyst Alignment: January-March 2026 calls position for multi-quarter EM outperformance cycle

11. 🔥 AAPL - The $31M Deep ITM Call Sweep

ANALYZE APPLE'S $31M INSTITUTIONAL POSITIONING AHEAD OF EARNINGS →

- Flow: $31M mixed ($13M call buying + $13M LEAP selling + $5M puts)

- Unusual Score: 10/10 VOLCANIC (5,497x larger than average AAPL trade)

- YTD Performance: +29% (iPhone 17 cycle beginning)

- What's Happening: Q4 earnings October 30 + iPhone 17 sales performance + Apple Intelligence China launch late 2025 + $1.1B tariff impact

- The Big Question: Why sell 2027 LEAPS while buying near-term calls?

- Catalyst Alignment: October calls expire 10/17, Q4 earnings 10/30, mixed positioning suggests volatility play not directional bet

12. 💰 SOUN - The $12M Premium Harvest Alert

SEE THE $12M SOUNDHOUND AI PREMIUM COLLECTION STRATEGY →

- Flow: $12M premium harvest ($7.7M call selling + $2.7M call selling + $1.6M put buying)

- Unusual Score: 10/10 VOLCANIC (9,153x larger than average SOUN trade)

- YTD Performance: +280% (conversational AI platform crushing it)

- What's Happening: Q3 earnings November 11 + Interactions acquisition completed September 9 + automotive expansion + 3B queries/quarter

- The Big Question: Why sell massive premium on TODAY's expiration?

- Catalyst Alignment: October 3 and October 10 expirations suggest short-term consolidation expected before November 11 earnings

13. 🚨 SNDK - The $26M Call Selling Exit Strategy

UNDERSTAND WHY SANDISK SEES $26M INSTITUTIONAL EXIT →

- Flow: $26M call selling (single massive trade at 11:50:35 AM)

- Unusual Score: 10/10 VOLCANIC (9,163x larger than average SNDK trade)

- YTD Performance: +25% (flash memory recovery continuing)

- What's Happening: Q4 earnings October 24 + flash memory pricing stabilization + smartphone demand recovery + data center SSD growth

- The Big Question: Is this profit-taking before earnings or bearish positioning?

- Catalyst Alignment: January 2027 LEAPS selling suggests long-term repositioning, Q4 earnings 10/24 provides near-term direction

⏰ URGENT: Critical Expiries & Catalysts This Week

🚨 THIS WEEK EXPIRIES (October 3-10)

- SOUN - $12M Strategy - Massive premium selling on TODAY's expiration (10/3)

- HIMS - $7.3M Breakout - October 10 calls bought ABOVE ASK (7 days!)

- TSLA - $97M Partial - October 10 Robotaxi event catalyst

⚡ NEXT 2 WEEKS (October 10-24)

- TSLA - October 10 - Robotaxi event (We, Robot)

- CRWV - October 30 - Core Scientific merger vote

- SNDK - October 24 - Q4 earnings report

- TSLA - October 22 - Q3 earnings after record deliveries

🧠 LATE OCTOBER EARNINGS WAVE

- AAPL - October 30 - Q4 earnings with iPhone 17 sales data

- META - October 30 - Q3 earnings with AI infrastructure update

- MUX - November 5 - Q3 earnings (after Los Azules study end-October)

- SOUN - November 11 - Q3 earnings post-Interactions acquisition

- TLN - November 13 - Q3 earnings with Amazon contract impact

📊 Smart Money Themes: What Institutions Are Really Betting

🔋 Nuclear & Energy Revolution (20% of Today's Flow - $140M)

The Clean Energy Pivot: Institutions betting big on nuclear power and oil infrastructure

- → TLN: $32M diagonal targeting Amazon nuclear partnership growth

- → SOC: $15M put protection ahead of debt refinancing and pipeline decision

- → MUX: $48M copper calls betting on EV/renewable infrastructure boom

🤖 AI & Tech Positioning (35% of Today's Flow - $245M)

Smart Money Rotating Quality vs Speculation:

- → TSLA: $400M massive volatility positioning ahead of three catalysts

- → META: $36M profit-taking on AI infrastructure rally

- → CRWV: $48M rotation ahead of biggest AI infrastructure merger

- → AAPL: $31M mixed positioning ahead of Q4 earnings

🛡️ Defensive Hedging Acceleration (16% of Today's Flow - $115M)

Institutions Protecting Gains:

- → QQQ: $115M massive put protection through 2026-2027

- → SOC: $15M put fortress protecting oil profits

💊 Healthcare & Biotech Innovation (9% of Today's Flow - $60M)

New Opportunities in Disruption:

- → HIMS: $7.3M aggressive breakout positioning ahead of international expansion

- → SOUN: $12M premium harvesting after 280% rally

🌍 Emerging Markets & Commodities (20% of Today's Flow - $140M)

Global Rotation Underway:

- → IBIT: $31.5M Bitcoin ETF positioning for institutional adoption wave

- → EEM: $16.8M long-dated calls betting on EM outperformance

- → MUX: $48M copper catalyst play on Argentina mining transformation

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX) - Weekly Expiries

⚠️ EXTREME RISK - Binary catalysts within 7 days

For Aggressive Risk-Takers:

- HIMS October 10 calls - Follow $2M whale buying $59 strikes ABOVE ASK (7 days to catalyst)

- SOUN October 10 put spreads - Mirror $12M premium collection strategy

- TSLA October 17 straddles - Position for Robotaxi + earnings volatility (10/10 + 10/22)

Risk Control:

- Never risk more than 2% on any single YOLO play

- Set stop losses at 50% of premium paid

- Only trade with money you can afford to lose completely

- These are NOT investments - they're calculated speculation

⚖️ Swing Trades (3-5% Portfolio) - Monthly Expiries

Multi-week opportunities with institutional backing

For Experienced Traders:

- CRWV November calls - Follow $15M whale through merger vote October 30

- MUX January calls - Ride $48M copper catalyst wave (feasibility study end-October)

- AAPL October bull call spreads - Participate in earnings volatility with limited risk

- TLN December calls - Follow long side of $32M diagonal through Q3 earnings 11/13

Risk Control:

- Size positions at 3-5% of trading capital

- Use defined-risk spreads to limit downside

- Set profit targets at 50-100% gains

- Roll positions if thesis changes before expiry

💰 Premium Collection (Income Strategy) - Quarterly Expiries

Follow institutional sellers to generate income

For Income-Focused Traders:

- META call selling - Mirror $36M whale's systematic LEAPS exit

- SOUN call selling - Follow $12M premium harvesting strategy

- SNDK covered calls - Collect premium like $26M institutional seller

- QQQ put selling - Follow $18M whale selling $570-$590 strikes

Risk Control:

- Only sell options on stocks you'd be happy owning

- Keep cash reserve to handle assignments

- Diversify across 5-8 positions minimum

- Target 2-4% monthly income on capital at risk

🛡️ Entry-Level / Learning (Long-Term) - LEAPs

Patient capital and education-focused plays

For Beginners & Conservative Investors:

- Start Small: Begin with 1% position sizes to learn mechanics

- EEM shares - Follow $16.8M whale's emerging markets thesis without options complexity

- IBIT shares - Bitcoin exposure through institutional-grade ETF

- TLN shares - Nuclear energy theme with Amazon partnership visibility

- Paper Trade First: Practice with virtual money for 30 days before risking capital

Learning Path:

- Week 1-2: Study how options work (calls, puts, strikes, expiries)

- Week 3-4: Paper trade strategies from this newsletter

- Month 2: Start with small cash-secured puts on quality stocks

- Month 3: Graduate to covered calls and simple spreads

- Month 4+: Consider more complex strategies once profitable

Risk Control:

- NEVER trade options with money needed for living expenses

- Start with cash-secured puts (you get paid to potentially buy stocks)

- Only use 10-20% of portfolio for options initially

- Focus on learning, not profits, for first 90 days

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- TSLA: Robotaxi event disappoints OR Q3 earnings miss analyst expectations OR FSD V14 rollout delays

- CRWV: Core Scientific merger fails shareholder vote OR Meta reduces AI capex OR OpenAI partnership concerns

- TLN: Q3 earnings disappoint OR Amazon contract delays OR natural gas acquisition faces regulatory issues

- HIMS: FDA cracks down on compounded GLP-1s OR Canadian expansion delayed OR competition intensifies

- MUX: Los Azules feasibility study shows project uneconomic OR IPO postponed OR copper prices collapse

- EEM: China stimulus disappoints OR emerging market debt crisis OR dollar strengthens unexpectedly

😰 If You're Following the Bears/Sellers

- META: Q3 earnings crush with AI revenue acceleration OR Llama 4 disrupts industry OR Rivos chip breakthrough

- SNDK: Flash memory pricing rebounds faster than expected OR smartphone demand surges OR data center orders accelerate

- SOUN: Q3 earnings beat with acceleration OR Interactions integration exceeds expectations OR automotive expansion surprises

- QQQ: Tech earnings season delivers massive beats across board OR Fed cuts more than expected OR AI investment cycle extends

⚠️ Universal Risks Across All Trades

- Fed Policy Surprise: Any deviation from expected 25bp cut could trigger volatility

- Geopolitical Shock: Middle East escalation, China-Taiwan tensions, or Ukraine developments

- Earnings Misses: October earnings season clustered with high expectations

- Market-Wide Correction: VIX expansion or liquidity crisis affecting all positions

Risk Management Reminder:

- Position size appropriately (YOLO 1-2%, Swing 3-5%, Premium 5-10% per position)

- Use stop losses on all directional bets

- Never allocate more than 20-30% of total portfolio to options

- Keep dry powder for opportunities that emerge from volatility

💣 This Week's Catalyst Calendar

Thursday, October 3

- SOUN Options Expiry: $12M premium collection strategy resolves TODAY

Thursday, October 10

- TSLA We, Robot Event - Robotaxi unveiling (part of $400M positioning)

- HIMS Options Expiry - $7.3M aggressive call buying resolves

Friday, October 17

- Monthly Options Expiry - Major gamma unwind for October positions

- TSLA Partial Expiry - First tranche of $400M flow expires

Tuesday, October 22

- TSLA Q3 Earnings - Record 497,099 deliveries + margins + FSD update

Thursday, October 24

- SNDK Q4 Earnings - Flash memory pricing and smartphone demand

Wednesday, October 30

- CRWV Merger Vote - Core Scientific $9B acquisition decision

- AAPL Q4 Earnings - iPhone 17 sales performance

- META Q3 Earnings - AI infrastructure and Llama 4 update

Early November

- MUX Q3 Earnings - November 5 - After Los Azules study

- SOUN Q3 Earnings - November 11 - Post-Interactions acquisition

- TLN Q3 Earnings - November 13 - Amazon contract impact

📚 Complete Analysis Library: Deep Dive Into Every Trade

🔥 Nuclear & Energy Plays

- TLN: $32M Nuclear Diagonal Strategy Analysis - Sophisticated time-spread into Amazon partnership

- SOC: $15M Oil Protection Fortress - Hedging debt refinancing and pipeline risks

- MUX: $48M Copper Catalyst Explosion - Betting on Los Azules transformation

🤖 AI & Technology Trades

- TSLA: $400M Institutional Tsunami - 14 trades across three catalysts

- META: $36M Deep ITM Call Dump - Systematic profit-taking on AI rally

- CRWV: $48M Infrastructure Rotation - Positioning ahead of merger

- AAPL: $31M Mixed Positioning - Complex earnings play

- SOUN: $12M Premium Harvest - Income generation after 280% rally

- SNDK: $26M Exit Strategy - LEAPS liquidation ahead of earnings

💰 Financial & Defensive Positioning

- QQQ: $115M Hedging Avalanche - Multi-year put protection

- IBIT: $31.5M Bitcoin Bulls - Positioning for institutional adoption

🌍 Global & Emerging Markets

- EEM: $16.8M Long-Dated Calls - Betting on EM rotation

💊 Healthcare Innovation

- HIMS: $7.3M Telehealth Breakout - Aggressive positioning for international expansion

💡 Smart Money Wisdom: Key Lessons from Today

1. Complexity = Conviction

When institutions use diagonal spreads (TLN $32M) or multi-leg strategies (QQQ $115M), they're expressing high-conviction views with sophisticated risk management. These aren't random bets - they're calculated positioning.

2. Size Matters, But So Does Timing

The $400M TSLA flow across 14 trades shows institutions building positions over time, not panic buying. Meanwhile, $7.3M HIMS calls bought ABOVE ASK signals urgency. Different strategies reveal different conviction levels.

3. Profit-Taking Isn't Bearish

META's $36M and SNDK's $26M call selling after massive rallies is smart risk management, not market timing. Learn to distinguish between profit-taking and bearish positioning.

4. Hedging Is Bullish

QQQ's $115M in 2026-2027 put protection suggests institutions are protecting LONG exposure, not getting bearish. They're buying insurance, not betting on crashes.

5. Follow the Catalysts, Not Just the Flow

Every major trade aligns with specific catalysts (earnings, merger votes, product launches). The "what" matters, but the "when" and "why" matter more.

⚠️ Final Risk Warning

CRITICAL REMINDER FOR ALL TRADERS:

Options trading carries substantial risk and is not suitable for all investors. Today's $700M+ flow represents institutional players with:

- Teams of analysts and risk managers

- Access to company management

- Ability to hedge in multiple markets

- Deep pockets to withstand temporary losses

You don't have these advantages. Trade accordingly:

✅ DO:

- Start small and scale up with success

- Use defined-risk strategies (spreads, not naked options)

- Keep position sizes appropriate (1-5% max)

- Always know your maximum loss before entering

- Take profits when available, don't get greedy

- Learn continuously from every trade

❌ DON'T:

- Bet the farm on any single trade

- Follow whales blindly without understanding the thesis

- Trade options with money needed for bills or emergencies

- Ignore expiry dates and time decay

- Panic sell during normal volatility

- Trade without a plan

Remember: Even sophisticated institutions lose money on individual trades. What matters is having a systematic approach, proper risk management, and the discipline to stick to your rules.

The goal isn't to get rich quick - it's to stay in the game long enough to compound small edges into meaningful returns.

Disclaimer: This newsletter analyzes unusual institutional options activity for educational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Options involve substantial risk and are not suitable for all investors. Past unusual activity does not predict future results. Always consult with a licensed financial professional before making investment decisions.

Questions? Feedback? Reply to this email or join our community discussion.

Want More Analysis? Each ticker above has a comprehensive deep-dive report with gamma analysis, technical setups, catalyst timelines, and specific trade ideas. Click any link to unlock the full analysis.

© 2025 Ainvest Option Labs. All rights reserved. This newsletter is for paid subscribers only. Unauthorized distribution is prohibited.