Ainvest Option Flow Digest - October 17, 2025

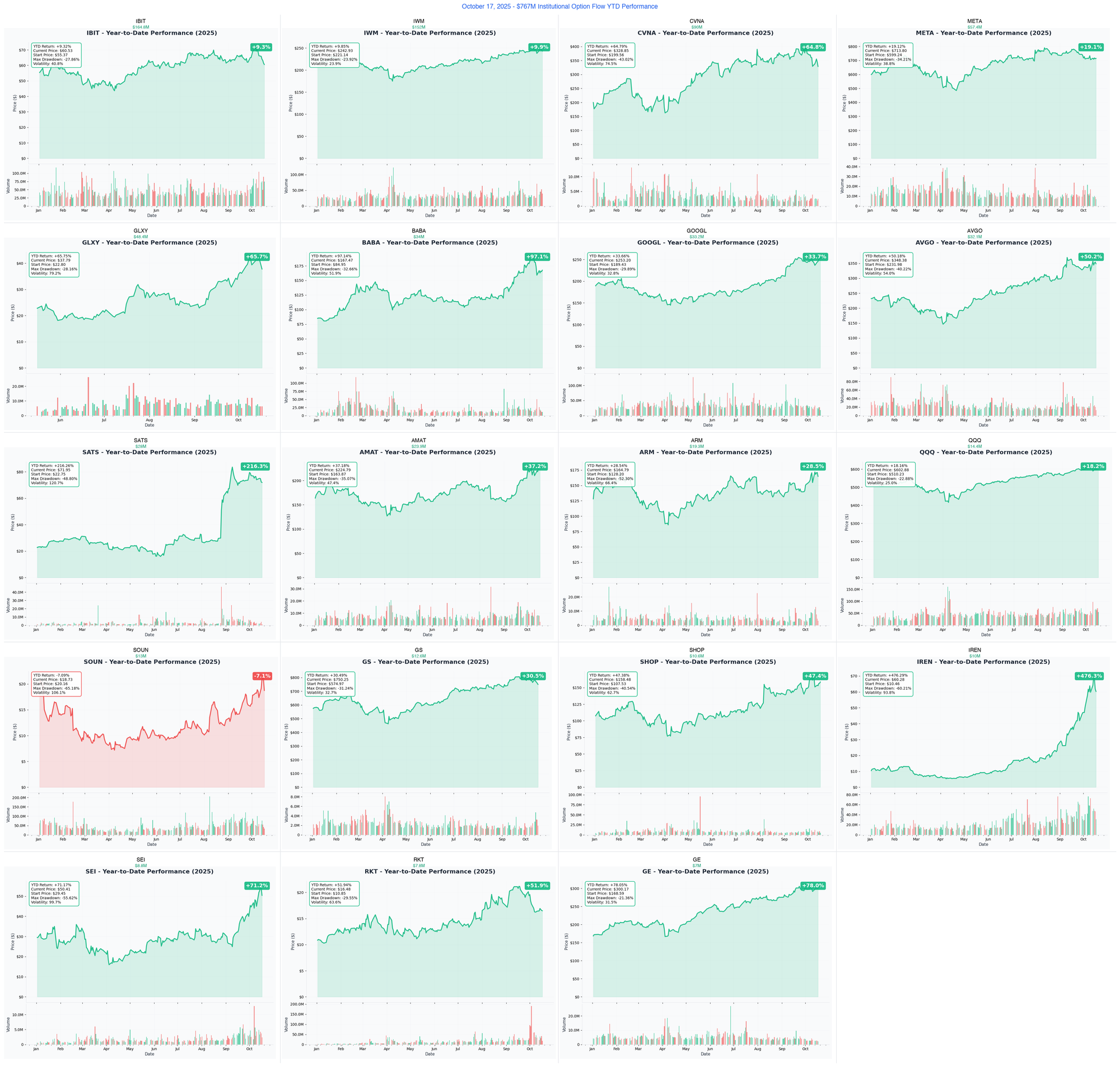

$767M across 19 tickers marks Q4 2025's biggest option flow day. Big money loads Bitcoin exposure via IBIT's $71M iron condor, shorts small-caps with IWM's $76M calls, and hedges earnings with Carvana's $45M bearish puts and Alibaba's $17M bullish bet.

🚨 $767M INSTITUTIONAL TSUNAMI: Smart Money Bets Big on Bitcoin, Bearish on Small Caps & Tech

What's Happening Today:

Institutional money just deployed $767 million across 19 tickers in what appears to be the most significant option flow day of Q4 2025. The story is clear: Big money is loading up on Bitcoin exposure through IBIT's $71M iron condor, betting against small-cap rallies with IWM's $76M double short calls, and taking massive hedges ahead of critical earnings catalysts. From Carvana's $45M bearish put ladder 12 days before earnings to Alibaba's $17M bullish bet on Singles' Day, today's flow reveals exactly where smart money sees opportunity—and risk.

The Standouts:

- 🟦 Bitcoin Believer: BlackRock's IBIT sees $71M iron condor betting BTC stays $116K-$160K through June 2027

- 🐻 Small-Cap Skeptic: Someone's saying "not so fast" on Russell 2000 with $76M in naked short calls at $250

- 🚗 Carvana Crash Bet: $45M put ladder positioned for 20%+ drop before Oct 29 earnings—Amazon competition heating up?

- 🐉 China Bull Run: Alibaba's $17M deep ITM call signals confidence ahead of Singles' Day mega-shopping event

- 🔌 SpaceX Spectrum Play: EchoStar's $14M deep call tsunami bets on $40B spectrum deal approvals

19 tickers, $767M in premium, one day of unprecedented institutional positioning

📊 Market Pulse: What The Flow Is Telling Us

Today's $767 million in option flow isn't random—it's a coordinated institutional response to converging catalysts across multiple sectors. Here's what the smart money sees:

The Bitcoin Conviction Trade

IBIT's $71M iron condor isn't betting on Bitcoin going to the moon—it's betting on controlled appreciation. With $22.8M in net premium collected, this institutional player expects Bitcoin to trade between $116K-$160K over the next 20 months. Translation: The explosive crypto volatility is over; we're entering the institutional adoption phase. Luxembourg's sovereign wealth fund just allocated 1% to Bitcoin, and Standard Chartered predicts $200K by year-end. But smart money? They're selling volatility, not buying it.

The Small-Cap Top Call

IWM's $76M double short call strategy at $250 and $260 strikes is institutional money saying "the party's over" for small caps. After hitting their first record high in four years, Russell 2000 faces headwinds: 30-33% of constituents are unprofitable, Fed rate cuts are already priced in, and 40% EPS growth expectations seem too optimistic. The gamma data backs this up—weak call gamma above $250 means any breakout attempt will face sellers.

Earnings Season Hedging Frenzy

The clustering of massive bearish bets ahead of earnings is striking:

- CVNA: $45M put ladder 12 days before Q3 earnings (Oct 29)—up 63% YTD but facing Amazon-Hertz competition

- META: $19M bear call spread with Oct 31 expiration, just 2 days after Oct 29 earnings

- GLXY: $24M bearish puts 4 days before Oct 21 earnings—even after 248% six-month rally

What this means: Even winners need protection. After massive YTD runs (CVNA +63%, GLXY +66%), smart money hedges ahead of binary events.

🎯 Today's Unusual Activity Deep Dives

🟦 IBIT: The $71M Bitcoin Range Trade

Premium: $71M | Strategy: Iron Condor | Expiration: June 2027

BlackRock's IBIT just saw the most sophisticated institutional Bitcoin play of 2025. This isn't a "Bitcoin to $500K" moonshot—it's a calculated bet on controlled institutional adoption. The trader collected $22.8M in net premium by selling the $65-$90 range and buying $55-$140 wings for protection.

What makes this fascinating: The gamma setup shows massive support at $60 (275M GEX) and the $65 short put strike sits perfectly above it. Market makers will defend that level aggressively. Meanwhile, Luxembourg became the first Eurozone sovereign wealth fund to buy Bitcoin through IBIT—setting a precedent for the 4 nations and 5 U.S. states expected to adopt strategic reserves by end of 2026.

YTD Performance: +9.0% despite 40.8% volatility—resilient through Q1 correction

For Different Traders:

- YOLO: Counter-trade with Jan 2027 $70/$100 call spreads if you think Bitcoin explodes past $160K

- Swing: Mini iron condors on Nov/Dec expirations—capture same thesis, shorter timeframe

- Premium Collectors: Covered calls at $70-$80 strikes generate 9% annualized income

- Entry Level: Study how institutions use iron condors—this is masterclass-level positioning

🐻 IWM: The $76M Small-Cap Ceiling

Premium: $76M | Strategy: Double Naked Short Calls | Expirations: Dec '25, June '26

After four years of underperformance, Russell 2000 finally hit new highs in September. But someone just sold $76M worth of naked calls at $250 (Dec) and $260 (June '26), betting the rally stalls here. The conviction? This represents $915M in notional exposure per leg.

The bear case is compelling: Small caps now trade with 40% EPS growth expectations baked in, but 30-33% of the index is unprofitable. The gamma data shows weak call resistance above $250—if this level holds through December, it confirms the top. Bulls need to see earnings deliver on those lofty expectations, or this trade prints $76M.

YTD Performance: +9.64% | Gamma Resistance: $250 (first strike), $260 (second strike)

For Different Traders:

- YOLO: Bull call spreads $245/$255 if you think rate cuts spark small-cap rotation (contrarian bet against institutional flow)

- Swing: Wait for $238-240 support test before entering long—40% EPS growth story is real if they deliver

- Premium Collectors: Follow smart money with mini short call spreads $250/$255 (Dec expiration)

- Entry Level: This shows how pros use naked options to express macro views—requires serious capital and risk management

🚗 CVNA: The $45M Pre-Earnings Protection Play

Premium: $45M | Strategy: Bear Put Ladder | Expiration: January 2026

Carvana is up 63% YTD, trading at 85-107x P/E, and facing Amazon-Hertz competition. Twelve days before Q3 earnings, someone deployed $45M across five put strikes ($250-$290) in a classic bear put ladder. The heaviest positioning—$11M at the $290 strike—expects at least a 13% decline.

Timing is everything: This comes after CEO Ernest Garcia III sold $5M+ worth of shares in October at $348-$393. The Amazon-Hertz partnership announced in August already triggered a 4.2% drop. With Q3 earnings on October 29 and the stock 17% off its April highs, this institutional player is betting the 248% six-month rally needs a reset.

Gamma Setup: Breaking $325 support triggers vacuum to $310, then $300—exactly what put buyers want

For Different Traders:

- YOLO: Contrarian bull—sell cash-secured $280 puts if you believe turnaround story (effective entry $260-265)

- Swing: Follow the flow with Jan '26 $290/$270 put spread (2:1 risk-reward, defined risk through earnings)

- Premium Collectors: If assigned shares at $280, you're buying the dip on the e-commerce transformation story

- Entry Level: Study how institutions use put ladders for protection—spreading risk across multiple strikes

🐉 BABA: The $17M Singles' Day Bull Play

Premium: $17M | Strategy: Deep ITM Calls | Expiration: December 2025

Alibaba is having a monster year (+96% YTD), and someone just dropped $17M on deep in-the-money $110 calls with the stock at $166. This isn't speculation—it's leveraged stock ownership with limited downside. The trade controls $49M worth of BABA stock for just $17M, with 95 delta exposure.

Catalyst Stack: Singles' Day launching NOW (world's largest shopping event with 50 billion yuan in subsidies), Q2 earnings November 13-14 (expecting strong beat), Jack Ma's return to active leadership, and $50B AI infrastructure buildout finally showing ROI. Alibaba Cloud grew 26% YoY with AI products maintaining triple-digit growth for 8 consecutive quarters.

YTD Performance: +96.4% | Gamma Support: $165 (53.1M GEX) creates massive floor

For Different Traders:

- YOLO: ATM $167.50/$170 calls for maximum gamma exposure if Singles' Day blows out

- Swing: $165/$180 call debit spread positioned between strongest support/resistance (Dec expiration)

- Premium Collectors: Shares + $178 covered calls capture base case move with income generation

- Entry Level: Deep ITM calls show how institutions get leveraged exposure with risk control—powerful educational trade

📡 SATS: The $14M SpaceX Spectrum Tsunami

Premium: $14M | Strategy: Deep ITM Calls | Expiration: December 2025

EchoStar transformed from near-bankruptcy to a $40 billion spectrum deal with SpaceX ($17B) and AT&T ($22.65B). Someone just bet $14M on deep ITM $50 calls with stock at $72—that's 44.9% in-the-money, functioning like leveraged stock. The conviction? This 6,000-contract position (167% of open interest) expects the transformation to accelerate.

The Opportunity: FCC approval expected Q4 2025-Q1 2026 unlocks $31B+ cash and $9.5B SpaceX equity stake. Boost Mobile becomes Starlink's exclusive terrestrial partner for direct-to-cell service—potentially revolutionary. But the trade expires December 19, capturing Q3 earnings (Nov 11) and potential regulatory news, not waiting until 2026 closings.

YTD Performance: +216% | Gamma Support: $70 (10M GEX) provides major floor

For Different Traders:

- YOLO: Follow the whale with deep ITM $60 calls (lower strike = more leverage, 17% cushion)

- Swing: $75/$85 debit call spread targets previous highs with defined risk (3:1 reward-risk)

- Premium Collectors: Shares + $78-80 covered calls generate income during consolidation before FCC decision

- Entry Level: This transformation story—from distressed to SpaceX partner—shows how catalysts can reshape valuations rapidly

🔵 META: The $19M Post-Earnings Bear Bet

Premium: $19M | Strategy: Synthetic Short | Expiration: October 31

Meta reports Q3 earnings October 29, and someone just executed a $19M synthetic short at the $660 strike (stock at $710). This trader collected $16M selling calls and bought $3.2M in puts—betting META pulls back or consolidates after the report. The Oct 31 expiration (just 2 days post-earnings) shows this is tactical positioning, not a fundamental short.

The Setup: After +19% YTD and hitting $800 in July, META has pulled back to $710. The gamma data shows massive resistance at $715 (35.4M GEX) and critical support at $710 (31.9M GEX)—creating a tight trading range. Wall Street expects strong Q3 results, but this trader thinks the AI infrastructure spending narrative needs more proof.

For Different Traders:

- YOLO: Counter-trade with $715/$750 bull call spreads if you believe AI monetization surprises (Nov expiration)

- Swing: Long straddle at $710 captures volatility either direction—need >8% move to profit

- Premium Collectors: Bull put spread $700/$695 rides massive gamma support at $710 with defined risk

- Entry Level: Synthetic shorts show how institutions create bearish exposure while collecting premium—advanced strategy

💎 GLXY: The $24M Crypto-AI Bear Play

Premium: $24M | Strategy: Bearish Put Spread | Expiration: October 17 & 24

Galaxy Digital sits at the intersection of crypto finance and AI infrastructure, up 66% YTD. But someone just deployed $24M in bearish puts ahead of October 21 Q3 earnings—including $7.8M in SAME-DAY expiration puts! The conviction? Even with the $460M strategic investment closing and CoreWeave partnership, near-term pressure is coming.

The Concerns: Trading at 7.1% above analyst fair value estimates despite 248% six-month rally. The $38 gamma resistance level (55.9M GEX) creates an iron ceiling, while put gamma dominates the structure 2.3:1. With Bitcoin volatility elevated and regulatory approvals needed for CoreWeave buildout, this trade bets on "sell-the-news" reaction to earnings.

For Different Traders:

- YOLO: Aggressive call buyers targeting $40-42 if earnings beat significantly and BitcoinBull sentiment returns

- Swing: Oct 24 $37.50/$35 put spread mimics institutional positioning with defined risk through earnings

- Premium Collectors: Wait for post-earnings clarity—IV crush will make selling premium more attractive

- Entry Level: This shows event-driven hedging—even 66% YTD winners need protection before catalysts

🔍 GOOGL: The $11M Synthetic Long Before Earnings

Premium: $11M | Strategy: Synthetic Long | Expiration: October 31

Alphabet reports October 29, and institutional money just deployed $11M on a synthetic long position at $230 strike (stock at $252). This trader bought deep ITM $230 calls for $10M while selling $230 puts for $1.1M—creating 1:1 stock exposure with October 31 expiration just 2 days after earnings.

The Bull Case: Cloud revenue hitting $50B annual run rate, Google securing $10B+ 6-year contract with Meta, and AI Overviews proving they generate equivalent ad revenue to traditional search. Federal court ruling in September avoided Chrome/Android breakup and preserved the $20-26B annual Apple search deal. The gamma setup shows massive support at $250 (82M GEX) providing a strong floor.

YTD Performance: +33.2% | Breakeven: $252.50 (current price + premium paid)

For Different Traders:

- YOLO: $255/$265 call spread targets gamma breakout above resistance (Oct 31 for earnings exposure)

- Swing: Smaller synthetic long (5-10 contracts) mimics institutional strategy at reduced scale

- Premium Collectors: Bull put spread $250/$245 rides massive gamma wall with attractive risk-reward

- Entry Level: Synthetic longs provide leveraged exposure with defined risk—compare to buying shares outright

🚀 AVGO: The $10M Contrarian Short

Premium: $10M | Strategy: Synthetic Short | Expiration: October 31

Broadcom rallied 10% on the OpenAI partnership announcement and sits +50% YTD. But someone just executed a $10M synthetic short at $315 strike with stock at $347—betting on near-term consolidation or pullback. The trade collected $11M selling calls while buying $1.1M in put protection.

The Bear Thesis: Trading at 88-90x forward P/E after explosive rally, $350 gamma resistance creates massive wall (40.49M GEX), and VMware pricing controversy continues in Europe. The Oct 31 expiration (well before Dec 11 earnings) shows this is tactical positioning for profit-taking, not a fundamental short on AVGO's AI story.

For Different Traders:

- YOLO: Counter-trade with $350/$370 bull call spreads betting on continued AI momentum (Nov expiration)

- Swing: Iron condor $335/$355 range captures consolidation in gamma bands before December catalyst

- Premium Collectors: Wait for $350 breakout or $330 breakdown—don't fight the tape in tight ranges

- Entry Level: This shows even AI winners face profit-taking—valuation matters even in growth stories

⏰ Time-Sensitive Catalysts (Don't Miss These!)

This Week's Binary Events

October 21 (Monday) - GLXY Q3 Earnings: $24M bearish puts expire Oct 24 | Analyst estimates: -$1.23 EPS, $3.75B revenue | Key: $460M investment closing details and CoreWeave partnership update

October 24 (Thursday) - Multiple Expirations: CVNA $45M put ladder, GLXY puts, SOUN $6.5M synthetic long all settle

October 29 (Tuesday) - Mega-Cap Earnings Triple Header:

- META Q3 Earnings (after close): $19M synthetic short expires Oct 31 | Consensus: $2.12 EPS, $64B revenue

- GOOGL Q3 Earnings (after close): $11M synthetic long expires Oct 31 | Estimates: $1.86 EPS, $17.4B revenue

- CVNA Q3 Earnings (after close): $45M put ladder targeting 20%+ drop | Expected: $1.25-1.30 EPS

October 31 (Thursday) - Judgement Day: META, GOOGL, and AVGO options expire—$40M+ settles based on earnings reactions

Next Month's Major Catalysts

November 11 (Tuesday) - Earnings Marathon:

- SATS Q3 Earnings (before open): $14M deep calls positioned through this | Focus: Spectrum deal regulatory updates

- SOUN Q3 Earnings (after close): $6.5M position targets pre-earnings move | Expected: -$0.04 EPS, $40M revenue

November 13-14 - BABA Q2 Earnings: $17M deep ITM call expires Dec 19 | Consensus: $2.11-2.31 EPS | Key: Singles' Day results, Cloud growth, AI monetization

December 11 - AVGO Q4 Earnings: Real catalyst for the AI chip narrative | Expected: $1.86 EPS, $17.4B revenue | First discussion of OpenAI partnership financial impact

Regulatory & Deal Timelines

Q4 2025 - Q1 2026: SATS spectrum deals FCC approval expected | $40B total ($17B SpaceX + $22.65B AT&T) | Approval triggers stock re-rating from distressed to net cash position

June 2027: IBIT iron condor expires | Sovereign wealth fund adoption wave, altcoin ETF approvals, Bitcoin $116K-$160K range thesis

Singles' Day & Holiday Season

NOW - November 11: Alibaba Singles' Day extended promotional period | 50 billion yuan in subsidies, AI-powered shopping | World's largest retail event tests consumer spending

🎢 Risk-Based Action Plans: What To Do NOW

For The YOLO Trader (High Risk / High Reward)

Your Profile: You've got conviction, capital to risk, and want explosive asymmetric returns. Today's $767M flow gives you multiple high-octane setups—but manage your sizing!

This Week's Best Bets:

- CVNA Oct 29 Earnings Volatility: Long straddle at $325 strike captures 20%+ move either direction. Premium expensive but justified—stock historically moves 15-25% on earnings. If Amazon competition story accelerates OR turnaround beats expectations, you profit. Size small—this is binary risk.

- SOUN Pre-Earnings Momentum: Follow the $6.5M bullish synthetic with Nov 1st $20/$21 call spread. If $19 gamma wall breaks, short squeeze potential with 32% short interest. Risk: $0.50-0.70 per spread. Target: 200-300% if move to $21+ before Nov earnings.

- BABA Singles' Day Pop: ATM $167.50 or $170 calls (Dec expiration) for maximum gamma exposure. Singles' Day starting NOW—early results could drive pre-earnings rally. Analyst targets $187-196 (+13-23%). Risk: Full premium. Reward: 10x if China consumption surprises.

CRITICAL RISK RULES:

- Size each position at 2-5% of total risk capital MAX

- Set hard stop losses at 50% of premium paid

- Don't add to losers—lock profits at 100% gains

- These are lottery tickets, not core holdings

For The Swing Trader (Balanced Approach)

Your Profile: You hold 2-8 weeks, use defined-risk spreads, and want institutional-grade setups with clear catalysts. Today's flow hands you multiple 60-70% probability trades.

Your November Playbook:

- IWM Small-Cap Ceiling Trade: Follow the $76M bet with Dec $245/$255 call credit spread. Collect $3-4 credit, risk $7 per spread. Profit if IWM stays below $245 (currently $242). Gamma resistance at $250 creates natural ceiling. Probability: 60-65%.

- META Earnings Range Trade: Iron butterfly at $710 (Nov 15 expiration). Sell $710 call + put, buy $700 put + $720 call protection. Profit if META consolidates post-earnings between massive gamma bands ($700-720). Risk: $10 per spread. Reward: $3-4 credit. Wait until AFTER Oct 29 earnings to enter.

- BABA Multi-Catalyst Spread: $165/$180 call debit spread (Dec expiration). Position between strongest support ($165 with 53M GEX) and major resistance ($180). Risk: $5-7. Reward: $8-10 max profit. Captures Singles' Day AND Nov 13-14 earnings. Exit half at 50% profit, ride remainder for 100%+.

- GOOGL Cloud Growth Play: Wait for post-earnings clarity (Oct 29), then Nov $255/$265 call spread if beats. Gamma resistance at $260 (40.8M GEX) becomes support after breakout. Risk: $3-4. Target: $10 max profit at $265.

Position Sizing Discipline:

- Max 3 positions open simultaneously

- Each position = 5-10% of swing trading capital

- Set profit targets at 50% and 100% gains

- Exit ALL positions if broader market breaks key supports

For Premium Collectors (Income-Focused)

Your Profile: You sell options to generate consistent income, collect theta decay, and use high IV environments to your advantage. Today's 106% (SOUN) and 120% (SATS) IV creates premium bonanzas.

This Month's Income Strategies:

- IBIT Covered Call Ladder: Own IBIT shares + sell $70-$80 covered calls (Jan/Mar expirations). Collect 9% annualized income while holding Bitcoin exposure. If assigned at $70-80, you've captured upside + premium. Rinse and repeat. The $71M iron condor validates this is THE range.

- IWM Bull Put Spreads: Sell $240/$235 put spreads (Nov expiration). Collect $1.50-2.00 credit per spread. Massive gamma support at $240 (433.6M GEX) creates high-probability floor. Risk: $3 per spread. Probability of profit: 70%+. Repeat weekly for consistent income.

- AVGO Range-Bound Iron Condor: After +50% YTD run, AVGO is pinned $345-350. Sell iron condor: $335/$330 put spread + $355/$365 call spread (Nov expiration). Collect $1.50-2.50 credit. Max risk: $10 per condor. Stock needs to stay $330-365 (90% probability given gamma bands).

- CVNA Post-Earnings Volatility Sale: WAIT until after Oct 29 earnings, then sell $280 cash-secured puts (Nov expiration). IV crush makes premium attractive, and if assigned at $280, effective cost basis is $260-265 area—reasonable entry for the turnaround story. Only if you're willing to own CVNA.

Risk Management Rules:

- Never sell naked options (always use spreads or covered)

- Keep 30-50% of capital in cash for assignments

- Close winners at 50% max profit—don't get greedy

- Roll losing positions BEFORE expiration to next month

- Target 2-3% monthly portfolio returns from premium

For Entry Level Investors (Learning Mode)

Your Profile: You're building knowledge, using small position sizes, and want to understand how institutional money thinks. Today's $767M flow is a masterclass in options strategy.

Your Learning Path This Month:

- Paper Trade First: Open a paper trading account and mirror these institutional trades at 1/10th the size. Track how they perform. Notice how gamma levels affect price action around key strikes. Study the relationship between IV, time decay, and option pricing.

- Study The Structures:

- Iron Condors (IBIT $71M): How institutions sell volatility and collect premium in range-bound markets

- Synthetic Positions (GOOGL $11M long, AVGO $10M short): How to replicate stock positions with defined risk

- Put Ladders (CVNA $45M): How to hedge portfolios across multiple strikes

- Deep ITM Calls (BABA $17M, SATS $14M): Leveraged stock exposure with capped downside

- Your First Real Trade (After Paper Trading):

- Start with GOOGL bull put spread $250/$245 (Nov expiration) POST-EARNINGS

- Why this one? Massive gamma support at $250 (82M GEX) creates high-probability floor

- Size: 1 contract only ($500 risk)

- Learn: How gamma affects price, theta decay, and IV crush post-earnings

- Journal: Track entry, exit, P&L, and what you learned

- Risk Control Foundations:

- NEVER risk more than 1-2% of total capital on any single trade

- Always use defined-risk strategies (spreads, not naked options)

- Set stop losses at 50% of premium paid

- Don't chase trades—wait for your setup

- Exit winners at 50% max profit—leave greed to the pros

- Resources to Study:

- Read each full analysis linked above—they explain Greeks, gamma, and strategy rationale

- Focus on the "Why" behind each trade: catalyst timing, technical setup, institutional behavior

- Notice how today's $767M isn't random—it clusters around earnings, regulatory approvals, and macro catalysts

- Learn to identify high-probability trades: strong support/resistance, massive gamma walls, institutional confirmation

Most Important Lesson: Today's flow shows that even with $767M deployed, smart money uses defined-risk structures, hedges positions, and times trades around catalysts. They don't YOLO into weekly OTM calls hoping for 100x. They build positions with 60-70% probability of profit and size appropriately. Study their discipline, not just their directions.

🚨 Critical Warnings: What Could Go Wrong

The Bearish Cluster Is A Warning Signal

Four of today's largest trades are bearish or hedging in nature: CVNA $45M puts, IWM $76M short calls, META $19M synthetic short, AVGO $10M synthetic short, and GLXY $24M puts. That's $174M in bearish positioning out of $767M total flow.

What this signals: After massive YTD runs (META +19%, AVGO +50%, CVNA +63%, GLXY +66%), institutional money is taking profits and hedging ahead of earnings catalysts. Even winners need protection when trading at rich valuations. If these earnings disappoint, the cascading effect could be severe.

Valuation Concerns Are Real

- AVGO: 88-90x forward P/E after 50% YTD run—any deceleration in AI chip revenue triggers correction

- CVNA: 85-107x forward P/E—leaves zero margin for error, analysts cite "valuation stretched"

- SOUN: 40-50x trailing sales while burning $22M/quarter—runs out of cash if profitability slips

- GLXY: Trading 7.1% above fair value estimates despite 248% six-month rally

These aren't "cheap" entry points. You're buying growth, momentum, and execution—if any piece fails, downside is steep.

The Earnings Minefield (October 29)

Three major trades expire October 31, just 2 days after October 29 earnings: META synthetic short, GOOGL synthetic long, and CVNA put ladder. This creates massive binary risk—if all three surprise the same direction (bullish OR bearish), volatility will spike across markets.

What to watch: If META and GOOGL both disappoint on AI spending concerns, tech sector faces systematic repricing. If CVNA misses with weak guidance, e-commerce transformation story gets questioned. Conversely, if all three beat, the bearish traders face severe pain.

Don't Blindly Follow The Flow

Just because an institution deployed $45M doesn't mean they're right. They might be:

- Hedging existing positions: The CVNA puts could be protecting a large long equity stake

- Closing positions: These could be exits, not new entries

- Part of larger strategy: We only see the options flow, not their full portfolio

- Wrong: Even billion-dollar funds make bad trades

Your job: Understand the thesis, validate with your own research, and size appropriately for YOUR risk tolerance. Don't scale positions to match theirs—they have different capital, time horizons, and risk management.

Gamma Is A Double-Edged Sword

Yes, GOOGL has massive support at $250 (82M GEX) and AVGO resistance at $350 (40M GEX). But if price breaks those levels on high volume, the gamma flip ACCELERATES the move. Market makers suddenly switch from supporting dips to amplifying breakouts (or breakdowns).

Translation: Those "safe" support levels can turn into trapdoors if broken decisively. Always use stop losses, even when gamma "should" protect you.

The Macro Wildcard

None of today's $767M flow accounts for:

- Fed policy surprises (rate cut acceleration or pause)

- Geopolitical shocks (China-Taiwan, Middle East escalation)

- Banking sector stress (remember SVB?)

- Recession fears resurfacing

These options are priced in current-environment assumptions. Black swan events aren't priced in. Maintain dry powder, don't over-leverage, and remember 2008/2020—things can change FAST.

📝 The Bottom Line: What Smart Money Is Really Saying

Today's $767 million in institutional option flow isn't noise—it's a clear signal about how professional money views the next 60-90 days across multiple sectors:

On Bitcoin & Crypto

The IBIT $71M iron condor + GLXY $24M bearish puts tell a nuanced story: Bitcoin's explosive growth phase is over, but institutional adoption continues in controlled fashion. Expect $116K-$160K range, not moonshots. The volatility sellers are winning.

On Small Caps & Cyclicals

The IWM $76M short call strategy is a direct bet that the Russell 2000 rally stalls at $250-$260. After four years of underperformance and hitting new highs, smart money says "that's enough." With 30-33% of the index unprofitable and 40% EPS growth expectations, the bar is high. Caution warranted.

On Tech Valuations

AVGO's $10M synthetic short + META's $19M synthetic short both expire October 31—tactical profit-taking after explosive rallies, not fundamental shorts. The message: Even AI winners need to consolidate after 50% YTD runs. Don't chase extended tech at rich valuations.

On E-Commerce & Disruption

CVNA's $45M put ladder ahead of earnings shows skepticism about 248% rallies holding. Amazon-Hertz competition is real, CEO insider selling is notable, and valuation at 85-107x P/E leaves no room for error. The transformation story might be real, but timing matters—wait for better entry.

On China & AI Growth

BABA's $17M deep ITM call + GOOGL's $11M synthetic long show confidence in specific growth stories: China consumption recovery through Singles' Day and Google Cloud's AI monetization. These aren't speculative lottery tickets—they're leveraged stock positions with defined risk from sophisticated players.

On Transformation Stories

SATS $14M deep calls on the SpaceX spectrum deal is pure conviction in regulatory approval and strategic positioning. From near-bankruptcy to $40B in spectrum monetization with exclusive Starlink partnership—if FCC approves, this could be the trade of Q4/Q1.

Your Action Items TODAY:

- Mark Your Calendar: Oct 21 (GLXY), Oct 24 (multiple expirations), Oct 29 (META/GOOGL/CVNA triple threat), Oct 31 (settlement day)

- Set Price Alerts: Key gamma levels on each ticker—these are institutional reference points

- Size Appropriately: Even billion-dollar funds use 1-3% position sizing—you should too

- Trade The Catalyst, Not The Flow: Understand WHY these trades exist—timing around earnings, regulatory approvals, and macro events

- Stay Liquid: Keep 40-50% cash to deploy if bearish scenarios play out—opportunities come from volatility

The smart money deployed $767M today not because they're smarter than you, but because they have process, discipline, and institutional resources. Your edge? You can move faster, take smaller positions, and wait for higher-probability setups. Use their positioning as a roadmap, not gospel.

Trade smart. Size smart. Think like an institution, act with retail agility.

Disclaimer: This analysis is for educational purposes only and not financial advice. Options trading involves substantial risk of loss and is not suitable for all investors. The unusual options activity described may represent hedging, portfolio rebalancing, or institutional strategies that don't necessarily reflect directional bets. All premium amounts and trade details are sourced from actual unusual options flow data as of October 17, 2025. Past performance doesn't guarantee future results. Always conduct your own due diligence, consider your risk tolerance, and consult a licensed financial advisor before making investment decisions.

About This Digest: Ainvest Option Flow Digest provides institutional-grade analysis of unusual options activity, gamma exposure levels, and sophisticated option strategies. We decode smart money positioning so retail traders can make informed decisions. For real-time option flow alerts and deeper technical analysis, visit https://labs.ainvest.com