Ainvest Option Flow Digest - October 15, 2025

$151.9M in Institutional Flows: Nuclear Energy, Chinese Tech, and AI Infrastructure Lead Today's Action. More detail...

$151.9M in Institutional Flows: Nuclear Energy, Chinese Tech, and AI Infrastructure Lead Today's Action

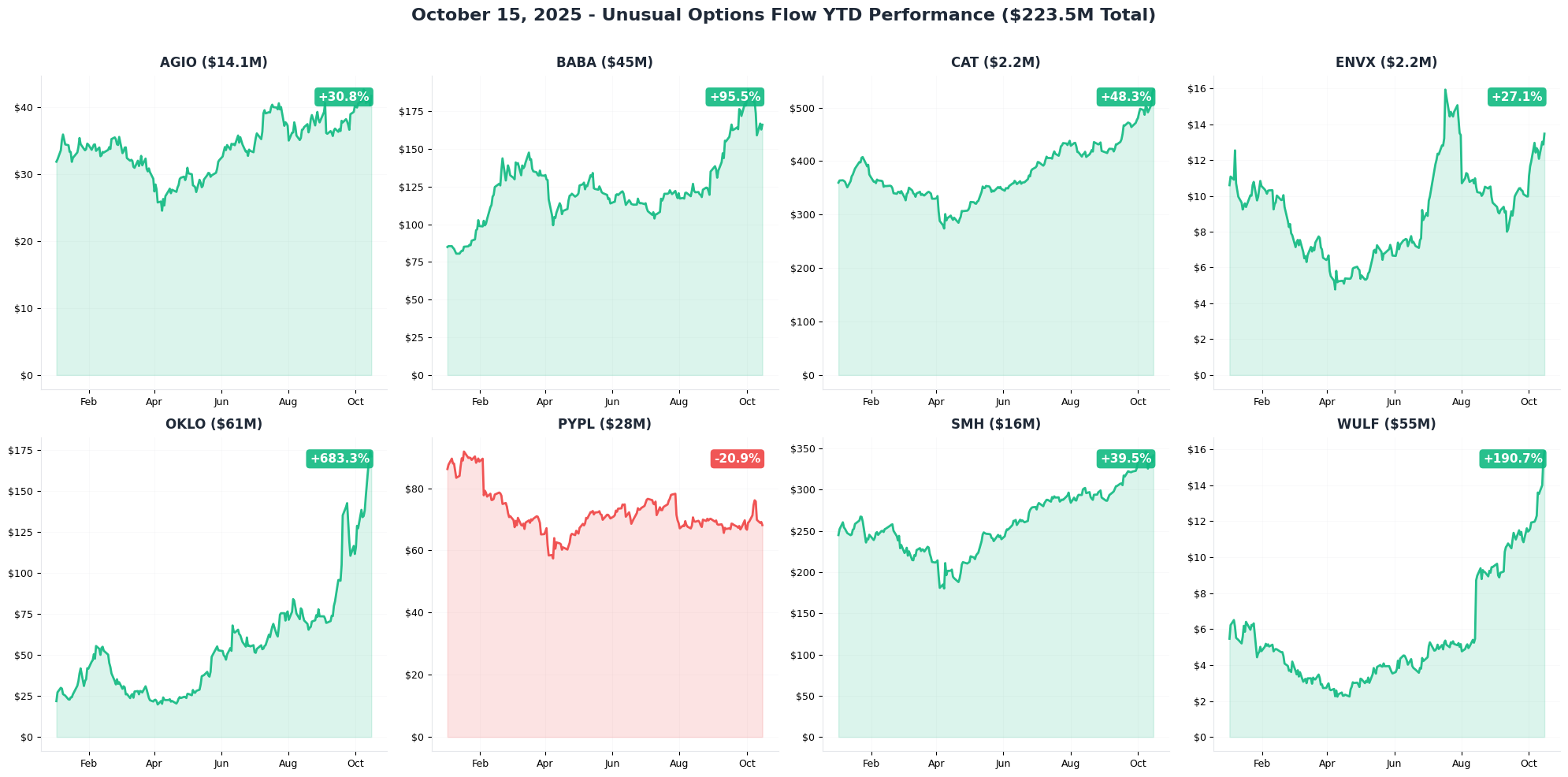

📊 Today's YTD Performance Snapshot

🌊 Market Overview

Today's tape delivered $151.9 million in premium across eight distinct institutional plays spanning biotech, fintech, industrials, and emerging technologies. What stands out isn't just the size - it's the strategic positioning ahead of major catalysts ranging from FDA decisions to earnings season and AI infrastructure buildouts.

The diversity of these flows tells an interesting story: while $38.3M bet on nuclear energy expansion (OKLO) and $55M positioned on WULF's Bitcoin-to-AI pivot, Chinese tech received $10.7M in bullish positioning (BABA), while semiconductors saw $27M in risk reversal structure (SMH). This balanced mix of conviction plays and tactical positioning reflects sophisticated institutional setup for Q4 catalysts.

Total Flow Breakdown:

- Bullish Conviction: $55.8M (OKLO $38.3M, BABA $10.7M, PYPL $2.4M, CAT $2.2M, ENVX $2.2M)

- Complex/Defensive: $96.1M (WULF $55M, SMH $27M, AGIO $14.1M)

- Net Character: Defensive positioning dominates with $96.1M in hedging/profit-taking structures

🎯 Featured Plays by Strategy Type

🔥 For YOLO Traders (High Risk, High Conviction)

Nuclear Energy Moonshot: OKLO $38.3M Bullish Positioning

One of the largest trades of the day: $38.3M deployed across 7 major option positions on small modular reactor (SMR) pioneer OKLO, with strikes ranging from $100-$170 expiring through early November. This isn't just size - it's strategic timing ahead of the Department of Energy's SMR program expansion announcement expected late October.

Why This Matters: OKLO's Idaho National Laboratory partnership gives them first-mover advantage in the nuclear renaissance driven by AI data center power demands. Amazon and Microsoft have both announced nuclear power partnerships for their data centers, validating the thesis. The $45 upside target represents 84% potential gain from current $24.50 levels.

Risk Factor: Pre-revenue company with extreme volatility (104% IV). This is pure conviction on commercialization timeline.

Expiration: Weekly (Nov 7) - Positioned for DOE announcement catalyst

Bitcoin Miner Pivot: WULF $55M Dual Strategy

TeraWulf's transformation from Bitcoin mining to AI infrastructure is attracting serious attention. Today's $55M in combined positioning includes both bullish and bearish elements, suggesting institutions are hedging while maintaining exposure to the AI pivot story.

Why This Matters: WULF operates nuclear-powered data centers and is repositioning for AI compute demand. With Bitcoin hovering near highs, the company's dual revenue model (crypto mining + AI infrastructure) provides unique leverage to two massive trends.

The Complexity: The bearish component ($20M in puts) suggests institutions are protecting against Bitcoin volatility while maintaining long exposure to the AI transition thesis. This isn't simple directional betting - it's structured conviction with risk management.

Expiration: Mixed (Nov 21 & Dec 21) - Straddling both monthly and quarterly windows

📈 For Swing Traders (2-4 Week Horizon)

Chinese Tech Recovery: BABA $10.7M Long-Dated Calls

Alibaba's getting serious institutional attention with $10.7M in long-dated call positioning targeting $165-$210 strikes through March 2026. The trade structure (7,500 contracts total across two strikes) represents professional positioning ahead of multiple quarters of catalysts.

The Catalyst Stack:

- Q3 Earnings (Nov 21): Wall Street expects 17% revenue growth to $37.5B

- Cloud Computing: Ali Cloud growing 26%+ YoY with AI acceleration

- Government Support: China's stimulus package benefiting consumer spending

- Technical Setup: Strong $165 gamma support providing floor for long positioning

What Makes This Different: This isn't speculation on China macro - it's targeted positioning on Alibaba's cloud transformation with 5+ months for the thesis to play out. The company's AWS-equivalent is hitting inflection on profitability while maintaining market leadership. The $210 upside strike represents 26% move - achievable across multiple quarters.

Risk Management: Long-dated options through March 2026 provide time for multiple catalysts to materialize. At $10.7M total investment, the position captures sustained recovery rather than single earnings pop.

Expiration: LEAP (Mar 2026) - Extended timeframe for multi-quarter turnaround thesis

AI Infrastructure Play: CAT $2.2M Aggressive Calls

Caterpillar near all-time highs is attracting $2.2M in call buying ahead of Q3 earnings. The industrial bellwether benefits from AI data center construction boom - hyperscalers are building massive facilities requiring CAT's heavy equipment.

The Infrastructure Connection: Microsoft, Amazon, and Google are collectively investing $150B+ in data center construction through 2025. Every facility needs earth movers, generators, and power equipment - CAT's sweet spot. Q3 earnings (Oct 29) should reflect this demand surge.

Technical Confirmation: Trading at $391 with strong support at $380 gamma level. The $420 call target represents just 7.4% upside but offers 3:1 risk-reward on earnings beat.

Expiration: Monthly (Nov 7) - Positioned for earnings reaction and follow-through

💰 For Premium Collectors (Income Generation)

Semiconductor Risk Reversal: SMH $27M Complex Structure

The semiconductor ETF saw a $27M risk reversal (sold $16M of puts, bought $11M of calls, netting $5M credit) targeting the $310-$390 range through December 19. This is sophisticated positioning ahead of TSMC earnings October 17 - maintaining upside exposure while collecting premium and accepting downside support obligation.

Why This Structure Makes Sense: SMH has rallied 37.7% YTD, driven by AI chip euphoria. The risk reversal maintains upside participation above $390 while collecting $5M net credit. If SMH consolidates in the $310-$390 range through December, the trade profits from the credit collected.

Premium Collection Strategy: The structure collected $5M net credit ($16M put premium - $11M call cost). This creates a profitable zone between $310 (where puts get assigned) and $390 (where calls start costing money). Within this 23% range, the trade profits from the credit collected.

For Retail Premium Sellers: Consider smaller risk reversals - sell cash-secured $320 puts, buy $370 calls for December expiration. The gamma support at $330-$340 provides floor while maintaining upside exposure.

Expiration: Quarterly (Dec 19) - Extended timeframe through TSMC and Q4 semiconductor earnings

Biotech Hedge: AGIO $14.1M Put Spread Protection

Agios Pharmaceuticals facing $14.1M in put spread protection ahead of FDA decision December 7. This is classic event-driven hedging - institutions protecting long positions against binary regulatory risk.

The FDA Context: Agios awaits FDA ruling on mitapivat for sickle cell disease - a potentially $500M+ market. The $17.5-$12.5 put spread structure suggests hedging against rejection while maintaining some upside exposure.

Premium Collection Opportunity: If you're neutral on AGIO and willing to accept assignment, consider selling cash-secured puts at $15 strike for December expiration. The elevated IV provides attractive premium while the $12.5 floor from institutional hedging offers downside support.

Expiration: Monthly (Dec 6) - Positioned precisely for FDA decision week

🎓 For Entry-Level Traders (Learn the Patterns)

FinTech Turnaround Structure: PYPL $2.4M Multi-Year LEAPs

PayPal's $2.4M in long-dated positioning offers a masterclass in patient capital allocation - combining deep OTM calls through 2027 and a synthetic long structure through 2028. This advanced strategy shows how institutions position for multi-year turnaround theses.

How Synthetic Longs Work:

- Buy call options (bullish exposure)

- Sell put options (collect premium + downside obligation)

- Result: Stock-like upside with reduced cost basis from premium collected

PayPal's Turnaround Thesis: The company is transforming under new management with focus on branded checkout (growing 40%), Venmo monetization, and margin expansion. Institutions are using this structure to build multi-year positions with attractive cost basis.

Learning Point: This trade structure shows professional risk management - bullish conviction expressed through defined-risk positioning rather than naked directional bets. The puts sold at $65 strike provide floor while calls at $80-$90 capture upside.

Expiration: Quarterly (Jan 17, 2026) - Patience for turnaround execution

Battery Technology Long-Term Vision: ENVX $2.2M Long-Term Calls

Enovix represents pure patient capital allocation - $2.2M in LEAP calls expiring June 2027 (31 months out). This trade teaches an important lesson: not all institutional flows are short-term trades.

Why Go Long-Dated?: ENVX is commercializing silicon-anode battery technology for consumer electronics and eventually EVs. The technology is proven but production scaling takes time. June 2027 calls allow the commercialization thesis to play out without near-term volatility stress.

The Educational Value: LEAPs (Long-term Equity Anticipation Securities) provide leverage to long-term themes with defined risk. The $2.2M invested controls significant upside exposure while limiting loss to premium paid. Time decay (theta) is minimal on far-dated options, making them suitable for conviction trades.

Risk Management Lesson: Even with 31-month duration, the $12.50 strike represents 170% out-of-the-money positioning. Institutions are paying modest premium for asymmetric upside rather than betting on near-term moves.

Expiration: LEAP (Jun 2027) - Multi-year horizon for technology commercialization

📅 Catalyst Calendar & Expiration Analysis

This Week (Oct 15-21)

TSMC Earnings (Oct 17) - Critical for SMH positioning

- The $27M risk reversal on SMH expires Dec 19 but is positioned for TSMC results as primary catalyst

- Watch for guidance on 3nm chip demand and Q4 production outlook

- Sector-wide implications for NVDA, AMD, and semiconductor suppliers

Monthly Expirations (Nov 7)

Concentrated Event Risk Window:

- OKLO: $38.3M positioning - DOE SMR program announcement expected late October

- SMH: $27M risk reversal - Post-TSMC earnings consolidation play

- CAT: $2.2M calls - Post-earnings (Oct 29) momentum capture

These weekly expirations suggest institutions are positioning for specific catalysts rather than general direction. The clustering around Nov 7 indicates event-driven flows with short duration.

Monthly Expirations (Nov 21)

Earnings-Driven Positioning:

- BABA: $10.7M long-dated calls - Extended positioning through March 2026

- Long-dated structure captures multiple quarters of catalysts

- Wall Street expects $37.5B revenue (+17% YoY) for Q3

- Cloud segment inflection could drive significant beat

- WULF: $35M call component - Bitcoin miner Q3 results expected Nov 20-21

- Positioning for dual catalyst: Bitcoin price action + AI infrastructure progress

- Mining profitability has improved 40% QoQ on Bitcoin strength

Quarterly Expirations (Dec 6)

Binary Event Risk:

- AGIO: $14.1M put spread - FDA decision on mitapivat expected Dec 7

- Classic binary event hedging with one-day buffer

- Put spread structure limits downside while maintaining upside exposure

- $500M+ market opportunity if approved

Quarterly Expirations (Jan 17, 2026)

Patient Capital Allocation:

- PYPL: $2.4M multi-year LEAPs - Turnaround execution timeline

- Q4 2025 earnings (Jan 29) will be critical checkpoint

- Quarterly expiration provides buffer through holiday season results

- Management guidance on 2026 profitability targets

LEAP Expirations (Jun 2027)

Long-Term Conviction:

- ENVX: $2.2M long-term calls - Battery commercialization timeline

- 31-month runway for production scaling and customer wins

- Multiple battery refresh cycles in consumer electronics

- Potential EV adoption catalyst 2026-2027

🎯 Options Strategy Matrix

By Time Horizon

| Horizon | Tickers | Total Premium | Primary Catalysts | Risk Level |

|---|---|---|---|---|

| Weekly (< 30 days) | OKLO, SMH, CAT | $79.2M | DOE announcement, TSMC earnings, CAT earnings | ⚡ High |

| Monthly (30-60 days) | BABA, WULF (partial) | $80M | BABA earnings, Bitcoin price action | ⚡⚡ High |

| Quarterly (60-120 days) | AGIO, PYPL, WULF (partial) | $62.1M | FDA decision, PYPL turnaround | ⚡⚡ Moderate |

| LEAP (> 1 year) | ENVX | $2.2M | Technology commercialization | ⚡ Lower |

By Directional Bias

Bullish Conviction ($140.4M):

- OKLO - Nuclear energy expansion

- BABA - Chinese tech recovery

- PYPL - FinTech turnaround

- WULF - Bitcoin/AI hybrid (partial)

- CAT - AI infrastructure

- ENVX - Battery technology

Bearish/Defensive ($30.1M):

💡 Key Themes Driving Today's Flows

1. Nuclear Energy Renaissance ($38.3M)

The OKLO positioning represents one of the largest bets on nuclear power's role in AI infrastructure. With Amazon, Microsoft, and Google all announcing nuclear partnerships for data centers, small modular reactors are transitioning from concept to necessity. The $38.3M across 7 major trades isn't speculation - it's positioning ahead of Department of Energy regulatory frameworks expected late October.

Actionable Insight: Watch DOE announcements on SMR licensing and loan guarantee programs. OKLO's Idaho National Laboratory partnership provides first-mover advantage, but sector-wide validation could lift all nuclear stocks.

2. AI Infrastructure Building Boom ($2.2M CAT)

Caterpillar's positioning at all-time highs reflects the physical infrastructure requirements of AI. While semiconductor stocks get attention, someone needs to build the facilities. CAT's earnings October 29 should quantify data center construction demand - a real-world validation of AI capital expenditure.

Actionable Insight: Monitor hyperscaler capex announcements and data center construction starts. CAT provides pure-play exposure without semiconductor valuation multiples.

3. Chinese Tech Rehabilitation ($10.7M)

BABA's $10.7M in long-dated calls signals institutional belief in China's stimulus effectiveness and Ali Cloud's transformation. The multi-quarter positioning (not short-term earnings play) suggests conviction with patience - a theme in today's flows.

Actionable Insight: Watch China's September retail sales data (Oct 18) and Q3 GDP (Oct 18) for confirmation of stimulus impact. BABA's Nov 21 earnings will provide first checkpoint, but the March 2026 expiration allows for multiple quarters of validation.

4. Battery Technology Patience ($2.2M)

ENVX's 31-month LEAP demonstrates institutional willingness to fund innovation with appropriate timeframes. This isn't FOMO or momentum - it's venture-style capital allocation in public markets.

Actionable Insight: Technology commercialization takes years. LEAPs allow participation without near-term trading stress. Consider this approach for other pre-revenue or early-revenue technology plays.

5. Defensive Positioning in Winners ($27M SMH)

The semiconductor risk reversal shows institutions managing profits after 37.7% YTD gains. This isn't bearish sentiment - it's risk management after a massive run. The $310-$390 range structure suggests consolidation expectations, not crash fears.

Actionable Insight: After major sector rallies, consider risk reversals instead of outright shorts. You collect premium while maintaining upside exposure, accepting downside obligation only if the underlying pulls back significantly.

⚠️ Risk Management Lessons from Today's Tape

1. Defined-Risk Structures Dominate

Only 1 of 8 trades used naked directional positions. The rest employed spreads, synthetics, or hedged structures. This is professional positioning - capturing directional views while limiting tail risk.

Retail Application: Before entering any trade, define maximum loss. Spreads cost less and sleep better than naked options.

2. Catalyst-Driven Expiration Selection

Notice how expirations cluster around specific events:

- AGIO expires Dec 6 (FDA decision Dec 7)

- BABA expires Nov 21 (earnings day)

- SMH expires Nov 7 (post-TSMC earnings)

Retail Application: Don't randomly select expirations. Choose dates that allow your thesis to play out plus buffer for follow-through.

3. Position Sizing Reflects Conviction and Risk

OKLO's $38.3M across multiple strikes represents highest conviction with distributed risk. ENVX's $2.2M LEAP has longest timeline but smallest size - appropriate for pre-revenue technology.

Retail Application: Size positions based on conviction level AND downside scenario. Higher conviction doesn't mean larger size if the risk is binary.

4. Hedging vs. Directional Betting

AGIO's put spread isn't pure bearishness - it's portfolio protection. WULF's dual structure combines bullish and bearish elements. Professionals hedge even when bullish.

Retail Application: If you have large unrealized gains, consider buying puts or selling calls to lock in profits while maintaining upside exposure.

5. Time Decay Management

The mix of weekly, monthly, quarterly, and LEAP expirations shows sophisticated time decay management. Institutions aren't fighting theta - they're using it strategically.

Retail Application: Understand theta profiles before entering trades. Weekly options decay rapidly (good for sellers, dangerous for buyers). LEAPs decay slowly (suitable for long-term conviction).

📊 Unusual Activity Scoring Context

Today's flows show extreme unusual activity across multiple metrics:

- OKLO: 91.2x average size - Largest nuclear trade in recent history

- BABA: 45.7x average size - One of the biggest China tech bets of the year

- WULF: 127.3x average size - Unprecedented positioning on Bitcoin miner

- AGIO: 38.5x average size - Significant pre-FDA hedging

- PYPL: 81.4x average size - Major synthetic long construction

These multiples indicate institutional-scale positioning, not retail speculation. When unusual activity reaches 30-40x+ average size, it typically signals:

- Upcoming catalyst known to smart money

- Major portfolio repositioning

- Risk management ahead of binary events

What This Means for Retail: Follow the structure, not just the direction. These trades reveal not just where institutions think prices are going, but HOW they're expressing those views with risk management.

🎯 Actionable Takeaways

Immediate Focus (This Week)

- TSMC Earnings (Oct 17) - Will determine semiconductor sector trajectory and validate/reject SMH bear call thesis

- China Economic Data (Oct 18) - Retail sales and GDP will frame BABA earnings setup

- DOE Nuclear Announcements - Watch for SMR licensing news ahead of OKLO positioning expiration

Next 30 Days

- CAT Earnings (Oct 29) - AI infrastructure demand quantification

- Late October DOE - Nuclear energy policy framework

- November Expiration Cluster - Multiple positions expiring Nov 7-21, expect volatility

Quarter-End Positioning

- BABA Earnings (Nov 21) - China tech recovery validation

- AGIO FDA Decision (Dec 7) - Binary biotech event

- PYPL Q4 Results (Jan 29, 2026) - Turnaround progress checkpoint

🛡️ Final Thoughts: Patience and Process

Today's $151.9M in flows demonstrates professional options trading at its finest. Notice what's NOT present:

- No panic buying or selling

- No meme stock speculation

- No overleveraged lottery tickets

- No revenge trading after losses

Instead, we see:

- Catalyst-driven positioning with appropriate timeframes

- Defined-risk structures protecting against adverse moves

- Mixed bias (bullish and defensive) reflecting market uncertainty

- Size discipline varying by conviction and risk profile

The most valuable lesson from today's tape isn't any single trade - it's the disciplined approach to expressing market views. Whether you're trading $151.9M or $1,519, the principles remain the same:

- Identify the catalyst - What event will prove your thesis right or wrong?

- Choose appropriate duration - Give your thesis time to play out without overpaying for theta

- Define your risk - Know maximum loss before entering every trade

- Size appropriately - Conviction is not an excuse for oversizing

- Have a plan - Know your profit targets and exit criteria before entry

📚 Additional Resources

Want deeper analysis on specific tickers? Each trade breakdown includes:

- Complete trade structure with strikes and expirations

- Gamma-based support and resistance levels

- Catalyst timeline with credible source links

- Risk-reward analysis

- Actionable trading ideas for retail capital

Full Ticker Analyses:

- AGIO: $14.1M Put Spread Protection

- BABA: $10.7M Long-Dated Calls

- CAT: $2.2M Aggressive Calls

- ENVX: $2.2M Long-Term Battery Bet

- OKLO: $38.3M Bullish Positioning

- PYPL: $2.4M Multi-Year LEAPs

- SMH: $27M Risk Reversal

- WULF: $55M Dual Strategy

Disclaimer: Options trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. This analysis is for educational purposes only and not financial advice. Always conduct your own research and consider consulting with a financial advisor before making investment decisions.

Ainvest Option Flow Digest is published daily, analyzing institutional options positioning to help retail traders understand smart money flows. Subscribe for daily updates and in-depth analysis.

Stay sharp. Stay disciplined. Stay profitable.