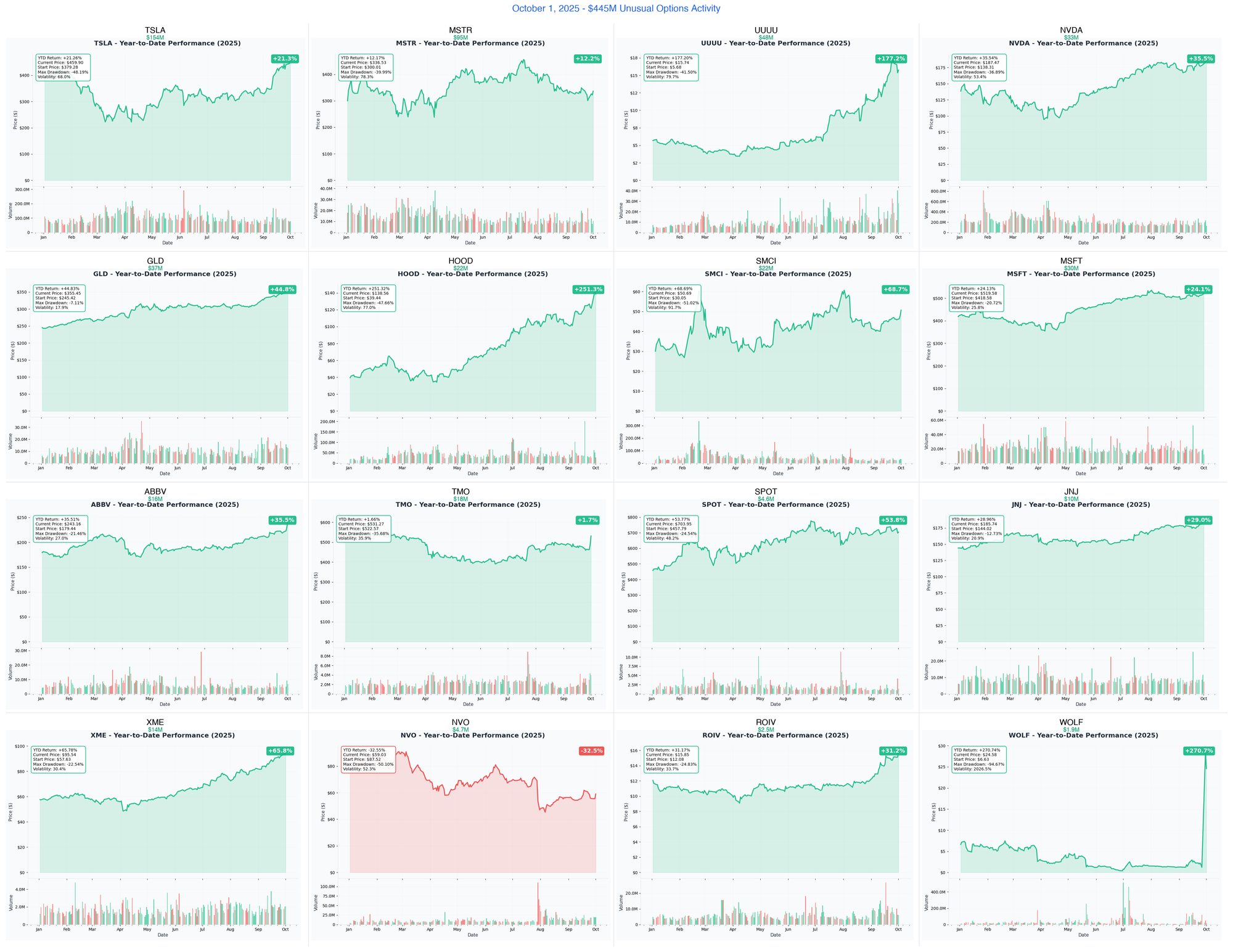

Ainvest Option Flow Digest- Oct 1, 2025: $445M+ Option Flow Avalanche Crushes 16 Tickers

$445+ MILLION in options activity across 16 tickers - Tesla's massive $154M call selling betting against breakout, MSTR's $95M profit-taking spree, and UUUU's $48M nuclear renaissance bull call spread. smart money rotation into gold (GLD $37M), AI infrastructure (NVDA $32.9M) etc.

📅 October 1, 2025 | 🚨 UNPRECEDENTED Day: Tesla's $154M Call Seller BOMB + MSTR's $95M Exit + Nuclear Renaissance $48M UUUU Play | ⚠️ Record-Breaking Flow Across AI, Gold, Healthcare & Mining

🎯 The $445M Institutional Money Avalanche: Track Every Movement

🔥 INSANE DAY ALERT: We just witnessed $445+ MILLION in earth-shaking options activity across 16 tickers - featuring Tesla's massive $154M call selling tsunami betting against breakout, MSTR's $95M profit-taking spree ahead of S&P inclusion, and UUUU's $48M nuclear renaissance bull call spread. This isn't just institutional money moving - this is coordinated smart money rotation into gold (GLD $37M), AI infrastructure (NVDA $32.9M), defensive pharma plays, and contrarian mining bets while taking profits from recent winners.

Total Flow Tracked: $445,000,000+ 💰 Most Shocking: TSLA $154M call selling at $455 (17,250x unusual - betting on range-bound action!) Biggest Bull Bet: UUUU $48M spread targeting $30 by 2028 (174x unusual - nuclear renaissance play!) Gold Rush: GLD $37M calls betting on central bank demand explosion AI Dominance: NVDA $32.9M positioning ahead of Blackwell + OpenAI catalysts

🚀 THE COMPLETE WHALE LINEUP: All 16 Monster Trades

1. ⚡ TSLA - The $154M Call Seller Tsunami at $455

DISCOVER WHY INSTITUTIONS DUMP $154M IN TESLA CALLS RIGHT NOW →

- Flow: $154M November $455 call selling (34,500 contracts - 17,250x unusual!)

- What's Happening: Big money fading rally at $455 with deliveries Thursday + earnings Oct 22nd ahead

- YTD Performance: +107% (near all-time highs but facing resistance)

- The Big Question: Will Thursday's deliveries beat 480K estimates or disappoint?

- Catalyst: Q3 deliveries Oct 3rd + FSD V14 launch + Robotaxi expansion + Q3 earnings Oct 22nd

2. 🪙 MSTR - The $95M Call Tsunami Exit

ANALYZE WHY STRATEGY SEES $95M PROFIT-TAKING SPREE →

- Flow: $95M call selling across multiple strikes (79,600 contracts - massive profit-taking!)

- What's Happening: Deep ITM call selling with 2 days to expiry - locking in gains near highs

- YTD Performance: +258% (Bitcoin proxy trading at $340 with premium to NAV)

- The Big Question: Can MSTR qualify for S&P 500 inclusion by December?

- Catalyst: Oct 29 earnings + S&P 500 inclusion potential + $42B capital raising plan + BTC holdings

3. ⚛️ UUUU - The $48M Nuclear Renaissance Bull Call Spread

EXPLORE THE MASSIVE URANIUM PLAY TARGETING $30 BY 2028 →

- Flow: $48M bull call spread $17/$30 (35,000 contracts - 174x unusual size!)

- What's Happening: Patient capital betting on 100%+ move over 2+ years with uranium supercycle

- YTD Performance: +42.9% in past month (breakout from $10 to $15+ on uranium surge)

- The Big Question: Will uranium hit $100/lb and trigger explosive mining supercycle?

- Catalyst: Q3 earnings Oct 30 + Pinyon Plain 3.51% grades (highest in US) + Donald Project Australia JV

4. 💎 GLD - The $37M Institutional Gold Rush

SEE WHY GOLD GETS $37M WHALE BET AHEAD OF RATE CUTS →

- Flow: $37M October $350 calls (47,500 contracts - 950x unusual with 9 days to expiry!)

- What's Happening: Aggressive positioning for breakout above $356 gamma wall with rate cut catalyst

- YTD Performance: +40% (crushing SPX by 33% - gold at $3,675/oz ATH)

- The Big Question: Will central banks continue buying 244 tons quarterly driving prices higher?

- Catalyst: Fed rate decision Oct 29-30 + Q3 central bank gold purchases Nov 1 + ETF inflow reversal

5. 🤖 NVDA - The $32.9M AI Dominance Mega-Whale

UNDERSTAND NVIDIA'S $32.9M BET ON BLACKWELL + OPENAI →

- Flow: $32.9M mixed call buying ($26M Nov + $6.9M ultra-short Oct 3rd)

- What's Happening: Event-driven positioning ahead of Blackwell rollout and $100B OpenAI partnership

- YTD Performance: +35.6% ($4.5T market cap - world's largest)

- The Big Question: Will Blackwell 5.2M shipments and Vera Rubin deployment exceed expectations?

- Catalyst: Q3 earnings Nov 20-27 + OpenAI $100B infrastructure deal + Blackwell production ramp

6. 🛡️ MSFT - The $30M Synthetic Long Protection Fortress

DECODE MICROSOFT'S $30M PROTECTIVE COLLAR STRATEGY →

- Flow: $30M protective collar (sells $18M June '26 $500 calls, buys $12M Dec '26 $500 puts)

- What's Happening: Sophisticated hedging at $517 after 24% rally - locking in gains while maintaining upside

- YTD Performance: +23.7% (Azure $75B revenue growing 39% annually)

- The Big Question: Can $30B quarterly AI capex deliver ROI or will margins compress?

- Catalyst: Q1 2026 earnings Oct 29 + Azure 37% growth target + AI business $13B run rate

7. 🖥️ SMCI - The $22M Bull Call Tsunami

SEE WHY SUPER MICRO GETS $22M BULLISH POSITIONING →

- Flow: $22.3M net bullish (4.0:1 ratio - 1,750x unusual with Oct 3rd expiry!)

- What's Happening: Aggressive 2-day play targeting $51 gamma wall breakout with AI server demand

- YTD Performance: +67.6% (consolidating $47-50 after August correction)

- The Big Question: Will governance resolution and Blackwell partnership drive squeeze above $51?

- Catalyst: Nov 3-4 earnings + BDO audit Oct 15 + DOJ clarity + NVIDIA Blackwell ramp

8. 💹 HOOD - The $22M Call Selling at All-Time Highs

ANALYZE WHY ROBINHOOD SEES $22M PROFIT-TAKING →

- Flow: $22M call selling at $112 strike (8,000 contracts - profit-taking after 226% rally!)

- What's Happening: Deep ITM call closing or covered call writing as HOOD trades $139 near ATH $143

- YTD Performance: +226% (prediction markets + crypto driving explosive growth)

- The Big Question: Can prediction markets sustain $200M annual revenue run rate?

- Catalyst: Q3 earnings Oct 29 + 4B contracts traded milestone + Bitstamp crypto integration

9. 💊 ABBV - The $16M Historic Bullish Stampede

DISCOVER ABBVIE'S UNPRECEDENTED $16M INSTITUTIONAL BET →

- Flow: $16M calendar diagonal spread (12,562x unusual - ABOVE ASK urgency!)

- What's Happening: Deep ITM Nov calls + selling March '26 $250 calls betting on pharma pipeline

- YTD Performance: +28.7% (methodical climb toward $245 highs)

- The Big Question: Will Skyrizi + Rinvoq hit $31B sales target driving oncology moonshot?

- Catalyst: Q3 earnings Oct 29 + Icotrokinra NDA filed + INLEXZO bladder cancer approval + oncology pipeline

10. 🧬 TMO - The $18M Calendar Spread Wall Street Play

EXPLORE THERMO FISHER'S SOPHISTICATED $18M VOLATILITY BET →

- Flow: $18M calendar spread (sells Oct $510 calls, buys Nov $570 calls - 5,500x unusual!)

- What's Happening: Collecting $5.9M net credit betting on consolidation then earnings breakout

- YTD Performance: +0.02% (6-month base building $480-530 with coiled spring energy)

- The Big Question: Will Solventum $4.1B acquisition synergies exceed expectations?

- Catalyst: Q3 earnings Oct 22 + Solventum integration + ASHG Annual Meeting + China exposure recovery

11. ⛏️ XME - The $14.4M Mining Supercycle Mega-Spread

SEE THE MASSIVE BET ON URANIUM + COPPER EXPLOSION →

- Flow: $14.4M call spread (sells $12M in $90 calls, buys $2.4M in $105 calls - March '26)

- What's Happening: Covered spread targeting $105 breakout while collecting premium above $90

- YTD Performance: +59.68% (leading all sector ETFs - uranium/copper supercycle)

- The Big Question: Will nuclear renaissance and copper shortage drive XME above $100?

- Catalyst: Uranium demand quadrupling to 200M pounds + 400GW nuclear capacity target + copper supply deficit

12. 🩺 JNJ - The $10.3M Pure Bullish Call Flood

UNDERSTAND JOHNSON & JOHNSON'S $10.3M ZERO-HEDGE BET →

- Flow: $10.3M PURE call buying (ZERO put activity - 100% bullish conviction!)

- What's Happening: Long-dated 6+ month calls ahead of Oct 14 earnings with oncology catalysts

- YTD Performance: +28.7% (testing $186.56 new highs with momentum)

- The Big Question: Can oncology franchise hit $50B by 2030 with Darzalex + Carvykti growth?

- Catalyst: Q3 earnings Oct 14 + INLEXZO approval + Imaavy "pipeline-in-a-product" + biosimilar transition success

13. 💉 NVO - The $4.7M GLP-1 Reversal Play

DECODE NOVO NORDISK'S $4.7M BOTTOM-FISHING BET →

- Flow: $4.7M December $60 calls (8,116 contracts - catching falling knife after -32.7% YTD)

- What's Happening: Betting on reversal from $58 support with 9,000 job cuts saving $1.25B annually

- YTD Performance: -32.7% (collapsed from $120 to $58 on Eli Lilly competition)

- The Big Question: Will oral semaglutide trial results unlock $50B+ addressable market?

- Catalyst: Q3 earnings mid-October + oral semaglutide late-stage data + Alzheimer's indication trial

14. 🎵 SPOT - The $4.6M Earnings Breakout Bet

ANALYZE SPOTIFY'S $4.6M CALL BET AHEAD OF EARNINGS →

- Flow: $4.6M November $720 calls (949 contracts - needs $768 breakeven!)

- What's Happening: Aggressive 3-day post-earnings play targeting breakout above $720 gamma wall

- YTD Performance: +53.0% (building on 2024's 154.7% gain - first profitable year!)

- The Big Question: Will audiobooks and AI DJ drive 1 billion MAU target from 696M current?

- Catalyst: Q3 earnings Nov 4 + 9-22% price increases + $1B podcast revenue target + AI DJ rollout

15. 🧬 ROIV - The $2.5M Biotech Call Tsunami

EXPLORE ROIVANT'S $2.5M PRE-EARNINGS ACCUMULATION →

- Flow: $2.5M October $14 calls (15,032 contracts - 750x unusual with Oct 17 expiry!)

- What's Happening: Deep ITM calls betting on pre-earnings run with $4.5-6.6B cash fortress

- YTD Performance: +30.3% (climbing from $10 August lows to $15.74)

- The Big Question: Will brepocitinib NDA filing unlock $2B+ peak sales opportunity?

- Catalyst: Q2 earnings Nov 17 + VTAMA commercial ramp + brepocitinib Phase 3 success + IMVT-1402 readouts

16. 🐺 WOLF - The $1.9M Bankruptcy Phoenix Hedge

UNDERSTAND THE DEEP VALUE PUT PLAY ON WOLFSPEED →

- Flow: $1.9M January '27 $2 puts (11,000 contracts - extreme downside protection!)

- What's Happening: Deep OTM puts hedging catastrophic risk 3 days post-bankruptcy emergence

- YTD Performance: Volatile (1,686% pop on bankruptcy exit, now trading $25)

- The Big Question: Can WOLF execute $4B revenue target by fiscal 2027 or fail again?

- Catalyst: Nov 5 first post-bankruptcy earnings + CHIPS Act $750M funding + fab ramp execution

⏰ URGENT: Critical Expiries & Catalysts This Week

🚨 2 DAYS TO EXPIRY (October 3rd)

- MSTR - $95M Strategy - Profit-taking with S&P inclusion ahead

- NVDA - $6.9M Position - Ultra-short dated Blackwell catalyst play

- SMCI - $22M Positioning - Betting on $51 gamma wall break

⚡ THIS THURSDAY - TESLA DELIVERIES (October 3rd)

- TSLA - $154M Call Selling - Make-or-break 480K delivery target test

📊 OCTOBER EARNINGS TSUNAMI

- JNJ - October 14 - Oncology franchise $50B target

- TMO - October 22 - Life sciences recovery test

- TSLA - October 22 - FSD V14 + Robotaxi updates

- MSFT - October 29 - Azure $75B revenue + AI $13B run rate

- ABBV - October 29 - Pipeline updates + Skyrizi/Rinvoq growth

- MSTR - October 29 - Bitcoin accumulation + S&P qualification path

- HOOD - October 29 - Prediction markets $200M revenue test

- UUUU - October 30 - Pinyon Plain production ramp

🎯 NOVEMBER CATALYST WAVE

- SMCI - November 3-4 - First post-governance earnings

- SPOT - November 4 - 1B MAU target progress

- WOLF - November 5 - Post-bankruptcy viability test

- ROIV - November 17 - Biotech pipeline updates

- NVDA - November 20-27 - Blackwell shipment confirmation

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Profit-Taking After Massive Rallies (42% of Today's Flow)

The $187M Exit Message: Smart money booking gains on parabolic winners

- → TSLA: $154M systematic call selling after 107% rally

- → MSTR: $95M profit-taking ahead of critical catalysts

- → HOOD: $22M call closing at all-time highs after 226% move

⚛️ Nuclear + Mining Supercycle Positioning ($62.4M Long-Term Bets)

Patient Capital Finding Multi-Year Themes:

- → UUUU: $48M bull call spread on uranium renaissance

- → XME: $14.4M covered spread on mining sector explosion

🤖 AI Infrastructure Dominance ($85.2M Strategic Positioning)

Selective Quality Plays in AI Winners:

- → NVDA: $32.9M mixed calls on Blackwell + OpenAI catalysts

- → MSFT: $30M protective collar on Azure growth

- → SMCI: $22.3M bullish tsunami on liquid cooling leadership

💊 Healthcare + Pharma Defensive Rotation ($31M Quality Shift)

Institutions Seeking Stability with Growth:

- → ABBV: $16M unprecedented bullish bet on oncology pipeline

- → JNJ: $10.3M pure call buying (ZERO puts!) ahead of earnings

- → NVO: $4.7M reversal play after -32.7% collapse

💎 Safe Haven + Gold Rush ($37M Macro Hedge)

Central Bank Demand Driving Institutional Flows:

🎯 Event-Driven Earnings Plays ($25.5M Catalyst Positioning)

Betting on Specific Near-Term Events:

- → TMO: $18M calendar spread into Q3 earnings volatility

- → SPOT: $4.6M aggressive call bet 3 days post-earnings

- → ROIV: $2.5M biotech accumulation ahead of pipeline updates

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - High volatility binary events

- SMCI October calls - 2-day expiry targeting $51 gamma squeeze

- NVDA Oct 3rd calls - Ultra-short dated Blackwell catalyst play

- UUUU bull spreads - 2-year nuclear supercycle lottery ticket

- ROIV Oct 17 calls - Biotech gamma squeeze setup

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

- NVDA Nov spreads - Following $26M whale through earnings

- GLD October calls - Rate cut catalyst play with gamma support

- XME March spreads - Mining supercycle positioning

- ABBV Nov calls - Pharma pipeline earnings play

💰 Premium Collection (Income Strategy)

Follow institutional sellers to collect premium

- TSLA call selling - $470+ strikes following $154M whale

- MSTR call selling - $345-350 strikes for income

- HOOD call selling - Covered calls above $140 resistance

- TMO calendar spreads - Volatility collection strategy

🛡️ Conservative LEAPs (Long-term)

Patient capital and protection plays

- UUUU Jan 2028 spreads - Multi-year nuclear theme

- JNJ Jan 2026 calls - Quality pharma exposure

- GLD shares - Direct gold exposure without options complexity

- MSFT shares - Quality AI exposure with Azure growth

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- NVDA/MSFT: AI bubble bursts or Blackwell delays derail hype cycle

- UUUU/XME: Uranium prices collapse or mining supercycle theory fails

- GLD: Dollar surges on hawkish Fed surprise crushing gold

- JNJ/ABBV: Pipeline failures or Medicare pricing pressures accelerate

- SPOT: Competition from Apple Music or royalty cost inflation

😰 If You're Following the Bears

- TSLA: Thursday deliveries crush 480K estimates triggering squeeze

- MSTR: S&P 500 inclusion announcement sparks parabolic move

- HOOD: Prediction markets expand internationally faster than expected

- NVO: Oral semaglutide trial results unlock massive addressable market

💣 This Week's Catalysts & Key Dates

📊 This Week (October 1-6):

- October 3: TSLA Q3 deliveries (447K-480K expected)

- October 3: SMCI/MSTR/NVDA ultra-short options expire (massive gamma unwind)

🗓️ October Earnings Avalanche:

- October 10: GLD options expire (Fed rate cut positioning)

- October 14: JNJ Q3 earnings (oncology franchise test)

- October 17: ROIV options expire (biotech gamma squeeze potential)

- October 22: TSLA + TMO earnings (FSD V14 + life sciences recovery)

- October 29: MSFT + ABBV + MSTR + HOOD earnings (mega-cap tech + pharma + crypto proxy + fintech)

- October 30: UUUU earnings (uranium production ramp)

🧠 November Decision Points:

- November 3-4: SMCI + SPOT earnings (AI servers + streaming)

- November 5: WOLF post-bankruptcy test

- November 7: SPOT options expire (breakout or breakdown)

- November 17: ROIV biotech pipeline updates

- November 20-27: NVDA earnings (THE AI infrastructure event)

- November 21: TSLA + ABBV options expire (major gamma unwind)

🎯 The Bottom Line: Follow the $445M Institutional Rotation Signal

This is the clearest institutional positioning we've seen in Q4 2025. $445+ million flowing IN multiple directions: profit-taking from winners (TSLA, MSTR, HOOD), aggressive bets on new themes (UUUU nuclear, XME mining, GLD safe haven), strategic AI positioning (NVDA, MSFT, SMCI), and defensive pharma rotation (ABBV, JNJ, NVO). Smart money is clearly repositioning portfolios for the next market phase.

The biggest questions:

- Will Tesla's $154M call seller be right about range-bound action through earnings?

- Can UUUU's $48M spread capture the nuclear renaissance to $30?

- Will NVIDIA's $32.9M bet pay off on Blackwell + OpenAI deployment?

- Does GLD's $37M gold rush signal safe-haven rotation?

Your move: This multi-directional flow across sectors demands attention. Follow the smart money themes (nuclear, AI quality, safe havens, defensive pharma) or position contrarian - but don't ignore $445 million in institutional conviction.

🔗 Get Complete Analysis on Every Trade

💰 Mega-Cap Rotation & Profit-Taking:

- TSLA $154M Call Tsunami - Range-Bound Bet Through Earnings

- MSTR $95M Profit-Taking - S&P Inclusion Game

- HOOD $22M Exit - Prediction Markets Peak?

⚛️ Nuclear Renaissance & Mining Supercycle:

🤖 AI Infrastructure Dominance:

- NVDA $32.9M Mega-Whale - Blackwell + OpenAI

- MSFT $30M Protection Fortress - Azure Growth Hedge

- SMCI $22M Bull Tsunami - Liquid Cooling Leadership

💊 Healthcare & Pharma Quality Rotation:

- ABBV $16M Historic Bet - Oncology Pipeline

- JNJ $10.3M Pure Calls - Zero Put Activity!

- TMO $18M Calendar Spread - Life Sciences Recovery

- NVO $4.7M Reversal Play - GLP-1 Bottom Fishing

💎 Safe Haven & Event-Driven:

- GLD $37M Gold Rush - Rate Cut Catalyst

- SPOT $4.6M Earnings Bet - Streaming Breakout

- ROIV $2.5M Biotech Play - Pipeline Catalysts

🐺 Special Situations:

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 3 Expiry)

- MSTR $95M profit-taking with S&P inclusion ahead

- SMCI $22M gamma squeeze targeting $51

- NVDA ultra-short dated Blackwell catalyst

📆 Monthly (October 10-17 Expiries)

- GLD $37M rate cut positioning

- ROIV $2.5M biotech pre-earnings run

- SPOT $4.6M post-earnings breakout bet

🗓️ Quarterly (October-November Earnings)

- TSLA Oct 22 - FSD V14 + Robotaxi updates

- TMO Oct 22 - Life sciences recovery

- MSFT Oct 29 - Azure + AI monetization

- ABBV Oct 29 - Oncology pipeline updates

- MSTR Oct 29 - Bitcoin + S&P qualification

- HOOD Oct 29 - Prediction markets test

- UUUU Oct 30 - Uranium production ramp

- SMCI Nov 3-4 - Post-governance clarity

- SPOT Nov 4 - 1B MAU target progress

- WOLF Nov 5 - Post-bankruptcy viability

- JNJ Oct 14 - Oncology franchise

- ROIV Nov 17 - Biotech catalysts

- NVDA Nov 20-27 - Blackwell confirmation

🚀 LEAPS (2026-2028 Expiries)

- UUUU Jan 2028 - Nuclear renaissance 2-year play

- MSFT June/Dec 2026 - Protective collar structure

- XME March 2026 - Mining supercycle positioning

- JNJ Jan/April 2026 - Quality pharma exposure

- WOLF Jan 2027 - Bankruptcy downside protection

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position

- 2-day lottery: SMCI Oct 3 calls targeting $51 gamma squeeze

- Deliveries play: TSLA Oct 3 options on Thursday catalyst

- Nuclear moonshot: UUUU $17/$30 spread for 2-year hold

- Biotech squeeze: ROIV Oct 17 calls on gamma setup

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary: NVDA Nov spreads following $32.9M whale through Blackwell

- Secondary: GLD Oct calls on Fed rate cut timeline

- Defensive: ABBV Nov calls pharma quality with pipeline catalysts

- Mining theme: XME March spreads on supercycle thesis

💰 Premium Collector (Income Focus)

Strategy: Follow institutional sellers

- High premium: TSLA call selling at $470+ following $154M whale

- Systematic exits: MSTR call selling at resistance levels

- ATH fades: HOOD call selling above $140 following profit-takers

- Volatility harvest: TMO calendar spreads collecting time decay

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education

- Paper trade: All strategies first before risking capital

- ETF exposure: Consider XME for mining, GLD for gold without options complexity

- Quality shares: MSFT or JNJ for AI/pharma exposure

- Education first: Study protective collars (MSFT example), calendar spreads (TMO pattern), bull spreads (UUUU structure)

⚠️ Risk Management for All Types

Essential Rules:

- Never risk more than 1-5% per position (based on investor type)

- Set stop losses at 20-30% of option premium paid (50% for YOLO plays)

- Take profits at 50-100% gains - this rotation is happening FAST

- Watch time decay - October 3rd and 17th expiries losing value rapidly

- Follow earnings closely - Multiple catalysts across 16 tickers!

Sector Rotation Warning: Today's $445M flow shows institutions rotating between sectors - not just buying or selling. Winners (TSLA, MSTR, HOOD) seeing profit-taking while new themes (UUUU nuclear, GLD safe haven, healthcare defensive) getting fresh capital. Don't chase yesterday's winners.

Event Risk Alert:

- Thursday Oct 3: TSLA deliveries could gap stock 5-10%

- Oct 14-Nov 27: Earnings tsunami creates daily volatility

- Multiple 2-day expiries (SMCI, MSTR, NVDA Oct 3) = extreme time decay

Remember: Institutions often have complex positions we can't see. TSLA's $154M systematic exit suggests coordinated hedging. UUUU's $48M spread is 2+ year patient capital. Always maintain proper position sizing and understand the time horizon behind unusual activity.

Entry Level Critical: This multi-sector rotation requires sophisticated understanding. Start with broad ETFs (XME for mining, GLD for gold), practice with paper trading, and focus on learning why institutions are making these moves before attempting to replicate complex strategies.

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management, maintain strict position sizing (never more than 1-5% per trade based on risk tolerance), set stop losses, and never risk more than you can afford to lose. Past performance does not guarantee future results.

📈 Market Conditions: Volatility elevated across all sectors. TSLA deliveries Thursday create binary event risk. Fed rate decision Oct 29-30 impacts gold/rates. Earnings season Oct 14-Nov 27 drives individual stock moves. Nuclear/mining themes multi-year plays requiring patience.

🎯 Position Sizing Reminder: YOLO (1-2%), Swing (3-5%), Income (5-10%), Conservative (10-15%). Never violate these limits regardless of conviction. Institutions spreading $445M across 16 names for diversification - follow their risk management lead.

⏰ Time Decay Alert: Options with Oct 3 expiry (SMCI, MSTR, NVDA ultra-short) losing 30-50% value daily. Only for experienced traders comfortable with binary outcomes. October 10 (GLD) and October 17 (ROIV) expiries accelerating decay this week.

📊 Key Levels to Watch:

- TSLA: $455 call seller strike (break above invalidates thesis)

- SMCI: $51 gamma wall (break triggers squeeze)

- GLD: $356 resistance (Fed cut catalyst)

- NVDA: $190 gamma wall (Blackwell catalyst)

- UUUU: $17 gamma concentration (nuclear theme)