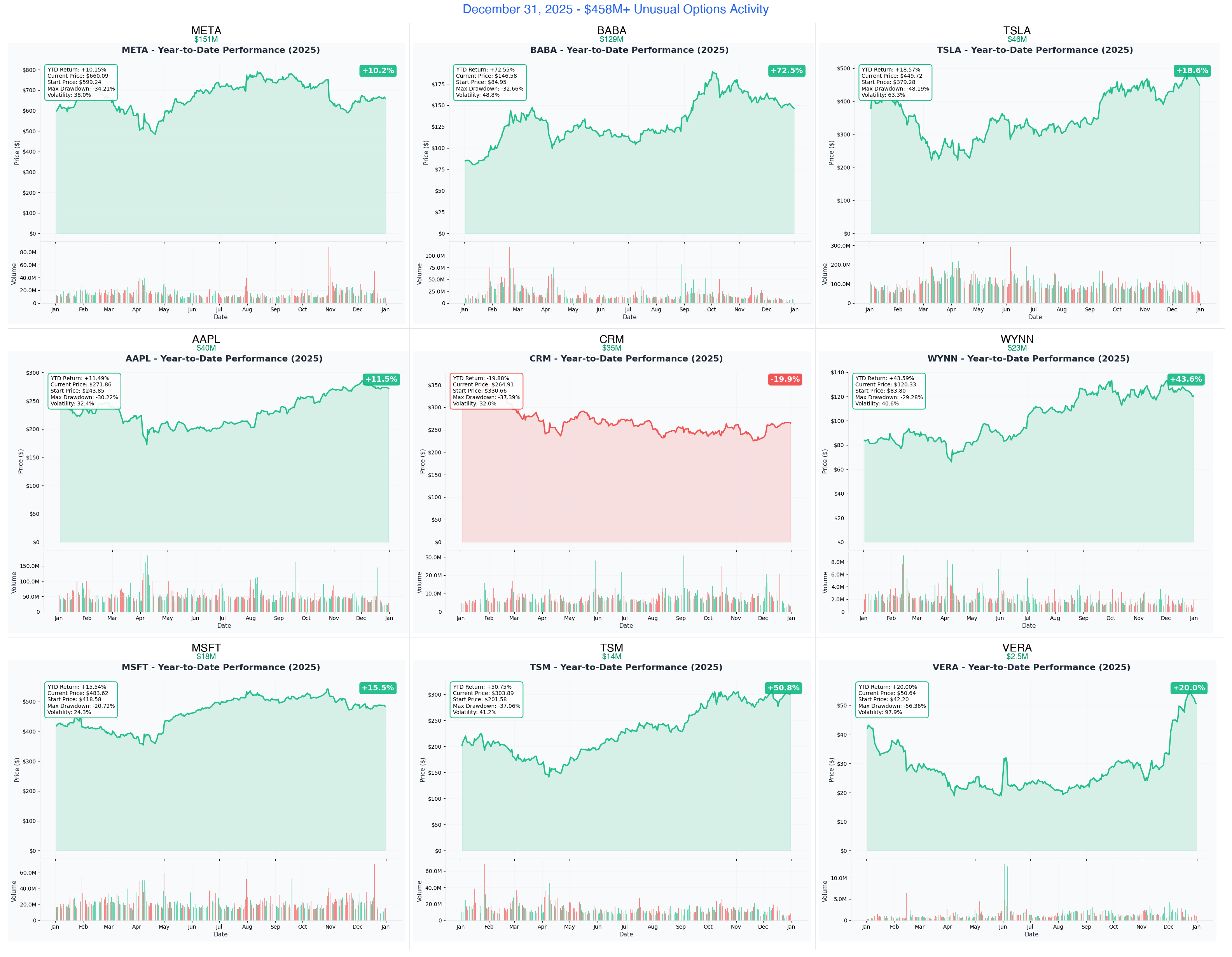

Ainvest Option Flow Digest - 2025-12-31: $458M Year-End Institutional Tsunami – Smart Money Locks in Gains & Opens 2026 Bets

📅 December 31, 2025 | 🔥 YEAR'S FINAL FLOW: META $151M Hedge + BABA $129M Bullish Bet + TSLA $46M Protective Spread | ⚠️ Massive Profit-Taking Meets Strategic 2026 Positioning

🎯 The $458M Year-End Repositioning: What Smart Money Did on 2025's Last Trading Day

🔥 HISTORIC YEAR-END ACTIVITY: We just tracked $458 MILLION in explosive options activity across 9 major tickers on 2025's final trading day. This isn't random noise – this is institutional money locking in profits, hedging into Q1 catalysts, and making bold directional bets for 2026. The headline act? A $129M bullish put spread on BABA that signals massive conviction in China's e-commerce giant, while META's $151M put complex shows big tech hedging into earnings season.

Total Flow Tracked: $458,500,000 💰 Biggest Bullish Bet: BABA $129M bullish put spread – someone's willing to own shares at $159 Largest Hedge: META $151M put complex – Z-score 5.83 (extremely unusual) Year-End Protection: TSLA $46M protective put spread – hedging $450 stock with $507 puts

📊 Complete Flow Summary Table

| Ticker | Premium | Expiration | Catalyst | Strategy | Meaning |

|---|---|---|---|---|---|

| META | $151M | Jan 16 / Feb 20 | Q4 Earnings ~Jan 26-30 | Put Complex + Call Buy | Hedging + Volatility |

| BABA | $129M | Jan 16, 2026 | FQ3 Earnings Feb 19 | Bullish Put Spread Opened | Directional Bullish |

| TSLA | $46M | Jan 2, 2026 | Q4 Deliveries Early Jan | Protective Put Spread | Hedging Long Position |

| AAPL | $40M | Jan 2/9/16, 2026 | Q1 Earnings Jan 29 | Put Calendar Roll | Hedging/Defensive |

| CRM | $35M | Jan 16, 2026 | Q4 Earnings Feb 25/Mar 4 | Bear Put Spread Unwind | Closing Hedge |

| WYNN | $23M | Mar 20, 2026 | Q4 Earnings Feb 11 | Close Long Calls | Profit-Taking |

| MSFT | $18M | Feb 20, 2026 | Q2 Earnings Jan 28 | Close Long Calls | Profit-Taking |

| TSM | $14M | Feb 20, 2026 | Q4 Earnings Jan 15 | Buy to Close Short Calls | Position Adjustment |

| VERA | $2.5M | Jan 16 / Feb 20 | FDA PDUFA Q2-Q3 2026 | Close Long Calls | Profit-Taking |

🚀 THE COMPLETE BREAKDOWN: All 9 Institutional Positions

1. 💻 META - The $151M Year-End Hedge Fortress

DECODE THE $151M YEAR-END HEDGE WITH Z-SCORE 5.83

- Flow: $151M ($23M February call purchase + $128M January put complex)

- What's Happening: Institutions deploying massive protection at $730-$800 put strikes while buying upside calls

- The Big Question: Why is smart money hedging so aggressively with META near all-time highs?

- Catalyst: Q4 2025 Earnings expected week of January 26-30, 2026

2. 🐉 BABA - The $129M Bullish China Bet

SEE WHY SOMEONE JUST BET $129M BABA STAYS ABOVE $190

- Flow: $129M bullish put spread opened in ONE SECOND across 93,800 contracts

- What's Happening: Sold $190/$185/$155 puts, bought $175/$180 puts – Z-scores up to 5.25

- The Big Question: With BABA at $146, why is smart money willing to own at effective $159 cost basis?

- Catalyst: Fiscal Q3 2026 Earnings on February 19, 2026

3. 🔥 TSLA - The $46M Protective Hedge

UNDERSTAND THE SOPHISTICATED $46M YEAR-END PROTECTION PLAY

- Flow: $46M protective put spread – bought $507.5 puts, sold $505/$510/$520 to finance

- What's Happening: Z-score 3.07 (555x average activity) – someone's hedging massive TSLA long

- The Big Question: Why lock in protection 2 days before expiry unless expecting volatility?

- Catalyst: Q4 Deliveries early January, Q4 Earnings late January 2026

4. 🍎 AAPL - The $40M Put Calendar Roll

ANALYZE THE INSTITUTIONAL $22M BET ON 48-HOUR VOLATILITY

- Flow: $40M put rollout – closing scattered positions, concentrating into $290 put

- What's Happening: $22M into puts expiring in just 48 hours – Z-score 2.06

- The Big Question: Why pay premium for protection expiring January 2?

- Catalyst: Q1 FY2026 Earnings on January 29, 2026

5. ☁️ CRM - The $35M Bear Spread Unwind

DISCOVER WHY SOMEONE CLOSED $35M IN BEARISH PROTECTION

- Flow: $35M bear put spread closed 16 days before expiration

- What's Happening: Z-score 3.94 on $300 put – removing massive downside hedge

- The Big Question: Why close protection with CRM down 21% YTD right before Q4 earnings?

- Catalyst: Q4 FY26 Earnings expected February 25 or March 4, 2026

6. 🎰 WYNN - The $23M Profit-Taking Exit

SEE WHY SMART MONEY CASHED OUT 16,000 CONTRACTS

- Flow: $23M closing long $110 calls with 16,000 contracts – Z-score 2.98

- What's Happening: Banking gains after WYNN's 46.5% YTD run ($121 vs ~$95-105 entry)

- The Big Question: Is Macau recovery fully priced after this massive rally?

- Catalyst: Q4 Earnings February 11, Chinese New Year January 29, 2026

7. 🖥️ MSFT - The $18M Cloud Profits Locked

UNDERSTAND THE $18M PROFIT-TAKING ON AZURE AI MOMENTUM

- Flow: $18M closing deep ITM $460 calls (stock at $485) – Z-score 1.67

- What's Happening: Locking in profits with 51 days remaining

- The Big Question: What does smart money know about Azure AI demand ahead of earnings?

- Catalyst: Q2 FY2026 Earnings expected January 28, 2026

8. 🔧 TSM - The $14M Position Uncapping

ANALYZE WHY SOMEONE BOUGHT BACK $14M IN SOLD CALLS

- Flow: $14M buying back previously sold $250 calls – with TSM at $305

- What's Happening: Removing upside cap before Q4 earnings

- The Big Question: Does someone expect TSM to rally further on 2nm chip ramp news?

- Catalyst: Q4 2025 Earnings January 15, 2026

9. 💊 VERA - The $2.5M Biotech Cash-Out

DISCOVER WHY INSTITUTIONS CASHED OUT AFTER 110% RALLY

- Flow: $2.5M closing $45 and $40 calls – Z-scores 4.23 and 3.17

- What's Happening: Banking profits near $56 all-time high before FDA binary event

- The Big Question: Is the FDA approval already priced in?

- Catalyst: FDA PDUFA Decision expected Q2-Q3 2026

⏰ Upcoming Catalysts Calendar

🗓️ January 2026 (Immediate Catalysts)

| Date | Event | Related Ticker |

|---|---|---|

| Jan 2 | TSLA puts expire, AAPL puts expire | TSLA, AAPL |

| Jan 9 | AAPL put rollout second leg | AAPL |

| Jan 15 | TSM Q4 Earnings | TSM |

| Jan 16 | BABA, CRM, META options expire | BABA, CRM, META |

| Jan 28 | MSFT Q2 Earnings | MSFT |

| Jan 29 | AAPL Q1 Earnings, Chinese New Year | AAPL, WYNN |

| Late Jan | TSLA Q4 Earnings, META Q4 Earnings | TSLA, META |

🗓️ February-March 2026 (Quarterly)

| Date | Event | Related Ticker |

|---|---|---|

| Feb 11 | WYNN Q4 Earnings | WYNN |

| Feb 19 | BABA FQ3 Earnings | BABA |

| Feb 20 | MSFT, TSM, VERA options expire | MSFT, TSM, VERA |

| Feb 25/Mar 4 | CRM Q4 Earnings | CRM |

| Mar 20 | WYNN options expire | WYNN |

🗓️ Later 2026 (LEAPs)

| Event | Related Ticker |

|---|---|

| FDA PDUFA Decision Q2-Q3 | VERA |

📊 Expiration Timeline Tags

📅 Weekly (Jan 2, 2026)

- TSLA – Protective put spread expires

- AAPL – Primary $290 put position expires

📆 Monthly (Jan 16, 2026)

- BABA – Bullish put spread position

- CRM – Bear spread unwind

- META – Primary put complex

- VERA – Partial position

🗓️ Quarterly (Feb-Mar 2026)

- MSFT – Closed call position (Feb 20)

- TSM – Bought-back calls (Feb 20)

- META – February call position (Feb 20)

- WYNN – Closed call position (Mar 20)

🚀 LEAP (2026+)

- VERA – FDA catalyst extends into Q2-Q3 2026

🎯 Your Action Plan by Investor Type

🎰 YOLO Trader (1-2% Max Per Position)

High Risk/High Reward – Binary Events

Top Plays:

- BABA January calls – Follow the $129M bullish conviction into February earnings. If institutions are willing to own at $159, upside to $170+ is in play.

- TSM January calls – Someone uncapped their upside before January 15 earnings. 2nm production news could send this higher.

Risk Warning: These are lottery tickets. Size appropriately – 1% max. BABA has China regulatory risk, TSM has geopolitical exposure.

⚖️ Swing Trader (3-5% Portfolio)

Multi-Week Opportunities with Institutional Backing

Primary Plays:

- META calendar spreads – $151M positioning suggests volatility. Consider February call spreads to capture post-earnings move.

- WYNN-style profit rotation – Follow smart money OUT of extended names (WYNN) INTO names with upcoming catalysts (TSM, BABA).

Risk Management:

- Set 30% stop loss on premium

- Take 50% profits at 50% gain

- Close positions 3 days before earnings if not playing the event

💰 Premium Collector (Income Strategy)

Harvest IV from Elevated Uncertainty

Income Opportunities:

- BABA cash-secured puts – If institutions sold $190 puts, you can sell $130-140 puts and collect premium while getting paid to potentially own lower.

- META iron condors – With $151M creating elevated IV, sell premium around the $730-$800 range where put activity concentrated.

Risk Rules:

- Only sell puts on stocks you'd own at strike price

- Close at 50% profit, don't be greedy

- Roll before going ITM

🛡️ Entry Level Investor (Learning Mode)

Start Small, Focus on Education

What to Learn From Today's Flow:

- Profit-Taking Lesson: Watch how MSFT, WYNN, and VERA closed winning positions. This is proper risk management – banking gains before catalysts.

- Hedging Lesson: Study TSLA's protective put spread. They're LONG the stock and ADDING protection, not betting against it. Big difference.

- Conviction Bet Lesson: BABA's $129M bullish spread shows extreme institutional conviction. Z-score 5.25 means this is 500x+ normal activity.

Recommended Actions:

- Paper trade a BABA bull put spread to understand the mechanics

- Track how META options perform through January earnings (IV crush lesson)

- Start with shares of quality names (MSFT, AAPL) before options

Critical Rule: Don't trade options until you've watched at least 10 earnings cycles. Start with 1% position sizes maximum.

⚠️ Risk Management: What Could Go Wrong

🚨 For Bullish Positions:

- BABA: China regulatory crackdown resumes, Alibaba Cloud growth disappoints

- TSM: Geopolitical tensions over Taiwan escalate, 2nm yield issues

- META: AI spending concerns, Reality Labs losses expand, advertising slowdown

🚨 For Hedged Positions:

- TSLA: Deliveries beat expectations, removing need for protection

- AAPL: iPhone 16 demand stronger than feared, puts expire worthless

- CRM: Agentforce AI traction exceeds expectations, unwound hedge was premature

🔑 Universal Rules:

- Never blindly follow unusual activity – institutions have hedges we can't see

- Position size discipline – YOLO 1-2%, Swing 3-5%, never more

- Respect catalysts – IV crush destroys positions even when directionally correct

- Take profits – smart money closed $61.5M today (WYNN + MSFT + VERA). Learn from them.

📈 The Bottom Line

On 2025's final trading day, institutions deployed $458M with a clear message:

- Profit-taking is prudent – MSFT, WYNN, VERA all closed winning positions before Q1 catalysts

- Hedging into earnings – META's $151M and TSLA's $46M show smart money isn't complacent

- Selective bullishness – BABA's $129M bet stands out as the boldest conviction play

The unified theme: Year-end repositioning, not panic. Smart money locked in 2025 gains while positioning for 2026 catalysts. Follow the discipline, not just the direction.

🔗 Complete Analysis Links

💰 Largest Flows (>$100M):

🛡️ Hedging & Protection:

📤 Profit-Taking Exits:

- WYNN: $23M Call Position Closed

- MSFT: $18M Call Position Closed

- TSM: $14M Call Buy-Back

- VERA: $2.5M Biotech Cash-Out

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. Always practice proper risk management and never risk more than you can afford to lose completely.

📊 Total Flow Summary:

- Total Tracked: $458,500,000

- Largest Position: META $151M (33% of total flow)

- Sector Mix: Big Tech 63% (META, AAPL, MSFT, CRM), International 31% (BABA, TSM), Consumer 5% (WYNN, TSLA), Biotech 1% (VERA)

- Theme: Year-end profit-taking + Q1 2026 catalyst positioning