Ainvest Option Flow Digest - 2025-12-30: Year-End Institutional Exit Wave - $199M Smart Money Locks In 2025 Profits

Year-End Institutional Exit Wave - $199M Smart Money Locks In 2025 Profits

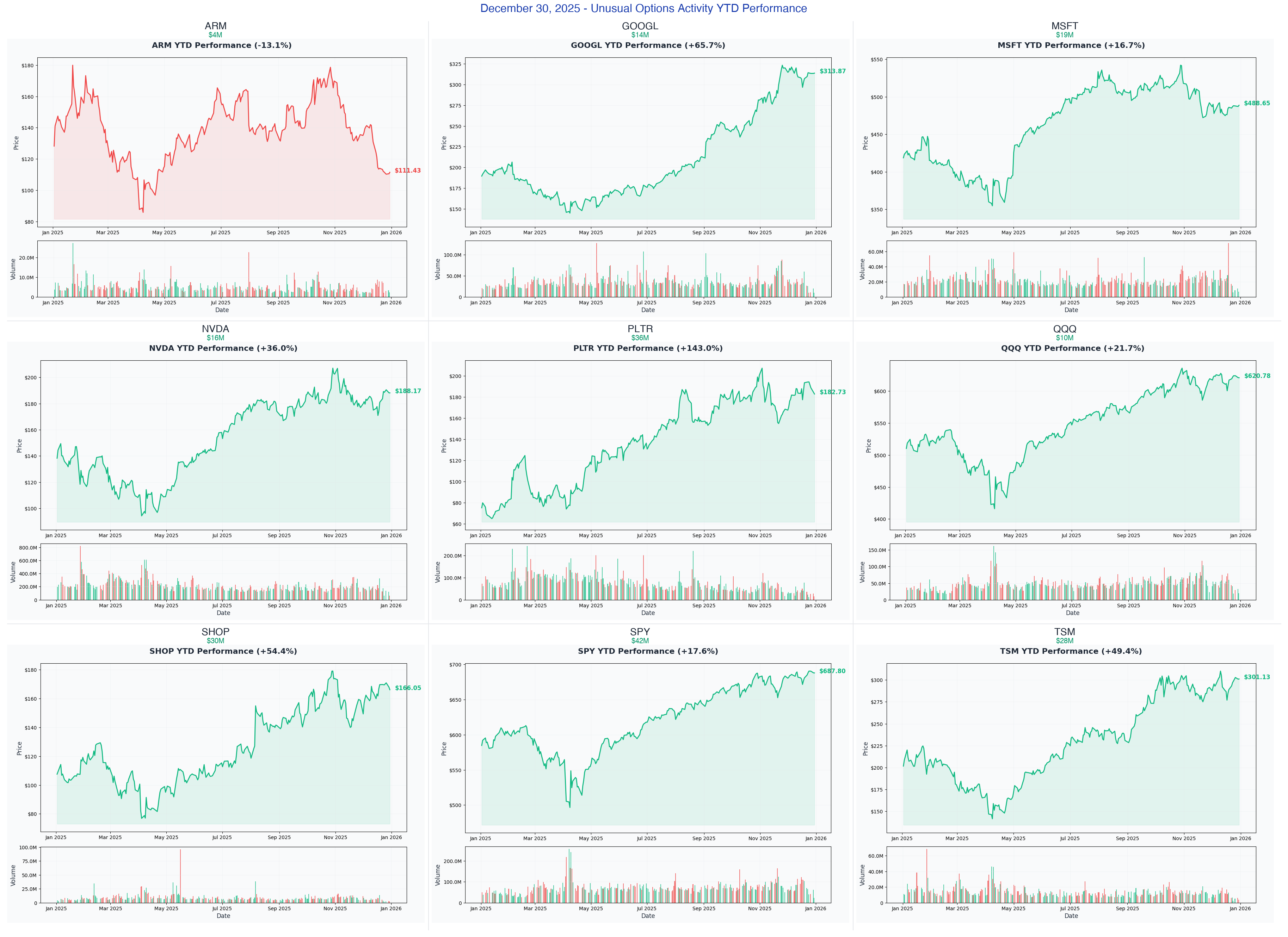

December 30, 2025 | MASSIVE EXODUS: $199M+ Institutional Profit-Taking Across 9 Tech/AI Giants | CES 2026 + Q4 Earnings Season Catalysts Ahead

The $199M Year-End Profit-Taking Tsunami

The smart money message is crystal clear: With 2025 delivering historic gains across AI, semiconductors, and big tech - institutions are cashing out before the calendar flips. We tracked $199 MILLION in unusual options activity today, dominated by PROFIT-TAKING on winners like PLTR (+150% YTD), SHOP (+57% YTD), TSM (+43% YTD), and NVDA (+42% YTD).

The playbook? Lock in extraordinary gains before Q4 earnings season volatility and let retail traders handle the binary risk events ahead.

Total Flow Tracked: $199,000,000 Theme Dominating: Institutional profit-taking (75%+ of flow) Biggest Position: SPY $42.4M calendar spread (year-end volatility arbitrage) Most Aggressive Exit: PLTR $36M call sale after +150% YTD rally Defensive Positioning: QQQ $10M put protection + ARM $4M put hedge

Complete Flow Summary Table

| Ticker | Premium | Expiration | Strategy | What's Happening | Play Type |

|---|---|---|---|---|---|

| SPY | $42.4M | Weekly | Calendar Spread | Volatility arbitrage betting on controlled move to $690-695 through Santa Claus rally | Theta/Vol |

| PLTR | $36M | Quarterly | Short Call | Locking in +150% YTD gains via $160 strike call sale before Q4 earnings | Profit-Taking |

| SHOP | $30M | Monthly | Call Exit | Unloading $140 calls after riding 57% rally, pre-Q4 earnings de-risk | Profit-Taking |

| TSM | $28M | Monthly | Call Exit | Cashing out $250 strike calls ($52 ITM) 16 days before earnings | Profit-Taking |

| MSFT | $19M | Monthly | Short Call | Selling $460 calls into Q2 earnings, locking in October rally gains | Income/Hedge |

| NVDA | $16M | Quarterly | Call Exit | Taking profits on $160 calls (120-200% gains) ahead of CES 2026 keynote | Profit-Taking |

| GOOGL | $14M | Monthly | Call Exit | Exiting $260 deep ITM calls at all-time highs, pre-Q4 earnings cash-out | Profit-Taking |

| QQQ | $10M | Monthly | Long Put | Two-layer $620/$605 put protection on massive long positions before Apple earnings | Hedge |

| ARM | $4M | LEAP | Long Put | LEAP puts post-Goldman downgrade, hedging first-party chip strategy risk | Directional |

The 9 Whale Trades: Complete Breakdown

1. SPY - $42.4M Complex Calendar Spread (Year-End Volatility Play)

DECODE THE $42M INSTITUTIONAL VOLATILITY ARBITRAGE STRATEGY

- Flow: $42.4M calendar/diagonal spread across Jan 2 and Jan 9 expirations

- What's Happening: Institutions betting on controlled upside to $690-695 with LOW volatility through year-end, collecting massive theta decay

- Catalyst: Santa Claus rally window (Dec 24-Jan 3), Employment report Jan 9, CPI Jan 13

- YTD: +18%

- The Big Question: Will the historic Santa Claus rally pattern hold, or does January bring the volatility shock?

2. PLTR - $36M Short Call (AI Defense Rally Profit-Taking)

SEE WHY $36M IS EXITING PALANTIR'S 150% RALLY

- Flow: $36M sold at $160 strike, quarterly expiration

- What's Happening: Massive institutional profit-taking after PLTR's stunning +150% YTD run on government AI contracts

- Catalyst: Q4 2025 Earnings February 2-18, 2026

- YTD: +150%

- The Big Question: Is PLTR's 150% rally sustainable, or is smart money right to cash out before earnings?

3. SHOP - $30M Call Exit (E-Commerce Giant Profit Lock)

UNDERSTAND THE $30M PROFIT-TAKING ON SHOP'S 57% RALLY

- Flow: $30M exiting $140 strike calls, February 20 expiration

- What's Happening: Institutions locking in massive gains after SHOP rallied from $110 to $180, ahead of critical holiday quarter earnings

- Catalyst: Q4 2025 Earnings February 18, 2026 (50 days away)

- YTD: +57.6%

- The Big Question: Will holiday e-commerce numbers justify the rally, or did smart money time the top?

4. TSM - $28M Call Exit (AI Chip Rally Cash-Out)

ANALYZE TSM'S $28M PROFIT-TAKING BEFORE JANUARY EARNINGS

- Flow: $28M selling $250 strike calls (now $52 in-the-money at $302)

- What's Happening: Converting huge paper profits to cash 16 days before Q4 earnings, not risking gains on binary event

- Catalyst: Q4 2025 Earnings January 15, 2026 (16 days)

- YTD: +43%

- The Big Question: Is TSM at fair value post-AI boom, or does earnings guidance reveal more upside?

5. MSFT - $19M Short Call (AI Infrastructure Consolidation Bet)

DECODE MSFT'S $19M COVERED CALL INTO Q2 EARNINGS

- Flow: $19M sold at $460 strike, February 20 expiration

- What's Happening: Smart money betting MSFT consolidates around current levels through Q2 earnings, despite Azure's 40% growth

- Catalyst: Q2 FY2026 Earnings January 28, 2026 (29 days)

- YTD: +1%

- The Big Question: Can Azure AI growth re-accelerate, or has MSFT's 2024 rally already priced in perfection?

6. NVDA - $16M Call Exit (Pre-CES Profit Protection)

SEE WHY SMART MONEY EXITS $16M BEFORE CES 2026

- Flow: $16M exiting $160 strike deep ITM calls, March 20 expiration

- What's Happening: Locking in 120-200%+ gains just 6 DAYS before Jensen's CES keynote - classic "sell the news" setup

- Catalyst: CES 2026 Keynote January 5 (6 days!), Q4 Earnings Feb 25, GTC March 16-19

- YTD: +41.88%

- The Big Question: Will CES announcements exceed sky-high expectations, or is the smart money right to exit?

7. GOOGL - $14M Call Exit (All-Time High Cash-Out)

UNDERSTAND THE $14M EXIT AT GOOGL'S PEAK

- Flow: $14M selling $260 strike calls (94% intrinsic value) at $314 stock price

- What's Happening: Converting deep ITM position to cash at all-time highs, before Q4 earnings volatility

- Catalyst: Q4 2025 Earnings early February 2026

- YTD: +120% from April lows

- The Big Question: Has GOOGL's AI/search dominance been fully priced, or is there more upside in 2026?

8. QQQ - $10M Long Put (Tech Index Portfolio Protection)

ANALYZE THE $10M TECH HEDGE BEFORE APPLE EARNINGS

- Flow: $10M split across $620 and $605 strike puts (15,500 contracts total)

- What's Happening: Two-layer defensive insurance on massive long positions ahead of Apple earnings (1 day before expiry!)

- Catalyst: Apple Q1 FY2026 Earnings January 29, CES 2026 January 6-9, Fed FOMC January 28-29

- YTD: +22.7%

- The Big Question: Is QQQ's near-all-time-high a setup for pullback, or will Apple's Vision Pro momentum push higher?

9. ARM - $4M Long Put (Post-Downgrade Defensive Hedge)

DISCOVER WHY $4M FLOWS INTO ARM PUTS AFTER GOLDMAN DOWNGRADE

- Flow: $4M buying $120 strike puts, January 2027 LEAP expiration

- What's Happening: Smart money buying insurance on 150,000 shares after Goldman downgrades to Sell with $120 target

- Catalyst: Goldman downgrade December 15, Q3 FY2026 Earnings February 4, First-party chip launch risk

- YTD: -15%

- The Big Question: Will ARM's pivot to first-party chips alienate customers and validate Goldman's bearish call?

Critical Catalysts & Dates

THIS WEEK (Dec 30 - Jan 3)

- Santa Claus Rally Window - SPY $42.4M calendar spread positioned for controlled upside

NEXT WEEK (Jan 5-10)

- Jan 5: NVDA CES 2026 Keynote - $16M already exited ahead of announcement

- Jan 6-9: CES 2026 - QQQ $10M put hedge active through event

- Jan 9: Employment Report - SPY calendar spread expiration

MID-JANUARY (Jan 13-15)

- Jan 13: CPI Report - Inflation data could shock volatility

- Jan 15: TSM Q4 Earnings - $28M already exited, 16 days early

LATE JANUARY (Jan 28-29)

- Jan 28: MSFT Q2 FY2026 Earnings - $19M short call positioned

- Jan 28-29: FOMC Meeting - Fed rate decision

- Jan 29: Apple Q1 FY2026 Earnings - QQQ $10M puts expire NEXT DAY

FEBRUARY (Earnings Wave)

- Feb 4: ARM Q3 FY2026 Earnings - $4M LEAP puts hedging

- Feb 2-18: PLTR Q4 Earnings - $36M already exited

- Feb 18: SHOP Q4 Earnings - $30M already exited

- Feb 20: Multiple option expiries - GOOGL, MSFT, TSM, SHOP

- Feb 25: NVDA Q4 Earnings - Smart money already out

Trading Playbooks by Investor Type

YOLO Trader (1-2% Portfolio Max)

High risk, binary outcomes - size SMALL

Earnings Volatility Plays:

- TSM earnings straddle (Jan 15) - Ride the AI chip volatility either direction

- NVDA CES momentum (Jan 5) - Speculative calls IF announcement exceeds expectations

- ARM recovery bounce - Contrarian play if market overreacted to Goldman downgrade

Why these work: Binary events create explosive moves. Smart money already exited = less institutional resistance. But size tiny because 100% loss is possible.

Risk Management: Exit at 100% gain or 50% loss. NEVER hold through the event without trailing stops.

Swing Trader (3-5% Portfolio)

2-4 week holds with defined catalysts

Follow the Institutional Exit Theme:

- Short PLTR spreads - If $36M exit is right, stock consolidates around $160

- SHOP iron condor - Range-bound into February earnings after smart money exit

- SPY calendar spreads - Copy the $42.4M positioning for Santa Claus rally

Why these work: Institutions have better information. When they exit en masse, stocks often consolidate or pull back. Defined-risk spreads let you profit from their insight.

Risk Management: 30% stop loss on premium. Take 50% profits at target. Don't fight the tape if momentum continues.

Premium Collector (Income Focus)

Harvest theta from elevated IV

High-IV Harvesting Opportunities:

- NVDA covered calls - Sell $200 calls into CES (IV elevated, smart money exiting)

- PLTR cash-secured puts - Sell $140 puts to buy the dip if it comes

- QQQ put credit spreads - Sell $600/$590 spreads under the institutional hedge level

Why these work: When institutions buy protection (QQQ puts) or exit (call sales), IV spikes. Selling premium captures this elevated fear premium.

Risk Management: Only sell premium on stocks you'd own. Close at 50-60% profit. Roll losers BEFORE they become worthless.

Entry-Level Investor (Learning Mode)

Start small, focus on education

Paper Trade These First:

- Watch how TSM trades into January 15 earnings - See how institutional exits affect price

- Track NVDA through CES - Classic "buy rumor, sell news" education

- Follow SPY calendar spread - Learn how theta decay works in real-time

Safe Learning Trades:

- QQQ shares - Broad tech exposure without single-stock risk

- SPY shares - Market beta with institutional positioning tailwind

- MSFT shares below $480 - Quality name where smart money is selling calls, not stock

Critical Rules:

- Never risk more than 1% per trade

- Avoid options entirely until you understand Greeks

- Watch 10+ earnings cycles before trading them

- If you don't understand the strategy, don't trade it

What Could Destroy These Trades

If You're Following the Profit-Takers (Bearish Bias):

- NVDA CES blowout - Revolutionary announcements could squeeze shorts

- TSM guidance raise - AI demand could exceed even bull cases

- PLTR contract surprise - Government AI deal announcements

- Santa Claus rally extension - SPY breaks above $700, crushing calendar spreads

If You're Staying Long:

- Fed hawkish surprise - Inflation reaccelerates, rate cuts delayed

- Apple earnings miss - QQQ puts suddenly become very valuable

- Geopolitical shock - Taiwan tensions spike, affecting TSM/semiconductors

- Year-end rebalancing - Pension fund selling creates January volatility

The Bottom Line: Smart Money Says "Thank You, 2025"

This is the clearest institutional message we've seen all quarter: After delivering historic returns in AI, semiconductors, and big tech - the smart money is saying "enough." $199 million in profit-taking and hedging activity tells you everything about institutional sentiment going into 2026.

Key Questions Going Into the New Year:

- Will NVDA's CES keynote justify the $16M exit or create a buying opportunity?

- Is SPY's $42M calendar spread the template for year-end trading?

- Can PLTR sustain momentum after $36M institutional exit?

- Will TSM earnings in 16 days prove the $28M exit prescient or premature?

Your move: The institutions have made theirs. They're locking in gains, hedging risk, and preparing for potential volatility. Whether you follow their lead or take the other side, respect the signal - this much money doesn't move without conviction.

Complete Analysis Links

Profit-Taking Exits:

- SPY $42.4M Calendar Spread - Year-End Volatility Arbitrage

- PLTR $36M Short Call - AI Defense Rally Profit-Taking

- SHOP $30M Call Exit - E-Commerce Giant Profit Lock

- TSM $28M Call Exit - Semiconductor Profit Protection

- NVDA $16M Call Exit - Pre-CES Profit Taking

- GOOGL $14M Call Exit - All-Time High Cash-Out

Income/Hedging Strategies:

- MSFT $19M Short Call - AI Infrastructure Covered Call

- QQQ $10M Long Put - Tech Index Portfolio Hedge

- ARM $4M Long Put - Post-Downgrade Defensive Hedge

Expiration Tags

Weekly (Jan 2-9)

- SPY Calendar spread legs expiring Jan 2 and Jan 9

Monthly (Jan 30 - Feb 20)

- QQQ Put protection expires Jan 30 (1 day after Apple earnings!)

- GOOGL Call exit Feb 20

- MSFT Short call Feb 20

- SHOP Call exit Feb 20

- TSM Call exit Feb 20

Quarterly (March 20)

- NVDA Call exit March 20 (triple witch)

- PLTR Short call quarterly expiration

LEAP (2027)

- ARM Put hedge January 15, 2027

Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios. These positions represent past institutional behavior and don't guarantee future performance. The dominant profit-taking theme suggests institutions believe risk/reward has shifted - but they could be wrong. Always practice proper risk management and never risk more than you can afford to lose. Don't blindly follow whale trades - understand the thesis before committing capital.

Total Flow Summary:

- Total Tracked: $199,000,000

- Dominant Theme: Profit-Taking/De-Risking (75%+ of flow)

- Sectors: AI/Semiconductors, Big Tech, E-Commerce, Index ETFs

- Expiry Range: Weekly (Jan 2) through LEAP (Jan 2027)

- Key Message: Institutions locking in 2025 gains before 2026 volatility