Ainvest Option Flow Digest - 2025-11-26: 🎯 Profit-Taking Tsunami - $68.2M Smart Money Exits at All-Time Highs

📅 November 26, 2025 | 🚨 DEFENSIVE ROTATION: GLD's $11.7M Synthetic Exit + SMH's $12M Put Close + MAR's $7.6M Call Sale | ⚠️ Institutions Lock in Gains While Hedging Year-End Risk

🎯 The $68.2M Institutional Profit Lock: Smart Money Exits at Peak Valuations

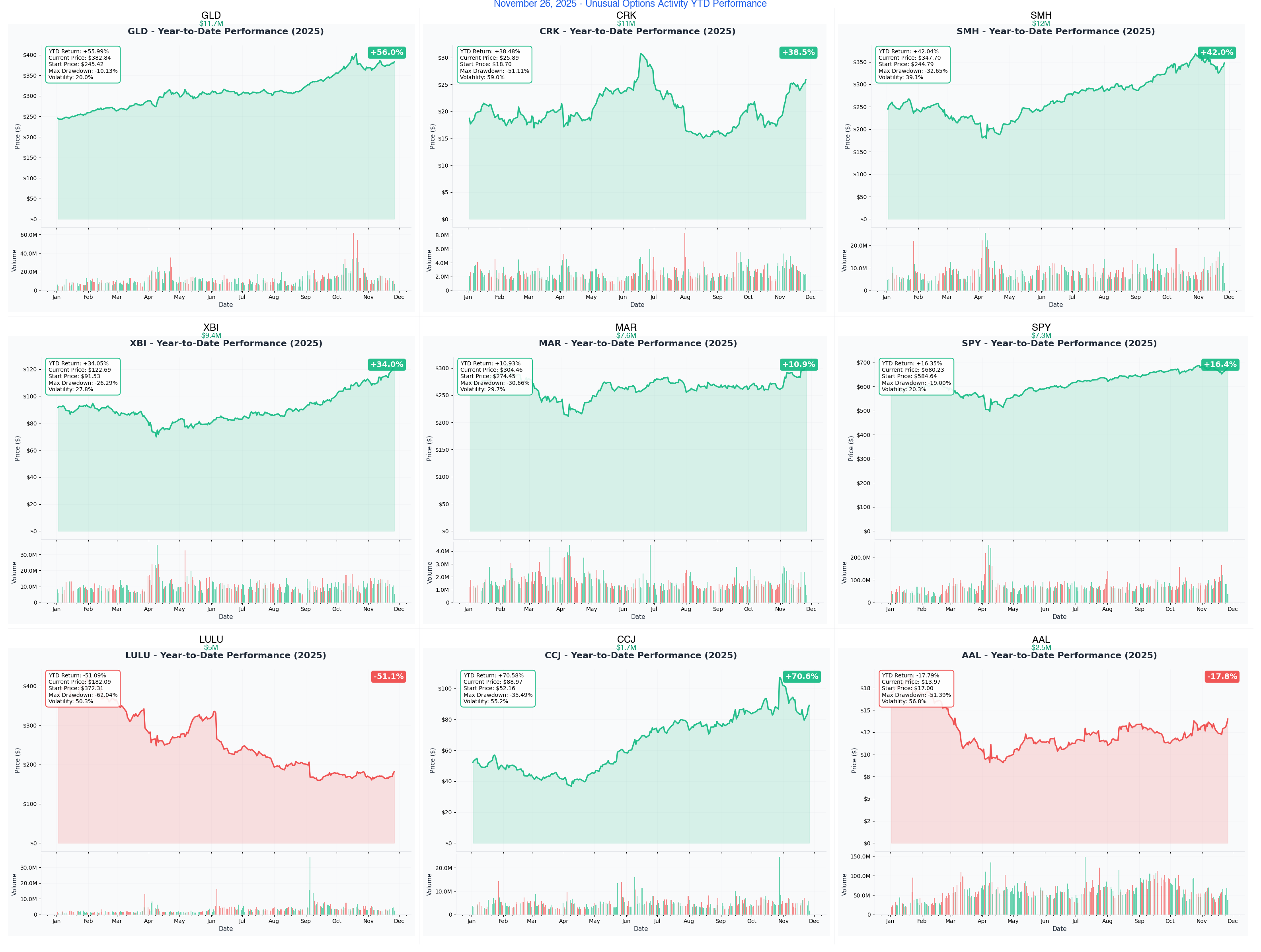

🔥 UNPRECEDENTED DEFENSIVE SHIFT: We just tracked $68.2 MILLION in sophisticated profit-taking and hedging activity across 9 key positions - headlined by GLD's $11.7M synthetic long exit (locking in 56% gold rally profits), SMH's $12M put buyback (semiconductors reducing downside protection), and MAR's $7.6M deep ITM call sale (hotels cashing out at all-time highs). This isn't bearish capitulation - this is smart money securing gains after massive rallies while strategically hedging SPY ($7.3M) and biotech XBI ($9.4M) into year-end uncertainty.

Total Flow Tracked: $68,200,000 💰 Biggest Position Close: GLD $11.7M synthetic long unwind (booking est. $8.5-9M profit) Largest Hedge: SMH $12M put buyback (confidence in $330-340 floor) + SPY $7.3M disaster insurance Defensive Theme: $33.4M in protective puts across SPY, XBI, CCJ (institutions buying year-end insurance)

📊 Complete Flow Summary Table

| Ticker | Premium | Expiration | Timeframe | Strategy | Catalyst | Directional Bias |

|---|---|---|---|---|---|---|

| GLD | $11.7M | Dec 19, 2025 | Monthly | Synthetic Long Close | Central banks +634t YTD, Fed rate cuts, geopolitical tensions | Profit-Taking (Neutral near-term) |

| SMH | $12M | Feb 20, 2026 | Monthly | Put Buyback | NVDA Blackwell ramp, TSMC Q4 Jan 10 | Confidence Signal (Bullish) |

| CRK | $11M | Nov 20, 2026 | LEAP | Call Sale | Natural gas $4.55 (+117%), Shelby Trough sale | Profit-Taking (Neutral) |

| XBI | $9.4M | Feb 20, 2026 | Quarterly | Dual Put Hedge | JPM Healthcare Jan 12-15, FDA PDUFA Q1 | Defensive Hedge (Bearish) |

| MAR | $7.6M | Feb 20, 2026 | Monthly | Deep ITM Call Sale | Q4 earnings Feb, 30+ properties opening 2025 | Profit-Taking (Neutral) |

| SPY | $7.3M | Dec 19, 2025 | Monthly | Tail-Risk Puts | Dec 9-10 FOMC, Dec 18 CPI, TCJA expiration | Disaster Insurance (Neutral) |

| LULU | $5M | Jan 15, 2027 | LEAP | Short Call Sale | Q3 earnings Dec 4 (±13.3% move), tariff impact $240M | Bearish Income (Bearish) |

| AAL | $2.5M | Jan 16, 2026 | Monthly | Long Call | Holiday travel season, Q4 earnings late Jan | Bullish Recovery (Bullish) |

| CCJ | $1.7M | Jan 16, 2026 | Monthly | Put Hedge | Q4 earnings Feb 11-13, uranium $76→$90-135/lb | Portfolio Protection (Neutral) |

🚀 THE COMPLETE WHALE LINEUP: All 9 Institutional Positions

1. 💎 GLD - The $11.7M Synthetic Long Exit (Booking $8.5-9M Profit)

DISCOVER WHY SMART MONEY EXITS GOLD AT ALL-TIME HIGHS AFTER 56% RALLY

- Flow: $11.7M synthetic long unwind ($8.9M call buy + $2.8M put sell simultaneously)

- What's Happening: Institutional trader closes synthetic long established months ago at lower levels - textbook profit-taking at $383 (up from $245 start of year). Central banks added record 634 tons YTD.

- YTD Performance: +56% (from $245 to $383)

- The Big Question: Is this the top for gold, or just tactical profit-taking before consolidation?

- Catalyst: December 19 monthly OPEX (23 days), Fed rate path uncertainty, year-end geopolitical risk

2. 🔥 SMH - The $12M Put Close (Semiconductors Reducing Downside Fear)

ANALYZE WHY $12M PUT PROTECTION GETS UNWOUND AFTER 42% CHIP RALLY

- Flow: $12M put buyback ($23 per contract × 5,000 contracts) - institutions CLOSING protective puts they bought cheaper weeks ago

- What's Happening: Smart money paid MORE for these puts when SMH was $310-330, now selling them back at lower prices after rallying to $346.67. This signals confidence in $330-340 support floor, NOT bearish sentiment.

- YTD Performance: +42% (semiconductor ETF benefiting from AI chip demand)

- The Big Question: Is this bullish rotation or just reducing hedge exposure?

- Catalyst: NVDA Blackwell ramp (sold out through 2026), TSMC Q4 earnings January 10

3. 💎 CRK - The $11M Call Sale (Natural Gas Rally Profit Harvest)

DECODE THE MASSIVE $11M NATURAL GAS PROFIT-TAKING POSITION

- Flow: $11M covered call sale - 38,000 contracts at $35 strike (Z-score 1,323.76 - literally one of largest CRK trades ever recorded)

- What's Happening: Natural gas prices doubled from $2.10 to $4.55/MMBtu driving +38.5% YTD rally in Comstock. Institutional trader caps upside at profitable $35 level rather than remaining fully exposed.

- YTD Performance: +38.5% (natural gas sector benefiting from 25% YoY LNG export growth)

- The Big Question: Has natural gas rally run too far, too fast?

- Catalyst: Shelby Trough asset sale closing, Western Haynesville delineation updates, winter 2025-2026 heating season demand

4. 🧬 XBI - The $9.4M Biotech Hedge (Protecting 52-Week Highs)

UNDERSTAND THE $9.4M INSURANCE POLICY ON BIOTECH AT PEAK VALUATIONS

- Flow: $9.4M dual-leg protective hedge ($115 strike + $100 strike puts) - 5,198x average size

- What's Happening: Someone deployed institutional-scale insurance just as XBI hit 52-week highs (+34% YTD), with primary $115 strike positioned EXACTLY at gamma support - expecting floor collapse if sector momentum breaks.

- YTD Performance: +34% (biotech recovery benefiting from FDA approval acceleration)

- The Big Question: Do institutions know something about biotech valuations being stretched?

- Catalyst: JPM Healthcare Conference (January 12-15), 12+ FDA PDUFA decisions through Q1 2026

5. 🏨 MAR - The $7.6M Hotel Call Sale (Marriott Exits at All-Time Highs)

SEE WHY $7.6M EXITS MARRIOTT AFTER 44% RALLY TO RECORD PRICES

- Flow: $7.6M deep ITM call sale (779 contracts at $210 strike, $95 below current $305 spot) - Z-score 15.73 (898x average trade)

- What's Happening: NOT bearish - this is smart money converting deep ITM position worth $95 intrinsic value into $7.6M cash at all-time highs, locking in 30-40% gains after April recovery.

- YTD Performance: +44% (luxury hotel recovery with RevPAR growth)

- The Big Question: Has luxury travel peaked, or just profit-taking before Q4 earnings?

- Catalyst: Q4 earnings February 2026 (testing 2-4% RevPAR growth guidance), 30+ property openings in 2025

6. 🛡️ SPY - The $7.3M Tail-Risk Insurance (Hedging at All-Time Highs)

EXPLORE WHY $7.3M BUYS DISASTER PROTECTION WITH SPY AT RECORDS

- Flow: $7.3M deep OTM puts ($505 + $555 strikes) protecting $20.4 BILLION in underlying SPY exposure - Z-score 63.76 (2,411x average size)

- What's Happening: NOT directional bearish bet - this is tail-risk protection against 18-26% crash scenarios while base case remains consolidation in $665-685 range.

- YTD Performance: SPY at all-time highs despite binary catalysts converging

- The Big Question: Why buy insurance at peaks with strong fundamentals?

- Catalyst: December 9-10 FOMC (72% probability 25bp cut but divided on 2026), delayed November CPI December 18, TCJA tax deadline Dec 31

7. 🩱 LULU - The $5M Bearish Call Sale (Betting Against Athleisure Recovery)

UNPACK THE $5M BET THAT LULULEMON STAYS BELOW $210 THROUGH 2027

- Flow: $5M short call sale (1,500 contracts at $210 strike, 415 days to expiration) - 646x unusual score

- What's Happening: Seller positioned EXACTLY at $210 resistance zone where every 2025 rally failed, suggesting institutional knowledge of technical barriers + fundamental headwinds from -51% YTD decline and Alo Yoga/Vuori competition.

- YTD Performance: -51% (market share erosion to competitors)

- The Big Question: Can LULU stabilize U.S. comps at -4.5% or will competition accelerate decline?

- Catalyst: Q3 earnings December 4 (8 days away, ±13.3% implied move), tariff impact discussion ($240M expected), holiday season performance

8. ✈️ AAL - The $2.5M Airline Recovery Bet (Bullish Call at $14 Gamma Pivot)

DISCOVER THE $2.5M BET ON AIRLINES RECOVERY RALLY TO $15-16

- Flow: $2.5M long calls (26,000 contracts at $14 strike) - positioned EXACTLY at gamma pivot level

- What's Happening: Institutional buyer struck at $14 gamma resistance - betting on breakout above $14.50 where market makers forced to buy stock to hedge, creating positive momentum to $15-16 range.

- YTD Performance: -27% from August highs (after -51% drawdown from peak)

- The Big Question: Is airlines bottoming, or just dead cat bounce before recession?

- Catalyst: Peak holiday travel (Thanksgiving-New Year), December investor presentations, Q4 earnings late January

9. 💎 CCJ - The $1.7M Nuclear Put Hedge (Protecting 70.6% Rally)

ANALYZE THE $1.7M INSURANCE ON URANIUM LEADER AFTER MASSIVE RALLY

- Flow: $1.7M put protection ($70 strike positioned EXACTLY at "disaster floor" gamma support) - 792x average size

- What's Happening: NOT bearish - this is portfolio insurance on massive underlying position (~$151M in stock) after 70.6% YTD rally. Long-term bullish on nuclear thesis, near-term cautious.

- YTD Performance: +70.6% (uranium spot $76/lb with forecasts $90-135/lb by Q1 2026)

- The Big Question: Will uranium prices sustain rally or consolidate into 2026?

- Catalyst: Q4 earnings preview late Dec/early Jan, full earnings Feb 11-13, Westinghouse reactor deployment timeline Q1 2026

⏰ URGENT: Critical Expiries & Catalysts This Quarter

🚨 8 DAYS TO LULU EARNINGS (December 4)

- LULU - $5M Short Calls - U.S. comp stabilization test (±13.3% implied move)

⚡ 23 DAYS TO TRIPLE WITCH (December 19)

- GLD - $11.7M Synthetic Close - Monthly OPEX profit lock

- SPY - $7.3M Tail-Risk Puts - December FOMC + CPI convergence

🧠 January-February Earnings Tsunami

- AAL - Late January - Q4 earnings with holiday travel metrics

- CCJ - Feb 11-13 - Full earnings with 2026 production guidance

- MAR - February - Q4 RevPAR growth validation

🔬 Regulatory & Macro Catalysts

- December 9-10: FOMC meeting (SPY tail-risk event)

- December 18: Delayed November CPI release

- December 31: TCJA tax cut expiration deadline

- January 10: TSMC Q4 earnings (SMH catalyst)

- January 12-15: JPM Healthcare Conference (XBI catalyst)

📊 Smart Money Themes: What Institutions Are Really Signaling

💰 Profit-Taking Tsunami ($42.4M Exits at Peak Valuations)

Smart Money Locking in Gains After Massive Rallies:

- → GLD: $11.7M synthetic close - booking est. $8.5-9M profit on 56% gold rally

- → SMH: $12M put buyback - reducing hedge after 42% semiconductor rally

- → CRK: $11M call sale - capping upside at $35 after natural gas doubles

- → MAR: $7.6M deep ITM call sale - exiting hotels at all-time highs

🛡️ Year-End Defensive Hedging ($18.4M Protection)

Institutions Buying Insurance Into Uncertainty:

- → SPY: $7.3M tail-risk puts - protecting $20.4B exposure at ATH

- → XBI: $9.4M dual put hedge - biotech at 52-week highs needs protection

- → CCJ: $1.7M put protection - nuclear rally insurance

📉 Bearish Income Generation ($5M Premium Collection)

Selling Premium Against Rallies That Won't Materialize:

📈 Contrarian Bullish Bets ($2.5M Bottom Fishing)

Buying the Dip on Beaten-Down Names:

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

Earnings Lottery Ticket:

- LULU December OTM puts - Fade Dec 4 earnings if U.S. comps disappoint (±13.3% move)

- Risk: IV crush even if directionally correct

- Reward: 200-300% if guidance cut and tariff impact worse than expected

Airline Recovery Gamble:

- AAL January $15-16 call spreads - Follow $2.5M whale into Q4 earnings

- Risk: Total loss if recession fears resurface

- Reward: 10x if holiday travel beats and stock breaks $14.50 gamma resistance

⚠️ PATIENCE CRITICAL: Do NOT blindly copy unusual flow - wait for confirmation of catalysts and technical setups.

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with risk management

Profit-Taking Rotation:

- GLD December puts - Follow institutional exit, expect $363-394 consolidation

- MAR calendar spreads - Fade strength, target $300-310 range

- Timeline: Hold through December consolidation, re-evaluate at support

Hedge Replication:

- SPY December OTM puts - Copy institutional tail-risk protection (3-5% of equity exposure)

- XBI February puts - Biotech hedge into JPM Healthcare Conference

- Timeline: Hold through December volatility events, reassess after FOMC

⚠️ RISK CONTROL: Use stop-losses at -20% to -30% on swing trades. Never risk more than 1% of portfolio on single position.

💰 Premium Collection (Income Strategy)

Follow institutional sellers to harvest premium

High IV Opportunities:

- LULU covered calls - Sell $195-200 strikes ahead of Dec 4 earnings (collect juicy IV premium)

- AAL short puts - Sell $12-13 strikes if willing to own at lower levels

Calendar Spread Income:

- CRK calendar spreads - Copy whale's 2026 LEAP positioning

- MAR short-term calls - Sell December/January against potential long position

⚠️ MARGIN SAFETY: Only sell premium with 50%+ margin of safety. Be prepared to own stock at strike prices.

🛡️ Conservative Positioning (Entry-Level Investors)

Low-risk, educational following with small size

Learn From Institutional Hedging:

- Start with SPY shares + small protective put position (1-2% cost)

- Practice: Understand how tail-risk protection works without large capital commitment

- Timeline: Hold through December events, study how institutions manage risk

Build Core Positions:

- SMH shares or LEAPs - Semiconductor ETF for long-term AI exposure

- CCJ shares - Nuclear energy with small protective put if desired

- Timeline: Multi-month to multi-year holding periods

⚠️ EDUCATION FIRST: Paper trade options strategies before risking real capital. Start with 0.5-1% position sizes.

🚨 What Could Destroy These Trades

😱 If You're Following the Profit-Takers (GLD, SMH, CRK, MAR)

Market Continuation Risk:

- Gold breaks above $400 on escalating geopolitical tensions (missed upside)

- Semiconductors rally another 20% on NVDA Blackwell demand exceeding expectations

- Natural gas spikes to $6+ on extreme winter weather

- Marriott beats Q4 earnings with stronger-than-expected RevPAR growth

Timing Risk:

- Exiting too early before final 10-15% rally leg

- Missing year-end Santa Claus rally in equities

- Underestimating institutional FOMO into Q1 2026

😰 If You're Following the Hedgers (SPY, XBI, CCJ)

False Alarm Risk:

- December FOMC delivers dovish surprise, markets rally

- Biotech sector rallies on unexpected FDA approvals at JPM Conference

- Nuclear thesis accelerates faster than hedged positions expect

- SPY consolidates at highs without the feared correction

Hedge Decay:

- Time decay erodes put value if markets stay range-bound

- Implied volatility collapses after catalysts pass uneventfully

- Insurance premium wasted if tail-risk events don't materialize

💣 If You're Following the Bears (LULU) or Bulls (AAL)

LULU Bearish Bet Risks:

- Q3 earnings beat with better-than-expected U.S. comp stabilization

- China growth exceeds 20-25% expectations

- Tariff impact less severe than $240M feared

- Stock breaks above $210 resistance on positive guidance

AAL Bullish Bet Risks:

- Holiday travel disappoints due to economic slowdown

- Fuel costs spike on oil price surge

- Recession fears accelerate airline sector decline

- Stock fails to break $14.50 gamma resistance, stalls below breakout level

💣 This Week's Catalysts & Key Dates

📊 This Week (November 26 - December 2):

- Thanksgiving Week: Holiday travel data for AAL thesis validation

- Black Friday: Consumer spending indicators for MAR hotel demand

- Natural Gas Storage: Weekly inventory data for CRK positioning

🧠 Next Week (December 3-9):

- December 4: LULU Q3 earnings - $5M short call positioned for disappointment (±13.3% implied move)

- December 9-10: FOMC Meeting - $7.3M SPY tail-risk protection converges with rate decision

🚀 December Critical Events:

- December 18: Delayed November CPI release (SPY volatility catalyst)

- December 19: Monthly OPEX - GLD synthetic close expiration, SPY puts expire

- December 31: TCJA tax cut expiration deadline (market uncertainty)

📅 January-February Catalysts:

- January 10: TSMC Q4 earnings (SMH semiconductor demand validation)

- January 12-15: JPM Healthcare Conference (XBI biotech catalyst)

- Late January: AAL Q4 earnings with holiday travel results

- February 11-13: CCJ full earnings with 2026 production guidance

- February 20: SMH, XBI, MAR, CRK option expirations

🎯 Complete Link Directory: Deep Dive Analyses

Profit-Taking Exits:

Defensive Hedging:

Directional Bets:

⚠️ Critical Risk Warnings

DO NOT Blindly Follow Unusual Flow

Institutional Context Matters:

- GLD's $11.7M exit could be rebalancing, not bearish signal

- SMH's $12M put close could be position rolling, not bullish conviction

- SPY's $7.3M tail-risk could protect $20B portfolio, not predict crash

- Institutions have different risk tolerances, time horizons, and capital bases

Your Risk Management:

- Position Size: Never risk more than 1-2% of portfolio on single trade

- Stop Losses: Set mechanical stops at -20% to -30% on swing trades

- Catalyst Dependency: Don't hold through binary events without conviction

- Time Decay: Options lose value daily - factor theta into holding periods

- Implied Volatility: IV crush after earnings can destroy profitable directional trades

Patience is Profit:

- Wait for technical confirmation before entering

- Don't chase entries after 10%+ moves

- Let setups come to you at planned price levels

- Better to miss a trade than blow up account on FOMO

📧 Questions? Reply to this email with your option flow analysis questions.

🔔 Tomorrow's Flow: We track institutional activity daily - stay tuned for Wednesday's whale watch.

⚠️ Disclaimer: Options trading involves substantial risk. This analysis is for educational purposes only, not investment advice. Past performance does not guarantee future results. Always conduct your own research and consult a financial advisor before trading.