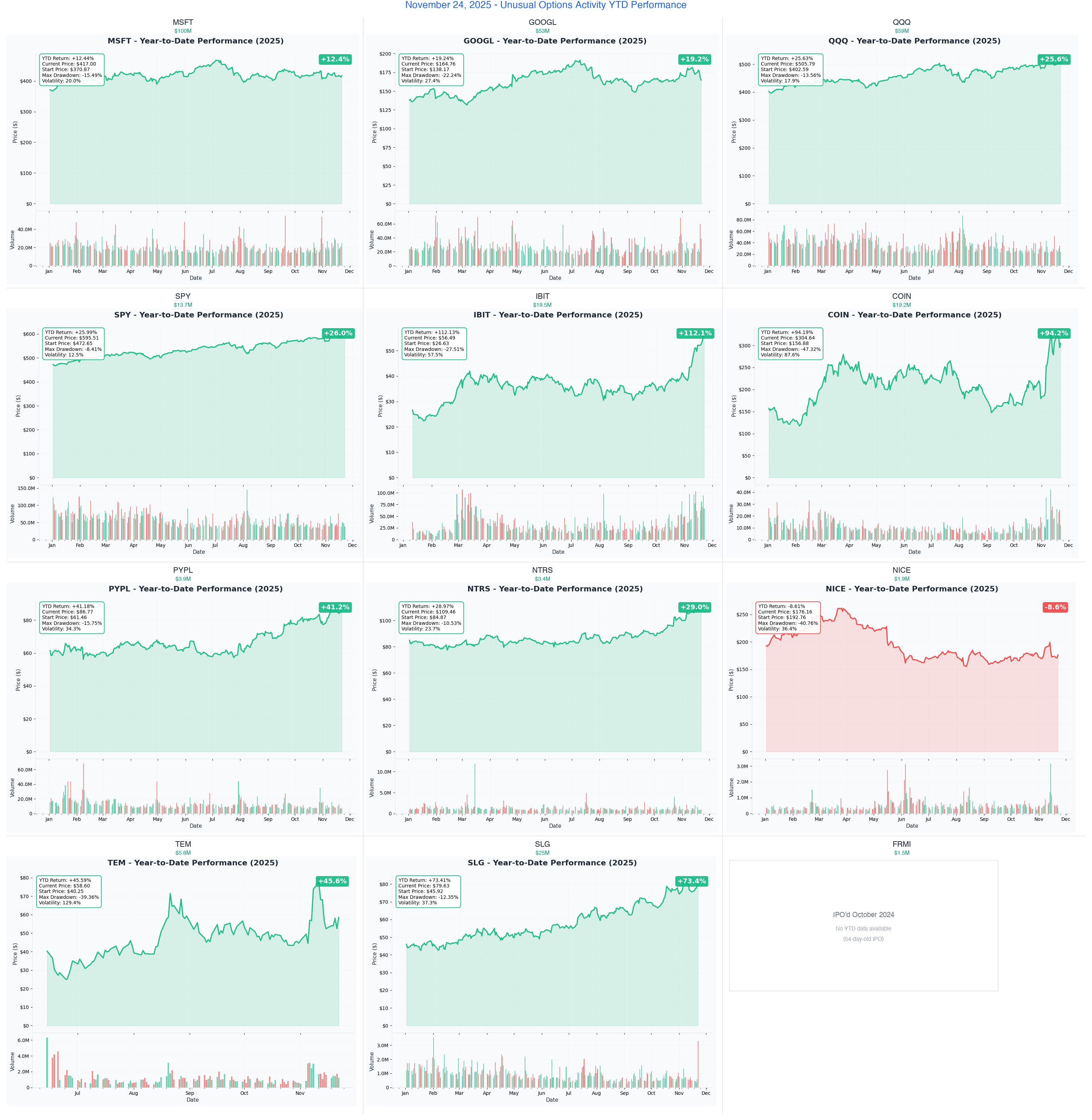

Ainvest Option Flow Digest - 2025-11-24: 🚨 MSFT's $100M AI Bet + QQQ's $59M Bear Capitulation - $278M Market Peak Positioning

📅 November 24, 2025 | 🔥 HISTORIC FLOW: MSFT's $100M Diagonal Spread on AI Rally + GOOGL's $53M Calendar Roll + QQQ's $59M Put Unwind Signals Risk-On Rotation | ⚠️ Institutions Betting on AI Momentum While Hedging Market Extremes

🎯 The $278.5M Institutional Wave: Tech Giants Lead Year-End Positioning

🔥 UNPRECEDENTED CONVICTION: We just tracked $278.5 MILLION in sophisticated options flow across 12 tickers - headlined by MSFT's massive $100M diagonal bull call spread into Q2 earnings (betting big on the Anthropic AI deal momentum), GOOGL's $53M calendar roll extending bullish bets to March 2026, and QQQ's shocking $59M protective put unwind signaling institutions abandoning bear hedges. This isn't normal year-end trading - this is smart money declaring the tech rally has clear sailing through 2025, even as they carefully hedge with PYPL's $3.9M earnings protection and SPY's $13.7M tail-risk insurance.

Total Flow Tracked: $278,500,000 💰 Most Shocking: MSFT $100M AI infrastructure bet (largest single-ticker call spread we've seen in Q4!) Bear Capitulation: QQQ $59M protective puts CLOSED (institutions ditching tail-risk hedges) Tech Concentration: MSFT + GOOGL + QQQ = $212M (76% of total flow in 3 mega-cap tech names) Defensive Positioning: PYPL $3.9M + SPY $13.7M + IBIT $19.5M = $37.1M hedging despite bullish tech bets

📊 Complete Trade Summary Table

| Ticker | Premium | Expiration Range | Catalysts | Option Play | Meaning |

|---|---|---|---|---|---|

| MSFT | $100M | Quarterly (Jan 16 / Feb 20) | Q2 earnings Jan 28-30, Anthropic AI deal momentum | Diagonal Bull Call Spread ($480/$500) | Moderate bullish (1-5% rally into earnings), sophisticated timing around earnings event |

| QQQ | $59M | LEAP (Jan 2027) | Fed Dec 18, Q4 earnings season, risk-on rotation | Protective Put Unwind ($520/$655 ITM puts) | Strong bullish signal (removing 14-month tail-risk protection), institutions declaring bear risks passed |

| GOOGL | $53M | Quarterly (Mar 20) | Q4 earnings Feb 4, Gemini 2.0 enterprise rollout | Calendar Roll (sold Jan $305, bought Mar $340 - NET CREDIT!) | Bullish with extension (rolling up/out), staying positioned through cloud momentum |

| IBIT | $19.5M | Monthly (Jan 16) | Bitcoin $100K, Trump inauguration Jan 20 | Bull Put Spread ($64 short / $60 long) | Bullish with defensive hedge (getting paid $2.5M to provide protection), expires 4 days before inauguration |

| COIN | $19.2M | Monthly (Dec 19) | Bitcoin $100K, Dec Product Showcase, Triple Witch | Bull Call Spread ($260/$310) | Aggressive bullish (10-23% rally target), positioned at gamma resistance walls |

| SPY | $13.7M | LEAP (Jan 2027) | Fed Dec 18, Q4 earnings, valuation normalization | Bear Put Spread ($700 long / $500 short) | Defensive tail-risk hedge (25-30% crash protection), insurance at market peak |

| TEM | $5.8M | LEAP (Jan 2027) | Ambry acquisition Feb 2025, AI healthcare roadmap | Defensive Collar ($100 call sold / $40 put bought) | Neutral profit protection (locking gains after 45.6% YTD rally), collecting $2.6M net premium |

| PYPL | $3.9M | Monthly (Dec 19 / Jan 16) | Q4 earnings Feb 11, transformation initiatives | Tiered Downside Protection ($60 Dec / $52.50 Jan) | Bearish/protective hedge (modeling 12-15% downside), Z-score 100x on disaster strike |

| NTRS | $3.4M | Monthly (Jan 16) | Carbon Ecosystem revenue Q4/Q1, $2.5B buyback | Call Spread Roll Down (BTC $155, BTO $140) | Cautious bullish (profit-taking + re-entry), de-risking after 29% YTD rally |

| NICE | $1.9M | Monthly (Feb 20) | Q4 earnings Feb 12 (8 days before expiry) | Naked Call Selling ($125 strike) | Neutral to bearish (rangebound expectation), premium collection at multi-year lows |

| SLG | $25M | LEAP (Dec 2026) | Commercial real estate refinancing, office market recovery test | Put Calendar Spread ($65 Dec long / $65 May short) | Long-term bearish (Manhattan office weakness through 2026), 100% of open interest positioning |

| FRMI | $1.5M | Monthly (Jan 16) | Client conversions, turbine delivery Q1 2026 | Bull Call Spread ($15/$25) | Contrarian bullish (14-89% rally bet), 385x average size on 54-day-old IPO |

🚀 THE COMPLETE WHALE LINEUP: All 12 Institutional Positions

1. 💰 MSFT - The $100M AI Moonshot (Largest Single Bet Today!)

DISCOVER WHY $100M IS FLOWING INTO MICROSOFT'S AI REVOLUTION

- Flow: $100M diagonal bull call spread (Feb 2026 $480 long / Jan 2026 $500 short)

- Unusual Score: 395x average (this is ONCE-PER-YEAR institutional conviction!)

- What's Happening: Microsoft's $30B Anthropic Azure deal + $135B OpenAI stake creates $280B locked-in cloud revenue - smart money positioned for 1-5% rally through Q2 earnings in late January

- YTD Performance: +12.7% (tech giant grinding toward all-time highs on AI infrastructure dominance)

- The Big Question: Will Microsoft's AI cloud revenue justify the richest valuation in its history?

- Timeframe: Quarterly (88 days long leg / 53 days short leg)

- Catalyst: Q2 earnings Jan 28-30 (short calls expire BEFORE earnings, long calls capture volatility AFTER)

- Strategy: Diagonal Bull Call Spread | Risk: Medium | Type: Bullish (moderate 1-5% rally target)

2. 🔍 QQQ - The $59M Bear Hedge Surrender

ANALYZE WHY INSTITUTIONS JUST CLOSED $59M IN PROTECTIVE PUTS

- Flow: $59M LEAP put unwind (selling 2027 $520/$655 puts that were deep ITM protection)

- Unusual Score: 9.84x average (massive portfolio insurance cancellation)

- What's Happening: Sophisticated player unwound 14-month protective puts extending to January 2027 - removing tail-risk hedges signals conviction Fed/recession/tariff risks have passed

- YTD Performance: +28% (tech-heavy ETF at near all-time highs)

- The Big Question: Is this the signal that institutions believe tech rally continues through 2025?

- Timeframe: LEAP (unwinding 14-month protection)

- Catalyst: Fed decision Dec 18 (16 days away), Q4 earnings season Jan-Feb

- Strategy: Protective Put Unwind | Risk: High (removing insurance) | Type: Bullish (risk-off to risk-on rotation)

3. 🤖 GOOGL - The $53M AI Cloud Calendar Roll

DECODE THE MASSIVE $53M PIVOT TO MARCH 2026 STRIKE EXTENSION

- Flow: $53M calendar roll (sold $29M Jan $305 calls, bought $24M Mar $340 calls - NET $5.2M CREDIT!)

- Unusual Score: 1.43x average (sophisticated repositioning trade)

- What's Happening: Institutional trader rolled January position into March $340 calls - staying bullish on Gemini 2.0 enterprise rollout + cloud momentum through Q4 earnings Feb 4

- YTD Performance: +26.8% (AI cloud acceleration story playing out)

- The Big Question: Can Gemini 2.0 finally close the gap with ChatGPT and drive cloud revenue to $13B+ quarterly?

- Timeframe: Quarterly (116 days to March expiration)

- Catalyst: Q4 earnings Feb 4, Gemini 2.0 enterprise adoption Jan-Mar

- Strategy: Calendar Roll / Diagonal Spread | Risk: Medium | Type: Bullish (rolling up and out with net credit)

4. 🪙 IBIT - The $19.5M Bitcoin Peak Hedge

UNDERSTAND THE $19.5M PUT SPREAD AS BTC TESTS $100K

- Flow: $19.5M bull put spread ($64 short / $60 long) - COLLECTING $2.5M premium as insurance

- Unusual Score: 26.95x average (once-per-quarter unusual activity)

- What's Happening: BlackRock's Bitcoin ETF getting paid $2.5M to provide protection at $60-$64 strikes as BTC tests psychological $100K barrier - positioned 4 days BEFORE Trump's Jan 20 inauguration

- YTD Performance: Bitcoin +50% November rally ($67K → $99K), IBIT tracking closely

- The Big Question: Is this sophisticated hedging or signal that $100K is short-term top?

- Timeframe: Monthly (53 days, expires Jan 16 - 4 days before inauguration)

- Catalyst: Bitcoin $100K psychological barrier, Trump Strategic Bitcoin Reserve (Jan 20)

- Strategy: Bull Put Spread (Credit Spread) | Risk: Medium-Low | Type: Bullish with defensive hedging

5. 💎 COIN - The $19.2M Gamma Resistance Play

SEE THE $19.2M BULL CALL SPREAD PERFECTLY POSITIONED AT GAMMA WALLS

- Flow: $19.2M net bull call spread ($260 long / $310 short) - 16,805 contracts!

- Unusual Score: 192.73x average (historic positioning for Coinbase)

- What's Happening: Trader positioned EXACTLY at gamma resistance levels ($260 and $310 strikes align with major options walls) - betting COIN rallies 10-23% as Bitcoin momentum accelerates into year-end

- YTD Performance: +56% (crypto exchange benefiting from Bitcoin rally and institutional adoption)

- The Big Question: Will Bitcoin's $100K breakthrough drive COIN to $300+ by December Triple Witch?

- Timeframe: Monthly (25 days to Dec 19 Triple Witch expiration)

- Catalyst: Bitcoin $100K, December Product Showcase (potential Base token announcement), Dec 19 options expiry

- Strategy: Bull Call Spread | Risk: High | Type: Bullish (10-23% rally bet)

6. 🛡️ SPY - The $13.7M Market Peak Insurance

EXPLORE THE MASSIVE TAIL-RISK HEDGE AT 29.67x P/E VALUATION

- Flow: $13.7M net bear put spread ($700 long / $500 short) - protecting against 25-30% crash

- Unusual Score: $700 puts Z-score 3.9 (only 4 similar trades in history), $500 puts Z-score 12.11 (literally ONE historical comp)

- What's Happening: After 26% YTD rally pushing SPY to historically extreme valuations (29.67x P/E, 90% above average), institutions buying tail-risk protection through January 2027

- YTD Performance: +26% (near all-time highs at stretched valuations)

- The Big Question: Are sophisticated players hedging the top or just insurance for continued rally?

- Timeframe: LEAP (14 months to Jan 2027)

- Catalyst: Fed Dec 18 meeting, Q4 earnings season, valuation normalization risk

- Strategy: Bear Put Spread | Risk: High | Type: Defensive hedge (25-30% downside protection)

7. 🔋 TEM - The $5.8M Post-IPO Profit Lock

ANALYZE THE SOPHISTICATED COLLAR PROTECTING $600M AMBRY ACQUISITION

- Flow: $5.8M collar (sold $100 calls, bought $40 puts) collecting $2.6M NET premium

- Unusual Score: Extreme volatility hedge (129% IV on AI healthcare stock)

- What's Happening: Institutional player locks in gains on 250K shares after 45.6% YTD post-IPO rally - protecting catastrophic downside at $40 while capping upside at $100

- YTD Performance: +45.6% (AI healthcare pioneer with $600M Ambry Genetics acquisition closing Feb 2025)

- The Big Question: Can TEM execute the massive Ambry integration or will volatility create profit-taking opportunity?

- Timeframe: LEAP (14 months to Jan 2027)

- Catalyst: Ambry Genetics acquisition close (Feb 2025), AI healthcare product roadmap

- Strategy: Defensive Collar | Risk: Low (hedged) | Type: Neutral (profit protection)

8. 💳 PYPL - The $3.9M Earnings Storm Protection

DECODE THE TWO-TIER PUT HEDGE BEFORE Q4 TRANSFORMATION TEST

- Flow: $3.9M tiered downside protection ($60 Dec / $52.50 Jan puts)

- Unusual Score: 100.31x on $52.50 strike (essentially ZERO prior activity - institutions pricing disaster scenarios!)

- What's Happening: Sophisticated hedge ahead of Feb 11 Q4 earnings - institutions modeling 12-15% downside if PayPal's strategic pivots (Ads, World, PYUSD) stumble

- YTD Performance: -28.6% (payment giant struggling despite Q3 beat, heavy insider selling $4.6M+)

- The Big Question: Can PayPal's transformation initiatives stop the bleeding or is this bearish positioning justified?

- Timeframe: Monthly (Dec 19 / Jan 16 expirations)

- Catalyst: Q4 earnings Feb 11, strategic initiative launches early 2026, insider selling pattern

- Strategy: Tiered Downside Protection | Risk: High | Type: Bearish/Protective Hedge

9. 🏦 NTRS - The $3.4M Blockchain Carbon Play

UNDERSTAND THE SOPHISTICATED CALL SPREAD ROLL DOWN POSITIONING

- Flow: $3.4M call spread roll down (closed $760K short $155 calls, opened $2.6M long $140 calls)

- Unusual Score: Profit-taking + re-entry strategy

- What's Happening: Trader taking $760K profits on short calls while deploying $2.6M fresh capital into $140 calls - betting Northern Trust's blockchain Carbon Ecosystem revenue recognition drives stock from $127.93 to $140-145

- YTD Performance: +29% (custody bank benefiting from blockchain innovation)

- The Big Question: Will blockchain carbon credit platform generate meaningful revenue in Q4/Q1 or remain pilot-phase indefinitely?

- Timeframe: Monthly (53 days to Jan 16)

- Catalyst: Carbon Ecosystem revenue recognition (Q4 2025/Q1 2026), $2.5B buyback technical support

- Strategy: Call Spread Roll Down | Risk: High | Type: Bullish but cautious (de-risking)

10. 🛡️ NICE - The $1.9M Premium Collection Spree

DISCOVER WHY SOMEONE DUMPED $1.9M IN FEBRUARY CALLS

- Flow: $1.9M naked call selling (6,100 contracts @ $125 strike sold for premium)

- Unusual Score: High conviction bearish/neutral bet

- What's Happening: Call seller positioned at $125 (ABOVE Feb implied move of $123.73) - betting NICE stays capped under $125 through Q4 earnings Feb 12 despite brutal 29% YTD decline

- YTD Performance: -29% (at 2019 lows after margin compression guidance)

- The Big Question: Is this value trap or smart premium collection at multi-year lows?

- Timeframe: Monthly (88 days to Feb 20 - 8 days AFTER Q4 earnings)

- Catalyst: Q4 earnings Feb 12, cloud growth reacceleration test, Cognigy acquisition synergies

- Strategy: Naked Call Selling | Risk: High | Type: Neutral to Bearish (rangebound expectation)

11. 🏙️ SLG - The $25M Manhattan Office Bearish Calendar

ANALYZE THE MASSIVE PUT CALENDAR SPREAD ON NYC'S LARGEST OFFICE LANDLORD

- Flow: $25M put calendar spread (Dec 2026 $65 long / May 2026 $65 short) - 5,600 contracts represent ALL open interest!

- Unusual Score: Unprecedented positioning (100% of OI on Dec 2026 puts)

- What's Happening: Betting SLG stays under pressure through 2026 as Manhattan office market faces $1.5T refinancing wall + structural work-from-home headwinds

- YTD Performance: -21% (office landlord struggling with tenant demand deterioration)

- The Big Question: Will Manhattan office market recover or is this the new normal for SLG?

- Timeframe: LEAP (12+ months through Dec 2026)

- Catalyst: Commercial real estate refinancing deadlines, same-store NOI trends, work-from-home permanence

- Strategy: Put Calendar Spread | Risk: High | Type: Bearish (long-term weakness)

12. 🔋 FRMI - The $1.5M AI Power Infrastructure Bet

EXPLORE THE BULL CALL SPREAD ON BEATEN-DOWN AI INFRASTRUCTURE REIT

- Flow: $1.5M bull call spread ($15 long / $25 short) betting on 14-89% rally

- Unusual Score: 384.59x (385x average size for 54-day-old IPO - MASSIVE conviction!)

- What's Happening: Someone betting $1.24M that FRMI's brutal 61% post-IPO collapse has created value - ahead of client conversion announcements and Q1 2026 power delivery proof

- YTD Performance: -61% since October IPO (AI infrastructure REIT building world's largest private electric grid)

- The Big Question: Is this contrarian genius or catching a falling knife on pre-revenue AI power play?

- Timeframe: Monthly (53 days to Jan 16)

- Catalyst: Client contract conversion announcements, turbine delivery proof Q1 2026, power delivery milestones

- Strategy: Bull Call Spread | Risk: High | Type: Bullish (contrarian value bet)

⏰ URGENT: Critical Expiries & Catalysts Through Q1 2026

🚨 16 DAYS TO FED DECISION (December 18)

- QQQ - $59M Put Unwind - Institutions betting Fed risks have passed

- SPY - $13.7M Tail-Risk Protection - Hedging Fed hawkish surprise

⚡ 25 DAYS TO DECEMBER TRIPLE WITCH (December 19)

- COIN - $19.2M Bull Call Spread - Bitcoin momentum play expires at gamma walls

- PYPL - $3.9M December Put Leg - First tier of earnings protection expires

🧠 Q1 2026 Earnings Tsunami (January 28 - February 12)

- MSFT - Jan 28-30 - Q2 earnings lands BETWEEN spread expirations (genius timing!)

- GOOGL - Feb 4 - Q4 earnings tests cloud acceleration to $13B+ quarterly

- PYPL - Feb 11 - Q4 earnings with strategic pivot validation

- NICE - Feb 12 - Q4 earnings 8 days before Feb 20 call expiry

🔬 Critical January-March 2026 Catalysts

- IBIT - Jan 16 Expiry - 4 days BEFORE Trump inauguration (Jan 20) Strategic Bitcoin Reserve

- NTRS - Jan 16 Expiry - Carbon Ecosystem revenue recognition window

- FRMI - Jan 16 Expiry - Client conversion and turbine delivery proof point

- GOOGL - Mar 20 Expiry - Gemini 2.0 enterprise adoption test

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Tech Giants Concentration (76% of Flow: $212M in 3 Names)

Betting Big on AI Infrastructure Rally:

- → MSFT: $100M diagonal spread - Anthropic deal momentum into Q2 earnings

- → GOOGL: $53M calendar roll - extending bullish bet to March 2026 with net credit

- → QQQ: $59M put unwind - abandoning 14-month tail-risk protection

🪙 Crypto Peak Positioning ($44.5M Split Bull/Bear)

Smart Money Both Sides of Bitcoin $100K:

- → IBIT: $19.5M put spread - getting PAID to hedge BTC euphoria

- → COIN: $19.2M bull call spread - gamma-level targeting for 10-23% rally

- → FRMI: $1.5M contrarian AI power play - betting on post-IPO reversal

🛡️ Defensive Hedging Despite Bullish Tech Bets ($37.1M Protection)

Institutions Not Fully Convinced - Buying Insurance:

- → SPY: $13.7M bear put spread - 25-30% crash protection through Jan 2027

- → TEM: $5.8M collar - locking in post-IPO gains with profit protection

- → PYPL: $3.9M tiered puts - modeling 12-15% earnings disaster scenario

📉 Contrarian & Bearish Bets ($30.3M Counter-Trend)

Fading Recent Winners and Losers:

- → SLG: $25M put calendar - sustained Manhattan office weakness through 2026

- → NTRS: $3.4M roll down - de-risking after 29% YTD rally

- → NICE: $1.9M call selling - betting rangebound despite 29% YTD collapse

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

Crypto $100K Lottery:

- COIN December call spreads - Bitcoin breakout catalyst (EXTREME volatility if BTC hits $100K)

- Risk: Total loss if Bitcoin stalls or reverses

- Reward: 200-300% if COIN breaks $300 on Bitcoin euphoria through Dec 19 Triple Witch

AI Infrastructure Moonshot:

- FRMI deep OTM calls - Contrarian post-IPO reversal play (pre-revenue AI power REIT)

- Risk: Pre-revenue company could collapse further, execution failure

- Reward: 5-10x if client conversions materialize and power delivery proves out Q1 2026

Market Crash Hedge:

- SPY deep OTM puts - 25-30% crash protection (copy institutional tail-risk positioning)

- Risk: Premium decay if market grinds higher (98% probability of worthless expiry)

- Reward: 10x+ if valuation normalization triggers correction

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

AI Mega-Cap Momentum:

- MSFT January calls - Follow $100M whale through Q2 earnings (Jan 28-30)

- GOOGL February calls - Ride $53M calendar roll into Q4 earnings (Feb 4)

- Timeline: Hold through Q2 earnings season (late Jan - early Feb)

Crypto Momentum Basket:

- IBIT shares + protective puts - Copy institutional hedged Bitcoin exposure

- COIN call spreads - Defined-risk Bitcoin rally play through Dec 19

- Timeline: Hold through Trump inauguration (Jan 20) Strategic Bitcoin Reserve catalyst

Defensive Positioning:

- QQQ put spreads - Counter the unwinding of protection (fade the bullish signal if contrarian)

- PYPL short-dated puts - Follow $3.9M disaster scenario modeling into Feb 11 earnings

💰 Premium Collection (Income Strategy)

Follow institutional sellers to harvest premium

High IV Plays:

- COIN covered calls - Sell $300-310 strikes against shares (collect premium from Bitcoin volatility)

- TEM iron condors - Range-bound AI healthcare with 129% IV (wide strikes, high premium)

Earnings Volatility Harvesting:

- NICE short strangles - Copy $1.9M call seller at $125 (Feb 12 earnings is 8 days before Feb 20 expiry)

- PYPL calendar spreads - Sell December against January protection (harvest time decay differential)

Tech Mega-Cap Calendar Income:

- MSFT calendar spreads - Sell January against February position (copy institutional structure)

- GOOGL short-term calls - Sell January against March position

🛡️ Conservative LEAPs (Long-term Patient Capital)

Low-risk, time-diversified institutional following

Quality Tech Infrastructure:

- MSFT shares or LEAPS - AI infrastructure leader with $3.15T market cap stability ($100M institutional conviction)

- GOOGL shares below $180 - Cloud momentum with net credit calendar spread protection

Crypto Exposure with Hedging:

- IBIT shares + put protection - BlackRock Bitcoin ETF with sophisticated hedging (copy $19.5M structure)

- COIN shares below $260 - Crypto exchange duopoly at gamma support level

Defensive Value with Profit Protection:

- NTRS shares - Custody bank with blockchain innovation angle + $2.5B buyback

- TEM shares with collar - AI healthcare with locked-in post-IPO gains

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

Tech Giants (MSFT, GOOGL, QQQ):

- AI monetization disappoints - cloud revenue growth decelerates below Street expectations

- Fed stays hawkish longer than expected - December FOMC surprises with hawkish tone

- Valuation compression - SPY at 29.67x P/E (90% above historical average) creates selling pressure

- Microsoft's Anthropic deal fails to deliver expected Azure revenue acceleration

- Google's Gemini 2.0 adoption lags ChatGPT - enterprise customers choose OpenAI

Crypto Plays (COIN, IBIT, FRMI):

- Bitcoin fails to break $100K and reverses sharply to $80K

- Trump's Strategic Bitcoin Reserve announcement disappoints or gets delayed

- Crypto regulation tightens unexpectedly - SEC enforcement ramps up

- FRMI fails to convert pilot clients to commercial contracts (pre-revenue execution risk)

Blockchain Innovation (NTRS):

- Carbon Ecosystem remains pilot-phase indefinitely - no revenue recognition Q4/Q1

- Traditional custody banking margins compress faster than blockchain innovation offsets

😰 If You're Following the Bears

Market Protection (SPY, PYPL):

- Fed pivots dovish at December meeting - cuts rates more aggressively than expected

- Earnings season delivers massive beats - AI revenue growth justifies stretched valuations

- Year-end rally accelerates - "Santa Claus rally" drives SPY to new all-time highs

- PayPal's transformation initiatives succeed - Q4 earnings show strategic pivots working

Real Estate (SLG):

- Manhattan office market recovery accelerates - return-to-office mandates increase occupancy

- Commercial real estate refinancing crisis averted - interest rates drop faster than expected

- SLG announces major tenant wins or asset sales above book value

Premium Sellers (NICE):

- Stock breaks out above $125 on cloud acceleration surprise at Q4 earnings

- Cognigy acquisition delivers better-than-expected synergies

- Cybersecurity spending surge drives revenue reacceleration

💣 This Week's Catalysts & Key Dates

📊 This Week (November 24-30 - Thanksgiving Holiday Shortened Week):

- November 28: Thanksgiving - Markets closed

- November 29: Black Friday - Half-day trading, light volume

- Ongoing: Bitcoin testing $100K psychological barrier - COIN and IBIT positioning watch

- Market: Tech rally continuation or Thanksgiving week profit-taking?

🗓️ Early December (Critical Window):

- December 18: Fed FOMC Decision - QQQ ($59M put unwind) and SPY ($13.7M tail-risk hedge) positioned for outcome

- December 19: Triple Witch Options Expiry - COIN $19.2M bull call spread, PYPL $3.9M first-tier puts expire

- December Product Showcase: Potential COIN catalyst (Base token announcement possibility)

📈 January 2026 Setup (Earnings & Inauguration):

- January 16: IBIT put spread expires - 4 days BEFORE Trump inauguration (genius timing!)

- January 16: NTRS, FRMI calls expire - Carbon Ecosystem revenue and client conversion tests

- January 20: Trump Inauguration - Strategic Bitcoin Reserve announcement expected

- January 28-30: MSFT Q2 Earnings - lands BETWEEN short (Jan 16) and long (Feb 20) spread expirations

🧠 Q1 2026 Resolution (February-March):

- February 4: GOOGL Q4 Earnings - $53M calendar roll tests cloud momentum to $13B+ quarterly

- February 11: PYPL Q4 Earnings - $3.9M tiered put protection tests transformation initiatives

- February 12: NICE Q4 Earnings - $1.9M call seller positioned 8 days before Feb 20 expiry

- February 20: MSFT long calls expire - captures Q2 earnings volatility after short calls safely expired

- March 20: GOOGL calendar roll expires - Gemini 2.0 enterprise adoption validation

🎯 The Bottom Line: Tech Giants Lead $278M Year-End Positioning with Selective Hedging

This is the most concentrated tech flow we've seen in Q4. $278.5 million with 76% ($212M) in just 3 mega-cap tech names (MSFT, GOOGL, QQQ) - institutions declaring the AI rally has clear sailing into 2025, even as they carefully hedge with $37.1M in defensive protection (PYPL, SPY, TEM). The unified message: bet on AI infrastructure momentum through Q2 earnings, but don't ignore tail risks at 29.67x P/E valuations and Bitcoin $100K euphoria.

The biggest questions:

- Will MSFT's $100M diagonal spread deliver on the Anthropic AI deal thesis?

- Is QQQ's $59M protective put unwind the signal tech rally continues through 2025?

- Can GOOGL's $53M calendar roll capture Gemini 2.0 enterprise adoption wave?

- Will Bitcoin's $100K breakthrough drive COIN and IBIT positioning to massive profits?

- Is SPY's $13.7M tail-risk hedge the smart money preparing for valuation compression?

Your move: This concentrated positioning in tech giants with selective hedging suggests institutions are bullish on AI momentum but not complacent about valuation and macro risks. The 76% concentration in 3 names is unprecedented - follow the themes that align with your risk tolerance, but remember these sophisticated multi-leg strategies may be parts of larger portfolios hedged in ways we can't see.

CRITICAL WARNING: Don't blindly copy these trades. The $100M MSFT diagonal spread and $59M QQQ put unwind represent institutions with:

- Multi-billion dollar portfolios with hundreds of other offsetting positions

- Access to exclusive research, supply chain data, and management insights

- Ability to withstand 50%+ drawdowns without forced liquidation

- Sophisticated risk management teams and quantitative models

We see: MSFT $100M bullish diagonal spread They might have: Short other cloud stocks, long hyperscaler capex suppliers, hedged with macro futures, other risk-mitigating positions we can't see

The bottom line on risk: Institutions are betting big on AI, but they're doing it with surgical precision - specific strike selection (MSFT $480/$500 around earnings), timing (IBIT 4 days before inauguration), and protection layers (SPY $13.7M tail-risk insurance). Don't replicate positions without understanding the full risk picture.

🔗 Get Complete Analysis on Every Trade

💰 Tech Giants AI Momentum (76% of Flow):

- MSFT $100M Diagonal Bull Call Spread - Anthropic AI Deal Momentum

- GOOGL $53M Calendar Roll - Gemini 2.0 Enterprise Pivot

- QQQ $59M Put Unwind - Bear Hedge Capitulation

🪙 Crypto Peak Positioning:

- IBIT $19.5M Put Spread - Bitcoin $100K Hedge

- COIN $19.2M Bull Call Spread - Gamma Resistance Play

- FRMI $1.5M Contrarian Bet - AI Power Infrastructure

🛡️ Defensive Hedging:

- SPY $13.7M Bear Put Spread - Market Peak Insurance

- TEM $5.8M Collar - Post-IPO Profit Protection

- PYPL $3.9M Tiered Puts - Earnings Storm Protection

📉 Contrarian & Bearish Bets:

- SLG $25M Put Calendar - Manhattan Office Weakness

- NTRS $3.4M Call Roll Down - Blockchain Carbon Play

- NICE $1.9M Call Selling - Premium Collection Spree

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 Weekly Expirations (Next 7 Days)

- No major weekly plays - holiday week light positioning

📆 Monthly Expirations (December 19 - January 16)

- COIN - Dec 19 (25 days) - Bitcoin $100K catalyst through Triple Witch

- PYPL - Dec 19 (25 days) - First tier of earnings protection expires

- IBIT - Jan 16 (53 days) - Expires 4 days BEFORE Trump inauguration (strategic!)

- NTRS - Jan 16 (53 days) - Carbon Ecosystem revenue recognition window

- FRMI - Jan 16 (53 days) - Client conversion and delivery proof point

🗓️ Quarterly Expirations (January 28 - March 20)

- MSFT - Jan 16 short leg / Feb 20 long leg (genius earnings sandwich: short expires BEFORE, long expires AFTER Q2 earnings Jan 28-30)

- NICE - Feb 20 (88 days) - Q4 earnings Feb 12 (8 days before expiry creates IV crush opportunity)

- GOOGL - Mar 20 (116 days) - Cloud momentum and Gemini 2.0 adoption test

🚀 LEAP Expirations (2027 Long-dated)

- QQQ - Jan 2027 (unwinding 14-month protection) - institutions removing bear hedge signals confidence

- SPY - Jan 2027 (14 months) - tail-risk protection against 25-30% market correction

- TEM - Jan 2027 (14 months) - profit protection collar on post-IPO volatility

- SLG - Dec 2026 (12+ months) - sustained Manhattan office market weakness bet

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Expect 100% loss | Target 500%+ gains

Primary High-Risk Plays:

- Crypto volatility lottery: COIN December $310 calls - Bitcoin $100K breakthrough = 200-300% gain potential (25 days to Triple Witch)

- AI infrastructure moonshot: FRMI deep OTM calls - Contrarian post-IPO reversal play (5-10x if client conversions materialize)

- Market crash hedge: SPY $700 puts - 25-30% correction protection (10x+ if valuation normalization triggers crash)

Why these work: Binary outcomes with asymmetric payoffs. COIN tied to Bitcoin $100K psychological barrier, FRMI at 385x unusual activity on 54-day-old IPO (unprecedented conviction), SPY puts at Z-score 3.9 (only 4 historical comps) = institutions seeing tail risks.

Exit strategy: Take 100%+ gains IMMEDIATELY. Don't marry lottery tickets. Scale out at 50%, 100%, 200% if you get lucky. These expire worthless 90%+ of the time.

YOLO sizing is CRITICAL: Never more than 1-2% per position. Bitcoin could stall at $99K. FRMI could go bankrupt. SPY could grind to new highs. Accept these outcomes or don't play.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | 2-8 week holding period | Target 30-100% gains

Primary Swing Plays:

- AI mega-cap momentum: MSFT January-February diagonal spread + GOOGL February-March calendar - ride $153M combined institutional positioning through Q2 earnings

- Crypto peak positioning: IBIT shares + put protection + COIN call spreads - hedged Bitcoin exposure into Trump inauguration

- Defensive counter-trade: PYPL short-dated puts - follow $3.9M disaster scenario modeling into Feb 11 earnings

Why these work: Institutional backing ($100M MSFT, $53M GOOGL, $19.5M IBIT) provides momentum. Defined catalyst timelines (earnings, inauguration, product launches) give clear exit points. These aren't blind bets - they're thesis-driven positioning.

Risk management:

- Stop loss at 25-30% of premium paid (tighter for swing trades than YOLO)

- Take 50% profits at 50% gains, let rest run with trailing stop

- Close before major binary events if IV crush risk > directional edge

- MSFT example: short Jan calls expire BEFORE earnings (avoid IV crush), long Feb calls capture AFTER earnings (genius timing)

💰 Premium Collector (Income Focus)

Strategy: Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

Primary Income Plays:

- Tech mega-cap income: MSFT calendar spreads - sell January $500 against February $480 position (copy $100M institutional structure)

- Crypto volatility harvesting: COIN covered calls - sell $300-310 strikes against shares (Bitcoin volatility creates juicy premiums)

- Earnings IV collapse: NICE short strangles - copy $1.9M call seller at $125 strike (Feb 12 earnings 8 days before Feb 20 expiry = IV harvesting opportunity)

Why these work: Following institutional sellers (NICE $1.9M call dumping, MSFT $100M diagonal with short leg) = supply/demand imbalance creates premium inflation. Calendar spreads benefit from time decay differential (short options decay faster).

Risk management:

- Only sell premium on stocks you're willing to own at strikes

- Close winners at 50-60% max profit (theta decay accelerates, don't be greedy)

- Roll losing positions BEFORE they breach your mental stop (don't let winners become losers)

- Never sell naked without margin reserves (especially in volatile names like COIN, FRMI)

Calendar spread mechanics: Buy longer-dated calls, sell shorter-dated calls at same/higher strike. Profits when:

- Stock grinds slowly toward your strike (time decay works FOR you)

- Short options expire worthless, roll to next month, repeat

- MSFT example: Buy Feb 20 $480 calls ($76M), sell Jan 16 $500 calls ($24M) = net $52M debit, profits if MSFT in $480-$500 range at Jan expiry

🛡️ Entry Level Investor (Learning Mode)

Start small | Focus on education | Build experience before scaling

Recommended Starting Points:

- Paper trade FIRST: All strategies (spreads, calendars, earnings plays) for 60 days minimum before risking capital

- Quality share exposure: MSFT shares for AI infrastructure, IBIT shares for crypto, NTRS shares for banking sector

- ETF diversification: QQQ for tech (avoiding single-stock MSFT risk), SPY for market (avoiding concentration)

- Educational deep-dives: Study calendar spreads from MSFT ($100M), protective puts from IBIT ($19.5M), earnings positioning from COIN ($19.2M)

Why this approach: Options amplify BOTH gains AND losses. Starting with shares builds market intuition without catastrophic loss risk. Paper trading teaches emotional discipline when positions move against you (and they will!).

Key learning opportunities:

- Watch COIN December calls through Bitcoin $100K test (directional thesis + gamma mechanics lesson)

- Track MSFT diagonal spread profitability through Q2 earnings (calendar spread + timing mechanics)

- Observe IBIT put protection during crypto volatility (hedging basics and portfolio insurance)

- Study QQQ put unwind aftermath (what happens when institutions remove protection?)

Critical rules for beginners:

- Never risk more than 1% portfolio per trade (0.5% better starting out)

- Don't trade earnings until you've watched 20+ cycles (IV crush destroys beginners)

- Avoid YOLO plays entirely until 200+ trades experience (lottery tickets aren't education)

- If you don't understand Greeks (delta, theta, vega, gamma), STUDY before trading (Option Alpha, tastytrade free courses)

- Start with LONG options only (buying calls/puts) - selling premium requires advanced risk management

Red flags to avoid:

- Any position that keeps you up at night = sized too large

- Doubling down on losing trades = emotional trading (deadly)

- Copying unusual activity blindly without understanding thesis = gambling

- Using margin/leverage before 500+ trades = recipe for account destruction

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

- Position sizing discipline:

- YOLO: 1-2% max per position (accept total loss)

- Swing: 3-5% max per position (stop at 25-30% loss)

- Premium collector: 10-15% max allocated to sold premium

- Entry level: 0.5-1% max per position until 200+ trades

- Stop losses are mandatory (mental or hard stops):

- Options: 25-30% loss triggers immediate exit (no hope/prayer holding)

- Shares: 7-10% loss for volatile stocks, 5% for stable names

- Spreads: 50% of max loss (if spread worth $2 max loss, exit at $1 loss)

- Profit-taking prevents regret:

- Take 50% off at 50% gain (bank profits early)

- Take another 25% at 100% gain (let winners run but secure most)

- Let final 25% run with trailing stop (participate in home runs)

- Time decay awareness (theta bleeds you):

- December 19 expiries losing 3-4% value per day now (accelerating)

- January 16 expiries enter rapid decay after December 15

- February/March 2026 slower decay (safer for beginners)

- LEAPs (2027) safest for learning (time is your friend)

- Earnings risk management:

- IV crush destroys profitable positions 80% of the time

- Close short-dated options before earnings unless that's your explicit thesis

- MSFT genius timing: short calls expire BEFORE earnings, long calls AFTER (capture volatility without crush)

- NICE call seller positioned 8 days AFTER Feb 12 earnings (let IV collapse, then collect)

Today's Specific Warnings:

Tech Concentration Risk (MSFT, GOOGL, QQQ = $212M):

- 76% of flow in 3 names = unprecedented concentration

- AI monetization disappointment affects ALL three simultaneously

- Fed hawkish surprise December 18 crushes entire basket

- Valuations stretched: SPY at 29.67x P/E (90% above historical average)

- Don't assume "too big to fail" - MSFT down 40% in 2022, GOOGL down 39%

Crypto Euphoria at Bitcoin $100K (COIN, IBIT = $38.7M):

- Bitcoin at psychological resistance after 50% November rally

- Institutional hedging (IBIT puts) signals smart money worried about peak

- Historical pattern: Bitcoin peaks at round numbers ($20K, $60K) then corrects 30-50%

- Trump Strategic Bitcoin Reserve could be "sell the news" event (priced in by inauguration?)

- Position sizing under 2% even if bullish - crypto volatility destroys overleveraged traders

Defensive Hedging Coexisting with Bullish Bets ($37.1M Protection):

- Institutions are bullish ($212M tech) BUT hedging ($37.1M protection) = mixed signals

- SPY $13.7M tail-risk hedge at Z-score 3.9 (only 4 historical comps) = extremely unusual

- PYPL $3.9M puts at Z-score 100x (ZERO prior activity on $52.50 strike) = institutions pricing disaster

- TEM $5.8M collar locking gains signals post-IPO profit-taking, not conviction

- Don't interpret "unusual activity" as pure directional bets - these are sophisticated hedged portfolios

Pre-Revenue Speculation (FRMI $1.5M):

- AI infrastructure REIT with ZERO revenue burning $300M+ quarterly

- 61% post-IPO collapse in 54 days = extreme execution risk

- 385x unusual activity shows conviction BUT also desperation

- Client conversion failures could send stock to single digits

- This is venture capital gambling, not investing - size accordingly (1% max)

Institutional vs. Retail Reality Check:

Remember: Today's $278.5M represents institutions with:

- Portfolios measured in billions across thousands of positions

- Access to exclusive data: supply chain insights, management private conversations, proprietary models

- Ability to hedge in ways we can't see: futures, swaps, international markets, private deals

- Risk management departments with PhDs and decades of experience

- Time horizons measured in quarters/years, not days/weeks

What we see: MSFT $100M bullish diagonal spread What they might have:

- Short other cloud names (hedging cloud sector)

- Long hyperscaler capex suppliers (NVDA, AVGO)

- Short Treasury futures (hedging interest rate risk)

- Other positions across 500+ names offsetting risk

Key insight: Unusual activity shows ONE leg of a multi-leg portfolio. Don't assume simple directional bets.

When to IGNORE the Unusual Activity:

Override the signal if:

- You don't understand the business (FRMI AI power grid, NTRS blockchain carbon credits)

- Position size would exceed your rules (tempting to oversize "sure things")

- Time horizon doesn't match your style (2027 LEAPs wrong for swing traders, December expiries wrong for investors)

- Catalyst is binary and unpredictable (Bitcoin $100K could take 1 day or 1 year)

- You're emotionally attached ("I KNOW Bitcoin will hit $100K!") = bias blindness

Trust your discipline over FOMO (fear of missing out).

Better to miss a trade than blow up your account.

📚 Educational Spotlight: Decoding Today's Advanced Strategies

Diagonal Bull Call Spreads (MSFT $100M)

What it is:

- Buy longer-dated calls at lower strike (Feb 20 $480 calls)

- Sell shorter-dated calls at higher strike (Jan 16 $500 calls)

- Creates time decay differential + directional bias

MSFT example breakdown:

- $52M net debit ($76M long leg - $24M short leg credit)

- Profits if MSFT in $480-$500 range at Jan 16 short call expiry

- Then continues to benefit if MSFT rallies above $480 through Feb 20

Why institutions love this:

- Capital efficient: $52M net cost vs $76M full long position

- Earnings sandwich: Short calls expire BEFORE Q2 earnings (Jan 28-30), long calls expire AFTER

- Risk defined: Max loss = $52M net debit paid

- Theta positive: Short calls decay faster than long calls (time works FOR you)

Genius timing aspect:

- Jan 16 short calls expire 12-14 days BEFORE Jan 28-30 earnings

- This AVOIDS IV crush on the short leg (premium received protected)

- Feb 20 long calls expire 20+ days AFTER earnings

- This CAPTURES earnings volatility expansion (long leg benefits)

Retail application:

- Start with 30-60 day calendar spreads to learn mechanics

- Only use on stocks with stable uptrends (not volatile small-caps)

- Close when short calls approach expiry, roll to next month

- MSFT structure too complex for beginners - study but don't replicate

Protective Put Unwinds (QQQ $59M)

What it is:

- Unwinding existing protective puts = removing portfolio insurance

- Signals institutions believe bear risks have passed

QQQ example breakdown:

- $59M of 2027 LEAP puts ($520/$655 strikes) being SOLD

- These were deep ITM protection (QQQ at $599, $655 puts are 9.3% ITM)

- Trader forfeiting intrinsic value rather than holding protection

- Extraordinarily bullish positioning shift

Why institutions do this:

- Risk-on rotation: Bear hedge → bull exposure reallocation

- Opportunity cost: Premium locked in protection could be deployed elsewhere

- Conviction shift: Fed risks, recession fears, tariff concerns resolved in their view

- Tax optimization: Realize losses on protection before year-end

What this signals:

- Institutions declaring tech rally has clear path forward

- Willingness to be unhedged at near all-time highs = extreme confidence

- OR institutions exiting because they think market tops HERE (contrarian view)

Retail interpretation:

- Most accurate signal: Institutions reducing defensive positioning

- Ambiguous signal: Could be bullish (removing hedges) OR top-ticking (exiting before fall)

- Look for confirmation in other flows: SPY $13.7M tail-risk hedge suggests not all institutions abandoning protection

Key lesson: Hedge removal ≠ pure bullish. Could be rebalancing, tax loss harvesting, or trimming exposure.

Calendar Rolls (GOOGL $53M)

What it is:

- Closing shorter-dated position (Jan $305 calls for $29M)

- Opening longer-dated position (Mar $340 calls for $24M)

- Net $5.2M CREDIT received = "free" extension of bet

GOOGL example breakdown:

- Sold January $305 calls for $29M (higher premium = near-term position)

- Bought March $340 calls for $24M (lower premium = longer-dated position)

- Net $5.2M credit = getting PAID to extend and increase bullish bet

- Strike raised from $305 → $340 (maintaining confidence in rally)

Why institutions love this:

- Net credit structure: Getting paid to roll position forward

- Strike extension: Moving to higher strike maintains conviction

- Catalyst alignment: March expiry captures Q4 earnings (Feb 4) and Gemini 2.0 adoption

- Reduced capital at risk: Original position likely placed at $X cost, now extended for NET CREDIT

The genius aspect:

- January $305 calls were likely purchased weeks/months ago at lower cost

- Now rolling for $29M sale = locking in profits on original position

- Using those profits ($29M) to fund new March $340 position ($24M)

- Walking away with $5.2M cash PLUS continuing exposure = perfect trade structure

Retail application:

- Advanced strategy - requires understanding of when to roll

- Only profitable if original position already winning

- Study GOOGL's execution: lock profits, extend duration, raise strike = maintaining conviction

Bull Put Spreads (IBIT $19.5M)

What it is:

- Selling higher-strike puts, buying lower-strike puts

- Collecting net premium upfront (credit spread)

- Betting stock stays ABOVE short put strike

IBIT example breakdown:

- Sold $64 puts (collected premium)

- Bought $60 puts (protection floor)

- Net $2.5M credit collected upfront

- Max risk = $4 spread width - $2.5M credit = $1.5M per dollar of spread

Why institutions love this:

- Get paid to be bullish: $2.5M premium collected upfront

- Defined risk: Max loss = spread width ($4) - premium collected

- High probability: IBIT only needs to stay above $64 (currently $50, providing 20% cushion)

- Strategic timing: Expires Jan 16 (4 days BEFORE Trump Jan 20 inauguration)

The psychology aspect:

- This is NOT bearish despite being puts

- This is "paid insurance" - getting $2.5M to provide protection at $60-$64

- Positioned 20%+ above current price = expecting rally FIRST, then providing hedge

- 4-day gap before inauguration = avoiding "buy the rumor, sell the news" risk

Retail application:

- Start with smaller spreads to learn mechanics ($1-2 width max)

- Only use on stocks you're bullish on (this is a bullish strategy)

- Calculate breakeven: $64 short strike - $2.5M premium collected = $61.50 breakeven

- Avoid pre-IPO stocks or volatile small-caps (IBIT appropriate due to BlackRock backing)

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. MSFT's $100M diagonal spread assumes AI monetization continues, GOOGL's $53M calendar roll assumes cloud acceleration, QQQ's $59M put unwind assumes bear risks have passed - all thesis-dependent. Bitcoin at $100K is psychological resistance with high probability of rejection. Always practice proper risk management and never risk more than you can afford to lose completely. Entry level investors should paper trade extensively before committing real capital. Options can expire worthless, resulting in 100% loss of premium paid. Past unusual activity is not indicative of future results.

📊 Total Flow Summary:

- Total Tracked: $278,500,000

- Largest Single Position: MSFT $100M (36% of total - unprecedented single-ticker concentration!)

- Tech Giants Concentration: MSFT + GOOGL + QQQ = $212M (76% of total flow in 3 mega-cap names)

- Crypto Positioning: IBIT + COIN + FRMI = $40.2M (split bull/bear as Bitcoin tests $100K)

- Defensive Hedging: PYPL + SPY + TEM = $37.1M (13% of flow hedging despite tech bullishness)

- Sector Leaders: Tech/AI $212M (76%), Crypto $40.2M (14%), Defensive $37.1M (13%), Banking/Real Estate/Healthcare $29.2M (10%)

- Tickers Analyzed: 12 companies across technology, crypto, payments, banking, real estate, healthcare

- Expiry Range: December 19, 2025 through January 2027 LEAPs (up to 14-month duration)

- Unusual Score Range: 1.43x (GOOGL) to 384.59x (FRMI) - with multiple Z-scores >100 signaling once-per-year positioning

- Bullish vs Bearish: $241.4M bullish/neutral (87%) vs $37.1M defensive/bearish (13%) = institutions betting on AI rally continuation with selective hedging