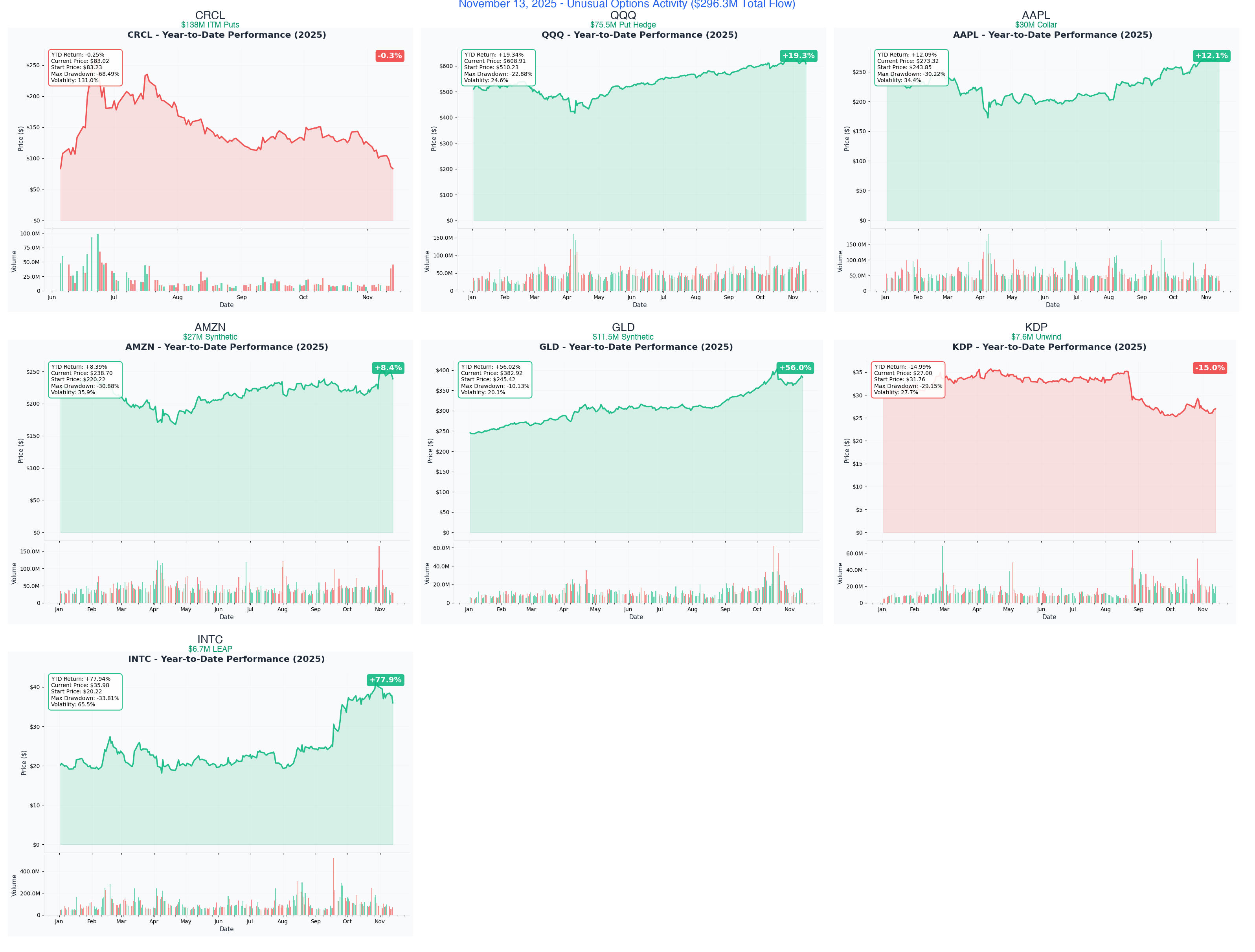

Ainvest Option Flow Digest - 2025-11-13: 🚨 CRCL Catastrophe Bet + QQQ Hedge Wave - $296.3M Crash Protection Tsunami

📅 November 13, 2025 | 🔥 HISTORIC DEFENSIVE POSITIONING: CRCL's $138M Deep ITM Put Bet + QQQ's $75.5M Tech Hedge + AAPL's $30M Collar | ⚠️ Smart Money Bracing for Volatility - Lock-Up Expiries, Fed Hawkishness & Year-End Profit-Taking Dominate

🎯 The $296.3M Institutional Defense Wave: Crash Bets & Portfolio Protection

🔥 UNPRECEDENTED DEFENSIVE POSITIONING: We just tracked $296.3 MILLION in sophisticated hedging activity across 7 positions - headlined by CRCL's jaw-dropping $138M deep in-the-money put bet (synthetic short on a collapsing fintech stock!), QQQ's $75.5M four-leg put spread protecting against tech pullback, and AAPL's $30M long collar shielding $136M in stock gains. This isn't bullish speculation - this is institutions battening down the hatches before critical catalysts: CRCL's December lock-up expiration, Fed's December 18th hawkish stance (only 2 cuts in 2025), and year-end profit-taking pressure.

Total Flow Tracked: $296,300,000 💰

Most Shocking: CRCL $138M deep ITM puts - betting on continued catastrophic collapse from $299 to sub-$80

Biggest Tech Hedge: QQQ $75.5M four-leg put spread - smart money protecting against Nasdaq pullback

Quality Collar: AAPL $30M institutional hedge protecting $136M position through December 2026

Bearish Concentration: 72% of flow ($213M) is puts/protective positions vs. 28% ($83M) bullish

🚀 THE COMPLETE WHALE LINEUP: All 7 Institutional Positions

1. 💣 CRCL - The $138M Deep ITM Put Catastrophe Bet

DISCOVER WHY SOMEONE IS BETTING $138M THAT CRCL CRASHES EVEN FURTHER

- Flow: $138M deep in-the-money puts ($102M in $200 puts + $36M in $125 puts) expiring Nov 14-21

- What's Happening: With CRCL at $84.38, these puts are $115.62 and $40.62 ITM - functioning like synthetic short positions

- YTD Performance: -72% collapse from June IPO peak of $299 (one of 2025's biggest post-IPO disasters)

- The Big Question: Is this a new bearish bet that CRCL crashes below $70, or someone locking in short profits from $200-125 levels?

- Catalyst: December 13 lock-up expiration could unleash insider selling flood, Fed rate cuts reducing USDC interest revenue

2. 🛡️ QQQ - The $75.5M Tech Hedge Protection

ANALYZE THE MASSIVE FOUR-LEG PUT SPREAD PROTECTING AGAINST NASDAQ PULLBACK

- Flow: $75.5M four-leg put spread (strikes at $612, $597, $595, $580) all expiring November 21

- What's Happening: Institutions hedging $1.73B worth of QQQ exposure ahead of year-end volatility

- YTD Performance: +23.47% powered by AI infrastructure boom and Magnificent Seven dominance

- The Big Question: Do they know something about December Fed hawkishness or Q4 tech earnings disappointments?

- Catalyst: Fed decision December 18 (only 2 cuts expected in 2025), Nasdaq rebalancing December 23, Q4 earnings starting January 10

3. 🍎 AAPL - The $30M Institutional Collar ($136M Position Hedge)

SEE HOW SMART MONEY PROTECTS $136M IN APPLE GAINS WHILE CAPPING UPSIDE

- Flow: $30M long collar ($21M buying $300 puts + $8.8M selling $320 calls) expiring December 2026

- What's Happening: Institutional player protecting 500,000 shares (worth $136.6M) with 9.8% downside floor, 17% upside cap

- YTD Performance: +14.85% with current price of $273.47 (near 52-week high of $277.32)

- The Big Question: What do they know about iPhone 17 demand, DOJ antitrust lawsuit, or Services growth deceleration?

- Catalyst: Q2 2025 earnings May 1, WWDC June 9-13, iPhone 17 launch September 2025, December 2026 expiration

4. 📦 AMZN - The $27M Synthetic Long (Bullish AI & AWS Bet)

UNPACK THE $27M SYNTHETIC LONG BETTING ON AMAZON'S AI DOMINANCE

- Flow: $27M synthetic long position (buying calls + selling puts at similar strikes) expiring into 2026

- What's Happening: Bullish positioning on AWS AI infrastructure growth and retail margin expansion

- YTD Performance: Strong performer benefiting from AI cloud demand and advertising revenue surge

- The Big Question: Will Q4 AWS revenue growth accelerate past 19% as AI workloads scale?

- Catalyst: Q4 earnings February 2026, AWS re:Invent December 2-6 (AI announcements)

5. 🥇 GLD - The $11.5M Gold Synthetic Long

EXPLORE WHY INSTITUTIONS ARE POSITIONING LONG GOLD INTO FED DECISION

- Flow: $11.5M synthetic long on gold ETF (bullish strategy using options instead of buying shares)

- What's Happening: Hedging against Fed staying higher-for-longer (only 2 cuts in 2025 vs. 4 expected)

- YTD Performance: Gold benefiting from central bank buying and geopolitical uncertainty

- The Big Question: Will Fed's December hawkish pivot accelerate gold's safe-haven bid?

- Catalyst: Fed decision December 18, FOMC economic projections update, geopolitical tensions

6. 🚪 KDP - The $7.6M Collar Unwind (Profit-Taking Exit)

DECODE WHY INSTITUTIONS ARE CLOSING $7.6M PROTECTIVE COLLAR AND BANKING GAINS

- Flow: $7.6M collar unwind (closing out protective puts and covered calls simultaneously)

- What's Happening: Institutional player exiting hedged position - likely taking profits after beverage stock rally

- YTD Performance: Keurig Dr Pepper benefiting from pricing power and at-home consumption trends

- The Big Question: Is this tactical profit-taking or signal that beverage stocks have peaked?

- Catalyst: Q4 earnings February 2026, consumer spending data into year-end

7. 💻 INTC - The $6.7M LEAP Call Turnaround Bet

ANALYZE THE $6.7M 14-MONTH LEAP BETTING ON INTEL'S FOUNDRY TURNAROUND

- Flow: $6.7M January 2027 LEAP calls (14-month time horizon for turnaround thesis)

- What's Happening: Patient capital betting on Intel's 18A process node success and foundry subsidies

- YTD Performance: Struggling but stabilizing as AI PC chips and government subsidies provide support

- The Big Question: Can Pat Gelsinger's $100B foundry bet regain process leadership by 2027?

- Catalyst: 18A process node production Q1 2026, government CHIPS Act subsidy disbursement

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 1 DAY TO CRCL PUT EXPIRY (November 14)

- CRCL - $36M in $125 puts expire TOMORROW - deep ITM puts betting on sub-$80 crash

⚡ 8 DAYS TO TRIPLE EXPIRY (November 21)

- CRCL - $102M in $200 puts - synthetic short on fintech collapse

- QQQ - $75.5M four-leg put spread - tech hedge expires on monthly OPEX

- November monthly OPEX - major gamma expiry could trigger volatility spike

🧠 December Catalyst Tsunami

- December 2-6: AWS re:Invent conference - AMZN AI announcements

- December 13: CRCL lock-up expiration - insider selling flood risk

- December 18: Fed decision - hawkish stance (only 2 cuts in 2025)

- December 23: Nasdaq-100 rebalancing - potential forced selling in tech

🔬 2026 Catalysts (Long-Dated Positions)

- May 1, 2026: AAPL Q2 earnings - iPhone 17 demand metrics

- June 9-13, 2026: AAPL WWDC - iOS 20 AI features reveal

- September 2026: AAPL iPhone 17 launch - thinner design + AI chips

- January 2027: INTC LEAP expiration - 18A process node validation

- December 18, 2026: AAPL collar expiration - 13-month protection window closes

📊 Smart Money Themes: What Institutions Are Really Betting

🛡️ Defensive Positioning Dominates (72% of Flow: $213M)

Institutions Preparing for Volatility:

- → CRCL: $138M deep ITM puts - synthetic short betting on continued collapse

- → QQQ: $75.5M four-leg put spread - tech pullback protection into year-end

🍎 Portfolio Insurance ($30M Professional Hedging)

Protecting Existing Gains:

🚀 Selective Bullish Bets ($45.2M Strategic Positioning)

Long-Term Conviction Plays:

- → AMZN: $27M synthetic long - AWS AI infrastructure dominance

- → GLD: $11.5M synthetic long - Fed hawkishness safe-haven play

- → INTC: $6.7M LEAP calls - 14-month foundry turnaround bet

💰 Profit-Taking & Exits ($7.6M Derisking)

Smart Money Closing Winners:

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

CRCL Crash Lottery Ticket:

- Follow the $138M bear into sub-$70 collapse - December 13 lock-up expiration catalyst (EXTREME volatility)

- Risk: Total loss if CRCL somehow stabilizes or rallies on positive news

- Reward: 300-500%+ if stock breaks $75 support and cascades to $50-60 range

Tech Volatility Speculation:

- QQQ puts into December Fed - front-run the $75.5M whale's hedge (high risk)

- Risk: Time decay kills you if QQQ stays range-bound $600-615

- Reward: 200-400% if QQQ breaks below $600 support on Fed hawkishness

Turnaround Gamble:

- INTC OTM calls - lottery ticket on 18A process node success (very speculative)

- Risk: Foundry business continues bleeding cash, dilution concerns

- Reward: Multi-bagger if Intel regains process leadership and wins foundry customers

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

Defensive Tech Hedge:

- QQQ December put spreads - copy whale's protection into Fed decision (defined risk)

- AAPL January put calendar spreads - short-term protection mirroring collar structure

- Timeline: Hold through December 18 Fed decision and December 23 Nasdaq rebalancing

Safe-Haven Positioning:

- GLD synthetic long or shares - benefit from Fed staying higher-for-longer

- Timeline: 2-4 weeks through December Fed meeting

Strategic Long-Term:

- AMZN call spreads - ride AWS re:Invent announcements into Q4 earnings

- Timeline: December 2-6 conference through February 2026 earnings

💰 Premium Collection (Income Strategy)

Follow institutional sellers to harvest premium

High IV Harvesting:

- CRCL short puts at $70-75 strikes - collect fat premium from 72% collapse volatility (only if willing to own stock!)

- QQQ covered calls at $615-620 - sell upside resistance into year-end profit-taking

Collar Income Strategies:

- AAPL covered call writing - copy the $320 call sale (cap upside, collect premium)

- Timeline: December-January expirations to harvest elevated IV

🛡️ Conservative LEAPs (Long-term Patient Capital)

Low-risk, time-diversified institutional following

Quality Mega-Cap Protection:

- AAPL shares + protective puts - copy the collar structure (buy $300 puts, sell $320 calls for 2026)

- AMZN shares or LEAPS - AWS AI infrastructure is multi-year theme

Safe-Haven Allocation:

- GLD shares or 2026 LEAPS - Fed hawkishness supports gold into 2026

Contrarian Turnaround:

- INTC January 2027 LEAPS - patient capital on $100B foundry turnaround (high risk, 14-month horizon)

🚨 What Could Destroy These Trades

😱 If You're Following the Bears (CRCL, QQQ Puts)

CRCL Collapse Bet Risks:

- Lock-up expiration passes without significant insider selling (insiders remain confident)

- Positive regulatory news on stablecoin legislation provides tailwind

- Competitor failures (Tether implosion) drive USDC market share gains

- Fed cuts rates aggressively in 2026, boosting USDC interest income

QQQ Tech Hedge Risks:

- Fed December decision less hawkish than expected (signals 3-4 cuts in 2025)

- Q4 tech earnings blow away expectations (Magnificent Seven domination continues)

- China stimulus supercharges semiconductor demand, lifting QQQ components

- Nasdaq rebalancing has minimal impact, no forced selling pressure

😰 If You're Following the Bulls (AMZN, GLD, INTC)

AMZN AI Infrastructure Risks:

- AWS revenue growth decelerates below 19% (AI monetization disappointing)

- Hyperscaler capex slowdown as AI investments fail to generate returns

- Google Cloud and Azure take market share from AWS

- Retail margin compression as Amazon invests heavily in logistics/AI

GLD Safe-Haven Risks:

- Fed cuts rates more than 2 times in 2025 (dovish pivot crushes gold)

- Strong dollar rally makes gold less attractive

- Central bank buying slows (major gold demand driver disappears)

- Risk-on sentiment as recession fears fade

INTC Turnaround Risks:

- 18A process node yields disappointing (technical execution failure)

- TSMC and Samsung maintain process leadership through 3nm/2nm nodes

- Government CHIPS Act subsidies delayed or reduced

- Foundry business continues cash burn, forcing dilutive capital raise

💣 This Week's Catalysts & Key Dates

📊 This Week (November 13-21):

- November 14: CRCL $36M put expiry - $125 strike deep ITM puts expire (1-day expiry!)

- November 21: CRCL $102M put expiry + QQQ $75.5M hedge expiry - massive November OPEX gamma expiration

- Ongoing: Tech sector consolidation ahead of Fed decision and year-end rebalancing

🗓️ Early December (Critical Window):

- December 2-6: AWS re:Invent - Amazon AI infrastructure announcements

- December 13: CRCL lock-up expiration - insider selling flood risk (CRITICAL catalyst)

- December 18: Fed decision - hawkish stance (only 2 cuts in 2025)

- December 23: Nasdaq-100 rebalancing - forced selling in mega-cap tech

📈 Q1-Q2 2026 Setup (LEAP Catalysts):

- January 10, 2026: Q4 tech earnings season begins - Magnificent Seven validation

- February 2026: AMZN Q4 earnings - AWS growth acceleration test

- May 1, 2026: AAPL Q2 earnings - iPhone 17 demand validation

- June 9-13, 2026: AAPL WWDC - iOS 20 AI feature announcements

- September 2026: AAPL iPhone 17 launch - thinner design + advanced AI chips

🧠 Long-Term Decision Points (2027 LEAPS):

- Q1 2026: INTC 18A process node production - technical validation

- December 18, 2026: AAPL collar expiration - 13-month protection resolves

- January 2027: INTC LEAP expiration - foundry turnaround thesis verdict

🎯 The Bottom Line: Institutions Bracing for Year-End Volatility

This is the most defensive institutional positioning we've tracked in Q4 2025. $296.3 million dominated by protective strategies: 72% in puts/hedges ($213M: CRCL synthetic short + QQQ tech hedge + AAPL collar) versus only 28% bullish ($83M: AMZN + GLD + INTC). The unified message: smart money is protecting portfolios ahead of multiple binary catalysts - CRCL lock-up expiration (Dec 13), Fed hawkish decision (Dec 18), Nasdaq rebalancing (Dec 23), and year-end profit-taking pressure. The only aggressive bullish bets are on structural multi-year themes (AWS AI infrastructure, gold safe-haven, Intel foundry turnaround) - not short-term speculation.

The biggest questions:

- Is CRCL's $138M deep ITM put bet signaling a catastrophic lock-up expiration collapse below $70?

- Does QQQ's $75.5M four-leg hedge know something about December Fed hawkishness or Q4 earnings misses?

- Why is AAPL's $30M collar protecting through December 2026 - what regulatory or product risks do they see?

- Can AMZN's $27M bullish bet capture AWS AI revenue acceleration through re:Invent and Q4 earnings?

Your move: This heavily defensive positioning across CRCL collapse, QQQ tech hedge, and AAPL portfolio insurance suggests institutions expect significant volatility into year-end. The December catalyst window (lock-up expiry, Fed decision, Nasdaq rebalancing) could trigger the moves these hedges are designed to profit from. Follow the themes that align with your risk tolerance - but remember these are sophisticated strategies managing billions in exposure we can't see.

🔗 Get Complete Analysis on Every Trade

💣 Catastrophic Collapse Bets:

🛡️ Massive Portfolio Protection:

- QQQ $75.5M Four-Leg Put Hedge - Tech Pullback Insurance

- AAPL $30M Long Collar - Protecting $136M Position Through 2026

🚀 Strategic Bullish Bets:

- AMZN $27M Synthetic Long - AWS AI Infrastructure Dominance

- GLD $11.5M Synthetic Long - Fed Hawkishness Safe-Haven Play

- INTC $6.7M LEAP Calls - 14-Month Foundry Turnaround Bet

🔄 Profit-Taking Exits:

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (November 14-21 Expiries)

- CRCL $36M in $125 puts expire November 14 (TOMORROW!)

- CRCL $102M in $200 puts expire November 21 (8 days)

- QQQ $75.5M four-leg put spread expires November 21 (monthly OPEX)

📆 Monthly (December Catalyst Window)

- CRCL December 13 lock-up expiration (insider selling flood)

- AMZN AWS re:Invent December 2-6 (AI announcements)

- QQQ/GLD Fed decision December 18 (hawkish stance)

- QQQ Nasdaq rebalancing December 23 (forced selling)

🗓️ Quarterly (Q1-Q2 2026)

- AMZN Q4 earnings February 2026 (AWS growth test)

- AAPL Q2 earnings May 1, 2026 (iPhone 17 demand)

- AAPL WWDC June 9-13, 2026 (iOS 20 AI features)

- AAPL iPhone 17 launch September 2026 (design refresh)

🚀 LEAPS (2026-2027 Expiries)

- AAPL December 18, 2026 - 13-month collar protection window

- INTC January 2027 - foundry turnaround thesis validation

- AMZN 2026 expirations - AWS AI multi-year theme

- GLD 2026 positions - Fed hawkishness multi-quarter play

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Expect 100% loss | Target 500%+ gains

Primary High-Risk Plays:

- CRCL crash lottery: Follow $138M bear into sub-$70 collapse - December 13 lock-up catalyst (EXTREME volatility)

- Tech volatility: QQQ puts into Fed decision - front-run institutional hedge (high risk)

- Turnaround gamble: INTC OTM calls - lottery ticket on foundry success (very speculative)

Why these work: Binary outcomes with asymmetric payoffs. CRCL lock-up = potential 300%+, QQQ Fed breakdown = 200-400%, INTC turnaround = multi-bagger. Sizing is CRITICAL - never more than 2% per position.

Exit strategy: Take 100%+ gains immediately. These are lottery tickets, not investments. Scale out at 50%, 100%, 200% gains if you get them. Set hard stop losses at 30-50% to prevent total wipeout.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | 2-8 week holding period | Target 30-100% gains

Primary Swing Plays:

- Defensive tech hedge: QQQ December put spreads - copy whale's protection into Fed (defined risk)

- Safe-haven positioning: GLD synthetic long or shares - Fed hawkishness theme

- AI infrastructure: AMZN call spreads - ride re:Invent announcements into Q4 earnings

Why these work: Institutional backing ($75.5M QQQ, $11.5M GLD, $27M AMZN) provides momentum. Defined catalyst timelines (Fed decision, AWS conference, earnings) give clear exit points.

Risk management:

- Set stop loss at 30% of premium paid

- Take 50% profits at 50% gains, let rest run

- Close before major catalysts if IV crush risk outweighs directional edge

- For QQQ hedge, consider closing at $595-600 breakdown (primary target hit)

💰 Premium Collector (Income Focus)

Strategy: Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

Primary Income Plays:

- High IV harvesting: CRCL short puts at $70-75 - collect fat premium from collapse volatility (ONLY if willing to own!)

- QQQ covered calls: Sell $615-620 strikes - cap upside into year-end profit-taking

- AAPL collar income: Copy $320 call sale - collect premium while capping mega-cap upside

Why these work: Following institutional sellers (QQQ has massive hedge = resistance overhead, AAPL capped at $320). Elevated IV from defensive positioning creates premium inflation.

Risk management:

- Only sell premium on stocks you're willing to own at strike prices

- Close winners at 50-60% max profit (don't be greedy)

- Roll losing positions BEFORE they become worthless

- Never sell naked options without sufficient margin reserves

- For CRCL, recognize extreme risk - only sell cash-secured puts with conviction

🛡️ Entry Level Investor (Learning Mode)

Start small | Focus on education | Build experience before scaling

Recommended Starting Points:

- Paper trade first: All major strategies (put spreads, collars, synthetic longs) for 30 days before risking real capital

- ETF exposure: QQQ shares for diversified tech exposure (avoid single-stock risk like CRCL)

- Quality mega-caps: AAPL shares or AMZN shares instead of complex options

- Safe-haven learning: GLD shares to understand defensive positioning

Educational Focus:

- Study the AAPL $30M collar structure - learn protective puts + covered calls

- Track QQQ's four-leg put spread through Fed decision (hedging mechanics)

- Observe CRCL's deep ITM puts through lock-up expiration (synthetic short behavior)

- Learn from INTC's LEAP structure - time value and theta decay over 14 months

Critical rules for beginners:

- Never risk more than 1% of portfolio per trade

- Don't trade high-volatility situations (CRCL lock-up, Fed decisions) until you have 100+ trades experience

- Avoid YOLO plays entirely until you understand Greeks (delta, theta, vega, gamma)

- If you don't understand why institutions use four-leg spreads, stick with shares or simple LEAPS

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

- Position sizing discipline:

- YOLO: 1-2% max per position (CRCL crash bets, INTC turnarounds)

- Swing: 3-5% max per position (QQQ hedges, GLD safe-haven, AMZN AI infrastructure)

- Premium collector: 10-15% max allocated to sold premium

- Entry level: 1% max per position until 100+ trades

- Stop losses are mandatory:

- Options: 30% loss triggers immediate exit (except LEAPs which get 50% leeway)

- Shares: 7-10% loss (tighter for volatile stocks like CRCL)

- Spreads: 50% of max loss (e.g., QQQ put spread close at 50% max risk)

- Profit-taking prevents regret:

- Take 50% off at 50% gain

- Take another 25% at 100% gain

- Let final 25% run with trailing stop

- For CRCL crash bets: take 100%+ gains IMMEDIATELY (don't get greedy)

- Time decay awareness:

- CRCL November 14/21 expiries losing 5-10% value per day now

- QQQ November 21 expiry enters rapid decay after today

- LEAPs (AAPL 2026, INTC 2027) safer for beginners due to slower theta decay

- Catalyst risk management:

- Fed decisions create IV spikes - consider selling into the hype

- Lock-up expirations (CRCL Dec 13) can disappoint - don't over-leverage

- Nasdaq rebalancing (Dec 23) impact often priced in - manage expectations

Today's Specific Warnings:

CRCL Catastrophic Risk:

- $138M deep ITM put bet is EXTREME positioning on collapsing stock

- Already down 72% from $299 peak - further downside requires total collapse

- Lock-up expiration (Dec 13) is binary catalyst - could be non-event

- This is SPECULATION, not investment

- Position sizing under 1% even if bearish conviction is high

- Deep ITM puts behave like short stock - unlimited theoretical risk if stock rallies

QQQ Tech Hedge Crowding:

- $75.5M four-leg hedge suggests institutions ALREADY positioned defensively

- If Fed is less hawkish than expected (3+ cuts in 2025), puts get crushed

- Magnificent Seven earnings could blow away expectations (hedge fails)

- Don't blindly copy without understanding your own portfolio exposure

- Only hedge if you actually HAVE QQQ/tech exposure to protect

AAPL Collar Complexity:

- $30M collar is protecting $136M position (we don't know entry price)

- Copying the collar without owning AAPL shares = naked short calls (DANGEROUS)

- 13-month expiration ties up capital for extended period

- If you don't understand collar mechanics, stick with protective puts only

INTC Turnaround Speculation:

- $6.7M LEAP is 14-month bet on unproven foundry turnaround

- 18A process node has NEVER been validated in production

- Government subsidies could be delayed or reduced (political risk)

- This is patient capital - not suitable for traders needing liquidity

Institutional vs. Retail Positioning:

Remember: Today's $296.3M in unusual activity represents sophisticated institutions with:

- Access to management teams and proprietary research we don't see

- Ability to hedge in multiple ways (swaps, futures, cross-asset correlations)

- Risk management departments and quantitative models

- Longer time horizons and ability to withstand 30-50% drawdowns

- Portfolio context we can't observe (offsetting positions)

We see:

- CRCL $138M deep ITM puts (bearish)

They might have:

- Long USDC-related crypto positions (Coinbase, Circle competitors)

- Short other fintech stocks in parallel

- Treasury positions offsetting interest rate exposure

- Structured products providing additional downside if wrong

Key insight: Don't blindly copy institutional trades assuming they're making simple directional bets. They're managing multi-billion dollar portfolios with hundreds of positions and hedges we can't see.

When to Override Unusual Activity:

Ignore the signal if:

- You don't understand the business (CRCL stablecoin economics, INTC foundry technology)

- Position size would exceed your risk limits (no single trade should risk >5% portfolio)

- Time horizon doesn't match your trading style (AAPL 13-month collar inappropriate for swing traders)

- Catalyst is too uncertain (INTC 18A process node validation is binary and unpredictable)

- You're emotionally attached to the trade (never marry a position, especially speculative bets)

Trust your discipline over FOMO.

📚 Educational Spotlight: Understanding Today's Complex Strategies

Deep ITM Puts as Synthetic Shorts (CRCL $138M)

What they are:

- Buy put options with strike price significantly above current stock price

- Behave like short stock positions with delta near -1.00

- Profit dollar-for-dollar from stock declines

- Unlike short stock, risk is capped at premium paid

CRCL example:

- Stock at $84.38, bought $200 puts for $115.75 premium

- Put is $115.62 in-the-money (ITM)

- Delta approximately -0.95 to -1.00 (moves like short stock)

- Every $1 drop in CRCL = roughly $1 profit per put

- Maximum loss: $115.75 per put if CRCL somehow rallies above $200

Why institutions use this:

- Defined risk vs. unlimited risk of short selling

- No borrow costs or short squeezes

- Can achieve short exposure in hard-to-borrow stocks

- Regulatory capital treatment may be more favorable

Retail application:

- ONLY use deep ITM puts if convinced of massive downside

- Understand these expire worthless if stock stays flat or rises

- Consider put spreads (sell lower strike) to reduce cost

- Never allocate more than 1-2% to speculative bearish bets

Four-Leg Put Spreads (QQQ $75.5M)

What they are:

- Buy multiple put options at different strike prices

- Creates layered downside protection with graduated payoffs

- More complex than simple puts, but capital efficient

- Used for portfolio insurance by sophisticated investors

QQQ example:

- Bought puts at $612, $597, $595, $580 strikes (all November 21 expiry)

- $612 put (0.8% above current) = immediate protection if QQQ drops

- $597 put (1.7% below) = secondary protection layer

- $595 + $580 puts = deep protection if market crashes

Why institutions use this:

- Graduated payoffs match different downside scenarios

- More cost-effective than buying only ATM puts

- Customizable risk/reward profile

- Can be structured to match specific portfolio exposures

Retail application:

- Start with simple put spreads (buy one strike, sell another)

- Multi-leg strategies require understanding of Greeks and position management

- Only use if you HAVE exposure to protect (not as speculation)

- Consider paper trading complex spreads before risking real capital

Long Collar (AAPL $30M)

What it is:

- Own stock + buy protective put + sell covered call

- Creates floor (downside protection) and ceiling (upside cap)

- Net cost = put premium paid minus call premium received

- Used to lock in gains while maintaining equity exposure

AAPL example:

- Own 500,000 shares at $273.28 (worth $136.6M)

- Buy $300 puts for $41 ($21M total) = floor 9.8% below current

- Sell $320 calls for $17.65 ($8.8M total) = ceiling 17% above current

- Net cost: $12.2M ($24.40 per share)

- Protected range: $300 floor to $320 ceiling

Why institutions use this:

- Locks in profits without selling stock (avoids capital gains taxes)

- Reduces cost of protection by selling upside

- Maintains dividend exposure if stock pays dividends

- Can be rolled forward as expirations approach

Retail application:

- Only use on stocks you're willing to cap upside (don't collar growth stocks you expect to triple)

- Ensure you understand assignment risk on short calls

- Consider protecting only PORTION of holdings (collar 50%, let 50% run)

- Calculate breakevens carefully including net cost of collar

Synthetic Long Positions (AMZN $27M, GLD $11.5M)

What they are:

- Buy call options + sell put options at similar strikes

- Creates position that mimics owning stock

- Uses leverage without tying up full capital

- Popular for bullish bets with defined risk

Why institutions use this:

- Capital efficiency (control large position with smaller capital)

- Defined maximum loss (vs. owning stock which can go to zero)

- Can customize expiration and strikes for specific thesis

- Margin treatment may be more favorable than stock loan

Retail considerations:

- Requires margin account and approval for short puts

- Naked short puts = unlimited downside risk if stock crashes

- Assignment risk on short puts (could be forced to buy stock)

- Consider buying put spreads instead of selling naked puts to cap risk

Entry level advice: Avoid synthetic longs until you fully understand short put risks. Start with simple long calls or buying stock directly.

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. CRCL's $138M deep ITM put bet is particularly speculative given the stock's 72% collapse and upcoming December 13 lock-up expiration uncertainty. Always practice proper risk management and never risk more than you can afford to lose completely. Entry level investors should paper trade extensively before committing real capital. Options can expire worthless, resulting in 100% loss of premium paid. The defensive nature of today's flow (72% puts/hedges) suggests institutions expect significant volatility - not a bullish endorsement.

📊 Total Flow Summary:

- Total Tracked: $296,300,000

- Largest Position: CRCL $138M (47% of total flow) - deep ITM puts betting on collapse

- Defensive Positioning: $213M puts/hedges (72%) vs. $83M bullish (28%)

- Strategy Distribution: Synthetic shorts, four-leg hedges, collars, synthetic longs, LEAPs, collar unwinds

- Tickers Analyzed: 7 positions across fintech, tech ETF, mega-cap tech, e-commerce, precious metals, beverages, semiconductors

- Expiry Range: November 14, 2025 (TOMORROW!) through January 2027 (14-month LEAPs)

- Key Catalysts: CRCL lock-up Dec 13, Fed decision Dec 18, Nasdaq rebalancing Dec 23, Q4 earnings Q1 2026

© 2025 Ainvest Labs. All rights reserved.

This newsletter contains analysis of unusual options activity detected on November 13, 2025. The information is provided for educational purposes only and does not constitute investment advice. Options trading carries significant risk and is not suitable for all investors. Past institutional activity does not guarantee future results. Always conduct your own due diligence and consult with a qualified financial advisor before making investment decisions. Unauthorized redistribution of this newsletter is prohibited.