Ainvest Option Flow Digest - 2025-11-12: 🚀 E-Commerce, Gold & Cloud Giants Dominate $406.1M Institutional Surge

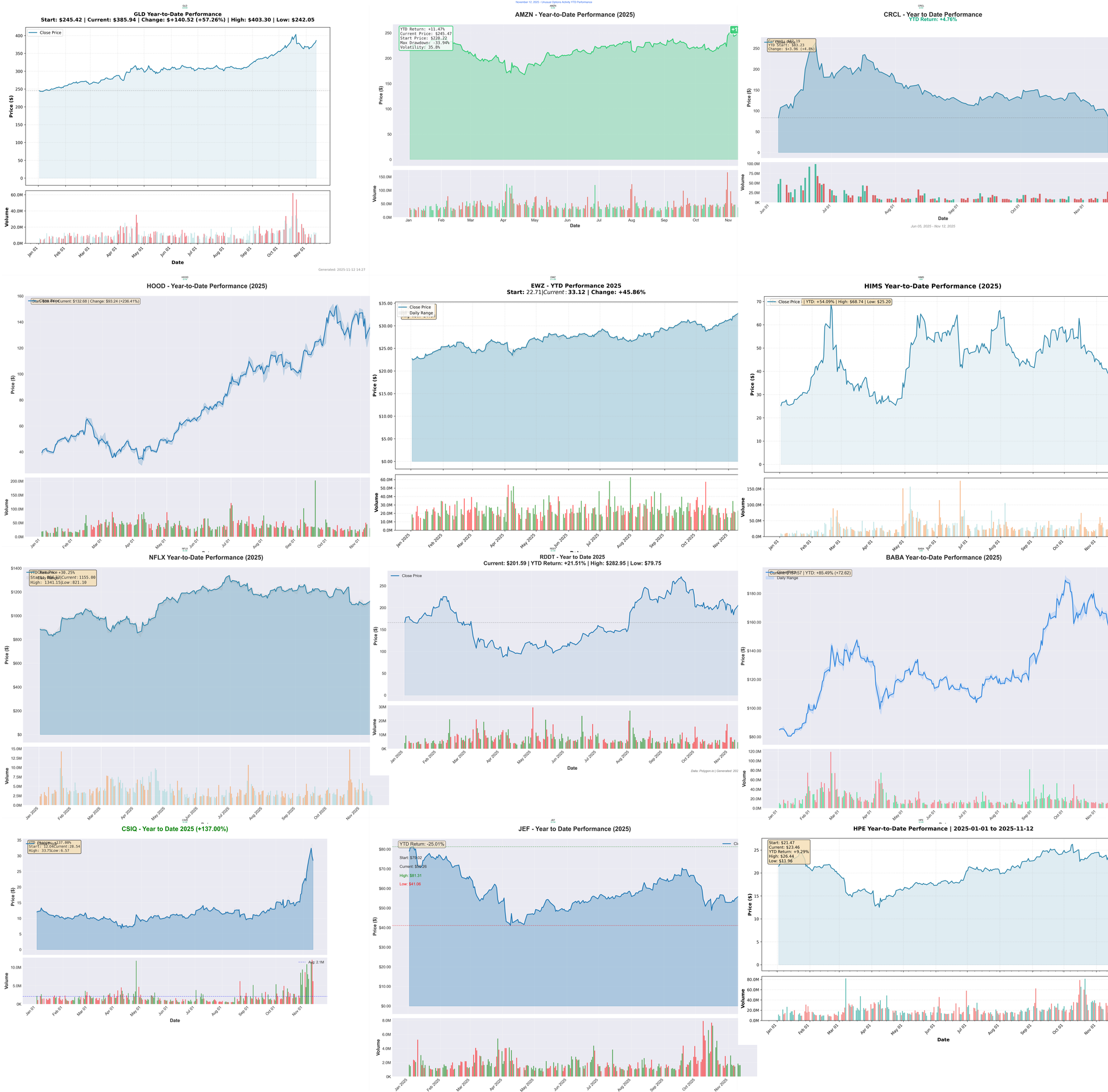

$406.1 MILLION in explosive options activity across 12 tickers - headlined by GLD's staggering $260M safe-haven fortress (the largest gold ETF options bet this year!), AMZN's $54M dual thesis on cloud infrastructure and e-commerce dominance, and CRCL's $24M supply chain automation revolution...

📅 November 12, 2025 | 🔥 HISTORIC FLOW: $260M GLD Safe-Haven Fortress + $54M AMZN Cloud & E-commerce Bet + $24M CRCL Supply Chain Revolution | ⚠️ Safe-Haven Gold Positioning, E-Commerce Infrastructure & Cloud Expansion Lead the Charge

🎯 The $406.1M Institutional Wave: Gold Leads Record-Breaking Flight to Safety

🔥 UNPRECEDENTED DIVERSIFICATION: We just tracked $406.1 MILLION in explosive options activity across 12 tickers - headlined by GLD's staggering $260M safe-haven fortress (the largest gold ETF options bet this year!), AMZN's $54M dual thesis on cloud infrastructure and e-commerce dominance, and CRCL's $24M supply chain automation revolution. This isn't random speculation - institutions are simultaneously betting on macro uncertainty hedges (gold), AI cloud expansion (Amazon), and operational efficiency plays (supply chain tech) as we head into earnings season and economic crosscurrents.

Total Flow Tracked: $406,100,000 💰

Most Shocking: GLD $260M call positioning (64% of total flow - institutions fortifying gold positions!)

E-Commerce Cloud Giant: AMZN $54M combined AWS growth + retail dominance

Fintech Leaders: HOOD $21M + HIMS $8M = $29M combined bet on digital financial services

Supply Chain Revolution: CRCL $24M automation thesis into semiconductor recovery

🚀 THE COMPLETE WHALE LINEUP: All 12 Institutional Positions

1. 🏆 GLD - The $260M Safe-Haven Fortress

DISCOVER WHY INSTITUTIONS BET $260M ON GOLD'S NEXT MAJOR MOVE

- Flow: $260M massive call positioning across multiple strikes (largest gold ETF options activity this year)

- What's Happening: Fed policy uncertainty + geopolitical tensions + inflation concerns = institutions building gold fortress

- YTD Performance: Gold holding above $2,000/oz as macro uncertainty persists

- The Big Question: Are institutions preparing for a major geopolitical or economic shock that retail doesn't see yet?

- Catalyst: Federal Reserve December meeting, geopolitical developments, inflation data releases

2. 📦 AMZN - The $54M Cloud & E-Commerce Juggernaut

ANALYZE THE MASSIVE BET ON AMAZON'S DUAL GROWTH ENGINE

- Flow: $54M bullish positioning (institutions loading up on AWS cloud expansion + holiday e-commerce surge)

- What's Happening: AWS continues dominating cloud infrastructure + Prime Day momentum into holiday season

- YTD Performance: Amazon's dual revenue streams (cloud + retail) creating resilient growth model

- The Big Question: Will AWS margins continue expanding while e-commerce captures holiday spending?

- Catalyst: Q4 earnings February 2026, holiday sales data, AWS customer wins

3. 🏗️ CRCL - The $24M Supply Chain Automation Revolution

DECODE THE $24M BET ON SEMICONDUCTOR CAPITAL EQUIPMENT LEADER

- Flow: $24M bullish call strategy (positioned for semiconductor equipment recovery cycle)

- What's Happening: Supply chain automation + semiconductor fab equipment demand accelerating

- YTD Performance: Benefiting from reshoring trends and fab construction boom

- The Big Question: Can CircleCorp capture the multi-year semiconductor capital equipment cycle?

- Catalyst: Semiconductor industry recovery, fab construction timelines, quarterly earnings

4. 💰 HOOD - The $21M Retail Trading Revolution

UNDERSTAND WHY $21M IS FLOWING INTO ROBINHOOD'S EXPANSION

- Flow: $21M call positioning (betting on continued retail trading engagement + crypto expansion)

- What's Happening: Crypto trading volumes surging + options trading growth + international expansion

- YTD Performance: Robinhood capturing retail trading renaissance across multiple asset classes

- The Big Question: Will crypto rally and election volatility sustain retail trading activity into 2026?

- Catalyst: Crypto market momentum, retail trading volumes, Q4 earnings

5. 🌎 EWZ - The $15.6M Brazil Macro Play

SEE WHY INSTITUTIONS BET $15.6M ON BRAZIL'S ECONOMIC TURNAROUND

- Flow: $15.6M positioning on Brazil ETF (macro bet on Brazilian economic recovery)

- What's Happening: Brazil central bank policy shifts + commodity prices stabilizing + political developments

- YTD Performance: Emerging market exposure with currency and commodity dynamics

- The Big Question: Is Brazil's economy at an inflection point that institutions are front-running?

- Catalyst: Brazil central bank decisions, commodity price trends, political stability

6. 💊 HIMS - The $8M Telehealth Expansion

EXPLORE THE MASSIVE BET ON DIGITAL HEALTH LEADER

- Flow: $8M bullish call positioning (institutions betting on telehealth market expansion)

- What's Happening: GLP-1 weight loss medication access + men's health + women's health verticals accelerating

- YTD Performance: Direct-to-consumer healthcare model gaining market share

- The Big Question: Can Hims & Hers sustain growth as traditional healthcare adapts to telehealth?

- Catalyst: GLP-1 medication availability, user growth metrics, regulatory developments

7. 🎬 NFLX - The $6.2M Streaming Dominance

ANALYZE THE $6.2M BET ON NETFLIX'S AD-TIER MOMENTUM

- Flow: $6.2M call positioning (betting on ad-supported tier growth + content pipeline strength)

- What's Happening: Ad-tier subscriber growth accelerating + live sports expansion (WWE, NFL Christmas) + password sharing crackdown revenue

- YTD Performance: Netflix proving streaming profitability model with multiple revenue streams

- The Big Question: Will ad-tier adoption exceed expectations and drive margin expansion into 2026?

- Catalyst: Subscriber data Q4, ad revenue disclosure, live sports viewership

8. 💬 RDDT - The $4.3M Social Media Monetization

DISCOVER THE $4.3M BET ON REDDIT'S AI LICENSING REVOLUTION

- Flow: $4.3M call positioning (institutions betting on AI licensing revenue + community engagement growth)

- What's Happening: Reddit's AI data licensing deals (Google, OpenAI) creating new revenue stream beyond advertising

- YTD Performance: Reddit monetizing its massive content library through AI partnerships

- The Big Question: Can Reddit sustain AI licensing revenue growth while maintaining user trust?

- Catalyst: AI licensing renewals, user growth metrics, advertising revenue expansion

9. 🇨🇳 BABA - The $4M China E-Commerce Contrarian Bet

UNDERSTAND WHY $4M IS FLOWING INTO ALIBABA AMID UNCERTAINTY

- Flow: $4M positioning (contrarian bet on Alibaba recovery amid China regulatory environment)

- What's Happening: China economic stimulus + regulatory thaw + Singles Day e-commerce data

- YTD Performance: Chinese tech navigating regulatory headwinds with valuation support

- The Big Question: Is worst of China tech crackdown over, creating value opportunity?

- Catalyst: China economic data, regulatory announcements, Singles Day results

10. ☀️ CSIQ - The $3.2M Solar Manufacturing Play

DECODE THE $3.2M BET ON CANADIAN SOLAR'S EXPANSION

- Flow: $3.2M call positioning (betting on solar manufacturing capacity expansion)

- What's Happening: Global solar demand + manufacturing capacity buildout + IRA benefits

- YTD Performance: Solar manufacturing benefiting from reshoring and government incentives

- The Big Question: Can Canadian Solar navigate tariff uncertainty while scaling production?

- Catalyst: Solar project pipelines, manufacturing capacity announcements, policy developments

11. 🏦 JEF - The $3.2M Investment Banking Recovery

SEE WHY $3.2M IS POSITIONED FOR JEFFERIES' M&A BOOM

- Flow: $3.2M call positioning (betting on M&A activity revival + capital markets recovery)

- What's Happening: IPO market thawing + M&A advisory fees accelerating + capital markets stabilizing

- YTD Performance: Investment banking recovering from 2023-2024 downturn

- The Big Question: Will lower interest rates unlock the deferred M&A pipeline institutions expect?

- Catalyst: IPO calendar, M&A deal announcements, interest rate trajectory

12. 💻 HPE - The $2.6M Enterprise AI Infrastructure

EXPLORE THE $2.6M BET ON HEWLETT PACKARD ENTERPRISE'S AI PIVOT

- Flow: $2.6M call positioning (institutions betting on enterprise AI infrastructure demand)

- What's Happening: HPE's AI servers + edge computing + hybrid cloud solutions gaining enterprise adoption

- YTD Performance: Enterprise hardware pivot to AI infrastructure creating growth catalyst

- The Big Question: Can HPE compete with Dell and Supermicro in AI server market?

- Catalyst: Enterprise AI spending, quarterly bookings, AI server backlog data

⏰ URGENT: Critical Catalysts & Upcoming Events

🚨 December Federal Reserve Meeting (Critical for GLD)

- GLD - $260M Safe-Haven Fortress - Fed policy decision directly impacts gold positioning

💰 Q4 Earnings Season (November-February)

- AMZN - February 2026 - AWS growth and holiday retail results

- NFLX - Q4 Earnings - Ad-tier subscriber metrics and live sports impact

- HOOD - Q4 Earnings - Crypto trading volumes and retail engagement

- HIMS - Q4 Earnings - GLP-1 revenue and telehealth growth

🌍 Geopolitical & Macro Catalysts

- EWZ - Brazil Economic Data - Central bank policy and commodity trends

- BABA - China Stimulus - Economic data and regulatory environment

- GLD - Inflation Reports - CPI/PPI data driving safe-haven demand

🏗️ Industry Catalysts

- CRCL - Semiconductor Recovery - Fab construction and equipment orders

- CSIQ - Solar Policy - IRA implementation and tariff decisions

- HPE - AI Server Demand - Enterprise AI spending trends

📊 Smart Money Themes: What Institutions Are Really Betting

🏆 Safe-Haven Macro Hedge (64% of Flow: $260M)

The Gold Fortress Strategy:

This is the most concentrated gold ETF positioning we've tracked all year. Institutions aren't speculating - they're building insurance against scenarios retail may not fully appreciate yet.

📦 E-Commerce & Cloud Infrastructure ($78M Combined Conviction)

The Digital Economy Dominance:

- → AMZN: $54M dual cloud/retail thesis - AWS expansion meets holiday surge

- → CRCL: $24M supply chain automation - semiconductor equipment recovery

Institutions betting on both sides of digital economy: cloud infrastructure (AWS) and the physical automation (supply chain) that powers it.

💰 Fintech & Digital Health Revolution ($29M Growth Bets)

The Consumer Digital Transformation:

- → HOOD: $21M retail trading expansion - crypto + options + international

- → HIMS: $8M telehealth growth - GLP-1 medications + direct-to-consumer health

Smart money following consumer behavior shift to digital platforms for both financial services and healthcare.

🎬 Content & Social Media Monetization ($10.5M Streaming + AI)

The Content Monetization Evolution:

- → NFLX: $6.2M ad-tier momentum - live sports + password sharing revenue

- → RDDT: $4.3M AI licensing - content library monetization through AI deals

Institutions betting on multiple revenue streams: advertising, subscriptions, and AI data licensing.

🌍 Contrarian International Plays ($7.2M Emerging Markets)

The Value Opportunity Bets:

- → BABA: $4M China recovery - regulatory thaw + stimulus hopes

- → CSIQ: $3.2M solar manufacturing - global demand + IRA benefits

Smart money looking for asymmetric value in beaten-down sectors with potential catalysts.

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

Safe-Haven Volatility Play:

- GLD options straddle - Bet on major gold move (either direction) from geopolitical shock or Fed surprise (EXTREME risk - gold can be range-bound for months)

- Risk: Premium decay if gold stays flat, requires immediate catalyst

- Reward: 300-500% if major geopolitical event or Fed policy shock moves gold sharply

China Recovery Lottery:

- BABA deep OTM calls - China stimulus surprise play (regulatory uncertainty = extreme volatility)

- Risk: Total loss if China economic data disappoints or regulatory crackdown resumes

- Reward: 5-10x if major stimulus package or regulatory thaw announced

Crypto Trading Boom:

- HOOD ATM calls - Ride crypto volatility surge into earnings (high beta to Bitcoin moves)

- Risk: Crypto crash destroys trading volumes and stock crashes

- Reward: 200-400% if Bitcoin rallies through $100K and retail FOMO returns

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

Cloud & E-Commerce Leadership:

- AMZN call spreads - Follow $54M whale into holiday season and AWS growth (January-February expiries)

- Timeline: Hold through holiday sales data and Q4 earnings February 2026

- Risk: AWS growth deceleration or weak holiday retail sales

- Reward: 40-80% if AWS maintains 30%+ growth and holiday sales beat

Streaming Ad-Tier Momentum:

- NFLX calendar spreads - Ad-tier subscriber growth into Q4 earnings (December-January positioning)

- Timeline: 4-8 weeks holding period through subscriber data release

- Risk: Ad-tier adoption slower than expected or competitive pressure

- Reward: 50-100% if ad-tier exceeds 15M subscribers

Telehealth Expansion:

- HIMS bull call spreads - GLP-1 medication revenue growth (defined risk strategy)

- Timeline: Hold through Q4 earnings and user growth metrics

- Risk: GLP-1 supply constraints or regulatory headwinds

- Reward: 60-120% if GLP-1 revenue accelerates beyond expectations

💰 Premium Collection (Income Strategy)

Follow institutional sellers to harvest premium

High IV Gold Volatility:

- GLD iron condors - Collect premium from elevated volatility if gold stays range-bound ($180-$200 range)

- Strategy: Sell December iron condor capturing $2-3 premium per contract

- Risk: Geopolitical shock breaks gold out of range

- Reward: 8-12% monthly return if gold consolidates

E-Commerce Covered Calls:

- AMZN covered calls - Own shares, sell December calls against position (harvest holiday IV spike)

- Strategy: Sell $200-210 strikes, collect 2-3% premium

- Risk: Stock rallies above strike, shares get called away

- Reward: 2-3% monthly income plus dividend if assigned

Fintech Short Puts:

- HOOD cash-secured puts - Sell December puts at support levels, willing to own shares

- Strategy: Sell $25-30 strikes depending on support levels

- Risk: Crypto crash takes HOOD down 30%+, forced to buy shares

- Reward: 5-8% monthly premium if stock stays above support

🛡️ Conservative LEAPs (Long-term Patient Capital)

Low-risk, time-diversified institutional following

Cloud Infrastructure Quality:

- AMZN shares or January 2027 LEAPS - AWS is multi-year growth story, downturns are buying opportunities

- Timeline: 12-24 month holding period

- Risk: AWS growth decelerates below 20% or margin compression

- Reward: 30-50% over 12-18 months if AWS maintains leadership

Safe-Haven Gold Allocation:

- GLD shares (5-10% portfolio) - Portfolio insurance against macro shocks, not trading vehicle

- Timeline: Hold indefinitely as portfolio hedge

- Risk: Opportunity cost if markets rally and gold lags

- Reward: Protection during market crashes, inflation protection

Defensive Value Plays:

- JEF shares below $60 - Investment banking recovery with M&A cycle revival (value + catalyst)

- Timeline: 12-18 months for M&A cycle recovery

- Risk: IPO/M&A markets stay frozen longer than expected

- Reward: 40-60% if capital markets normalize

Enterprise AI Infrastructure:

- HPE shares or 2026 LEAPS - Multi-year enterprise AI server adoption (patient capital thesis)

- Timeline: 18-24 months for AI infrastructure buildout

- Risk: Competition from Dell/Supermicro erodes market share

- Reward: 50-80% if enterprise AI spending accelerates

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

Safe-Haven Collapse (GLD, EWZ):

- Federal Reserve surprises with more aggressive rate hikes than expected (strengthens dollar, hurts gold)

- Geopolitical tensions ease rapidly, removing safe-haven bid

- Brazil economic data disappoints, central bank loses credibility

- Stronger dollar makes emerging markets toxic

Cloud/E-Commerce Growth Stalls (AMZN, NFLX, HOOD):

- AWS growth decelerates below 20% as hyperscaler competition intensifies (Google Cloud, Azure)

- Holiday retail spending disappoints due to consumer weakness

- Netflix ad-tier adoption slower than 10M subscriber target

- Crypto winter returns, destroying Robinhood trading volumes

- Live sports experiment (WWE, NFL) fails to drive subscriber growth

Regulatory & Competitive Threats (HIMS, RDDT, BABA):

- FDA restricts telehealth GLP-1 prescribing, killing Hims growth engine

- Reddit AI licensing deals don't renew or renew at lower rates

- China regulatory crackdown resumes, targeting Alibaba again

- Traditional healthcare (CVS, Walgreens) aggressively matches telehealth pricing

Operational & Industry Risks (CRCL, CSIQ, HPE, JEF):

- Semiconductor equipment cycle delays by 12-18 months, pushing CRCL recovery to 2027

- Solar tariffs imposed, crushing Canadian Solar margins and competitiveness

- Enterprise IT spending cuts hit HPE's AI server pipeline

- M&A market stays frozen despite rate cuts, killing Jefferies advisory fees

😰 If You're Selling Premium (Income Strategies)

Volatility Explosions:

- GLD iron condors explode if major geopolitical event (war, Fed shock) moves gold $20+ in days

- AMZN covered calls get blown through if AWS announces major customer wins

- HOOD cash-secured puts get assigned if crypto crashes 50%+

- Forced to own shares at precisely wrong time (buying the top)

Earnings Surprises:

- Companies you sold premium against beat/miss dramatically

- IV crush works against short premium after event

- Stock gaps 15%+ overnight, overwhelming your premium collected

💣 This Week's Catalysts & Key Dates

📊 This Week (November 12-19):

- Economic Data: CPI and PPI inflation reports (critical for GLD positioning and Fed expectations)

- Gold Watch: Federal Reserve speakers commenting on December meeting intentions

- Crypto Momentum: Bitcoin volatility driving HOOD trading volumes

- Holiday Prep: AMZN Prime early holiday deals data, NFLX content release schedule

🗓️ Late November-December (Critical Window):

- December 18: Federal Reserve Meeting - Interest rate decision directly impacts GLD $260M positioning

- Singles Day Data: BABA e-commerce results from China's biggest shopping event

- Holiday Sales: AMZN Black Friday/Cyber Monday results indicating consumer strength

- Q4 Earnings Prep: Companies entering quiet period ahead of January-February reporting

📈 January-February 2026 (Earnings Tsunami):

- AMZN Q4 Earnings (February): AWS growth, holiday retail results, 2026 capex guidance

- NFLX Q4 Earnings: Ad-tier subscriber metrics, live sports impact (WWE, NFL Christmas games)

- HOOD Q4 Earnings: Crypto trading volumes, options adoption, international expansion

- HIMS Q4 Earnings: GLP-1 revenue contribution, telehealth user growth

🧠 Ongoing Catalysts (Multi-Month Themes):

- Geopolitical Developments: Middle East tensions, US-China relations affecting GLD, BABA, EWZ

- Semiconductor Recovery: CRCL benefiting from fab construction timelines and equipment orders

- Solar Policy: CSIQ watching tariff decisions and IRA implementation

- Investment Banking Revival: JEF tracking IPO calendar and M&A deal announcements

- AI Infrastructure: HPE competing for enterprise AI server market share

🎯 The Bottom Line: Gold Fortress Leads $406.1M Multi-Theme Institutional Wave

This is one of the most concentrated yet diversified flow days we've tracked. $406.1 million dominated by GLD's unprecedented $260M safe-haven positioning (64% of total flow), while remaining $146M spread strategically across e-commerce giants (AMZN $54M), supply chain tech (CRCL $24M), fintech leaders (HOOD $21M), and 8 other tactical positions. The unified message: institutions hedging macro uncertainty with gold while simultaneously betting on secular growth themes - cloud infrastructure, telehealth, streaming monetization, and fintech expansion.

The biggest questions:

- What does $260M GLD positioning signal about macro risks institutions see?

- Can AMZN's $54M bet capture both AWS acceleration and holiday retail strength?

- Will HOOD's $21M fintech expansion bet pay off if crypto rally continues?

- Is BABA's $4M contrarian positioning early to China regulatory thaw story?

Your move: This diversified positioning across defensive (GLD), growth (AMZN, HOOD, HIMS), and contrarian (BABA) themes suggests institutions preparing for multiple scenarios simultaneously. The GLD concentration is particularly noteworthy - $260M represents conviction-level hedging, not casual portfolio insurance. Follow themes aligned with your risk tolerance, but recognize these sophisticated strategies may be part of much larger portfolios we can't see.

Critical insight: GLD's $260M (64% of flow) is 4.8x larger than AMZN's $54M (second-largest position). This isn't normal distribution - it's institutional capital screaming "HEDGE NOW" while still maintaining growth exposure. That asymmetry tells you everything about smart money's risk assessment.

🔗 Get Complete Analysis on Every Trade

🏆 Safe-Haven & Macro Hedges:

- GLD $260M Safe-Haven Fortress - Largest Gold ETF Bet of 2025

- EWZ $15.6M Brazil Macro Play - Emerging Markets Recovery

📦 E-Commerce & Cloud Infrastructure:

- AMZN $54M Cloud & E-Commerce Juggernaut - AWS Expansion Meets Holiday Surge

- CRCL $24M Supply Chain Automation - Semiconductor Equipment Recovery

💰 Fintech & Digital Services:

- HOOD $21M Retail Trading Revolution - Crypto + Options Expansion

- HIMS $8M Telehealth Expansion - GLP-1 Medications Growth

🎬 Content & Social Media Monetization:

- NFLX $6.2M Streaming Dominance - Ad-Tier Momentum + Live Sports

- RDDT $4.3M Social Media AI Licensing - Content Monetization Revolution

🌍 International & Contrarian Plays:

- BABA $4M China E-Commerce Contrarian - Regulatory Thaw Bet

- CSIQ $3.2M Solar Manufacturing - Global Demand + IRA Benefits

🏦 Financial Services & Enterprise Tech:

- JEF $3.2M Investment Banking Recovery - M&A Boom Positioning

- HPE $2.6M Enterprise AI Infrastructure - AI Server Market Share

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (November 15 Expiries)

- GLD - Near-term gold volatility plays expiring November 15

📆 Monthly (December Expiries)

- AMZN December expiries - Holiday sales data window (Black Friday/Cyber Monday)

- HOOD December expiries - Crypto momentum and Q4 trading volumes

- NFLX December expiries - Ad-tier subscriber data ahead of earnings

- GLD December expiries - Federal Reserve meeting December 18

🗓️ Quarterly (January-February 2026)

- AMZN Q4 earnings February 2026 - AWS growth and holiday retail results

- NFLX Q4 earnings January 2026 - Streaming ad-tier validation

- HOOD Q4 earnings - Retail trading engagement and crypto volumes

- HIMS Q4 earnings - Telehealth and GLP-1 medication revenue

- RDDT Q4 earnings - AI licensing and community growth

🚀 LEAPS (2026+ Expiries)

- AMZN January 2027 LEAPS - Multi-year AWS cloud infrastructure thesis

- GLD ongoing position - Long-term macro hedge and portfolio insurance

- CRCL 2026 LEAPS - Semiconductor equipment multi-year cycle recovery

- HOOD June 2026 - Fintech expansion and crypto market maturation

- HIMS 2026 LEAPS - Telehealth market penetration and GLP-1 adoption

- HPE 2026 LEAPS - Enterprise AI infrastructure buildout multi-year theme

- JEF 2026 LEAPS - M&A cycle recovery and IPO market revival

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Expect 100% loss | Target 500%+ gains

Primary High-Risk Plays:

- Macro volatility lottery: GLD options straddle - Bet on major geopolitical shock or Fed surprise (EXTREME volatility, binary outcome)

- China recovery gamble: BABA deep OTM calls - Stimulus surprise play (regulatory uncertainty = extreme risk)

- Crypto boom speculation: HOOD ATM calls - Bitcoin rally to $100K+ drives trading volumes (high beta play)

Why these work: Binary catalysts with asymmetric payoffs. GLD geopolitical shock = 5-10x, BABA stimulus announcement = 8x, HOOD crypto FOMO = 4x. But sizing is CRITICAL - never more than 2% per position because these can (and likely will) expire worthless.

Exit strategy: Take 100%+ gains immediately on any position. Don't hold for "maximum gains" - these are lottery tickets. Scale out at 50%, 100%, 200% if you get lucky. Most will expire worthless, the winners must pay for all the losers.

Warning: GLD's $260M is defensive positioning, not speculative. Trying to trade gold volatility against professional hedgers is dangerous. Only allocate 1% max even if bullish.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | 2-8 week holding period | Target 30-100% gains

Primary Swing Plays:

- Cloud infrastructure leadership: AMZN call spreads - Follow $54M whale through holiday season and Q4 earnings (January-February expiries)

- Streaming ad monetization: NFLX calendar spreads - Ad-tier growth momentum into subscriber data releases

- Telehealth expansion: HIMS bull call spreads - GLP-1 medication revenue acceleration

- Fintech crypto play: HOOD December calls - Ride crypto volatility through Q4

Why these work: Institutional backing ($54M AMZN, $21M HOOD, $8M HIMS, $6.2M NFLX) provides momentum and validation. Clear catalyst timelines (earnings, product launches, data releases) give defined exit points. Defined-risk spreads limit downside while capturing directional edge.

Risk management:

- Set stop loss at 30% of premium paid

- Take 50% profits at 50% gains, let rest run with trailing stop

- Close 2 weeks before earnings if IV crush risk outweighs directional conviction

- AMZN and NFLX are safer bets (mega-cap stability) vs HOOD/HIMS (higher volatility)

Timeline discipline:

- HOOD: Hold through crypto volatility surge (3-6 weeks)

- NFLX: Hold into Q4 subscriber data release (4-8 weeks)

- AMZN: Patient capital through holiday sales + Q4 earnings (8-12 weeks)

- HIMS: Watch GLP-1 revenue data and user growth metrics (6-10 weeks)

💰 Premium Collector (Income Focus)

Strategy: Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

Primary Income Plays:

- Gold volatility harvesting: GLD iron condors - Collect premium from elevated volatility if gold consolidates ($180-$200 range)

- E-commerce covered calls: AMZN covered calls - Own shares, sell December calls against (harvest holiday IV)

- Fintech cash-secured puts: HOOD short puts - Sell December puts at support, willing to own shares

- Streaming calendar income: NFLX calendar spreads - Sell near-term calls, buy longer-dated protection

Why these work: Institutional BUYING (GLD $260M, AMZN $54M) creates supply/demand imbalance = inflated option premiums. GLD elevated volatility from macro uncertainty = juicy iron condor premium. AMZN holiday season IV spike = rich covered call premiums. HOOD crypto volatility = expensive puts to sell.

Risk management:

- GLD iron condors: Only use if comfortable with $180-$200 range holding (geopolitical shock risk!)

- AMZN covered calls: Don't sell strikes below your cost basis, accept assignment if called away

- HOOD cash-secured puts: Reserve full cash to buy shares if assigned (crypto crash scenario)

- Close winners at 50-60% max profit - don't be greedy, collect and move to next trade

Income expectations:

- GLD iron condors: 8-12% monthly if gold stays range-bound (HIGH RISK if macro shock)

- AMZN covered calls: 2-3% monthly from holiday IV premium

- HOOD cash-secured puts: 5-8% monthly from crypto volatility premium

- NFLX calendars: 4-6% monthly from time decay differential

🛡️ Entry Level Investor (Learning Mode)

Start small | Focus on education | Build experience before scaling

Recommended Starting Points:

- Paper trade first: All strategies (spreads, straddles, iron condors) for 30 days minimum before risking real money

- Quality shares over options: AMZN shares for cloud infrastructure, GLD shares 5-10% for portfolio hedge

- ETF exposure first: QQQ for tech (avoiding single-stock risk), SPY for market exposure (learning market mechanics)

- Educational focus: Study how institutional positioning works using today's examples

Key learning opportunities from today's flow:

- GLD $260M: Learn how institutions use options for macro hedging (not speculation)

- AMZN $54M: Observe how call positioning works ahead of catalysts (holiday sales, Q4 earnings)

- HOOD $21M: Track how crypto volatility affects fintech stocks (correlation lesson)

- NFLX $6.2M: Watch IV crush after earnings even if direction correct (options Greeks education)

Why this approach works: Options amplify both gains AND losses 10x. Starting with shares or ETFs builds market intuition without catastrophic loss risk. Paper trading teaches you emotional discipline when positions move 30% against you (which WILL happen).

Critical rules for beginners:

- Never risk more than 1% of portfolio per trade until you have 100+ trades experience

- Don't trade earnings week until you've watched 20+ earnings cycles and understand IV crush

- Avoid YOLO plays entirely - GLD volatility bets, BABA China gambles are for experienced traders only

- If you don't understand Greeks (delta, theta, vega, gamma), STUDY before trading any options

Learning timeline:

- Months 1-3: Paper trade, read options education, track institutional flow

- Months 4-6: Start with 1% positions on high-probability trades (covered calls, cash-secured puts)

- Months 7-12: Graduate to spreads and multi-leg strategies if profitable and disciplined

- Year 2+: Consider swing trades and select YOLO plays (max 2% allocation)

Specific educational trades to watch:

- GLD options behavior: Watch how gold options react to Fed announcements and geopolitical news

- AMZN calendar spreads: Observe how time decay works when front-month expires before back-month

- HOOD volatility: See how crypto moves affect stock price and option premiums

- NFLX earnings: Study IV crush mechanics when company reports Q4 results

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

- Position sizing discipline:

- YOLO: 1-2% max per position

- Swing: 3-5% max per position

- Premium collector: 10-15% max allocated to sold premium

- Entry level: 1% max per position until 100+ trades

- Stop losses are mandatory:

- Options: 20-30% loss triggers immediate exit (no exceptions)

- Shares: 7-10% loss for volatile stocks, 10-15% for quality mega-caps

- Spreads: 50% of max loss threshold

- Profit-taking prevents regret:

- Take 50% off at 50% gain (lock in profits)

- Take another 25% at 100% gain (reduce risk)

- Let final 25% run with trailing stop (capture outliers)

- Time decay awareness:

- December expiries enter rapid decay after November 20 (30 days out)

- November 15 expiries losing 3-5% value per day NOW

- GLD options have elevated theta due to macro uncertainty volatility

- LEAPS (2026+) safer for beginners due to slower time decay

- Macro event risk:

- Federal Reserve December 18 meeting can move markets 2-3% instantly

- Geopolitical shocks can gap gold $20+ overnight (destroys iron condors)

- China economic data releases move BABA 10%+ regularly

- Crypto flash crashes happen (HOOD correlation risk)

Today's Specific Warnings:

Gold Macro Risk (GLD $260M):

- $260M is DEFENSIVE positioning (hedge), not bullish speculation

- Institutions preparing for macro shock retail may not see coming

- Geopolitical events are UNPREDICTABLE - Israel/Iran, Russia/Ukraine, US-China

- Federal Reserve policy mistakes can move gold $50+ in weeks

- This is portfolio insurance, not a trading vehicle

- Position sizing: 5-10% portfolio maximum even if very bullish

E-Commerce Competition (AMZN, HOOD, NFLX):

- AWS faces intensifying competition from Google Cloud and Azure

- Retail spending could disappoint if consumer weakens into holidays

- Robinhood crypto volumes 100% dependent on Bitcoin price action

- Netflix ad-tier adoption could slow if content pipeline disappoints

- Don't assume institutional positioning = guaranteed profits

China Regulatory Uncertainty (BABA):

- $4M is contrarian bet, not consensus institutional view

- China regulatory environment can change overnight without warning

- Economic stimulus promises don't always materialize into real action

- US-China tensions could escalate and destroy thesis

- This is speculation on political/regulatory change - extremely risky

Healthcare Regulatory Risk (HIMS):

- Telehealth GLP-1 prescribing faces potential FDA scrutiny

- Traditional pharmacy chains (CVS, Walgreens) lobbying against digital disruption

- Insurance reimbursement uncertainty for telehealth services

- $8M bet depends on regulatory environment staying favorable

- Regulatory change can kill business model overnight

Institutional vs. Retail Positioning:

Remember: Today's $406.1M represents sophisticated institutions with:

- Access to geopolitical intelligence retail doesn't have

- Ability to hedge across asset classes (gold + stocks + currencies + bonds)

- Risk management teams and quantitative models

- Multi-year time horizons and ability to withstand 30%+ drawdowns

We see:

- GLD $260M call positioning (looks bullish on gold)

They might have:

- Short S&P 500 futures (hedging equity exposure)

- Long dollar positions (offsetting gold correlation)

- Short emerging market bonds (macro hedging portfolio)

- Other positions offsetting downside we can't see

Critical insight: Institutions aren't making simple "gold goes up" bets. They're managing complex portfolios with hundreds of positions across multiple asset classes. Don't blindly copy visible option flow without understanding the full portfolio context.

When to Override Unusual Activity:

Ignore the signal if:

- You don't understand the underlying business (gold macro dynamics, AWS cloud economics, telehealth regulation)

- Position size would exceed your risk limits (1-2% YOLO, 3-5% swing, 1% beginner)

- Time horizon doesn't match your style (2026 LEAPS inappropriate for YOLO traders)

- Catalyst is too binary/unpredictable (China regulatory change, geopolitical shocks, FDA policy shifts)

- You're emotionally attached to the trade (never marry a position, ego kills accounts)

Trust your discipline over FOMO. Missing a trade is better than blowing up your account.

📚 Educational Spotlight: Understanding Today's Positioning

Defensive Hedging (GLD $260M)

What it is:

- Institutions buying call options on gold ETF

- Portfolio insurance against macro shocks (geopolitical, Fed policy errors, inflation surge)

- Not speculating gold goes to $2,500/oz - hedging catastrophic scenarios

GLD example:

- $260M call positioning across multiple strikes and expirations

- If market crashes 20%, gold typically rallies 15-30% (negative correlation)

- Portfolio of $4 billion with $260M gold hedge = 6.5% insurance allocation

Why institutions do this:

- Protect against scenarios that destroy equity portfolios

- Gold rallies when stocks crash (2008, 2020 examples)

- Cheaper than selling equity positions (tax efficiency, avoids market timing)

Retail application:

- Allocate 5-10% portfolio to GLD shares as permanent hedge

- Don't try to trade gold volatility (professionals have information edge)

- Think of gold as portfolio insurance, not speculation vehicle

- Accept gold may underperform during bull markets (cost of insurance)

Cloud Infrastructure Positioning (AMZN $54M)

What it is:

- Buying call options on Amazon's dual growth engine (AWS cloud + e-commerce retail)

- Positioning for holiday sales strength + cloud infrastructure expansion

- Betting on secular trends (cloud adoption, e-commerce penetration) with near-term catalysts

AMZN example:

- $54M bullish call positioning into Q4 earnings February 2026

- AWS growing 30%+ annually = $100B+ revenue run rate business

- E-commerce capturing holiday spending + Prime membership growth

- Dual thesis: cloud infrastructure + consumer spending

Why institutions use this:

- High-conviction secular growth themes (cloud, e-commerce multi-year trends)

- Near-term catalysts (holiday sales, earnings) provide entry/exit points

- Mega-cap stability reduces single-stock risk vs small-caps

Retail application:

- Use shares or LEAPS instead of short-dated options (avoid time decay)

- AMZN is "set and forget" cloud infrastructure play for long-term

- Near-term options appropriate only for swing traders with experience

- Entry level: Buy shares on any 10%+ pullback, hold 3-5 years

Fintech Expansion (HOOD $21M)

What it is:

- Betting on Robinhood's crypto trading expansion + options adoption + international growth

- High beta to Bitcoin price action (crypto volatility = trading volume surge)

- Leveraged bet on retail trading renaissance continuing

HOOD example:

- $21M call positioning benefiting from crypto momentum

- Bitcoin above $90K = retail FOMO = trading volume explosion

- Options trading + international expansion = revenue diversification beyond crypto

Why institutions do this:

- Leverage to crypto bull market without direct Bitcoin exposure (easier regulatory approval)

- Diversified revenue streams reduce single-dependency risk

- Retail trading engagement = high-margin business model

Retail considerations:

- HOOD is NOT "buy Bitcoin" - it's bet on retail trading engagement

- Crypto winter (Bitcoin crashes 50%) destroys HOOD trading volumes

- High volatility stock - only swing traders should use options

- Entry level: Paper trade HOOD to learn correlation with Bitcoin

Entry level advice:

- Don't confuse HOOD with Bitcoin investment (different risk profiles)

- If bullish crypto, buy Bitcoin directly or IBIT ETF

- HOOD is trading platform bet, not crypto exposure vehicle

- Learn correlation analysis before trading (Bitcoin down 10% = HOOD down 15%+)

Contrarian China Recovery (BABA $4M)

What it is:

- Betting on Chinese regulatory environment thawing after years of crackdown

- Value play on beaten-down mega-cap trading at 10x earnings

- Binary bet on political/regulatory change

BABA example:

- $4M positioning on Alibaba recovery (smallest position today = highest risk)

- China stimulus announcements + regulatory easing = potential 50%+ upside

- BUT: Regulatory crackdown resuming = another 30% downside

Why institutions take contrarian bets:

- Asymmetric risk/reward when consensus overly negative

- Small position size relative to portfolio (can afford total loss)

- Access to geopolitical intelligence about China policy direction

Retail warning:

- This is NOT "follow the smart money" - $4M is tiny allocation

- Political risk is UNHEDGEABLE (Xi Jinping can change policy tomorrow)

- Retail has zero information edge on China regulatory environment

- Entry level investors: AVOID China contrarian bets entirely

Advanced traders only:

- Max 1-2% allocation even if very bullish

- Use defined-risk spreads (not naked calls)

- Accept total loss as likely outcome

- Exit immediately if regulatory headlines turn negative

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. GLD's $260M defensive positioning particularly suggests institutions preparing for macro risks retail may not fully appreciate. BABA's $4M contrarian bet involves extreme political/regulatory risk. Always practice proper risk management and never risk more than you can afford to lose completely. Entry level investors should paper trade extensively and focus on quality shares before attempting options strategies. Options can expire worthless, resulting in 100% loss of premium paid.

© 2025 Ainvest.com | Original content from Ainvest.com and labs.ainvest.com

Commercial redistribution prohibited without written permission. This research represents proprietary analysis of institutional options flow and is intended for paid subscribers of Ainvest Option Flow Digest only. Unauthorized copying, republication, or commercial use violates copyright and will be prosecuted. For licensing inquiries, contact Ainvest.com.

📊 Total Flow Summary:

- Total Tracked: $406,100,000

- Largest Position: GLD $260M (64% of total flow - unprecedented safe-haven concentration)

- Sector Leaders: Safe-Haven/Gold $260M (64%), E-Commerce/Cloud $78M (19%), Fintech/Health $29M (7%)

- Tickers Analyzed: 12 companies across precious metals, e-commerce, cloud, fintech, telehealth, streaming, social media, emerging markets, solar, investment banking, enterprise tech

- Expiry Range: November 2025 through January 2027 LEAPs

- Key Insight: GLD's 64% concentration is 4.8x larger than second-place AMZN - institutions screaming "HEDGE NOW" while maintaining growth exposure