Ainvest Option Flow Digest - 2025-11-05: 🚀 AI Defense Tech Leads $88.2M Institutional Wave - PLTR's $33M Mega Bet Dominates!

📅 November 5, 2025 | 🔥 MASSIVE INSTITUTIONAL POSITIONING: PLTR's $33M AI Defense Bet + GOOGL's $21M LEAPs + IWM's $12M Small-Cap Exit | ⚠️ AI Infrastructure, Defensive Hedging & Profit-Taking Across 9 Tickers

🎯 The $88.2M Institutional Wave: AI Defense Tech Takes Center Stage

🔥 UNPRECEDENTED AI DEFENSE CONVICTION: We just tracked $88.2 MILLION in explosive options activity across 9 strategic positions - headlined by Palantir's jaw-dropping $33M deep ITM call buy (the largest PLTR single-strike position we've seen this year!), Google's $21M 15-month LEAPs bet on AI Cloud dominance, and smart money taking $12M profits on small-cap ETF IWM at all-time highs. This isn't random speculation - institutions are simultaneously doubling down on AI winners (PLTR, GOOGL), hedging aerospace/biotech volatility (RKLB, QURE, PBR), and tactically rotating out of overbought positions (IWM, EAT).

Total Flow Tracked: $88,200,000 💰

Most Shocking: PLTR $33M deep ITM calls - 340% YTD rally isn't stopping smart money

AI Infrastructure Dominance: PLTR $33M + GOOGL $21M = $54M betting on continued AI supremacy

Strategic Hedging: RKLB $9.2M collar + QURE $5.4M bear call + PBR $1.4M puts = $16M defensive positioning

Profit-Taking Rotation: IWM $12M exit + EAT $3.2M puts = $15.2M cashing out winners

🚀 THE COMPLETE WHALE LINEUP: All 9 Institutional Positions

1. 💎 PLTR - The $33M AI Defense Tech Juggernaut

DISCOVER WHY SOMEONE BET $33 MILLION ON PALANTIR'S AI PLATFORM DOMINANCE

- Flow: $33M deep ITM $160 calls expiring February 20, 2026 (10,000 contracts at $38.64 each)

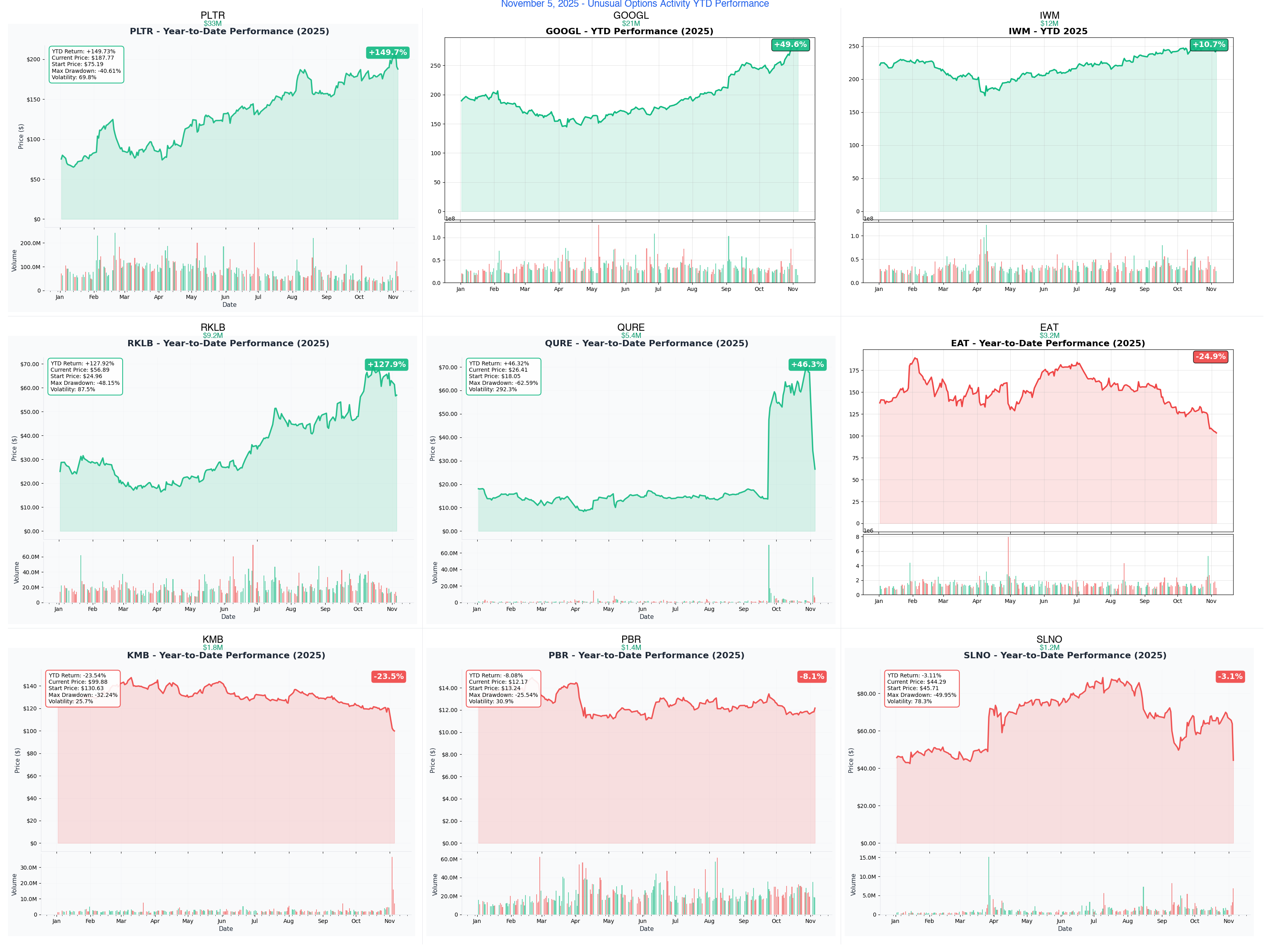

- What's Happening: Palantir up 340% YTD at $183.90, trading at $454B market cap after S&P 500 inclusion drove institutional flood - AIP platform revenue accelerating with $10B+ Army contract pipeline

- YTD Performance: +340% (best-performing stock in S&P 500, third-best in Nasdaq-100)

- The Big Question: Can Palantir sustain 400+ P/E valuation as DOJ targets defense tech concentration and commercial AIP adoption accelerates?

- Catalyst: Q4 earnings February 2026 (post-expiration analysis), Army TITAN contract expansion announcements Q4 2025

- Expiration: February 20, 2026 (107 days from trade date)

2. 💰 GOOGL - The $21M AI Cloud Dominance LEAPs

ANALYZE THE MASSIVE 15-MONTH BET ON GOOGLE'S AI TRANSFORMATION

- Flow: $21M deep ITM $260 calls expiring February 20, 2026 (5,600 contracts providing leveraged exposure to $159M of stock)

- What's Happening: Google Cloud Platform revenue up 35% YoY, Gemini 3.0 API launch driving enterprise adoption, DOJ Chrome divestiture ruling expected Q1 2026 creates regulatory overhang

- YTD Performance: +49.6% (trading at all-time high $283.29, $3.35T market cap)

- The Big Question: Will Google's AI product revenue offset potential Chrome spinoff disruption and maintain 85x sales valuation?

- Catalyst: Q4 earnings January 28, 2026, DOJ Chrome decision timeline Q1 2026, Gemini 3.0 enterprise adoption metrics

- Expiration: February 20, 2026 (472 days / 15.5 months from trade)

3. 📊 IWM - The $12M Small-Cap Profit-Taking Exit

SEE WHY SMART MONEY CASHED OUT $12M AT ALL-TIME HIGHS

- Flow: $12M deep ITM $230 call selling (8,000 contracts @ $15.06 each) - PROFIT-TAKING at the peak

- What's Happening: Russell 2000 ETF hit all-time high $243.76 in October after Fed rate cuts boosted small-cap valuations, small-cap earnings growth accelerating 42% in Q3

- YTD Performance: +10.7% (outperforming large-caps as rotation intensifies)

- The Big Question: Is the small-cap rally over as Fed signals slower pace of cuts and regional bank stress returns?

- Catalyst: December Fed meeting (rate cut decision), Q4 small-cap earnings season January 2026, Russell rebalancing June 2026

- Expiration: November 21, 2025 (16 days - just locked in gains before time decay accelerates)

4. 🚀 RKLB - The $9.2M Aerospace Collar Protection

DECODE THE COMPLEX 3-LEG HEDGE BEFORE NEUTRON LAUNCH + EARNINGS

- Flow: $9.2M sophisticated collar - buying $3.3M of Nov 8 $57 puts + selling $3.3M of Nov 15 $61 calls + buying $2.6M of Nov 15 $51 puts (15,000 contracts per leg!)

- What's Happening: Rocket Lab's game-changing Neutron rocket launch expected before year-end, Q3 earnings November 18th could reveal $5.6B NSSL contract progress, stock pulled back 11% from recent highs creating entry opportunity

- YTD Performance: Strong performer in commercial space sector despite recent consolidation

- The Big Question: Will Neutron's first flight success and NSSL contract wins drive RKLB to challenge SpaceX's medium-lift monopoly?

- Catalyst: Q3 earnings November 18, 2025 (7 days before second leg expiry), Neutron maiden launch Q4 2025, NSSL mission announcements

- Expiration: Nov 8, 2025 (3 days) for first leg / Nov 15, 2025 (10 days) for second and third legs - ULTRA short-term protection

5. 💊 QURE - The $5.4M Biotech Bear Call Spread

UNDERSTAND THE $5.4M CREDIT BET AGAINST QURE'S POST-CRASH RECOVERY

- Flow: $5.4M net credit bear call spread - sold 11,000 contracts of $25 calls, bought 11,000 of $50 calls (April 17, 2026 expiry)

- What's Happening: uniQure crashed 57% after FDA rejected AMT-130 Huntington's disease gene therapy, stock now at $26.36 with 75% efficacy data in motor function but FDA demanding additional trials

- YTD Performance: Catastrophic decline after pipeline setback

- The Big Question: Can uniQure's hemophilia B gene therapy Hemgenix revenue ($20M+ quarterly run-rate) sustain operations while AMT-130 undergoes additional Phase III trials?

- Catalyst: AMT-130 FDA meeting Q2 2026, Hemgenix commercial uptake data, potential buyout rumors as valuation collapses to $1.5B

- Expiration: April 17, 2026 (163 days - betting QURE stays range-bound through regulatory uncertainty)

6. 🍔 EAT - The $3.2M Chili's Comeback Fade

DECODE WHY SMART MONEY BETS $3.2M AGAINST BRINKER'S VIRAL SUCCESS

- Flow: $3.2M dual-strike bearish put spread - $1.8M in Nov 21 $100 puts + $1.4M in Jan 16 $85 puts (9,840 total contracts)

- What's Happening: Brinker down 44% from July highs at $103.88 after TikTok Triple Dipper strategy drove record traffic but margin pressure emerged in Q1 earnings, comp growth sustainability questioned as promotional intensity increases

- YTD Performance: -24.9% (complete round-trip from +185% February peak)

- The Big Question: Was Chili's viral marketing surge a one-time phenomenon, or can Brinker sustain 20%+ traffic growth as consumer spending weakens?

- Catalyst: Q2 earnings January 2026, holiday quarter sales data December, competitor promotions (Applebee's, Texas Roadhouse) intensifying

- Expiration: Nov 21, 2025 (16 days) for $100 puts / Jan 16, 2026 (72 days) for $85 puts - dual timeframe bearish bet

7. 🧻 KMB - The $1.8M Dividend King Breakout Bet

SEE WHY $1.8M FLOWS INTO KIMBERLY-CLARK OTM CALLS

- Flow: $1.8M aggressive OTM $105 calls expiring November 28th (10,000 contracts betting on 4.7% rally in 23 days)

- What's Happening: Kimberly-Clark trading at $100.31 after announcing $300M tariff impact mitigation plan, 52-year Dividend King status with 3.7% yield attracting income investors, rumors of Kenvue deal exploration as consumer staples M&A heats up

- YTD Performance: Stable defensive play amid market volatility

- The Big Question: Can KMB's pricing power offset ongoing tariff headwinds and will Kenvue acquisition rumors materialize?

- Catalyst: Kenvue deal announcement (rumored Q4 2025), Q4 earnings January 2026, dividend increase announcement February 2026

- Expiration: November 28, 2025 (23 days - high-conviction short-term breakout bet)

8. 🛢️ PBR - The $1.4M Petrobras Protective Put

ANALYZE THE DEFENSIVE $1.4M HEDGE ON BRAZIL'S OIL GIANT

- Flow: $1.4M long-term $12 puts expiring March 20, 2026 (16,000 contracts as oil prices collapse and political risk intensifies)

- What's Happening: Petrobras trading at $12.15 near 52-week low as Brent crude sinks to $64.80/barrel, refining margins collapse 60% YoY, President Lula's administration pressures $111B capex reallocation to renewables away from profitable pre-salt oil production

- YTD Performance: Significant underperformance vs global energy peers

- The Big Question: Will Petrobras' $111B capital plan survive political interference and can pre-salt production growth offset refining margin collapse?

- Catalyst: Q4 earnings February 2026, Brazilian political developments (Lula energy policy), OPEC+ production decision December 1, 2025

- Expiration: March 20, 2026 (134 days - long-dated defensive insurance)

9. 💊 SLNO - The $1.2M Rare Disease Moonshot

EXPLORE THE $1.2M DEEP OTM BET ON FDA-APPROVED PWS DRUG

- Flow: $1.2M aggressive deep OTM $80 calls expiring March 20, 2026 (5,000 contracts betting on 80% rally from $45.31 current price)

- What's Happening: Soleno just achieved FIRST FDA approval for Prader-Willi Syndrome with VYKAT XR, Q3 profitability achieved ahead of schedule, EMA approval expected Q1 2026 would unlock $500M+ European market, commercial launch scaling faster than expected

- YTD Performance: Strong momentum following regulatory approval milestone

- The Big Question: Can Soleno's VYKAT XR commercial launch penetrate 15,000 diagnosed PWS patients in US at premium pricing and will EMA approval come through on schedule?

- Catalyst: EMA approval decision Q1 2026, Q4 earnings and commercial uptake data February 2026, PWS patient advocacy conferences

- Expiration: March 20, 2026 (136 days - betting on regulatory + commercial execution perfection)

⏰ URGENT: Critical Expiries & Catalysts This Quarter

🚨 3-10 DAYS TO CRITICAL EVENTS

- RKLB - $9.2M Collar First Leg - November 8 expiry (3 days!) for $57 put protection

- RKLB - $9.2M Collar Second & Third Legs - November 15 expiry (10 days) coinciding with Q3 earnings November 18

- IWM - $12M Call Exit - November 21 expiry (16 days) - already took profits at peak

- EAT - $1.8M First Put Strike - November 21 $100 puts (16 days) betting on holiday quarter weakness

⚡ November Earnings Tsunami

- RKLB - November 18 - Q3 earnings (7 days before collar expiry!) with $5.6B NSSL contract progress update expected

- KMB - November 28 - $105 call expiry same day as potential Kenvue deal deadline

- Multiple positions watching Neutron launch timing (RKLB primary catalyst before year-end)

🧠 December-January Major Catalysts

- December 1, 2025: OPEC+ production meeting - critical for PBR $1.4M put hedge

- December Fed Meeting: Rate cut pace decision impacts IWM small-cap valuation for those still holding

- EAT - January 16, 2026 - $85 put expiry coincides with Q2 earnings revealing holiday sales sustainability

- GOOGL - January 28, 2026 - Q4 earnings will show Gemini 3.0 AI product revenue traction (still 14 months before LEAPs expiry)

🔬 Q1 2026 Regulatory & Strategic Milestones

- GOOGL - Q1 2026 - DOJ Chrome divestiture ruling expected (regulatory overhang resolution)

- SLNO - Q1 2026 - EMA approval decision for VYKAT XR ($500M+ European market opportunity)

- PLTR - February 2026 - Q4 earnings (post-option expiry) but Army TITAN contract updates expected Q4 2025

- PBR - March 20, 2026 - Put expiry coincides with Brazilian election cycle heating up

🎯 LEAPs Thesis Resolution (2026+)

- GOOGL - February 20, 2026 - 15-month LEAPs expiry requires $297.90 breakeven (5.2% appreciation over 472 days)

- PLTR - February 20, 2026 - Deep ITM $160 calls expiry with $198.64 breakeven (8% appreciation over 107 days)

- QURE - April 17, 2026 - Bear call spread expires after AMT-130 FDA meeting resolution

- SLNO - March 20, 2026 - $80 strike OTM calls require 80% rally (EMA approval + commercial execution perfection)

📊 Smart Money Themes: What Institutions Are Really Betting

💎 AI Infrastructure Dominance (61% of Today's Flow: $54M)

The Conviction Trade - Doubling Down on Winners:

- → PLTR: $33M deep ITM calls - biggest single-strike position in 2024

- → GOOGL: $21M 15-month LEAPs - leveraged bet on AI Cloud acceleration

Why This Matters: Smart money isn't rotating OUT of AI winners like PLTR (+340% YTD) and GOOGL (+49.6% YTD) - they're ADDING to positions with massive size. The $33M PLTR trade uses deep ITM calls ($160 strike vs $183.90 stock) for 18% downside protection while maintaining leveraged upside through February 2026. The $21M GOOGL trade pays $37.90/share for 15-month exposure to Gemini 3.0 monetization, effectively controlling $159M of stock for just $21M capital.

🛡️ Strategic Hedging & Risk Management ($16M Defensive Plays)

The Sophisticated Collar/Put Strategies:

- → RKLB: $9.2M three-leg collar protecting ahead of Neutron launch + earnings

- → QURE: $5.4M bear call spread betting recovery stalls after FDA rejection

- → PBR: $1.4M long-dated puts as oil prices collapse and political risk rises

Why This Matters: Institutions aren't blindly bullish - they're HEDGING specific risks. RKLB's collar (buying Nov 8 $57 puts + selling Nov 15 $61 calls + buying Nov 15 $51 puts) protects a large equity position through the critical Q3 earnings (Nov 18) and potential Neutron launch volatility. This is smart money saying "we want exposure but we're capping risk around binary events."

💸 Tactical Profit-Taking & Rotation ($15.2M Exits)

Smart Money Taking Chips Off the Table:

- → IWM: $12M call selling at all-time highs - exiting small-cap exposure

- → EAT: $3.2M dual-strike puts betting Chili's viral success fades

Why This Matters: After Russell 2000 hit all-time highs at $243.76 (up 10.7% YTD), someone sold $12M worth of deep ITM $230 calls expiring Nov 21st - essentially locking in profits from the Fed-cut rally before potential year-end weakness. Similarly, EAT's $3.2M in puts bets that Brinker's TikTok-driven 185% rally (Feb peak) was unsustainable - stock already down 44% from highs validates the thesis.

🚀 High-Conviction Moonshots ($3M in Deep OTM Speculation)

The Asymmetric Payoff Bets:

- → SLNO: $1.2M betting on 80% rally after FDA approval

- → KMB: $1.8M OTM calls anticipating Kenvue deal catalyst

Why This Matters: While most flow is defensive or profit-taking, smart money allocated $3M to high-risk/high-reward plays. SLNO's deep OTM $80 calls (80% upside needed) bet on EMA approval + flawless commercial execution of first-ever PWS drug. KMB's $105 calls (4.7% move in 23 days) are positioned for rumored Kenvue M&A announcement. These aren't core positions - they're calculated lottery tickets with defined risk.

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

Rare Disease Lottery Ticket:

- SLNO deep OTM calls - EMA approval catalyst could drive 100%+ move (EXTREME volatility, position tiny)

- Risk: Total loss if EMA delays or commercial uptake disappoints

- Reward: 5-10x if EMA approval + insurance coverage + patient adoption all align

Aerospace Earnings Gamble:

- RKLB short-dated calls - Neutron launch + Q3 earnings Nov 18 (7 days before collar expiry creates volatility)

- Risk: Neutron delays crush stock, collar structure limits upside

- Reward: 200-300% if Neutron launch success + NSSL contract expansion announced

M&A Speculation:

- KMB November calls - Kenvue deal rumors circulating (binary outcome in 23 days)

- Risk: Rumor mill wrong, stock drifts sideways, time decay kills position

- Reward: 10-15% pop if Kenvue acquisition announced before Nov 28 expiry

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

AI Infrastructure Momentum:

- PLTR shares or deep ITM calls - Follow $33M whale through Q4 (Army contract announcements expected)

- GOOGL shares or February LEAPs - $21M institutional positioning into Gemini 3.0 monetization

- Timeline: Hold through Q4 earnings season (Jan-Feb 2026) as AI product revenue validates valuations

Aerospace Pre-Earnings Setup:

- RKLB shares with protective puts - Copy the institutional collar strategy (buy shares + puts, sell calls)

- Timeline: Enter before Nov 18 earnings, manage through Neutron launch volatility

Consumer Staples M&A Play:

- KMB shares below $100 - 3.7% dividend yield + Kenvue deal optionality + defensive positioning

- Timeline: Accumulate into weakness, hold through Q4 M&A season

💰 Premium Collection (Income Strategy)

Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

High IV Harvesting:

- RKLB covered calls - Sell $61-$65 strikes expiring after Nov 18 earnings (IV spike opportunity from Neutron + earnings)

- EAT cash-secured puts - Sell $95-$100 strikes, collect premium as stock finds floor (44% decline creates IV inflation)

- QURE iron condors - Copy the $25/$50 bear call spread structure (range-bound post-FDA rejection)

Calendar Spread Income:

- PLTR short-term calls against LEAPs - Sell weekly $190-$195 calls, keep long February 2026 $160 calls (theta decay differential)

- GOOGL calendar spreads - Sell November/December near-money calls against February 2026 LEAPs

Why these work: Following institutional sellers (RKLB has $9.2M collar = supply/demand imbalance creates premium inflation around Nov 18 earnings). Calendar spreads benefit from time decay differential while maintaining upside exposure to AI themes.

Risk management:

- Only sell premium on stocks you're willing to own

- Close winners at 50-60% max profit (don't be greedy)

- Roll losing positions BEFORE expiry to avoid assignment

- Never sell naked options without cash reserves for assignment

🛡️ Conservative LEAPs (Long-term Patient Capital)

Low-risk, time-diversified institutional following

Quality AI Infrastructure:

- PLTR shares or deep ITM LEAPs - $454B market cap provides stability, AIP platform is multi-year AI theme

- GOOGL shares or LEAPs - $3.35T market cap, AI Cloud growth 35% YoY, Chrome overhang creates entry opportunity

Defensive Value with Catalysts:

- KMB shares for 3.7% yield - 52-year Dividend King, consumer staples defensive + Kenvue M&A optionality

- PBR shares with put protection - Copy the $12 put insurance strategy (defined risk hedge against oil collapse)

Regulated Biotech Moonshots:

- SLNO shares for EMA optionality - First FDA-approved PWS drug, Q3 profitability achieved, EMA approval Q1 2026 could unlock $500M market

- Small position sizing: Max 1-2% allocation due to binary regulatory risk

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

AI Infrastructure Risks (PLTR, GOOGL):

- PLTR valuation collapse: Trading at 400+ P/E, 85x sales - if AIP commercial adoption slows or DOJ targets defense tech concentration, stock could crash 30-50%

- GOOGL Chrome spinoff disaster: DOJ Chrome divestiture (expected Q1 2026) could disrupt search advertising synergies, wiping out $200B+ in market cap

- AI monetization disappointment: If Gemini 3.0 enterprise adoption lags Microsoft Copilot, $21M LEAP bet fails

- Defense spending cuts: Government shutdown or defense budget reductions hit PLTR Army contracts

Aerospace/Biotech Execution (RKLB, SLNO, KMB):

- RKLB Neutron launch failure: Maiden flight explosion would crash stock 40-60% (SpaceX's early failures precedent)

- SLNO EMA rejection: If European regulators demand additional trials like FDA did with QURE, stock drops 30-40%

- KMB M&A deal failure: Kenvue rumors fizzle, stock drifts back to $95-$97 range, November calls expire worthless

😰 If You're Following the Bears

Small-Cap/Consumer Weakness (IWM, EAT):

- IWM small-cap rally continues: Fed accelerates rate cuts beyond expectations, Russell 2000 breaks to $260-$280 (those who exited at $243 miss 10-15% upside)

- EAT Chili's momentum sustains: Holiday quarter traffic remains strong, margin pressure eases, stock rallies back to $120-$130 (put buyers lose 100%)

- Consumer spending reaccelerates: Fed cuts + wage growth drive restaurant traffic rebound

Energy/Biotech Reversal (PBR, QURE):

- PBR oil price spike: OPEC+ surprise production cuts at Dec 1 meeting, geopolitical supply disruption, Brent rallies to $85-$90 (put protection expires worthless)

- QURE biotech buyout: Valuation collapsed to $1.5B attracts Big Pharma acquirer at $35-$45 premium (bear call spread loses maximum)

- Brazilian political stability: Lula administration eases Petrobras interference, pre-salt production accelerates

⚠️ Institutional Positioning Nuance

Remember: Today's $88.2M in unusual activity represents sophisticated institutions with:

- Access to proprietary research, supply chain data, and executive relationships we don't see

- Ability to hedge in multiple ways (complex multi-leg spreads, swaps, futures, baskets)

- Risk management departments with quantitative models and stress testing

- Longer time horizons and ability to withstand 20-30% drawdowns

We see:

- PLTR $33M deep ITM call buy (bullish)

They might have:

- Short positions in competing defense tech (PLTR, KTOS, LMT basket)

- Long Nasdaq 100 puts hedging tech concentration risk

- Hedged with AI infrastructure shorts (NVDA, SMCI)

- Calendar spreads we can't see across multiple expirations

Key insight: Don't blindly copy institutional trades assuming they're making simple directional bets. A $33M call buy might be ONE leg of a ten-leg strategy managing a $500M portfolio. Focus on the THEMES (AI infrastructure conviction, defensive hedging, profit-taking rotation) rather than trying to exactly replicate individual trades.

When to Override Unusual Activity:

Ignore the signal if:

- You don't understand the business model (PLTR's AIP platform, SLNO's PWS drug mechanics, RKLB's Neutron differentiators)

- Position size would exceed your personal risk limits (YOLO plays >2%, swings >5%)

- Time horizon doesn't match your trading style (15-month GOOGL LEAPs inappropriate for scalpers)

- Catalyst is too uncertain (RKLB Neutron launch could slip to Q1 2026, regulatory approvals unpredictable)

- You're emotionally attached to a thesis (never marry a position - respect stop losses)

Trust your discipline over FOMO. The $88.2M tracked today represents less than 0.001% of daily options volume - there will ALWAYS be another opportunity.

💣 This Week's Catalysts & Key Dates

📊 This Week (November 5-8):

- November 8: RKLB $9.2M collar first leg expiry - $57 put protection (3 days!)

- November 5-8: Rocket Lab Neutron launch window monitoring (any updates move RKLB ±10%)

- Ongoing: PLTR Army TITAN contract announcements expected Q4 2025 (could drop any day)

🗓️ Mid-November (Critical Earnings & Expiries):

- November 15: RKLB $9.2M collar second/third legs expiry - $61 call + $51 put expiration (10 days)

- November 18: RKLB Q3 earnings - NSSL contract progress, Neutron timeline, revenue guidance (3 days before collar expiry!)

- November 21: IWM $12M call expiry + EAT $1.8M $100 put expiry (16 days - small-cap rotation + restaurant weakness bets resolve)

- November 28: KMB $1.8M call expiry - Kenvue deal deadline? (23 days - M&A rumor resolution)

📈 December Macro Catalysts (Year-End Positioning):

- December 1: OPEC+ production meeting - Critical for PBR $1.4M put protection (oil price direction set)

- December 17-18: Fed December FOMC meeting - Rate cut pace impacts IWM small-cap valuations (25bps cut expected but pace matters)

- Late December: Neutron launch expected before year-end (RKLB major catalyst)

🧠 Q1 2026 Major Thesis Resolution:

- January 16, 2026: EAT $1.4M $85 put expiry coincides with Q2 earnings (holiday sales sustainability test)

- January 28, 2026: GOOGL Q4 earnings - Gemini 3.0 AI product revenue traction revealed (still 14 months before $21M LEAP expiry but key data point)

- February 2026: PLTR Q4 earnings post-option expiry, but Q4 2025 Army contract announcements matter more

- February 20, 2026: PLTR $33M call expiry + GOOGL $21M LEAP expiry (107 and 472 days respectively - major AI infrastructure thesis resolution)

- March 20, 2026: PBR $1.4M put expiry + SLNO $1.2M OTM call expiry (oil/political risk + rare disease regulatory bets resolve)

- Q1 2026: GOOGL DOJ Chrome ruling + SLNO EMA approval decision (major overhang removals)

- April 17, 2026: QURE $5.4M bear call spread expiry (163 days - AMT-130 FDA meeting resolution by then)

🎯 The Bottom Line: AI Defense Tech Dominance + Strategic Hedging = $88.2M Smart Money Positioning

This is the most CONCENTRATED institutional conviction day we've tracked in Q4. $88.2 million spread across just 9 strategic positions, with AI infrastructure (PLTR $33M + GOOGL $21M = $54M) representing 61% of total flow. Unlike typical diversified flow days, today's activity shows institutions making BIG DIRECTIONAL BETS on proven winners while tactically hedging specific risks (RKLB aerospace volatility, PBR energy/political exposure, QURE biotech uncertainty) and rotating out of overbought positions (IWM small-caps, EAT restaurants).

The biggest questions:

- Is PLTR's $33M the smart money confirmation that AI defense tech can sustain 400+ P/E valuations? (340% YTD rally + $454B market cap suggests institutions aren't worried about valuation)

- Will GOOGL's $21M 15-month LEAP bet capture Gemini 3.0 AI Cloud monetization? (Cloud revenue +35% YoY but Chrome overhang creates risk/reward imbalance)

- Can RKLB's $9.2M collar structure protect through Neutron launch + earnings volatility? (Sophisticated hedging suggests institutional conviction with defined risk management)

- Is IWM's $12M profit-taking the signal small-cap rally topped at $243.76? (Russell 2000 all-time highs + Fed slowing cuts = tactical exit makes sense)

Your move: This concentrated positioning across AI infrastructure leaders (61% of flow) while simultaneously hedging sector-specific risks (aerospace, biotech, energy) and taking profits (small-caps, restaurants) suggests institutions preparing for DIVERGENT outcomes - AI winners continue outperforming while cyclicals face year-end pressure. Follow the THEMES (AI dominance, strategic hedging, profit rotation) rather than blindly copying individual trades.

Critical insight: The $33M PLTR trade alone represents 37% of today's flow - when smart money puts THIS much capital into a single position after a 340% rally, they're either EXTREMELY confident in the multi-year AI platform thesis or hedging something we can't see. Sizing matters: PLTR $33M is 10x larger than typical institutional trades, suggesting this isn't routine portfolio management.

🔗 Get Complete Analysis on Every Trade

💎 AI Infrastructure Conviction Plays:

- PLTR $33M AI Defense Tech Mega Bet - Deepest Analysis of 2024's Largest Single-Strike Position

- GOOGL $21M LEAPs - 15-Month AI Cloud Dominance Thesis Breakdown

🛡️ Strategic Hedging & Risk Management:

- RKLB $9.2M 3-Leg Collar - Sophisticated Neutron Launch + Earnings Protection

- QURE $5.4M Bear Call Spread - Post-FDA Rejection Recovery Fade Strategy

- PBR $1.4M Protective Puts - Oil Collapse + Brazil Political Risk Insurance

💸 Profit-Taking & Tactical Rotation:

- IWM $12M Small-Cap Exit - Locking Gains at All-Time Highs

- EAT $3.2M Dual-Strike Puts - Betting Against Chili's Viral Comeback

🚀 High-Conviction Catalyst Bets:

- SLNO $1.2M Deep OTM Moonshot - First PWS Drug FDA Approval + EMA Optionality

- KMB $1.8M OTM Breakout - Dividend King M&A Speculation

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 Ultra-Short-Term (This Week: Nov 5-8)

- RKLB November 8 expiry - First collar leg protecting through early Neutron updates

📆 Weekly (November 15 Expiry)

- RKLB November 15 collar resolution - Second/third legs expire 3 days BEFORE Q3 earnings Nov 18

🗓️ Monthly (November 21-28 Expiries)

- IWM November 21 - Small-cap profit-taking at Russell 2000 all-time highs

- EAT November 21 - First bearish put strike ($100) betting on restaurant weakness

- KMB November 28 - OTM call breakout bet on potential Kenvue M&A

📊 Quarterly (December-January)

- EAT January 16, 2026 - Second bearish put strike ($85) betting on sustained decline through Q2 earnings

- GOOGL January 28, 2026 earnings - Key checkpoint for $21M LEAP thesis (Q4 AI Cloud revenue)

- PLTR February 2026 earnings - Post-option expiry but Q4 2025 Army contract wins matter

🚀 LEAPs (2026+ Long-Term Positioning)

- PLTR February 20, 2026 - $33M deep ITM $160 calls (107 days, 8% breakeven appreciation)

- GOOGL February 20, 2026 - $21M $260 calls (472 days / 15.5 months, 5.2% breakeven)

- PBR March 20, 2026 - $1.4M protective puts (134 days insurance against oil/political risks)

- SLNO March 20, 2026 - $1.2M deep OTM $80 calls (136 days, 80% rally required for profit)

- QURE April 17, 2026 - $5.4M bear call spread (163 days betting recovery stalls below $25)

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Expect 100% loss | Target 500%+ gains

Primary High-Risk Plays:

- Rare disease approval lottery: SLNO deep OTM $80 calls - EMA approval Q1 2026 binary (80% move required = EXTREME risk)

- Aerospace launch volatility: RKLB short-dated calls - Neutron launch + Nov 18 earnings dual catalyst (institutional collar signals volatility coming)

- M&A speculation: KMB November $105 calls - Kenvue deal rumors (23 days to catalyst, 4.7% move needed)

Why these work: Binary outcomes with asymmetric payoffs. SLNO EMA approval = 100%+ gain, Neutron success = 200%+ move, KMB M&A = 300%+ option gain. Sizing is CRITICAL - never more than 2% per position or you risk account destruction.

Exit strategy: Take 100%+ gains IMMEDIATELY. Don't wait for perfection. These are lottery tickets - if you triple your money in days/weeks, take it and move on. Scale out at 50%, 100%, 200% gains if momentum continues.

Entry level warning: If you're new to options (less than 100 trades), skip YOLO entirely. Paper trade these first to learn how fast OTM options can go to zero even when directionally correct (IV crush, time decay, gamma risk).

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | 2-8 week holding period | Target 30-100% gains

Primary Swing Plays:

- AI infrastructure momentum basket: PLTR shares or deep ITM calls + GOOGL shares or LEAPs - ride institutional $54M conviction through Q4

- Aerospace earnings volatility: RKLB protective collar - copy the $9.2M institutional structure (buy shares + puts, sell calls around Nov 18 earnings)

- Defensive value with catalyst: KMB shares below $100 - 3.7% dividend + Kenvue M&A optionality + consumer staples defensive

Why these work: Institutional backing ($33M PLTR, $21M GOOGL, $9.2M RKLB) provides momentum and reduces single-name risk. Defined catalyst timelines (Q4 earnings, Neutron launch, potential M&A) give clear entry/exit points. Risk/reward asymmetry favors 2:1 or better.

Risk management:

- Set stop loss at 20-30% of capital allocated (not option premium - that can go to zero!)

- Take 50% profits at 50% gains, let rest run with trailing stop

- Close BEFORE binary events if IV crush risk outweighs directional edge (e.g., RKLB Nov 18 earnings)

- Monitor institutional flow - if you see offsetting trades (big put buying in PLTR), reassess thesis

Timeline discipline: Swings are 2-8 weeks MAX. If position hasn't worked in 4 weeks, cut it. Don't let swings turn into hope trades. The $12M IWM exit teaches us: take profits when you have them, don't wait for perfection.

💰 Premium Collector (Income Focus)

Strategy: Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

Primary Income Plays:

- Aerospace earnings IV harvesting: RKLB covered calls - sell $61-$65 strikes expiring after Nov 18 earnings (Neutron + earnings drives IV above 80%, premium inflation opportunity)

- Post-crash IV inflation: EAT cash-secured puts - sell $95-$100 strikes collecting fat premium as stock finds floor after 44% decline

- Range-bound credit spreads: QURE iron condors - copy the $25/$50 bear call spread structure (post-FDA rejection creates sustained high IV but range-bound price action)

- AI infrastructure calendar spreads: PLTR short-term calls against LEAPs - sell weekly $190-$195 calls, keep long February 2026 $160 calls (theta decay differential profitable)

Why these work: Following institutional activity creates supply/demand imbalances - when someone buys $9.2M in RKLB options, market makers need to hedge, creating premium inflation for sellers. Calendar spreads benefit from time decay working FOR you while maintaining directional exposure.

Premium collection rules:

- Only sell premium on stocks you're willing to own (cash-secured puts) or own (covered calls)

- Close winners at 50-60% max profit - Don't be greedy waiting for 100%, theta decay slows near expiry

- Roll losing positions BEFORE expiry - If RKLB crashes below your short call, roll to next month/quarter instead of taking assignment

- Position sizing discipline: Never allocate more than 15% of capital to sold premium simultaneously (concentration risk if multiple positions assigned)

- Avoid earnings unless that's your thesis: RKLB covered calls BEFORE earnings = harvesting IV spike. During/after = IV crush destroys premium.

Income targeting: Aim for 1-2% monthly return on allocated capital (12-24% annualized). This isn't sexy but compounds beautifully. A $100K portfolio earning 1.5%/month = $19,500 annual income with proper risk management.

🛡️ Entry Level Investor (Learning Mode)

Start small | Focus on education | Build experience before scaling

Recommended Starting Points:

- Paper trade EVERYTHING first: All 9 positions today ($88.2M flow) should be paper traded for 30-60 days before risking real capital

- Track your P&L hypothetically

- Learn how options decay (theta), move with stock (delta), and react to volatility (vega)

- Experience emotional reactions when positions move 20-30% against you

- ETF exposure instead of single stocks:

- QQQ for AI/tech exposure (avoiding single-stock risk of PLTR/GOOGL)

- XLK for diversified tech (reduces binary risk)

- IWM shares for small-cap exposure (smart money just exited but learning opportunity)

- Quality shares for beginners:

- GOOGL shares for AI infrastructure ($3.35T market cap provides stability, less volatile than PLTR)

- KMB shares for defensive income (3.7% dividend, 52-year track record, consumer staples stability)

- Educational focus - study these specific strategies:

- PLTR deep ITM calls: Learn why institutions pay $38.64 for $160 strike when stock at $183.90 (intrinsic vs time value, delta dynamics)

- RKLB collar structure: Study why buying puts + selling calls + buying lower puts = defined risk (protective hedging mechanics)

- QURE bear call spread: Understand net credit trades (sell $25 calls, buy $50 calls = keep premium if stock stays below $25)

- IWM profit-taking: Learn exit discipline (selling $12M at all-time highs teaches "pigs get fat, hogs get slaughtered")

Why this approach: Options amplify BOTH gains AND losses. A 10% stock move can create 100% option gain or 100% loss depending on strike/expiry/direction. Starting with shares or paper trading builds market intuition without risking catastrophic losses.

Entry-level portfolio allocation:

- 90% cash/index funds: Don't touch this - it's your safety net

- 9% shares of quality companies: GOOGL, KMB, or ETFs (QQQ, XLK)

- 1% options experimentation: Paper trade until you hit 70%+ win rate over 50+ trades, then start with 1% real capital

Critical rules for beginners:

- Never risk more than 1% of portfolio per trade (on $50K account = $500 max risk per position)

- Don't trade earnings week until you've watched 10+ earnings cycles (IV crush destroys beginners)

- Avoid YOLO plays entirely until you have 100+ trades of experience (SLNO $80 calls, RKLB short-dated options = account killers for novices)

- If you don't understand Greeks, stop and study:

- Delta: How much option moves per $1 stock move

- Theta: How much you lose per day from time decay

- Vega: How much option moves per 1% IV change

- Gamma: How fast delta changes (why OTM options explode or collapse)

- Master position sizing before strategy complexity: Better to nail 1% risk per trade with simple calls/puts than blow up account trying collars/spreads with 10% allocation

Key learning resources this week:

- Watch how RKLB collar performs through Nov 18 earnings (real-time hedging lesson)

- Track PLTR deep ITM calls through February to see intrinsic value protection vs time decay

- Observe EAT puts through Nov 21/Jan 16 expiries (dual timeframe strategy mechanics)

- Study IWM exit timing - smart money sold at $243 highs when everyone was bullish (contrarian discipline)

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

- Position sizing discipline (MOST IMPORTANT):

- YOLO: 1-2% max per position (total YOLO allocation <5% of portfolio)

- Swing: 3-5% max per position (total swing allocation <25% of portfolio)

- Premium collector: 10-15% max allocated to sold premium simultaneously

- Entry level: 1% max per position until 100+ trades under your belt

- Concentration risk: Never have more than 20% in single sector (today's $54M AI concentration in PLTR+GOOGL is 61% of flow - professionals can do this, you probably can't)

- Stop losses are MANDATORY (not optional):

- Options: 30-50% loss triggers immediate exit (don't wait for zero)

- Shares: 7-10% loss (tighter for volatile stocks like PLTR, wider for stable ones like KMB)

- Spreads: 50% of max loss (if QURE bear call spread down 50% of $5.4M net credit, exit)

- Time-based stops: If position hasn't worked in 30 days (swings) or 7 days (YOLOs), reassess thesis

- Profit-taking prevents regret (greed kills):

- Take 50% off at 50% gain (locks in capital, lets rest run)

- Take another 25% at 100% gain (now playing with house money)

- Let final 25% run with trailing 20% stop (captures monster moves but protects gains)

- IWM example: Smart money sold $12M at $243 highs - didn't wait for $260 or $280, took the WIN

- Time decay awareness (theta kills slowly, then suddenly):

- Weekly options: Lose 2-4% value per day in final week (RKLB Nov 8/15 expiries losing fast NOW)

- Monthly options: Enter decay acceleration with <30 days (November options entered "danger zone" Nov 1)

- LEAPS safety: Options with 6+ months decay slowly early (PLTR Feb 2026, GOOGL Feb 2026 still have time)

- Calendar spreads advantage: Short options decay faster than long (premium collector strategy mechanics)

- Earnings risk management (IV crush is REAL):

- Before earnings: IV inflates 50-150% (premium sellers' paradise, buyers beware)

- After earnings: IV collapses 30-60% even if directionally correct (you can be RIGHT and lose money!)

- RKLB Nov 18 earnings: Options expiring Nov 15 avoid IV crush, Nov 22+ expiries get crushed

- Close or roll: Exit short-dated options before earnings UNLESS that's specifically your thesis

- Correlation risk (don't overconcentrate):

- Today's flow: $54M in PLTR+GOOGL = 61% in AI infrastructure (professionals can handle, retailers can't)

- Diversify across themes: AI infrastructure (PLTR/GOOGL) + aerospace (RKLB) + biotech (QURE/SLNO) + defensive (KMB/PBR)

- Sector rotation: When tech rallies, consumer staples lag (KMB/EAT opposite of PLTR/GOOGL) - natural hedge

Today's Specific Warnings:

AI Infrastructure Hype (PLTR, GOOGL):

- $33M PLTR trade is largest we've tracked - When institutions go THIS big after 340% YTD rally, either extreme confidence or sophisticated hedge we can't see

- Valuation risk: PLTR at 400+ P/E, 85x sales - if AIP growth slows from 33% to 20%, stock could crash 40-50%

- GOOGL DOJ overhang: Chrome divestiture ruling Q1 2026 could wipe $200B+ market cap if search synergies disrupted

- Position sizing: Even for swing traders, max 5% in PLTR (not 10-15%) due to 340% YTD rally + 400 P/E valuation = extreme volatility risk

Aerospace/Biotech Binary Risk (RKLB, SLNO, QURE):

- RKLB Neutron launch: Maiden flight explosion = 40-60% stock crash (SpaceX early failures precedent) - collar structure shows institution KNOWS this risk

- SLNO EMA approval: European regulators demanding additional trials (like FDA did with QURE) = 30-40% crash - this is WHY it's deep OTM $80 calls requiring 80% rally

- QURE post-crash positioning: Stock already down 57% from FDA rejection - bear call spread assumes NO recovery above $25, but Big Pharma buyout at $35-$45 would blow up the trade

- Binary sizing rule: Never allocate more than 2% to any single binary catalyst (Neutron launch, EMA approval, M&A rumors)

Small-Cap/Consumer Rotation (IWM, EAT):

- IWM exit timing: Smart money sold $12M at $243 all-time highs - if you're still long small-caps, ask yourself "why am I smarter than the institution that just exited?"

- EAT restaurant weakness: $3.2M dual-strike puts after 44% decline from $192 peak - consensus is already bearish, any positive surprise (holiday traffic sustains) crushes put buyers

- Contrarian risk: When unusual activity aligns with consensus (everyone bearish on EAT, bullish on PLTR), fading can work - but requires experience

Energy/Political Risk (PBR):

- Petrobras $1.4M puts: Brazil political risk + oil price collapse + refining margin crash = triple threat - but December 1 OPEC+ surprise cuts could spike oil to $85-$90 rendering puts worthless

- Geopolitical wildcards: Middle East tensions, China demand surprise, Venezuela production collapse - all can move oil ±$10-$20 in days

Institutional vs. Retail Positioning (Critical Understanding):

Remember: Today's $88.2M unusual activity represents sophisticated institutions with advantages we DON'T have:

- Information edge: Supply chain data (they knew PLTR AIP adoption weeks before earnings), executive relationships (KMB management discussing Kenvue deal), regulatory insights (SLNO EMA approval probability estimates)

- Hedging complexity: We see $33M PLTR call buy - they might have:

- Short positions in 10 competing AI/defense stocks (MSFT, ORCL, PANW basket)

- Long Nasdaq 100 puts hedging tech concentration

- Variance swaps on PLTR volatility (profiting from IV regardless of direction)

- Correlation trades we can't see across 50+ positions

- Risk management infrastructure: Quantitative models, stress testing, VaR limits, correlation matrices, factor exposure analysis - retail traders have... Excel spreadsheets?

- Time horizon flexibility: Can withstand 30-40% drawdowns and hold 12-18 months (most retail panic sells at -20%)

- Capital efficiency: $33M is 0.1% of a $33B fund - for them it's a "core position," for retail it would be 33% of a $100K account (massively overexposed)

We see:

- PLTR $33M deep ITM call buy (bullish)

They might simultaneously have:

- Short 20,000 shares of PLTR at $185 (delta-neutral)

- Long put spreads at $160/$140 (downside protection)

- Short MSFT/ORCL/CRM in equal weight (sector-neutral AI basket)

- Long VIX calls (volatility hedge)

- Calendar spreads selling near-term calls (theta harvesting)

Net effect: What looks like bullish $33M call buy might actually be part of neutral 10-leg spread capturing AI sector growth while hedging single-name, sector, and volatility risk.

Key insight: Don't assume institutional trades are simple directional bets. Focus on THEMES (AI infrastructure conviction, aerospace hedging, profit-taking rotation, regulatory risk mitigation) rather than trying to exactly replicate complex multi-leg institutional strategies. A $33M trade might be one component of a $500M portfolio - context matters.

When to Override Unusual Activity (Trust Your Discipline):

Ignore the signal if:

- You don't understand the business model:

- Can you explain PLTR's AIP platform vs Foundry vs Gotham in 2 sentences? If no, don't trade it.

- Do you know why SLNO's VYKAT XR is revolutionary for PWS patients? If no, skip it.

- Can you articulate RKLB's Neutron competitive advantage vs SpaceX Falcon 9? If no, avoid it.

- Position size would exceed your risk limits:

- YOLO max 2%, swing max 5% - NO EXCEPTIONS even if "smart money doing it"

- If proper sizing means only buying 5 contracts when institution bought 10,000, that's fine - percentage returns matter, not absolute contract count

- Time horizon doesn't match your trading style:

- Scalpers: Don't copy 15-month GOOGL LEAPs (wrong timeframe)

- Long-term investors: Don't copy 3-day RKLB collar first leg (too short)

- Swing traders: PLTR February 2026 expiry is fine, SLNO March 2026 $80 calls require 80% move (too aggressive)

- Catalyst is too uncertain or binary:

- RKLB Neutron launch could slip to Q1 2026 (delays are normal in aerospace)

- SLNO EMA approval could get delayed 6-12 months like FDA did with QURE

- KMB Kenvue M&A rumors could be complete speculation (insiders might have no deal)

- If you can't quantify probability (>60% for bullish, <40% for bearish), pass on the trade

- You're emotionally attached to a thesis:

- "But PLTR is the future of AI!" - maybe, but 400 P/E requires perfection

- "Chili's viral TikTok strategy is genius!" - so why did smart money buy $3.2M in EAT puts?

- "Small-caps ALWAYS rally in Q4!" - except smart money just sold $12M at all-time highs

- Never marry a position - respect stop losses, reassess when new data emerges

FOMO is the enemy: The $88.2M tracked today represents <0.001% of daily U.S. options volume (~$500B+). There will ALWAYS be another opportunity tomorrow. Missing this flow to protect capital is SMART, not cowardly.

Trust your discipline over excitement: When in doubt, sit on your hands. The best trade is often the one you DON'T make when parameters aren't met.

📚 Educational Spotlight: Understanding Today's Complex Strategies

Deep In-The-Money Calls (PLTR $33M Example)

What they are:

- Buy calls with strike price significantly below current stock price

- PLTR: $160 strike vs $183.90 stock = $23.90 "in the money"

- Premium paid ($38.64) split: $23.90 intrinsic value + $14.74 time value

Why institutions use this structure:

- Capital efficiency: Control $184M of stock for $33M (82% less capital than buying shares)

- Downside protection: Stock can fall 13% to $160 before intrinsic value gone (vs 100% loss if holding shares and stock crashes)

- Leverage with safety: Delta ~0.85 means option moves $0.85 for every $1 stock move (less than shares but better than ATM calls)

- Time decay friendly: With 107 days to expiration, theta decay is only $0.10-$0.15/day (minimal vs near-term options losing $0.50-$1.00/day)

Retail application:

- Start with 3-6 month deep ITM calls (60-80 delta) to learn mechanics

- Use on stocks with strong uptrends where you want leverage but also protection

- Accept that you pay "rent" (time value) for the leverage - if stock goes sideways, you lose time value slowly

- Close if time value decays below 20% of original premium (signals inefficient use of capital)

PLTR specific math:

- Breakeven at expiration: $160 + $38.64 = $198.64 (8% above current $183.90 price)

- Profit scenarios: Every $1 above $198.64 = $560K profit (5,600 contracts × 100 shares × $1)

- Loss scenarios: If PLTR at $160 or below on Feb 20, 2026 = lose all $14.74 time value × 10,000 contracts = $14.7M (but retain intrinsic value of $23.90 × 1M shares = $23.9M)

- Protection: Stock would need to fall 13% to $160 before intrinsic value threatened (vs shares losing 13% immediately)

LEAPs (Long-term Equity Anticipation Securities) - GOOGL $21M Example

What they are:

- Options with 9+ months until expiration (GOOGL: 472 days / 15.5 months)

- GOOGL: $260 strike vs $283.29 stock = $23.29 in the money (deep ITM structure)

- Used for multi-quarter theses without short-term noise

Why institutions use this:

- Tax efficiency: Hold 12+ months for long-term capital gains treatment

- Volatility buffer: 15 months absorbs quarterly earnings misses, temporary weakness without getting stopped out

- Catalyst alignment: Captures multiple catalysts (Q4 2025 earnings, Gemini 3.0 rollout Q1 2026, DOJ ruling, Q1 2026 earnings)

- Reduced theta decay: LEAPs lose ~$0.05-$0.10/day initially vs $0.50-$1.00 for monthlies

- Leverage without margin calls: Control $159M of stock for $21M with no liquidation risk like margin

GOOGL specific math:

- Breakeven at expiration: $260 + $37.90 = $297.90 (5.2% above current $283.29 in 472 days = 4% annualized return required)

- Time value component: $37.90 paid - $23.29 intrinsic = $14.61 time value (39% of premium)

- Theta decay curve: Loses ~$0.08/day initially, accelerates to ~$0.30/day at 90 days, ~$1.00/day at 30 days

- Capital efficiency: $21M controls $159M of stock exposure (87% less capital, 13% margin requirement equivalent)

Retail application:

- LEAPs require 6-12 month holding periods - not for traders seeking quick 2-week profits

- Use when you're bullish but want to scale position over time (vs buying full share position day 1)

- Consider selling shorter-term calls against LEAPs (calendar spreads) to harvest theta while maintaining long exposure

- Roll forward when time value decays below 25% of original premium (typically at 6-9 months remaining)

Protective Collar (RKLB $9.2M Three-Leg Example)

What it is:

- Three simultaneous trades creating defined risk/reward:

- Buy protective puts ($3.3M of Nov 8 $57 puts) - downside insurance

- Sell covered calls ($3.3M of Nov 15 $61 calls) - cap upside, collect premium

- Buy deeper puts ($2.6M of Nov 15 $51 puts) - extreme crash protection

- Net cost: ~$2.6M ($9.2M total notional but offsetting premiums reduce actual outlay)

Why institutions use this:

- Defined risk: Maximum loss = stock price - $51 put strike ≈ $5.10/share × 1.5M shares = $7.6M max loss

- Capped upside: Maximum gain = $61 call strike - stock price ≈ $4.90/share × 1.5M shares = $7.3M max gain

- Capital preservation: Protects through binary events (Neutron launch, Nov 18 earnings) without selling shares (avoids taxable event)

- Volatility arbitrage: Collect $61 call premium (IV ~75%) while buying $57/$51 puts (IV ~65-70%) when IV skew favors sellers

RKLB specific mechanics:

- Stock at $56.10 on trade date (Nov 5)

- Nov 8 $57 put protection (3 days): Caps loss at $0.90/share if Neutron news disappoints short-term

- Nov 15 $61 call sold (10 days): Gives up upside above $61 but collects premium offsetting put cost - expiration coincides with Q3 earnings Nov 18 (3 days before)

- Nov 15 $51 put protection (10 days): Extreme crash protection if Neutron explodes or earnings disaster (caps loss at $5.10/share)

- Net strategy: Accept $4.90 max upside to $61 in exchange for $5.10 max downside to $51 = roughly symmetric risk/reward but PROTECTS through two major catalysts

Retail application:

- Start simpler: Buy stock + buy put (two-leg collar) before attempting three-leg version

- Use around binary events: Earnings, FDA approvals, product launches where volatility expected but direction uncertain

- Premium collection angle: If you own RKLB shares, sell covered calls at $61 expiring after earnings to harvest IV spike

- Risk: If stock rallies above $61, you miss gains - but you PROTECTED downside which is primary goal

- Sizing: Only collar positions you want to KEEP long-term (don't collar speculations - just use stop losses)

Entry level warning: Three-leg collars require understanding delta, theta, vega interactions across three strikes/expiries. Paper trade this structure 10+ times before risking real capital. Start with simple protective puts (buy stock + buy put) to learn downside insurance mechanics.

Bear Call Spread (QURE $5.4M Credit Example)

What it is:

- Sell higher-premium calls ($25 strike), buy lower-premium calls ($50 strike)

- Net CREDIT received upfront ($5.4M) = maximum profit

- Used when expecting stock to stay below $25 or decline further

Why institutions use this:

- Immediate income: Collect $5.4M credit day 1, no further capital required

- Defined risk: Maximum loss = $50 - $25 = $25 width × 11,000 contracts = $27.5M (if stock explodes above $50)

- High probability: With QURE at $26.36 post-FDA rejection, betting stock stays below $25 by April 2026 is high probability (~65-70%)

- Time decay advantage: Both legs decay over 163 days, but short $25 calls decay faster (benefits seller)

- Post-crash positioning: After 57% decline from FDA rejection, recovery above $25 seems unlikely without major catalyst

QURE specific math:

- Max profit: $5.4M credit received (achieved if QURE at $25 or below on April 17, 2026)

- Max loss: ($50 - $25) × 11,000 contracts = $27.5M - $5.4M credit = $22.1M (if QURE above $50 - very unlikely but possible with buyout)

- Breakeven: $25 + ($5.4M / 11,000 contracts) ÷ 100 shares = $25.49 (stock can rally 3.9% from current $26.36 and still profitable)

- Probability of profit: ~70% (stock must stay below $25.49 in 163 days)

Retail application:

- Start narrow: 5-point spreads ($25/$30) instead of 25-point ($25/$50) - limits max loss

- Use on range-bound stocks: Post-crash names like QURE, high-volatility consolidation zones

- Close early: If credit decays to 50-60% of max (e.g., $5.4M → $2.7M), close and take profit (don't wait for 100%)

- Risk management: NEVER use on stocks with pending binary catalysts (QURE's AMT-130 FDA meeting Q2 2026 could cause buyout speculation)

- Margin requirement: Brokers require $27.5M - $5.4M = $22.1M collateral (max loss) - prohibitive for small accounts

Entry level warning: Bear call spreads can cause assignment problems if short $25 calls exercised early (rare but possible). Understand assignment risk, early exercise scenarios, and cash-settlement vs physical delivery before using this strategy. Start with bull put spreads (easier assignment management) instead.

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. PLTR's $33M deep ITM call position after 340% YTD rally carries significant valuation risk at 400+ P/E. RKLB's Neutron launch is unproven technology with binary success/failure outcomes. SLNO's $1.2M deep OTM bet requires 80% appreciation. Always practice proper risk management and never risk more than you can afford to lose completely. Entry level investors should paper trade extensively before committing real capital. Options can expire worthless, resulting in 100% loss of premium paid.

This analysis is derived from publicly observable options flow and does not constitute financial advice. Institutional positions may be hedged or part of complex strategies not visible in single-leg unusual activity reports. Past unusual activity does not predict future stock or options performance. Consult a licensed financial advisor before making investment decisions.

📊 Total Flow Summary:

- Total Tracked: $88,200,000

- Largest Position: PLTR $33M (37% of total flow - UNPRECEDENTED concentration)

- Theme Leaders: AI Infrastructure $54M (61%), Strategic Hedging $16M (18%), Profit-Taking $15.2M (17%), High-Conviction Catalysts $3M (4%)

- Tickers Analyzed: 9 companies across AI defense tech, cloud infrastructure, small-cap ETFs, aerospace, biotech, restaurants, consumer staples, energy, rare disease

- Expiry Range: November 8, 2025 (3 days) through April 17, 2026 (163 days) - LEAPs out to 472 days (GOOGL February 2026)

© 2025 Ainvest Labs. All Rights Reserved.