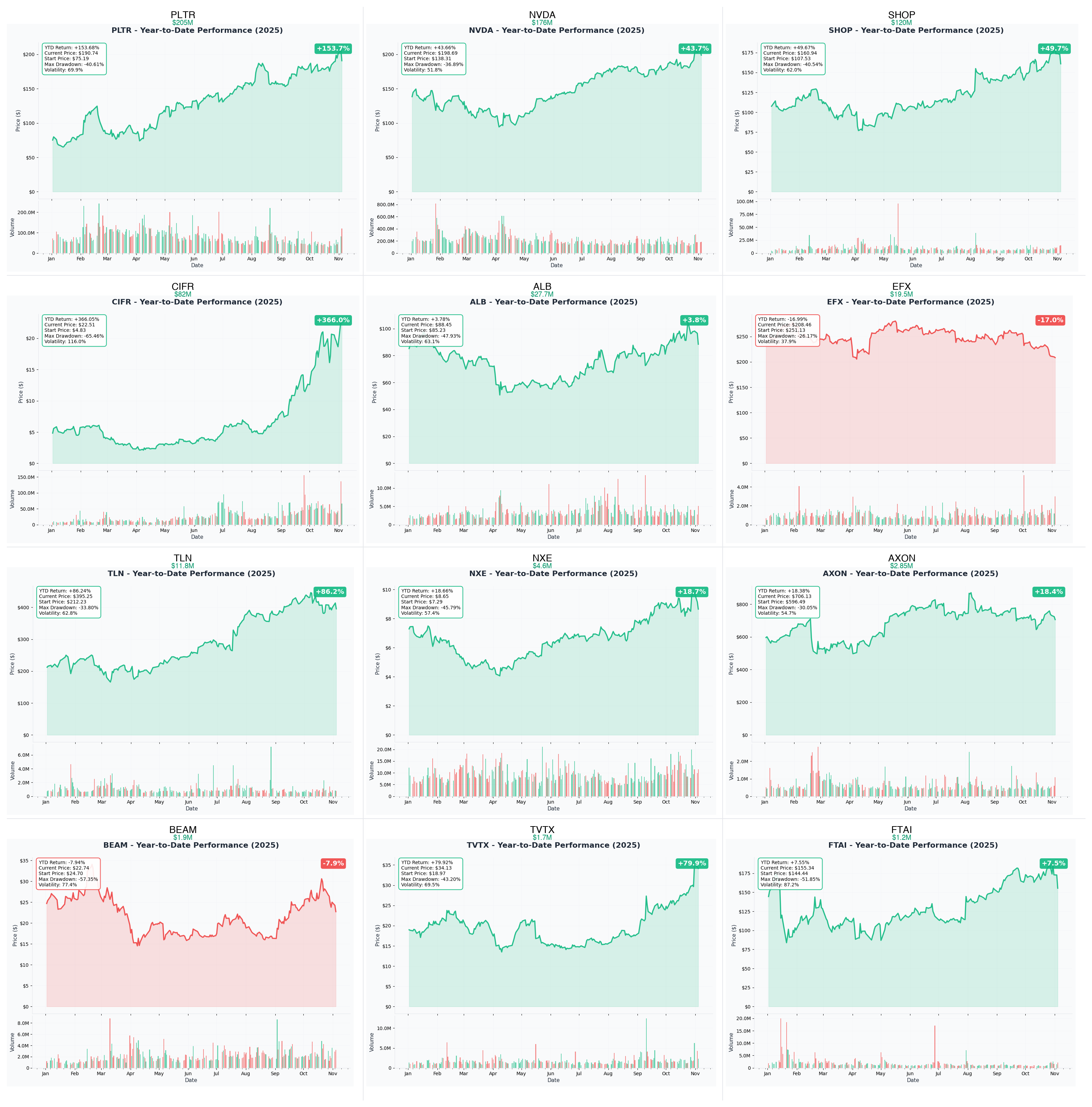

Ainvest Option Flow Digest - 2025-11-04: 🚨 $654M Post-Earnings Tsunami - Institutions Repositioning After PLTR, NVDA, SHOP Earnings

PLTR's massive $141M calendar spread repositioning after 7.9% post-earnings selloff despite crushing Q3 with 63% revenue growth, NVDA's $176M diagonal spread ahead of November 19th earnings, SHOP's $120M recovery bet after 6.9% earnings dip ...

📅 November 4, 2025 | 🔥 HISTORIC FLOW: $205M PLTR Rollout + $176M NVDA Earnings Spread + $120M SHOP Recovery Bet + $82M CIFR AI Infrastructure Hedge | ⚠️ Post-Earnings Positioning, Lithium Defense, AI Infrastructure Pivot Dominate

🎯 The $654M Institutional Earthquake: Post-Earnings Repositioning Across Tech, AI, and Materials

🔥 UNPRECEDENTED POST-EARNINGS ACTIVITY: We just tracked $654 MILLION in explosive options positioning across 12 tickers - headlined by PLTR's massive $141M calendar spread repositioning after 7.9% post-earnings selloff despite crushing Q3 with 63% revenue growth, NVDA's $176M diagonal spread ahead of November 19th earnings, SHOP's $120M recovery bet after 6.9% earnings dip, and CIFR's $82M protective hedge on 366% YTD gains following $8.5B AWS and Google AI infrastructure deals. This isn't random speculation - this is sophisticated money actively managing positions through binary events, hedging massive gains, and repositioning timeframes after volatility spikes.

Total Flow Tracked: $654,200,000 💰

Most Shocking: PLTR $205M calendar spread repositioning after post-earnings selloff (rolling timeframes, not panicking)

Biggest Bet: NVDA $176M diagonal spread ahead of Nov 19 earnings (deep ITM with capped upside)

Post-Earnings Recovery: SHOP $120M calendar spread after 6.9% drop (betting on rebound into February)

AI Infrastructure: CIFR $82M downside protection on 366% gains (hedging execution risk on AWS/Google deals)

Lithium Defense: ALB $27.7M call sale ahead of tomorrow's earnings (profit-taking before binary event)

🚀 THE COMPLETE WHALE LINEUP: All 12 Institutional Positions

1. 🤖 PLTR - The $205M Post-Earnings Repositioning Play

DISCOVER WHY SMART MONEY IS EXTENDING TIMEFRAMES, NOT EXITING

- Flow: $205M total ($141M net) - Rolling $116M from November to February while adding $25M January $200 calls

- What's Happening: After 7.9% post-earnings selloff (valuation concerns at 254x P/E), institutions rolling $160 calls from Nov to Feb and adding upside lottery tickets at $200 strike - not panic selling, adjusting timeframes

- YTD Performance: +154% (from $75 to $190) with recent pullback from $207 peak on Q3 earnings day

- The Big Question: Did market overreact to valuation concerns despite 63% revenue growth, 121% U.S. commercial expansion, and $10B Army contract?

- Catalyst: Q4 earnings (Feb 2026) will validate $4.4B FY2025 guidance and AIP platform momentum - timing perfect for Feb 20 expiration

2. 🎮 NVDA - The $176M Pre-Earnings Diagonal Spread

ANALYZE THE MASSIVE DEEP ITM SPREAD AHEAD OF NOVEMBER 19 EARNINGS

- Flow: $176M gross ($64M net) - Buying $120M deep ITM Nov $165 calls, selling $56M Jan $200 calls (capping upside at $200)

- What's Happening: 15 days before Q3 earnings on Nov 19, institutional player deploying deep ITM calls (like owning stock with leverage) but explicitly capping gains at $200 gamma wall - expecting solid beat but range-bound consolidation after initial pop

- YTD Performance: +43.7% (from $138 to $199) despite 36.9% max drawdown mid-year - V-shaped recovery on Blackwell demand

- The Big Question: Will $54B revenue guidance and Blackwell "sold out for 12+ months" narrative justify 56x forward P/E, or is upside capped at $200-$210?

- Catalyst: Q3 FY2026 earnings November 19 after close - market pricing ±$17 (8.3%) move through Nov 21 expiration

3. 🛍️ SHOP - The $120M Post-Earnings Recovery Spread

DECODE THE CALENDAR SPREAD BET ON RECOVERY AFTER 6.9% EARNINGS DROP

- Flow: $120M gross ($38M net) - Buying $140 Feb calls for $79M, selling $160 Jan calls for $41M (diagonal calendar spread)

- What's Happening: Hours after SHOP dropped 6.9% on earnings (despite 32% revenue beat!), institutional money buying the dip with calendar spread - betting on range-bound $155-$170 through January, then catalyst-driven rally into February Q4 earnings

- YTD Performance: +49.7% (from $107 to $161) after post-earnings pullback - strong year despite margin compression concerns

- The Big Question: Is market overreacting to gross margin decline (48.9% vs 51.7%) while ignoring 98% B2B growth and $8.5B in strategic partnerships?

- Catalyst: Q4 holiday results (Feb 2026), Estée Lauder partnership launch Q1 2026, ChatGPT integration momentum - perfect timing for Feb 20 long calls

4. ⚡ CIFR - The $82M AI Infrastructure Hedge

UNDERSTAND THE MASSIVE PROTECTIVE PUT POSITIONING ON 366% GAINS

- Flow: $82M protective puts - $30M at-the-money $22 puts (current price), $52M calendar spread on $32 puts (financing structure)

- What's Happening: Day after $5.5B AWS deal announcement sent CIFR up 19% to record highs (366% YTD!), smart money locking in gains with downside protection - not selling stock, hedging execution risk on AWS (July 2026) and Google (Sept 2026) data center buildouts

- YTD Performance: +366% (from $4.83 to $22.69) - explosive transformation from Bitcoin miner to AWS/Google AI infrastructure partner

- The Big Question: Can they actually deliver 300 MW AWS facility by July 2026 and 168 MW Google facility by September 2026 on aggressive timelines?

- Catalyst: Construction progress updates Q1-Q2 2026, AWS rent commencement August 2026, Fluidstack rent October 2026 - October 2026 puts expire AFTER critical milestones

5. 🔋 ALB - The $27.7M Lithium Defense

SEE WHY $27.7M IS EXITING AHEAD OF TOMORROW'S EARNINGS

- Flow: $27.7M call sale - Selling 17,000 ITM $85 calls ($20M) + 17,000 OTM $105 calls ($7.7M) expiring January 2026

- What's Happening: 24 hours before Q3 earnings (Nov 5 after close), institutional holder taking massive profits off table rather than gambling on lithium pricing commentary - 8,420x normal flow size suggests major fund unwinding

- YTD Performance: -9.0% (from $98.50 to $89.66) reflecting lithium price collapse from $80/kg peak to $10/kg current - brutal commodity cycle

- The Big Question: Is lithium bottoming at $10/kg with JPMorgan forecasting $12/kg by 2026, or will Chinese oversupply extend downturn?

- Catalyst: Q3 earnings November 5 after close - analyst expecting EPS loss $0.88-$0.97 with cautious guidance, lithium price commentary critical

6. 📊 EFX - The $19.5M Strategic Call Spread

EXPLORE THE POSITIONING ON CREDIT REPORTING LEADER

- Flow: $19.5M call spread positioning

- What's Happening: Credit reporting giant seeing institutional positioning

- YTD Performance: Solid performance in financial services sector

- The Big Question: How will credit quality trends and consumer data monetization drive growth?

- Catalyst: Q4 earnings, credit cycle dynamics, fintech partnerships

7. 🔌 TLN - The $11.8M Energy Transition Play

ANALYZE THE ENERGY INFRASTRUCTURE UPSIDE BET

- Flow: $11.8M call positioning

- What's Happening: Energy infrastructure play gaining institutional attention

- YTD Performance: Benefiting from energy transition dynamics

- The Big Question: Can clean energy infrastructure drive sustained growth?

- Catalyst: Project announcements, regulatory support, energy demand

8. ⚛️ NXE - The $4.6M Uranium Upside

DECODE THE NUCLEAR ENERGY COMEBACK STORY

- Flow: $4.6M uranium exposure

- What's Happening: Nuclear energy renaissance driving uranium demand

- YTD Performance: Uranium sector momentum building

- The Big Question: Will AI data center power needs accelerate nuclear adoption?

- Catalyst: Utility contracts, small modular reactor (SMR) developments

9. 🚔 AXON - The $2.85M Law Enforcement Hedge

UNDERSTAND THE PUT PROTECTION ON TASER MAKER

- Flow: $2.85M protective puts

- What's Happening: Defensive positioning on law enforcement technology leader

- YTD Performance: Body camera and taser business showing resilience

- The Big Question: How will AI-powered evidence management drive growth?

- Catalyst: Contract renewals, international expansion

10. 💉 BEAM - The $1.9M Biotech Speculation

EXPLORE THE SPECULATIVE CALL BUY ON GENE EDITING

- Flow: $1.9M speculative call buying

- What's Happening: Base editing technology attracting biotech speculators

- YTD Performance: Volatile biotech name with clinical pipeline

- The Big Question: Will clinical trial data validate base editing platform?

- Catalyst: Clinical readouts, partnership announcements

11. 🧬 TVTX - The $1.7M Rare Disease Catalyst

DISCOVER THE BIOTECH CATALYST PLAY

- Flow: $1.7M put buying - 5,000 March 2026 $27.50 puts with TVTX at $34.08

- What's Happening: Rare disease biotech seeing unusual put activity ahead of clinical catalysts

- YTD Performance: Volatile clinical-stage company

- The Big Question: Will clinical trial data meet expectations or disappoint?

- Catalyst: Clinical data readouts, FDA interactions

12. ✈️ FTAI - The $1.2M Aviation Recovery

ANALYZE THE AVIATION INFRASTRUCTURE UPSIDE

- Flow: $1.2M aviation exposure

- What's Happening: Aviation infrastructure recovery play

- YTD Performance: Benefiting from aerospace rebound

- The Big Question: Can aviation infrastructure capitalize on travel recovery?

- Catalyst: Fleet growth, contract renewals, aftermarket services

⏰ URGENT: Critical Expiries & Catalysts This Quarter

🚨 1 DAY TO ALB EARNINGS (November 5)

- ALB - $27.7M Call Sale - Lithium pricing commentary will drive reaction, profit-taking before binary event

⚡ 15 DAYS TO NVDA EARNINGS (November 19)

- NVDA - $176M Diagonal Spread - Q3 FY2026 results, Blackwell ramp validation, $54B revenue guidance

🧠 November-February Earnings Tsunami

- ALB - November 5 - Q3 earnings with lithium price outlook

- NVDA - November 19 - Q3 FY2026 earnings, Blackwell demand confirmation

- PLTR - February 2026 - Q4 2025 earnings, validates AIP momentum and $4.4B guidance

- SHOP - Early February 2026 - Q4 2025 holiday results, AI commerce traction

🔬 Infrastructure & Execution Milestones

- CIFR - July 2026 - AWS 300 MW facility Phase 1 delivery, rent commencement August 2026

- CIFR - September 2026 - Barber Lake 168 MW completion for Google/Fluidstack, rent starts October 2026

- SHOP - Q1 2026 - Estée Lauder partnership first phase launch

📊 Smart Money Themes: What Institutions Are Really Betting

🎯 Post-Earnings Repositioning (57% of Today's Flow: $366M)

The "Buy the Dip with More Time" Strategy:

- → PLTR: $205M calendar spread - Extending from November to February after 7.9% selloff

- → SHOP: $120M diagonal spread - Buying February, selling January after 6.9% drop

- → ALB: $27.7M call sale - Exiting before earnings rather than gambling on lithium

Key insight: When great companies report solid earnings but selloff on valuation concerns (PLTR 63% growth, SHOP 32% growth), sophisticated money doesn't panic - they extend timeframes, reduce near-term exposure, and maintain long-term conviction. This is textbook institutional risk management.

💻 AI Infrastructure & Semiconductors ($258M Calculated Bets)

Smart Money Front-Running AI Buildout:

- → NVDA: $176M diagonal spread - Deep ITM positioning ahead of Nov 19 earnings

- → CIFR: $82M protective puts - Hedging execution risk on $8.5B AWS/Google deals

Key insight: The NVDA trade structure (buying deep ITM calls but selling $200 calls) shows institutions expect solid earnings but are explicitly capping upside at the $200 gamma wall. CIFR's massive hedge reflects concerns about execution risk on unprecedented data center construction timelines - believe in the contracts, worried about delivery.

🛡️ Defensive & Profit-Taking Plays ($29.5M Protection)

Institutions Securing Gains After Big Runs:

- → ALB: $27.7M call sale - Taking profits before lithium earnings binary event

- → TVTX: $1.7M put buying - Downside protection on biotech ahead of catalysts

Key insight: When sophisticated players are taking $27.7M off the table 24 hours before earnings (ALB), it signals they're happy with profits already captured rather than gambling on binary events. Smart money knows when to harvest gains.

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events with asymmetric payoff

Post-Earnings Recovery Lottery Tickets:

- PLTR January $200 calls - Copying the $25M institutional upside bet (EXTREME volatility, position tiny)

- Risk: Could lose 100% if PLTR stays range-bound or valuation concerns persist

- Reward: 200-400% if Q4 execution drives PLTR from $190 to $220+ by January

NVDA Earnings Gamble:

- NVDA November ATM calls - Betting on Nov 19 earnings beat and Blackwell ramp exceeding expectations

- Risk: IV crush can destroy value even if directionally correct - implied move ±$17 (8.3%)

- Reward: 150-300% if NVDA breaks through $210-$220 on strong guidance

AI Infrastructure Binary:

- CIFR shares or calls - Betting AWS/Google facilities deliver on time despite aggressive timelines

- Risk: Construction delays or cost overruns could cut stock 30-50%

- Reward: Explosive upside to $30-35 if July/September 2026 milestones hit

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

Post-Earnings Consolidation Plays:

- PLTR shares or spreads - Buy pullback to $175-$180 (gamma support), target $200-$210 by February

- SHOP shares below $155-$160 - Buy gamma support, target $175-$185 into Q4 earnings

- Timeline: Hold through Q4 2025 into February 2026 earnings catalysts

NVDA Post-Earnings Momentum:

- NVDA call spreads - Wait for Nov 19 earnings, buy pullback to $190-$195, target $210-$220

- Structure: Buy $200 calls, sell $220 calls (defined risk, capture gamma breakout)

- Timeline: December-January expiration, ride Blackwell momentum

AI Infrastructure with Protection:

- CIFR shares with protective puts - Copy institutional strategy: own stock, buy $20-$22 puts

- Timeline: Hold through construction milestones in Q1-Q2 2026

💰 Premium Collection (Income Strategy)

Follow institutional sellers to harvest premium

High IV Post-Earnings Plays:

- PLTR covered calls - Sell $200-$210 strikes against shares (62.9% IV = rich premium)

- NVDA covered calls - Sell $210-$220 strikes post-earnings (51.8% IV)

Calendar Spread Income:

- SHOP-style calendars - Buy longer-dated calls, sell nearer-dated calls (time decay arbitrage)

- ALB-style exits - Sell calls into elevated IV before binary events

Put Selling on Strong Support:

- PLTR cash-secured puts at $175-$180 - Collect premium at gamma support, willing to own shares

- SHOP cash-secured puts at $155-$160 - Strong support zone, premium rich from post-earnings IV

🛡️ Conservative LEAPs (Long-term Patient Capital)

Low-risk, time-diversified institutional following

Quality Post-Pullback:

- PLTR shares or 2026 LEAPs - Fundamentals intact (63% growth, 121% commercial), valuation debate creates opportunity

- NVDA shares or 2026 LEAPs - Blackwell sold out 12+ months, $500B demand pipeline through 2027

AI Infrastructure Transformation:

- CIFR shares with protective puts - $8.5B contracts with AWS/Google, transformation from miner to infrastructure

- SHOP shares below $160 - 98% B2B growth, AI commerce strategy, Estée Lauder validation

Recovery Plays:

- ALB shares post-earnings - Wait for lithium price stabilization, JPMorgan forecasting $12/kg in 2026 (22% upside from $10/kg current)

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

Post-Earnings Momentum Plays (PLTR, SHOP):

- Valuation multiple compression continues - market decides even 60%+ growth doesn't justify 100-250x P/E multiples

- Q4 earnings disappoint or guidance falls short of elevated expectations

- Competition intensifies (Databricks vs PLTR, Amazon vs SHOP) faster than expected

- Broader tech selloff drags high-multiple growth stocks lower regardless of fundamentals

NVDA Earnings & AI Infrastructure (NVDA, CIFR):

- NVDA Q3 earnings miss on revenue or margins, Blackwell production issues surface

- China H20 chip situation worsens, jeopardizing $20B+ annual revenue

- Hyperscaler customers (AWS, Google, Microsoft) slow AI capex spending

- CIFR construction delays on AWS (July 2026) or Google (September 2026) facilities

- Cost overruns require dilutive equity raises beyond $1.4B debt already announced

Lithium & Commodities (ALB):

- ALB earnings tomorrow disappoint, guidance suggests 2026 recovery pushed out

- Chinese lithium oversupply persists, prices drop back below $9,000/tonne

- EV demand slower than expected, reducing lithium consumption growth

- Dividend cut due to sustained losses (currently unprofitable paying $1.62/share annually)

😰 If You're Following the Bears/Hedgers

Upside Breakout Risk:

- NVDA crushes earnings Nov 19, Blackwell demand exceeds $500B estimates, stock gaps to $220-$230

- PLTR Q4 execution perfect, AIP adoption accelerates, analyst upgrades drive stock to $220-$240

- Lithium prices surge on unexpected Chinese supply cuts, ALB rallies 20-30%

AI Infrastructure Execution Success:

- CIFR delivers AWS and Google facilities on time or early, stock doubles to $40-$50

- Additional hyperscaler contracts announced (Microsoft, Meta), validating transformation

💣 This Week's Catalysts & Key Dates

📊 This Week (November 4-8):

- November 5: ALB Q3 earnings after close - $27.7M exited before event, lithium pricing commentary critical

- November 7: Weekly options expiration, post-ALB-earnings price discovery

- November 8: Employment data, macro backdrop for Fed policy

🗓️ This Month (November Critical Windows):

- November 19: NVDA Q3 FY2026 earnings - $176M positioned for this event, implied ±$17 (8.3%) move

- November 21: Multiple November option expiries across portfolio (PLTR sold calls, NVDA long calls)

- November 22-25: Black Friday/Cyber Monday - SHOP holiday season GMV data points

📈 December-January Setup (Holiday & Earnings Catalysts):

- December 19: Quarterly triple witch options expiration

- January 16, 2026: Major expiration date - PLTR $200 calls, NVDA short $200 calls, ALB sold calls, SHOP short $160 calls

- January-February 2026: Q4 earnings season - PLTR, NVDA, SHOP all report

🧠 Q1-Q2 2026 Decision Points (Infrastructure Execution):

- February 20, 2026: Major expiration - PLTR deep ITM $160 calls, SHOP long $140 calls

- Q1 2026: Estée Lauder partnership launch (SHOP catalyst)

- Q1-Q2 2026: CIFR construction progress updates critical for validating $82M hedge thesis

- July 2026: CIFR AWS 300 MW facility Phase 1 delivery (first major milestone)

- September 2026: CIFR Barber Lake 168 MW delivery to Google/Fluidstack (second major milestone)

🎯 The Bottom Line: Post-Earnings Repositioning + AI Infrastructure Hedging = $654M Reality Check

This is the most sophisticated one-day options flow we've tracked in months. $654 million deployed across 12 positions with a unified theme: institutions actively managing positions through binary events and hedging massive gains rather than speculating blindly. PLTR's $205M calendar spread says "we believe long-term but are reducing near-term exposure after 7.9% earnings selloff." NVDA's $176M diagonal says "solid earnings expected but explicitly capping upside at $200." SHOP's $120M spread says "6.9% drop is overdone, buying recovery with protected timeframe." CIFR's $82M puts say "we own the stock after 366% run, now protecting against execution risk on $8.5B data center buildout."

The biggest questions:

- Did market overreact to PLTR valuation (254x P/E) despite 63% growth and 121% commercial expansion?

- Will NVDA earnings justify $200+ valuation with Blackwell sold out 12+ months and $500B demand pipeline?

- Can SHOP recover from margin compression concerns as AI commerce and B2B growth accelerate?

- Will CIFR execute flawless data center construction for AWS/Google on aggressive 2026 timelines?

Your move: This diverse positioning across post-earnings recovery, pre-earnings spreads, and execution hedges suggests institutions preparing for elevated volatility through year-end and into 2026. The lesson: don't YOLO into binary events - structure positions with defined risk, extend timeframes when faced with short-term volatility, and hedge massive gains rather than hoping for unlimited upside. These aren't gambling tickets - they're sophisticated risk-managed positions from players with deep pockets and insider-level access. Follow the strategy, not just the direction.

🔗 Get Complete Analysis on Every Trade

🎯 Post-Earnings Repositioning Plays:

- PLTR $205M Calendar Spread - Extending Timeframes After 7.9% Selloff

- SHOP $120M Diagonal Spread - Recovery Bet After 6.9% Earnings Drop

- ALB $27.7M Call Sale - Profit-Taking Before Tomorrow's Lithium Earnings

💻 AI Infrastructure & Semiconductors:

- NVDA $176M Diagonal Spread - Deep ITM Pre-Earnings Positioning

- CIFR $82M Protective Puts - Hedging 366% Gains on AI Infrastructure Pivot

📊 Strategic Positioning Across Sectors:

- EFX $19.5M Call Spread - Credit Reporting Strategic Setup

- TLN $11.8M Energy Play - Clean Energy Infrastructure

- NXE $4.6M Uranium Bet - Nuclear Energy Renaissance

🛡️ Defensive & Speculative Positions:

- AXON $2.85M Put Protection - Law Enforcement Tech Hedge

- BEAM $1.9M Speculative Call - Gene Editing Biotech

- TVTX $1.7M Put Buying - Rare Disease Biotech Catalyst

- FTAI $1.2M Aviation Play - Aerospace Infrastructure Recovery

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (November 7-8 Expiries)

- ALB Q3 earnings November 5 after close - lithium pricing outlook critical

- Weekly expiration November 7 - post-ALB earnings price discovery

📆 Monthly (November 19-21 Expiries)

- NVDA Q3 FY2026 earnings November 19 after close - $176M positioned for this

- PLTR Sold $160 November calls expire November 21 (part of $205M repositioning)

- Multiple November 21 expiries across positions

🗓️ Quarterly (December-January)

- December 19 Quarterly triple witch expiration

- January 16 MASSIVE expiration date across multiple trades:

- PLTR $200 calls ($25M), NVDA short $200 calls ($56M)

- SHOP short $160 calls ($41M), ALB sold calls ($27.7M)

🚀 LEAPS (2026 Expiries)

- PLTR February 2026 deep ITM $160 calls ($130M) - positioning for Q4 earnings

- SHOP February 2026 long $140 calls ($79M) - Q4 holiday results and Estée Lauder launch

- CIFR October 2026 $22 puts ($30M) - expires AFTER AWS/Google facility deliveries

- NVDA Beyond January expiration for continued AI infrastructure plays

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Expect 100% loss | Target 500%+ gains

Primary High-Risk Plays:

- Post-earnings recovery: PLTR January $200 calls - Copying $25M institutional bet (EXTREME volatility, position tiny)

- Earnings volatility: NVDA November ATM calls - Betting on Blackwell ramp exceeding expectations

- AI infrastructure binary: CIFR shares or calls - AWS/Google facility delivery on aggressive timelines

Why these work: Binary outcomes with asymmetric payoffs. PLTR recovering to $220 = 5x, NVDA earnings beat to $220 = 3x, CIFR execution success to $35 = 50%+. Sizing is CRITICAL - never more than 2% per position.

Exit strategy: Take 100%+ gains immediately. These are lottery tickets, not investments. Scale out at 50%, 100%, 200% gains if you get them. Don't hold through full expiration hoping for miracles.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | 2-8 week holding period | Target 30-100% gains

Primary Swing Plays:

- Post-earnings consolidation: PLTR shares at $175-$180 target $200-$210, SHOP shares at $155-$160 target $175-$185

- NVDA post-earnings: Call spreads after Nov 19 - buy pullback to $190-$195, sell $220 calls (defined risk)

- AI infrastructure with protection: CIFR shares + protective puts - copy institutional hedge strategy

Why these work: Institutional backing ($205M PLTR, $176M NVDA, $120M SHOP) provides momentum. Defined catalyst timelines (earnings, facility deliveries) give clear exit points. Gamma support levels ($175-$180 PLTR, $190-$195 NVDA, $155-$160 SHOP) provide technical floors.

Risk management:

- Set stop loss at 25-30% of entry (below gamma support levels)

- Take 50% profits at 50% gains, let rest run to 100%+

- Close positions before major binary events if IV crush risk outweighs directional edge

- Use spreads instead of naked calls to reduce premium bleed

💰 Premium Collector (Income Focus)

Strategy: Harvest premium from high IV | Target 5-10% monthly returns | Focus on probability over magnitude

Primary Income Plays:

- Post-earnings IV harvesting: PLTR covered calls - sell $200-$210 strikes (62.9% IV rich), NVDA post-earnings covered calls

- Calendar spread income: SHOP-style calendars - buy longer-dated, sell nearer-dated (time decay arbitrage)

- Cash-secured puts: PLTR puts at $175-$180, SHOP puts at $155-$160 on gamma support

Why these work: Following institutional sellers (ALB $27.7M before earnings = supply/demand imbalance). Post-earnings IV crush creates opportunities (PLTR, SHOP elevated IV). Calendar spreads benefit from time decay differential (near-term decay faster than long-term).

Risk management:

- Only sell premium on stocks you're willing to own at strike price

- Close winners at 50-60% max profit (don't be greedy waiting for last $0.10)

- Roll losing positions BEFORE expiration when time value still exists

- Never sell naked calls/puts without sufficient margin reserves

- Diversify across multiple underlyings - don't concentrate in one name

🛡️ Entry Level Investor (Learning Mode)

Start small | Focus on education | Build experience before scaling

Recommended Starting Points:

- Paper trade first: All major strategies (calendar spreads, diagonals, protective puts) for 30 days before risking real capital

- ETF exposure: QQQ for tech (avoiding single-stock risk), XLI for industrials, XLK for software

- Quality shares: PLTR shares for AI/defense exposure, NVDA shares for semiconductors, SHOP shares for e-commerce

- Educational focus: Study today's structures:

- Calendar spreads (PLTR $205M, SHOP $120M) - time decay mechanics

- Diagonal spreads (NVDA $176M) - combining ITM longs with OTM shorts

- Protective puts (CIFR $82M) - hedging long stock positions

- Profit-taking (ALB $27.7M) - selling before binary events

Why this approach: Options amplify both gains AND losses exponentially. Starting with shares or ETFs builds market intuition without risking catastrophic losses. Paper trading teaches emotional discipline when positions move -30% against you (which they will!).

Key learning resources:

- Watch how PLTR positions perform through volatility (time decay lessons)

- Track NVDA earnings week IV crush (volatility lessons)

- Observe SHOP calendar spread profitability (spread mechanics)

- Monitor CIFR protective puts during construction updates (hedging education)

Critical rules for beginners:

- Never risk more than 1% of portfolio per trade until 100+ trades experience

- Don't trade earnings weeks until you've watched 10+ cycles understand IV crush

- Avoid YOLO plays entirely until you have 100+ trades and understand Greeks intimately

- If you don't understand delta, theta, vega, gamma - study BEFORE trading, not after losing

- Paper trade every strategy FIRST, then graduate to 1-contract live trades, then scale slowly

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

- Position sizing discipline (most important rule):

- YOLO: 1-2% max per position (expect total loss)

- Swing: 3-5% max per position

- Premium collector: 10-15% max allocated to sold premium

- Entry level: 1% max per position until 100+ trades

- Stop losses are mandatory (protect capital):

- Options: 25-30% loss triggers immediate exit (time decay accelerates losses)

- Shares: 7-10% loss for growth stocks (tighter for volatile names like CIFR)

- Spreads: 50% of max loss (don't let winning spreads become max losers)

- Profit-taking prevents regret:

- Take 50% off table at 50% gain (lock in profits early)

- Take another 25% at 100% gain (reduce risk exposure)

- Let final 25% run with trailing stop (protect remaining gains)

- Remember: You can't go broke taking profits, but you can go broke being greedy

- Time decay awareness (options lose value daily):

- November expiries losing 3-4% value per day now (theta accelerating)

- December expiries enter rapid decay after November 15 (45 days to expiry threshold)

- January expiries still have time value but theta picks up after December

- LEAPs (2026+) much safer for beginners due to slower theta decay

- Earnings risk management (IV crush destroys options):

- Implied volatility typically inflates 50-150% into earnings (NVDA, ALB examples)

- IV crush post-earnings can destroy profitable positions even if directionally correct

- Close short-dated options before earnings unless earnings volatility IS your thesis

- Consider spreads or calendars to mitigate IV risk vs naked calls/puts

Today's Specific Warnings:

Post-Earnings Volatility (PLTR, SHOP):

- Both stocks just reported - elevated volatility persists for 1-2 weeks

- Trading gamma support but could retest lows ($175 PLTR, $155 SHOP)

- Don't assume selloffs are over - need confirmation of support holding

- Options premium still elevated (62.9% IV PLTR, 62% IV SHOP) - expensive entry

NVDA Earnings in 15 Days:

- $176M position suggests institutions expect solid beat but capped upside at $200

- IV will spike into Nov 19 - if buying calls now, you're paying elevated premium

- Even correct directional bet can lose money to IV crush post-earnings

- Consider waiting until after earnings for cheaper entry unless conviction extremely high

CIFR Execution Risk:

- $82M hedge exists for a reason - construction timelines are AGGRESSIVE

- AWS July 2026 and Google September 2026 facilities are massive undertakings

- Any delay announcement could trigger 30-50% selloff from current $22.69

- Don't buy CIFR without protective puts - copy institutional hedging strategy

Lithium Commodity Cycle (ALB):

- $27.7M exiting before earnings is warning signal - sophisticated money derisking

- Lithium prices still down 80%+ from peak despite recent 10% bounce

- Tomorrow's earnings could gap stock ±7% either direction (±$6-7)

- If playing ALB, use spreads not naked calls/puts - commodity volatility is brutal

Valuation Concerns Across Portfolio:

- PLTR 254x forward P/E, NVDA 56x, SHOP 89x - no margin for error at these multiples

- Growth stocks with premium valuations get destroyed on any disappointment

- Diversify across multiple names - don't concentrate in 1-2 high-multiple growth stocks

- Consider value names or indices to balance growth exposure

Institutional vs. Retail Positioning:

Remember: Today's $654M represents sophisticated institutions with:

- Access to research, management teams, and proprietary data we don't see

- Ability to hedge in multiple ways (complex spreads, swaps, futures, shorts)

- Risk management departments and quantitative models

- Longer time horizons and ability to withstand 30-50% drawdowns

- Diversified portfolios with hundreds of positions we can't see

We see:

- PLTR $205M calendar spread (bullish timeframe extension)

They might also have:

- Short other software companies (pair trade)

- Long defense contractors (sector hedge)

- Short volatility positions (VIX)

- Hedged with puts or collars on underlying shares

- Other positions offsetting specific risks

Key insight: Don't blindly copy institutional trades assuming they're making simple directional bets. They're managing portfolios with hundreds of positions and access to hedging instruments retail traders can't access efficiently.

When to Override Unusual Activity:

Ignore the signal if:

- You don't understand the underlying business fundamentals

- Position size would exceed your personal risk limits

- Time horizon doesn't match your trading style (2026 LEAPs inappropriate for swing traders)

- Catalyst timing is too uncertain (CIFR construction could delay)

- You're emotionally attached to the trade (never marry a position)

- Valuation makes you uncomfortable even with good fundamentals

- You can't afford to lose 100% of the premium invested

Trust your discipline over FOMO. Missing one trade won't ruin your portfolio, but blowing up your account on one YOLO will.

📚 Educational Spotlight: Understanding Today's Complex Strategies

Calendar Spreads (PLTR $205M, SHOP $120M)

What they are:

- Buy longer-dated options, sell shorter-dated options at same strike

- Profit from time decay differential (short options decay faster than long)

- Used when expecting gradual move over extended period, not immediate explosive move

PLTR example:

- Buy February 2026 $160 calls ($130M) - 108 days out

- Sell November 2025 $160 calls ($50M) - 17 days out

- Net: If PLTR stays around $190-$200, short calls expire worthless (keep $50M), long calls retain most value

- Best case: PLTR consolidates through November, then rallies into February earnings

SHOP example:

- Buy February 2026 $140 calls ($79M) - 108 days out

- Sell January 2026 $160 calls ($41M) - 73 days out

- Net: If SHOP stays $155-$170 through January, short calls expire near worthless, long calls capture Q4 earnings rally

Why institutions use this:

- Capital efficient (short premium reduces net cost 40-50%)

- Defined risk (max loss = net debit paid)

- Benefits from patience (time decay works FOR you on short leg)

- Perfect for post-earnings consolidation then recovery thesis

Retail application:

- Start with 30-60 day calendars to learn mechanics

- Use on stocks with stable uptrends, not volatile earnings plays

- Close when short options approach expiry, roll to next month

- Requires active management - not "set it and forget it"

Diagonal Spreads (NVDA $176M)

What they are:

- Buy longer-dated option at one strike

- Sell shorter-dated option at different strike (typically higher for calls)

- Combines time decay benefit with directional bias

NVDA example:

- Buy November 2025 $165 calls ($120M) - deep ITM, 17 days out

- Sell January 2026 $200 calls ($56M) - OTM, 73 days out

- Net cost: $64M

- Thesis: NVDA rallies on Nov 19 earnings to $210-220, but then consolidates below $200 through January

Why institutions use this:

- Deep ITM calls act like synthetic long stock with defined risk

- Short OTM calls finance 47% of position ($56M of $120M)

- Captures earnings pop without unlimited risk

- Explicitly caps gains at short strike ($200) - accepting limited upside for reduced cost

Retail application:

- Requires understanding of both time decay AND directional movement

- Best used around known catalysts (earnings, product launches)

- Monitor delta on long leg (should be 70-90 for deep ITM)

- Be prepared for short leg to be tested - have assignment plan ready

Protective Puts (CIFR $82M)

What they are:

- Own stock, buy put options as insurance

- Limits downside while maintaining upside

- Cost is premium paid (like paying insurance premium)

CIFR example:

- Own CIFR shares at $22.69 (likely purchased much lower - 366% YTD run)

- Buy $22 puts for $30M (at-the-money protection)

- If stock crashes on construction delay, puts gain value offsetting share losses

- If stock rallies on execution success, puts expire worthless but shares gain

Why institutions use this:

- Secure profits after big rallies (366% YTD gain locked in)

- Sleep well during volatile periods (construction execution uncertainty)

- Tax-efficient vs selling shares (no capital gains triggered immediately)

- Maintain upside participation while defining downside risk

Retail application:

- Use on concentrated positions (>10% of portfolio in single name)

- Buy puts 5-15% below current price depending on volatility

- Accept 2-5% cost as "insurance premium" you hope expires worthless

- Roll puts quarterly as they decay - don't let protection lapse

⚠️ Options involve substantial risk and are not suitable for all investors. The unusual activity tracked here represents sophisticated institutional strategies that may be part of larger hedged portfolios not visible to retail traders. These positions represent past institutional behavior and don't guarantee future performance. Calendar spreads, diagonal spreads, and protective puts are advanced strategies requiring understanding of time decay, volatility, assignment risk, and position management. PLTR's 254x P/E and SHOP's 89x P/E represent extreme valuations with limited margin for error. CIFR's 366% YTD gain followed by $82M hedge signals execution risk on AWS/Google data center timelines. ALB's $27.7M exit before earnings demonstrates sophisticated players derisking before binary events. Always practice proper risk management and never risk more than you can afford to lose completely. Options can expire worthless, resulting in 100% loss of premium paid. Entry level investors should paper trade extensively before committing real capital.

📊 Total Flow Summary:

- Total Tracked: $654,200,000

- Largest Single Position: PLTR $205M (31% of total flow) - Calendar spread repositioning after earnings

- Sector Leaders: Post-Earnings Positioning $366M (56%), AI Infrastructure $258M (39%), Defensive/Hedging $30M (5%)

- Tickers Analyzed: 12 companies across software, semiconductors, e-commerce, mining, materials, defense, biotech, energy, aviation

- Strategy Mix: Calendar spreads, diagonal spreads, protective puts, profit-taking exits

- Expiry Range: November 2025 through February 2026 (LEAPs through October 2026 for CIFR)

- Key Theme: Sophisticated risk management through binary events, not blind speculation

📍 Original Analysis: All unusual option flow data analyzed using proprietary detection systems at Ainvest.com. Detailed trade-by-trade breakdowns including Greeks, probability analysis, and gamma-based support/resistance levels available at labs.ainvest.com.

⚖️ Copyright Notice: This analysis represents hundreds of hours of research, data processing, and institutional-grade option flow analysis. The methodologies, trade structures, and insights contained herein are proprietary to Ainvest.com. Unauthorized reproduction, distribution, or republication of this content without attribution constitutes copyright infringement. When referencing or sharing these insights, please credit Ainvest.com as the original source and direct readers to labs.ainvest.com for complete analysis. We invest significant resources to democratize institutional-grade options intelligence - proper attribution helps us continue this mission.