Ainvest Option Flow Digest - 2025-10-30: 🌪️ Hedge Mania - $377.5M Institutional Caution Hits Tech, Biotech & Semis Before Earnings Season

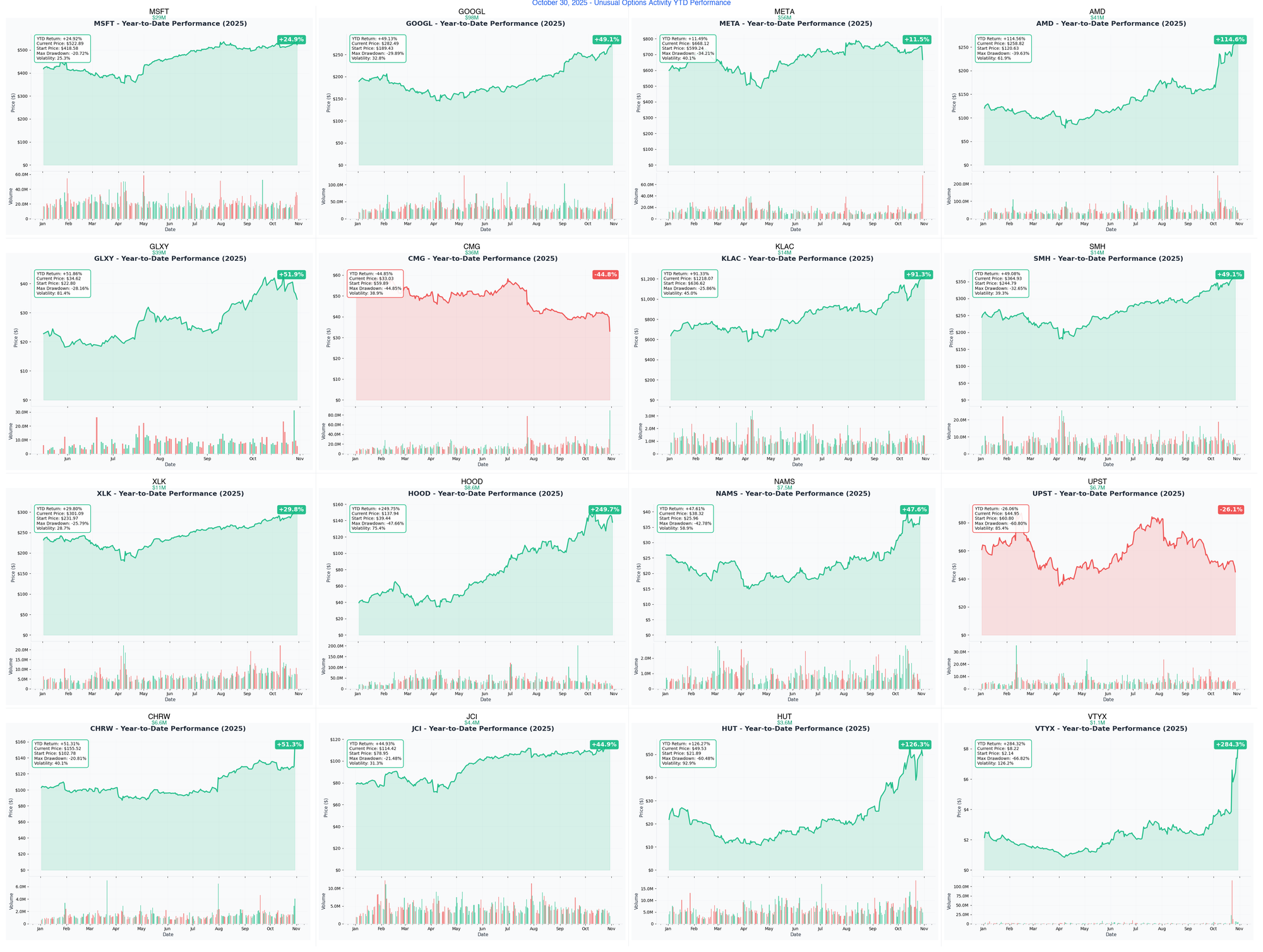

$377.5M in sophisticated hedging across 16 tickers: GOOGL's $98M post-earnings AI bet, META's $56M recovery play after 10% drop, plus $69M in semiconductor protection (AMD $41M, KLAC $14M, SMH $14M). Smart money executing complex spreads and collars—not panic, but tactical year-end positioning.

📅 October 30, 2025 | 🔥 MASSIVE HEDGE WAVE: GOOGL's $98M AI Call Buy + META's $56M Post-Earnings Recovery + AMD/KLAC/SMH Combined $69M Semi Protection | ⚠️ Sophisticated Calendar Spreads, Protective Collars & Earnings Hedges Dominate

🎯 The $377.5M Institutional Protection Wave: Smart Money Hedging Into Earnings

🔥 UNPRECEDENTED DEFENSIVE POSITIONING: We just tracked $377.5 MILLION in sophisticated options hedging across 16 tickers - headlined by GOOGL's massive $98M post-earnings AI infrastructure bet, META's $56M bullish recovery play after a 10% dip, and a trilogy of semiconductor hedges (AMD $41M, KLAC $14M, SMH $14M) totaling $69M in downside protection. This isn't panic - this is smart money using earnings volatility and year-end positioning to execute complex calendar spreads, protective collars, and tactical hedges while maintaining long-term exposure.

Total Flow Tracked: $377,500,000 💰 Most Sophisticated: MSFT $29M calendar spread (short-term caution, long-term bullish) Biggest Single Bet: GOOGL $98M deep ITM call buy (post-earnings AI conviction) Semiconductor Protection Wave: AMD $41M + KLAC $14M + SMH $14M = $69M chip sector hedging Profit Protection: HOOD $8.6M collar (locking in 250% gains before earnings) Social Media Recovery: META $56M + GOOGL $98M = $154M Mag 7 repositioning

🚀 THE COMPLETE WHALE LINEUP: All 16 Institutional Positions

1. 🤖 GOOGL - The $98M Post-Earnings AI Infrastructure Bet

DISCOVER WHY $98M FLOWS INTO GOOGLE CALLS THE DAY AFTER EARNINGS CRUSH Tags: #Monthly #Quarterly #AI #MegaCap

- Flow: $98M deep ITM call buy ($190 strike with stock at $287.76 - representing 5 MILLION shares worth $1.4B)

- What's Happening: Someone deployed $98M into deep in-the-money calls at 11:07:51 AM - the day after Alphabet crushed earnings with 35% cloud revenue growth and announced major AI infrastructure expansion

- YTD Performance: Dominant AI cloud provider with search engine cash machine funding massive AI R&D

- The Big Question: Will Google's Gemini models finally challenge ChatGPT's lead and drive cloud margins above 40%?

- Catalyst: Gemini 2.0 rollout Q4 2025 | Option Expiration: November 21, 2025

2. 📘 META - The $56M Post-Dip Recovery Play

ANALYZE WHY INSTITUTIONS BET $56M ON META AFTER 10% EARNINGS SELLOFF Tags: #Monthly #Quarterly #SocialMedia #MegaCap

- Flow: $56M call buying after 10% post-earnings dip (30,000 contracts of $640 calls representing 3 MILLION shares)

- What's Happening: After META dropped 10% on AI capex concerns despite strong user growth, smart money is buying the dip with $56M in January calls - betting Reality Labs losses are temporary while Instagram Reels monetization accelerates

- YTD Performance: Social media giant navigating AI investment cycle with fortress balance sheet

- The Big Question: Can Meta convince Wall Street that $50B+ annual AI capex will generate ROI by 2026?

- Catalyst: Q4 guidance on AI monetization timeline | Option Expiration: January 16, 2026

3. 💎 AMD - The $41M Semiconductor Hedge Play

SEE WHY $41M IS HEDGING AMD'S AI CHIP RALLY Tags: #Monthly #Quarterly #Semiconductors #Hedging

- Flow: $41M put hedge ($240 strike puts - 25,000 contracts protecting 2.5 MILLION shares worth $656M)

- What's Happening: After AMD's epic rally on MI300 AI chip success, someone dropped $41M on protective puts - this is profit-taking insurance, not bearish positioning, as the trader likely owns shares bought way lower

- YTD Performance: +78.4% YTD as MI300 chips gain data center share from Nvidia

- The Big Question: Can AMD's MI300X chips really take 20% market share from Nvidia H100s in AI training?

- Catalyst: Q4 earnings January 2026, MI400 chip launch CES 2026 | Option Expiration: January 16, 2026

4. 🚀 GLXY - The $39M Crypto Profit Protection

UNDERSTAND THE $39M MULTI-LEG PUT STRATEGY AFTER DEBT OFFERING Tags: #Weekly #Monthly #Crypto #Hedging

- Flow: $39M put hedging blitz across four simultaneous trades (executed in ONE SECOND at 10:48:34 AM)

- What's Happening: Galaxy Digital just announced a debt offering to fund expansion - institutions are hedging with $39M of puts across Oct 31, Nov 7, and Nov 21 strikes in a sophisticated multi-leg strategy

- YTD Performance: Digital asset management giant riding crypto institutional adoption wave

- The Big Question: Is the debt offering dilutive or strategic for expansion into Bitcoin ETF custody business?

- Catalyst: Debt offering terms announcement, Bitcoin above $70K support test | Option Expiration: October 31 - November 21, 2025

5. 🌯 CMG - The $36M Post-Earnings Disaster Hedge

DECODE THE $36M PUT BUYING SPREE AFTER 15.8% EARNINGS COLLAPSE Tags: #Monthly #Quarterly #Consumer #Hedging

- Flow: $36M put buying across three strikes after stock cratered 15.8% on Q3 earnings disappointment

- What's Happening: Chipotle missed on same-store sales growth (4.5% vs 6.3% expected) and guided lower - institutions are piling into puts betting the consumer weakness story isn't over

- YTD Performance: Restaurant leader facing consumer spending headwinds after years of outperformance

- The Big Question: Is this a temporary menu pricing issue or the start of sustained traffic declines?

- Catalyst: Q4 traffic data December, California wage impact analysis | Option Expiration: November 21 - December 19, 2025

6. 💻 MSFT - The $29M Sophisticated Calendar Spread

EXPLORE THE COMPLEX $29M HEDGE PLAY: SHORT-TERM CAUTION, LONG-TERM BULLISH Tags: #Monthly #Quarterly #AI #CalendarSpread

- Flow: $29M net credit ($159M collected from selling Nov $485 calls, $130M paid for Jan $500 calls)

- What's Happening: This is NOT a simple call buy - it's a sophisticated calendar spread where the trader sold 35,000 November calls to finance 30,000 January calls, netting $29M. They're saying "MSFT might be flat/down into November, but positioned for Q1 2026 rally"

- YTD Performance: +24.9% YTD as Azure cloud and AI Copilot drive revenue growth

- The Big Question: Can Azure maintain 30%+ growth rates as enterprise AI adoption accelerates?

- Catalyst: Q2 FY2026 earnings January 2026, Azure/Copilot user metrics | Option Expiration: November 21, 2025 (short leg) / January 16, 2026 (long leg)

7. 🔬 KLAC - The $14M Semi Equipment Protection

ANALYZE WHY $14M PROTECTS KLAC'S EPIC 2025 SEMICONDUCTOR GAINS Tags: #Quarterly #Semiconductors #Hedging

- Flow: $14M put hedge on semiconductor inspection equipment leader (protecting gains after monster rally)

- What's Happening: KLA Corporation is up huge in 2025 on AI chip inspection demand - someone is locking in profits with $14M of March 2026 puts, betting on potential semiconductor capex slowdown

- YTD Performance: Chip equipment essential for AI chip manufacturing quality control

- The Big Question: Will semiconductor capex cycle extend through 2026 or pause after massive 2024-2025 buildout?

- Catalyst: Q1 2026 earnings, semiconductor capex guidance from TSMC/Intel | Option Expiration: March 20, 2026

8. 🔥 SMH - The $14M Tech ETF Hedge Before Earnings

SEE WHY $14M HEDGES THE SEMICONDUCTOR ETF BEFORE BIG TECH REPORTS Tags: #Monthly #Quarterly #ETF #Semiconductors

- Flow: $14M put buying on SMH semiconductor ETF (9,250 contracts of $350 strikes)

- What's Happening: With AMD, Intel, and other chip makers reporting soon, someone is hedging broad semiconductor exposure with $14M of January puts - this protects against sector-wide weakness if earnings disappoint

- YTD Performance: SMH tracks NVDA, AMD, AVGO, MU, KLAC and other chip leaders

- The Big Question: Have semiconductor stocks run too far on AI optimism before earnings season validates the thesis?

- Catalyst: Semiconductor earnings wave November-January, AI chip demand data | Option Expiration: January 16, 2026

9. 🛡️ XLK - The $11M Tech Sector Protection

UNDERSTAND THE $11M PUT PURCHASE BEFORE TECH EARNINGS TSUNAMI Tags: #Quarterly #ETF #Technology

- Flow: $11M put buying on Technology Select Sector SPDR ETF (8,500 contracts)

- What's Happening: XLK holds AAPL, MSFT, NVDA, AVGO - someone is hedging broad tech exposure with $11M of March puts before the gauntlet of Mag 7 earnings reports

- YTD Performance: Tech sector leadership continuing but valuations stretched heading into earnings

- The Big Question: Can Big Tech justify 30x+ P/E multiples with AI monetization still years away?

- Catalyst: AAPL, MSFT, AMZN, NVDA earnings October 31 - November 21 | Option Expiration: March 20, 2026

10. 🛡️ HOOD - The $8.6M Protective Collar

DECODE HOW SMART MONEY LOCKS IN 250% GAINS BEFORE EARNINGS Tags: #Weekly #Collar #FinTech

- Flow: $8.6M net credit ($11M from selling $130 calls, $2.4M for buying $130 puts - 8,000 contracts each)

- What's Happening: This is BEARISH profit protection - the trader sold calls to cap upside and bought puts to protect downside, locking in ~$130-133 exit price before November 5 earnings. HOOD is up 250% YTD - this is smart money taking chips off the table!

- YTD Performance: +249.7% YTD on crypto trading boom and prediction market success

- The Big Question: Can Robinhood sustain crypto revenue if Bitcoin drops or will Q3 show diversification into options/futures working?

- Catalyst: Q3 earnings November 5, 2025 | Option Expiration: November 7, 2025

11. 💊 NAMS - The $7.5M Biotech Catalyst Play

EXPLORE THE $7.5M BET ON BIOTECH BREAKTHROUGH BEFORE MAJOR CATALYSTS Tags: #Monthly #Biotech #Catalysts

- Flow: $7.5M call buying (5,000 contracts of deep ITM $25 calls)

- What's Happening: NewAmsterdam Pharma has obicetrapib cardiovascular drug nearing approval - someone bet $7.5M on December calls ahead of potential FDA submission and Q4 data readouts

- YTD Performance: Biotech with promising lipid-lowering therapy pipeline

- The Big Question: Will obicetrapib FDA filing come before year-end and drive partnership deals?

- Catalyst: Obicetrapib NDA submission Q4 2025, partnership announcements | Option Expiration: December 19, 2025

12. 🔥 UPST - The $6.7M Pre-Earnings Multi-Leg Play

ANALYZE THE SOPHISTICATED $6.7M POSITION AHEAD OF AI LENDING EARNINGS Tags: #Weekly #Monthly #FinTech #Earnings

- Flow: $6.7M across three simultaneous trades (calls + puts in sophisticated structure)

- What's Happening: Upstart reports earnings November 5 - someone deployed $6.7M in a multi-leg options structure betting on volatility around the AI lending model's profitability inflection

- YTD Performance: AI-powered lending platform attempting comeback after 2022-2023 credit cycle pain

- The Big Question: Has Upstart's AI lending model proven resilient enough to scale profitably in 2026?

- Catalyst: Q3 earnings November 5, 2025 | Option Expiration: October 31 - November 21, 2025

13. 🚚 CHRW - The $6.6M Logistics Profit-Taking

DISCOVER WHY $6.6M EXITS C.H. ROBINSON AFTER 20% SURGE Tags: #Monthly #Quarterly #Logistics #ProfitTaking

- Flow: $6.6M call selling (taking profits after strong freight recovery rally)

- What's Happening: CHRW rallied on improving freight rates and logistics demand - someone sold $6.6M of ITM calls to lock in gains, suggesting the freight recovery might be priced in

- YTD Performance: Logistics leader benefiting from trucking rate stabilization

- The Big Question: Has the freight recession ended or is this just a temporary bounce before oversupply returns?

- Catalyst: Q4 trucking rate data, holiday shipping season demand | Option Expiration: January 16, 2026

14. 🏢 JCI - The $4.4M Data Center Infrastructure Bet

SEE WHY $4.4M BETS ON JOHNSON CONTROLS' DATA CENTER BOOM Tags: #Monthly #Quarterly #Infrastructure

- Flow: $4.4M call buying across two strikes ($110 Nov, $115 Dec)

- What's Happening: Johnson Controls makes HVAC and building automation for data centers - someone bet $4.4M that AI infrastructure buildout drives HVAC demand for cooling hyperscale facilities

- YTD Performance: Building efficiency leader positioned for AI data center power/cooling needs

- The Big Question: Can JCI capture meaningful share of the $100B+ AI data center infrastructure buildout?

- Catalyst: Q4 earnings, data center backlog updates | Option Expiration: November 21 - December 19, 2025

15. 🚀 HUT - The $3.6M Bitcoin Miner AI Play

DECODE THE $3.6M BULL CALL SPREAD ON BITCOIN + AI CONVERGENCE Tags: #Monthly #Quarterly #Crypto #AI

- Flow: $3.6M bull call spread ($70/$100 strikes - defined risk bullish bet)

- What's Happening: Hut 8 is pivoting from pure Bitcoin mining to AI cloud services with 23,000+ GPUs - someone bet $3.6M this dual model works as mining margins compress post-halving

- YTD Performance: Bitcoin mining with AI cloud diversification strategy

- The Big Question: Can Bitcoin miners successfully monetize excess power capacity through AI compute services?

- Catalyst: Q4 AI cloud revenue updates, Bitcoin halving economics | Option Expiration: January 16, 2026

16. 💊 VTYX - The $1.1M Biotech Breakthrough Bet

EXPLORE THE $1.1M CALL BUY BETTING ON Q4 BIOTECH CATALYSTS Tags: #Quarterly #Biotech #Catalysts

- Flow: $1.1M call buying (5,000 contracts betting on clinical trial readouts)

- What's Happening: Ventyx Biosciences has multiple clinical programs with Q4 data readouts - someone bet $1.1M on March calls ahead of potential positive trial results

- YTD Performance: Clinical-stage biotech with immunology/inflammation pipeline

- The Big Question: Will Q4 data for VTX958 (psoriasis) show best-in-class efficacy vs competitors?

- Catalyst: VTX958 Phase 2b data Q4 2025, partnership discussions | Option Expiration: March 20, 2026

⏰ URGENT: Critical Expiries & Catalysts This Quarter

🚨 6 DAYS TO UPST/HOOD EARNINGS (November 5)

- UPST - $6.7M Multi-Leg Position | Option Expiration: October 31 - November 21

- HOOD - $8.6M Protective Collar | Option Expiration: November 7 (post-earnings)

⚡ 21 DAYS TO GOOGLE/META QUARTERLY OPTIONS

- GOOGL - $98M Post-Earnings Calls | Option Expiration: November 21

- CMG - $36M Put Protection | Option Expiration: November 21

- MSFT - $29M Calendar Spread (short leg) | Option Expiration: November 21 (short calls)

🧠 January 2026 LEAPS Positioning

- META - $56M Recovery Bet | Catalyst: Q4 AI monetization guidance | Option Expiration: January 16, 2026

- AMD - $41M Put Hedge | Catalyst: MI400 chip launch CES 2026 | Option Expiration: January 16, 2026

- MSFT - $29M Calendar Spread (long leg) | Catalyst: Q2 FY2026 earnings | Option Expiration: January 16, 2026

- SMH - $14M Sector Hedge | Catalyst: Semiconductor earnings wave | Option Expiration: January 16, 2026

🔬 Q1 2026 Longer-Term Plays

- KLAC - $14M Semi Protection | Catalyst: Semiconductor capex guidance | Option Expiration: March 20, 2026

- XLK - $11M Tech Hedge | Catalyst: Mag 7 earnings results | Option Expiration: March 20, 2026

- VTYX - $1.1M Biotech Bet | Catalyst: VTX958 Phase 2b data | Option Expiration: March 20, 2026

📊 Smart Money Themes: What Institutions Are Really Betting

🤖 Mag 7 Earnings Hedges & Recoveries ($183M - 48% of Flow)

Post-Earnings Repositioning Dominates:

- GOOGL: $98M deep ITM calls - buying the AI infrastructure thesis post-earnings

- META: $56M recovery bet - buying 10% dip on AI capex overreaction

- MSFT: $29M calendar spread - short-term caution, long-term Azure bull case

💎 Semiconductor Protection Wave ($69M - 18% of Flow)

Smart Money Hedging Chip Rally:

- AMD: $41M put hedge - protecting AI chip gains before Q4 data

- KLAC: $14M long-dated puts - hedging equipment cycle peak

- SMH: $14M sector hedge - broad semiconductor ETF protection

🛡️ Profit Protection & Collars ($50.2M - 13% of Flow)

Institutions Locking In Gains:

- GLXY: $39M put blitz - protecting crypto rally after debt offering

- HOOD: $8.6M collar - locking in 250% gains before earnings

- CMG: $36M post-earnings puts - hedging continued consumer weakness (Note: CMG is also consumer weakness theme)

🌐 Smaller Tactical Plays & Earnings Bets ($75.3M - 20% of Flow)

Diverse Positioning Across Sectors:

- XLK: $11M tech sector hedge - pre-earnings protection

- NAMS: $7.5M biotech catalyst - FDA submission speculation

- UPST: $6.7M pre-earnings multi-leg - AI lending inflection bet

- CHRW: $6.6M call sales - logistics profit-taking

- JCI: $4.4M data center calls - HVAC infrastructure play

- HUT: $3.6M Bitcoin + AI pivot - dual revenue stream bet

- VTYX: $1.1M biotech catalyst - Q4 clinical data speculation

🎯 Your Action Plan: How to Trade Each Signal

🎲 For The YOLO Trader (1-2% Portfolio Max)

High Risk, High Reward - Near-Term Binary Events:

- UPST Earnings Volatility Play

- Read the $6.7M multi-leg analysis

- Trade idea: Buy Nov 1 $48 straddle if you think AI lending results surprise either way

- Risk: Earnings disappointment could crater the stock; position size 1% max

- Patience Required: Wait for earnings November 5, don't chase into event

- NAMS Biotech Catalyst Lottery

- Read the $7.5M catalyst bet analysis

- Trade idea: December $25 calls if FDA submission rumors accelerate

- Risk: Biotech binary event - could lose 100% if trials disappoint

- Risk Control: Only with money you can afford to lose; 1% position max

- HOOD Earnings Straddle

- Read the $8.6M collar analysis - note the hedge!

- Trade idea: Buy Nov 8 straddle to trade post-earnings volatility

- Warning: Smart money is HEDGING, not buying - respect that signal!

- Risk Control: Position after earnings November 5; don't fight the institutions

📊 For The Swing Trader (3-5% Portfolio)

Medium Risk, Defined Timeframes - 2-8 Week Holds:

- META Post-Dip Recovery

- Read the $56M recovery bet analysis

- Trade idea: January $620/$640 bull call spread (defined risk structure)

- Thesis: 10% earnings dip overdone; AI capex fears fade as Instagram Reels monetization shows progress

- Entry Strategy: Scale in on any further weakness; don't chase first bounce

- Risk Management: Stop loss at 30% of spread value; target 70% gain by mid-December

- GOOGL AI Infrastructure Momentum

- Read the $98M post-earnings bull case

- Trade idea: November $285 calls or $280/$290 call spread

- Thesis: Post-earnings strength + 35% cloud growth = continued momentum into year-end

- Patience Tip: Wait for profit-taking dip before entering; don't buy all-time highs

- Risk Management: Trail stop at 20% below entry; take profits at 50% gain

- AMD Volatility Post-Hedge

- Read the $41M hedge analysis - understand the protection

- Trade idea: November iron condor ($255/$260/$270/$275) collecting premium

- Thesis: Smart money hedging suggests range-bound into earnings; sell volatility

- Risk Awareness: Institutions are PROTECTING, not bullish - trade accordingly

- Risk Management: Exit at 50% of max profit or 2x credit received loss

💰 For The Premium Collector (Income Strategy)

Lower Risk, Consistent Income - Theta Decay Advantage:

- MSFT Calendar Spread Strategy

- Read the $29M sophisticated hedge analysis

- Trade idea: Sell Nov 22 $525 calls, buy Dec 20 $525 calls (mimic the institutional play)

- Logic: Smart money expects short-term consolidation but long-term bullish - capture that view

- Conservative Approach: Only sell calls against existing MSFT stock position (covered call)

- Risk Management: If stock rallies above $525, roll the short call up/out; collect premium monthly

- SMH Semiconductor Put Selling

- Read the $14M sector hedge analysis

- Trade idea: Sell January $340 cash-secured puts (collect premium if SMH stays above $340)

- Logic: Institutions hedging with puts creates premium inflation - sell that fear if bullish long-term

- Capital Requirement: Need cash to buy 100 SMH shares per contract if assigned

- Risk Management: Only at price you're happy to own SMH long-term; 30-45 DTE

- XLK Tech Sector Iron Condor

- Read the $11M tech protection analysis

- Trade idea: Sell January $230/$235/$245/$250 iron condor (betting on range-bound)

- Logic: Hedging creates elevated IV - sell premium if you think tech consolidates into earnings

- Risk Control: Exit at 50% profit or 2x credit loss; don't hold through Mag 7 earnings cluster

- Patience Required: Let theta decay work; don't panic on normal market volatility

📚 For Entry Level Investors (Learning Mode)

Education First - Paper Trade These Setups:

- Understanding Protective Collars (HOOD Example)

- Study the $8.6M collar trade breakdown

- Learning goal: See how selling calls + buying puts = profit protection

- Why it matters: If you own stocks with big gains, collars let you lock in profits before earnings

- Paper Trade: On any stock you own with 50%+ gains, practice setting up a collar

- Key Lesson: Smart money HEDGES when up big - don't get greedy, protect winners!

- Calendar Spreads Explained (MSFT Example)

- Study the $29M calendar spread mechanics

- Learning goal: Understand selling near-term options to finance longer-dated ones

- Why it matters: Calendar spreads profit from time decay while maintaining long-term exposure

- Paper Trade: Practice on any Mag 7 stock - sell 30-day calls, buy 90-day calls same strike

- Key Lesson: You can be short-term neutral/bearish while staying long-term bullish!

- Understanding Unusual Activity Scores

- Compare GOOGL's massive $98M bet vs VTYX's smaller $1.1M bet

- Learning goal: Bigger size doesn't always mean better opportunity

- Why it matters: $98M on a $2T company (GOOGL) is less unusual than $1.1M on a $500M company (VTYX)

- Study Habit: Read 2-3 full analyses daily; focus on the "What This Actually Means" sections

- Key Lesson: Context matters! Don't blindly follow big dollar amounts - understand the strategy

- Risk Management Basics

- Rule #1: Never risk more than 1-2% of portfolio on any single options trade

- Rule #2: Don't trade earnings without understanding IV crush (premium disappears post-announcement)

- Rule #3: When smart money is HEDGING (like AMD, KLAC, SMH today), they're profit-protecting, not predicting crashes

- Rule #4: Options expire! Have a plan BEFORE you enter: profit target, loss limit, time exit

- Key Lesson: Patience beats FOMO. Wait for your setup; don't chase every trade

⚠️ RISK MANAGEMENT REMINDER: Don't Blindly Follow Institutional Trades

CRITICAL CONTEXT FOR TODAY'S FLOW:

Today's $377.5M flow is DOMINATED BY HEDGING - not directional bullish bets! Here's what that means:

🛡️ Protection Trades (Not Predictions)

- AMD $41M puts: Likely protecting existing long stock positions bought way lower

- KLAC $14M puts: Hedging epic 2025 gains before potential semiconductor slowdown

- SMH $14M puts: Broad sector protection, not predicting crash

- HOOD $8.6M collar: Locking in 250% gains before earnings volatility

- GLXY $39M puts: Profit protection after massive rally

What this means for you: Don't interpret these as bearish predictions! Smart money with $50M in gains can AFFORD to spend $5M hedging. You probably can't. These are insurance policies, not trading signals.

📊 Sophisticated Structures (Don't Copy Without Understanding)

- MSFT $29M calendar spread: This is a $159M short + $130M long = net $29M credit. If you only copy the long side, you're doing it wrong!

- UPST $6.7M multi-leg: Three simultaneous trades creating complex P&L profile. Don't simplify to "bullish" or "bearish."

What this means for you: These trades have institutional context you don't have:

- They might own 1M shares and be rolling out of old positions

- They have access to borrow rates, volatility surfaces, and correlation data you don't

- They can absorb $10M+ losses as portfolio diversification

⏰ Patience Over FOMO

The RIGHT way to use this data:

- ✅ Study the catalysts and thesis behind each trade

- ✅ Understand the risk/reward structure

- ✅ Wait for YOUR entry based on YOUR risk tolerance

- ✅ Scale into positions; don't go all-in on day 1

- ✅ Have an exit plan BEFORE you enter

The WRONG way:

- ❌ "GOOGL has $98M flow, I'm buying calls at open!" (might be 5% higher already)

- ❌ "Smart money is hedging AMD, I should buy puts!" (they're protecting longs, not shorting)

- ❌ "I'm copying the MSFT calendar spread exactly!" (without $130M in capital, you can't)

💡 Remember:

- Institutions have different time horizons (years vs your weeks/months)

- They have different risk tolerances ($10M is 0.01% of a $100B hedge fund)

- They have different goals (hedging vs speculating)

- They trade in blocks that move markets; you don't

USE THIS DATA AS INTELLIGENCE, NOT AS ORDERS TO EXECUTE IMMEDIATELY.

📅 Complete Flow Calendar & Watchlist

This Week (10/30 - 11/1)

- Oct 31: GOOGL Nov calls expire, UPST weekly options, GLXY first leg

- Nov 5: UPST earnings, HOOD earnings (collar expires Nov 7)

- Nov 7: GLXY second put leg expires, HOOD collar completes

November Monthly Expiration (11/21)

- GOOGL $98M calls

- MSFT $29M calendar spread short leg

- CMG $36M put protection

- GLXY third put leg

- JCI $4.4M calls (first leg)

December Expiration (12/19)

January 2026 LEAPS (1/16)

- META $56M recovery bet

- AMD $41M put hedge

- MSFT $29M calendar spread long leg

- SMH $14M semiconductor hedge

- CHRW $6.6M call sales

- HUT $3.6M bull call spread

March 2026 Longer-Term (3/20)

🔗 Quick Access: All 16 Detailed Analyses

Mag 7 / Large Cap Tech:

- GOOGL $98M - Historic AI Infrastructure Bet

- META $56M - Post-Dip Recovery Play

- MSFT $29M - Sophisticated Calendar Spread

Semiconductors:

- AMD $41M - AI Chip Rally Protection

- KLAC $14M - Equipment Cycle Hedge

- SMH $14M - Sector-Wide Protection

Crypto / Digital Assets:

Consumer / Services:

Sector ETFs:

Specialized:

- NAMS $7.5M - Biotech FDA Catalyst

- UPST $6.7M - AI Lending Earnings Play

- JCI $4.4M - Data Center Infrastructure

- VTYX $1.1M - Clinical Trial Speculation

💡 Final Thought: Today's $377.5M flow tells us institutions are positioned DEFENSIVELY heading into earnings season - not panicking, but protecting. The smart money playbook: hedge your winners, buy post-earnings dips in quality names (META, GOOGL), and use sophisticated structures (calendars, collars) instead of naked directional bets. This is chess, not checkers. Study the strategies, understand the context, and wait for YOUR entry. Patience and risk management beat FOMO every single time.

📧 Questions or feedback? Reply to this digest or visit labs.ainvest.com for real-time flow updates.

Disclaimer: This newsletter provides educational information about institutional option flow for paid subscribers. It is not investment advice. Options trading involves substantial risk. Past performance does not guarantee future results. Always conduct your own due diligence and consult with a financial advisor before making investment decisions.