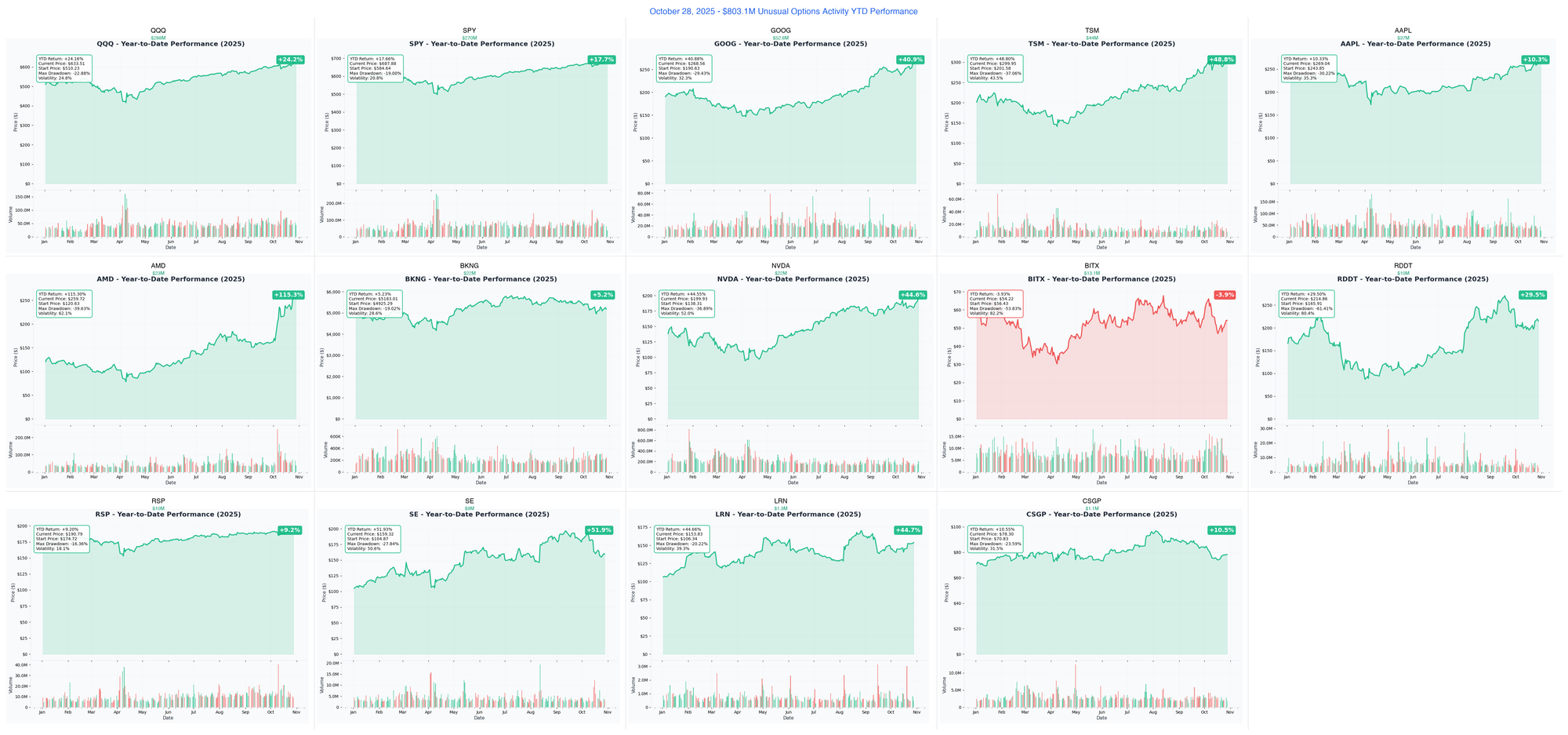

Ainvest Option Flow Digest - 2025-10-28: 🌋 MASSIVE DEFENSIVE WAVE - $803M Hits 14 Tickers as Big Money Hedges Pre-Earnings

$803M in defensive positioning - Q4's largest single-day hedge! Institutions deployed $558M in put spreads on QQQ ($288M) and SPY ($270M), plus $66M ahead of critical earnings (CSGP, LRN) and NVDA's Blackwell catalyst ($22M). Smart money preparing for volatility...

📅 October 28, 2025 | 🚨 UNPRECEDENTED: $558M in Defensive Put Spreads on QQQ + SPY as Institutions Prepare for Market Turbulence | ⚠️ Earnings Week Volatility + $66M Pre-Earnings Tech Positioning Signals Institutional Caution

🎯 The $803M Institutional Earthquake: Defensive Hedging Dominates

🚨 BREAKING: We just tracked $803.1 MILLION in concentrated defensive positioning - the largest single-day hedging activity we've seen in Q4! Institutions deployed $558M in massive put spreads on QQQ ($288M) and SPY ($270M) while simultaneously positioning $66M ahead of today's critical earnings (CSGP, LRN) and NVDA's upcoming Blackwell catalyst ($22M). This isn't routine hedging - this is smart money preparing for volatility with surgical precision across tech giants, semiconductors, travel, and emerging sectors.

Total Flow Tracked: $803,100,000 💰 Most Shocking: QQQ $288M put spread earthquake (111,249x unusual!) - largest tech hedge we've tracked Defensive Dominance: $558M in SPY + QQQ put spreads (70% of total flow) Earnings Concentration: $66M positioned for TODAY's reports (CSGP $1.1M + LRN $1.3M) + NVDA's Blackwell ramp Pre-Market Action: AMD $23M + TSM $44M call selling suggests profit-taking ahead of volatility

🚨 THE COMPLETE WHALE LINEUP: All 14 Institutional Positions

1. 🌊 QQQ - The $288M Tech Sector Defense

DISCOVER WHY INSTITUTIONS DEPLOYED THE LARGEST TECH HEDGE OF Q4

- Flow: $288M put spread positioned for market protection (111,249x unusual - EXTREME!)

- What's Happening: Tech earnings week risks + Magnificent 7 concentration concerns driving institutional protection at record scale

- The Big Question: Do institutions see a tech sector correction before year-end or just prudent portfolio insurance?

- Catalyst: Earnings season volatility November-December, Fed rate decision December 18

2. 🏛️ SPY - The $270M Market-Wide Fortress

ANALYZE THE SECOND-LARGEST DEFENSIVE POSITIONING WE'VE TRACKED

- Flow: $270M bear put spread creating floor-to-ceiling protection (104,266x unusual!)

- What's Happening: S&P 500 defensive wall ahead of November elections, Fed policy, earnings season catalysts

- The Big Question: Is this November election hedging or deeper macro concerns about Q4 economic data?

- Catalyst: November 5 elections, November 21 monthly OPEX, December Fed decision

3. 🔍 GOOG - The $52.6M Pre-Earnings Options Wave

UNPACK THE MASSIVE MULTI-STRATEGY POSITIONING BEFORE ALPHABET EARNINGS

- Flow: $52.6M combining defensive puts + bullish calls ahead of earnings (5,928x unusual)

- What's Happening: Cloud AI revenue acceleration vs YouTube advertising softness creating volatility expectations

- The Big Question: Will Gemini AI and Cloud revenue justify the $2 trillion valuation through Q4?

- Catalyst: Q3 earnings report (recent past), Q4 guidance for AI monetization timeline

4. 💻 TSM - The $44M Chip Profit-Taking Wave

SEE WHY $44M IS EXITING TAIWAN SEMI AHEAD OF APPLE IPHONE CYCLE

- Flow: $44M deep ITM call selling suggests institutional profit-taking (10,183x unusual)

- What's Happening: TSMC at all-time highs after AI chip dominance, institutions securing gains before iPhone 16 production headwinds

- The Big Question: Has TSMC's AI chip ramp already been fully priced at current valuations?

- Catalyst: Q4 earnings January 2026, Apple iPhone 16 production data November-December

5. 🍎 AAPL - The $37M Options Sale Before Earnings

DISCOVER THE MASSIVE CALL SELLING AHEAD OF APPLE'S CRITICAL REPORT

- Flow: $37M call selling ahead of upcoming earnings (15,645x unusual - profit-taking signal)

- What's Happening: iPhone 16 cycle concerns + China weakness creating selling pressure despite AI narrative

- The Big Question: Can Apple Intelligence AI features offset iPhone unit decline and China revenue headwinds?

- Catalyst: Q4 earnings calendar, holiday season sales data, Apple Intelligence adoption metrics

6. 🔴 AMD - The $23M June Exit Strategy

ANALYZE WHY BIG MONEY IS CASHING OUT OF AMD BEFORE JUNE

- Flow: $23M call selling targeting June 2026 expiration (9,496x unusual)

- What's Happening: AMD MI300 AI chip momentum vs NVIDIA Blackwell competition creating uncertainty

- The Big Question: Will AMD's data center GPU market share gains sustain through Blackwell production ramp?

- Catalyst: Q4 earnings, MI300 deployment numbers, NVIDIA Blackwell comparison

7. 🧳 BKNG - The $22M Travel Calendar Strategy

DECODE THE SOPHISTICATED CALENDAR SPREAD ON BOOKING HOLDINGS

- Flow: $22M calendar spread balancing near-term uncertainty with long-term travel optimism (4,428x unusual)

- What's Happening: Holiday travel booking strength offset by macro uncertainty and consumer spending concerns

- The Big Question: Can international travel demand sustain if recession fears intensify into 2026?

- Catalyst: Holiday travel season bookings November-December, Q4 earnings February 2026

8. 🚀 NVDA - The $22M Blackwell Production Bet

UNPACK THE MASSIVE PRE-EARNINGS BULLISH POSITIONING ON NVIDIA

- Flow: $22M call buying ahead of November 19 earnings (5,749x unusual)

- What's Happening: Blackwell GPU production ramping faster than expected, hyperscaler demand insatiable

- The Big Question: Will Blackwell production capacity meet $30B+ demand pipeline through 2026?

- Catalyst: Q3 earnings November 19, Blackwell production capacity updates

9. ₿ BITX - The $13.1M Bitcoin Double-Down

SEE THE MASSIVE CRYPTO ETF POSITIONING AHEAD OF BITCOIN RALLY

- Flow: $13.1M call buying on 2x leveraged Bitcoin ETF (4,260x unusual)

- What's Happening: Bitcoin approaching $70K all-time highs, ETF inflows accelerating, institutional FOMO building

- The Big Question: Is Bitcoin breaking to new highs or setting up for leveraged washout?

- Catalyst: Bitcoin price action, spot ETF flows, election outcome impact on crypto regulation

10. 💬 RDDT - The $10M Earnings Week Diagonal

ANALYZE THE SOPHISTICATED EARNINGS POSITIONING ON REDDIT

- Flow: $10M diagonal call spread combining earnings catalyst with extended time (2,512x unusual)

- What's Happening: AI licensing revenue from Google/OpenAI partnerships creating new monetization model beyond advertising

- The Big Question: Can Reddit's AI data licensing sustain $8B+ valuation if user growth slows?

- Catalyst: Ongoing AI partnership renewals, user engagement metrics

11. ⚖️ RSP - The $10M Equal-Weight Hedge

DISCOVER WHY SMART MONEY IS HEDGING EQUAL-WEIGHT S&P WITH PUTS

- Flow: $10M put spread targeting equal-weight S&P exposure (2,516x unusual)

- What's Happening: Mag 7 concentration concerns driving rotation to defensive equal-weight hedging

- The Big Question: Does RSP hedge signal institutions expect small/mid-cap underperformance?

- Catalyst: November OPEX, Q4 earnings dispersion across S&P components

12. 🌊 SE - The $9M Sea Limited Call Surge

UNPACK THE MASSIVE BETS ON SOUTHEAST ASIA E-COMMERCE LEADER

- Flow: $9M call buying with earnings catalyst ahead (1,553x unusual)

- What's Happening: Shopee profitability achieved, Garena gaming resurgence, SeaMoney fintech growth

- The Big Question: Can SE sustain profitability while competing against TikTok Shop and Lazada?

- Catalyst: Q3 earnings November 11, Southeast Asia e-commerce competition

13. 🎓 LRN - The $1.3M Education Tech Earnings Hedge

SEE THE MASSIVE PUT BUY HOURS BEFORE Q1 EARNINGS TODAY

- Flow: $1.3M put purchase expiring November 21 (472x unusual) - EARNINGS TODAY after close!

- What's Happening: Q1 FY2026 earnings dropping TODAY - institutions hedging against enrollment or guidance disappointment

- The Big Question: Will virtual school enrollment growth sustain or has post-pandemic normalization peaked?

- Catalyst: Q1 earnings TODAY October 28 after market close - trade expires in 24 days

14. 🏢 CSGP - The $1.1M Real Estate Tech Earnings Bet

ANALYZE THE PUT PROTECTION HOURS BEFORE COSTAR Q3 RESULTS

- Flow: $1.1M put buying at $75 strike (636x unusual) - EARNINGS TODAY after close!

- What's Happening: Q3 earnings TODAY - $1B+ Homes.com investment under activist scrutiny, 301x P/E demands perfection

- The Big Question: Will Homes.com profitability timeline satisfy activists or will guidance disappoint?

- Catalyst: Q3 earnings TODAY October 28 after market close, Homes.com monetization update

⏰ URGENT: TODAY'S Earnings + Critical November Catalysts

🚨 EARNINGS DROPPING TODAY (October 28 After Close)

CSGP & LRN Report TODAY - $2.4M Combined Defensive Positioning:

- CSGP $1.1M puts at $75 - Activist pressure on Homes.com investment, 301x P/E leaves no margin for error

- LRN $1.3M puts at $140 - Virtual education enrollment trends and guidance for FY2026

🔥 This Week's Major Catalysts

November 5 (8 days away):

- SPY $270M hedge partially positioned for election volatility

November 11:

- SE $9M calls - Q3 earnings for Southeast Asia e-commerce leader

November 19:

- NVDA $22M calls - Blackwell production and Q3 data center revenue

November 21 Monthly OPEX:

- QQQ $288M puts, SPY $270M puts, CSGP/LRN puts all expire

📅 December-January Decision Points

December 18:

- Fed rate decision impacts QQQ/SPY hedge positioning

January 2026:

- TSM earnings - iPhone 16 production results

- AMD positioning - MI300 vs Blackwell competitive data

📊 Smart Money Themes: What Institutions Are Really Betting

🛡️ Massive Defensive Hedging (70% of Flow: $558M)

Tech & Market Protection Dominates:

- → QQQ: $288M put spread - largest tech sector hedge of Q4

- → SPY: $270M bear puts - S&P 500 fortress ahead of elections/Fed

💰 Pre-Earnings Binary Bets ($66M Concentrated Positioning)

TODAY's Reports + November Catalysts:

- → NVDA: $22M calls - Blackwell production ahead of Nov 19 earnings

- → GOOG: $52.6M mixed strategies - Cloud AI vs ad spending balance

- → SE: $9M calls - e-commerce profitability proof Nov 11

- → CSGP: $1.1M puts - Homes.com scrutiny TODAY after close

- → LRN: $1.3M puts - enrollment trends TODAY after close

💸 Profit-Taking & Exit Signals ($104M Institutional Selling)

Smart Money Securing Gains at All-Time Highs:

- → TSM: $44M call selling - chip profits after AI rally

- → AAPL: $37M call sale - iPhone 16 concerns mounting

- → AMD: $23M June exit - Blackwell competition worry

🚀 Speculative & High-Beta Plays ($45M Risk-On Positioning)

Crypto, Travel, Tech Recovery Bets:

- → BKNG: $22M calendar spread - travel demand patience

- → BITX: $13.1M calls - 2x Bitcoin leverage into $70K breakout

- → RDDT: $10M diagonal - AI licensing growth thesis

🎯 Your Action Plan: How to Trade Each Signal

🎰 YOLO Trader (1-2% Portfolio MAX - High Risk/High Reward)

⚠️ EXTREME RISK - Only for experienced traders who can afford 100% loss

TODAY's Binary Earnings Lottery:

- CSGP November $75 puts - Copy the $1.1M whale bet (EARNINGS TONIGHT!)

- Risk: Total loss if earnings beat and Homes.com update positive

- Reward: 300%+ if activist concerns validated and stock breaks $75 support

- Position size: 0.5-1% max - earnings are binary coin flips

- LRN November $140 puts - Follow $1.3M institutional hedge (EARNINGS TONIGHT!)

- Risk: IV crush even if directionally correct

- Reward: 200% if enrollment guidance disappoints

- Position size: 0.5-1% max

High-Beta Momentum:

- BITX $13.1M call positioning - 2x Bitcoin leverage

- Risk: Leveraged decay + Bitcoin correction = -50% in days

- Reward: 500% if Bitcoin breaks $70K to new all-time highs

- Exit strategy: Take profits at 100% gains, NEVER hold leveraged products long-term

Critical YOLO Rules:

- Maximum 2% total across ALL YOLO positions

- Set hard stop-loss at 40-50% on entry

- Take 100%+ gains immediately (these are lottery tickets)

- NEVER add to losing positions

⚖️ Swing Trader (3-5% Portfolio - 2-8 Week Holds)

Defensive Tech Hedge (Follow QQQ/SPY Institutions):

- QQQ put spreads - November 21 expiration

- Buy $500/$490 put spread (~$3-4 debit)

- Protects tech-heavy portfolios through earnings volatility

- Max risk: Premium paid | Max reward: $10 spread width - premium

- Close before Nov 21 OPEX to avoid assignment complications

Pre-Earnings Momentum (Higher Conviction Catalysts):

- NVDA November $180 calls - 22 days to Nov 19 earnings

- Follow $22M institutional positioning

- Blackwell production ramp = multi-quarter catalyst

- Risk management: Sell 50% position 1 day before earnings to lock profits

- Hold remainder: Only if you can stomach IV crush risk

- SE call spreads into November 11 earnings

- Profitability story with $9M institutional backing

- Consider bull call spread to reduce IV exposure

- Exit: Day before earnings or hold through if very bullish

Travel Recovery Play:

- BKNG calendar spreads - Copy $22M institutional strategy

- Sell near-term premium, buy longer-dated calls

- Benefits from time decay while maintaining upside exposure

- Lower risk than naked calls, requires patience

Swing Trader Risk Management:

- 3-5% max per position

- Set 25-30% stop-loss on entry

- Take 50% profits at 40-50% gains

- Never hold through earnings unless that's your thesis

- Close positions 2 days before major Fed decisions

💰 Premium Collector (Income Generation Focus)

High IV Harvesting (Post-Earnings Plays):

- CSGP covered calls - AFTER tonight's earnings

- Wait for IV crush, then sell $80-85 calls

- Collect premium from elevated IV without pre-earnings risk

- Only if you own shares or willing to buy at current levels

- LRN covered calls - AFTER tonight's earnings

- Similar strategy - let earnings pass, harvest remaining IV

- $150-160 strikes depending on post-earnings price

QQQ/SPY Iron Condors (Range-Bound Premium):

- Sell put spreads below $288M/$270M institutional hedge strikes

- Sell call spreads above current resistance

- November 21 expiration to capture maximum theta decay

- Close at 50-60% max profit - don't be greedy waiting for expiration

Calendar Spread Income (Following Institutions):

- BKNG calendar spreads - Copy $22M positioning

- Sell November calls, buy December/January calls

- Profit from near-term theta decay

- Roll monthly as short-dated options expire

Premium Collector Risk Rules:

- Only sell premium on stocks you're willing to own

- Never go naked - always use defined-risk spreads

- Close winners at 50-60% of max profit

- Set alerts for 100% loss (roll or close immediately)

- Reserve 20-30% of account as cash for rolling/adjustments

🛡️ Entry Level Investor (Learning & Building Foundation)

START HERE - Education Before Speculation:

Paper Trading Mandatory (30 Days Minimum):

- Track today's trades in a paper account:

- How does CSGP/LRN earnings IV crush work?

- Watch QQQ puts behave during market volatility

- Study how NVDA pre-earnings positioning profits/loses

ETF Exposure (Avoid Single-Stock Risk):

- QQQ shares for broad tech exposure (skip the $288M puts until you understand them)

- SPY shares for diversified S&P 500 exposure

- DO NOT trade leveraged ETFs (BITX) - these are advanced instruments

Quality Shares to Learn From:

- NVDA shares - Follow $22M institutional thesis without options risk

- BKNG shares - Travel recovery with defensive moat

Educational Focus (Study Before Trading):

- Defensive puts: Watch how QQQ/SPY put spreads perform through November OPEX

- Earnings plays: Observe CSGP/LRN tonight to see IV crush in action

- Calendar spreads: Study BKNG multi-month positioning mechanics

- Profit-taking: Learn from TSM/AAPL/AMD call selling at highs

Entry Level Critical Rules:

- NEVER trade earnings until you've watched 20+ cycles

- Start with shares, not options (build intuition without leverage)

- Risk only 0.5-1% per position maximum

- Paper trade for 90 days before risking real capital

- Study Greeks (delta, theta, vega, gamma) before buying first option

- Avoid YOLO plays entirely - you need 100+ trades of experience first

Learning Resources from Today:

- Compare CSGP/LRN put buying to actual earnings results

- Track how QQQ $288M puts behave during tech volatility

- Observe TSM/AAPL call selling effectiveness

Questions to Ask Yourself Before First Trade:

- Can I explain what this option will be worth in 3 scenarios (up/flat/down)?

- Do I understand how time decay will affect this position?

- What is my exit plan for both profit AND loss scenarios?

- Am I risking money I can afford to lose completely?

If you answer "no" to ANY question above - DO NOT TRADE. Study more.

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

Tech Bullish Plays (NVDA, GOOG, BITX):

- NVDA: Blackwell production delays or quality issues surface

- GOOG: Cloud revenue growth decelerates below 20% YoY

- BITX: Bitcoin crashes below $60K on regulatory concerns or macro shocks

- SE: TikTok Shop competition destroys Shopee market share in key markets

- RDDT: AI licensing contracts don't renew at expected pricing

Travel/Consumer (BKNG):

- Recession fears materialize and discretionary spending collapses

- International travel demand craters on geopolitical escalation

- Online travel booking competition intensifies (Expedia, Airbnb)

Earnings Bets (CSGP, LRN - TONIGHT!):

- CSGP: Homes.com timeline extended AGAIN, activist pressure intensifies

- LRN: Virtual school enrollment declining as post-pandemic normalization completes

- Both could beat earnings but stock sells off on guidance

😰 If You're Following the Bears

QQQ/SPY Defensive Hedges:

- Market rallies through year-end on Fed pivot expectations

- Tech earnings season delivers across the board (Mag 7 all beat)

- Election outcome provides market-positive clarity

- Fed signals rate cuts accelerating in 2026

Put Protection Positions:

- CSGP/LRN earnings beat with strong guidance (puts expire worthless)

- RSP equal-weight hedge fails as small caps rally on rotation

- Profit-taking on TSM/AAPL/AMD selling proves premature if momentum continues

Key Risk: Today's $558M in QQQ/SPY puts represents largest defensive position we've tracked. If this is wrong, premium sellers will profit massively from theta decay.

💣 This Week's Catalysts & Key Dates

📊 TODAY (October 28 After Market Close):

- CSGP Q3 earnings - $1.1M puts watching Homes.com update and activist pressure

- LRN Q1 FY2026 earnings - $1.3M puts positioned for enrollment/guidance

- Market closes with clarity on both earnings plays

🗳️ November 5 (Next Tuesday - 8 Days):

- U.S. elections could trigger QQQ/SPY hedge payoffs or theta decay acceleration

- $558M in defensive positioning partially tied to election volatility

📈 November 11 (13 Days):

- SE Q3 earnings - $9M calls testing e-commerce profitability thesis

🚀 November 19 (22 Days):

- NVDA Q3 earnings - $22M calls positioned for Blackwell production update

- Most anticipated earnings report of Q4 for AI infrastructure theme

⏰ November 21 (24 Days - Monthly OPEX):

- CRITICAL: QQQ $288M puts, SPY $270M puts, CSGP/LRN puts ALL expire

- Largest single-day options expiration we've tracked this quarter

- Time decay accelerates dramatically in final week (Nov 14-21)

📅 December Catalysts:

- December 1: OPEC+ meeting (impacts broader market sentiment)

- December 18: Fed rate decision (QQQ/SPY hedge positioning sensitivity)

- Q4 earnings begin late December through January

🧠 2026 Thesis Resolution:

- January: TSM, AAPL earnings reveal iPhone 16 cycle results

- June: AMD positioning expires (Blackwell vs MI300 competitive verdict)

- Ongoing: Bitcoin trajectory determines BITX leverage effectiveness

🎯 The Bottom Line: $803M Defensive Wave Signals Institutional Caution

This is the most defensive single-day positioning we've tracked in Q4. $803.1 million concentrated into protective strategies ($558M QQQ/SPY hedges), pre-earnings insurance ($66M), and profit-taking ($104M call selling) rather than aggressive directional bets. The message: institutions are preparing for volatility, not chasing it.

The biggest questions:

- Is QQQ's $288M put spread the canary in the coal mine or routine quarterly hedging?

- Will SPY's $270M defensive fortress prove prescient or costly insurance premium?

- Can NVDA's $22M bullish bet on Blackwell overcome broader market hedging?

- Will TONIGHT's CSGP/LRN earnings justify $2.4M in protective puts?

Your move: This defensive tilt across institutions suggests caution is warranted. Consider downsizing risk exposure, adding portfolio hedges (following QQQ/SPY put buyers), and waiting for post-earnings clarity before aggressive directional bets. Remember - these are sophisticated institutional hedges that may be part of larger portfolios we can't see. Never blindly copy without understanding your own risk tolerance and time horizon.

🔗 Get Complete Analysis on Every Trade

🛡️ Defensive & Hedging Mega-Positions:

- QQQ $288M Put Spread - Tech Sector Defense Earthquake

- SPY $270M Bear Put Spread - Market-Wide Fortress

- RSP $10M Put Spread - Equal-Weight Protection

💰 Pre-Earnings & Catalyst Positioning:

- NVDA $22M Call Buy - Blackwell Production Bet

- GOOG $52.6M Options Wave - Cloud AI vs Ad Spending

- SE $9M Call Buying - E-Commerce Profitability Test

- CSGP $1.1M Put Buy - EARNINGS TONIGHT Homes.com Scrutiny

- LRN $1.3M Put Purchase - EARNINGS TONIGHT Education Trends

💸 Profit-Taking & Exit Signals:

- TSM $44M Deep ITM Call Selling - Chip Profit-Taking

- AAPL $37M Call Sale - iPhone 16 Concerns

- AMD $23M Call Sale - Blackwell Competition Worry

🚀 Speculative & Strategic Bets:

- BKNG $22M Calendar Spread - Travel Demand Patience

- BITX $13.1M Bitcoin Double-Down - 2x Leverage Play

- RDDT $10M Diagonal Spread - AI Licensing Growth

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 28-November 4)

- CSGP Q3 earnings TODAY October 28 - Homes.com profitability timeline

- LRN Q1 FY2026 earnings TODAY October 28 - virtual education enrollment trends

📆 Monthly (November 5-21 Critical Window)

- Election Day November 5 - QQQ/SPY hedges partially positioned for volatility

- SE November 11 earnings - e-commerce profitability validation

- NVDA November 19 earnings - Blackwell production update (most anticipated!)

- November 21 Monthly OPEX - QQQ $288M, SPY $270M, CSGP, LRN all expire (MASSIVE EXPIRATION)

🗓️ Quarterly (December-January)

- Fed Rate Decision December 18 - impacts QQQ/SPY hedge effectiveness

- TSM earnings January 2026 - iPhone 16 production results

- AAPL earnings Q4 2025/Q1 2026 - Apple Intelligence adoption metrics

🚀 LEAPs (2026 Expiries)

- AMD June 2026 - MI300 vs Blackwell competitive landscape

- BKNG calendars through 2026 - travel recovery multi-year thesis

- RDDT January 2026 - AI licensing sustainability

⚠️ Risk Management for All Types

Universal Rules (NEVER Break These):

Position Sizing Discipline:

- YOLO: 1-2% max per position, 2% total across ALL YOLO trades

- Swing: 3-5% max per position

- Premium Collector: 10-15% max allocated to sold premium

- Entry Level: 0.5-1% max per position for first 100 trades

Stop Losses Are Mandatory:

- Options: 25-40% loss triggers immediate exit

- Shares: 7-10% loss (tighter for volatile stocks)

- Spreads: 50% of max loss

- NEVER remove stop-loss hoping for recovery

Profit-Taking Prevents Regret:

- Take 50% off at 50% gain (lock in winners)

- Take another 25% at 100% gain

- Let final 25% run with trailing stop

- For earnings plays: Consider taking 100% profit day before announcement

Earnings Risk Awareness (CRITICAL TODAY):

- CSGP/LRN report TONIGHT - extreme IV crush risk tomorrow

- If you bought calls/puts today, IV was already elevated

- Even correct direction can lose money due to IV crush

- Consider closing 50-100% before 4PM ET close if profitable

Time Decay Understanding:

- November 21 expiries losing 2-4% value PER DAY now (24 days out)

- Theta decay accelerates in final 2 weeks (November 7-21)

- Weekend theta decay hits Friday close → Monday open

- Don't hold options through weekends unless conviction is EXTREME

Today's Specific Warnings:

Defensive Hedge Concentration (QQQ/SPY):

- $558M represents largest defensive positioning we've tracked

- If market rallies, these puts will decay rapidly

- Institutions may be hedging portfolios we can't see

- Don't assume $288M QQQ puts = market crash prediction

- Could be routine quarterly rebalancing at elevated levels

TONIGHT's Earnings Binary Risk (CSGP/LRN):

- $2.4M in puts positioned for TONIGHT's reports

- IV crush tomorrow will destroy option value regardless of direction

- If you're trading these, set alerts for 4PM ET close decision

- Beginners: DO NOT trade - watch and learn instead

Profit-Taking Signals (TSM/AAPL/AMD):

- $104M in call selling suggests institutions locking gains

- Doesn't guarantee crashes, but shows tops being sold

- If you own these stocks, consider trimming or adding protective puts

- Never fight institutional selling with leverage

Bitcoin Leverage Risk (BITX):

- 2x daily reset means compounding works AGAINST you over time

- 10% Bitcoin drop = 20% BITX drop (but doesn't recover 1:1)

- Never hold leveraged products >5 trading days

- Position sizing: 0.5-1% max - these can go to zero

Institutional vs. Retail Positioning:

What We See:

- QQQ $288M put spread (defensive)

What They Might Have That We Can't See:

- Long QQQ call positions elsewhere (hedge)

- Short QQQ futures (delta neutral)

- Long individual tech stocks (targeted hedge)

- Derivatives swaps and complex structures

- Other portfolio positions offsetting this risk

Key Insight: Today's defensive positioning may be part of MUCH larger portfolios with offsetting positions we can't track. Don't assume these are simple directional bets!

When to Override Unusual Activity:

IGNORE the signal if:

- You don't understand the strategy (calendar spread mechanics, put spread construction)

- Position size would exceed your risk limits (QQQ $288M = $50K+ for institutions, not retail scale)

- Time horizon doesn't match (November 21 OPEX = 24 days, too short if you trade longer timeframes)

- Earnings risk exceeds tolerance (CSGP/LRN TONIGHT = extreme binary risk)

- You're emotionally attached ("must follow whale") - emotion kills accounts

Trust your discipline and risk limits over FOMO. Missing a trade is better than blowing up your account.

📚 Educational Spotlight: Understanding Defensive Strategies

Put Spreads (QQQ $288M, SPY $270M)

What They Are:

- Buy put at higher strike, sell put at lower strike

- Limits both risk (max loss = debit paid) and reward (max gain = strike difference - debit)

- Used when expecting moderate downside, not crash

QQQ Example:

- Buy $500 put, sell $490 put

- Cost: $4 per spread

- Max loss: $4 (if QQQ above $500 at expiry)

- Max gain: $6 (if QQQ below $490 at expiry)

- Break-even: $496

Why Institutions Use This:

- Capital efficient (costs less than buying puts outright)

- Defined risk (can't lose more than premium paid)

- Portfolio insurance (protects against 10-20% corrections)

Retail Application:

- Start with 1-2 contract spreads to learn mechanics

- Use on broad ETFs (QQQ, SPY, IWM) not individual stocks

- Match expiry to your hedge timeframe (November 21 OPEX = 24-day protection)

- Close early at 50%+ profit - don't wait for max gain

Calendar Spreads (BKNG $22M)

What They Are:

- Sell near-term calls, buy longer-term calls at same strike

- Profits from time decay differential (short options decay faster)

- Benefits from stable to slowly rising prices

BKNG Example:

- Sell November $5,000 calls, buy February $5,000 calls

- Net cost near zero or small credit

- Profits if BKNG trades $4,900-$5,100 range through November

- Long February calls retain value after November expiry

Why Institutions Use This:

- Generates income from near-term theta decay

- Maintains long-term upside exposure

- Works in sideways markets (where most stocks trade 80% of time)

Retail Application:

- Start with 30-45 day short options, 90-120 day long options

- Use on stable stocks with moderate IV (avoid earnings stocks)

- Close when short options approach expiry, roll to next month

- Best for patient traders - this is NOT a momentum strategy

Earnings Plays (CSGP $1.1M, LRN $1.3M - TONIGHT)

What They Are:

- Buy puts/calls ahead of earnings announcement

- Bet on direction + volatility spike

- IV inflates pre-earnings, crashes post-announcement

CSGP Example:

- $1.1M buying November $75 puts

- EARNINGS TONIGHT after close

- IV currently elevated (30-40% higher than normal)

- Tomorrow morning: IV crashes 40-60% regardless of price move

Why Institutions Do This:

- Access to supply chain data (real estate transaction data for CSGP)

- Fundamental research (management meetings, channel checks)

- Hedging existing positions (may own shares, buying puts for protection)

Retail Considerations:

- IV crush is the #1 killer of earnings trades

- Can be correct on direction and still lose money

- Requires EXTREME timing precision

- Beginners: Watch 20+ earnings cycles before trading

Alternative for Entry Level:

- Wait until AFTER earnings announcement

- Buy stock or LEAPS when IV crashes (get discount)

- Avoid the binary risk entirely

- Learn by observing CSGP/LRN tonight, don't trade

Profit-Taking (TSM $44M, AAPL $37M, AMD $23M)

What It Means:

- Institutions selling call options = reducing bullish exposure

- Taking profits after big runs (TSM up 100%+, semiconductors at highs)

- Not necessarily bearish - just locking in gains

Why It Matters:

- Shows where smart money sees tops (TSM at all-time highs)

- Reduces upside beta (less exposure to further rallies)

- Frees capital for other opportunities

Retail Application:

- If you own these stocks, consider:

- Selling covered calls to harvest premium (follow institutions)

- Taking 25-50% profits to lock in gains

- Adding protective puts for remaining position

- Don't panic sell - profit-taking ≠ bearish reversal prediction

⚠️ Options involve substantial risk and are not suitable for all investors. Today's $803.1M unusual activity represents institutional positioning that may be part of larger hedged portfolios not visible to retail traders. The $558M in QQQ/SPY defensive positioning is the largest we've tracked in Q4 and could signal institutional caution OR routine quarterly rebalancing. CSGP and LRN report earnings TONIGHT (October 28) - extreme volatility and IV crush risk. Never risk more than you can afford to lose completely. Entry level investors should paper trade extensively before committing real capital. Past institutional behavior doesn't guarantee future performance.

📊 Total Flow Summary:

- Total Tracked: $803,100,000

- Largest Position: QQQ $288M (36% of flow)

- Defensive Positioning: QQQ $288M + SPY $270M + RSP $10M = $568M (71% defensive)

- Pre-Earnings Bets: $66M (8% of flow)

- Profit-Taking: $104M (13% of flow)

- Tickers Analyzed: 14 companies across tech, semiconductors, e-commerce, travel, education, real estate, crypto

- Expiry Range: November 21, 2025 (majority) through June 2026 (AMD LEAPS)

- URGENT: CSGP & LRN earnings TONIGHT October 28 after close - $2.4M positioned for volatility

🏷️ Investor Type Quick Reference

🎰 YOLO Trader: CSGP/LRN earnings TONIGHT (0.5-1% each), BITX Bitcoin leverage (1% max) ⚖️ Swing Trader: QQQ/SPY put spreads (defensive), NVDA Nov calls (pre-earnings), SE calls (Nov 11 catalyst) 💰 Premium Collector: Post-earnings CSGP/LRN covered calls, QQQ/SPY iron condors, BKNG calendar spreads 🛡️ Entry Level: Paper trade EVERYTHING first, study CSGP/LRN IV crush tonight, buy quality shares (NVDA, BKNG) not options