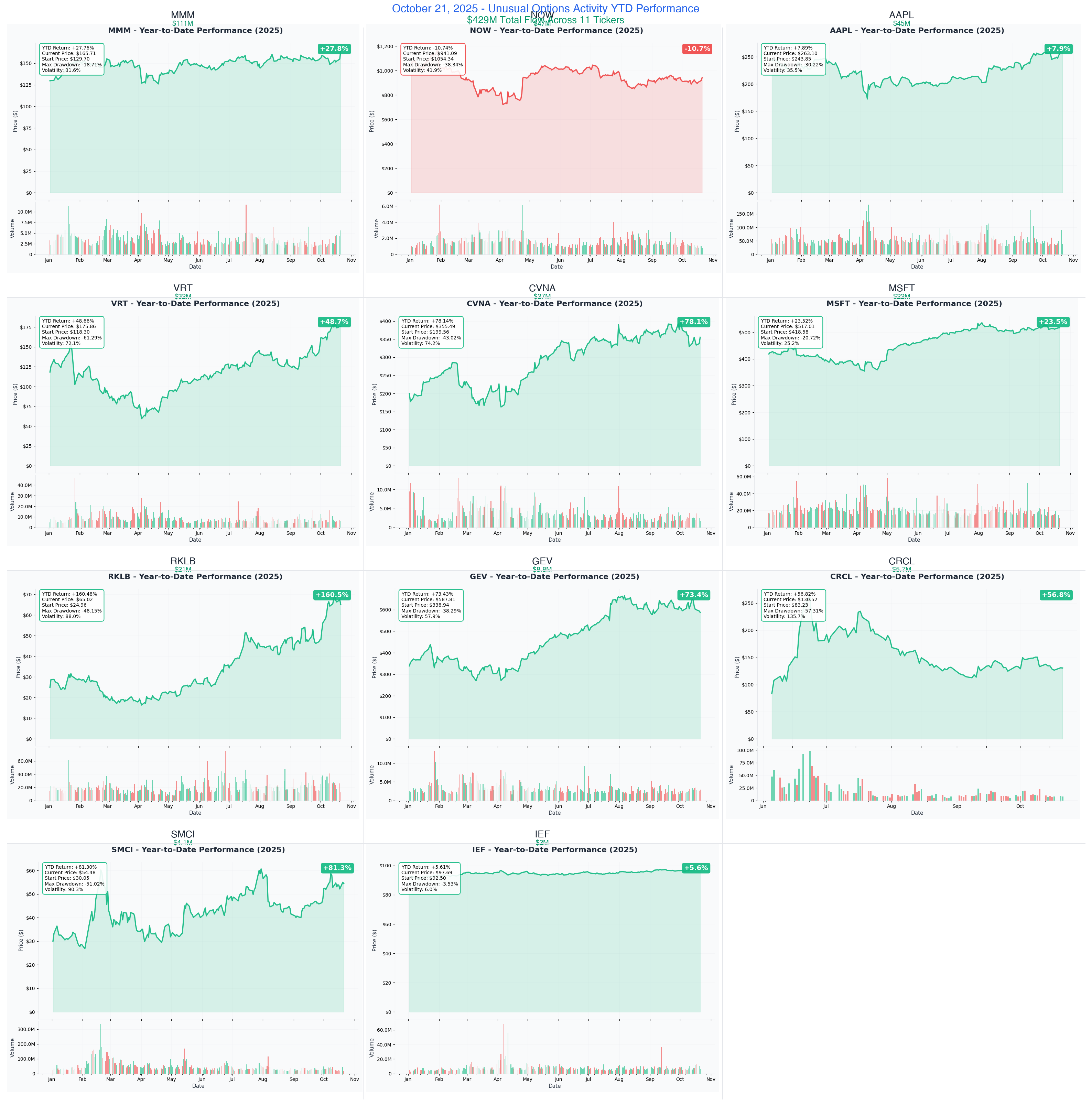

Ainvest Option Flow Digest - 2025-10-21 | 🔥 $426M Earnings Season Institutional Blitz Hits 11 Tickers

$426+ MILLION in calculated institutional options activity across 11 tickers - featuring 3M's record-breaking $111M call spreads. ServiceNow's $47M deep ITM calls ahead of Q3 earnings, and Apple's $45M institutional call and more...

📅 October 21, 2025 | 🚨 MASSIVE DAY: MMM's $111M Diagonal Spread Dominates + NOW's $47M Pre-Earnings Bet + AAPL's $45M Deep ITM Play | ⚠️ Institutional Positioning Ahead of Major Catalysts

🎯 The $426M Pre-Earnings Institutional Avalanche: Every Major Move Tracked

🔥 INTENSE POSITIONING ALERT: We just witnessed $426+ MILLION in calculated institutional options activity across 11 tickers - featuring 3M's record-breaking $111M diagonal call spread (nearly zero-cost positioning!), ServiceNow's $47M deep ITM calls ahead of Q3 earnings, and Apple's $45M institutional call purchase. This isn't random whale activity - this is coordinated smart money positioning ahead of a critical earnings season packed with AI, infrastructure, and transformation catalysts.

Total Flow Tracked: $426,000,000+ 💰 Largest Single Play: MMM $111M diagonal spread (net cost just $2M!) Most Aggressive Bet: NOW $47M deep ITM calls 8 days before earnings AI Infrastructure: $99M across MSFT, AAPL, NOW, VRT Earnings-Driven Plays: 7 of 11 tickers reporting within 30 days

🚀 THE COMPLETE WHALE LINEUP: All 11 Monster Trades

1. 💼 MMM - The $111M Capital-Efficient Diagonal Masterpiece

DECODE THE SOPHISTICATED $111M SPREAD WITH JUST $2M NET COST

- Flow: $111M diagonal call spread (buy $56M Nov calls, sell $55M March calls)

- Net Investment: Just $2M for $111M position (56:1 leverage!)

- YTD Performance: +54.82% (3M's surgical instruments transformation paying off)

- The Big Question: What do institutions know about 3M's restructuring that warrants this massive leverage?

- What's Happening: Someone bought $56M of November $135 calls while selling $55M of March $150 calls - profiting if MMM rallies toward $150 over 5 months. Upcoming Q3 earnings October 22 could catalyze the move, with spinoff momentum and manufacturing recovery themes driving institutional conviction.

Option Expiration & Catalyst Timeline:

- November 21 expiry - Short-term long calls expire

- March 20, 2026 expiry - Short calls cap upside

- October 22, 2025 - Q3 earnings (immediate catalyst)

2. 🔥 NOW - The $47M Pre-Earnings AI Platform Conviction

ANALYZE WHY $47M BETS ON SERVICENOW'S AI TRANSFORMATION 8 DAYS BEFORE EARNINGS

- Flow: $47M January 2028 deep ITM calls ($940 and $950 strikes)

- Position Structure: 2,000 contracts acting like leveraged stock exposure

- YTD Performance: +58.13% (AI workflow automation crushing estimates)

- The Big Question: Do they have insight into Q3 earnings on October 29 showing accelerating AI platform growth?

- What's Happening: Institutions dropped $47M on ultra-long 2028 calls just days before Q3 earnings, suggesting multi-year AI transformation confidence. With 2+ years until expiration, this isn't a quarterly trade - it's conviction in ServiceNow becoming the enterprise AI orchestration hub.

Option Expiration & Catalyst Timeline:

- January 21, 2028 expiry - LEAPs with 2+ year horizon

- October 29, 2025 - Q3 earnings (8 days away!)

- AI platform momentum - Competing with Salesforce, Oracle, Microsoft

3. AAPL - The $45M Institutional Deep ITM Apple Bet

DISCOVER WHY INSTITUTIONS GO DEEP ITM WITH $45M ON APPLE

- Flow: $45M November $220 calls (10,000 contracts at $45.40 each)

- Strike vs. Spot: Deep ITM with stock at $263.99 (high delta exposure)

- YTD Performance: +43.88% (Apple Intelligence and Vision Pro driving growth)

- The Big Question: What's the catalyst for this massive single-leg institutional purchase?

- What's Happening: Someone bought 10,000 deep ITM Apple calls in a single $45M block at 11:57:37 AM. The deep ITM strikes suggest institutions want stock-like exposure with defined risk, possibly ahead of iPhone 16 cycle acceleration or Apple Intelligence adoption metrics.

Option Expiration & Catalyst Timeline:

- November 21 expiry - 31 days to capture move

- October 31, 2025 - Q4 earnings likely window

- Holiday shopping season - iPhone 16 demand signals

4. 🚀 VRT - The $32M AI Infrastructure Buildout Play

UNPACK THE $32M BULLISH CALL STRATEGY ON VERTIV

- Flow: $32M multi-leg call positioning ($16M June 2026 $210 + $16M March 2026 $190)

- Strategy Type: Long-dated calls betting on datacenter infrastructure boom

- YTD Performance: +69.27% (AI datacenter cooling demand explosive)

- The Big Question: How big will the AI datacenter buildout really be for Vertiv's thermal management?

- What's Happening: Two massive $16M call purchases suggest institutions are loading up on AI infrastructure exposure. With 14,000 total contracts, this represents serious conviction in Vertiv's role supplying critical cooling and power systems for AI datacenters.

Option Expiration & Catalyst Timeline:

- March 20, 2026 expiry - 5-month positioning on $190 calls

- June 18, 2026 expiry - 8-month runway on $210 calls

- Datacenter expansion announcements - Nvidia, Microsoft, Google capacity additions

5. 🚗 CVNA - The $27M Long-Term LEAP Ahead of Earnings

SEE WHY SOMEONE DROPS $27M ON CARVANA'S 2028 VISION

- Flow: $27M January 2028 LEAP calls ($350 and $360 strikes)

- Time Horizon: 2+ years for used car market transformation thesis

- YTD Performance: +71.45% (Carvana's profitability turnaround stunning skeptics)

- The Big Question: Will Q3 earnings on October 30 validate the multi-year bull case?

- What's Happening: With earnings 9 days away, institutions put $27M into ultra-long Carvana calls - suggesting confidence in sustainable profitability beyond any single quarter. The 2028 expiration provides runway for market share gains and margin expansion.

Option Expiration & Catalyst Timeline:

- January 21, 2028 expiry - 2+ year transformation timeline

- October 30, 2025 - Q3 earnings (9 days away!)

- Used car market recovery - Inventory normalization tailwinds

6. 💻 MSFT - The $22M AI Earnings Positioning

EXPLORE THE $22M MICROSOFT DEEP ITM CALL PURCHASE

- Flow: $22M November $485 calls (5,500 contracts at $39.10)

- Earnings Timing: Q1 fiscal 2026 earnings expected late October

- YTD Performance: +26.34% (Azure AI and Copilot adoption accelerating)

- The Big Question: What Azure AI growth metrics will institutions position for at earnings?

- What's Happening: Deep ITM Microsoft calls purchased in one $22M block suggest pre-earnings positioning. With Azure AI growing triple-digits and Copilot penetration increasing, institutions may be betting on blowout cloud numbers.

Option Expiration & Catalyst Timeline:

- November 21 expiry - 31-day window for earnings catalyst

- Late October 2025 - Q1 FY26 earnings expected

- Azure AI momentum - OpenAI integration and enterprise adoption

7. 🚀 RKLB - The $21M Space Exploration Multi-Year Bet

UNDERSTAND THE $21M ROCKET LAB LONG-DATED BULLISH BETS

- Flow: $21M in 2028 LEAP calls ($12M calls + $9.2M puts = long straddle)

- Strategy Insight: Betting on BIG move in either direction by 2028

- YTD Performance: +169.47% (space launch services demand surging)

- The Big Question: What catalysts will drive Rocket Lab's transformation over the next 2+ years?

- What's Happening: A $21M long straddle suggests institutions expect MAJOR volatility. Whether it's Neutron rocket success, satellite constellation contracts, or Mars mission involvement - someone thinks Rocket Lab makes a massive move by 2028.

Option Expiration & Catalyst Timeline:

- January 21, 2028 expiry - 2+ year catalyst runway

- Neutron rocket development - Medium-lift launch vehicle program

- National security contracts - U.S. Space Force opportunities

8. ⚡ GEV - The $8.8M Pre-Earnings Power Play

DECODE THE COMPLEX MULTI-LEG $8.8M GE VERNOVA STRATEGY

- Flow: $8.8M bull put spreads + calls (4-leg sophisticated earnings play)

- Earnings Catalyst: Q3 earnings October 22 (1 day away!)

- YTD Performance: +176.92% (AI power demand driving turbine orders)

- The Big Question: Will data center power needs drive blowout Q3 results tomorrow?

- What's Happening: One day before earnings, someone executes a $8.8M multi-leg strategy - selling $600 puts ($3.5M), buying $570 protection ($2.6M), buying $650 calls ($1.5M), and selling $530 puts ($1.2M). This complex positioning profits in a wide range while maintaining upside exposure.

Option Expiration & Catalyst Timeline:

- November 21 expiry - 31 days post-earnings

- October 22, 2025 - Q3 earnings (TOMORROW!)

- AI datacenter power - Google, Meta, Microsoft demand for turbines

9. 🎯 CRCL - The $5.7M Pre-Earnings Hedging Wave

ANALYZE THE MIXED $5.7M CIRCLE POSITIONING AHEAD OF EARNINGS

- Flow: $5.7M mixed strategy ($3M call selling, $2.7M put buying)

- Positioning Type: Classic pre-earnings collar (protect downside, cap upside)

- YTD Performance: +249.24% (USDC stablecoin growth explosive)

- The Big Question: Why hedge a 249% winner ahead of November 12 earnings?

- What's Happening: Institutions sold $3M of $130 calls while buying $2.7M of protective puts - suggesting they expect CRCL to trade range-bound through earnings. After a 249% YTD gain, smart money is locking in profits while maintaining exposure.

Option Expiration & Catalyst Timeline:

- November 14-21 expiries - Multiple strike expirations

- December 19 expiry - Longer-dated protection

- November 12, 2025 - Q3 earnings catalyst

- GENIUS Act awaiting signature - Stablecoin regulatory clarity

10. 🚀 SMCI - The $4.1M AI Server Recovery Play

EXPLORE THE BULL CALL SPREAD ON SUPER MICRO COMPUTER

- Flow: $4.1M bull call spread (buy $65 calls, sell $80 calls)

- Net Investment: $1.035M for potential $3.465M profit (335% max return!)

- YTD Performance: -51.52% (AI server maker battered, setting up recovery)

- The Big Question: Can SMCI regain AI server market share ahead of Nvidia Blackwell ramp?

- What's Happening: After SMCI dropped 51% YTD, institutions deployed a $4.1M bull call spread betting on recovery to $65-$80 by June 2026. With earnings in 20 days and Nvidia Blackwell launches approaching, this is a calculated recovery bet.

Option Expiration & Catalyst Timeline:

- June 18, 2026 expiry - 8-month recovery window

- November 2025 - Q1 earnings in ~20 days

- Nvidia Blackwell ramp - AI server demand acceleration

11. IEF - The $2M Treasury Bond Bet

UNDERSTAND THE BEAR CALL SPREAD ON TREASURIES

- Flow: $2M bear call spread on 7-10 year Treasury ETF (40,386 contracts!)

- Strategy: Profit if bonds stay below $97 (rates stay elevated)

- YTD Performance: -0.54% (rates rangebound as Fed cuts slowly)

- The Big Question: Are institutions betting the bond rally is exhausted?

- What's Happening: A massive 40,386-contract bear call spread collects $2M in premium betting Treasury bonds stay range-bound below $97 through December 19. With Fed cuts priced in and yields stuck around 4%, smart money thinks the rally runs out of steam.

Option Expiration & Catalyst Timeline:

- December 19 expiry - 59 days for bonds to stay below $97

- November FOMC meeting - Fed rate decision

- 10-year Treasury yield - Key technical level at 4.0%

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 TOMORROW'S EARNINGS (October 22)

- MMM - $111M Diagonal Spread - Surgical instruments transformation test

- GEV - $8.8M Multi-Leg Play - AI power demand validation

⚡ THIS WEEK'S MAJOR CATALYSTS

- NOW - October 29 - ServiceNow Q3 earnings with $47M positioning

- CVNA - October 30 - Carvana Q3 profitability sustainability test

- AAPL - October 31 - Apple Q4 earnings, iPhone 16 cycle strength

🧠 November Earnings Wave

- CRCL - November 12 - Circle USDC growth amid regulatory clarity

- SMCI - Mid-November - AI server recovery thesis test

📅 November 21 Expiry Concentration

Major Gamma Exposure: AAPL, MMM, GEV, CRCL, MSFT all expire November 21 (31 days)

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Pre-Earnings Aggressive Positioning (50% of Today's Flow - $213M)

The Conviction Message: Smart money loading up BEFORE catalysts

- → MMM: $111M diagonal spread day before earnings

- → NOW: $47M deep ITM 8 days before AI earnings

- → GEV: $8.8M multi-leg 1 day before power earnings

- → CVNA: $27M LEAPs 9 days before profitability test

🚀 AI Infrastructure Dominance ($99M Coordinated Positioning)

Technology Transformation Conviction:

- → MSFT: $22M Azure AI earnings play

- → AAPL: $45M Apple Intelligence cycle bet

- → VRT: $32M datacenter thermal management boom

🛡️ Patient Capital LEAPs ($80M+ Long-Term Conviction)

Multi-Year Transformation Themes:

- → NOW: 2028 AI platform orchestration

- → CVNA: 2028 used car market dominance

- → RKLB: 2028 space exploration straddle

⚡ Recovery & Contrarian Plays ($14.9M Beaten-Down Bets)

Smart Money Finding Value:

- → SMCI: -51% YTD recovery setup with $4.1M

- → CRCL: Hedging 249% winner with $5.7M collar

- → IEF: $2M bond rally exhaustion bet

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Earnings binary events within days

Immediate Catalysts (October 22-31):

- MMM October spreads - Earnings TOMORROW, follow $111M diagonal positioning

- GEV November calls - Power demand catalyst TOMORROW

- NOW November calls - AI platform earnings 8 days away

Contrarian Recovery:

- SMCI bull call spreads - AI server recovery with 335% max return potential

⚠️ YOLO RISK WARNING: These are EARNINGS PLAYS with BINARY OUTCOMES. Position sizing is critical - allocate no more than 1-2% per position. Earnings can gap in either direction, creating 50-100% losses overnight.

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing and catalyst timelines

AI Infrastructure Theme:

- AAPL November calls - Follow $45M whale through iPhone 16 cycle + Q4 earnings

- MSFT November calls - Azure AI earnings with $22M institutional positioning

- VRT March/June spreads - Datacenter thermal management boom with 5-8 month runway

Earnings Recovery Stories:

- CVNA call spreads - Used car profitability validation through year-end

- MMM post-earnings plays - If earnings confirm turnaround, follow diagonal spread into March

⚖️ SWING TRADER RISK MANAGEMENT: Set stops at 30% of premium paid. Take profits at 75-100% gains. Watch November 21 expiry concentration - gamma risk intensifies final week.

💰 Premium Collection (Income Strategy)

Follow institutional sellers and complex spread strategies

High-Premium Call Selling:

- IEF bear call spreads - Collect premium like 40,386-contract whale, betting bonds stay below $97

- CRCL covered calls - $130 strikes following $3M institutional seller

Sophisticated Spread Income:

- MMM calendar spreads - Replicate diagonal spread structure for income

- SMCI bull put spreads - Sell puts below $50 support on beaten-down AI server maker

💰 PREMIUM COLLECTOR CHECKLIST:

- Verify implied volatility is elevated (earnings premium)

- Sell strikes with 30-40% probability of profit

- Target 1-2% monthly returns on capital deployed

- Avoid selling naked - always use defined-risk spreads

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education before replicating complex strategies

Paper Trade First:

- Study MMM's diagonal spread - Learn how institutions get 56:1 leverage

- Analyze GEV's 4-leg earnings play - Understand bull put spreads with call protection

- Review CRCL's collar strategy - See how to protect gains while staying invested

Conservative ETF Exposure (No Options):

- QQQ shares for tech exposure without single-stock risk

- IEF shares for Treasury bond exposure if you disagree with institutions

Small Position Real-Money Learning:

- VRT 1-contract call spreads - AI infrastructure theme with defined risk (~$500-800 total)

- AAPL 1-contract calls - Learn deep ITM call mechanics with minimal capital

Education Priority:

- Watch earnings reactions live (Oct 22-31) to see how options move

- Study why SMCI dropped 51% - understand AI server competitive dynamics

- Learn delta, gamma, theta basics before attempting spreads

- Calculate max loss BEFORE entering any position

🛡️ ENTRY LEVEL CRITICAL: This is NOT beginner territory - 7 of 11 tickers report earnings within 10 days. Earnings create violent volatility that can wipe out premium overnight. Start with paper trading or 1-contract positions to learn WITHOUT risking serious capital.

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

AI Infrastructure Risks:

- MSFT/AAPL/NOW: AI adoption slower than expected, cloud growth disappoints at earnings

- VRT: Datacenter buildout delays or power infrastructure investments pause

- SMCI: Fails to regain market share, Nvidia Blackwell goes to competitors

Transformation Story Risks:

- MMM: Q3 earnings disappoint, restructuring costs exceed benefits

- CVNA: Used car market deteriorates, profitability unsustainable

- GEV: AI power demand overstated, traditional energy market softness

Space & Crypto Risks:

- RKLB: Neutron delays, launch failures, contract losses to SpaceX

- CRCL: Stablecoin regulation turns negative, USDC market share erodes

😰 If You're Following the Bears

Treasury Bond Positioning:

- IEF: Fed cuts more aggressively than expected, bond rally resumes

- Unexpected geopolitical crisis driving flight-to-quality Treasury demand

Contrarian Recovery Failures:

- SMCI: Company-specific issues beyond market control (accounting, execution)

- Broad market selloff derailing all recovery plays regardless of fundamentals

💣 This Week's Catalysts & Key Dates

📊 This Week (October 21-25):

- October 22: MMM Q3 earnings + GEV Q3 earnings (TOMORROW!)

- October 29: NOW Q3 earnings ($47M positioned)

- October 30: CVNA Q3 earnings ($27M positioned)

- October 31: AAPL Q4 earnings likely ($45M positioned)

🗓️ Early November:

- November 12: CRCL Q3 earnings ($5.7M hedged)

- November 21: MASSIVE expiry - AAPL, MMM, GEV, MSFT, CRCL (gamma unwind risk)

📈 Beyond November:

- December 19: IEF bear call spread expiry

- March 2026: MMM short call leg, VRT calls, SMCI spread

- January 2028: NOW, CVNA, RKLB LEAPs

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 22-31 Earnings)

- MMM - Q3 earnings October 22

- GEV - Q3 earnings October 22

- NOW - Q3 earnings October 29

- CVNA - Q3 earnings October 30

- AAPL - Q4 earnings ~October 31

📆 Monthly (November 21 Expiry)

- AAPL $45M deep ITM positioning

- MSFT $22M AI earnings play

- MMM $56M long call leg

- GEV $8.8M multi-leg structure

- CRCL $3M call sales

🗓️ Quarterly (December-March Positioning)

- IEF December bear call spread (59 days)

- MMM March short call leg (5 months)

- VRT March calls ($16M), June calls ($16M)

- SMCI June recovery spread (8 months)

🚀 LEAPs (2026-2028 Multi-Year Bets)

- NOW January 2028 ($47M AI platform conviction)

- CVNA January 2028 ($27M used car transformation)

- RKLB January 2028 ($21M space exploration straddle)

🎯 The Bottom Line: Follow the $426M Earnings Season Blitz Signal

This is the most concentrated pre-earnings institutional positioning we've seen this year. $426+ million flowing into 11 tickers with 7 reporting within 10 days. This isn't random whale activity - this is calculated positioning ahead of make-or-break catalysts.

The biggest questions:

- Will MMM's $111M diagonal spread prove restructuring momentum at tomorrow's earnings?

- Does NOW's $47M bet 8 days before earnings signal blowout AI platform growth?

- Can GEV validate $8.8M power demand thesis at tomorrow's Q3 report?

- Will AAPL's $45M institutional bet pay off with iPhone 16 strength?

Your move: This concentrated earnings positioning demands attention. Follow the smart money themes or stay patient on the sidelines - but don't ignore $426 million in institutional conviction risked just days before binary catalysts.

⚠️ CRITICAL RISK WARNING: This is the MOST DANGEROUS time to blindly follow unusual activity. Earnings create binary outcomes that can wipe out 50-100% of option premium overnight. Institutions often have complex hedged positions we can't see. NEVER allocate more than 1-2% per YOLO earnings play, 3-5% for swing trades. Paper trade first if you're entry-level.

PATIENCE OVER FOMO: The biggest mistake retail traders make is chasing institutional flows without understanding the full picture. These whales have teams of analysts, proprietary data, and hedged positions. You have incomplete information and higher trading costs. Only engage when you have TRUE conviction in the catalyst - not just because "smart money" is playing.

🔗 Get Complete Analysis on Every Trade

💰 Mega-Cap Earnings Plays:

- MMM $111M Diagonal Spread - Capital-Efficient Positioning

- NOW $47M AI Platform Bet - Q3 Earnings 8 Days Away

- AAPL $45M Deep ITM Call - iPhone 16 Cycle Strength

- MSFT $22M Azure AI Play - Cloud Growth Catalyst

🚀 AI Infrastructure & Transformation:

- VRT $32M Datacenter Buildout - Thermal Management Boom

- CVNA $27M LEAP Play - Used Car Market Dominance

- RKLB $21M Space Straddle - Multi-Year Volatility Bet

⚡ Immediate Earnings Catalysts:

🛡️ Recovery & Contrarian Bets:

⚠️ Options involve substantial risk and are not suitable for all investors. Earnings announcements create extreme volatility that can result in total loss of option premium. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Never blindly follow whale trades - institutions have information, resources, and hedging strategies unavailable to retail investors. Always practice proper risk management, never risk more than you can afford to lose, and consider paper trading before risking real capital on complex earnings plays.