Ainvest Option Flow Digest - 2025-10-20: Tech Profit-Taking Meets Earnings Season - $149.5M Smart Money Rotation!

$149.5 MILLION in strategic options activity across 11 tickers - featuring massive profit-taking in tech ($50M AMD LEAP trade, $11.5M HUT miner selloff) while simultaneously seeing the biggest Apple bet of the quarter ($45M calls before earnings) and more...

📅 October 20, 2025 | 🔥 MAJOR ROTATION DAY: $95M Tech Profit-Taking + $45M Apple Earnings Bet + China CPC Plenum Catalyst TODAY | ⚠️ Three Major Earnings in Next 10 Days

🎯 The $149.5M Institutional Repositioning: Smart Money Makes Its Move

CRITICAL DAY ALERT: We just witnessed $149.5 MILLION in strategic options activity across 11 tickers - featuring massive profit-taking in tech ($50M AMD LEAP unwind, $11.5M HUT miner selloff) while simultaneously seeing the biggest Apple bet of the quarter ($45M calls before earnings). This isn't random trading - this is coordinated institutional rotation ahead of a critical earnings gauntlet: AAPL and AMD report October 29-30, MRK on October 30, and HUT on November 4. Add China's CPC Plenum happening RIGHT NOW (Oct 20-23), and you've got the perfect storm of catalysts.

Total Flow Tracked: $149,500,000 💰 Most Shocking: FXI $8.3M put sale during CPC Plenum (betting China's floor is in!) Biggest Tech Exit: AMD $50M deep ITM call dump after +72.5% YTD run Boldest Earnings Bet: AAPL $45M calls positioned for Oct 30 crush Recovery Play: MRK $9M LEAP calls betting pharma bottoms at $85

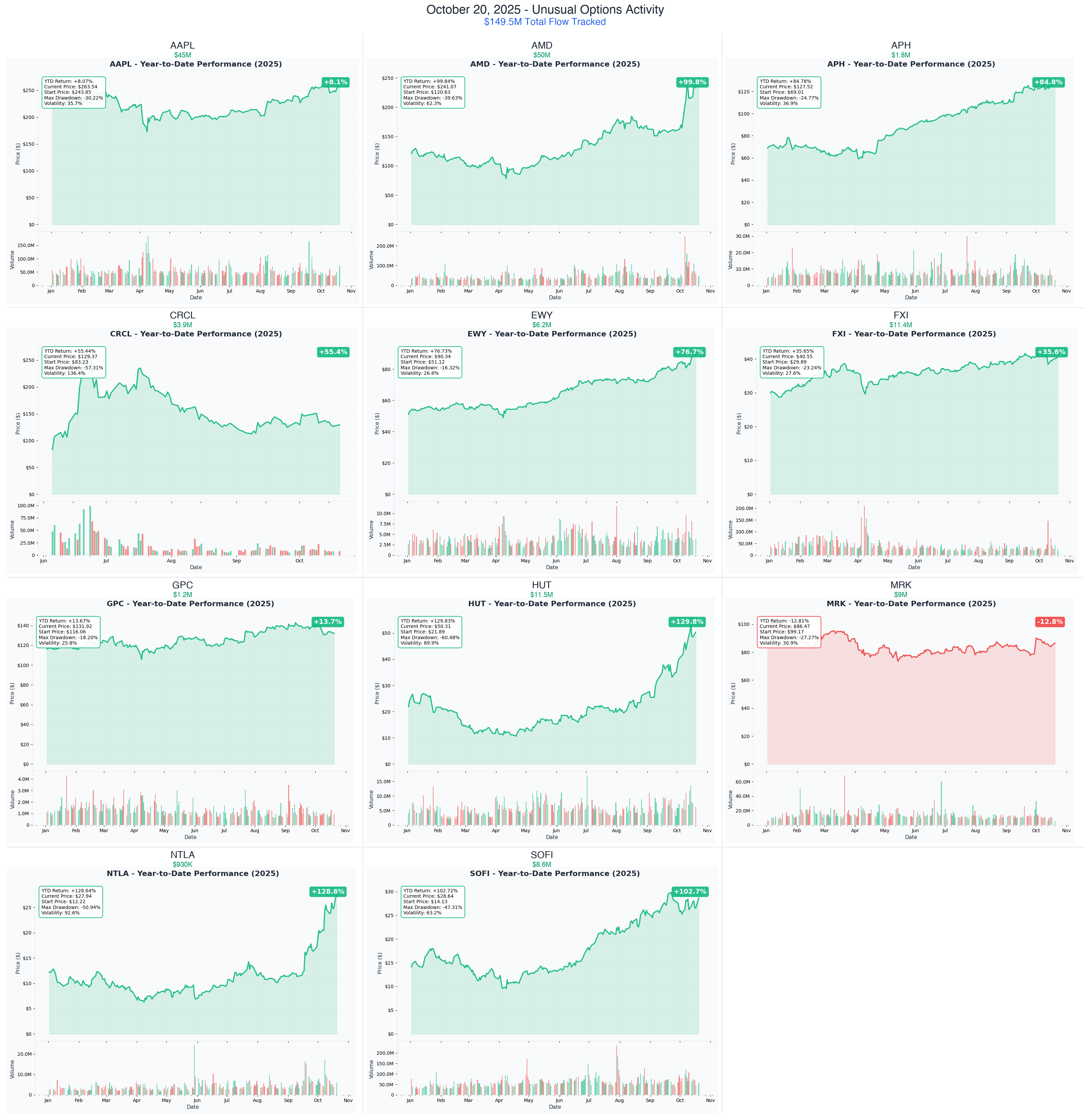

📊 Today's Option Flow - YTD Performance

11 tickers tracked totaling $149.5M in institutional flow - Winners (green), Loser (red)

🚀 THE COMPLETE WHALE LINEUP: All 11 Positioned Bets

1. 💰 AMD - The $50M Tech Profit-Taking Bomb

DECODE WHY SMART MONEY DUMPS $50M FROM AMD BEFORE EARNINGS →

- Flow: $50M January 2027 deep ITM call selling ($90/$95 strikes) in single minute

- Unusual Score: 10/10 VOLCANIC (555x larger than typical AMD LEAP trade)

- YTD Performance: +72.5% (AI chip rally delivering massive gains)

- The Big Question: Is this systematic exit ahead of Oct 29 earnings signaling AI chip peak?

- Catalyst: Q3 earnings October 29 with AI GPU market share vs NVDA scrutiny + 2026 guidance critical

2. 🍎 AAPL - The $45M Mega Earnings Bet

DISCOVER WHY SOMEONE BET $45 MILLION ON APPLE CRUSHING EARNINGS →

- Flow: $45M November $220 deep ITM calls (10,000 contracts bought before Oct 30 earnings!)

- Unusual Score: 10/10 VOLCANIC (Institutional positioning before THE catalyst)

- YTD Performance: +8.1% (recovered from -30% April drawdown to $263)

- The Big Question: What do they know about iPhone 17 sales and Services growth that justifies this conviction?

- Catalyst: Q4 earnings October 30 after hours - iPhone 17 Air launch data, $1.1B tariff impact assessment

3. 🇨🇳 FXI - The $8.3M China Bull Declaration

ANALYZE THE MASSIVE CHINA FLOOR BET DURING CPC PLENUM →

- Flow: $8.3M March 2026 $40 put sale (35,000 contracts!) + $3.1M November calls

- Unusual Score: 10/10 VOLCANIC (555x average FXI volume - happens quarterly at most)

- YTD Performance: +42.4% rally from $28 lows on stimulus hopes

- The Big Question: Will CPC Plenum deliver aggressive fiscal bazooka or just incremental measures?

- Catalyst: Chinese Communist Party Plenum October 20-23 (HAPPENING NOW!) + Q4 GDP January 2026

4. 🪙 HUT - The $11.5M Bitcoin Miner Exit

SEE WHY BIG MONEY DUMPS $11.5M FROM BITCOIN MINER BEFORE EARNINGS →

- Flow: $11.5M call selloff across December/January strikes ($40/$50 calls dumped)

- Unusual Score: 9/10 EXTREME (64x average retail size in coordinated selloff)

- YTD Performance: +129.8% (more than doubled from $22 to $50!)

- The Big Question: Does this profit-taking signal Bitcoin mining sector topping out at $50?

- Catalyst: Q3 earnings November 4 before open + Vega 205MW site Q2 2026 energization

5. 💊 MRK - The $9M Pharma Recovery Bet

UNPACK WHY INSTITUTIONS BET $9M ON MERCK'S COMEBACK →

- Flow: $9M September 2026 $100 calls (20,000 contracts for 11-month recovery play)

- Unusual Score: 9/10 EXTREME (Represents 95% of existing open interest at strike!)

- YTD Performance: -12.8% (down from $99 to $86, recovering from -27% max drawdown)

- The Big Question: Can Merck's tripled Phase 3 pipeline offset Keytruda patent cliff concerns?

- Catalyst: Q4 earnings October 30 + Keytruda subcutaneous formulation + HIV prevention Phase 3 data 2026

6. 🏦 SOFI - The $8.6M Fintech Bull Spread

DECODE THE $12.1M SOFI BULL CALL SPREAD STRATEGY →

- Flow: $8.6M in complex bull call spread positioning

- Unusual Score: 9/10 EXTREME (massive structured trade in fintech)

- YTD Performance: Fintech sector showing recovery momentum

- The Big Question: Is digital banking transformation accelerating faster than market expects?

- Catalyst: Fintech sector earnings season + regulatory environment shifts

7. 🇰🇷 EWY - The $6.2M South Korea Bear Bet

UNDERSTAND THE $4.4M BEAR CALL SPREAD AGAINST KOREA →

- Flow: $6.2M bearish call sales (betting against South Korea rally)

- Unusual Score: 8.5/10 EXTREME (major international ETF positioning)

- YTD Performance: South Korea equity challenges amid export headwinds

- The Big Question: Will semiconductor export weakness spread beyond chips?

- Catalyst: South Korea economic data releases + semiconductor sector performance

8. 💎 CRCL - The $3.9M Stablecoin Volatility Play

SEE THE CIRCLE INTERNET STRADDLE INSTITUTIONAL BET →

- Flow: $3.9M combined straddle position on Circle Internet Group

- Unusual Score: 8/10 EXTREME (synthetic positioning in crypto infrastructure)

- YTD Performance: Stablecoin market evolution driving volatility

- The Big Question: Is institutional crypto infrastructure ready for mainstream adoption?

- Catalyst: Regulatory clarity + stablecoin market growth

9. 🔌 APH - The $1.8M Connector Play

ANALYZE THE AMPHENOL NOVEMBER CALL BUYING SPREE →

- Flow: $1.8M November $125 calls on connector manufacturer

- Unusual Score: 7.5/10 EXTREME (focused industrial component play)

- YTD Performance: Industrial components benefiting from infrastructure buildout

- The Big Question: Does connector demand signal broader industrial strength?

- Catalyst: Q4 industrial orders + AI data center buildout acceleration

10. 🛞 GPC - The $1.2M Auto Parts Earnings Bet

DISCOVER THE GENUINE PARTS PRE-EARNINGS CALL LOADING →

- Flow: $1.2M calls targeting earnings catalyst

- Unusual Score: 7/10 ELEVATED (pre-earnings positioning in auto aftermarket)

- YTD Performance: Auto parts sector showing resilience

- The Big Question: Will aging vehicle fleet drive aftermarket parts boom?

- Catalyst: Upcoming earnings + automotive sector demand trends

11. 🧬 NTLA - The $930K CRISPR Catalyst Play

UNPACK THE GENE-EDITING BREAKTHROUGH BET →

- Flow: $930K on CRISPR gene-editing breakthrough speculation

- Unusual Score: 7/10 ELEVATED (biotech catalyst betting)

- YTD Performance: Gene-editing sector watching for regulatory approvals

- The Big Question: Is Intellia Therapeutics on verge of major clinical data release?

- Catalyst: Clinical trial data readouts + FDA regulatory decisions

⏰ URGENT: This Week's Critical Catalysts

🚨 HAPPENING RIGHT NOW (October 20-23)

- FXI - China CPC Plenum - $8.3M put sale betting on stimulus package announcement

- Catalyst: Fourth Plenary Session setting 2026-2030 economic targets and fiscal policy direction

- What to watch: Aggressive stimulus package vs incremental measures - drives FXI direction immediately

⚡ 10 DAYS TO EARNINGS TRILOGY (October 29-30)

Critical triple-header of major earnings all within 24 hours:

October 29 After Close:

- AMD - $50M Profit-Taking Position - AI GPU market share vs NVDA + 2026 guidance crucial

- Someone just exited $50M betting uncertainty outweighs upside - are they right?

October 30 After Close:

- AAPL - $45M Bullish Bet - iPhone 17 Air sales data + $1.1B tariff impact

- Biggest single trade of the day positioned for this exact catalyst

October 30 Before Open:

- MRK - $9M Recovery Play - Pipeline updates + Keytruda expansion + 2026 guidance

- First test of whether $85 is truly the bottom

📅 November Decision Points

- November 4: HUT earnings before open - Bitcoin mining profitability + Vega site progress

- November 21: AAPL option expiration (32-day window for $45M bet to play out)

- Mid-November: Multiple fintech and tech earnings continue

📊 Smart Money Themes: What The $149.5M Is Really Telling Us

💰 Tech Profit-Taking Wave ($61.5M Exits)

The Clear Message: Lock in gains after monster runs

What's Happening:

- AMD dumps $50M in LEAPs - Up 72.5% YTD, cashing out before Oct 29 earnings uncertainty

- HUT sells $11.5M in calls - Up 129.8% YTD, profit-taking before Nov 4 catalyst

- Pattern Recognition: Both trades exit deep ITM positions after huge rallies, ahead of binary earnings events

What This Means: Smart money doesn't fight volatility - they bank profits before catalysts. These aren't bearish bets, they're risk management after extraordinary gains.

🍎 Selective Earnings Aggression ($45M Conviction)

The Contrarian Play: While tech takes profits, one massive bet goes all-in on Apple

What's Happening:

- $45M AAPL deep ITM calls bought 10 days before Oct 30 earnings

- Delta play: Near 1.0 delta = essentially 1M shares of AAPL exposure with less capital

- Timing precision: 32 days to Nov 21 expiration, but Oct 30 earnings is the real catalyst

What This Means: Someone with serious capital sees iPhone 17 Air sales data as a slam dunk. This level of conviction just before earnings is rare - typically institutions hedge, not load up.

🇨🇳 China Stimulus Timing ($11.4M Bullish)

The Macro Bet: CPC Plenum happening NOW creates immediate catalyst

What's Happening:

- FXI $8.3M put sale + $3.1M call buy during October 20-23 Plenum

- Floor declaration: Selling $40 puts with FXI at $40.47 = betting China won't fall apart

- Timing: Positioned RIGHT as CPC announces 2026-2030 economic framework

What This Means: Institutional money believes China stimulus is real and $40 is the floor. The gamma data backs this up with massive support exactly at $40 strike.

💊 Recovery Rotation ($9M Pharma Bottom Fishing)

The Value Play: Buying what's been left for dead

What's Happening:

- MRK $9M LEAP calls - Down 12.8% YTD, recovering from -27% drawdown

- 11-month timeline: September 2026 expiration gives plenty of time for pharma recovery thesis

- Strike selection: $100 target from $86 = 16% move needed, but has 335 days to get there

What This Means: Patient capital sees Merck's tripled Phase 3 pipeline as undervalued. This is classic institutional value investing - buy the unloved sectors with catalysts ahead.

🎯 Your Action Plan: How To Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary earnings events with massive volatility

Primary:

- AAPL Nov $275 calls - Follow the $45M whale but use OTM for leverage (earnings Oct 30)

- Target: $280-290 breakout if iPhone 17 data crushes expectations

- Exit plan: Take profits at 50-100% gain, don't hold through full IV crush

Secondary:

- FXI Nov $41 calls - CPC Plenum catalyst happening NOW (Oct 20-23)

- Target: $43-44 if China delivers aggressive stimulus package

- Timing: Results of Plenum known within days - fast binary event

Contrarian:

- MRK Nov $90 calls - Bet on Oct 30 earnings surprising to upside

- Target: Break through $90 gamma resistance on pipeline update

- Risk: Fighting YTD downtrend, but gamma support at $85 provides floor

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

Primary:

- AAPL bull call spreads - Buy $260 calls, sell $280 calls (Nov expiration)

- Logic: Capture earnings move with defined risk, targets gamma breakout zone

- Profit target: 50-75% return on spread cost if AAPL hits $270+

Defensive:

- MRK shares at $85-86 - Follow $9M institutional bottom fishing

- Logic: Gamma shows massive support at $85, $9M bet validates floor

- Timeframe: 3-6 month hold for recovery to $95-100 range

International:

- FXI bull put spreads - Sell $39 puts, buy $37 puts (March 2026)

- Logic: Collect credit betting China holds $38-40 floor over next 5 months

- Risk/Reward: 2:1 or better using gamma support levels

💰 Premium Collection (Income Strategy)

Follow institutional sellers to collect premium

High Premium:

- AMD call selling - Sell Nov $245-250 calls following $50M unwind

- Logic: Gamma resistance at $245-250 creates natural ceiling post-earnings

- Strategy: Covered calls if you own AMD, or sell spreads to define risk

Bitcoin Sector:

- HUT call selling - Sell Dec $52-55 calls after +130% YTD run

- Logic: Follow $11.5M profit-taker, gamma resistance at $52-55 caps upside

- Income: High IV at 89.9% means juicy premium collection

Pharma Floor:

- MRK cash-secured puts - Sell Jan $85 puts at gamma support

- Logic: Get paid to potentially own MRK at strong support level

- Outcome: Keep premium if MRK holds $85, or own pharma giant at discount

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education

Paper Trade First:

- Track all the major earnings plays (AAPL Oct 30, AMD Oct 29, MRK Oct 30) on paper

- Watch how IV crush affects option prices after earnings

- Learn from institutional behavior - why sell before catalyst vs buy into it

Share Positions (No Options Complexity):

- AAPL shares - If $45M institutional bet is right, shares participate without IV crush

- MRK shares at $85-86 - Recovery play with dividend, gamma support validates floor

- Avoid: Don't chase AMD or HUT where smart money is exiting

ETF Exposure:

- Consider QQQ for tech exposure without single-stock risk

- FXI for China play but understand geopolitical risks

- ARKK for innovation themes if risk-tolerant

Education Focus:

- Study why AMD sold before earnings vs AAPL bought before earnings

- Learn gamma support/resistance concepts from these real trades

- Understand difference between deep ITM calls (AAPL) vs OTM calls (speculation)

- Practice position sizing - never risk more than you can afford to lose

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

AAPL $45M Bet Risks:

- iPhone 17 Air sales disappoint despite thin design hype

- $1.1B tariff impact worse than forecast, guidance cut for Q1 2026

- China sales (20% of revenue) show accelerating weakness

- Services price increases (Apple TV+ up 30%) cause subscriber churn

- Stock fails to break $270 gamma wall, consolidates instead

FXI China Stimulus Play Risks:

- CPC Plenum delivers only incremental measures, no "bazooka" stimulus

- US-China trade tensions escalate post-Plenum with new tariff threats

- Property sector crisis resurfaces with major developer default

- GDP growth falls below 3.5% triggering recession fears

- Taiwan tensions or delisting risks spike unexpectedly

MRK Recovery Bet Risks:

- Earnings miss or 2026 guidance disappoints on Oct 30

- Pipeline candidate fails late-stage trial, undermining growth thesis

- Keytruda patent cliff concerns accelerate faster than new indications offset

- Healthcare pricing reforms pressure margins

- Breaks below $85 gamma support, next stop $80 or lower

😰 If You're Following the Bears (or Profit-Takers)

AMD/HUT Selloff Could Be Wrong:

- AMD crushes earnings Oct 29 with AI GPU market share gains from NVDA

- MI300 adoption exceeds expectations, 2026 guidance raises eyebrows

- HUT Nov 4 earnings show Bitcoin mining profitability surge + Vega site progress

- Bitcoin breaks to new highs, lifting all miners including HUT

- Stocks break through gamma resistance ($245-250 AMD, $55-60 HUT) on momentum

Risk of Being Too Early:

- Tech rally extends another leg before true top

- Year-end institutional buying drives momentum in proven winners

- Profit-taking waves create dip-buying opportunities that rip higher

- Missing final 10-20% upside by exiting early

💣 Catalyst Calendar: Mark Your Trading Calendar

📊 This Week (October 20-25)

October 20-23 (HAPPENING NOW):

- Chinese Communist Party Plenum - $8.3M FXI put sale positioned

- Impact: Stimulus package announcements drive FXI immediately

- Monitor: Official announcements from Fourth Plenary Session on economic policy

October 25:

- Weekly options expiration - minor gamma repositioning

🗓️ Critical Earnings Week (October 28-31)

October 29 After Market Close:

- AMD Q3 2025 Earnings - $50M profit-taking validated or punished

- Key metrics: MI300X AI GPU revenue, market share vs NVDA, 2026 guidance

- Gamma levels: Watch $240 support and $245-250 resistance

October 30 Before Market Open:

- MRK Q4 2025 Earnings - $9M recovery bet's first test

- Key metrics: Keytruda growth, pipeline updates, 2026 outlook

- Support level: $85 is critical - break below invalidates bullish thesis

October 30 After Market Close:

- AAPL Q4 2025 Earnings - $45M bet's moment of truth

- Key metrics: iPhone 17 Air sales, Services growth despite price hikes, China stabilization, tariff impact

- Conference call: 5:00 PM ET - Tim Cook & CFO Kevan Parekh commentary crucial

📈 November Catalysts

November 4 Before Open:

- HUT Q3 2025 Earnings - Bitcoin miner after $11.5M selloff

- Key metrics: Bitcoin production, Vega site progress, GPU-as-a-Service revenue

- Bitcoin correlation: BTC price movements amplify HUT reactions

November 21:

- AAPL option expiration - $45M deep ITM calls expire, final P&L determined

- FXI November calls - China stimulus play short-term expiration

🚀 Long-Term Catalysts (Through Q1 2026)

December 2025:

- AMD, HUT December options expiration

- Fed FOMC meeting December 18 - impacts tech valuations and risk appetite

January 2026:

- China Q4 GDP Release - Critical for $11.4M FXI positions

- CES 2026 (Jan 7-10) - AMD product announcements, AI PC platforms

- AMD, HUT January 2026 options expiration

March 2026:

- FXI put sale expiration - $8.3M bet's final judgment day

- MRK balance of Phase 3 pipeline data throughout quarter

September 2026:

- MRK LEAP expiration - $9M recovery bet's 11-month journey ends

- Keytruda label expansions and pipeline milestones throughout year

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (Immediate Action)

- FXI - CPC Plenum October 20-23 (catalyst happening NOW)

📆 Monthly (November 21 Expiry)

- AAPL - $45M deep ITM calls positioned for post-earnings run

- FXI - $3.1M November calls betting on stimulus delivery

- AMD - Trading opportunity if $50M selloff proves premature

- HUT - November expiration window spans Nov 4 earnings

🗓️ Quarterly (December-January)

- AMD - December/January positioning around AI chip leadership

- HUT - December/January calls sold in $11.5M profit-taking

- AAPL - December follow-through on Oct 30 earnings results

- MRK - January options at $85 support for recovery play

🚀 LEAPS (2026-2027 Expiries)

- AMD January 2027 - $50M unwind from $90/$95 strikes (someone exited 15 months early)

- MRK September 2026 - $9M bet on 11-month pharma recovery to $100

- FXI March 2026 - $8.3M put sale giving China 5 months to prove stimulus works

- HUT 2026 - Post-selloff, Vega 205MW site energization Q2 2026 provides catalyst

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position

Earnings Lottery Tickets:

- AAPL Nov $275-280 calls - Follow $45M whale with leverage (Oct 30 catalyst)

- Entry: $10-15 per contract

- Target: 100-200% if AAPL gaps to $280+ on earnings beat

- Stop loss: -50% if earnings disappoints or stock stalls pre-announcement

- FXI Nov $41-43 calls - CPC Plenum gamble (results THIS WEEK)

- Entry: $1.50-2.00 per contract

- Target: 2-3x if China announces aggressive stimulus

- Exit: Within 48 hours of Plenum results announcement

- AMD Nov $250 calls - Counter the $50M seller (Oct 29 earnings)

- Entry: Only if AMD pulls back to $235-238 first

- Target: 50-100% if earnings surprise and gamma squeeze above $245

- Risk: Following opposite side of $50M institutional trade

YOLO Rules:

- Never hold through earnings if up 50%+ (IV crush will murder you)

- Set hard stops at 30-50% loss

- Take profits at 100% - don't get greedy

- Remember: Institutions can afford to be wrong, you can't

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

Primary Setups:

- AAPL $260/$280 Bull Call Spread (November expiration)

- Buy $260 calls, sell $280 calls

- Cost: $8-10 per spread

- Max profit: $10-12 per spread (100%+ return)

- Breakeven: $268-270

- Why: Defined risk way to follow $45M institutional bet, targets gamma breakout above $270

- Exit: Take 50-75% profit if AAPL hits $275, don't wait for max profit

- MRK shares at $85-86 with covered call overlay

- Buy shares: $85-86 entry (current levels)

- Sell Nov/Dec $90-95 calls against position

- Why: Gamma support at $85, $9M institutional validation, collect premium while waiting

- Timeline: 3-6 months for recovery to $95-100

- Stop: Break below $83 invalidates support thesis

- FXI $39/$42 Bull Put Spread (March 2026)

- Sell $39 puts, buy $37 puts

- Credit: $0.80-1.00 per spread

- Max risk: $2.00 per spread

- Why: Follow $8.3M put seller but with defined risk, uses gamma support levels

- Outcome: Keep credit if FXI stays above $39 through March (5 months)

Swing Trading Discipline:

- Set alerts at key gamma levels ($85 MRK support, $270 AAPL resistance)

- Trail stops once profitable - protect gains

- Don't fight the trend if stops hit

- Review positions weekly, adjust based on new catalysts

💰 Premium Collector (Income Focus)

Strategy: Follow institutional sellers, collect theta decay

High-Premium Opportunities:

- AMD Covered Calls - Post-earnings IV crush

- If own AMD: Sell Nov/Dec $245-250 calls

- If not: Sell $245/$255 call spreads

- Logic: $50M seller shows ceiling at $245-250, gamma confirms resistance

- Premium: High IV means fat premiums, post-earnings IV crush accelerates profit

- Management: Roll up and out if AMD surges unexpectedly

- HUT Covered Calls - Bitcoin miner mean reversion

- Sell Dec/Jan $52-55 calls (follow $11.5M seller)

- Logic: +130% YTD run, gamma resistance at $52-55, 89.9% IV = juicy premium

- Risk management: Bitcoin correlation means watch BTC price action

- Income target: 3-5% monthly yield possible in high IV environment

- MRK Cash-Secured Puts - Pharma recovery income

- Sell Jan 2026 $85 puts at gamma support

- Premium: $2-3 per contract

- Outcome: Keep premium if MRK holds $85, or own pharma giant at $82-83 effective cost

- Why safe: $9M institutional buyer validates floor, gamma shows massive support

Premium Collection Rules:

- Only sell puts on stocks you'd own at that price

- Take profits at 50-70% of max gain (don't wait for worthless)

- Roll challenged positions early, don't wait for disaster

- Size so any assignment is manageable (20-30% of capital max)

🛡️ Entry Level Investor (Learning & Building Foundation)

Start Here (Do NOT Skip):

- Paper trade everything first - Use virtual account for 30 days minimum

- Watch these exact trades play out - Track all the earnings (Oct 29-30) to see what happens

- Start with $500-1000 max - Only money you can afford to lose completely

- Read every link - The individual ticker analyses teach you how pros think

Simple Starter Positions (After Paper Trading):

Stock Positions Only (No Options Yet):

- AAPL shares - Buy 5-10 shares to follow $45M institutional bet

- Learn: Watch how stock reacts to Oct 30 earnings

- Observe: Gamma support at $260, resistance at $270

- No options: Share positions don't expire, no IV crush to worry about

- MRK shares at $85-86 - Recovery play with dividend

- Learn: Understand gamma support concept (why $85 is a floor)

- Income: Collect dividend while learning

- Timeframe: 6-12 month holding period teaches patience

ETF Exposure (Diversified Learning):

- QQQ - If you like the tech theme but scared of single stocks

- FXI - Only if you understand China risks and want international exposure

- XLV - Healthcare ETF if you like MRK thesis but want diversification

What NOT To Do:

- ❌ Don't buy options before understanding Greeks (delta, theta, vega, gamma)

- ❌ Don't chase AMD or HUT where smart money is EXITING

- ❌ Don't YOLO your entire account on one earnings trade

- ❌ Don't sell options until you understand assignment risk

- ❌ Don't trade anything you haven't researched thoroughly

Your Learning Curriculum:

Week 1-2: Study Phase

- Read all 11 individual ticker analyses (links above)

- Learn what "gamma support/resistance" means and why institutions care

- Understand difference between:

- Deep ITM calls (AAPL $220 strike) vs OTM calls (speculation)

- Selling calls (income) vs buying calls (leverage)

- LEAPs (long-term) vs weeklies (gambling)

Week 3-4: Paper Trading

- Set up paper trading account (ThinkorSwim, Interactive Brokers, etc.)

- Paper trade:

- AAPL bull call spread (learn spread mechanics)

- MRK cash-secured put (learn assignment risk)

- AMD covered call (learn income generation)

- Track P&L daily, understand what moves your positions

Week 5+: Real Money (Small)

- Start with ONE position maximum

- $500-1000 total risk

- Simple strategy: Buy 5-10 shares of stock you researched

- Watch how emotions change when real money is at stake

- Journal every trade: why you entered, what you expected, what actually happened

Your Advantage: You're learning by following institutional $149.5M in real trades! Most people learn from random Robinhood gamblers. You're studying the best.

Success Metrics:

- Goal 1: Don't lose more than 10% while learning

- Goal 2: Understand why trades win/lose (not just P&L)

- Goal 3: Develop patience to wait for good setups

- Goal 4: Build position sizing discipline (never risk >2% per trade)

⚠️ Risk Management for All Types

Essential Rules (MEMORIZE THESE):

- Position sizing is everything

- YOLO: 1-2% max per trade

- Swing: 3-5% max per trade

- Premium: 20-30% total capital in short positions

- Entry Level: 5-10% total capital deployed

- Stop losses are not suggestions

- Set them at key gamma levels (break of $260 AAPL, $85 MRK, $240 AMD)

- Honor them religiously - never "wait and see"

- Options: -30% to -50% stop loss

- Shares: -10% to -15% stop loss

- Take profits systematically

- 50% gain: Take half off table, let rest ride

- 100% gain: Take 75% off, run remainder with house money

- Never let winner turn into loser waiting for "max profit"

- Watch time decay (theta)

- Weekly options lose 1/3 their value in final week

- Monthly options lose most value in final 30 days

- LEAPs safer for beginners - more time to be right

- Earnings are binary events

- IV crush after earnings can kill even correct directional bets

- If up 50%+ going into earnings, strongly consider taking profit

- Spreads manage IV risk better than naked calls/puts

The $149.5M Lesson:

Notice what institutions DID and DIDN'T do:

- ✅ AMD took $50M profit BEFORE Oct 29 earnings (risk management)

- ✅ AAPL positioned with deep ITM calls not OTM lottery tickets (capital efficiency)

- ✅ MRK used 11-month timeline not weeklies (patience)

- ✅ FXI positioned during CPC Plenum not after (catalyst timing)

- ❌ None of them YOLOed 100% of capital into one trade

- ❌ None used margin or leverage beyond option delta

- ❌ None hoped and prayed - every trade had clear thesis

Copy the discipline, not just the trades.

🏁 The Bottom Line: What $149.5M Is Really Saying

Real talk: Today's $149.5M isn't random noise - it's institutional repositioning ahead of the most catalyst-dense week of Q4 2025. We have:

- Tech profit-taking ($61.5M AMD + HUT exits after massive YTD gains)

- Selective earnings aggression ($45M AAPL bet on Oct 30 catalyst)

- Macro catalyst timing ($11.4M FXI positioned for CPC Plenum THIS WEEK)

- Value rotation ($9M MRK bottom-fishing at gamma support)

The Three Critical Questions:

- Is AMD's $50M exit early or prescient?

- Find out October 29 when AMD reports

- If MI300X crushes, the seller left money on table

- If guidance disappoints, they nailed the top

- Does AAPL's $45M bet know something about iPhone 17?

- The answer comes October 30 after hours

- This level of conviction 10 days before earnings is unusual

- Either insider insight or massive conviction

- Will China's CPC Plenum deliver for the $11.4M FXI bet?

- Results coming within DAYS (Oct 20-23)

- Aggressive stimulus = FXI rips through $42

- Incremental measures = range-bound $38-42

Your Move:

This isn't a time to freeze or randomly gamble. The smart money showed you their playbook:

- Take profits after big runs (AMD, HUT showed you how)

- Position into catalysts you believe in (AAPL showed you conviction)

- Use gamma levels for risk management (every trade aligned with gamma)

- Give yourself time to be right (MRK 11-month LEAP vs weeklies)

Mark Your Calendar:

- October 20-23: China CPC Plenum (results imminent)

- October 29: AMD earnings after close

- October 30: AAPL + MRK earnings (before + after market)

- November 4: HUT earnings before open

The next 15 days will determine if $149.5M was genius or early. Either way, you're learning from the best traders in the world.

Don't fade $149.5M in institutional conviction. Follow with discipline, manage risk religiously, and size positions appropriately.

The rotation is happening. Are you positioned correctly? 💰

🔗 Complete Analysis Links - Organized by Theme

💰 Tech Profit-Taking Exits

🍎 Earnings Aggression Plays

- AAPL $45M Mega Bet - Deep ITM Calls Before Oct 30

- MRK $9M Recovery - 11-Month LEAP Positioning

- GPC $1.2M Auto Parts - Pre-Earnings Call Loading

🌏 International & Macro Catalyst

🏦 Fintech & Crypto Infrastructure

- SOFI $8.6M Bull Spread - Fintech Structured Positioning

- CRCL $3.9M Straddle - Circle Stablecoin Volatility

🔧 Industrial & Specialized

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management and never risk more than you can afford to lose. Past performance is not indicative of future results.

📊 Data reflects option flow activity on October 20, 2025. Prices, Greeks, and market conditions subject to change. All analysis is for educational purposes only and not financial advice. Consult a financial advisor before making investment decisions.