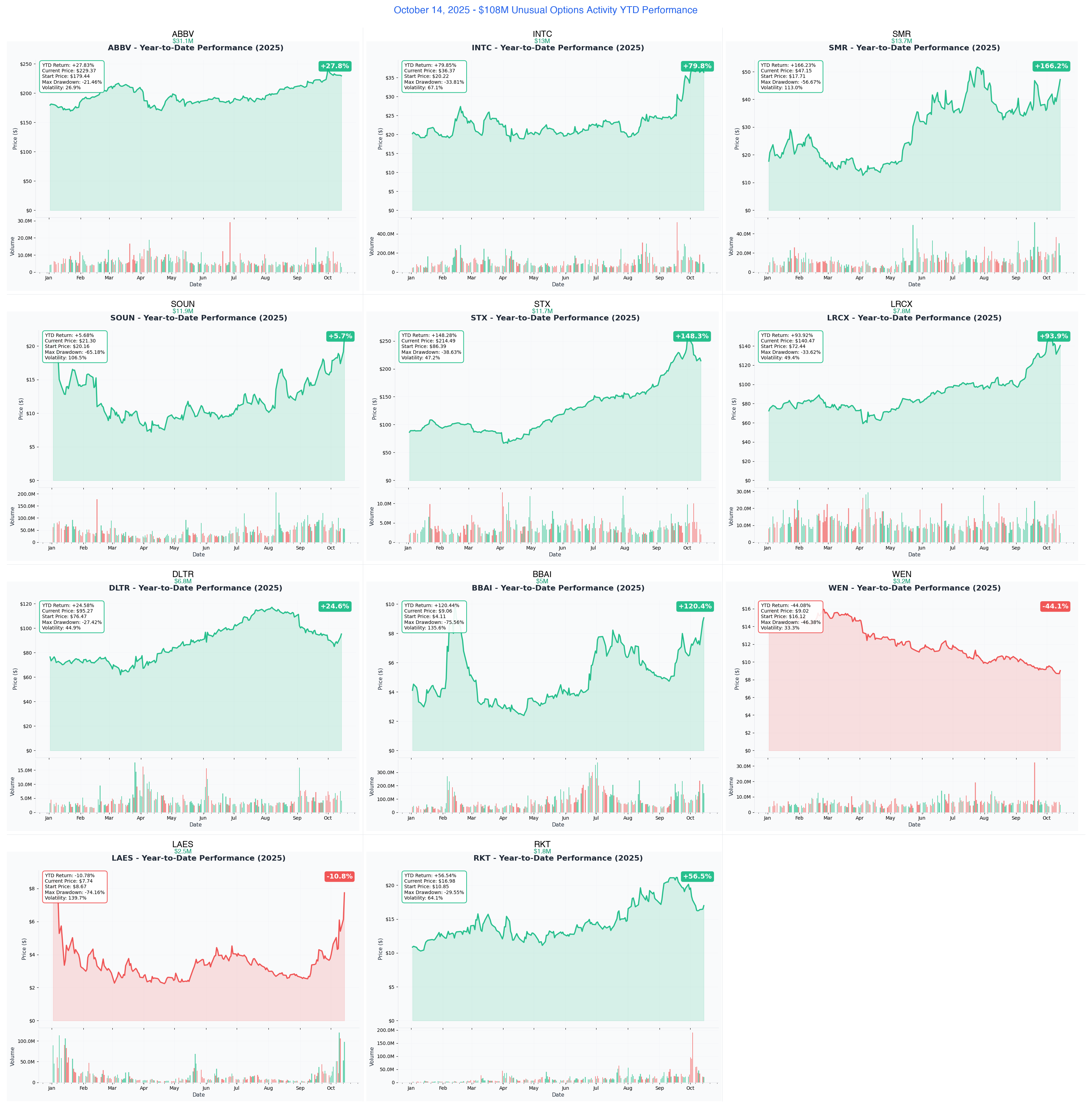

Ainvest Option Flow Digest - 2025-10-14: $108M Institutional Earthquake - Pharma Bulls Meet Chip Bears!

$108.5 MILLION in smart money $13M Intel profit-taking!) while AGGRESSIVELY loading pharma ($31.1M AbbVie sweep!), nuclear energy ($13.7M SMR complex play!), and AI voice technology ($11.9M SoundHound blitz!) and more...

📅 October 14, 2025 | 🚨 EXTREME VOLATILITY: $108M+ Option Flow Tsunami Hits 11 Tickers | 💊 Pharma's $31M Call Sweep + 🔧 Intel's $13M Profit-Taking + ☢️ Nuclear's $13.7M Bet | ⚠️ Multiple 3-Day Expiries Creating Gamma Chaos

🎯 The $108M Smart Money Earthquake: Sector Rotation Accelerating

🔥 HISTORIC DIVERGENCE: We just tracked $108.5 MILLION in jaw-dropping institutional options flow across 11 tickers - and the message is crystal clear: smart money is SPRINTING away from semiconductor momentum ($13M Intel profit-taking!) while AGGRESSIVELY loading pharma ($31.1M AbbVie sweep!), nuclear energy ($13.7M SMR complex play!), and AI voice technology ($11.9M SoundHound blitz!). This isn't random activity - this is coordinated sector rotation happening in REAL-TIME.

Total Flow Tracked: $108,500,000+ 💰 Largest Single Trade: ABBV $31.1M call sweep (7,694x unusual!) Most Bearish Signal: INTC $13M call SELLING (institutions capping upside!) Hottest Sector: Nuclear energy (SMR $13.7M with 4,894x multiplier!) Defensive Plays: $26.6M in put protection (STX $11.7M + WEN $3.2M)

Key Themes:

- 💊 Pharma Tsunami - AbbVie's $31.1M call sweep before Q3 earnings

- 💻 Chip Skepticism - Intel's $13M SELL call showing institutions capping gains

- ☢️ Nuclear Renaissance - SMR's $13.7M complex bet on TVA partnership

- 🔊 AI Voice Boom - SoundHound's $11.9M call blitz before Interactions acquisition

- 🛡️ Defensive Hedging - $26.6M in put protection across sectors

🚀 THE COMPLETE WHALE LINEUP: All 11 Monster Trades

1. 💊 ABBV - The $31.1M Pharma Tsunami Into Earnings

DISCOVER WHY ABBV GETS $31M IN 3 MINUTES BEFORE Q3 EARNINGS →

- Flow: $31.1M across 15,960 contracts - four massive blocks in just 3 minutes!

- Unusual Score: EXTREME (7,694x larger than average - happens 2-3 times per year!)

- YTD Performance: Stellar pharma year continuing momentum

- What's Happening: Institutional buyer swept deep ITM $210 calls expiring October 17 (3 days!) betting AbbVie breaks $230 resistance. Skyrizi/Rinvoq franchise crushing $25B+ run rate, Rinvoq patent extended to 2037, Q3 earnings October 31 showing continued growth.

- The Big Question: Will gamma squeeze through $230 wall trigger explosive breakout before Friday?

- Catalyst Timeline: October 17 expiry (3 days) for immediate gamma play, Q3 earnings October 31 for franchise validation

2. 💰 INTC - The $13M Covered Call SALE (Institutions Capping Upside!)

SEE WHY BIG MONEY IS SELLING $13M CALLS ON INTEL'S 18A HYPE →

- Flow: $13M call SELLING + $3.8M call buying = net bearish/neutral positioning

- Unusual Score: EXTREME (12,795x average size - rare institutional skepticism!)

- YTD Performance: +79.8% (but institutions don't believe in $45+)

- What's Happening: Someone SOLD 10,000 deep ITM $23 calls collecting $13.1 per share, capping upside at $36 by March 2026. This is classic profit-taking after the massive rally. Smaller $3.8M $37 call buy shows minority bullish opinion 3.4x smaller. Q3 earnings October 23 (9 days) will test 18A yields.

- The Big Question: Is this institutional vote that 18A yields won't support $40+ price?

- Catalyst Timeline: $23 call sale expires March 2026 (capping at $36), $37 call buy expires January 2026, Q3 earnings October 23

3. ☢️ SMR - The $13.7M Nuclear Energy Complex Bet

UNPACK THE 3-LEG NUCLEAR PLAY BETTING ON TVA PARTNERSHIP →

- Flow: $13.7M multi-leg strategy ($10M ITM calls + $2.2M OTM calls + $1.5M put selling)

- Unusual Score: EXTREME (4,894x average - once-a-year institutional conviction!)

- YTD Performance: +166.2% (nuclear energy revolution in full swing)

- What's Happening: Sophisticated bullish play combining $40.5 deep ITM calls (acts like owning 1.54M shares!), $49 speculative calls, and $43 put selling for 3-day expiration Friday. Historic 6GW TVA partnership creating blueprint for AI data center power, Q3 earnings November 6 could announce commercial contract.

- The Big Question: Will commercial deployment contract be announced before earnings?

- Catalyst Timeline: October 17 expiry (3 days) for short-term bet, Q3 earnings November 6 for contract updates, 2030 first commercial plant

4. 🔊 SOUN - The $11.9M AI Voice Call Blitz

ANALYZE WHY SOUNDHOUND GETS $11.9M BEFORE INTERACTIONS CLOSES →

- Flow: $11.9M across 65,000 contracts = massive bullish conviction

- Unusual Score: EXTREME (institutional bet on AI voice future)

- YTD Performance: Explosive AI voice technology growth

- What's Happening: Three coordinated call buys at $19, $22 strikes expiring October 17 (3 days!). Interactions acquisition closing imminently creating $140M revenue run rate, Perplexity integration driving adoption, NVIDIA partnerships validating technology. Trading near $21 with strong $20 support.

- The Big Question: Will Interactions acquisition close THIS WEEK triggering squeeze?

- Catalyst Timeline: October 17 call expiry (3 days), Interactions acquisition closing Q4 2025, Q3 earnings November

5. 🐻 STX - The $11.7M Long-Dated Put Hedge

DISCOVER WHY SOMEONE SPENT $11.7M HEDGING SEAGATE'S AI RALLY →

- Flow: $11.7M in put protection ($7.5M + $4.2M) expiring November 2025 & May 2026

- Unusual Score: Defensive positioning against AI storage hype

- YTD Performance: Strong AI storage demand narrative

- What's Happening: Dual put purchases at $200 and $190 strikes protecting against correction. With stock at $214, someone is paying big premium to protect AI storage gains. HAMR 40TB drives launching, but hedging suggests caution on valuation. Earnings likely late October.

- The Big Question: Do insiders know AI storage demand will disappoint?

- Catalyst Timeline: November 2025 put expiry, May 2026 put expiry for longer protection, Q4 fiscal 2025 earnings late October

6. 💎 LRCX - The $7.8M Semiconductor Equipment Bull Bet

SEE WHY LAM RESEARCH GETS $7.8M DEEP ITM CALL INVESTMENT →

- Flow: $7.8M total invested in deep ITM call strategy

- Unusual Score: Large institutional positioning

- YTD Performance: Chip equipment benefiting from CHIPS Act

- What's Happening: Deep in-the-money call purchase acting like leveraged stock ownership. Memory upcycle beginning, CHIPS Act funding creating domestic fab buildout, China exposure creating volatility. Earnings likely December.

- The Big Question: Will memory upcycle accelerate faster than expected?

- Catalyst Timeline: Expiration TBD from deep ITM positioning, fiscal Q2 2026 earnings December

7. 🛒 DLTR - The $6.8M Investor Day Bull Call Spread

DECODE THE MASSIVE $6.8M BET ONE DAY BEFORE INVESTOR DAY →

- Flow: $6.8M gross premium ($4.9M net credit collected)

- Unusual Score: EXTREME (5,076x average - 100th percentile!)

- YTD Performance: +24.6% (transformation story unfolding)

- What's Happening: Bull call spread selling $91 calls, buying $98 calls expiring October 17 (3 days!) positioned TOMORROW's Investor Day catalyst. Post-Family Dollar divestiture strategy reveal, multi-price rollout progress, CEO presenting refreshed long-term outlook.

- The Big Question: What growth targets will management unveil at Investor Day?

- Catalyst Timeline: Investor Day TOMORROW October 15, October 17 options expiry (3 days), Q3 earnings December 3

8. 🤖 BBAI - The $5M Defense AI LEAPS Play

EXPLORE THE $5M DEFENSE AI BET ON GOVERNMENT CONTRACTS →

- Flow: $5M premium collected on complex LEAPS strategy

- Unusual Score: Significant defense AI positioning

- YTD Performance: Government AI contracts driving growth

- What's Happening: Long-dated options strategy capitalizing on defense AI boom. OB3 platform winning government contracts, DoD AI adoption accelerating, geopolitical tensions creating budget expansion. LEAPS positioning shows patience for multi-quarter thesis.

- The Big Question: How big will DoD AI contract pipeline really get?

- Catalyst Timeline: LEAPS expiration dates TBD (2026+), ongoing government contract awards, fiscal year budget cycles

9. 🍔 WEN - The $3.2M Bearish Put Buy Before Earnings

UNDERSTAND WHY SOMEONE BOUGHT $3.2M PUTS ON WENDY'S →

- Flow: $3.2M put buying across two expirations

- Unusual Score: Defensive fast-food positioning

- YTD Performance: Facing operational headwinds

- What's Happening: Put purchases protecting against downside before earnings. Project Fresh restaurant remodel program showing mixed results, consumer spending pressures mounting, competitive fast-food environment intensifying.

- The Big Question: Will earnings show Project Fresh isn't working?

- Catalyst Timeline: Put expirations across Q4 2025, earnings reports through year-end

10. 🔐 LAES - The $2.5M Quantum Computing Bet

SEE WHY SOMEONE SPENT $2.5M ON POST-QUANTUM SECURITY →

- Flow: $2.5M deployed across 10,000 contracts

- Unusual Score: Quantum computing speculation

- YTD Performance: Emerging technology high volatility

- What's Happening: Calls targeting post-quantum cryptography opportunity. With quantum computing threats emerging, security solutions gaining urgency. Speculative but massive total addressable market if quantum threat accelerates.

- The Big Question: Is quantum computing threat timeline accelerating?

- Catalyst Timeline: Expiration TBD, quantum computing development milestones, security contract wins

11. 🚀 RKT - The $1.8M Mortgage Bull Call Spread

ANALYZE THE $1.8M BET ON MORTGAGE RECOVERY POST-ACQUISITIONS →

- Flow: $1.8M gross ($1.15M net debit)

- Unusual Score: 579x average (happens once-twice per year!)

- YTD Performance: +56.5% (acquisition integration underway)

- What's Happening: Bull call spread buying $18 calls, selling $22 calls expiring November 21 positioned for Q3 earnings November 11. First quarter with full Redfin + Mr. Cooper consolidation, declining mortgage rates creating tailwinds, 10 million homeowner servicing portfolio.

- The Big Question: Will integration synergies exceed expectations at earnings?

- Catalyst Timeline: Q3 earnings November 11 (after hours), November 21 option expiry (10 days post-earnings), declining rate environment 2025-2026

⏰ URGENT: Critical Expiries & Catalysts This Week

🚨 3 DAYS TO FRIDAY EXPIRY (October 17)

- ABBV - $31.1M Gamma Squeeze Play - Deep ITM calls need to break $230 wall

- SMR - $13.7M Nuclear Bet - Complex 3-leg strategy with gamma pin risk

- SOUN - $11.9M AI Voice Blitz - Interactions acquisition timing critical

- DLTR - $6.8M Investor Day Spread - TOMORROW's catalyst presentation

⚡ THIS WEEK'S BINARY EVENTS

- DLTR Investor Day - October 15 (TOMORROW!) - Post-Family Dollar strategy reveal with $6.8M positioned

🧠 Next Week's Major Catalysts

- INTC Q3 Earnings - October 23 - 18A yield progress test (9 days away)

- ABBV Q3 Earnings - October 31 - Skyrizi/Rinvoq franchise validation (17 days)

📊 November Earnings Tsunami

- SMR Q3 Earnings - November 6 - Commercial contract announcement potential

- RKT Q3 Earnings - November 11 - First post-merger results with integration synergies

📊 Smart Money Themes: What Institutions Are Really Betting

💊 Pharma Bullish Tsunami ($31.1M Aggressive Positioning)

The $31M Skyrizi/Rinvoq Story: Institutions SWEEPING calls ahead of Q3 earnings

- → See AbbVie's $31M gamma squeeze setup through $230

- → Why pharma gets institutional love while chips face selling

💻 Semiconductor Skepticism ($13M Profit-Taking Signal)

Intel's $13M Call SALE Shows Smart Money Capping Gains:

- → INTC: Why institutions don't believe in $45+ despite 18A hype

- → LRCX: $7.8M bet on equipment cycle vs. Intel pessimism

- → STX: $11.7M put protection shows AI storage skeptics

☢️ Nuclear Energy Renaissance ($13.7M TVA Validation)

The AI Data Center Power Solution:

🔊 AI Voice Technology Boom ($11.9M Future Bet)

Beyond ChatGPT - The Voice Interface Revolution:

- → SOUN: $11.9M betting Interactions acquisition unlocks value

- → Why voice AI is the next frontier after LLMs

🛡️ Defensive Hedging Acceleration ($26.6M Protection)

Smart Money Protecting Winners:

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Trader (1-2% Portfolio MAX)

⚠️ EXTREME RISK - Friday expiry gamma plays

- Primary: ABBV October 17 calls - Gamma squeeze through $230 (3 days to expiry!)

- Secondary: SMR October 17 positioning - Nuclear catalyst potential (3 days!)

- Speculative: SOUN October 17 calls - Interactions acquisition timing (3 days!)

⚠️ CRITICAL WARNING: These expire in 3 DAYS! Theta decay is BRUTAL. Only trade if you can afford 100% loss.

⚖️ Swing Trader (3-5% Portfolio)

Multi-week opportunities with earnings catalysts

- Primary: INTC October/November spreads - Fade the rally into Q3 earnings October 23

- Secondary: RKT November spreads - Follow $1.8M whale through November 11 earnings

- Defensive: STX put spreads - Protect AI storage gains like $11.7M whale

Sweet Spot: 2-4 week timeframe captures earnings without brutal theta burn

💰 Premium Collector (Income Strategy)

Follow institutional sellers to collect premium

- High Premium: INTC call selling - $38-40 strikes like $13M whale (cap upside after 79.8% rally)

- Post-Earnings: ABBV call selling - $235-240 strikes AFTER Q3 earnings (November)

- Defensive: WEN put selling - Cash-secured at gamma support levels

Key Strategy: Sell premium on stocks with high IV before events, close after IV crush

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education

- Paper Trade First: All short-dated strategies (October 17 expiries) to understand gamma dynamics

- ETF Exposure: Consider SMH for semiconductors (avoiding single stock risk), XLV for healthcare

- Share Positions: ABBV shares for pharma exposure without option complexity

- Education Focus: Study why institutions SELL calls (INTC) vs. BUY calls (ABBV) - understand the difference

Critical Learning: Never trade short-dated options (3 days to expiry!) until you understand theta decay and gamma risk. Practice with 30-60 DTE first.

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- ABBV: Q3 earnings disappoint on Skyrizi/Rinvoq growth or $2.7B R&D charge impacts sentiment worse than expected

- SMR: Commercial contract delays announced or 18A yields still struggling (impacting nuclear narrative)

- SOUN: Interactions acquisition falls through or integration costs exceed benefits

- RKT: Mortgage rate cuts delayed or housing market weakens despite declining rates

- LRCX: Memory upcycle timing pushes to 2026 or China restrictions impact revenue

😰 If You're Following the Bears

- INTC: 18A yields SURPRISE to upside at Q3 earnings, contract wins accelerate beyond expectations

- STX: AI storage demand exceeds forecasts, HAMR 40TB drives create pricing power

- WEN: Project Fresh results beat expectations, consumer spending resilient

Biggest Risk: Friday October 17 gamma pin - market makers may manipulate prices around major strikes to maximize profit on expiry. ABBV pinned at $230, SMR at $46-47, SOUN at $21-22 all possible.

💣 This Week's Catalysts & Key Dates

📊 THIS WEEK (October 14-18):

- October 15 (TOMORROW): DLTR Investor Day - $6.8M spread positioned for strategic reveal

- October 17 (FRIDAY): MAJOR gamma expiry - ABBV $31M, SMR $13.7M, SOUN $11.9M, DLTR $6.8M all expire

- October 18: Weekly expiry gamma unwind - volatility expected Monday as dealers cover

🗓️ NEXT WEEK (October 21-25):

- October 23: INTC Q3 earnings (after hours) - 18A yield progress test after $13M call sale

- October 31: ABBV Q3 earnings - Skyrizi/Rinvoq franchise validation after $31M call sweep

📈 NOVEMBER SETUP:

- November 6: SMR Q3 earnings - Commercial contract announcement potential

- November 11: RKT Q3 earnings (after hours) - First post-Redfin/Mr. Cooper results

- November 21: RKT option expiry - Bull call spread max profit zone at $22

🧠 Q4 2025 DEVELOPMENTS:

- December 3: DLTR Q3 earnings - Investor Day promises tested

- Late October: STX earnings - AI storage demand validation or disappointment

- Q4 Ongoing: SOUN Interactions acquisition closing, BBAI government contracts, LAES quantum developments

🎯 The Bottom Line: Follow the $108M Sector Rotation Signal

This is the clearest institutional sector rotation we've seen all month. $108.5 MILLION flowing INTO pharma ($31M ABBV!), nuclear energy ($13.7M SMR!), and AI voice ($11.9M SOUN!) while FLEEING semiconductors ($13M INTC selling!). Smart money is repositioning for Q4 earnings season - pharma growth stories rewarded, chip hype checked.

The biggest questions:

- Will AbbVie's $31M gamma squeeze break $230 before Friday expiry?

- Is Intel's $13M call SALE signaling 18A yields will disappoint?

- Does SMR's $13.7M bet predict commercial contract THIS WEEK?

- Will SoundHound's Interactions acquisition close before Friday?

Your move: This rotation from chips to pharma, storage hedging to nuclear energy demands attention. But remember - 4 major positions ($62.7M worth!) expire in 3 DAYS. Don't chase gamma without understanding the risks.

🔗 Get Complete Analysis on Every Trade

💊 Pharma & Healthcare Tsunami:

- ABBV $31.1M Bull Tsunami - Skyrizi/Rinvoq Gamma Squeeze

- WEN $3.2M Bearish Put Buy - Fast Food Headwinds

💻 Semiconductor Divergence:

- INTC $13M Covered Call SALE - Institutions Capping Upside

- LRCX $7.8M Deep ITM Calls - Equipment Cycle Bet

- STX $11.7M Put Protection - AI Storage Skepticism

☢️ Nuclear Energy Renaissance:

🤖 AI & Technology Themes:

- SOUN $11.9M AI Voice Blitz - Interactions Acquisition

- BBAI $5M Defense AI LEAPS - Government Contracts

- LAES $2.5M Quantum Computing - Post-Quantum Security

🛒 Retail & Consumer:

🏠 Mortgage & Real Estate:

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 17 Expiry) - 3 DAYS!

- ABBV $31.1M gamma squeeze through $230 resistance

- SMR $13.7M nuclear complex 3-leg strategy

- SOUN $11.9M AI voice catalyst timing

- DLTR $6.8M Investor Day (October 15) spread

📆 Monthly (November 21 Expiry)

- RKT $1.8M bull call spread through Q3 earnings (November 11)

- STX $11.7M put protection (November portion)

🗓️ Quarterly (Q4 2025 Earnings)

- ABBV Q3 earnings October 31 - Skyrizi/Rinvoq validation

- INTC Q3 earnings October 23 - 18A yield progress test

- SMR Q3 earnings November 6 - Commercial contract potential

- RKT Q3 earnings November 11 - First post-merger results

- DLTR Q3 earnings December 3 - Investor Day promises tested

- STX Q4 fiscal earnings late October - AI storage demand

🚀 LEAPS (2026+ Expiries)

- INTC $23 call SALE March 2026 - Capping at $36 effective price

- INTC $37 call BUY January 2026 - Contrarian 18A bet

- STX May 2026 puts - Long-dated AI storage protection

- BBAI 2026+ LEAPS - Defense AI government contracts

- LAES Long-dated quantum computing speculation

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position - THESE EXPIRE IN 3 DAYS!

- Gamma lottery: ABBV October 17 calls - Need $230 break Friday for 2-5x potential

- Nuclear speculation: SMR October 17 positioning - Contract announcement potential

- AI voice bet: SOUN October 17 calls - Interactions closing timing

⚠️ EXTREME RISK: These expire Friday! Theta decay is $0.20-0.50 per contract PER DAY. Only trade if you're prepared for 100% loss. Set stop losses at 30-50% loss.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary setup: INTC bear call spreads - Fade the rally into October 23 earnings (sell $38 calls, buy $42 calls)

- Earnings play: RKT November bull spreads - Follow $1.8M whale ($18/$22 spread expiring November 21)

- Defensive hedge: STX put spreads - Protect AI storage exposure (sell $200 puts, buy $190 puts November)

Sweet Spot Strategy: Avoid Friday expiry! Trade November options to capture earnings without 3-day theta burn. Close winners at 50-75% profit.

💰 Premium Collector (Income Focus)

Strategy: Follow institutional sellers to collect high premium

- Chip skepticism: INTC covered calls - Sell $38-40 calls November like $13M whale (collect $2-3 premium)

- Post-gamma: ABBV call selling - WAIT until after Friday expiry, then sell November $235 calls (high IV)

- Earnings premium: DLTR call selling - Sell $98-100 calls AFTER Investor Day (IV crush)

Key Timing: Never sell premium BEFORE Friday expiry - wait for IV crush Monday, then sell November options. Target 1-2% monthly returns.

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education - DO NOT TRADE FRIDAY EXPIRIES!

- Paper trade ONLY: Friday expiries (ABBV, SMR, SOUN, DLTR) to learn gamma dynamics without risking capital

- ETF exposure instead: XLV for healthcare (safer than ABBV options), SMH for semiconductors (avoid single-stock risk)

- Share positions: ABBV shares below $230 for pharma exposure without option complexity

- Education focus: Read all 11 detailed analyses to understand WHY institutions make different bets (calls vs. puts, buying vs. selling)

Critical Learning Path:

- Week 1-2: Paper trade only, focus on understanding theta decay and gamma

- Week 3-4: Start with cash-secured puts on quality names (ABBV, RKT) 30-45 DTE

- Month 2: Graduate to covered calls on shares you own

- Month 3+: Consider simple bull/bear spreads with 30+ DTE

Never:

- Trade options expiring in less than 7 days until you have 6+ months experience

- Risk more than 1% of portfolio on any single option trade

- Sell naked options (always use spreads to cap risk)

- Chase unusual activity without understanding the thesis

⚠️ Risk Management for All Types

Essential Rules for THIS WEEK:

- 3-day expiry EXTREME risk - ABBV, SMR, SOUN, DLTR positions losing 20-30% value PER DAY from theta

- Gamma pin risk - Market makers profit by pinning prices at max pain (likely ABBV $230, SMR $47, SOUN $21)

- Set hard stop losses - Exit at 30% loss for swing trades, 50% for YOLO trades (these can go to zero fast!)

- Take profits aggressively - 50% gain in 3 days? TAKE IT. Don't get greedy on short-dated options.

- Watch earnings closely - INTC October 23, ABBV October 31, SMR November 6, RKT November 11 all major catalysts

Friday Expiry Specific Warnings:

- Thursday 3pm ET: Theta decay accelerates dramatically - exit if not profitable by then

- Friday 9:30am-11am: Most volatile period - be ready to exit fast if against you

- Friday 2pm-4pm: Gamma pinning intensifies - don't expect big moves into close

Sector Rotation Context: Smart money is ROTATING from semiconductors (INTC $13M selling!) to pharma (ABBV $31M buying!), from AI storage hype (STX $11.7M hedging!) to nuclear energy (SMR $13.7M betting!). This isn't random - Q4 earnings will validate pharma growth while testing chip valuations.

Remember: Institutions have information advantages, complex hedges we can't see, and different time horizons. INTC's $13M call SALE might be tax harvesting gains. ABBV's $31M sweep could be delta hedging a larger position. Always maintain proper position sizing and understand you're trading against sophisticated players with more resources.

Entry Level CRITICAL: If you don't understand why someone would SELL calls on a stock up 79.8% (INTC) while BUYING calls on a stock near highs (ABBV), you are NOT ready to trade options. Study the difference between profit-taking strategies vs. bullish positioning before risking real money.

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Short-dated options (3 days to expiry) carry EXTREME risk of total loss from time decay and gamma manipulation. Always practice proper risk management, never risk more than you can afford to lose, and consider consulting a financial advisor before trading complex option strategies.