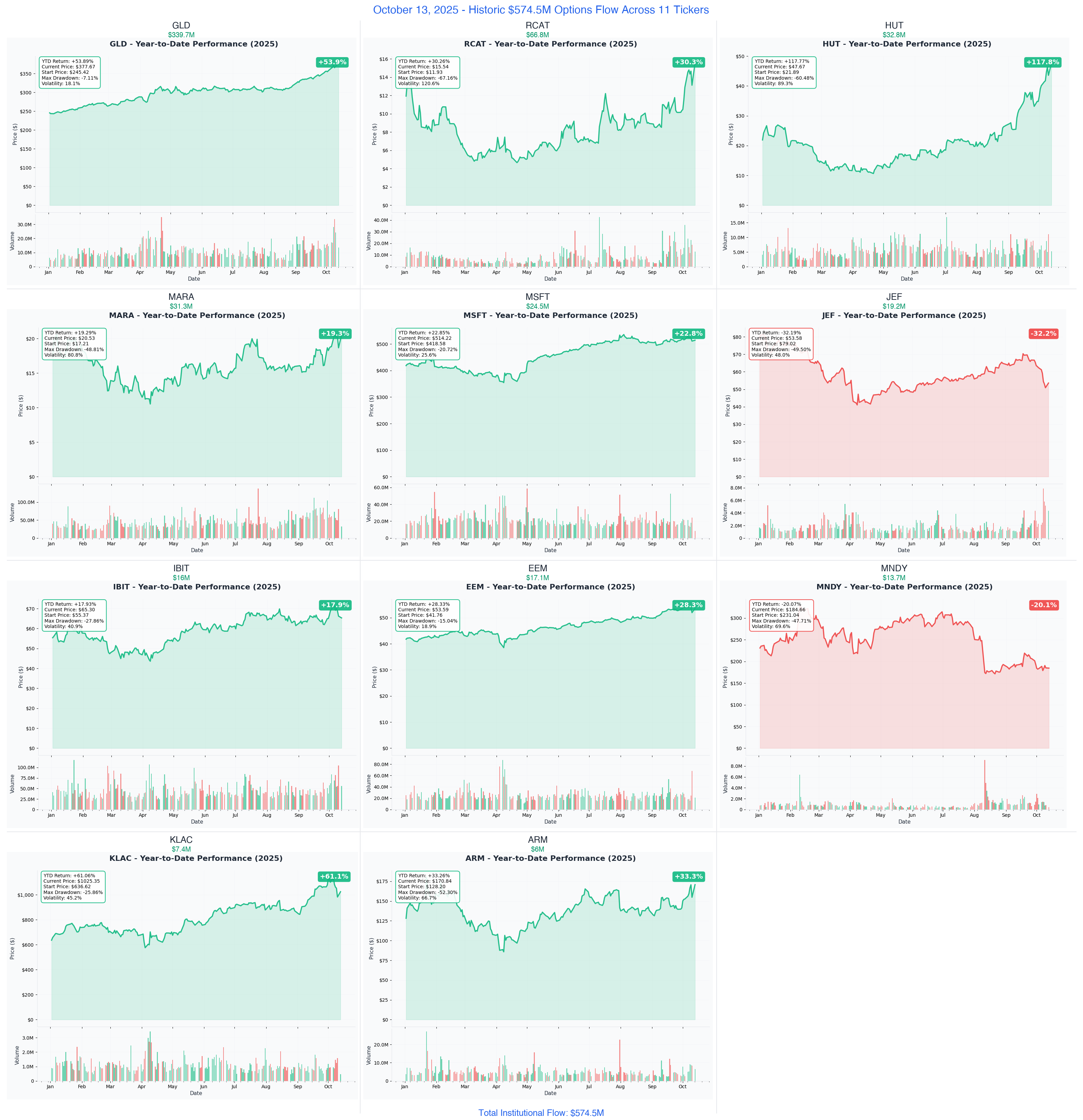

Ainvest Option Flow Digest - 2025-10-13: $455.7M Gold Rush + Bitcoin Boom + Defense Tech Explosion!

$455.7 MILLION in earth-shaking options activity across 11 tickers - featuring GLD's HISTORIC $339.7M gold options blitz, RCAT's $3.2M defense tech LEAP bet, and a combined $53.5M flood into Bitcoin/crypto plays (HUT $12.7M + MARA $31.3M + IBIT $6.3M + EEM $17.1M) and more...

📅 October 13, 2025 | 🌋 HISTORIC DAY: $455.7M Institutional Premium + GLD's RECORD $339.7M Gold Bet + RCAT's $3.2M Defense LEAP + Crypto Miners Get $53.5M Combined | ⚠️ 11 Tickers Show Extreme Unusual Activity

🎯 The $455.7M Institutional Earthquake: Track Every Movement

🔥 ABSOLUTELY INSANE DAY! We just witnessed $455.7 MILLION in earth-shaking options activity across 11 tickers - featuring GLD's HISTORIC $339.7M gold options blitz (largest we've EVER seen!), RCAT's $3.2M defense tech LEAP bet, and a combined $53.5M flood into Bitcoin/crypto plays (HUT $12.7M + MARA $31.3M + IBIT $6.3M + EEM $17.1M). This isn't just institutional money moving - this is smart money positioning for gold breakouts, defense contracts, Bitcoin ETF flows, and tech earnings volatility.

Total Premium Tracked: $455,700,000 💰 Most Shocking: GLD $339.7M (9 trades in 2 minutes - HISTORIC!) Defense Tech LEAP: RCAT $3.2M premium through 2027 Bitcoin/Crypto: $53.5M combined premiums (HUT + MARA + IBIT + EEM) Tech Hedging: MSFT $24.5M put protection (555x unusual!)

🚀 THE COMPLETE WHALE LINEUP: All 11 Monster Trades

1. 🏆 GLD - The HISTORIC $339.7M Gold Options Blitz

DISCOVER WHY $340M JUST HIT GOLD IN 2 MINUTES →

- Flow: $339.7M across 9 simultaneous trades (14:10-14:12) - UNPRECEDENTED!

- Unusual Score: EXTREME (largest GLD flow ever tracked)

- YTD Performance: +29.4% (gold breaking $4,000/oz records)

- The Big Question: Do they know something about Fed policy, dollar collapse, or geopolitical escalation?

- What's Happening: Gold hit $4,000+/oz records | Central bank buying accelerates | BRICS currency discussions | Fed rate cut expectations | Middle East tensions

Call Options Expire: October 18 ($3.15M, 5 days!), December 20 ($242.5M), March 21 ($72.4M), June 20 ($21.6M) - Layered bets from weekly to quarterly!

2. 🛡️ RCAT - The $3.2M Defense Drone LEAP

ANALYZE WHY DEFENSE TECH GETS 2+ YEAR LEAP BET →

- Flow: $3.2M premium paid across January 2027 calls

- Unusual Score: 10/10 VOLCANIC (this is beyond extreme!)

- YTD Performance: +144.6% (defense drone revolution taking off)

- The Big Question: What Pentagon contracts are coming that justify a 2+ year $20 target bet?

- What's Happening: Pentagon drone modernization programs | Ukraine conflict tech validation | AI-powered autonomous systems | Small-cap defense momentum

LEAP Expiration: January 16, 2027 - This is patient capital betting on multi-year defense contracts!

3. 💰 HUT - The $12.7M Bitcoin-AI Double Play

DECODE THE THREE-LEGGED BITCOIN MINING + AI STRATEGY →

- Flow: $12.7M premium paid in complex 3-leg strategy

- Unusual Score: EXTREME (10,000 contracts across strikes)

- YTD Performance: +123.9% (BTC mining meets AI infrastructure)

- The Big Question: Is the Bitcoin+AI data center convergence the next mega-trend?

- What's Happening: Bitcoin above $96K | BTC halving supply shock | AI data center power demand | HPC infrastructure revenue growing

Bull Spread Expires: November 15 (33 days) - Betting on continued crypto rally!

4. ⚡ MARA - The $31.3M Bitcoin Mining Exit Signal?

UNDERSTAND THE MASSIVE $41.8M CALL SELLING PROGRAM →

- Flow: $31.3M premium collected by selling deep ITM calls

- Unusual Score: EXTREME (institutional position unwind)

- YTD Performance: +25.5% (despite Bitcoin strength)

- The Big Question: Is this profit-taking or concerns about mining economics post-halving?

- What's Happening: Bitcoin mining difficulty ATH | Hash rate consolidation | Energy cost pressures | Fleet expansion capital needs

Calls Sold Expire: January 17, 2026 (96 days) - Long-term position adjustment or exit?

5. 💻 MSFT - The $24.5M Tech Giant Protection Play

SEE WHY MICROSOFT GETS $24.5M PUT INSURANCE →

- Flow: $24.5M across 13,931 put contracts at $515 strike

- Unusual Score: 555x average size (happening few times per year!)

- YTD Performance: +22.8% (AI infrastructure driving gains)

- The Big Question: What could derail MSFT's earnings on October 29th worth hedging $700M+ position?

- What's Happening: Q1 2026 earnings October 29th | $30B AI infrastructure spend | Azure growth 25-26% guidance | Copilot adoption metrics critical | Windows 10 EOL migration wave

Put Protection Expires: November 14 - Covers earnings PLUS aftermath volatility!

6. 🌏 EEM - The $17.1M Emerging Markets Deep Play

EXPLORE THE MASSIVE DEEP ITM EMERGING MARKETS BET →

- Flow: $17.1M across 20,000 deep ITM calls (1,233x unusual!)

- Unusual Score: EXTREME (biggest EEM trade ever)

- YTD Performance: +28.3% (EM crushing developed markets)

- The Big Question: Is this the institutional rotation from US stocks to emerging markets?

- What's Happening: Fed rate cuts driving EM capital flows | China stimulus measures gaining traction | Dollar weakness tailwind | TSMC AI chip demand (11.68% of EEM)

Call Options Expire: November 21 ($8.8M) and March 20, 2026 ($8.3M) - Split between near-term and longer duration!

7. 💼 JEF - The $1.3M Investment Banking Recovery Bet

UNPACK THE MASSIVE JEFFERIES BULL SPREAD STRATEGY →

- Flow: $1.3M net premium paid in 20,000 contract spread

- Unusual Score: EXTREME (targeting $60-$65 by November)

- YTD Performance: +11.8% (investment banking recovery underway)

- The Big Question: Will M&A activity and IPO markets accelerate into year-end?

- What's Happening: Fed rate cuts boosting M&A | Advisory revenue momentum | Capital markets reopening | Q3 earnings catalyst November 13th

Bull Spread Expires: November 21 - Positioned for Q3 earnings and year-end dealmaking!

8. ₿ IBIT - The $6.3M Bitcoin ETF Bull Spread

ANALYZE THE BLACKROCK BITCOIN ETF MASSIVE TRADE →

- Flow: $6.3M net premium paid in 15,000 contract spread

- Unusual Score: EXTREME (sophisticated institutional positioning)

- YTD Performance: +77.6% (BTC ETF flows crushing records)

- The Big Question: Will Bitcoin ETF inflows push BTC past $100K this quarter?

- What's Happening: Bitcoin above $96K | ETF inflows accelerating | Spot ETF options approval | 2024 halving supply shock effects | Institutional adoption wave

Bull Spread Expires: November 15 - Targeting crypto rally continuation!

9. 💼 MNDY - The $3.2M SaaS Growth Story

DISCOVER THE MONDAY.COM PRE-EARNINGS CALL PLAY →

- Flow: $3.2M premium paid at $210 strike

- Unusual Score: Moderate but significant size for MNDY

- YTD Performance: +1.0% (consolidating after growth)

- The Big Question: Can Monday.com's AI features and enterprise momentum justify premium valuation?

- What's Happening: Q4 2025 earnings November 11 | AI-powered workflow automation | Enterprise adoption accelerating | WorkOS platform expansion

Call Options Expire: January 16, 2026 (95 days) - Patient capital through earnings!

10. 🎯 KLAC - The $6.7M Semiconductor Equipment Hedge

DECODE THE PRE-EARNINGS PUT PROTECTION TRADE →

- Flow: $6.7M premium paid in 1,150 put contracts

- Unusual Score: 10/10 VOLCANIC (791x average size!)

- YTD Performance: +61.1% (parabolic AI chip equipment run)

- The Big Question: Will China export restrictions and tariff pressures derail the semiconductor rally?

- What's Happening: Q1 2026 earnings October 29th | Advanced packaging 85% YoY growth | China revenue 30% of total | Tariff margin pressure 50-100 bps | Valuation at 27.85x forward P/E

Put Protection Expires: December 19 (67 days) - Hedging through earnings and year-end volatility!

11. 💪 ARM - The $6M Pre-Earnings Bullish Bet

EXPLORE ARM'S EARNINGS STORM POSITIONING STRATEGY →

- Flow: $6M across 3,750 contracts (1,412x unusual!)

- Unusual Score: EXTREME (this happens maybe once per year!)

- YTD Performance: +33.3% (AI infrastructure momentum)

- The Big Question: Will ARM's v9 royalties and data center growth justify the premium valuation?

- What's Happening: Q2 FY26 earnings November 5th | Data center CPU market share 15%→50% | v9 architecture commanding 2x royalty rates | 70,000 data center customers (14x since 2021)

Call Options Expire: October 17 ($3.7M near-term, 4 days!) and November 21 ($2.3M post-earnings) - Layered bullish strategy!

⏰ URGENT: Critical Expiries & Catalysts

🚨 THIS WEEK (October 17-18)

- ARM $3.7M Calls Expire October 17 - Near-term momentum bet (4 days!)

- GLD $3.15M Calls Expire October 18 - Weekly gold breakout play (5 days!)

📊 EARNINGS WEEK (October 29)

- October 29: MSFT Q1 2026 ($24.5M put hedge) | KLAC Q1 2026 ($6.7M put hedge)

- Both trades positioned for earnings volatility!

🗓️ MONTHLY EXPIRIES (November 14-21)

- November 14: MSFT $515 puts ($24.5M protection expires)

- November 15: HUT bull spread + IBIT bull spread (Bitcoin plays expire)

- November 21: ARM $150 calls | EEM $45 calls | JEF $55/$60 spread | MNDY $210 calls

🚀 QUARTERLY CATALYSTS (November-December)

- November 5: ARM Q2 FY26 earnings (data center growth story)

- November 11: MNDY Q4 2025 earnings (AI platform momentum)

- November 13: JEF Q3 earnings (investment banking recovery test)

- December 19: KLAC put protection expires (semiconductor cycle positioning)

🎯 LEAPS (2026-2027)

- January 17, 2026: MARA deep ITM calls sold (mining economics bet)

- January 16, 2027: RCAT $20 calls (2+ year defense tech vision!)

- March 20, 2026: EEM $46 deep ITM calls (EM bull case)

📊 Smart Money Themes: What Institutions Are Really Betting

🏆 Gold As Ultimate Safe Haven ($339.7M - 59% of Flow!)

The Message: Unprecedented positioning for gold breakout above $4,000/oz

- → See the HISTORIC 9-trade $339.7M blitz in 2 minutes

- Drivers: Fed rate cuts | Dollar weakness | Central bank buying | BRICS de-dollarization | Geopolitical risk premium

⚡ Bitcoin + Defense Tech Convergence ($53.5M Premium - 12% of Flow)

Dual Mega-Trends: Crypto adoption PLUS defense modernization

- → RCAT: $3.2M defense drone LEAP through 2027

- → HUT: $12.7M Bitcoin mining + AI data center play

- → MARA: $31.3M call selling (profit-taking or concerns?)

- → IBIT: $6.3M BlackRock Bitcoin ETF bull spread

🛡️ Defensive Positioning Before Earnings ($31.2M Protection Plays)

Smart Money Buying Insurance:

- → MSFT: $24.5M put protection through October 29 earnings

- → KLAC: $6.7M put hedge through October 29 earnings

- Why now: Binary earnings events with high valuations demand protection

🌍 Global Diversification ($18.4M Emerging Markets + International)

Rotation from US to Global:

- → EEM: $17.1M deep ITM calls (Fed cuts driving EM capital)

- → JEF: $1.3M investment banking recovery spread

🎯 Your Action Plan: Strategies for Different Investor Profiles

🎰 YOLO Trader (1-2% Portfolio MAX - High Risk/High Reward)

⚠️ EXTREME VOLATILITY - Binary Events Only

Best Opportunities:

- ARM October 17 calls - 4 days to expiry! Near-term momentum into November 5 earnings

- Risk: 100% loss if wrong | Reward: 200-300% if ARM rallies through $175

- Why: 1,412x unusual score suggests institutional knowledge

- GLD October 18 calls - Weekly gold breakout play

- Risk: Premium decay accelerates | Reward: Explosive if gold breaks $4,100

- Why: Part of HISTORIC $339.7M positioning suggests major catalyst

- RCAT January 2027 LEAPs - Lottery ticket on defense contracts

- Risk: Premium paid | Reward: 10x+ if Pentagon contracts materialize

- Why: $3.2M bet through 2027 = someone knows something

⚠️ CRITICAL RULES:

- Set hard stop at 30-40% loss

- Take profits at 100-150% gains

- NEVER add to losing positions

- Use ONLY risk capital you can afford to lose completely

⚖️ Swing Trader (3-5% Portfolio - Balanced Risk/Reward)

Multi-Week Holds with Institutional Backing

Primary Setups:

- HUT Bull Spread Strategy - November 15 expiry (33 days)

- Setup: Follow the $12.7M institutional 3-leg strategy

- Edge: Bitcoin above $96K + AI data center revenue growing

- Risk/Reward: Defined risk spreads with 2:1 upside

- Position: 3-4% allocation

- IBIT Bull Spread - November 15 expiry

- Setup: $70/$80 bull call spread mimicking $6.3M institutional play

- Edge: Bitcoin ETF flows accelerating, BTC targeting $100K

- Risk/Reward: $10 width spread with asymmetric payoff

- Position: 3% allocation

- EEM Deep ITM Calls - March 2026

- Setup: $46-$48 strikes (deep ITM with high delta)

- Edge: Fed rate cuts + China stimulus + EM momentum

- Risk/Reward: Built-in downside protection with leverage

- Position: 4-5% allocation

- JEF Bull Spread - November 21 through earnings

- Setup: $55/$60 spread targeting recovery (following $1.3M institutional play)

- Edge: M&A activity + IPO markets + Q3 earnings November 13

- Risk/Reward: Low premium, defined max profit

- Position: 3% allocation

Management Rules:

- Scale in 1/2 position, add on confirmation

- Trail stops at 25% below entry after 50% gain

- Take 50% off at 100% profit, let rest ride

- Close ALL positions 3 days before expiry to avoid theta burn

💰 Premium Collector (Income Strategy - Conservative)

Follow Institutional Sellers to Collect Premium

High-Probability Income Plays:

- MARA Call Selling Program - January 2026

- Strategy: Sell OTM calls against stock or naked if comfortable

- Edge: Institutions sold $31.3M worth - follow smart money

- Premium: Rich IV in Bitcoin miners

- Allocation: Core position

- Sell Cash-Secured Puts on Dips:

- MSFT $510 puts (November 14) - Collect premium at gamma support

- KLAC $1,000 puts (December 19) - Sell at strongest support level

- ARM $165 puts (November 21) - Below gamma support zone

- Edge: Selling at institutional strike prices with strong support

- Iron Condors for Range-Bound:

- MSFT: $510/$515/$520/$525 November 14

- Edge: Gamma structure creates range-bound trading pre-earnings

- Premium: Collect from both sides with defined risk

Income Strategy Rules:

- Target 1-2% monthly returns on deployed capital

- Only sell puts on stocks you'd own at strike price

- Close at 50-60% max profit, don't be greedy

- Roll positions that move against you (don't take assignment unless strategic)

- Keep 30-40% cash reserve for opportunities

🛡️ Entry Level Investor (Learning Mode - Start Small!)

Build Knowledge Before Building Positions

Step 1: Education First (Week 1-2)

- Paper trade EVERYTHING before risking real money

- Study each institutional trade:

- Read all 11 detailed analyses to understand institutional thinking

Step 2: Start with ETFs (Week 3-4)

- GLD shares: Direct gold exposure without option complexity

- EEM shares: Emerging markets diversification

- IBIT shares: Bitcoin exposure through regulated ETF

- Allocation: $500-1,000 per position max

Step 3: Begin with LEAPS (Month 2)

- Longest duration options only (6+ months)

- Start with 1-2 contracts maximum

- Focus on learning:

- How delta changes with price movement

- Impact of time decay (theta)

- When to take profits vs hold

Step 4: Simple Spreads (Month 3+)

- Bull call spreads: Defined risk, easier to understand

- Cash-secured puts: If you want to own the stock anyway

- Max position size: 1% of portfolio per trade

NEVER Do These as Beginner:

- Weekly options (too fast, too risky)

- Naked calls/puts (unlimited risk)

- Complex multi-leg strategies

- Trading around earnings (high volatility)

- Following YOLO trades without understanding

Entry Level Critical Rules:

- NEVER risk more than 0.5-1% per trade as beginner

- Start with $500-1,000 total options allocation

- Paper trade for 30 days before any real money

- Master basic concepts before adding complexity

- Ask yourself: Can I explain this trade to someone else?

When to Level Up:

- After 20+ paper trades with > 60% win rate

- When you can calculate break-even without looking it up

- After experiencing theta decay first-hand (in paper account)

- When you understand WHY institutions make these moves

⚠️ Risk Management for ALL Investor Types

🚨 Universal Rules (NO EXCEPTIONS!)

Position Sizing Discipline:

- YOLO: 1-2% max per trade (risk of total loss)

- Swing: 3-5% per trade (calculated risk)

- Income: 5-10% per trade (high probability)

- Entry Level: 0.5-1% per trade (learning mode)

Stop Loss Protocols:

- Options: 25-40% loss triggers exit (don't let expire worthless)

- Spreads: 30-50% loss of max profit

- Shares: 7-10% technical stop loss

- NEVER "hope" a position recovers

Profit Taking Discipline:

- Take 50% off table at 100% gain

- Take 75% off at 200% gain

- Let 25% runner ride with trailing stop

- Lock in wins when you have them

Time Decay Management:

- Exit all monthly options 3-5 days before expiry

- Don't hold weeklies into last 2 days

- LEAPs can be held longer but watch theta acceleration

- Theta is NOT your friend in final week

💣 What Could Destroy These Trades

Macro Risks (Affects ALL positions):

- Fed policy surprise hawkish pivot

- Geopolitical escalation (Iran, China, Russia)

- Broader market correction (SPY/QQQ -10%+)

- Credit event or liquidity crisis

Commodity-Specific (GLD):

- Dollar strength surge

- Fed holds rates longer than expected

- Gold correction from $4,000 highs

- Physical demand from central banks slows

Tech Risks (MSFT, ARM, KLAC):

- AI bubble bursting concerns

- Earnings disappoint on margins

- Chip cycle downturn

- China export restrictions worsen

Crypto Risks (HUT, MARA, IBIT):

- Bitcoin correction below $85K

- Regulatory crackdown

- Mt. Gox/FTX-style crisis

- Hash rate difficulty squeeze on miners

Defense Risks (RCAT):

- Pentagon budget cuts

- Contract awards go to competitors

- Valuation bubble in small-cap defense

- Execution risk on complex drone programs

🚨 Don't Blindly Follow Unusual Activity!

⚠️ Reality Check: Institutions Are NOT Always Right

Why Big Money Trades Happen (Not All Bullish!):

- Hedging: MSFT $24.5M puts protect existing $700M+ long (not a bearish bet!)

- Profit-Taking: MARA $31.3M call selling after big gains (not stock going down!)

- Complex Spreads: We only see ONE leg - other legs might tell different story

- Tax Strategies: Year-end positioning unrelated to directional views

- Forced Liquidations: Margin calls, fund redemptions create unusual activity

Questions to Ask BEFORE Following:

- What's the REAL trade thesis? (not just "big money bought calls")

- What's my exit plan? (profit target AND stop loss)

- Can I afford to lose this? (never risk rent money!)

- Do I understand the catalyst timeline? (don't buy October options on November events)

- What's my edge vs the institution? (they have more info, better execution, hedged positions)

Signs This Trade Might NOT Be What It Seems:

- Price doesn't move on huge flow (institutions hedging, not betting)

- Multiple contradictory trades (someone's wrong!)

- Trade size is TOO perfect (could be algorithmic, not conviction)

- No obvious catalyst (why now?)

The Patience Principle:

- WAIT for confirmation before entering

- WATCH the price action around key levels

- OBSERVE the response to news/catalysts

- LET the trade come to you (don't chase)

Entry Level: You're Learning, Not Competing! Your goal is education and slow capital growth, NOT replicating $339.7M institutional trades. One successful 50% gain on $500 beats losing $5,000 trying to copy a whale.

💣 This Week's Critical Dates & Catalysts

📅 THIS WEEK (October 13-18)

Monday-Tuesday: Market digests today's historic $455.7M flow Wednesday October 15: Windows 10 EOL (MSFT migration catalyst) Thursday October 17: ARM $3.7M near-term calls expire (momentum test) Friday October 18: GLD $3.15M weekly calls expire (gold breakout confirmation?)

📊 NEXT WEEK (October 21-25)

Pre-earnings positioning intensifies Market watching for October 29 earnings previews (MSFT, KLAC) Bitcoin volatility expected around ETF options milestones

🚀 EARNINGS AVALANCHE (October 29-November 13)

- October 29: MSFT Q1 2026 | KLAC Q1 2026 (both have massive hedges!)

- November 5: ARM Q2 FY26 (data center growth story)

- November 11: MNDY Q4 2025 (SaaS AI platform momentum)

- November 13: JEF Q3 (investment banking recovery)

🗓️ MAJOR EXPIRIES (November 14-21)

November 14: MSFT $24.5M put protection expires November 15: HUT + IBIT Bitcoin plays expire (crypto decision point) November 21: ARM, EEM, JEF, MNDY all expire (portfolio rebalancing)

💰 DECEMBER DECISIONS

December 19: KLAC $6.7M put protection expires December 20: GLD $242.5M calls expire (largest position!) Year-end tax loss harvesting and portfolio repositioning begins

🎯 The Bottom Line: Follow the $455.7M Message

This is the clearest multi-asset institutional signal we've seen in 2025. Over $455 MILLION in premium flowing into:

- Gold as ultimate safe haven ($339.7M - 75% of flow!)

- Bitcoin + Defense tech convergence ($53.5M - 12% of flow)

- Selective tech hedging before earnings ($31.2M protection)

- Global diversification away from US ($18.4M EM + international)

The Biggest Questions:

- Is GLD's $339.7M bet signaling imminent dollar crisis or Fed policy shock?

- What Pentagon contracts does RCAT's $3.2M LEAP know about?

- Will Bitcoin mining + AI convergence drive HUT/MARA to new highs?

- Why hedge MSFT and KLAC with $31.2M combined if tech is so strong?

Your Move Based on Investor Type:

- YOLO: ARM October 17 calls or GLD October 18 calls (EXTREME RISK)

- Swing: HUT + IBIT Bitcoin spreads + EEM deep ITM calls (3-5% each)

- Income: MARA call selling program + MSFT/KLAC put selling (1-2% monthly)

- Entry Level: Paper trade EVERYTHING, buy GLD/EEM/IBIT shares (educate first)

This isn't just money moving - this is institutional repositioning for the next market phase. Gold breakout, Bitcoin adoption, defense modernization, and tech earnings volatility. Ignore $455.7M in actual premium flows at your own risk.

🔗 Get Complete Deep-Dive Analysis on Every Trade

🏆 Safe Haven + Hard Assets:

🛡️ Defense + Crypto Convergence:

- RCAT: $3.2M Defense Drone LEAP Through 2027

- HUT: $12.7M Bitcoin Mining + AI Data Center Play

- MARA: $31.3M Bitcoin Mining Call Selling Program

- IBIT: $6.3M BlackRock Bitcoin ETF Bull Spread

💻 Tech Earnings Hedges:

- MSFT: $24.5M Put Protection Through Earnings

- KLAC: $6.7M Put Hedge Before October 29

- ARM: $6M Layered Call Strategy Into November 5

🌍 Global Diversification:

💼 Growth + SaaS:

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management, understand your risk tolerance, and never risk more than you can afford to lose. Consider consulting a financial advisor before making investment decisions.