AInvest Option Flow Digest - 2025-10-02: Semiconductor Surge, Silver Squeeze & Tech Titans Collide

$285+ MILLION in coordinated institutional options activity across 12 powerhouse tickers - led by Microsoft's $49M AI infrastructure bet, Rocket Companies' monster $41M mortgage play, and silver's explosive $75M squeeze setup and more...

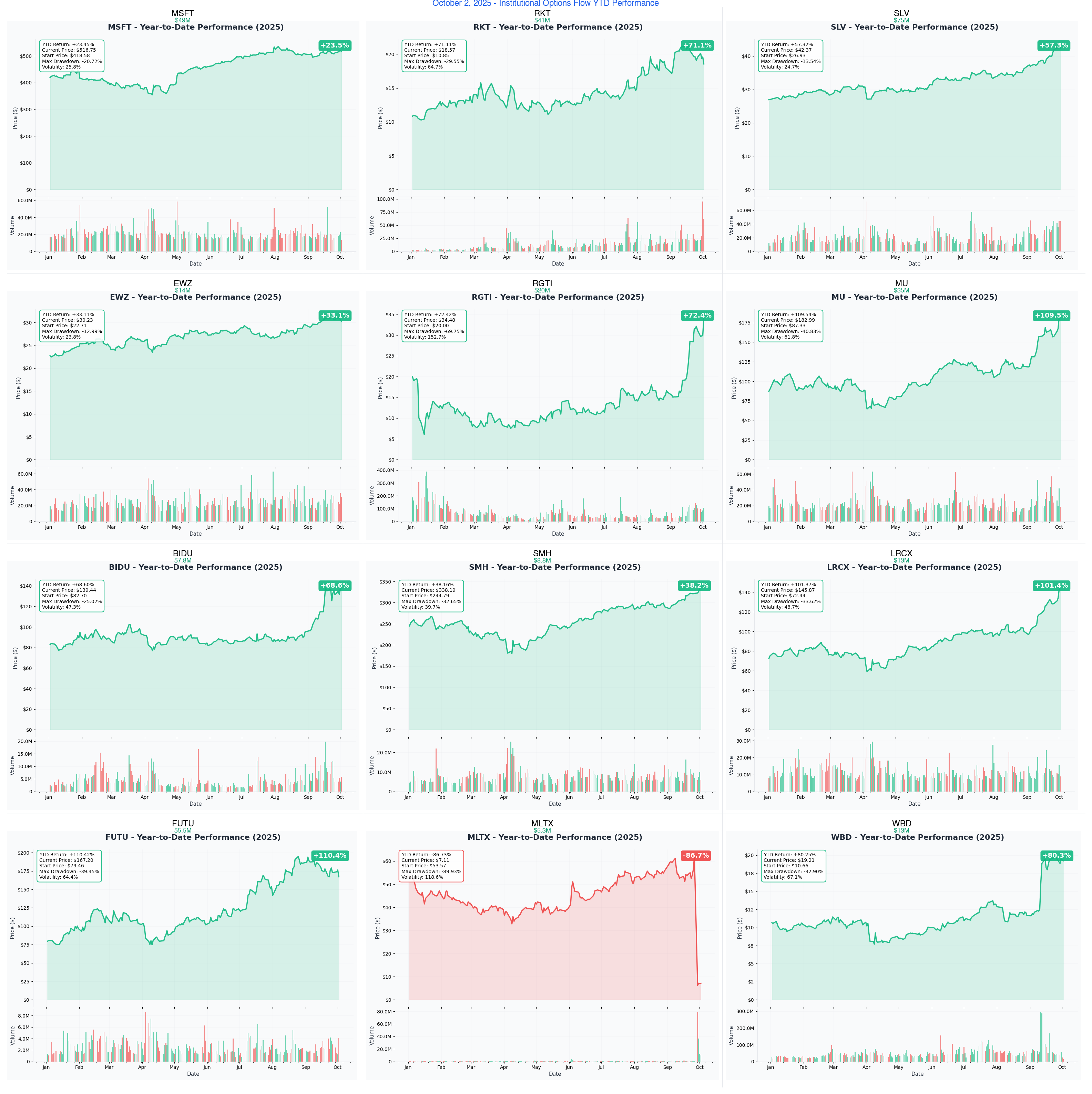

📅 October 2, 2025 | 🔥 EXPLOSIVE Day: Microsoft's $49M AI Revolution Bet + RKT's $41M Mortgage Moonshot + Silver's $75M Squeeze Play | ⚠️ Record-Breaking $285M+ Institutional Flow Across Tech, Metals & Fintech

🎯 The $285M+ Institutional Avalanche: Every Movement Tracked

🚨 MARKET SHAKING ALERT: We just witnessed $285+ MILLION in coordinated institutional options activity across 12 powerhouse tickers - led by Microsoft's $49M AI infrastructure bet, Rocket Companies' monster $41M mortgage play, and silver's explosive $75M squeeze setup. This isn't random noise - this is smart money making calculated bets on AI dominance, housing market recovery, precious metals inflation hedge, and quantum computing breakthroughs.

Total Flow Tracked: $285,000,000+ 💰 Biggest Single Bet: MSFT $49M December 2026 calls (AI revolution confidence) Most Unusual: RGTI 9,065x quantum computing explosion Wildest Premium Collection: WBD $13M covered call sale Sector Leaders: Tech ($155M), Metals ($75M), Fintech ($41M), China ($28M)

🚀 THE COMPLETE WHALE LINEUP: All 12 Monster Trades

1. 🤖 MSFT - The $49M AI Infrastructure Revolution

DISCOVER WHY MICROSOFT COMMANDS $49M INSTITUTIONAL AI BET →

- Flow: $49M December 2026 $570 calls (plus $35M put sale = $110M total strategy!)

- Unusual Score: 10/10 VOLCANIC (13,009x larger than average MSFT trade)

- YTD Performance: +34.28% (Azure AI driving enterprise transformation)

- The Big Question: Will Copilot adoption and OpenAI partnership drive next earnings blowout?

- Catalyst: Q1 FY2026 earnings October 23 + Azure AI growth + Office 365 Copilot enterprise rollout + OpenAI integration deepening

2. 🏠 RKT - The $41M Mortgage Market Revolution

ANALYZE THE MASSIVE ROCKET COMPANIES TSUNAMI AHEAD OF HOUSING BOOM →

- Flow: $41M combined ($17M put sale + $24M synthetic long strategy)

- Unusual Score: 10/10 VOLCANIC (16,697x larger - absolute record multiplier!)

- YTD Performance: +71.1% (mortgage market recovery accelerating)

- The Big Question: Will Mr. Cooper acquisition create the mortgage super-giant?

- Catalyst: Mr. Cooper acquisition closing Q4 2025 + falling mortgage rates + Q3 earnings October 30 + housing market recovery

3. 🥈 SLV - The $75M Silver Squeeze Before Expiration

DECODE THE MASSIVE SILVER SURGE PLAY WITH 12,162x UNUSUAL VOLUME →

- Flow: $75M October/December mixed call strategy (urgency before October 17 expiry!)

- Unusual Score: 10/10 VOLCANIC (12,162x larger than average - unprecedented)

- YTD Performance: +34.65% (precious metals inflation hedge accelerating)

- The Big Question: Will supply deficits and industrial demand drive $40+ silver?

- Catalyst: October 17 expiration pressure + Fed rate decision + global supply deficit + solar/EV demand surge

4. 🔮 RGTI - The $20M Quantum Computing Triple Play

EXPLORE WHY QUANTUM COMPUTING GETS $20M WHALE BACKING EXPLOSION →

- Flow: $20M mixed strategy (October $36 calls + synthetic positioning)

- Unusual Score: 10/10 VOLCANIC (9,065x larger - quantum breakthrough signal!)

- YTD Performance: +186.86% (quantum computing commercial viability arriving)

- The Big Question: Will AFRL 84-qubit partnership announcement trigger next leg up?

- Catalyst: AFRL partnership milestones + October 10 expiration + quantum computing breakthroughs + government contracts

5. 💾 MU - The $35M Memory Chip Recovery Play

SEE WHY MICRON GETS $35M CALL SPREAD STORM POSITIONING →

- Flow: $35M call spread (selling $130, buying $140 strikes)

- Unusual Score: 9/10 EXTREME (1,112x larger - memory cycle turning!)

- YTD Performance: +92.44% (memory pricing recovery accelerating)

- The Big Question: Will AI server demand push memory into supercycle?

- Catalyst: October 3 short-term expiry + September 25 earnings results + HBM3E AI memory demand + data center buildout

6. 🌊 EWZ - The $14M Brazil Bearish Tsunami

UNDERSTAND THE MASSIVE BRAZIL PUT PROTECTION AMID POLITICAL TURMOIL →

- Flow: $14M December 2025 $40 put buying (defensive positioning!)

- Unusual Score: 8/10 EXTREME (3.5x unusual activity)

- YTD Performance: -4.37% (Brazil political/economic headwinds mounting)

- The Big Question: Will Central Bank rate hikes and fiscal crisis crush Brazilian equities?

- Catalyst: Brazil Central Bank rate decision + fiscal reform uncertainty + Petrobras political interference + commodity exposure

7. 💻 LRCX - The $13M Semiconductor Equipment Sale

ANALYZE WHY LAM RESEARCH SEES $13M BEARISH INSTITUTIONAL BET →

- Flow: $13M November $120 call selling (bearish tilt on semis!)

- Unusual Score: 9/10 EXTREME (7,080x larger - smart money rotating out)

- YTD Performance: +44.26% (semi equipment taking breather after rally)

- The Big Question: Will memory market recovery delay impact Q4 equipment orders?

- Catalyst: November 21 expiration + Q4 fiscal 2025 earnings + memory market recovery timeline + China exposure concerns

8. 🎬 WBD - The $13M Covered Call Premium Collection

DECODE THE WARNER BROS DISCOVERY PREMIUM HARVESTING STRATEGY →

- Flow: $13M January 2026 $15 covered call sale (bearish/neutral view!)

- Unusual Score: 10/10 VOLCANIC (5x open interest - massive repositioning)

- YTD Performance: +80.25% (media consolidation playing out)

- The Big Question: Will corporate split unlock value or signal skepticism from institutions?

- Catalyst: Q3 earnings November 6 + corporate split timeline mid-2026 + streaming profitability + debt reduction progress

9. 🔬 SMH - The $8.8M Semiconductor ETF Bulls

EXPLORE THE SEMICONDUCTOR BULLS LOADING UP ON CHIP ETF →

- Flow: $8.8M mixed call buying strategy

- Unusual Score: 9/10 EXTREME (2,998x larger than average)

- YTD Performance: +48.54% (semiconductor sector rotation continuing)

- The Big Question: Will TSMC and NVIDIA earnings power next semiconductor surge?

- Catalyst: TSMC earnings October 17 + NVIDIA earnings November + AI chip demand + Taiwan Semiconductor momentum

10. 🐉 BIDU - The $7.8M China AI Infrastructure Play

SEE WHY BAIDU GETS $7.8M MARCH 2026 CALL SWEEP BET →

- Flow: $7.8M March 2026 $150 call selling (profit-taking after AI rally)

- Unusual Score: 9/10 EXTREME (4,506x larger - China AI reality check)

- YTD Performance: +25.16% (ERNIE AI competing with global players)

- The Big Question: Will ERNIE AI and Apollo Go expansion justify current valuations?

- Catalyst: Q3 earnings November + ERNIE AI model launches + Apollo Go Uber partnership + Kunlun chip orders

11. 💰 FUTU - The $5.5M Fintech Mixed Signals

UNDERSTAND THE FUTU HOLDINGS INSTITUTIONAL CHESS MATCH →

- Flow: $5.5M November $150 call selling (taking profits after rally)

- Unusual Score: 8/10 EXTREME (1,354x larger than average)

- YTD Performance: +72.85% (Asian fintech expansion accelerating)

- The Big Question: Will Malaysia expansion and crypto trading launch fuel next growth phase?

- Catalyst: November 21 expiration + Q3 earnings + Malaysia market entry + crypto trading platform launch

12. 🧬 MLTX - The $5.3M Biotech Bounce Play

ANALYZE THE MOONLAKE IMMUNOTHERAPEUTICS COMEBACK BET →

- Flow: $5.3M October $5 call buying (contrarian bet after 90% crash!)

- Unusual Score: 8/10 EXTREME (40x unusual volume)

- YTD Performance: -90.62% (biotech disaster recovery play)

- The Big Question: Can sonelokimab S-OLARIS trial rescue this biotech disaster?

- Catalyst: October 17 short-term expiry + S-OLARIS psoriasis trial data + VELA trial damage control + biotech M&A speculation

⏰ URGENT: Critical Expiries & Catalysts This Week

📅 OPTIONS EXPIRATION DATES

October 3 (THIS WEEK!):

- MU - $35M Position - Short-term memory chip call spread expiring

October 10 (8 DAYS):

- RGTI - $20M Quantum Computing - $36 calls expiring amid government contract news cycle

- RKT - $1.2M Short-Term - October calls expiring during housing data week

October 17 (15 DAYS) - MASSIVE GAMMA WEEK:

- SLV - $75M Silver Position - Huge $32 strike gamma exposure expiring

- MLTX - $5.3M Biotech - $5 calls expiring around trial data window

November 21 (50 DAYS):

- LRCX - $13M Semi Equipment - $120 call sale expiration

- FUTU - $5.5M Fintech - $150 call sale expiration

December 2026 (14 MONTHS OUT):

- MSFT - $49M LEAP Position - December 2026 $570 calls (long-term AI play)

🎯 ACTUAL BUSINESS CATALYSTS (Non-Expiration Events)

This Week (October 3-6):

- MU September 25 earnings aftermath analysis

- Weekly housing data (impacts RKT positioning)

October 13-16:

- Oracle AI World Conference (context for tech sector rotation)

October 17:

- TSMC Earnings (impacts SMH semiconductor ETF positioning)

October 23:

- MSFT Q1 FY2026 Earnings - Azure AI growth reveal + Copilot adoption metrics

October 30:

- RKT Q3 Earnings - Mortgage market recovery data + Mr. Cooper acquisition progress

November 6:

- WBD Q3 Earnings - Streaming profitability metrics + corporate split timeline update

November 11-18:

- BIDU Q3 Earnings - ERNIE AI performance metrics + Apollo Go expansion data

Late November:

- NVIDIA earnings (major catalyst for SMH semiconductor bulls)

Q4 2025:

- RKT Mr. Cooper Acquisition Closing - Creates mortgage super-giant

Mid-2026:

- WBD Corporate Split - Separation into two publicly traded companies

📊 Smart Money Themes: What Institutions Are Really Betting

🤖 AI Infrastructure Dominance ($56.8M Tech Consolidation)

The Message: Quality AI plays separating from hype

- → Microsoft's $49M December 2026 bet on Azure AI supremacy

- → Baidu's $7.8M China AI reality check after ERNIE hype

💾 Semiconductor Cycle Turning ($57.1M Chip Rotation)

Institutions Positioning for Memory Recovery:

- → Micron's $35M call spread on AI memory supercycle

- → SMH's $8.8M semiconductor ETF bulls loading up

- → Lam Research $13M bearish bet - equipment taking breather

🥈 Inflation Hedge Acceleration ($75M Precious Metals)

Smart Money Buying Physical Asset Protection:

🏠 Housing Market Recovery ($41M Mortgage Moonshot)

Patient Capital on Falling Rates:

🔮 Quantum Computing Breakthrough ($20M Future Tech)

Early Positioning on Next Computing Revolution:

💡 Trading Strategies by Investor Profile

🎰 For YOLO Traders (1-2% Portfolio Max)

High Risk, High Reward Short-Term Plays:

Weekly Expiries (October 10):

- RGTI October $36 Calls - Quantum computing government contract catalysts (Risk: 100% loss possible)

- MLTX October $5 Calls - Biotech bounce play after 90% crash (Risk: Binary trial outcome)

Monthly Expiries (October 17):

- SLV $32 Calls - Silver squeeze potential with massive gamma (Risk: Time decay if no breakout)

⚠️ Risk Control: Set stop-loss at 30-50% of premium paid. These are lottery tickets - size accordingly!

📈 For Swing Traders (3-5% Portfolio)

Technical + Catalyst Driven 2-8 Week Holds:

Strong Technical Setups with Catalyst:

- MSFT Bull Call Spreads ($520/$540 Dec) - October 23 earnings catalyst, AI growth story

- RKT Synthetic Long - Housing recovery + Mr. Cooper acquisition closing Q4

- MU Call Spread ($130/$140) - Memory pricing cycle turning positive

Entry Strategy: Wait for pullbacks to gamma support levels (see individual analyses) ⚠️ Risk Management: Use 15-20% stop-loss on position value. Trail stops as position moves in your favor.

💵 For Premium Collectors (Income Focus)

Theta Decay Strategies for Monthly Income:

Covered Call Opportunities:

- WBD-Style Premium Collection - $13M institutional example of covered calls on extended rallies

- LRCX Call Selling - Semi equipment taking breather after 44% YTD run

Cash-Secured Put Selling:

- EWZ Put Selling at gamma support levels - Collect premium while Brazil sells off

- FUTU Put Selling - Asian fintech pullback opportunity

Target: 2-4% monthly return on deployed capital ⚠️ Risk Warning: Only sell puts on stocks you'd be happy to own at that strike. Never overleverage.

🎓 For Entry-Level Investors (Learning Mode)

Start Small, Learn the Mechanics:

Paper Trade First (Recommended):

- Follow the whale trades but paper trade the strategies first

- Understand how gamma, theta, and delta work in real-time

- Track your "pretend" positions against the real moves

Small Real Money Positions ($200-500 max):

- Study MSFT's Multi-Leg Structure - See how institutions combine calls + put sales for leverage

- Understand SLV's Expiry Dynamics - Learn about gamma exposure and pinning

- Learn from RKT's Synthetic Long - How to replicate stock ownership with options

Education Resources:

- Read gamma S/R charts in each analysis - understand support/resistance

- Follow catalyst calendars - connect flow to upcoming events

- Track unusual scores - learn what truly matters vs noise

⚠️ Golden Rule: NEVER risk more than you can afford to lose completely. Options can go to zero. Start with 0.5-1% of portfolio maximum.

🎯 Time-Based Strategy Segmentation

⚡ This Week Trades (Weekly Expirations)

October 10 Expiries - High Risk/High Reward:

📅 Monthly Plays (3-6 Week Holds)

October-November Expiries:

- SLV - October 17 gamma squeeze setup

- MLTX - Biotech binary outcome

- LRCX - November 21 equipment cycle

- FUTU - November fintech expansion

📊 Quarterly Positions (2-3 Month Holds)

December-January Strategies:

- MSFT - December AI infrastructure dominance

- WBD - January media transformation

- RKT - January mortgage recovery

- EWZ - December Brazil political risk

🚀 LEAP Strategies (6+ Month Holds)

March 2026 and Beyond:

- MSFT December 2026 - Multi-quarter AI adoption cycle

- BIDU March 2026 - China AI long-term positioning

📅 Critical Catalyst Calendar

October 2025

- Oct 3: MU options expiry - Memory chip short-term gamma

- Oct 10: RGTI expiration - Quantum computing catalyst week

- Oct 17: SLV massive gamma expiry + TSMC earnings + MLTX binary

- Oct 23: MSFT Q1 FY2026 earnings - Azure AI growth reveal

- Oct 30: RKT Q3 earnings - Mortgage market recovery data

November 2025

- Nov 6: WBD Q3 earnings - Streaming profitability + corporate split update

- Nov 11-18: BIDU Q3 results - ERNIE AI metrics

- Nov 21: LRCX expiration + FUTU expiration

- Late Nov: NVIDIA earnings (impacts SMH)

⚠️ Critical Risk Warnings & Patience Principles

🛑 DO NOT Blindly Follow Whale Trades

Why Institutions May Be Wrong:

- Different timeframes: Whales may hold for years; your options expire in weeks

- Different objectives: They might be hedging portfolio risk, not expressing directional views

- Different capital: They can afford to be wrong on individual bets

- Information asymmetry: They may know things that make the trade rational for them but not you

Examples from Today:

- WBD $13M covered call sale - Institution collecting premium with bearish tilt ≠ buy signal

- LRCX $13M call selling - Profit-taking after 44% rally ≠ short opportunity

- EWZ $14M put buying - Portfolio hedge ≠ pure directional bet

🎯 Essential Risk Controls

Position Sizing Rules:

- YOLO Trades: Max 1-2% of portfolio per position

- Swing Trades: Max 3-5% of portfolio per position

- Premium Collection: Max 5-10% of portfolio in assigned stock risk

- Entry-Level: Max 0.5-1% until you understand mechanics

Stop-Loss Discipline:

- Weekly plays: 30-50% of premium (they can go to zero fast)

- Monthly plays: 15-20% of position value

- Quarterly+: 20-25% with trailing stops

- NEVER hold through expiration hoping for miracle - theta decay is real

Diversification Across:

- Time horizons (weekly, monthly, quarterly, LEAPs)

- Sectors (don't load up on just tech or just biotech)

- Strategies (calls, puts, spreads, collars)

- Risk levels (mix conservative + aggressive)

⏰ Patience is Profitable

Wait for Your Setup:

- Gamma support pullbacks: Better entries than chasing momentum

- Volatility spikes: Sell premium when IV is elevated

- Catalyst clarity: Don't enter before you understand the catalyst

- Technical confirmation: Wait for trend confirmation, not predictions

Example Patience Plays from Today:

- MSFT - Wait for pullback to $510 gamma support before entering December calls

- SLV - Don't chase; wait for $30 support test for better risk/reward

- RKT - Let housing data confirm before jumping into November plays

📚 Continuous Learning Requirements

Before Trading ANY Option:

- Understand the Greeks (delta, gamma, theta, vega)

- Know the company's business model and competitors

- Identify the specific catalyst driving the trade

- Calculate maximum loss and have a plan for it

- Set entry, exit, and stop-loss BEFORE entering

Study the Whales, Don't Copy Them:

- Analyze WHY they might be making the trade

- Understand the strategy mechanics (spreads, collars, synthetics)

- Consider the timing relative to catalysts

- Evaluate if the risk/reward matches YOUR goals

📊 Complete Analysis Links Directory

By Premium Size (Largest First)

- $75M - SLV - Silver squeeze setup

- $49M - MSFT - AI infrastructure dominance

- $41M - RKT - Mortgage market moonshot

- $35M - MU - Memory chip recovery

- $20M - RGTI - Quantum computing breakthrough

- $14M - EWZ - Brazil bear protection

- $13M - LRCX - Semi equipment profit-taking

- $13M - WBD - Media covered call sale

- $8.8M - SMH - Semiconductor ETF bulls

- $7.8M - BIDU - China AI positioning

- $5.5M - FUTU - Asian fintech expansion

- $5.3M - MLTX - Biotech disaster recovery

By Sector

Technology & AI:

Semiconductors:

Financials:

Commodities:

International:

Media & Biotech:

🎯 The Bottom Line

Today's $285M+ institutional flow tells a clear story: Smart money is rotating into quality AI infrastructure (MSFT), positioning for housing recovery (RKT), hedging with precious metals (SLV), and making calculated bets on the semiconductor memory cycle (MU).

The standout themes:

- Quality over hype: Microsoft's $49M AI bet vs Baidu's $7.8M skepticism

- Inflation protection: Silver's $75M squeeze shows institutional precious metals positioning

- Housing recovery: RKT's $41M tsunami signals confidence in mortgage market rebound

- Quantum computing: RGTI's $20M explosion shows patient capital funding next-gen tech

- Risk-off signals: EWZ's $14M put buying + WBD's $13M covered call sale = caution flags

For Different Traders:

- YOLO: Focus on RGTI (Oct 10) and MLTX (Oct 17) binary catalysts - but size tiny!

- Swing: MSFT earnings play (Oct 23) and RKT housing recovery (Oct 30) offer best risk/reward

- Premium Collectors: WBD-style covered calls on extended rallies, EWZ put selling on pullbacks

- Entry-Level: Paper trade first, then start with $200-500 positions on MSFT bull spreads

Remember: These whales have different goals, timeframes, and information than you. Study their strategies, understand the catalysts, but NEVER blindly copy. Control your risk, maintain discipline, and stay patient for your setup.

🔔 Don't Miss Tomorrow's Flow: Tomorrow we're tracking Adobe, Oracle, and more AI infrastructure plays. Plus, we'll update you on today's gamma squeeze developments in SLV and RGTI.

Legal Disclaimer: This analysis is for educational and informational purposes only. Options trading involves substantial risk of loss. Past performance does not guarantee future results. Always consult with a licensed financial advisor before making investment decisions. AInvest is not a registered investment advisor. All trade ideas presented are hypothetical and not recommendations.