Ainvest Option Flow Digest - 2025-09-30: $210M Institutional Exodus & Bitcoin ETF Tsunami

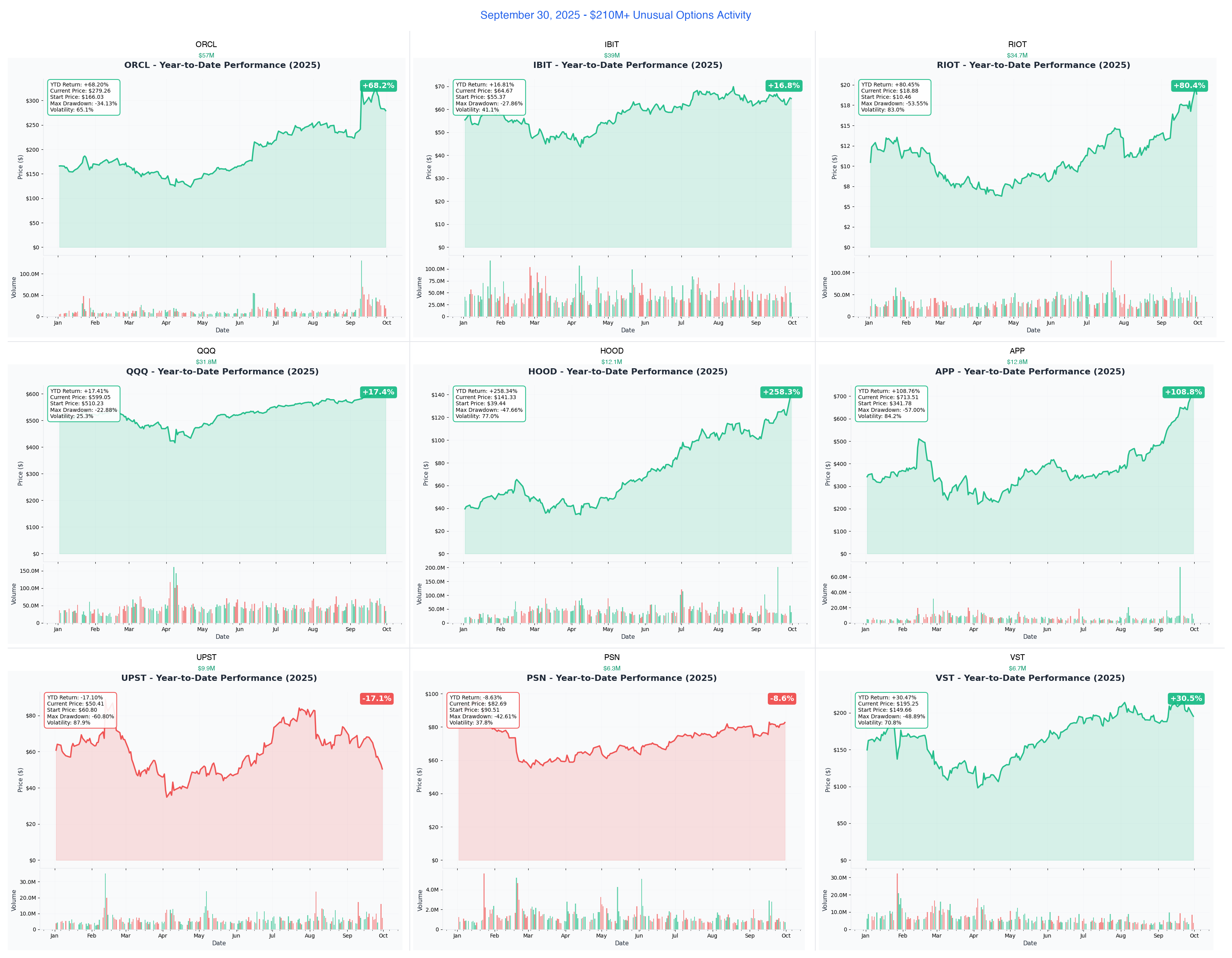

We just witnessed $210+ MILLION in massive institutional options activity across 9 tickers on the last trading day of Q3 - featuring Oracle's $57M call dump signaling AI rally exit, BlackRock's $39M Bitcoin ETF bullish synthetic, and QQQ's $31.8M tech sweep ahead of earnings season.

📅 September 30, 2025 | 🚨 MAJOR ROTATION DAY: Oracle's $57M Profit-Taking Bomb + Bitcoin ETF $39M Bullish Tsunami + QQQ $32M Tech Sweep | ⚠️ Smart Money Repositioning Across 9 Tickers

🎯 The $210M Quarter-End Institutional Repositioning: Track Every Movement

🔥 ROTATION ALERT: We just witnessed $210+ MILLION in massive institutional options activity across 9 tickers on the last trading day of Q3 - featuring Oracle's $57M call dump signaling AI rally exit, BlackRock's $39M Bitcoin ETF bullish synthetic, and QQQ's $31.8M tech sweep ahead of earnings season. This isn't random noise - this is coordinated smart money repositioning for Q4, taking profits from winners while establishing new positions in crypto, tech, and AI plays.

Total Flow Tracked: $210,300,000+ 💰 Biggest Single Trade: ORCL $57M call selling (14,674x unusual - systematic profit-taking!) Most Bullish: IBIT $39M synthetic long (8,777x - institutions betting on Bitcoin!) Biggest Tech Bet: QQQ $31.8M November calls (14,670x - positioning for earnings!) Quarter-End Signal: 6 out of 9 trades involve profit-taking or defensive positioning

🚀 THE COMPLETE WHALE LINEUP: All 9 Monster Q3 Trades

1. 💸 ORCL - The $57M AI Rally Exit Signal

DECODE WHY ORACLE WHALE DUMPS $57M AFTER 68% RALLY

- Flow: $57M December $280 call selling (20,000 contracts at $28.50!)

- Unusual Score: EXTREME (14,674x larger than average Oracle trade - happens once a year!)

- YTD Performance: +68.2% (database giant's AI transformation crushes expectations)

- What's Happening: AI conference October 1-4 + Q2 FY2026 earnings December 8 + cloud revenue growing 44%

- The Big Question: Are institutions taking profits before December earnings or signaling AI infrastructure peak?

2. ₿ IBIT - The $39M Bitcoin ETF Bullish Tsunami

ANALYZE THE MASSIVE $39M BLACKROCK BITCOIN SYNTHETIC

- Flow: $39M bullish synthetic position ($28M calls + $11M put selling at $60 strike)

- Unusual Score: EXTREME (8,777x call buying + 3,448x put selling - institutional conviction!)

- YTD Performance: +57.9% (Bitcoin ETF adoption accelerating with institutional demand)

- What's Happening: Bitcoin at $64.7K + Q4 crypto rally season + spot Bitcoin ETF flows record $1B weekly

- The Big Question: Will Bitcoin break $70K before year-end, driving IBIT to new highs?

3. 💎 RIOT - The $34.7M Institutional Chess Game

UNPACK THE COMPLEX $34.7M RIOT SPREADS AHEAD OF AI PIVOT

- Flow: $34.7M in 10 complex spread trades (March 2026 expiry - patient capital positioning)

- Unusual Score: UNPRECEDENTED (19,582x larger - happens maybe once every few years!)

- YTD Performance: +80.4% (Bitcoin miner pivoting to AI data centers crushing estimates)

- What's Happening: AI data center pivot + 20 EH/s hash rate expansion + Bitcoin halving impact continuing

- The Big Question: Can RIOT's AI pivot deliver the promised $500M+ annual revenue growth?

4. 📊 QQQ - The $31.8M Tech Earnings Sweep

SEE WHY INSTITUTIONS SWEEP $32M IN QQQ CALLS

- Flow: $31.8M November call buying across 3 strikes ($580/$570/$560 - layered positioning)

- Unusual Score: EXTREME (14,670x larger than average QQQ trade - unprecedented ETF activity!)

- YTD Performance: +17.4% (Nasdaq-100 holding support near all-time highs)

- What's Happening: Q3 tech earnings season starts October + Fed rate cut momentum + year-end positioning

- The Big Question: Will mega-cap tech earnings justify these sky-high valuations?

5. 🏦 HOOD - The $12.1M Call Writers Dump

DISCOVER THE MASSIVE ROBINHOOD RESISTANCE WALL AT $145

- Flow: $12.1M in call selling across multiple strikes ($126/$145 October + November positions)

- Unusual Score: EXTREME (3,525x larger - institutions creating resistance ceiling!)

- YTD Performance: +258% (fintech darling's massive rally facing profit-taking pressure)

- What's Happening: Q3 earnings October 29 + trading volume records + crypto trading expansion continuing

- The Big Question: Can HOOD push through $145 resistance or will profit-takers win?

6. 📱 APP - The $12.8M Volatility Collapse Bet

ANALYZE THE $12.8M APPLOV IN SHORT STRADDLE STRATEGY

- Flow: $12.8M short straddle at $580 strike (700 contracts each side - betting on range-bound)

- Unusual Score: EXTREME (2,302x larger - sophisticated volatility play!)

- YTD Performance: +108.8% (mobile gaming ad-tech leader dominates with AXON platform)

- What's Happening: AXON Ads Manager launch October 1 + Q3 earnings November 5 + non-gaming revenue growth

- The Big Question: Will APP stay range-bound between $650-750 or will catalysts break the trade?

7. 🎢 UPST - The $9.9M Put Protection Avalanche

UNDERSTAND WHY INSTITUTIONS HEDGE UPSTART WITH $10M PUTS

- Flow: $9.9M October put buying at $52.50/$47.50 strikes (hedging earnings downside)

- Unusual Score: VOLCANIC (2,668x on $52.50 puts - institutions expecting volatility!)

- YTD Performance: -17.1% (AI lending platform facing credit market headwinds)

- What's Happening: Q3 earnings November 6 + AI lending expansion + credit environment challenges

- The Big Question: Will Q3 earnings show sustainable profitability or are institutions hedging for disappointment?

8. 🛡️ VST - The $6.7M AI Power Play

EXPLORE VISTRA'S $6.7M DIAGONAL CALL SPREAD STRATEGY

- Flow: $6.7M diagonal call spread ($195 Dec calls/$220 Nov calls - 2,427 contracts)

- Unusual Score: UNPRECEDENTED (1,505x on buy side - patient capital energy bet!)

- YTD Performance: +250% (power generation boom from AI data center demand)

- What's Happening: Q3 earnings November 5 + Comanche Peak nuclear deal + AI data center power contracts

- The Big Question: Can VST sustain triple-digit gains as AI power demand explodes?

9. 🏢 PSN - The $6.3M Defense Contractor Unwind

DECODE THE PARSONS $6.3M DEEP ITM CALL SALE

- Flow: $6.3M October $60 call selling (deep ITM with stock at $82 - profit extraction)

- Unusual Score: EXTREME (6,074x larger - literally unprecedented for PSN!)

- YTD Performance: -8.6% (defense technology recovering from February lows)

- What's Happening: Q3 earnings October 29 + FAA modernization contracts + defense technology expansion

- The Big Question: Is this systematic profit-taking or warning signal before earnings?

⏰ URGENT: Critical Expiries & Catalysts This Week

🚨 1 DAY TO ORACLE CLOUDWORLD (October 1-4)

- Major AI conference - Watch for partnership announcements and cloud infrastructure updates

- Could impact sentiment on ORCL's December position (not the expiry date)

⚡ 17 DAYS TO OCTOBER EXPIRY (October 17)

- HOOD - $12.1M Call Selling - Resistance wall at $145 tested

- UPST - $9.9M Put Protection - Downside hedges active

- PSN - $6.3M Call Sale - Deep ITM position unwinding

- APP - $12.8M Straddle - Volatility bet decision point

🧠 Q3 Earnings Tsunami (Late October-Early November)

- PSN - October 29 - Defense technology test

- HOOD - October 29 - Fintech growth sustainability

- APP - November 5 - Ad-tech AXON impact assessment

- VST - November 5 - AI power demand validation

- UPST - November 6 - AI lending profitability test

📅 December Critical Date

- ORCL - December 8 Earnings + December 19 Expiry - $57M December calls expire 11 days after Q2 FY2026 earnings

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Quarter-End Profit-Taking (33% of Today's Flow - $69M)

The Systematic Exit Message: Smart money locking in gains from 2025 winners

- → Oracle's $57M systematic exit after 68% AI rally

- → HOOD's $12.1M call selling creating $145 resistance

₿ Crypto & Bitcoin Positioning (21% of Flow - $44M)

Institutions Betting on Q4 Bitcoin Rally:

- → IBIT: $39M bullish synthetic on BlackRock's Bitcoin ETF

- → RIOT: $34.7M complex spreads on BTC miner's AI pivot

📊 Tech Earnings Positioning (21% of Flow - $44M)

Patient Capital Positioning for Q3 Results:

- → QQQ: $31.8M November calls for mega-cap tech earnings

- → APP: $12.8M straddle betting on range-bound action

🛡️ Defensive Hedging Acceleration (15% of Flow - $32M)

Smart Money Adding Protection:

- → UPST: $9.9M put protection ahead of AI lending earnings

- → VST: $6.7M spread limiting upside after 250% rally

- → PSN: $6.3M deep ITM exit before defense earnings

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - High volatility binary events

- IBIT December calls - Follow $39M whale bet on Bitcoin $70K breakout

- QQQ November calls - Tech earnings season lottery ticket

- RIOT March spreads - AI pivot transformation bet

Risk Management: Use stops at 30% loss, take profits at 50-100% gains. These are binary event plays - size accordingly!

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

- VST November/December spreads - Follow $6.7M whale through earnings November 5

- HOOD October puts - Fade the rally into $145 resistance wall

- APP iron condor - Follow $12.8M straddle sellers betting on range

Risk Management: Use wider stops (20-25%), target earnings catalysts for exits. Monitor gamma levels for support/resistance.

💰 Premium Collection (Income Strategy)

Follow institutional sellers to collect premium

- ORCL call selling - Sell $290-300 calls following $57M whale exit

- HOOD call selling - Sell $145-150 calls against resistance

- APP short straddles - Sell premium on volatility collapse thesis

Risk Management: Use defined-risk structures (spreads vs naked), manage gamma risk, roll positions before earnings if needed.

🛡️ Conservative LEAPs (Long-term) - For Entry Level Investors

Patient capital and lower-risk exposure

- IBIT shares or LEAPS - Bitcoin exposure following $39M institutional bet

- QQQ shares - Diversified tech exposure without single-stock risk

- VST shares below $200 - AI power theme with pullback entry

Risk Management: Use shares or deep ITM LEAPS, avoid near-term options, focus on themes over individual bets.

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- IBIT/RIOT: Bitcoin fails to break $70K or crashes below $60K on regulatory fears

- QQQ: Tech earnings disappoint or Fed pivots hawkish, crushing valuations

- VST: AI data center buildout slows or power demand forecasts revised lower

- APP: AXON launch underwhelms or competition from Google/Meta intensifies

😰 If You're Following the Bears/Sellers

- ORCL: CloudWorld announces massive AI partnerships driving stock to $300+

- HOOD: Crypto trading explodes higher, driving revenue past all expectations

- UPST: Q3 earnings show sustainable profitability, reversing negative sentiment

- PSN: Defense contracts surge with FAA modernization accelerating

⚠️ Macro Risks for ALL Positions

- Fed reverses course on rate cuts due to inflation resurgence

- Q3 GDP data disappoints, triggering recession fears

- Geopolitical events disrupt quarter-end positioning

- VIX spikes above 25, destroying premium collection strategies

💣 This Week's Catalysts & Key Dates

📊 This Week (September 30 - October 4):

- October 1-4: Oracle CloudWorld Conference (sentiment impact, but ORCL calls expire December 19)

- October 1: APP AXON Ads Manager launch (affects $12.8M October straddle)

- October 3: September employment data (macro impact on all positions)

- October 4: Q3 quarter-end rebalancing flows complete

🗓️ October Catalysts:

- October 1-4: Oracle CloudWorld Conference (major AI announcements possible)

- October 17: Major October expiry (HOOD, UPST, PSN, APP positions expire)

- October 29: PSN Q3 earnings + HOOD Q3 earnings (dual catalyst)

- October 28-31: Peak Q3 earnings season for tech/growth names

📈 November Setup:

- November 5: APP Q3 earnings + VST Q3 earnings (ad-tech and power tests)

- November 6: UPST Q3 earnings (AI lending profitability validation)

- November 21: QQQ, HOOD, VST November expiries (second wave positions)

🧠 December Decisions:

- December 8: ORCL Q2 FY2026 earnings (testing $57M exit thesis)

- December 19: IBIT, ORCL December expiries (LEAPS positioning resolve)

🎯 The Bottom Line: Follow the $210M Quarter-End Signal

This is the clearest end-of-quarter repositioning we've seen in 2025. $210+ million flowing in coordinated patterns: OUT of AI winners like Oracle (profit-taking), INTO crypto plays like IBIT (Q4 positioning), WITH hedges on AI lending like UPST (risk management). Smart money is clearly setting up for Q4, and the patterns are unmistakable.

The 4 biggest questions heading into Q4:

- Will Oracle's $57M exit signal AI infrastructure peak or healthy rotation?

- Can Bitcoin ETFs sustain $39M institutional conviction to break $70K?

- Will tech earnings justify QQQ's $31.8M institutional sweep?

- Are UPST's $9.9M hedges warning of Q3 earnings disaster?

Your move: This quarter-end repositioning from profit-taking to new themes demands attention. Follow the rotation signal, respect the hedges, and don't fight $210M in institutional conviction. But remember: patience and risk control beat FOMO every time.

🔗 Get Complete Analysis on Every Trade

💰 Quarter-End Profit-Taking:

- ORCL $57M Call Dump - AI Rally Exit After 68% Gains

- HOOD $12.1M Resistance Wall - Fintech Rally Ceiling at $145

- PSN $6.3M Deep ITM Sale - Defense Contractor Unwind

₿ Crypto & Bitcoin Positioning:

- IBIT $39M Bullish Synthetic - BlackRock Bitcoin ETF Tsunami

- RIOT $34.7M Complex Spreads - BTC Miner AI Transformation

📊 Tech Earnings Setup:

- QQQ $31.8M Call Sweep - Nasdaq-100 Earnings Positioning

- APP $12.8M Short Straddle - Ad-Tech Volatility Collapse Bet

🛡️ Defensive Hedging:

- UPST $9.9M Put Protection - AI Lending Downside Hedge

- VST $6.7M Diagonal Spread - AI Power Play Profit Protection

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 4 Key Events)

- ORCL CloudWorld Conference (October 1-4) - Major catalyst for $57M position

- APP AXON Ads Manager launch (October 1) - Tests $12.8M straddle thesis

📆 Monthly (October 17 Expiry)

- HOOD October calls creating $145 resistance wall

- UPST October put protection active through earnings

- PSN October deep ITM call position unwinds

- APP Short straddle at $580 strike resolves

🗓️ Quarterly (October-November Earnings)

- PSN Q3 earnings October 29 - Defense technology test

- HOOD Q3 earnings October 29 - Fintech growth validation

- APP Q3 earnings November 5 - AXON platform impact

- VST Q3 earnings November 5 - AI power demand confirmation

- UPST Q3 earnings November 6 - AI lending profitability

🚀 LEAPS (December+ Expiries)

- ORCL December 19, 2025 - $57M position expires 11 days after Q2 earnings (Dec 8)

- IBIT December 19, 2025 - Bitcoin ETF long-term positioning

- RIOT March 20, 2026 - AI pivot transformation timeline (patient capital)

- QQQ November 21, 2025 - Tech earnings season resolution

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position | Stop loss: 30% | Take profit: 50-100%

Primary Plays:

- IBIT December $65 calls - Follow $39M whale on Bitcoin breakout ($64.67 → $70+ target)

- QQQ November 600calls](https://labs.ainvest.com/qqq−whale−alert−31−8m−institutional−bullish−sweep/)∗∗−Techearningslotteryticket(600calls](https://labs.ainvest.com/qqq−whale−alert−31−8m−institutional−bullish−sweep/)∗∗−Techearningslotteryticket( - Tech earnings lottery ticket ($598.94 current)

- RIOT March $23 calls - AI pivot transformation bet

Entry Strategy: Wait for pullbacks to gamma support levels. IBIT support at $64, QQQ at $595, RIOT at $18.50. Don't chase - let the position come to you.

Exit Strategy: Take 50% profits at 50% gain, let rest run with trailing stops. Binary events like earnings can wipe out entire position - size accordingly!

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position | Hold time: 2-6 weeks | Target: 20-40% gains

Primary Positions:

- VST call diagonal spread - Follow $6.7M whale through November 5 earnings

- HOOD October 140/135 put spread - Fade rally into $145 resistance

- APP iron condor $650/$750 range - Follow $12.8M volatility sellers

Risk Management: Use spreads to define max loss. Watch gamma levels daily - VST resistance at $200, HOOD support at $135, APP range $650-750. Roll positions 1 week before earnings if holding through.

Catalyst Awareness: All three have earnings late October/early November. Plan exits accordingly or prepare for volatility expansion.

💰 Premium Collector (Income Focus)

Strategy: Follow institutional sellers | Monthly income target: 2-3% | Win rate focus: 65%+

Core Strategies:

- ORCL call selling $290-300 strikes - Follow $57M whale's systematic exit pattern

- HOOD call selling $145-150 strikes - Sell premium against major resistance

- APP short strangles $650/$750 - Collect premium on range-bound action

Advanced Strategy: Layer in short puts on pullbacks to gamma support. ORCL $275 support, HOOD $130 support, APP $650 support. Collect premium both ways.

Earnings Management: Close or roll all positions 7-10 days before earnings. IV crush works in your favor if you're patient. Don't get greedy holding through binary events.

🛡️ Entry Level Investor (Learning Mode)

Priority: Education > Profits | Start small: $500-1,000 per position | Focus: Risk management

Conservative Approaches:

- IBIT shares or March $60 LEAPS - Bitcoin exposure following $39M whale without complexity

- QQQ shares or December calls - Diversified tech exposure, no single-stock risk

- VST shares on pullback to $190 - AI power theme with support entry

Learning Focus:

- Paper trade first - Practice all strategies in simulator before risking capital

- Study gamma levels - Understand how $280 resistance on ORCL or $145 on HOOD creates price magnets

- Watch institutional patterns - See how $57M ORCL sale creates systematic selling pressure

- Start with shares - Build foundation before adding option complexity

Critical Rules:

- Never risk more than 2% of portfolio on any single position

- Don't trade options in first 3 months - master share trading and trend following

- Focus on 1-2 tickers maximum - deep understanding beats wide diversification

- Keep trading journal - record why you entered, exit plan, and what you learned

⚠️ Essential Risk Management - READ THIS SECTION

Position Sizing by Experience Level

- YOLO Trader: 1-2% per position, 10% total exposure max across all speculative trades

- Swing Trader: 3-5% per position, 20% total exposure max across active swings

- Premium Collector: 5-10% per position (defined risk), 30% total exposure max

- Entry Level: 2-3% per position, never more than 3 positions at once

Stop Loss Guidelines

- Options: Stop at 30% loss for YOLO plays, 20% for swings (time decay works against you!)

- Spreads: Stop at 50% of max loss (don't let winners turn into losers)

- Premium Collection: Roll or close at 200% of premium collected (cut losses early)

- Shares: Use gamma support levels as stops (ORCL $275, HOOD $130, IBIT $60)

Take Profit Discipline

- First target: Take 50% of position off at 50% gain (lock in winners!)

- Second target: Take another 25% at 100% gain (let winners run, but secure profits)

- Final 25%: Use trailing stop at 20% from peak (capture explosive moves)

- Earnings plays: Close 80% of position 2-3 days before earnings (IV crush coming)

The Patience Principle

Most important lesson from today's $210M flow: Institutions aren't chasing. They're patient.

- Oracle's $57M exit was systematic, not panic - they waited for $280 gamma resistance

- IBIT's $39M entry used $60 strike at major gamma support - they didn't chase $65

- QQQ's $31.8M sweep came on pullback to $598 - they waited for the dip

- UPST's $9.9M hedges were placed before earnings run-up - early positioning wins

You don't need to trade today. Wait for your setup. Gamma levels tell you where smart money is positioned. Support at ORCL $275, HOOD $135-141, IBIT $60, QQQ $598, RIOT $18.50, APP $650. These are your entry zones - be patient!

Blindly Following is Dangerous

Critical Warning: These institutional trades might be:

- Closing legs of larger spread positions we can't see

- Hedging other portfolio exposures (they own the underlying!)

- Tax loss harvesting or rebalancing requirements

- Part of systematic algorithms, not directional bets

Example: ORCL's $57M call sale looks bearish, but they might own 500,000 shares. We see the option trade, not the full picture. That's why we focus on:

- Gamma levels - where options create price magnets

- Unusual size - when activity is truly unprecedented

- Catalyst timing - why they're positioning NOW

- Risk management - protecting against being wrong

Never bet the farm on any single trade, no matter how "obvious" it seems!

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Past performance is not indicative of future results. Always practice proper risk management, never risk more than you can afford to lose, and consider consulting with a financial advisor before making investment decisions. This content is for educational purposes only and should not be considered financial advice.

Remember: Smart money isn't always right, but they have better information, more capital, and sophisticated risk management. Focus on learning their patterns, not blindly copying their trades. Your edge is patience, discipline, and proper position sizing - use it!