Ainvest Option Flow Digest - 2025-09-28: $342M Whale Invasion Spans Tech Giants to Precious Metals

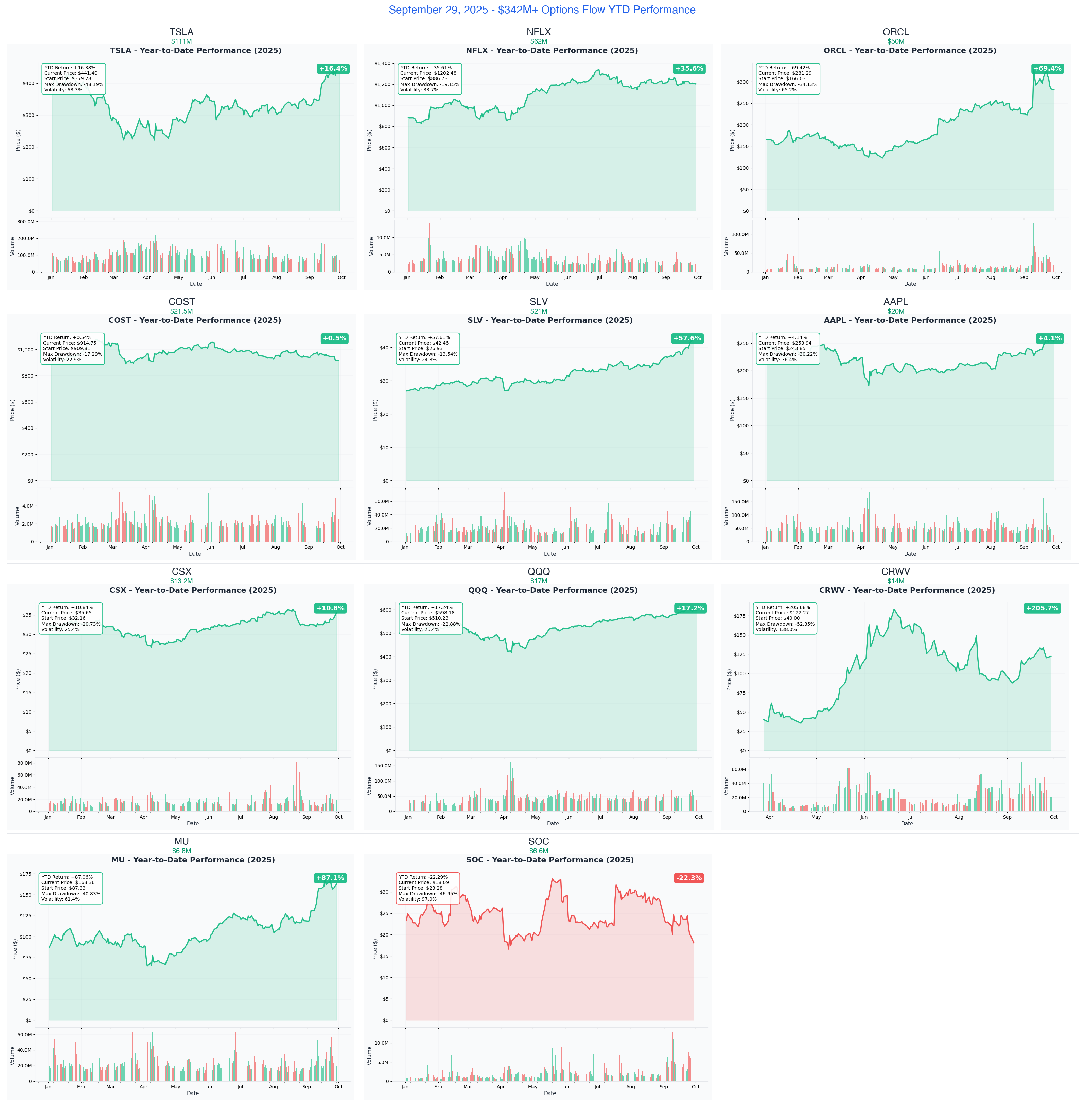

$342 MILLION in institutional option flow across 11 tickers today - led by Tesla's massive $111M call positioning ahead of Q3 deliveries, Netflix's $62M deep ITM streaming dominance play, and Oracle's $50M AI infrastructure bet.

📅 September 28, 2025 | 🔥 MASSIVE FLOW DAY: Tesla's $111M Call Army + Netflix $62M Streaming Bet + Oracle $50M AI Infrastructure Play | ⚠️ ALL 11 Trades Hit Perfect 10/10 Unusual Scores

🎯 The $342M Institutional Money Wave: Every Position Decoded

💰 UNPRECEDENTED ACTIVITY ALERT: We tracked $342 MILLION in institutional option flow across 11 tickers today - led by Tesla's massive $111M call positioning ahead of Q3 deliveries, Netflix's $62M deep ITM streaming dominance play, and Oracle's $50M AI infrastructure bet. This represents smart money making decisive moves ahead of critical October catalysts: earnings season (AAPL, NFLX, CSX), Fed rate cut impacts (SLV), and Tesla's robotaxi milestone. The mix of aggressive bullish positioning ($254M in calls) versus defensive hedging ($88M in puts/spreads) tells a story of selective optimism tempered with risk management.

Total Flow Tracked: $342,000,000+ 💰 Largest Single Bet: TSLA $111M calls (robotaxi + Q3 deliveries) Most Explosive YTD: CRWV +205.7% (AI cloud infrastructure) Biggest Memory Play: MU $6.8M puts protecting +87.1% gains Silver Surge: SLV $21M calls on 57.6% YTD rally + Fed cuts

🚀 THE COMPLETE WHALE LINEUP: All 11 Monster Trades

1. ⚡ TSLA - The $111M Robotaxi Revolution Bet

DISCOVER WHY TESLA GETS $111M IN CALLS BEFORE Q3 DELIVERIES →

- Flow: $111M mixed calls (Jan 2026 $300/$400 + Dec 2027 $220/$450 puts for hedge)

- Unusual Score: 10/10 VOLCANIC (12,872x larger than average Tesla trade)

- YTD Performance: +16.4% (rebounding from 2024 challenges into robotaxi era)

- The Big Question: Will October 2nd Q3 delivery numbers and robotaxi operational milestones trigger the next Tesla supercycle?

- Catalyst: Q3 deliveries Oct 2 + Robotaxi operational launch + FSD Version 14 rollout + Investor Day expectations

2. 🎬 NFLX - The $62M Streaming Dominance Lock

ANALYZE WHY INSTITUTIONS DROP $62M ON NETFLIX DEEP ITM CALLS →

- Flow: $62M deep ITM January 2026 calls ($600/$550/$650 strikes with stock at $720)

- Unusual Score: 10/10 VOLCANIC (1,869x larger than average NFLX trade)

- YTD Performance: +35.6% (streaming wars winner pulling away from competition)

- The Big Question: Can Netflix maintain momentum through Q3 earnings with 94M ad-tier users and NFL Christmas games driving subscriber growth?

- Catalyst: Q3 earnings October 21 + Ad-tier explosive growth (94M users) + NFL Christmas games debut + password sharing crackdown revenue

3. 🤖 ORCL - The $50M AI Infrastructure Empire

SEE WHY ORACLE GETS $50M CALL BET AMID AI DEAL FRENZY →

- Flow: $50M December 2025 $280 calls (deep ITM with stock at $353!)

- Unusual Score: 10/10 VOLCANIC (institutions betting on AI infrastructure boom)

- YTD Performance: +69.4% (database giant transforming into AI cloud powerhouse)

- The Big Question: Will Meta's $20B AI infrastructure deal and OpenAI's $300B contract push Oracle past $400?

- Catalyst: Meta $20B AI deal talks + OpenAI $300B infrastructure contract + Q2 fiscal 2026 earnings December 8 + multicloud expansion

4. 🛍 COST - The $21.5M Defensive Wall

DECODE THE MASSIVE COSTCO PUT PROTECTION BEFORE EARNINGS →

- Flow: $21.5M protective puts across October strikes ($1,020/$1,100/$990/$1,030)

- Unusual Score: 10/10 VOLCANIC (8,134x larger - institutions hedging rich valuation)

- YTD Performance: +0.54% (premium valuation creating cautious positioning)

- The Big Question: Will Q1 2025 earnings show membership fee increase impact or reveal margin compression from 50x P/E valuation?

- Catalyst: Q1 FY2025 earnings upcoming + Membership fee increase impact analysis + 50x P/E valuation concerns + consumer spending data

5. 🥈 SLV - The $21M Silver Supercycle Play

EXPLORE WHY INSTITUTIONS LOAD $21M IN SILVER CALLS →

- Flow: $21M deep ITM October 2025 $32 calls (stock at $35.68, 14-year highs!)

- Unusual Score: 10/10 VOLCANIC (675x larger than average SLV trade)

- YTD Performance: +57.6% (precious metals breaking out on Fed rate cuts + supply deficit)

- The Big Question: Can silver's industrial demand plus monetary hedge status drive it past $40 as Fed cuts accelerate?

- Catalyst: Fed rate cuts driving precious metals + Silver hitting 14-year highs + Global supply deficit report Oct 31 + Industrial AI/solar demand

6. 🍎 AAPL - The $20M iPhone Intelligence Bet

UNDERSTAND APPLE'S $20M DEEP ITM CALL CONFIDENCE SIGNAL →

- Flow: $20M November 2025 $220 calls (deep ITM with stock at $238)

- Unusual Score: 10/10 VOLCANIC (smart money positioning for iPhone cycle)

- YTD Performance: +4.14% (modest gains mask iPhone 17 + AI transformation potential)

- The Big Question: Will Q4 earnings October 30th reveal iPhone 17 supercycle driven by Apple Intelligence features?

- Catalyst: Q4 earnings October 30 + iPhone 17 holiday sales cycle + Apple Intelligence rollout + Services revenue acceleration

7. 🚂 CSX - The $13.2M Railroad Infrastructure Boom

DISCOVER WHY RAILROADS GET $13.2M INSTITUTIONAL BACKING →

- Flow: $13.2M February 2026 calls ($35/$40 strikes, three massive blocks)

- Unusual Score: 10/10 VOLCANIC (7,040x larger on the $10M trade alone!)

- YTD Performance: +10.84% (rail infrastructure benefiting from reshoring + efficiency)

- The Big Question: Will Q3 earnings October 16th show the profit impact of Howard Street Tunnel completion and operational efficiency gains?

- Catalyst: Q3 earnings October 16 + Howard Street Tunnel project completed ahead of schedule + Reshoring manufacturing boom + Intermodal efficiency

8. 📊 QQQ - The $17M Tech Hedge Shield

ANALYZE THE MASSIVE NASDAQ PUT SPREAD PROTECTION PLAY →

- Flow: $17M put spread (March 2026 $555 puts + Feb 2026 $525 puts)

- Unusual Score: 10/10 VOLCANIC (institutions hedging tech concentration risk)

- YTD Performance: +17.24% (strong gains prompting smart money protection)

- The Big Question: Are institutions hedging ahead of Q3 mega-cap tech earnings October 29-30, fearing valuation compression?

- Catalyst: Q3 mega-cap earnings season Oct 29-30 + Fed policy meetings + Tech valuation consolidation risk + Magnificent 7 concentration concerns

9. ☁️ CRWV - The $14M AI Cloud Transformation

SEE WHY CROWDVIEW GETS $14M DEEP ITM CALL BET →

- Flow: $14M December 2025 $105 calls (deep ITM with stock at $123, YTD monster!)

- Unusual Score: 10/10 VOLCANIC (979x larger - institutions locking in AI cloud gains)

- YTD Performance: +205.7% (AI infrastructure buildout driving explosive growth)

- The Big Question: Can CRWV sustain triple-digit growth through Q3 earnings November 12th with $30.1B revenue backlog?

- Catalyst: Q3 earnings November 12 + OpenAI partnership ($16B total deal value) + $30.1B revenue backlog + AI infrastructure expansion

10. 💾 MU - The $6.8M Memory Profit Protection

DECODE WHY MICRON GETS $6.8M PUT HEDGE AFTER 87% RALLY →

- Flow: $6.8M March 2026 $150 puts (protecting massive YTD gains)

- Unusual Score: 10/10 VOLCANIC (smart money locking in memory chip profits)

- YTD Performance: +87.1% (HBM3E memory surge driving historic gains)

- The Big Question: Will Q1 fiscal 2026 earnings (late January) show HBM3E demand sustaining or memory pricing peaking?

- Catalyst: Q1 FY2026 earnings late January + HBM3E production sold out through 2026 + Memory pricing surge + AI server demand

11. 💎 SOC - The $6.6M Pipeline Restart Play

EXPLORE THE SOUTH AMERICAN ENERGY TURNAROUND BET →

- Flow: $6.61M call spreads (October + January strikes betting on pipeline restart)

- Unusual Score: 10/10 VOLCANIC (institutions betting on operational turnaround)

- YTD Performance: -22.3% (pipeline shutdown creating contrarian opportunity)

- The Big Question: Will Las Flores Pipeline restart (imminent September/October) unlock 350K barrels in storage and reverse stock decline?

- Catalyst: Las Flores Pipeline restart imminent (Sep/Oct) + 350K barrels in storage awaiting transport + Q3 earnings + Production recovery timeline

⏰ URGENT: Critical October Catalysts & Expiries

🚨 THIS WEEK (October 2nd)

- TSLA Q3 Deliveries - $111M positioned for robotaxi milestone + delivery numbers ( not the option expiration but the catalyst)

⚡ MID-OCTOBER EARNINGS BLITZ (Oct 16-21)

- CSX Oct 16 - Railroad infrastructure profits test ($13.2M call bet)

- NFLX Oct 21 - Streaming dominance with $62M positioning

🧠 LATE OCTOBER BIG TECH (Oct 29-30)

- AAPL Oct 30 - iPhone 17 cycle catalyst ($20M deep ITM)

- QQQ Oct 29-30 - Mega-cap tech earnings ($17M hedge positioned)

📈 NOVEMBER-DECEMBER PIPELINE

- CRWV Nov 12 - AI cloud backlog reveal ($14M positioned for +205% YTD continuation)

- ORCL Dec 8 - AI infrastructure deals monetization ($50M call bet)

- MU Late Jan - HBM3E memory pricing cycle ($6.8M put hedge)

📊 Smart Money Themes: Institutional Playbook Decoded

💰 Tech Mega-Cap Rotation (52% of Flow - $178M)

Selective Quality Bets + Hedging Strategy:

- → TSLA: $111M betting on robotaxi transformation

- → NFLX: $62M streaming dominance lock at deep ITM

- → QQQ: $17M hedge protecting tech concentration

🤖 AI Infrastructure Buildout ($114M Positioning)

Cloud, Database, and Chipmaker Convergence:

- → ORCL: $50M on AI infrastructure empire (Meta $20B + OpenAI $300B deals)

- → CRWV: $14M on +205% YTD AI cloud rocket

- → AAPL: $20M iPhone Intelligence transformation bet

- → MU: $6.8M protecting HBM3E memory gains (+87% YTD)

🛡️ Defensive Positioning After Big Gains ($50M Protection)

Smart Money Locking In Profits:

- → COST: $21.5M put fortress against 50x P/E valuation

- → QQQ: $17M tech hedge ahead of earnings

- → MU: $6.8M memory profit protection after 87% rally

🚀 Contrarian Value & Recovery Plays ($41M Bold Bets)

Finding Opportunity in Overlooked Sectors:

- → SLV: $21M silver supercycle bet (Fed cuts + 14-year highs)

- → CSX: $13.2M railroad infrastructure boom

- → SOC: $6.6M pipeline restart turnaround

🎯 Your Action Plan: Trade Like The Institutions

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - High conviction binary events

- TSLA Oct 2 calls - Q3 delivery numbers + robotaxi announcement (3-day catalyst! NOT option expiration)

- SOC October calls - Pipeline restart imminent (contrarian turnaround)

- SLV short-term calls - Fed rate cuts + industrial demand surge

⚖️ Swing Trades (3-5% Portfolio)

Multi-week catalyst-driven opportunities

- NFLX October call spreads - Follow $62M whale through Oct 21 earnings (ad-tier growth + NFL content)

- ORCL November-December calls - AI infrastructure deals materializing into Dec 8 earnings

- CSX February calls - Railroad efficiency + reshoring momentum (Oct 16 earnings first test)

- CRWV November calls - AI cloud backlog reveal Nov 12 (sustaining +205% YTD?)

💰 Premium Collection (Income Focus)

Follow institutional hedgers to collect rich premium

- COST put selling - Sell out-of-money puts below $990 (institutions paid big premium for protection)

- QQQ put credit spreads - Sell below institutional $525 floor (collect premium on tech dips)

- MU put selling - Sell $140-145 puts (institutions hedging at $150)

🛡️ Conservative LEAPs & Shares (Long-term)

Patient capital following deep ITM institutional positioning

- ORCL shares or LEAPS - AI infrastructure secular growth (Meta + OpenAI deals)

- NFLX shares below $700 - Streaming leader with $62M deep ITM validation

- SLV shares or 2026 LEAPS - Fed rate cuts + industrial demand (long-term precious metals play)

- CRWV protective collars - Lock in some of +205% YTD while staying exposed to AI cloud growth

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (October 2-4)

- TSLA Q3 deliveries + robotaxi operational announcement

📆 Monthly (October Expiries)

- CSX October 16 Q3 earnings (railroad efficiency test)

- NFLX October 21 Q3 earnings (ad-tier + NFL content reveal)

- AAPL October 30 Q4 earnings (iPhone 17 intelligence cycle)

- QQQ October 29-30 mega-cap tech earnings (hedge trigger)

- COST October puts expiring (defensive positioning)

- SLV October 31 supply deficit report

🗓️ Quarterly (November-December)

- CRWV November 12 Q3 earnings (AI cloud backlog)

- ORCL December 8 Q2 FY2026 earnings (AI deals monetization)

🚀 LEAPS (2026-2027 Expiries)

- TSLA January 2026 calls + December 2027 hedge positions

- NFLX January 2026 deep ITM calls (streaming dominance)

- CSX February 2026 calls (railroad infrastructure cycle)

- MU March 2026 puts (memory profit protection)

- QQQ March 2026 + February 2026 put spreads (tech hedge)

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position

- 3-day binary: TSLA October calls (Q3 deliveries Oct 2 + robotaxi)

- Imminent catalyst: SOC October calls (pipeline restart any day)

- Momentum play: SLV short-term calls (Fed cuts + silver at 14-year highs)

⚠️ Risk Control: Set stop losses at 30-40% of premium paid. These are binary events - prepare for 100% loss or 200%+ gains.

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary October play: NFLX October spreads ($700/$720 call spreads into Oct 21 earnings)

- Quality AI infrastructure: ORCL November-December calls ($340/$360 call spreads)

- Multi-week setup: CSX February calls (Oct 16 earnings catalyst, hold through Feb)

- AI cloud momentum: CRWV November calls ($120/$130 spreads into Nov 12 earnings)

⚠️ Risk Control: Take 50% profits at 80-100% gains. Trail stop losses on remaining position. Watch time decay on monthly options.

💰 Premium Collector (Income Focus)

Strategy: Sell puts/spreads where institutions are hedging

- Rich premium: COST put selling ($980-$1,000 strike range - institutions paid huge premium)

- Tech hedge income: QQQ put credit spreads (sell $520/$510 put spreads below institutional $525 floor)

- Memory profit protection: MU put selling (sell $140-145 puts, institutions hedging at $150)

- Silver volatility: SLV call selling (sell $38-$40 calls against shares for income)

⚠️ Risk Control: Only sell puts on stocks you'd own at strike price. Size positions so assignment doesn't exceed 5% portfolio. Take profits at 50-70% max gain.

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education before risking capital

- Paper trade first: All strategies above with virtual money for 2-3 weeks minimum

- ETF exposure: Buy QQQ shares (diversified tech) or SLV (precious metals) without option complexity

- Quality stock positions: ORCL shares or NFLX shares (follow institutional deep ITM conviction without option risk)

- Covered call learning: If you own AAPL or NFLX shares, consider selling 1-month covered calls above current price (learn premium collection safely)

Education priorities:

- Study TSLA's call/put hedge combination - see how institutions protect $111M bets

- Learn from COST's protective put strategy - how to hedge rich valuations

- Analyze NFLX deep ITM positioning - why institutions pay for safety

⚠️ Risk Management for All Investor Types

Essential Rules - NO EXCEPTIONS:

- Position Sizing Discipline

- YOLO: Maximum 1-2% per position

- Swing: Maximum 3-5% per position

- Premium: Maximum 5-7% per position

- Entry Level: Maximum 1-3% per position

- NEVER risk more than you can afford to lose

- Stop Loss Strategy

- Set stops at 20-30% loss for swing trades

- Accept 100% loss possibility on YOLO plays (size accordingly!)

- Exit premium collection positions if underlying drops 8-10%

- Have mental stops even on LEAPS (don't "hope and hold")

- Profit Taking is NOT Optional

- Take 50% profits at 80-100% gains (let rest run with trailing stop)

- Scale out of positions - don't try to hit perfect tops

- Remember: Institutions took $342M in positions - they'll take profits too

- Time Decay Awareness

- October expiries losing value rapidly (15-21 days away!)

- Don't hold monthly options into final week unless intentional

- LEAPS (2026-2027) have time for thesis to play out

- Catalyst Correlation

- Every position should have a clear, dated catalyst

- Exit if catalyst passes without movement

- Don't hold through earnings unless that's the strategy

Specific Warnings for September 28th Flow:

⚠️ TSLA October 2 Risk: Q3 deliveries in 3 DAYS. If you miss entry today/tomorrow, don't chase. Binary event = total win or total loss.

⚠️ Tech Earnings Concentration: AAPL (Oct 30) + QQQ mega-caps (Oct 29-30) + NFLX (Oct 21) all report same week. One miss could trigger cascading losses. $17M QQQ hedge suggests institutions expect volatility.

⚠️ AI Bubble Valuation: CRWV at +205% YTD, ORCL at +69% YTD, MU at +87% YTD. Smart money is hedging (MU $6.8M puts, QQQ $17M hedge). Don't assume these rallies continue indefinitely.

⚠️ Commodity Whipsaw: SLV at 14-year highs on Fed cut hopes. If economic data stays strong and Fed pauses cuts, precious metals could reverse violently. The $21M bet is a trade, not a marriage.

⚠️ Deep ITM Complexity: NFLX $62M, ORCL $50M, CRWV $14M, AAPL $20M, SLV $21M all using deep ITM strategies. These positions have complex Greeks and likely represent delta exposure with downside protection. Don't blindly copy - understand the full strategy.

What Could Destroy Each Trade:

If You're Following the Bulls:

- TSLA: Q3 deliveries disappoint, robotaxi delayed again, margins compress

- NFLX: Ad-tier growth slows, subscriber additions miss, competition intensifies

- ORCL: AI deals fail to materialize, cloud growth disappoints, database legacy drags

- CRWV: Growth decelerates from +205%, AI spending slowdown, margins compress

- SLV: Fed pauses rate cuts, dollar strengthens, industrial demand weakens

If You're Following the Bears/Hedgers:

- COST: Earnings surprise positive, valuation concerns prove premature, membership fees work

- QQQ: Tech earnings blow out expectations, AI revolution accelerates beyond expectations

- MU: Memory pricing continues surging, HBM3E demand exceeds supply for years

💣 The Week Ahead: Critical Dates & Decisions

📊 This Week (September 29 - October 4):

- October 2: TSLA Q3 deliveries + robotaxi operational announcement ($111M positioned)

- October 3-4: Watch for SOC pipeline restart announcement ($6.6M bet timing)

- Market digests September employment data and Fed commentary

🗓️ Key October Milestones:

- October 16: CSX Q3 earnings - Railroad efficiency test ($13.2M call positioning)

- October 21: NFLX Q3 earnings - Ad-tier + NFL content reveal ($62M deep ITM positioned)

- October 29-30: QQQ mega-cap tech earnings - AAPL, MSFT, GOOGL, META, AMZN ($17M hedge + $20M AAPL call)

- October 31: Silver Institute global supply deficit report (SLV $21M call catalyst)

📈 November-December Setup:

- November 12: CRWV Q3 earnings - AI cloud backlog sustainability test (+205% YTD)

- December 8: ORCL Q2 FY2026 earnings - AI infrastructure deals monetization ($50M positioned)

- Late January 2026: MU Q1 FY2026 - Memory pricing cycle continuation/peak ($6.8M put hedge)

🎯 The Bottom Line: Follow The $342M AI-to-Industrial Rotation

This is institutional money making BIG bets ahead of October's catalyst-packed calendar. $342 million split between aggressive tech/AI positioning ($254M in calls: TSLA, NFLX, ORCL, CRWV, AAPL, CSX, SLV) and defensive hedging ($88M in puts/spreads: COST, QQQ, MU). The message is clear: selectively bullish on AI infrastructure winners (Oracle, CRWV), mega-cap quality (Netflix, Apple), and contrarian plays (railroads, silver), while hedging rich valuations (Costco) and tech concentration (QQQ, Micron profits).

The biggest questions demanding answers in October:

- Will TSLA's October 2nd deliveries + robotaxi launch justify $111M call bet?

- Can NFLX's $62M deep ITM positioning survive ad-tier growth scrutiny Oct 21?

- Will Oracle's $50M bet pay off with Meta $20B + OpenAI $300B AI deals?

- Does the $17M QQQ hedge signal smart money expects Oct 29-30 tech earnings disappointment?

- Can CRWV sustain +205% YTD momentum through Nov 12 earnings with $30.1B backlog?

Your move: This $342M institutional conviction across 11 tickers with PERFECT 10/10 unusual scores demands attention. The October catalyst calendar is packed with binary events. Position accordingly - but remember that patience, proper sizing, and risk control separate successful traders from gamblers. Don't blindly follow - understand the full strategy, know your catalysts, and have clear exit plans.

🔗 Get Complete Analysis on Every Trade

💰 Tech Mega-Cap Rotation ($178M):

- TSLA $111M Robotaxi Revolution - Q3 Deliveries Oct 2

- NFLX $62M Streaming Dominance - Deep ITM Oct 21 Earnings Play

- QQQ $17M Tech Hedge - Mega-Cap Earnings Protection

🤖 AI Infrastructure Empire ($114M):

- ORCL $50M AI Infrastructure - Meta + OpenAI Deals

- CRWV $14M AI Cloud Rocket - +205% YTD Momentum

- AAPL $20M iPhone Intelligence - Oct 30 Earnings Bet

- MU $6.8M Memory Protection - HBM3E Profit Hedge

🛡️ Defensive Positioning ($50M):

- COST $21.5M Put Fortress - 50x P/E Valuation Hedge

- QQQ $17M Tech Hedge - Concentration Risk Protection

- MU $6.8M Profit Lock - Memory Chip Gain Protection

🚀 Contrarian Value & Recovery ($41M):

- SLV $21M Silver Supercycle - Fed Cuts + 14-Year Highs

- CSX $13.2M Railroad Boom - Infrastructure Reshoring Play

- SOC $6.6M Pipeline Restart - Operational Turnaround Bet

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management, understand your catalysts, maintain position sizing discipline, and never risk more than you can afford to lose. The $342M in flow tracked today includes both bullish and defensive positioning - institutions are hedging their bets, and so should you.

Ainvest Option Labs - Institutional Option Flow Intelligence for Retail Traders