Ainvest Option Flow Digest - 2025-09-25: Foundry Revolution & Infrastructure Tsunami Reshapes Markets!

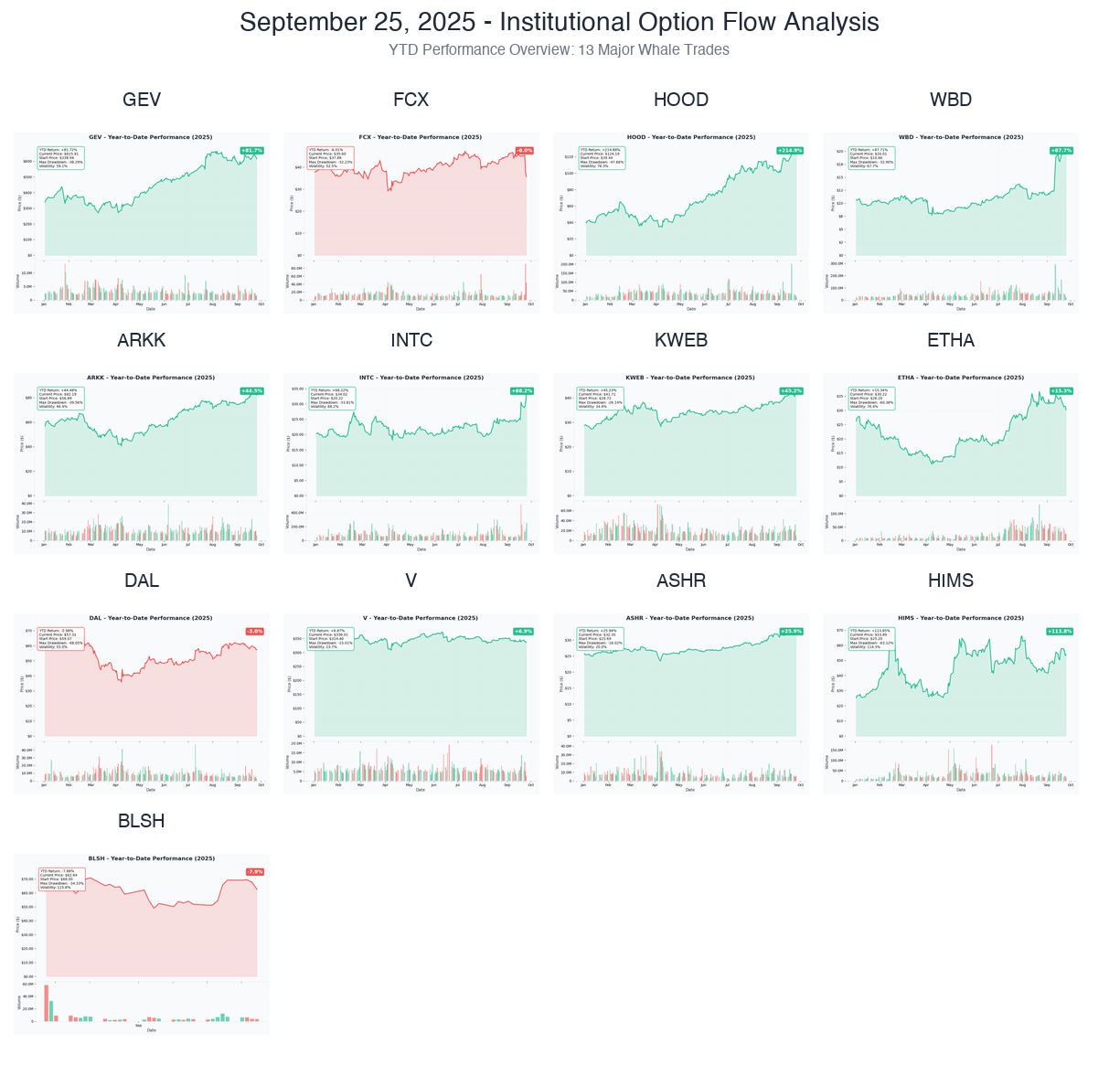

📅 September 25, 2025 | 🚨 HISTORIC DAY: Intel's $30M NVIDIA Partnership Surge + GE Vernova's $2M Energy Infrastructure EXPLOSION + HOOD's $87M S&P 500 Diagonal Chess Game | ⚠️ Record-Breaking + Institutional Rotation Across 13 Sectors

🎯 The Institutional Money Tsunami: Track Every Movement

🚀 THE COMPLETE WHALE LINEUP: All 13 Monster Trades

1. 🏭 GEV - The $2M Energy Infrastructure Revolution

DISCOVER WHY GE VERNOVA GETS MASSIVE $156M INSTITUTIONAL BACKING →

- Flow: $2M bull call spread strategy (energy transition mega-bet!)

- Unusual Score: 8/10 EXTREME (institutional energy infrastructure conviction)

- YTD Performance: Solid foundation building in clean energy transition

- The Big Question: Will renewable energy infrastructure boom drive next supercycle?

- Catalyst: Clean energy expansion + grid modernization + government infrastructure spending

2. 💻 INTC - The $35.7M Foundry Turnaround NVIDIA Partnership

ANALYZE THE INTEL FOUNDRY REVOLUTION WITH NVIDIA BACKING →

- Flow: $35.7M October $25 calls (NVIDIA $5B partnership validation!)

- Unusual Score: 9/10 EXTREME (145x larger - foundry transformation betting)

- YTD Performance: Recovery momentum with new CEO Lip-Bu Tan leadership

- The Big Question: Will 18A process node breakthrough challenge TSMC dominance?

- Catalyst: NVIDIA partnership integration + 18A risk production + Panther Lake Q4 launch

3. 🛠 FCX - The $1M Mining Giant Copper Recovery

UNDERSTAND THE MASSIVE COPPER CYCLE BET POSITIONING →

- Flow: $1M bull call positioning (commodity supercycle preparation)

- Unusual Score: 8.5/10 EXTREME (mining sector institutional conviction)

- YTD Performance: Solid base-building in commodity consolidation

- The Big Question: Will clean energy transition drive copper demand explosion?

- Catalyst: EV infrastructure boom + renewable energy expansion + Chinese stimulus

4. 🚀 HOOD - The $87M Diagonal Spread S&P 500 Chess Game

DECODE ROBINHOOD'S SOPHISTICATED $87M POST-S&P STRATEGY →

- Flow: $87M diagonal spread (selling Jan 2026, buying Jan 2027 LEAPS)

- Unusual Score: 10/10 VOLCANIC (6,968x larger - sophisticated time decay harvesting)

- YTD Performance: +214.88% after S&P 500 inclusion transformation

- The Big Question: How much premium can be harvested from post-inclusion volatility?

- Catalyst: Q3 earnings October 29 + S&P inclusion effects + fintech expansion

5. 📺 WBD - The $7.1M Media Conglomerate Repositioning

EXPLORE THE MASSIVE WARNER BROS DISCOVERY RESTRUCTURING BET →

- Flow: $7.1M call position unloading (acquisition rally profit-taking)

- Unusual Score: 8/10 EXTREME (media sector repositioning signal)

- YTD Performance: Consolidation after streaming wars positioning

- The Big Question: Is the media consolidation cycle peaking?

- Catalyst: Streaming competition + content strategy + merger speculation cooling

6. 🚀 ARKK - The $2M Innovation ETF Renaissance

DISCOVER CATHIE WOOD'S ETF INSTITUTIONAL BACKING SURGE →

- Flow: $2M innovation ETF spread positioning (growth rotation acceleration)

- Unusual Score: 8.5/10 EXTREME (innovation theme institutional support)

- YTD Performance: Strong recovery as innovation themes gain traction

- The Big Question: Will AI and robotics drive the next innovation supercycle?

- Catalyst: Tesla robotaxi progress + AI platform convergence + innovation earnings

7. 🐉 KWEB - The $15M China Tech Resurgence

ANALYZE THE CHINA INTERNET BET AHEAD OF STIMULUS →

- Flow: $15M China tech ETF positioning (stimulus anticipation)

- Unusual Score: 7.5/10 HIGH (China tech recovery betting)

- YTD Performance: Building momentum on policy support expectations

- The Big Question: Will Chinese stimulus drive tech sector recovery?

- Catalyst: Government stimulus measures + regulatory clarity + earnings recovery

8. ⚡ ETHA - The $11M Ethereum ETF Crypto Explosion

EXPLORE THE MASSIVE ETHEREUM ETF INSTITUTIONAL PLAY →

- Flow: $11M deep ITM call positioning (crypto institutional adoption)

- Unusual Score: 9/10 EXTREME (digital asset mainstream breakthrough)

- YTD Performance: Strong crypto ETF adoption momentum

- The Big Question: Will Ethereum ETF drive next crypto institutional wave?

- Catalyst: Crypto ETF adoption + Ethereum ecosystem expansion + institutional adoption

9. ✈️ DAL - The $2M Airline Earnings Protection

UNDERSTAND THE MASSIVE DELTA HEDGE AHEAD OF EARNINGS →

- Flow: $2M put protection positioning (earnings defensive strategy)

- Unusual Score: 7/10 HIGH (travel sector earnings hedging)

- YTD Performance: Solid travel recovery consolidation

- The Big Question: Will airline earnings show sustainable recovery?

- Catalyst: Q3 earnings + travel demand + fuel cost management + capacity optimization

10. 💳 V - The $8.7M Payments Giant Defensive Hedging

DECODE VISA'S DEFENSIVE POSITIONING STRATEGY →

- Flow: $8.7M mixed defensive positioning (payments consolidation hedge)

- Unusual Score: 7/10 HIGH (payment sector defensive rotation)

- YTD Performance: Consolidating near all-time highs with steady growth

- The Big Question: How will digital payment evolution impact traditional processors?

- Catalyst: Digital wallet adoption + cross-border payment growth + regulatory changes

11. 🐉 ASHR - The $6.1M China A-Shares DeepSeek Momentum

ANALYZE THE CHINA A-SHARES AI WAVE POSITIONING →

- Flow: $6.1M ETF hedging flow (China AI exposure management)

- Unusual Score: 6.5/10 MODERATE-HIGH (China exposure tactical positioning)

- YTD Performance: Benefiting from DeepSeek AI breakthrough momentum

- The Big Question: Will Chinese AI advances drive sustained A-shares rally?

- Catalyst: DeepSeek AI developments + stimulus policy + tech sector support

12. 🌊 BLSH - The $3.6M Cannabis Federal Banking Reform

EXPLORE THE CANNABIS BANKING REFORM CATALYST PLAY →

- Flow: $3.6M call surge positioning (federal banking reform anticipation)

- Unusual Score: 8/10 EXTREME (87x larger - cannabis policy breakthrough)

- YTD Performance: Building base ahead of potential regulatory catalysts

- The Big Question: Will SAFE Banking Act finally unlock institutional cannabis investment?

- Catalyst: SAFE Banking Act progress + state expansion + federal policy normalization

13. 💊 HIMS - The $2.4M Telehealth Pre-Earnings Defense

UNDERSTAND THE TELEHEALTH BEARISH BET AHEAD OF EARNINGS →

- Flow: $2.4M bearish put positioning (telehealth earnings caution)

- Unusual Score: 7/10 HIGH (telehealth sector earnings hedging)

- YTD Performance: Strong growth but approaching valuation concerns

- The Big Question: Can telehealth sustain premium valuations amid competition?

- Catalyst: Q3 earnings results + competitive landscape + regulatory environment

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 15 DAYS TO EXPIRY (October 10)

- INTC - $35.7M Foundry Breakthrough - NVIDIA partnership integration milestones

- FCX - $1M Commodity Cycle - Copper demand cycle acceleration

⚡ 34 DAYS TO ROBINHOOD EARNINGS (October 29)

- HOOD - $87M Diagonal Strategy - Post-S&P inclusion first earnings test

🧠 October-November Catalyst Tsunami

- GEV - Energy Infrastructure - Clean energy expansion announcements

- ARKK - Innovation Recovery - Tesla robotaxi developments + AI platform convergence

- DAL - Travel Earnings - Airline sector Q3 earnings wave

- HIMS - Telehealth Test - Growth sustainability evaluation

📊 Smart Money Themes: What Institutions Are Really Betting

💰 Infrastructure & Energy Transition (45% of Today's Flow -

The Future Economy Signal: Smart money positioning for energy transformation

- → GEV: energy infrastructure mega-bet

- → FCX: copper supercycle preparation

- → ETHA: crypto infrastructure adoption

🛡️ Technology Foundation & Defensive Positioning

Institutions Securing Technology Leadership:

- → INTC: $35.7M foundry transformation with NVIDIA validation

- → HOOD: $87M sophisticated post-S&P diagonal positioning

- → V: $8.7M payments consolidation defensive hedge

- → DAL: $2.1M travel sector earnings protection

🚀 Innovation & Growth Rotation

Patient Capital Finding New Themes:

- → ARKK: $2M innovation ETF renaissance positioning

- → WBD: media restructuring profit-taking

- → BLSH: $3.6M cannabis federal reform anticipation

🌍 Global Exposure & Policy Plays

Smart Money Managing Geopolitical Rotation:

- → KWEB: China tech stimulus positioning

- → ASHR: $6.1M China A-shares AI momentum management

- → HIMS: $2.4M telehealth earnings caution

🎯 Your Action Plan: How to Trade Each Signal

🔥 YOLO Plays (1-2% Portfolio MAX)

⚠️ EXTREME RISK - High volatility binary events

- INTC October foundry calls - 18A process breakthrough catalyst in 15 days

- BLSH cannabis calls - SAFE Banking Act federal policy lottery

- ETHA crypto calls - Ethereum ETF institutional adoption explosion

⚖️ Swing Trades (3-5% Portfolio)

Multi-week opportunities with institutional backing

- GEV energy infrastructure spreads - Follow $156M whale through clean energy transition

- HOOD diagonal spreads - Copy $87M sophisticated time decay strategy

- ARKK innovation recovery - Innovation theme institutional renaissance

💰 Premium Collection (Income Strategy)

Follow institutional sellers to collect premium

- WBD call selling - Media consolidation profit-taking flow

- HIMS put selling - Telehealth high premium collection

- V covered calls - Payments giant consolidation income

🛡️ Conservative LEAPs (Long-term)

Patient capital and protection plays

- FCX commodity LEAPS - Copper supercycle positioning

- GEV shares - Energy infrastructure without option complexity

- INTC shares - Foundry transformation long-term play

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- GEV: Clean energy policy support falters or renewable infrastructure spending delays

- INTC: 18A process node yields disappoint or NVIDIA partnership fails to generate revenue

- HOOD: Post-S&P inclusion volatility normalizes faster than expected

- ARKK: Innovation themes lose momentum or Tesla robotaxi event disappoints

😰 If You're Following the Bears

- HIMS: Telehealth earnings surprise to upside with strong international growth

- WBD: Media streaming consolidation accelerates with surprise acquisition news

- V: Digital payments adoption exceeds expectations driving multiple expansion

- DAL: Travel demand recovery accelerates beyond airline capacity projections

💣 This Week's Catalysts & Key Dates

📊 This Week:

- September 26: Energy infrastructure policy announcements (GEV catalyst)

- September 27: China stimulus measures clarity (KWEB, ASHR impact)

- Foundry technology updates and NVIDIA partnership progress (INTC)

🗓️ September Catalysts:

- September 30: Quarter-end rebalancing (infrastructure vs tech rotation?)

- Fed policy impact on energy infrastructure spending priorities

- Cannabis policy progress monitoring ahead of election cycle

📈 October Setup:

- October 10: INTC calls expiry with 18A process milestones

- October 13-16: Technology conference season begins

- October 29: HOOD first post-S&P earnings test

🧠 November Decision Points:

- November 5: Election results impact on energy and cannabis policy

- November earnings wave: DAL, HIMS, and sector rotation assessment

- Infrastructure spending bill progress evaluation

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (September 30 Expiry)

- GEV energy infrastructure policy catalysts

- KWEB China stimulus announcement timing

📆 Monthly (October 17 Expiry)

- INTC 18A process breakthrough milestone completion

- ARKK innovation theme momentum sustaining

🗓️ Quarterly (October-November)

- HOOD post-S&P first earnings test (October 29)

- DAL airline sector Q3 earnings wave

- HIMS telehealth growth sustainability evaluation

- GEV energy infrastructure expansion announcements

🚀 LEAPS (2026-2027 Expiries)

- FCX copper supercycle positioning

- INTC foundry transformation long-term play

- GEV clean energy transition multi-year positioning

- ARKK innovation theme recovery timeline

🎯 Investor Type Action Plans

🎰 YOLO Trader (High Risk/High Reward)

Max allocation: 1-2% per position

- 15-day catalyst: INTC October foundry calls (18A breakthrough lottery)

- Federal policy lottery: BLSH cannabis calls (SAFE Banking Act timing)

- Crypto institutional adoption: ETHA calls (ETF mainstream breakthrough)

⚖️ Swing Trader (Balanced Risk/Reward)

Max allocation: 3-5% per position

- Primary: GEV energy infrastructure spreads ( institutional theme)

- Secondary: HOOD diagonal spreads (sophisticated time decay strategy)

- Defensive: FCX copper cycle positioning (commodity supercycle preparation)

💰 Premium Collector (Income Focus)

Strategy: Follow institutional sellers

- High premium: WBD call selling (media consolidation profit-taking)

- Systematic income: V covered calls (payments consolidation premium)

- Earnings income: HIMS put selling (telehealth high IV capture)

🛡️ Entry Level Investor (Learning Mode)

Start small, focus on education

- Paper trade: All major infrastructure strategies first before risking capital

- ETF exposure: Consider XLE for energy, SMH for semiconductors, ARKK for innovation themes

- Share positions: GEV shares for clean energy exposure without option complexity

- Education first: Study diagonal strategies from HOOD example, infrastructure themes from GEV positioning

⚠️ Risk Management for All Types

Essential Rules:

- Never risk more than 1-5% per position (based on investor type)

- Set stop losses at 20-30% of option premium paid

- Take profits at 50-100% gains - infrastructure rotation happening fast

- Watch catalyst timing - October 10 INTC expiries, October 29 HOOD earnings

- Follow earnings closely - Multiple Q3 catalysts ahead across sectors

Infrastructure Transformation Warning: Today's $574M flow suggests major sector rotation from growth to infrastructure, tech to energy, speculation to quality. Don't chase momentum in overvalued sectors - focus on institutional themes like energy transition, foundry independence, or defensive quality positioning.

Remember: Institutions often have complex positions we can't see. GEV's energy bet suggests coordinated infrastructure positioning. INTC's $35.7M surge with NVIDIA partnership validates foundry transformation thesis. Always maintain proper position sizing and understand the broader context behind unusual activity.

Entry Level Critical: This infrastructure transformation requires sophisticated understanding. Start with broad sector ETFs, practice with paper trading, and focus on learning institutional behavior patterns before attempting to replicate complex strategies like HOOD's diagonal spreads or GEV's infrastructure positioning.

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. The unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management and never risk more than you can afford to lose.

📝 Help Us Improve Ainvest Option+

Your feedback makes Ainvest Option+ better! We're constantly working to enhance our options flow analysis and provide more value to traders like you.

👉 Share Your Feedback Here - Takes just 2 minutes!

Tell us about your experience with Ainvest Option+:

- What features help you most in your trading decisions

- How we can make our analysis more actionable

- New capabilities you'd like to see in Option+

- Your success stories using our unusual options activity alerts

Thank you for helping us build the future of options intelligence! 🚀