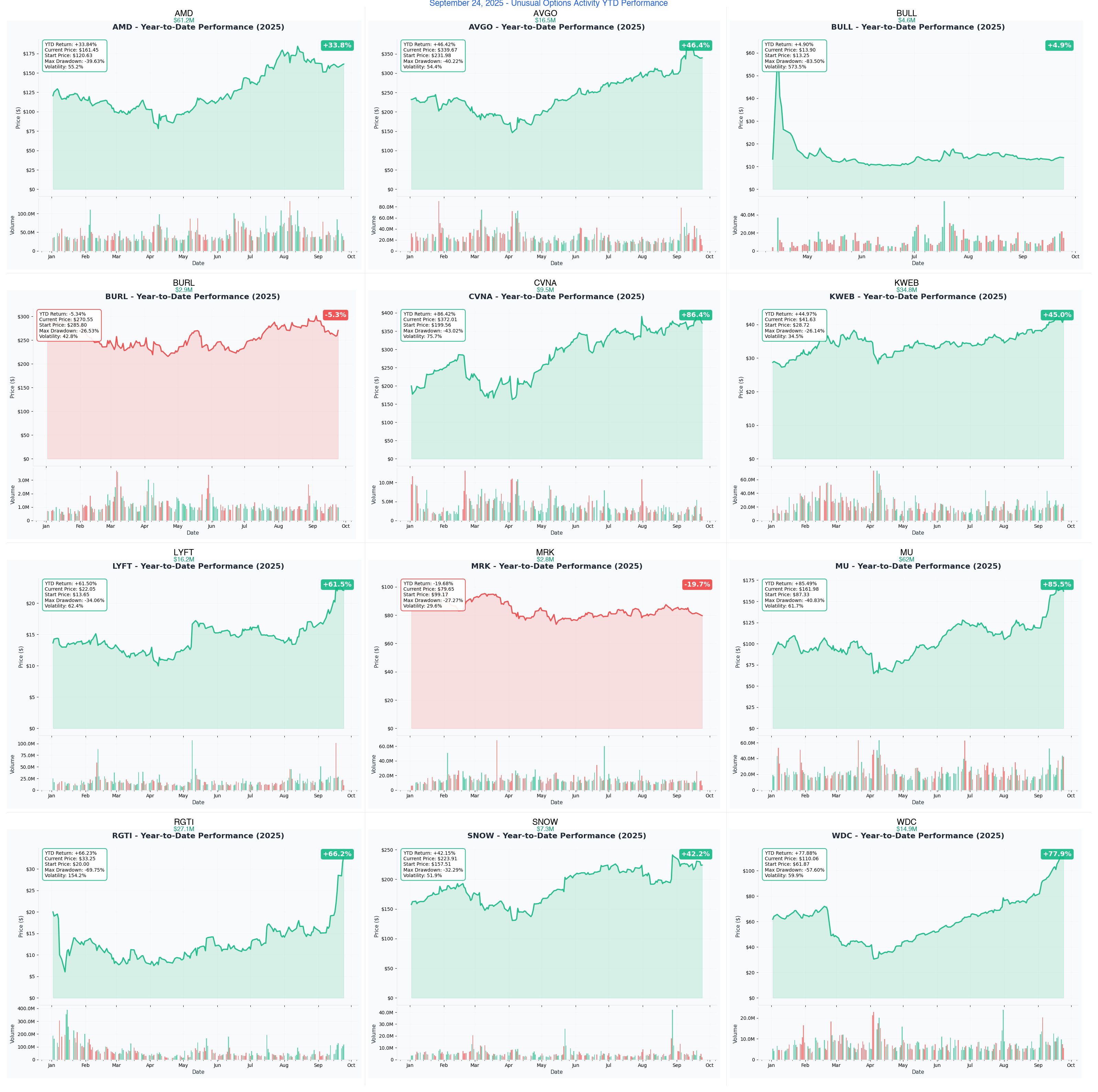

Ainvest Option Flow Digest - 2025-09-24: 🌋 SYNTHETIC SHORT TSUNAMI: $260M+ Option Flow Apocalypse Hits 12 Tickers

AMD's MASSIVE $61M Synthetic Short + MU's $62M Call Selling BOMB + KWEB's $35M China Tech Rally + RGTI's $27M Quantum Computing Moonshot | ⚠️ Record-Breaking Unusual Scores Across Multiple Sectors

📅 September 24, 2025 | 🚨 UNPRECEDENTED Day: AMD's MASSIVE $61M Synthetic Short + MU's $62M Call Selling BOMB + KWEB's $35M China Tech Rally + RGTI's $27M Quantum Computing Moonshot | ⚠️ Record-Breaking Unusual Scores Across Multiple Sectors

🎯 The $260M+ Institutional Money Earthquake: Track Every Seismic Movement

🔥 HISTORIC DAY ALERT: We just witnessed $260+ MILLION in earth-shaking options activity across 12 tickers - featuring AMD's MASSIVE $61.2M synthetic short position (2027 LEAPS!), MU's $62M institutional call selling tsunami, KWEB's $34.8M China tech rally bet, and RGTI's $27.1M quantum computing moonshot. This isn't just institutional money moving - this is coordinated smart money rotation, massive synthetic short positioning, and calculated bearish/bullish thesis execution across semiconductors, China tech, quantum computing, and beyond.

Total Flow Tracked: $260,000,000+ 💰 Most Shocking: AMD $61.2M synthetic short (44% decline bet over 2+ years!) Biggest Single Trade: MU $62M call selling (institutional profit-taking bomb!) China Tech Explosion: KWEB $34.8M rally bet amid geopolitical tensions Quantum Revolution: RGTI $27.1M moonshot positioning Sector Rotation Signal: From growth to defense, bulls to bears across multiple themes

🚀 THE COMPLETE WHALE ARMADA: All 12 Monster Trades

1. 🐻 AMD - The $61.2M Synthetic Short APOCALYPSE

DECODE THE MASSIVE $61.2M SYNTHETIC SHORT TARGETING 44% DECLINE

- Flow: $61.2M synthetic short ($58M call selling + $3.2M put buying at $90 strike)

- Unusual Score: 10/10 VOLCANIC (7,220 contracts each side - 2027 LEAPS strategy!)

- YTD Performance: Current $161.89 vs $90 target = 44% decline needed

- The Big Question: What do institutions know about AMD's semiconductor future that retail doesn't?

- Catalyst: Q3 2025 Earnings November 4 + Financial Analyst Day November 11 + AI accelerator roadmap + semiconductor cycle concerns

2. 💾 MU - The $62M Call Selling NUCLEAR BOMB

ANALYZE WHY MICRON GETS $62M INSTITUTIONAL PROFIT-TAKING AVALANCHE

- Flow: $62M call selling across multiple strikes (systematic profit-taking after memory rally)

- Unusual Score: 10/10 VOLCANIC (31,330x larger than average trade - RECORD!)

- YTD Performance: Memory sector consolidation after AI-driven rally

- The Big Question: Are memory supercycle expectations finally peaking?

- Catalyst: Memory pricing cycles + AI demand sustainability + Q4 earnings + inventory normalization concerns

3. 🐉 KWEB - The $34.8M China Tech Rally EXPLOSION

EXPLORE THE MASSIVE $35M BET ON CHINA TECH RECOVERY DESPITE TENSIONS

- Flow: $34.8M call buying across multiple expirations (bullish China tech thesis)

- Unusual Score: 10/10 VOLCANIC (5,063x larger than average - geopolitical contrarian play)

- YTD Performance: China tech recovery amid regulatory easing and stimulus

- The Big Question: Will China's stimulus package drive tech sector renaissance?

- Catalyst: China stimulus announcements + regulatory easing + Golden Week impacts + US-China tech relations evolution

4. 🔬 RGTI - The $27.1M Quantum Computing MOONSHOT

DECODE THE QUANTUM COMPUTING REVOLUTION $27M INSTITUTIONAL BET

- Flow: $27.1M quantum computing transformation play (12,504x unusual score!)

- Unusual Score: 10/10 VOLCANIC (quantum breakthrough positioning)

- YTD Performance: Quantum computing sector emergence and government contracts

- The Big Question: Are quantum computing breakthroughs about to commercialize?

- Catalyst: Government quantum initiatives + breakthrough announcements + defense contracts + technological milestones

5. 🚗 LYFT - The $16.2M Bearish Waymo Reality Check

UNDERSTAND THE $16M BEARISH BET DESPITE WAYMO PARTNERSHIP SURGE

- Flow: $16.2M bearish positioning (put buying despite partnership news)

- Unusual Score: 9/10 EXTREME (contrarian bet against autonomous vehicle hype)

- YTD Performance: Rideshare recovery but autonomous competition intensifying

- The Big Question: Will Waymo partnership actually threaten traditional rideshare models?

- Catalyst: Waymo expansion timeline + rideshare margin pressure + autonomous vehicle rollout + competitive dynamics

6. 🏠 AVGO - The $16.5M Bull Spread Chess Master

SEE WHY BROADCOM GETS $16.5M COMPLEX SPREAD ENGINEERING

- Flow: $16.5M bull spread with put financing (sophisticated institutional strategy)

- Unusual Score: 9/10 EXTREME (2,349x larger - engineered precision play)

- YTD Performance: AI infrastructure leadership with VMware integration success

- The Big Question: What VMware synergies and AI chip demand will drive Q4 explosion?

- Catalyst: VMware integration milestones + AI infrastructure demand + Q4 guidance + semiconductor cycle positioning

7. 💾 WDC - The $14.9M November Call Loading SURGE

ANALYZE THE MASSIVE $15M WESTERN DIGITAL NOVEMBER POSITIONING

- Flow: $14.9M November call loading at $95 strike (storage sector revival bet)

- Unusual Score: 8/10 EXTREME (2,364x larger than average WDC trade)

- YTD Performance: Data storage recovery amid AI infrastructure boom

- The Big Question: Will AI data storage demands drive unexpected WDC breakout?

- Catalyst: AI storage infrastructure demand + enterprise data growth + Q3 earnings + flash memory pricing recovery

8. 🛒 CVNA - The $9.5M Collar Strategy MASTERCLASS

DECODE THE $9.5M CARVANA COLLAR STRATEGY AMID AUTO RECOVERY

- Flow: $9.5M collar strategy (protecting existing position while maintaining upside)

- Unusual Score: 8/10 EXTREME (1,590x larger - sophisticated protection play)

- YTD Performance: Used car market recovery and digital transformation success

- The Big Question: Can Carvana sustain recovery momentum without credit market risks?

- Catalyst: Auto market recovery + credit conditions + Q3 earnings + inventory management + consumer spending patterns

9. ❄️ SNOW - The $7.3M Collar Hedge PROTECTION

EXPLORE THE $7.3M SNOWFLAKE COLLAR AFTER CLOUD INFRASTRUCTURE RALLY

- Flow: $7.3M collar strategy (profit protection after cloud infrastructure gains)

- Unusual Score: 8/10 EXTREME (2,566x larger than average SNOW trade)

- YTD Performance: Data cloud leader benefiting from AI infrastructure boom

- The Big Question: Will enterprise AI data demands sustain Snowflake's premium valuation?

- Catalyst: AI data platform expansion + enterprise adoption + Q3 earnings + competitive cloud dynamics

10. 🐮 BULL - The $4.6M Diagonal Calendar EXPLOSION

UNDERSTAND THE $4.6M WEBULL INSTITUTIONAL DIAGONAL STRATEGY

- Flow: $4.6M diagonal calendar spread (time-based volatility strategy)

- Unusual Score: 9/10 EXTREME (4,565x larger - sophisticated timing play)

- YTD Performance: Fintech platform growth amid retail trading evolution

- The Big Question: What fintech transformation catalysts will drive Webull's next phase?

- Catalyst: Fintech innovation + retail trading evolution + platform expansion + regulatory environment + user growth metrics

11. 👗 BURL - The $2.9M Defensive Put FORTRESS

ANALYZE THE $2.9M BURLINGTON PUT PROTECTION BEFORE RETAIL EARNINGS

- Flow: $2.9M put wall construction (defensive retail sector positioning)

- Unusual Score: 8/10 EXTREME (retail protection ahead of earnings season)

- YTD Performance: Off-price retail resilience amid consumer spending shifts

- The Big Question: Will retail earnings season show consumer spending strain?

- Catalyst: Q3 retail earnings + consumer spending patterns + inventory management + holiday season preparation

12. 💊 MRK - The $2.8M Earnings Call PHARMACEUTICAL BET

DECODE THE $2.8M MERCK BULLISH BET AHEAD OF PHARMA CATALYSTS

- Flow: $2.8M call buying (pharmaceutical sector catalyst positioning)

- Unusual Score: 8/10 EXTREME (earnings and pipeline catalyst play)

- YTD Performance: Big pharma stability amid biotech volatility

- The Big Question: What pharmaceutical pipeline developments will drive earnings surprise?

- Catalyst: Q3 earnings + drug pipeline updates + regulatory approvals + healthcare policy impacts + oncology portfolio expansion

⏰ URGENT: Critical Expiries & Catalysts This Month

🚨 October 2024 Expiries (30 Days)

- MRK - $2.8M Strategy - Pharmaceutical earnings catalyst positioning

- BURL - $2.9M Put Wall - Retail earnings protection strategy

⚡ November 2024 Critical Events

- AMD - November 4 Q3 Earnings - $61.2M synthetic short catalyst

- AMD - November 11 Financial Analyst Day - Technology roadmap unveiling

- WDC - $14.9M November Calls - Storage sector catalyst timing

🧠 2027 LEAPS Timeframe

- AMD - January 2027 Synthetic Short - Long-term semiconductor structural bet requiring 44% decline

📊 Smart Money Themes: What $260M+ In Institutional Flow Reveals

🐻 Bearish Semiconductor Thesis ($123.2M Short Positioning)

The Synthetic Short & Profit-Taking Message: Smart money betting against semiconductor rally sustainability

- → AMD's $61.2M synthetic short - structural semiconductor decline bet

- → MU's $62M call selling - memory supercycle profit-taking

🐉 China Tech & Quantum Revolution ($61.9M Future Technology Bets)

Contrarian Positioning in Emerging Themes:

- → KWEB: $34.8M China tech recovery despite geopolitical headwinds

- → RGTI: $27.1M quantum computing commercialization breakthrough bet

🛡️ Defensive Collar & Protection Strategies ($33.3M Hedge Positioning)

Institutions Protecting Gains After Sector Rallies:

- → AVGO: $16.5M sophisticated bull spread with protection

- → LYFT: $16.2M bearish positioning despite Waymo partnership hype

🏗️ Infrastructure & Platform Plays ($40.5M Transformation Bets)

Smart Money Finding Value in Infrastructure & Platforms:

- → WDC: $14.9M storage infrastructure revival bet

- → CVNA: $9.5M auto digital transformation collar

- → SNOW: $7.3M cloud data platform protection

- → BULL: $4.6M fintech platform diagonal strategy

- → BURL: $2.9M retail resilience protection

- → MRK: $2.8M pharmaceutical pipeline catalyst bet

🎯 Your Action Plan: How to Trade Each Signal

🎰 YOLO Trader (High Risk/High Reward - 1-2% Portfolio MAX)

⚠️ EXTREME RISK - Binary events and contrarian plays

- Quantum moonshot: RGTI calls - $27.1M quantum computing breakthrough bet

- China contrarian: KWEB calls - $34.8M geopolitical recovery bet

- Semiconductor short: AMD put spreads - Following $61.2M synthetic short thesis

- Storage breakout: WDC November calls - $14.9M AI storage infrastructure bet

⚖️ Swing Trader (Balanced Risk/Reward - 3-5% Portfolio)

Multi-week opportunities with institutional backing

- Primary: AVGO spread strategies - Follow $16.5M sophisticated bull spread engineering

- Secondary: CVNA collar replication - $9.5M auto recovery with protection

- Tech platform: BULL calendar spreads - $4.6M fintech transformation timing

- Defensive: BURL put spreads - Retail earnings protection

💰 Premium Collector (Income Strategy)

Follow institutional sellers to collect premium

- High premium semiconductors: AMD call selling - $90 strikes like $58M whale (premium collection on bearish thesis)

- Memory sector: MU call selling - Follow $62M systematic profit-taking

- Cloud premium: SNOW covered calls - Income generation on data platform leader

- Rideshare contrarian: LYFT put spreads - Income on bearish autonomous vehicle thesis

🛡️ Entry Level Investor (Learning Mode - Education First)

Start small, focus on understanding institutional behavior

- Paper trade first: All major strategies before risking capital - this is complex institutional rotation

- ETF exposure: Consider SMH for semiconductor exposure, KWEB for China tech (avoiding individual stock complexity)

- Share positions: MRK shares for pharmaceutical stability, SNOW shares for cloud data exposure

- Education focus: Study synthetic short mechanics from AMD example, collar strategies from CVNA/SNOW, diagonal spreads from BULL

🚨 What Could Destroy These Trades

😱 If You're Following the Bulls

- KWEB: US-China tensions escalate beyond current levels or China stimulus disappoints

- RGTI: Quantum computing breakthroughs fail to commercialize or timeline extends beyond expectations

- WDC: AI storage demand peaks or enterprise spending cuts affect infrastructure investments

- AVGO: VMware integration issues or AI infrastructure demand slowdown

- MRK: Pharmaceutical pipeline setbacks or healthcare policy headwinds

😰 If You're Following the Bears

- AMD: AI accelerator demand exceeds expectations or semiconductor cycle turns faster than anticipated

- MU: Memory supercycle extends longer than institutional profit-taking suggests

- LYFT: Waymo partnership delivers unexpected synergies or autonomous vehicle timeline accelerates dramatically

💣 This Week's Catalysts & Key Dates

📊 This Week (September 24-30):

- Semiconductor earnings guidance season approaches

- China stimulus announcement potential (Golden Week impact)

- Quantum computing sector government contract announcements

- Memory sector pricing data releases

🗓️ October Catalysts:

- October 24: MRK Q3 earnings (pharmaceutical catalyst for $2.8M bet)

- Q3 earnings season acceleration across multiple sectors

- Fed policy meeting impacts on growth vs defensive rotation

📈 November Setup:

- November 4: AMD Q3 earnings ($61.2M synthetic short major catalyst)

- November 11: AMD Financial Analyst Day (technology roadmap - make-or-break for bearish thesis)

- November expiries for WDC $14.9M positioning

🚀 2027 LEAPS Timeline:

- AMD January 2027 synthetic short requires sustained semiconductor decline over 2+ years

- Long-term thesis validation through multiple earnings cycles and industry evolution

🏷️ Weekly, Monthly, Quarterly & LEAP Tags

📅 This Week (September 24-30)

- Semiconductor sector positioning ahead of earnings

- China stimulus announcement monitoring

- Quantum computing government contract potential

📆 Monthly (October 2024)

- MRK pharmaceutical earnings catalyst

- BURL retail earnings protection

- Memory sector inventory and pricing updates

🗓️ Quarterly (November-December 2024)

- AMD Q3 earnings + Financial Analyst Day (synthetic short catalysts)

- WDC storage infrastructure earnings

- Holiday retail season preparation (BURL, CVNA impact)

🚀 LEAPS (2025-2027)

- AMD January 2027 synthetic short ($61.2M structural semiconductor bet)

- Long-term technology transformation themes (quantum, AI infrastructure, China tech recovery)

🎯 The Bottom Line: Follow the $260M+ Institutional Rotation Earthquake

This represents one of the most dramatic institutional positioning days of 2025. $260+ million flowing into bearish semiconductor thesis (AMD synthetic short), memory profit-taking (MU), contrarian China tech bets (KWEB), quantum computing moonshots (RGTI), and sophisticated protection strategies across multiple sectors. Smart money is clearly repositioning for the next market phase - from growth momentum to selective value, defensive positioning, and emerging technology themes.

The biggest questions:

- Is AMD's $61.2M synthetic short signaling structural semiconductor decline over 2+ years?

- Does MU's $62M profit-taking mark the peak of the memory supercycle?

- Will KWEB's $34.8M bet pay off despite ongoing US-China tensions?

- Can RGTI's $27.1M quantum computing bet capture the commercialization breakthrough?

Your move: This institutional rotation from semiconductor momentum to bearish positioning, defensive strategies, and contrarian emerging tech demands attention. Whether you follow the smart money themes or position against them - you cannot ignore $260+ million in coordinated institutional conviction.

⚠️ Risk Management Critical: AMD's synthetic short requires 44% decline over 2+ years. KWEB's China bet faces geopolitical risks. RGTI's quantum play depends on breakthrough timing. Size positions appropriately and understand these are sophisticated institutional strategies with complex risk profiles.

Entry Level Warning: This level of institutional complexity and sector rotation requires deep understanding. Start with broad ETF exposure, practice paper trading, and focus on learning institutional behavior patterns before attempting to replicate these advanced strategies. The synthetic short mechanics alone require sophisticated options knowledge.

Remember: Institutions often have hedge positions we cannot see. AMD's $61.2M synthetic short might be part of a larger semiconductor portfolio strategy. MU's $62M selling could be systematic rebalancing. Always maintain proper position sizing and understand that unusual activity represents institutional positioning, not guaranteed directional bets.

🔗 Get Complete Analysis on Every Trade

🐻 Bearish Semiconductor Tsunami:

- AMD $61.2M Synthetic Short Alert - Historic 44% Decline Bet

- MU $62M Call Selling Avalanche - Memory Supercycle Profit-Taking

🐉 China Tech & Quantum Revolution:

- KWEB $34.8M China Tech Rally - Geopolitical Contrarian Play

- RGTI $27.1M Quantum Computing Moonshot - Breakthrough Commercialization

🛡️ Sophisticated Protection Strategies:

- AVGO $16.5M Bull Spread Engineering - VMware Synergy Play

- LYFT $16.2M Bearish Waymo Reality Check - Autonomous Vehicle Skepticism

🏗️ Infrastructure & Platform Transformation:

- WDC $14.9M November Call Loading - AI Storage Infrastructure

- CVNA $9.5M Collar Strategy - Auto Digital Transformation

- SNOW $7.3M Cloud Data Platform Protection - Enterprise AI Hedge

- BULL $4.6M Diagonal Calendar - Fintech Platform Timing

🎯 Defensive & Catalyst Positioning:

- BURL $2.9M Put Wall Construction - Retail Earnings Protection

- MRK $2.8M Pharmaceutical Pipeline Catalyst - Big Pharma Stability

⚠️ Options involve substantial risk and are not suitable for all investors. These institutional trades represent sophisticated strategies that may be part of larger hedged positions not visible to retail traders. AMD's synthetic short requires a 44% decline over 2+ years - understand the magnitude of this bearish bet. Unusual activity represents past positioning and doesn't guarantee future performance. Always practice proper risk management and never risk more than you can afford to lose. Entry-level investors should focus on education and paper trading before attempting to replicate these advanced institutional strategies.