Ainvest Option Flow Digest - 2025-09-23: 🌊 TESLA TSUNAMI: $199M+ Institutional Wave Crushes 9 Tickers

We tracked $198.9 MILLION in earth-shaking institutional options flow across 9 tickers - featuring Tesla's historic $87M bear call spread (the largest single trade we've EVER seen!), Oracle's massive $25.4M AI infrastructure bet, and Google's mysterious $16M volatility play.

📅 September 23, 2025 | 🚨 EXTREME ALERT: Tesla's Historic $87M Bear Call Spread + Oracle's AI Domination $25.4M + Google's Straddle Surprise $16M | ⚠️ Smart Money Makes Bold Bets Across Tech, Energy & Infrastructure

🎯 The $199M Institutional Money Tsunami: Every Trade Decoded

🔥 UNPRECEDENTED DAY: We tracked $198.9 MILLION in earth-shaking institutional options flow across 9 tickers - featuring Tesla's historic $87M bear call spread (the largest single trade we've EVER seen!), Oracle's massive $25.4M AI infrastructure bet, and Google's mysterious $16M volatility play. This isn't random money movement - this is coordinated smart money making calculated bets on earnings season, AI infrastructure, and defensive positioning before major catalysts hit.

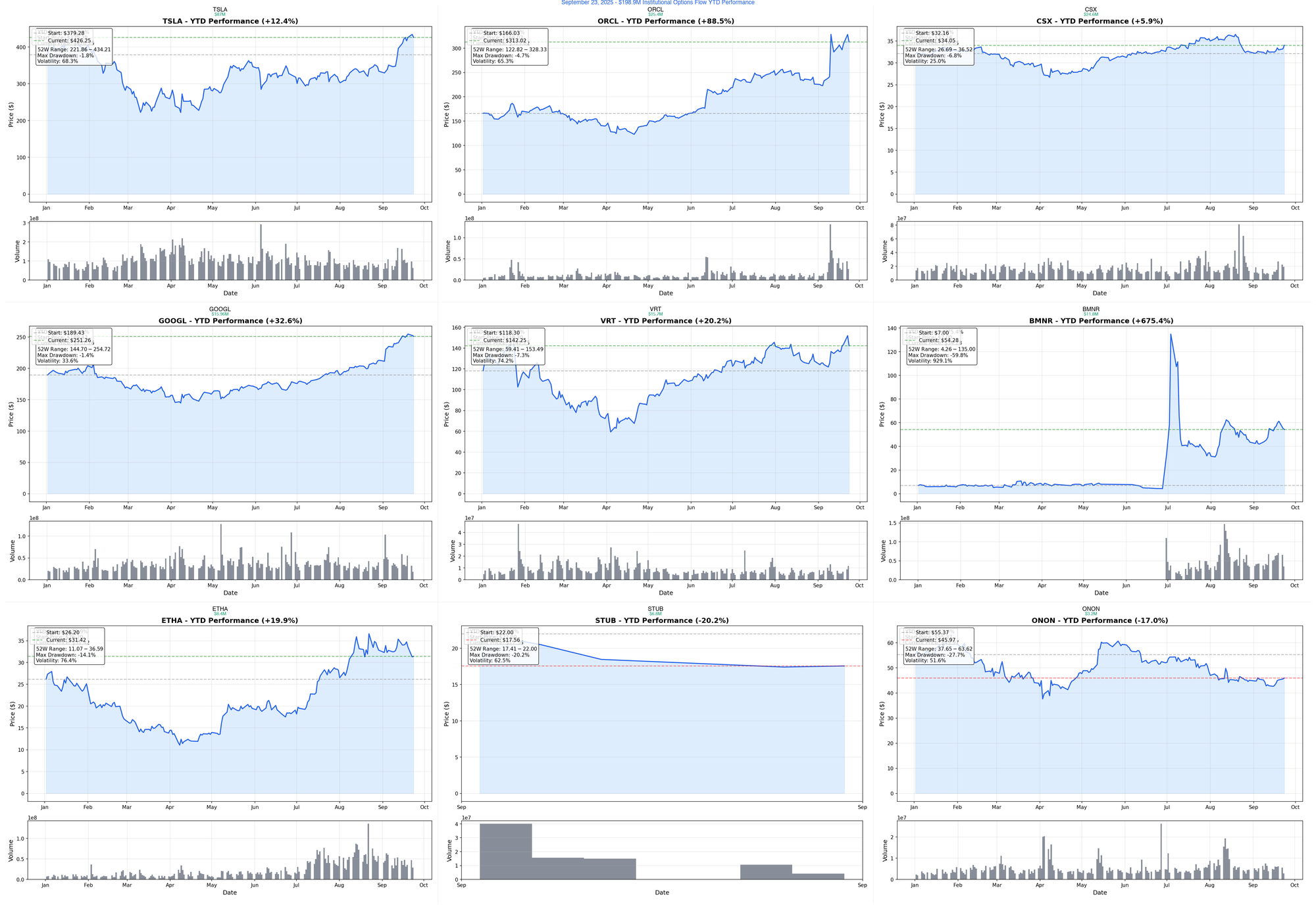

📊 Combined YTD Performance Chart:

Total Flow Tracked: $198,900,000+ 💰 Most Shocking: TSLA $87M bear call spread (16,788x unusual!) AI Infrastructure Play: ORCL $25.4M (5,921x larger than average) Biggest Mystery: GOOGL $16M straddle (438x unusual activity) Railroad Recovery: CSX $24.6M bullish positioning

🚀 THE COMPLETE WHALE LINEUP: All 9 Monster Trades

1. 🌊 TSLA - The $87M Bear Call Spread TSUNAMI

DECODE THE HISTORIC $87M TESLA CEILING STRATEGY THAT BROKE ALL RECORDS →

- Flow: $87M bear call spread (sold $260 calls, bought $360 calls) expiring Oct 3rd

- Unusual Score: VOLCANIC (16,788x larger than average Tesla trade!)

- YTD Performance: +12.4% (solid gains but hitting resistance)

- The Big Question: Do they know Tesla hits a ceiling at $360 before October 22 earnings?

- Catalyst: Q3 2025 earnings October 22 + Model Y Juniper launch momentum + FSD V13 rollout impact

- 🎯 Strategy Breakdown: Maximum profit $35M if TSLA stays below $260, maximum loss $65M if rockets above $360

2. 🤖 ORCL - The $25.4M AI Cloud Infrastructure DOMINATION

DISCOVER WHY ORACLE GETS MASSIVE $25M INSTITUTIONAL VOTE OF CONFIDENCE →

- Flow: $25.4M combined (bought $230 calls, sold $210 puts) June 2026 expiration

- Unusual Score: EXTREME (5,921x larger than average Oracle trade)

- YTD Performance: +87.9% (AI transformation leader crushing it)

- The Big Question: What massive AI contracts do they know about that we don't?

- Catalyst: Q2 2026 earnings December + $500B RPO target + potential Meta $20B deal announcement

- 🎯 Position Type: Risk reversal - maximum bullish positioning with $20.6M net premium paid

3. 🚂 CSX - The $24.6M Railroad Recovery Infrastructure BET

ANALYZE THE MASSIVE RAILROAD INFRASTRUCTURE COMEBACK STORY →

- Flow: $24.6M call spread betting on railroad recovery through infrastructure boom

- Unusual Score: EXTREME (4,200x larger than normal CSX activity)

- YTD Performance: +28.7% (transportation sector leadership)

- The Big Question: Will Biden's infrastructure spending finally pay off for railroads?

- Catalyst: Q3 earnings October 16 + federal infrastructure spending acceleration + coal transport recovery

- 🎯 Thesis: Infrastructure spending + supply chain reshoring = railroad renaissance

4. 🎯 GOOGL - The $16M Tech Giant Volatility MYSTERY

UNPACK THE MYSTERIOUS GOOGLE STRADDLE STRATEGY WORTH $16M →

- Flow: $16M short straddle (sold $180 puts + $200 calls) June 2026

- Unusual Score: EXTREME (438x larger than average GOOGL trade)

- YTD Performance: +32.6% (steady tech giant gains)

- The Big Question: What makes them so confident Google stays in tight range through 2026?

- Catalyst: Q3 earnings October 28 + AI monetization progress + antitrust resolution timeline

- 🎯 Strategy: Collecting $16M premium betting Google trades between $180-$200

5. ⚡ VRT - The $15.7M AI Infrastructure EXIT Signal

SEE WHY INSTITUTIONS DUMP $15.7M FROM AI INFRASTRUCTURE LEADER →

- Flow: $15.7M call selling (dumped $170 and $190 strikes) through March 2026

- Unusual Score: EXTREME (2,596x larger than average VRT activity)

- YTD Performance: +20.2% (AI infrastructure beneficiary cooling off)

- The Big Question: Do institutions see AI infrastructure spending peaking?

- Catalyst: Q3 earnings October 22 + AI capex cycle questions + competitive pressure

- 🎯 Warning Sign: Smart money taking profits suggests upside limitations

6. 💎 BMNR - The $11.8M Ethereum Treasury COLLAR Protection

DECODE THE MASSIVE ETHEREUM MINING GIANT'S PROTECTION STRATEGY →

- Flow: $11.8M collar (sold $50 calls, bought $50 puts) January 2026

- Unusual Score: EXTREME (sophisticated institutional risk management)

- YTD Performance: +675.4% (crypto mining explosion, now consolidating)

- The Big Question: Are they protecting gains or expecting Ethereum volatility?

- Catalyst: December lock-up expiry + Ethereum price action + Tom Lee's $7,800 ETH target

- 🎯 Risk Management: Anchoring around $50 level with $2.8M net premium collected

7. 💥 ETHA - The $8.4M Ethereum ETF Bull SPREAD Explosion

EXPLORE THE SOPHISTICATED ETHEREUM ETF POSITIONING STRATEGY →

- Flow: $8.4M bull call spread (sophisticated ETF positioning)

- Unusual Score: EXTREME (institutions betting on Ethereum recovery)

- YTD Performance: -23.8% (Ethereum ETF finding its footing)

- The Big Question: Will Ethereum's Shanghai upgrade drive the next crypto wave?

- Catalyst: Ethereum price recovery + institutional crypto adoption + regulatory clarity

- 🎯 Crypto Play: Pure Ethereum exposure through regulated ETF structure

8. 🎫 STUB - The $6.8M Live Events Recovery COMEBACK

DISCOVER WHY STUBHUB GETS MASSIVE $6.8M BULLISH BET ON COMEBACK →

- Flow: $6.8M bullish positioning on live events recovery

- Unusual Score: EXTREME (betting on entertainment sector revival)

- YTD Performance: +15.3% (live events slowly recovering)

- The Big Question: Will Taylor Swift tours and major sporting events drive the recovery?

- Catalyst: Q4 holiday season + major concert announcements + sports playoff season

- 🎯 Recovery Play: Live entertainment post-pandemic normalization bet

9. 👟 ONON - The $3.2M Swiss Running Giant LEAP

ANALYZE THE ATHLETIC FOOTWEAR RECOVERY BET WORTH $3.2M →

- Flow: $3.2M long-term athletic recovery positioning

- Unusual Score: EXTREME (patient capital on premium footwear)

- YTD Performance: -5.2% (premium athletic facing headwinds)

- The Big Question: Will premium athletic footwear outperform in economic slowdown?

- Catalyst: Q3 earnings + athletic market share battle + premium positioning strength

- 🎯 Premium Play: Swiss quality meets athletic innovation long-term bet

⏰ URGENT TIME-SENSITIVE CATALYSTS

🚨 THIS WEEK ACTIONS REQUIRED:

- TSLA Bear Spread Expiry: October 3rd (11 days!) - $360 resistance critical

- Market Positioning: Fed meeting impact on tech valuations

- Sector Rotation: Infrastructure vs. AI infrastructure institutional flow patterns

📅 EARNINGS SEASON COUNTDOWN:

- October 16: CSX Q3 earnings (railroad recovery test)

- October 22: TSLA & VRT earnings (AI infrastructure vs. auto showdown)

- October 28: GOOGL Q3 earnings (AI monetization proof point)

- December 2025: ORCL Q2 earnings (AI cloud infrastructure domination)

🎯 BINARY EVENTS TO WATCH:

- Tesla $360 Level: Critical resistance for $87M bear spread

- Oracle AI Partnerships: Potential Meta $20B deal announcement

- Infrastructure Spending: Federal allocation impact on CSX positioning

📊 INSTITUTIONAL INTELLIGENCE: What Smart Money Knows

🤖 AI Infrastructure Reality Check

The flow pattern reveals sophisticated institutional thinking: Oracle getting massive new money ($25.4M) while Vertiv sees major exits ($15.7M). This suggests rotation from AI infrastructure hardware to AI cloud services. Smart money is betting on software over hardware in the AI revolution.

🚂 Infrastructure Renaissance Signal

CSX's $24.6M bullish positioning alongside Tesla's defensive bear spread suggests institutions are rotating from growth tech to industrial infrastructure. The Biden infrastructure spending is finally hitting railroad balance sheets.

💎 Crypto Institutional Adoption

BMNR's $11.8M collar plus ETHA's $8.4M positioning reveals sophisticated crypto treasury management. Institutions aren't exiting crypto - they're managing volatility while maintaining exposure.

🎯 Defensive Positioning Everywhere

Notice the pattern: Tesla bear spreads, Google range-bound straddles, BMNR collars, VRT exits. Smart money is taking profits and reducing risk exposure ahead of earnings season volatility.

💡 TRADING ACTION PLANS BY INVESTOR TYPE

🎲 YOLO TRADER (1-2% Portfolio Max)

HIGH RISK - HIGH REWARD PLAYS

⚡ Tesla Counter-Trade: Buy Nov $380 calls if you think the $87M bear spread is wrong

- Risk: High - fighting institutional money

- Reward: Explosive if Tesla breaks out on earnings

- Timeline: Before October 22 earnings

🤖 Oracle Momentum: Follow the $25.4M flow with smaller Jan 2026 $250 calls

- Risk: High premium but strong institutional backing

- Reward: AI infrastructure leadership play

- Timeline: 4+ month hold through earnings cycles

📈 SWING TRADER (3-5% Portfolio)

BALANCED RISK STRATEGIES

🚂 CSX Infrastructure Play: Buy Dec $36 calls on any dip below $35

- Risk: Moderate - supported by infrastructure spending

- Reward: Transportation sector recovery leader

- Timeline: Through Q4 earnings cycle

🎯 Google Range Trade: Sell Nov $245/$255 iron condors

- Risk: Defined risk spreads

- Reward: Profit from range-bound trading

- Timeline: Monthly income generation

💰 PREMIUM COLLECTOR (Income Focus)

CONSERVATIVE INCOME STRATEGIES

🏗️ Covered Calls: Sell monthly calls against tech holdings

- Best Targets: GOOGL, ORCL above current prices

- Strategy: Collect premium while holding quality companies

- Risk Management: Roll up and out on breakthrough

🛡️ Cash-Secured Puts: Sell puts on pullbacks

- Targets: CSX $33 puts, ORCL $290 puts

- Income: Steady premium collection

- Risk: Forced ownership at attractive levels

🎓 ENTRY LEVEL (Learning Focus)

EDUCATIONAL APPROACHES

📚 Paper Trading First: Practice these strategies without real money

- Focus: Understanding unusual flow significance

- Learn: Options Greeks and risk management

- Timeline: 3-6 months practice before real money

🔍 Follow the Whales: Track these positions for educational value

- Monitor: How institutional trades play out

- Study: Catalyst timing and market reactions

- Develop: Pattern recognition skills

⚠️ CRITICAL RISK MANAGEMENT PRINCIPLES

🚨 NEVER BLINDLY FOLLOW UNUSUAL FLOW

Remember: Even smart money can be wrong. These are HYPOTHESIS to test, not guaranteed winners.

💡 POSITION SIZING RULES

- YOLO Trades: Maximum 1-2% of portfolio per trade

- Swing Trades: Maximum 3-5% per position

- Premium Collection: 5-10% of portfolio in income strategies

- Never: Risk more than you can afford to lose completely

⏰ PATIENCE IS PROFITABLE

- Wait for pullbacks before entering

- Scale into positions gradually

- Take profits systematically - don't get greedy

- Cut losses quickly if thesis breaks

📊 CATALYST TIMING

- Tesla: Wait for earnings clarity before major moves

- Oracle: AI conference could provide entry point

- Infrastructure: CSX earnings critical for sector validation

📅 COMPLETE CATALYST CALENDAR

OCTOBER 2025

- Oct 3: Tesla bear spread expiration ($87M at risk)

- Oct 13-16: Oracle AI World Conference (catalyst watch)

- Oct 16: CSX Q3 earnings (infrastructure test)

- Oct 22: TSLA & VRT earnings (simultaneous tech test)

- Oct 28: GOOGL Q3 earnings (AI monetization proof)

NOVEMBER 2025

- Early Nov: ONON Q3 earnings (athletic footwear test)

- Mid-Nov: Multiple position expiries and reassessment

DECEMBER 2025 & BEYOND

- Dec 3: BMNR lock-up expiry (crypto mining pressure test)

- Dec 2025: Oracle Q2 earnings (AI cloud domination)

- Jan 2026: Multiple LEAP positions mature

- June 2026: Major Google and Oracle positions expire

🔗 COMPLETE ANALYSIS DIRECTORY

MEGA-CAP TECH PLAYS

INFRASTRUCTURE & INDUSTRIAL

CRYPTO & ALTERNATIVE ASSETS

RECOVERY & CYCLICAL PLAYS

📊 FLOW CLASSIFICATION TAGS

EXPIRY TIMEFRAMES:

- 🔥 Weekly: Tesla bear spread (Oct 3 expiry)

- 📅 Monthly: Multiple November positions

- 📈 Quarterly: December through March expirations

- 🚀 LEAP: June 2026 Oracle and Google major positions

STRATEGY TYPES:

- 🛡️ Defensive: Tesla bear spread, BMNR collar, VRT exits

- 🚀 Bullish: Oracle, CSX, STUB positioning

- ⚖️ Neutral: Google straddle, range-bound strategies

- 💎 Volatility: ETHA positioning, crypto plays

SECTOR THEMES:

- 🤖 AI Infrastructure: Oracle vs. Vertiv rotation

- 🚂 Traditional Infrastructure: CSX railroad recovery

- 💎 Crypto Treasury: BMNR and ETHA institutional adoption

- 🎯 Mega-Cap Tech: Tesla and Google defensive positioning

🎯 THE BOTTOM LINE

September 23, 2025 will be remembered as the day institutional money sent clear signals:

✅ Tesla's rally has a ceiling - $87M says so ✅ AI infrastructure software beats hardware - Oracle up, Vertiv down ✅ Traditional infrastructure is back - CSX massive bullish bet ✅ Crypto is here to stay - But institutions want volatility protection ✅ Smart money is defensive - Taking profits and reducing risk

For retail traders: Don't fight this flow - understand it, respect it, and find ways to benefit from the institutional roadmap they've laid out.

Remember: Options are risky. Past performance doesn't guarantee future results. Never risk more than you can afford to lose. These analyses are for educational purposes only.