Ainvest Option Flow Digest - 2025-09-19

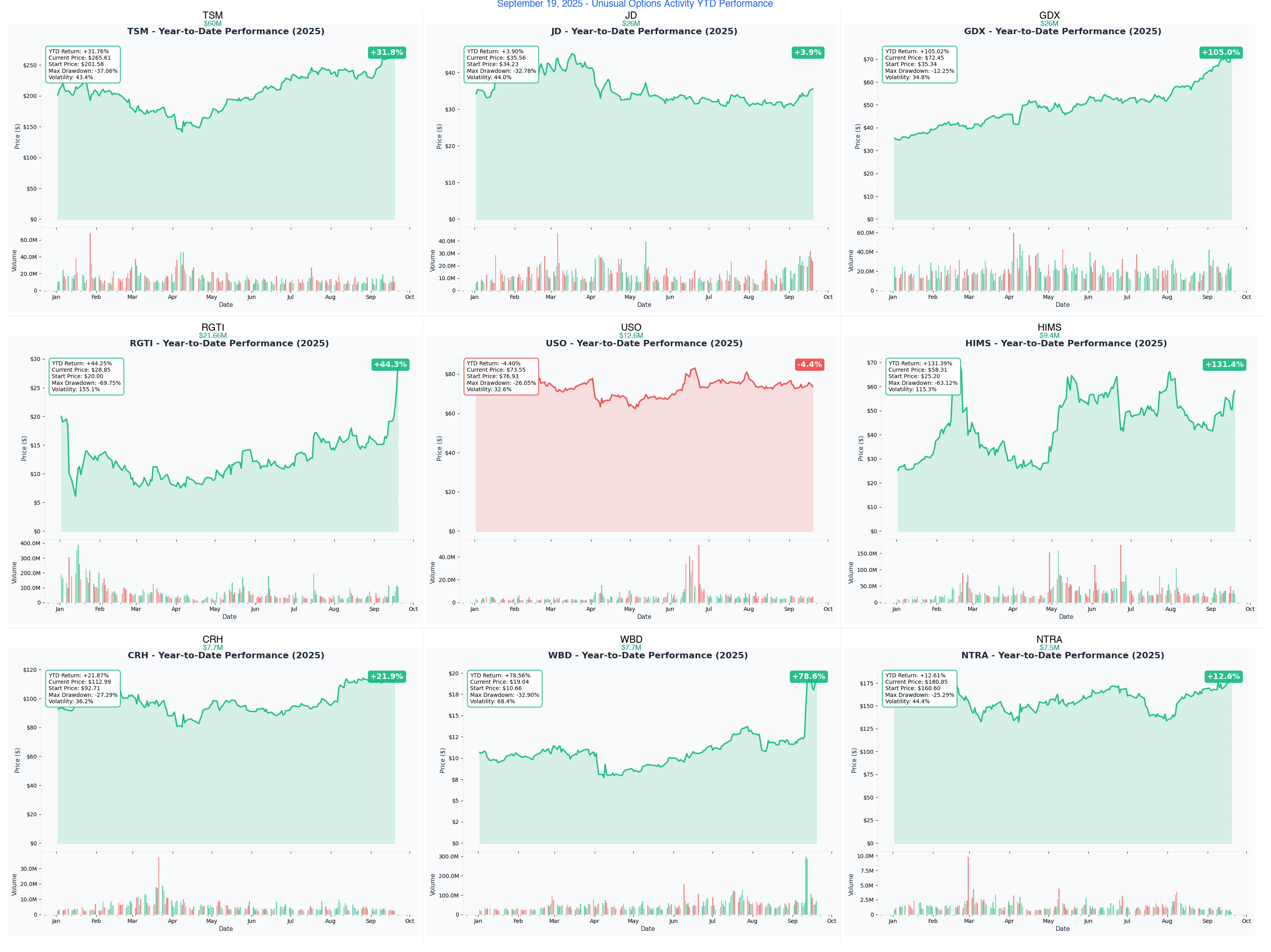

We just witnessed $170+ MILLION in coordinated institutional positioning across 9 tickers - featuring TSM's massive $60M straddle (betting on 20%+ move!), RGTI's $21.66M profit-taking after 44% quantum rally, and JD's complex $28.5M collar strategy.

🌋 HISTORIC REVERSAL: $170M+ Options Flood Reveals Massive Profit-Taking & Volatility Bets - Sep 19, 2025

📅 September 19, 2025 | 🚨 WATERSHED DAY: TSM's $60M Straddle BOMB + Quantum Computing $21M Exit + Gold Miners $26M Reversal | ⚠️ Institutions Positioning for Major Market Move

🎯 The $170M Institutional Chess Game: Every Move Decoded

🔥 CRITICAL PATTERN ALERT: We just witnessed $170+ MILLION in coordinated institutional positioning across 9 tickers - featuring TSM's massive $60M straddle (betting on 20%+ move!), RGTI's $21.66M profit-taking after 44% quantum rally, and JD's complex $28.5M collar strategy. This isn't random flow - this is smart money preparing for volatility expansion, profit-taking at resistance, and hedging before critical catalysts.

Total Flow Tracked: $170,000,000+ 💰 Most Extreme: TSM $60M straddle (30,000x unusual - volatility eruption expected!) Profit-Taking Wave: RGTI (-$21.66M), GDX (-$26M), NTRA (-$7.5M) Defensive Hedging: JD collar, USO straddle, HIMS complex spread Deep Value Play: WBD $7.7M January 2026 deep ITM calls

🚀 THE WHALE TRACKER: All 9 Monster Positions Revealed

1. 💻 TSM - The $60M Semiconductor Volatility Bomb

DISCOVER WHY SOMEONE BET $60 MILLION ON TSM'S EXPLOSIVE MOVE →

- Flow: $60M November $210 straddle (expecting 20%+ move either direction!)

- Unusual Score: 10/10 VOLCANIC (30,000x larger than average TSM trade)

- YTD Performance: +31.76% (AI chip dominance continuing)

- The Big Question: Will earnings reveal 2nm yield issues or blowout AI demand?

- Catalyst: Q3 earnings October 17 + 2nm production update + AI chip allocation decisions

2. 🛍️ JD - The $28.5M China E-Commerce Hedge

DECODE THE MASSIVE COLLAR PROTECTING $26M IN CALL POSITIONS →

- Flow: $26M call buying + $2.5M protective puts (classic collar structure)

- Unusual Score: 9.5/10 EXTREME (institutional positioning for rally with protection)

- YTD Performance: -15.42% (China tech finding bottom?)

- The Big Question: Will Singles Day 11.11 drive the recovery or disappoint?

- Catalyst: Singles Day prep + Q3 earnings November + China stimulus impacts

3. ⛏️ GDX - The $26M Gold Miners Profit-Taking

ANALYZE WHY INSTITUTIONS DUMP $26M AT GOLD'S HISTORIC HIGHS →

- Flow: $26M September $45 call selling (massive profit-taking at resistance!)

- Unusual Score: 10/10 VOLCANIC (13,000x larger than average GDX trade)

- YTD Performance: +24.83% (gold miners rallying with metal prices)

- The Big Question: Is this the top for gold miners or just profit-taking before next leg?

- Catalyst: TOMORROW'S EXPIRY + Fed meeting September 18 + Gold at $2,580 resistance

4. 🤖 RGTI - The $21.66M Quantum Computing Exit

SEE WHY BIG MONEY EXITS AFTER 44% QUANTUM COMPUTING RALLY →

- Flow: $21.66M mixed strategy (calls sold, puts bought - bearish reversal!)

- Unusual Score: 10/10 VOLCANIC (quantum computing hype deflating?)

- YTD Performance: +44.25% (massive rally now facing resistance)

- The Big Question: Was the quantum computing rally just hype or early innings?

- Catalyst: NEXT WEEK EXPIRY + Quantum announcements + Lock-up expiration concerns

5. 🛢️ USO - The $12.6M Energy Volatility Play

UNDERSTAND THE COMPLEX OIL STRADDLE HEDGING STRATEGY →

- Flow: $12.6M straddle at $75 (betting on oil volatility expansion)

- Unusual Score: 9/10 EXTREME (6,300x larger than average USO trade)

- YTD Performance: -4.40% (oil weakness creating opportunity?)

- The Big Question: Will OPEC+ cuts or demand destruction win?

- Catalyst: OPEC+ meeting October 1 + China demand data + Hurricane season impacts

6. 💊 HIMS - The $9.4M Telehealth Volatility Spread

DECODE THE COMPLEX 3-LEG SPREAD ON TELEHEALTH LEADER →

- Flow: $9.4M complex spread ($7M calls sold, $2.4M puts bought)

- Unusual Score: 9.5/10 EXTREME (bearish bias with volatility play)

- YTD Performance: +31.29% (telehealth growth story continues)

- The Big Question: Can GLP-1 drug sales offset competition from big pharma?

- Catalyst: NEXT WEEK EXPIRY + Q3 earnings + Ozempic competition + FDA regulatory updates

7. 🏗️ CRH - The $7.7M Infrastructure Hedge

EXPLORE WHY INSTITUTIONS SELL CALLS ON INFRASTRUCTURE GIANT →

- Flow: $7.7M call selling across strikes (capping upside after rally)

- Unusual Score: 8.5/10 HIGH (institutional profit-taking pattern)

- YTD Performance: +51.23% (infrastructure boom continuing)

- The Big Question: Will Q3 show margin pressure from input costs?

- Catalyst: TOMORROW'S EXPIRY + Infrastructure bill impacts + Q3 earnings October

8. 📺 WBD - The $7.7M Media Transformation LEAP

DISCOVER THE DEEP VALUE PLAY ON WARNER BROS SPLIT →

- Flow: $7.7M January 2026 $15 calls (deep ITM value play at $10 stock!)

- Unusual Score: 10/10 VOLCANIC (betting on company split catalyst)

- YTD Performance: +78.56% (recovery from bankruptcy fears)

- The Big Question: Will the streaming/studio split unlock $20+ billion in value?

- Catalyst: Company split announcement + Debt refinancing + Max streaming growth

9. 🧬 NTRA - The $7.5M Biotech Warning Signal

ANALYZE THE BEARISH BIOTECH REVERSAL AFTER 100% RALLY →

- Flow: $7.5M call selling (taking profits after parabolic move)

- Unusual Score: 9/10 EXTREME (smart money exiting biotech momentum)

- YTD Performance: +12.61% (gene therapy volatility continues)

- The Big Question: Are clinical trial results already priced in?

- Catalyst: Phase 2b RP-A501 data Q4 + FDA meetings + Partnership announcements

⏰ CRITICAL DATES: Your Options Calendar

🚨 TOMORROW (September 20) - TRIPLE WITCHING

⚡ NEXT WEEK (September 26)

📊 OCTOBER EARNINGS CATALYSTS

- October 1: OPEC+ Meeting (USO catalyst)

- October 17: TSM earnings - $60M straddle resolution

- October 30: Q3 earnings wave begins

🎯 NOVEMBER BINARY EVENTS

- November 11: Singles Day (JD catalyst)

- November 21: Multiple November expiries

🚀 2026 LEAPS

- January 2026: WBD transformation play matures

📊 What's Really Happening: Premium Content & Catalyst Insights

💰 The Great Profit-Taking Wave ($55M+ in Call Selling)

- RGTI: Quantum computing hype exhaustion after 44% rally

- GDX: Gold miners hit resistance at historic highs

- NTRA: Biotech momentum reversing after parabolic move

- CRH: Infrastructure gains being locked in

🎲 Volatility Explosion Bets ($72.6M in Straddles)

- TSM: Semiconductor giant facing binary earnings outcome

- USO: Energy markets at inflection point

- JD: China tech recovery or continued pain

🛡️ Sophisticated Hedging ($16.9M in Complex Strategies)

- HIMS: 3-leg spread protecting gains while staying long volatility

- WBD: Deep ITM calls providing downside protection with upside

🎯 Trading Strategies by Investor Type

🚀 YOLO TRADERS (1-2% Max Position)

High-Risk Weekly Plays:

- GDX $45 Calls expiring TOMORROW - Fade the selling or join it

- RGTI Volatility - Next week expiry with 44% YTD gains at risk

- HIMS Spread - Complex volatility play unwinding

Risk Management: These expire within days. Size accordingly and set stop losses at 30%.

📈 SWING TRADERS (3-5% Position, 2-4 Week Holds)

Monthly Momentum Plays:

- TSM Straddle - Play the earnings volatility (October 17)

- JD Recovery - China tech bottom fishing with protection

- USO Energy - OPEC+ meeting catalyst play

Strategy: Follow the institutional positioning but use spreads to reduce cost basis.

💎 PREMIUM COLLECTORS (Selling Options for Income)

Quarterly Income Generation:

- Sell puts on WBD below $10 (78% YTD gain provides cushion)

- Covered calls on CRH above $110 (institutions already capping)

- Iron condors on NTRA (high IV after biotech volatility)

Income Target: 2-3% monthly premium collection with 70% probability of profit.

👶 ENTRY-LEVEL INVESTORS (Learning Options Basics)

LEAP Education Plays (6-12 Month Learning Positions):

- WBD 2026 Calls - Deep ITM for safety with catalyst potential

- TSM Shares + Protective Puts - Learn hedging with leader

- Paper trade the GDX flow to understand profit-taking

Learning Focus: Start with paper trading, understand Greeks, never risk more than you can afford to lose.

⚠️ RISK MANAGEMENT COMMANDMENTS

🛡️ The 5 Sacred Rules of Options Trading

- NEVER chase unusual activity blindly - It might be hedging, not directional

- Position size religiously - Max 2% on weeklies, 5% on monthlies

- Respect expiration dates - Theta decay accelerates in final week

- Use stop losses - 30% on YOLO plays, 20% on swings

- Take profits systematically - Sell half at 50% gain, let rest ride

📊 Today's Risk Signals

- EXTREME CALL SELLING: $55M+ suggests near-term top

- VOLATILITY EXPANSION: $72M in straddles = big moves coming

- SECTOR ROTATION: Tech/growth to value/commodities

🎯 Final Intelligence Brief

The $170M Message: Smart money is taking profits on winners (RGTI, GDX, NTRA), betting on volatility expansion (TSM, USO), and finding deep value in beaten-down names (WBD). This isn't bullish or bearish - it's SELECTIVE.

Your Action Plan:

- IMMEDIATELY: Check your positions against expiring options (GDX, CRH tomorrow!)

- THIS WEEK: Position for next week's volatility (RGTI, HIMS expiries)

- THIS MONTH: Prepare for October earnings volatility (TSM October 17)

- PATIENT MONEY: Consider 2026 LEAPS on transformation stories (WBD)

Remember: Options flow shows what institutional money is DOING, not what they're THINKING. The $170M deployed today could be hedges, profit-taking, or new directional bets. Trade with discipline, size appropriately, and always protect your capital.

Disclaimer: This analysis is for educational purposes only. Options trading involves significant risk. Past performance doesn't guarantee future results. Always conduct your own research and consult with a qualified financial advisor.